What Would Singapore Property Prices Be Like In 30 Years?

October 27, 2024

Singapore real estate is in its own class, when it comes to inflation

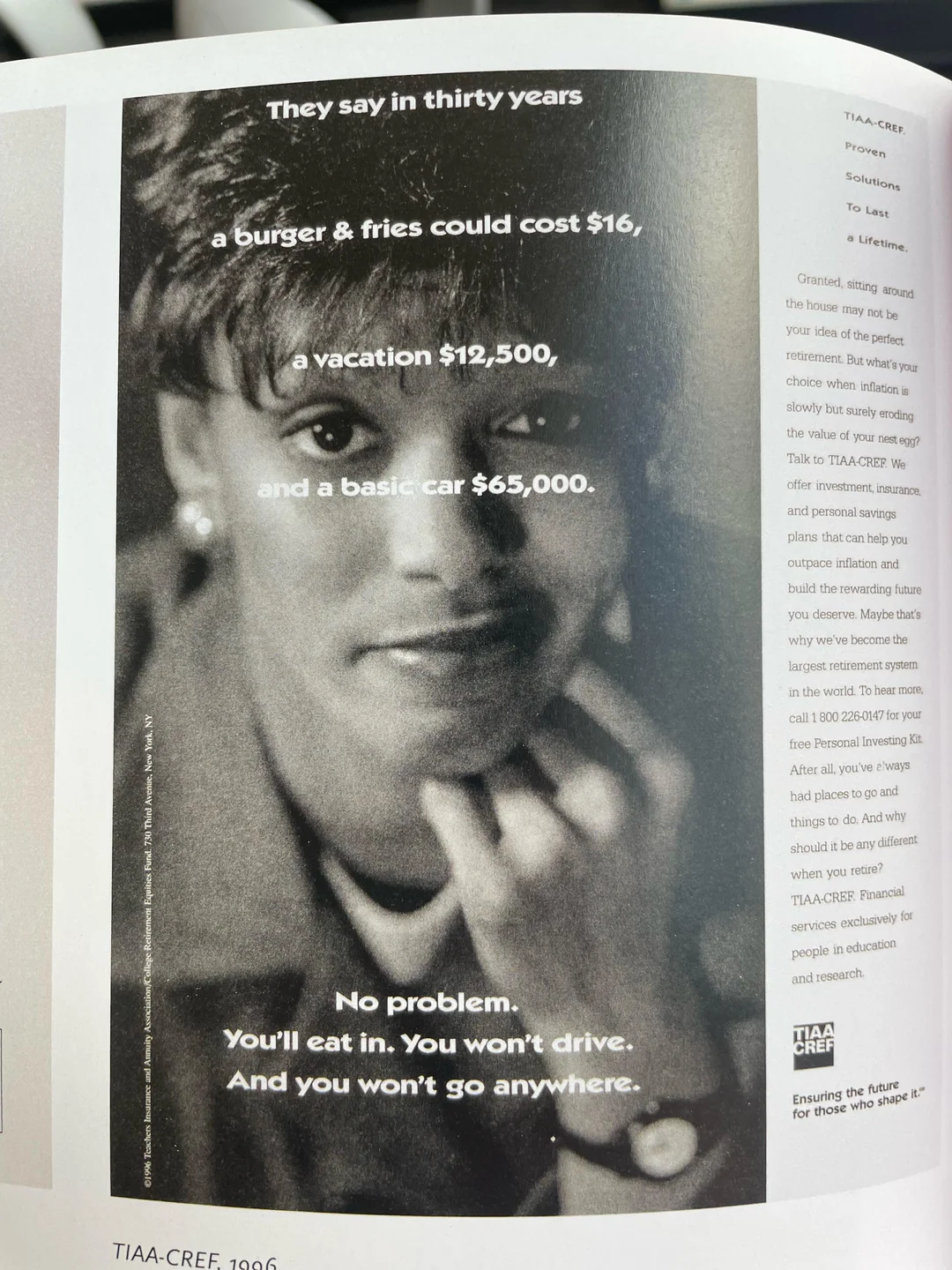

Maybe you’ve seen this old ad going around; and granted, it’s American, but the entire world has been feeling the effects of inflation lately. Most Singaporeans can probably still empathise. If you think that level of inflation is scary though, wait till you see the effects in the resale flat or private property market.

