Why Lentor Central Residences And Aurelle Sold 1,127 Units In One Weekend

March 10, 2025

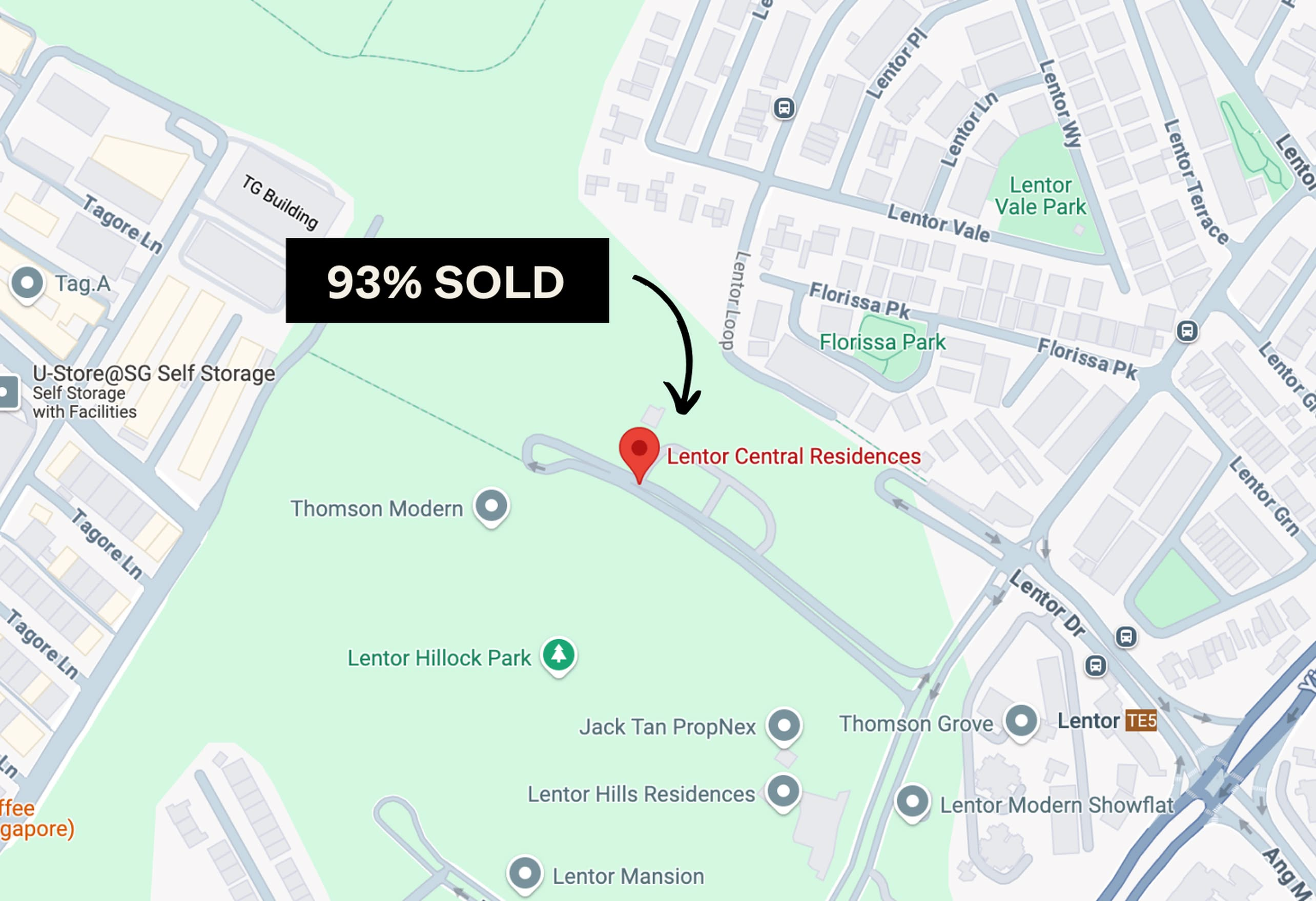

It’s been quite the weekend for new launches: Lentor Central Residences and Aurelle of Tampines saw overwhelming demand, with nearly all units snapped up (93 and 90 per cent, respectively). While both projects are in different locations, the strong sales may underscore a major, upcoming change in OCR to CCR demand. Here’s a look at what happened at the show flats, and what may be driving demand:

A note on price psf for the following: Please keep in mind that, due to GFA harmonisation, the two projects below don’t include features like air-con ledges in their total square footage. This has the effect of pushing up the price psf, though the overall quantum is unaffected by this.

