Updated List Of HDB Maisonettes In 2022: How Much Have Prices Increased & Where To Find Them

September 16, 2022

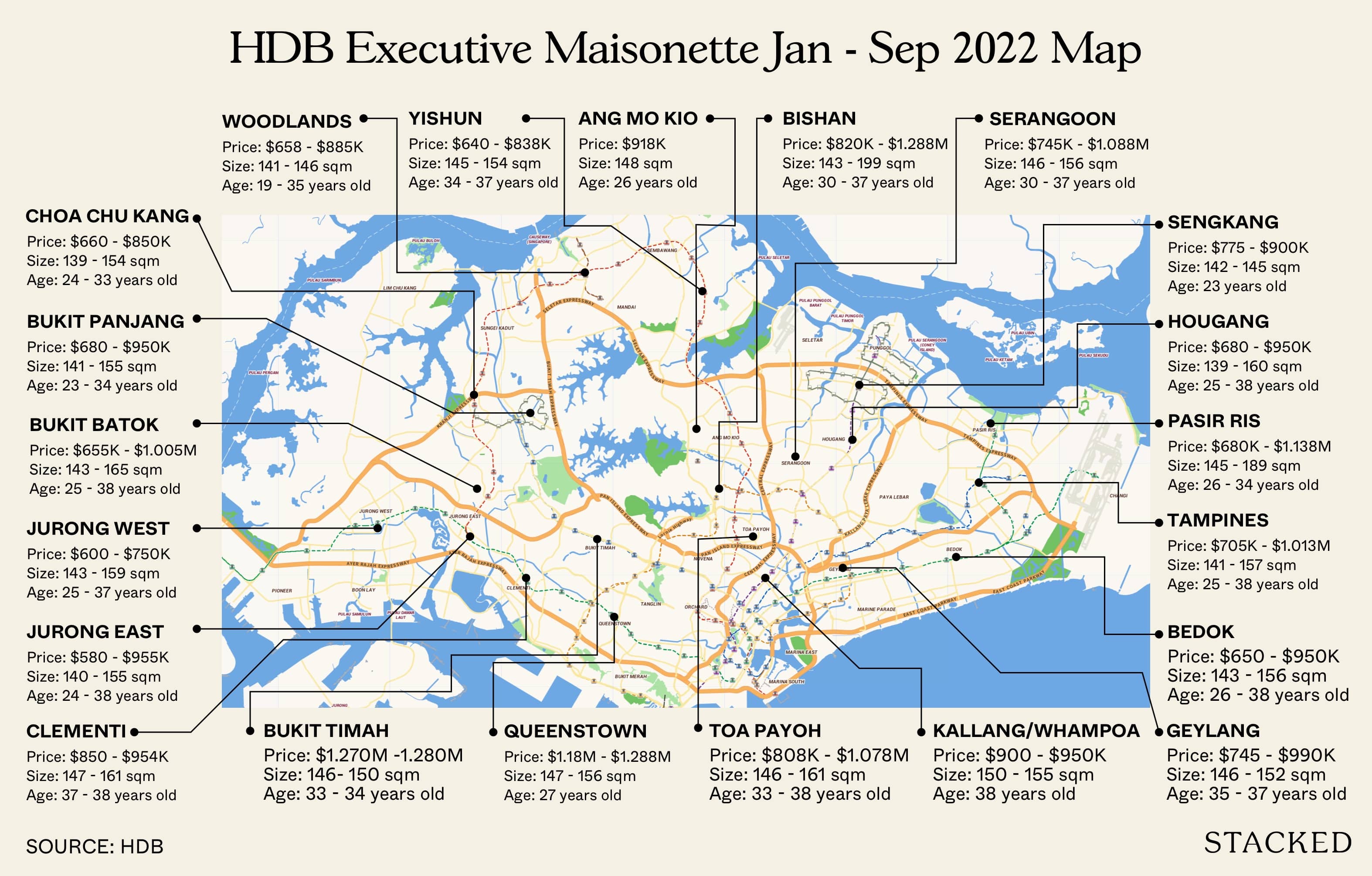

Back in February, we wrote about HDB maisonettes, where to find them, and their prices. With private home prices soaring, an increasing number of buyers are considering larger flats instead of condos: and the first that come to mind will probably be double-storey maisonettes. Here’s a look at how prices have moved since our last look:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What are HDB maisonettes?