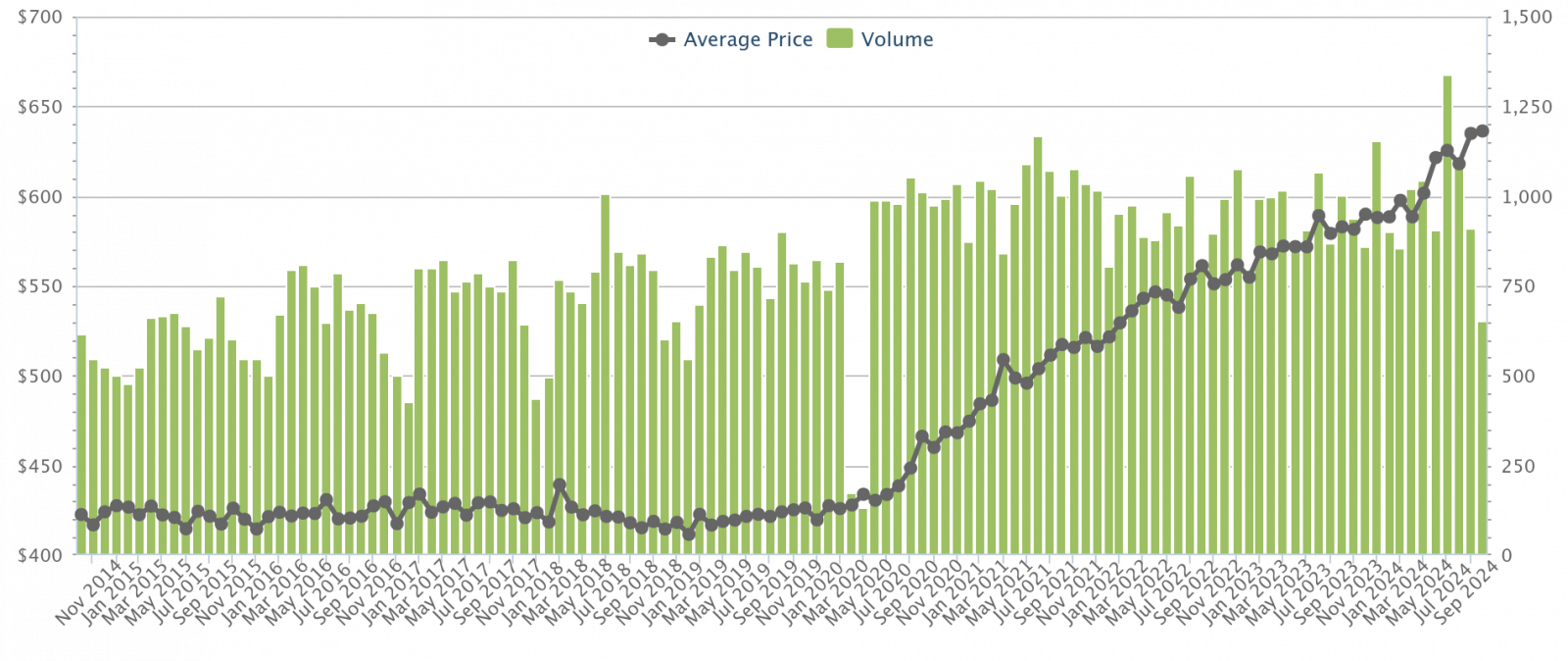

Even over 10 years, property price inflation is unmatched by other goods. Consider 4-room flat prices in 2014, versus 2024:

Back in October 2014, (resale) 4-room flats were at $423 psf on average. At around 960 sq.ft., which is a typical flat size, you could get one for a little over $400,000. As of October 2024, we’re up to $636 psf, or about $610,500+.

For the sake of comparison, I played around a bit with the MAS Inflation Calculator. It only goes to 2023, but that’s somewhat close enough (note: I admit this is nowhere near as rigorous as an actual article).

A meal that cost $3.50 in 2013, would cost around $4.50 today. A $50 doctor’s bill in 2013 should be about $58 today. You can play around with it and see if you agree; but the point is, nothing seems to have gone up as quickly as property prices, and this is just with regard to public housing.

The inflation rate given, for various baskets of goods like utilities, food, healthcare, etc. is typically around 2.5 to three per cent. If we consider that median wages in around 2013 were at $3,800 per month and that it’s at $5,200 per month in 2024, many of us have seen our wages match or outpace inflation in many categories. While I understand it’s not universally true, some people now have to work fewer hours to buy a TV, t-shirt, phone, etc.

But whilst it’s becoming easier to afford some consumer goods, resale flats and private properties have gone the other way. BTO flats are still kept affordable by government controls; but once you get to the secondary or private market, you’re likely working harder and longer than in previous years, to afford your home.

For young Singaporeans, it may be time for an apples-to-oranges comparison

If you must bypass the BTO queue for some reason, you’ll just have to throw enough money at someone to convince them to move. And Singaporeans have high savings and big expectations, as well as expensive replacement properties. So you’ll have to chuck a whole lot of money at them.

So maybe, instead of sticking to conventional comparisons (e.g., comparing location, square footage, which MRT lines are close), it’s worth going outside the property box. Is getting your flat a few years sooner, really worth the price of a degree or master’s? Is an extra 300 sq. ft. – because old flats are bigger – equal to ($636 x 300) = $190,800 worth of other life goals?

More from Stacked

6 Creative Discount/Payment Schemes That Developers Offer

For those expecting property sales to fall, you might be surprised to learn that new private home sales in Singapore…

It boils down to what’s going to make you happier in life, and the answer to that isn’t always that “I can walk to the MRT from here.”