Many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

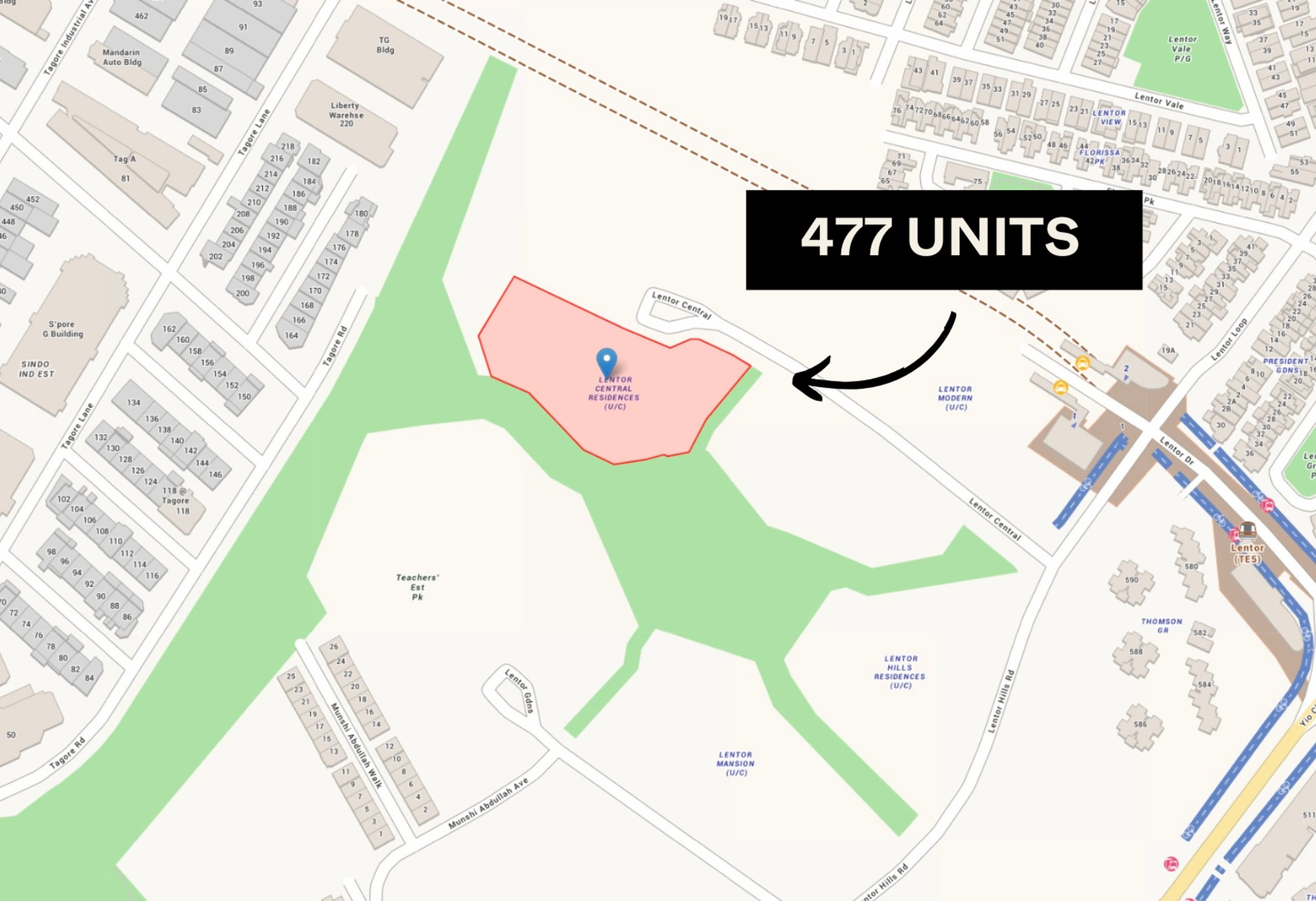

Lentor Central Residences

Lentor Central Residences moved 445 of 477 units (93 per cent) on launch weekend, managing an average of $2,200 psf. Lentor Central achieved this despite widespread concerns of oversupply: there are now six condos (including Lentor Central) in the new Lentor Hills estate. Since 2022, around 2,954 new homes have emerged here.

Nonetheless, Lentor Central Residences managed to pull the crowds, and beat all previous Lentor Hills projects for launch-weekend sales. The previous leader in launch-weekend sales was Lentor Modern, an integrated project (the first to be launched in the area) near Lentor Central Residences that managed 84 per cent sales at launch.