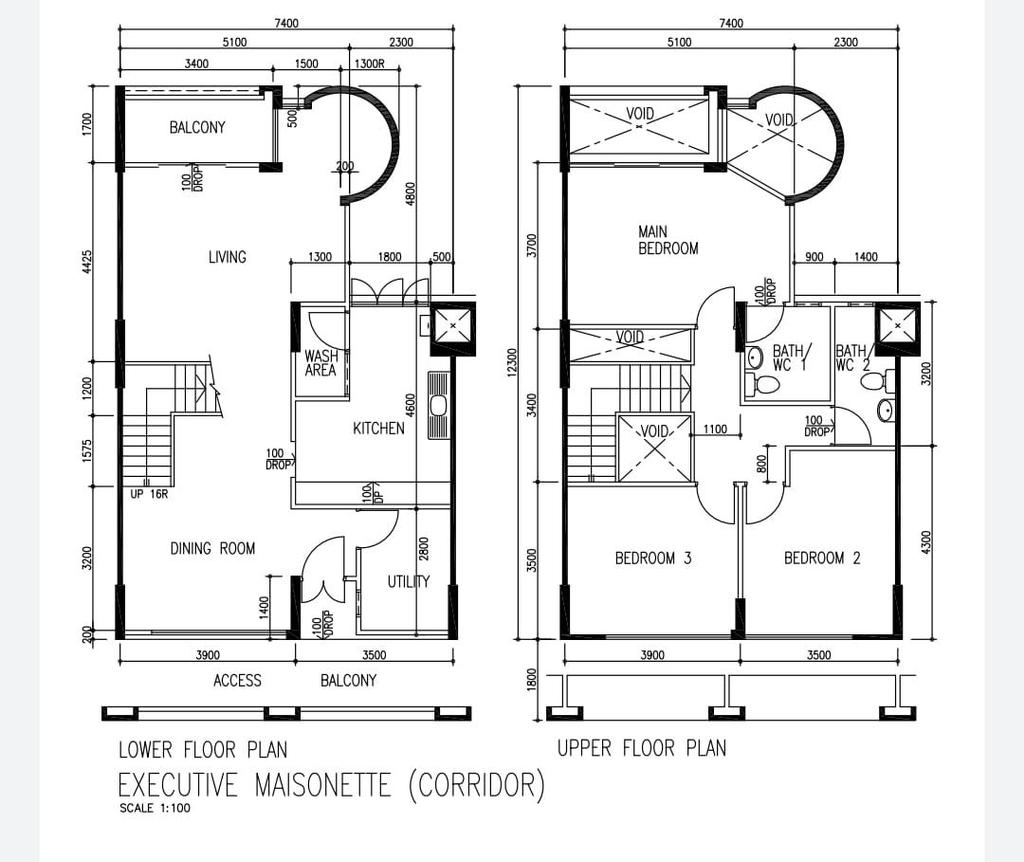

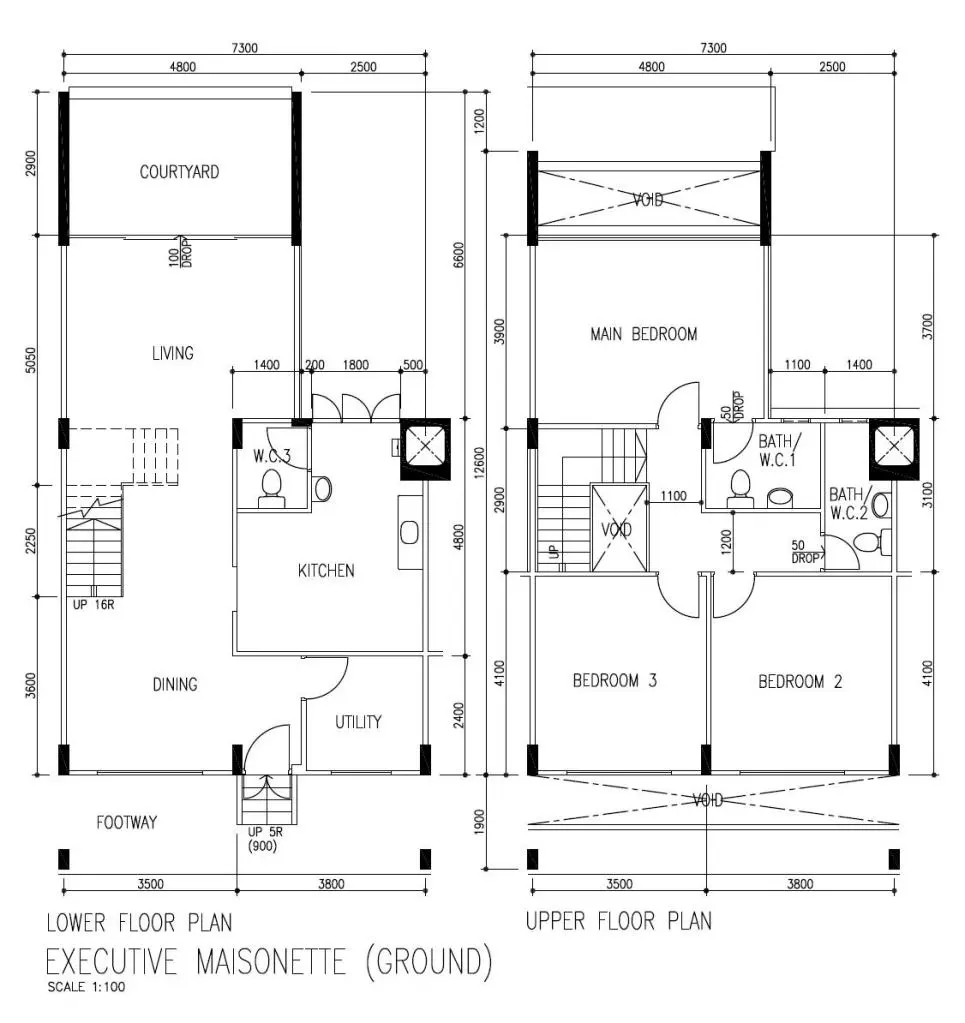

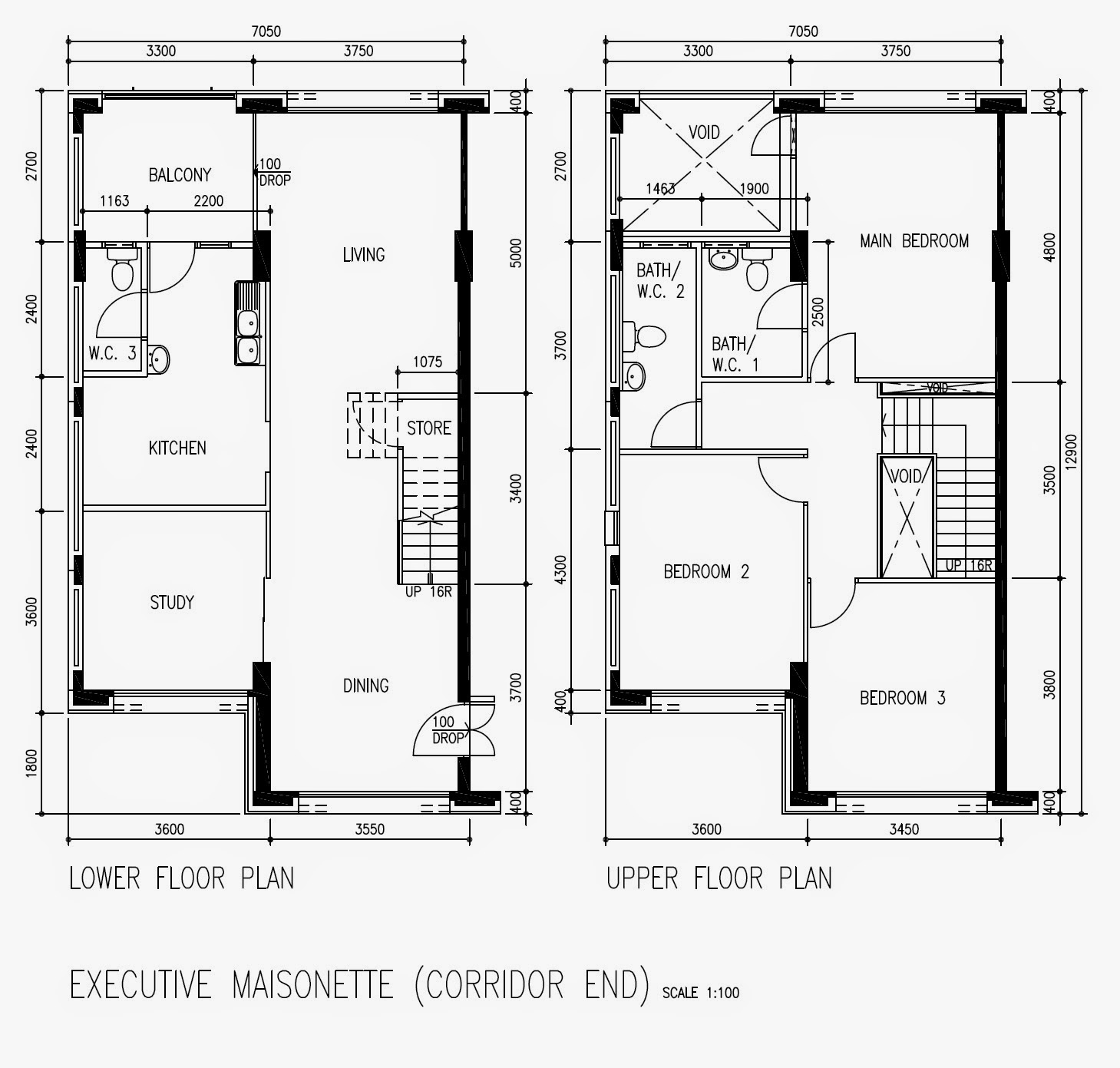

We have a detailed description in our previous article. For immediate reference, however, this refers to a flat type built between 1983 to 1995. Unit sizes average 1,540+ sq. ft. and are double-storey (you usually need to climb stairs to get to the bedrooms).