Inflation is a real thing, and I would never downplay it. But focusing on resale instead of BTO flats, or private property, greatly amplifies its perceived impact; to a much greater degree than other aspirations. For some of us, a good way to stop feeling the pain of inflation might be to channel our financial goals elsewhere, besides a pricier home.

Now that I’ve gotten myself preemptively fired from every agency for saying that, let’s look at what’s happening in…

Other property news

- The rising number of resale flats between $900,000 to $1 million, aka How BTO flats will save your life.

- We know some of you don’t have the BTO option though. To balance out the sense of panic, here are the cheapest 4-room resale flats near MRT stations. While they last, eh?

- Are mega-developments good? There must be some downsides to that lower price tag and more lavish facilities.

- Norwood Grand is selling really well, despite detractors screaming about $2,000+ psf prices in Woodlands.

Weekly Sales Roundup (14 October – 20 October)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| MEYER BLUE | $6,249,000 | 1905 | $3,280 | FH |

| KLIMT CAIRNHILL | $4,782,160 | 1432 | $3,340 | FH |

| TEMBUSU GRAND | $3,583,000 | 1432 | $2,503 | 99 yrs (2022) |

| 19 NASSIM | $3,538,000 | 969 | $3,652 | 99 yrs (2019) |

| ONE BERNAM | $3,430,000 | 1421 | $2,414 | 99 yrs (2019) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| NORWOOD GRAND | $988,000 | 495 | $1,995 | 99 years |

| KASSIA | $1,014,000 | 474 | $2,141 | FH |

| LENTORIA | $1,292,000 | 538 | $2,401 | 99 yrs (2022) |

| THE MYST | $1,342,000 | 657 | $2,044 | 99 yrs (2023) |

| PARC CANBERRA | $1,345,000 | 958 | $1,404 | 99 yrs (2018) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| TURQUOISE | $9,000,000 | 6900 | $1,304 | 99 yrs (2007) |

| AMBER SKYE | $6,750,000 | 4629 | $1,458 | FH |

| ST REGIS RESIDENCES SINGAPORE | $6,485,000 | 2594 | $2,500 | 999 yrs (1995) |

| THE WATERSIDE | $5,288,888 | 2400 | $2,203 | FH |

| THE SEAFRONT ON MEYER | $4,750,000 | 2088 | $2,275 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PARC ROSEWOOD | $615,000 | 431 | $1,428 | 99 yrs (2011) |

| HEDGES PARK CONDOMINIUM | $715,000 | 484 | $1,476 | 99 yrs (2010) |

| MILLAGE | $738,000 | 463 | $1,594 | FH |

| RIVERSAILS | $746,888 | 506 | $1,476 | 99 yrs (2011) |

| RIVERFRONT RESIDENCES | $782,000 | 463 | $1,690 | 99 yrs (2018) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE BOTANIC ON LLOYD | $3,500,000 | 1496 | $1,016 | $1,980,000 | 19 Years |

| SOUTHAVEN II | $2,550,000 | 1507 | $524 | $1,760,000 | 18 Years |

| THE SEAFRONT ON MEYER | $4,750,000 | 2088 | $1,490 | $1,639,000 | 17 Years |

| CITY SQUARE RESIDENCES | $2,380,000 | 1216 | $667 | $1,569,190 | 18 Years |

| GOLDENHILL PARK CONDOMINIUM | $2,080,000 | 926 | $742 | $1,393,300 | 24 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE BOTANY AT DAIRY FARM | $2,141,000 | 1033 | $2,072 | $0 | 1 Year |

| JUNIPER HILL | $2,625,000 | 958 | $2,816 | -$73,000 | 3 Years |

| MARTIN NO 38 | $4,200,000 | 1485 | $2,962 | -$200,000 | 13 Years |

| KLIMT CAIRNHILL | $4,526,400 | 1432 | $3,409 | -$353,600 | 1 Year |

| ALTEZ | $1,530,000 | 861 | $2,419 | -$552,796 | 12 Years |

Transaction Breakdown

For more on the Singapore property market and what’s happening, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How have property prices in Singapore changed over the past decade?

Why are property prices in Singapore rising faster than other goods?

What impact does inflation have on Singaporeans trying to buy homes?

Are BTO flats more affordable compared to resale or private properties?

How might Singapore property prices look in 30 years?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Singapore Property News Why Housing Took A Back Seat In Budget 2026

Latest Posts

Pro This Singapore Condo Has Bigger Units Near The MRT — But Timing Decided Who Made Money

Editor's Pick Happy Chinese New Year from Stacked

Editor's Pick How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

4 Comments

there are alot of calculation error

Top 5 Cheapest New Sales (By Project)

Kassia is $3000+ psf now?

Parc Canberra $PSF is higher than The Myst although it’s 300 sqft bigger with $3k more only?

There could be other errors which i didn’t check

So, What Would Singapore Property Prices Be Like In 30 Years?? I don’t feel like the question has been answered by the article.

Average Singaporeans leaving singapore let foreign invasion take over