What pulled so many buyers? Based on conversations with property agents, the main factors seem to be the following:

1. Some of the best unit layouts among new launches

Lentor Central’s units, particularly its 4-bedder layouts, are widely praised as some of the best in the market. At around 1,399 sq. ft., these units include an enclosable yard (a first for projects in Lentor), three bathrooms, wide frontage for the living room, and a master bedroom large enough to comfortably fit a walk-in wardrobe.

The 2-bedroom units feature a dumbbell layout, minimising wasted corridor space and ensuring both bedrooms are well-separated; and most units feature practical “nook” kitchens which allow for counters and cabinetry on both sides.

The efficiency of the layouts makes for a distinguishing feature, standing out even from its five counterparts in Lentor Hills.

2. Last chance at a competitive new launch price

At $2,200 psf, Lentor Central Residences was priced lower than Parktown Residence ($2,360), which also managed to nearly sell out at launch. Note that Parktown Residence was also less exclusive (it was a mega-development with 1,193 units). ELTA in Clementi, which we also covered here, was even pricier at around $2,537 psf.

For families, the quantum for 3-bedders started from as low as $1.88 million, for a unit of around 915 sq. ft. This contrasts quite sharply with other new launches, where more and more family-sized units tend to cross the $2 million mark, even in the OCR.

In this, we see a similar effect to what we witnessed with Emerald of Katong, another top-seller: when there are multiple new launches occurring in the market, the one with the lowest prices can draw buyers away from the others. (In the case of Emerald of Katong, it was cheaper than nearby competitors like Continuum, which pulled a lot of District 15 buyers).

In short, recent launches anchored the price higher, allowing Lentor Central to look affordable by comparison. On the ground, many agents were also pressing the point that Lentor Central is the last of the series of six launches; and it’s likely that subsequent launches this year will be priced much higher.

More from Stacked

LIV@MB Review: Fantastic Layouts With 80/20 Landscaping To Units Ratio

Having grown up in District 15, you could say that I definitely have a soft spot for the area. One of…

3. Proximity to the area’s only integrated project

Lentor Central is one of the closest projects to Lentor Modern. Residents will benefit from the same amenities as Lentor Modern, like its attached MRT station and commercial component. This is especially relevant in the Lentor area, which is just getting off the ground – having a nearby supermarket, shops, etc. will be even more important to the residents.

4. Support from nearby housing enclaves

We previously discussed this effect with Chuan Park, and it’s equally valid for Lentor Central: this condo’s surroundings include a large landed enclave, which provides good buyer support. While there are other larger condos nearby, alternatives like The Calrose, Thomson Grove, etc. are significantly older.

Aurelle of Tampines

Aurelle is an EC, which in itself already draws strong demand in today’s high market. The subsidised pricing of these projects is a godsend to sandwiched first-time buyers, or upgraders on a budget, in the current high-priced environment. That said, Aurelle’s performance was exceptional, and 90 per cent sold is a strong result even for an EC.

Note that Aurelle’s nearby EC counterpart, Tenet, “only” managed to move 72 per cent of units at launch, at $1,348 psf, back in December 2022.

682 of Aurelle’s 760 units have been sold, with an average price of $1,766 psf. ECs are family-oriented, so it’s probably no surprise that the bigger units were snapped up first: at the time of writing, no 4 or 5-bedroom units remain.

Aurelle’s reasons for success are straightforward: it launched right after Parktown Residence had anchored a strong price for the area. Aurelle is also likely to look good to future upgraders in Tampines North, one of the newer townships – its price point is much lower than Parktown, and upgraders who want to stay in the vicinity of Tampines (including other parts of Tampines) might be drawn to this.

On that basis though, Tenet could be the biggest winner with a first-mover advantage, having come in before both Aurelle and Parktown.

In both cases, there was one other common element driving sales

Waiting further would get the buyers nowhere. To be blunt, the latest batch of Lentor Central, Parktown Residence, Aurelle, etc. are among the last new launches not in the Core Central Region (CCR).

Going forward, launches in upcoming areas like Zion Road, Margaret Drive, etc., are bound to be much pricier. Buyers who don’t want to accept the current projects are at greater risk of being priced out, the longer they wait. As another sign of this, consider how Aurea (former Golden Mile) saw slower results on the launch weekend, compared to recent fringe-region successes like Parktown, Aurelle, etc.

Buyers are likely aware that these are among their last affordable options, and sales are picking up accordingly.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

0 Comments