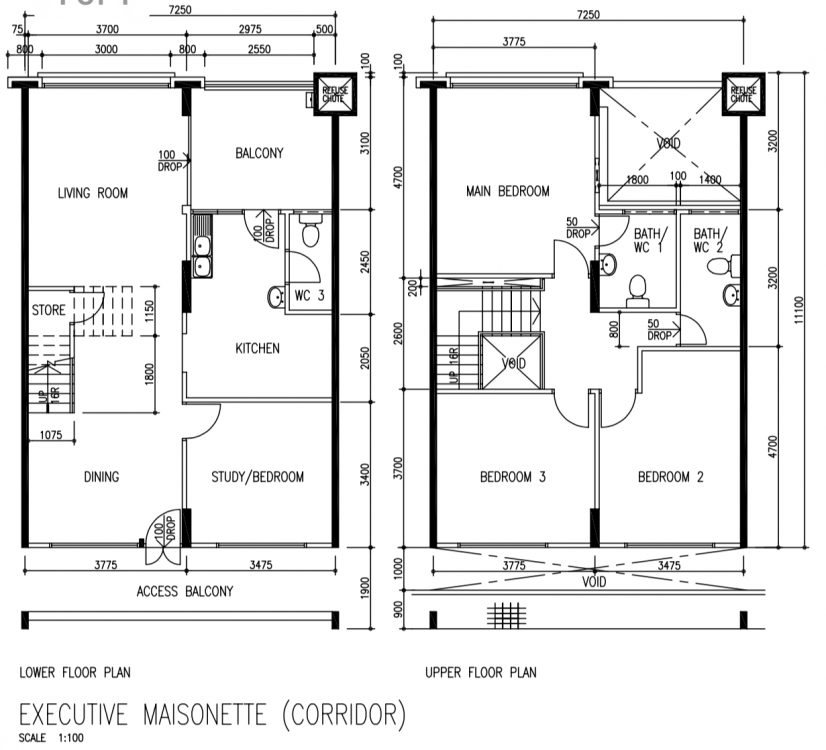

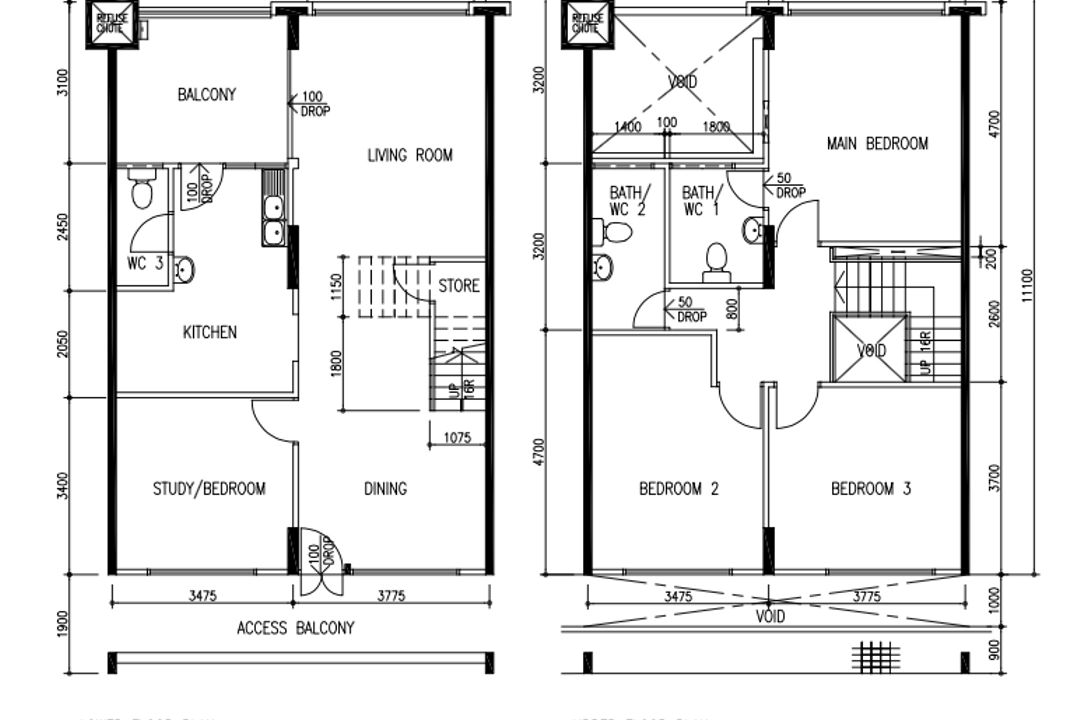

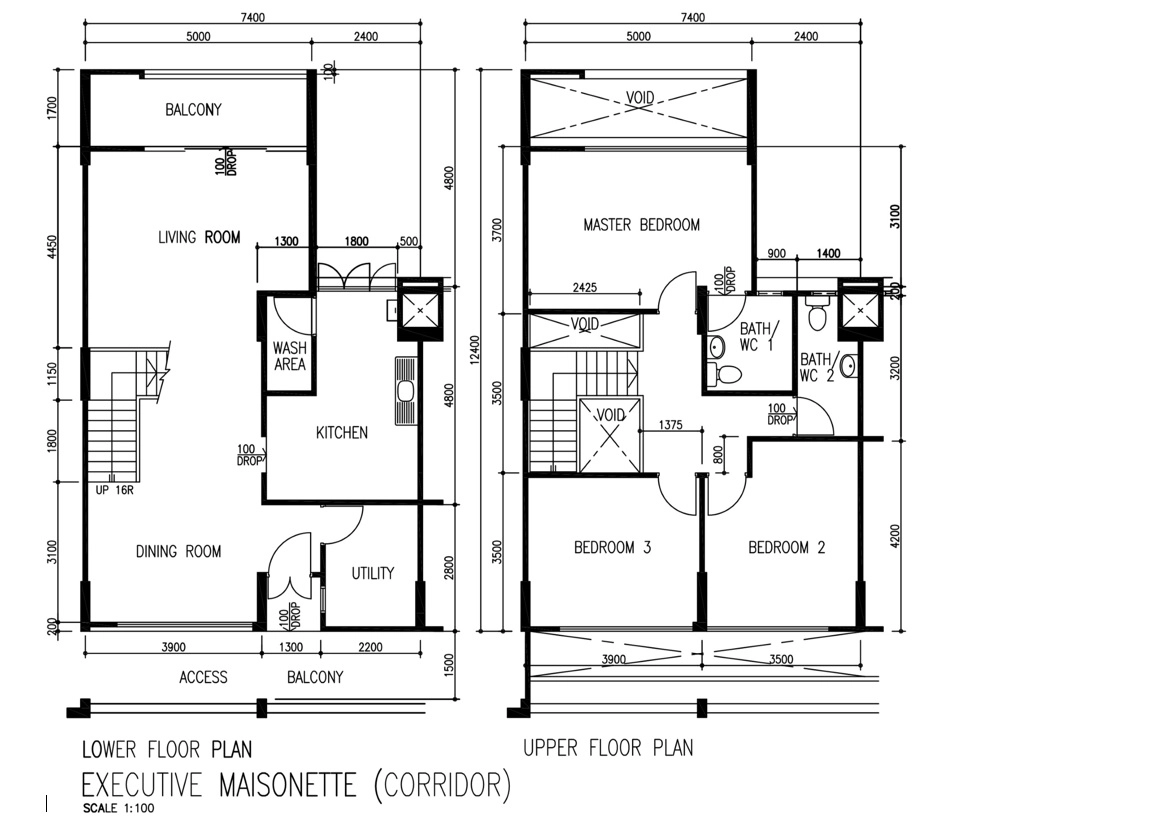

There are various sizes and types too, here are some floor plans to check out if you are considering an HDB maisonette.

As you can see the split level, balcony, high-loft ceilings, and even unique touches like a curved void space really give you a lot of options to make the space your own.

We’ve also done several house tours of Executive Maisonettes if you want to see just how different each can be:

An Old 1986 Executive Maisonette In Hougang Gets A Cosy Transformation Into A Modern Farmhouse Look

How This Old Maisonette In Paya Lebar Was Transformed With A $110k Renovation Budget

An Old 1,560 Sqft Executive Maisonette In The East Gets A Dreamy Refresh Into A Laidback Retreat

Prices and locations of HDB maisonettes today

| Town | No. of Tnx | Price | Average Price | Age | Size (SQM) |

| Ang Mo Kio | 1 | $918,000 | $918,000 | 26 | 148 |

| Bedok | 29 | $650,000 – $950,000 | $816,095 | 26 – 38 | 143 – 156 |

| Bishan | 40 | $820,000 – $1,288,000 | $1,032,225 | 30 – 37 | 143 – 199 |

| Bukit Batok | 35 | $655,000 – $1,005,000 | $776,643 | 25 – 38 | 143 – 165 |

| Bukit Panjang | 16 | $680,000 – $950,000 | $781,736 | 23 – 34 | 141 – 155 |

| Bukit Timah | 6 | $1,070,000 – $1,280,000 | $1,165,130 | 33 – 34 | 146 – 150 |

| Choa Chu Kang | 28 | $660,000 – $850,000 | $730,317 | 24 – 33 | 139 – 154 |

| Clementi | 10 | $850,000 – $954,000 | $895,450 | 37 – 38 | 147 – 161 |

| Geylang | 13 | $745,000 – $990,000 | $844,367 | 35 – 37 | 146 – 152 |

| Hougang | 62 | $680,000 – $958,000 | $811,878 | 25 – 38 | 139 – 160 |

| Jurong East | 21 | $580,000 – $955,000 | $742,709 | 24 – 38 | 140 – 155 |

| Jurong West | 43 | $600,000 – $750,000 | $669,779 | 25 – 37 | 143 – 159 |

| Kallang/Whampoa | 2 | $900,000 – $950,000 | $925,000 | 38 | 150 – 155 |

| Pasir Ris | 27 | $680,000 – $1,138,888 | $842,016 | 26 – 34 | 145 – 189 |

| Queenstown | 2 | $1,180,000 – $1,288,000 | $1,234,000 | 27 | 147 – 156 |

| Sengkang | 5 | $775,000 – $900,000 | $823,000 | 23 | 142 – 145 |

| Serangoon | 35 | $745,000 – $1,088,000 | $902,016 | 30 – 37 | 146 – 156 |

| Tampines | 91 | $705,000 – $1,013,113 | $839,079 | 25 – 38 | 141 – 157 |

| Toa Payoh | 13 | $808,000 – $1,078,666 | $938,581 | 33 – 38 | 146 – 161 |

| Woodlands | 23 | $658,000 – $885,000 | $726,348 | 23 – 34 | 141 – 146 |

| Yishun | 36 | $640,000 – $838,888 | $760,571 | 34 – 37 | 145 – 154 |

With one exception, prices of maisonettes have risen across the board. The most significant increases were in:

- Serangoon (+10.5%)

- Pasir Ris (+9%)

- Yishun (+8.9%)

- Bukit Timah (+8.9%), but note there were only six transactions

- Toa Payoh (+8.3%)

Here’s a look at the full comparison:

| Towns | 2021 | 2022 | Price Change | % Change |

| Ang Mo Kio | $928,600 | $918,000 | -$10,600 | -1.1% |

| Bedok | $804,672 | $816,095 | +$11,423 | +1.4% |

| Bishan | $996,915 | $1,032,225 | +$35,310 | +3.5% |

| Bukit Batok | $726,870 | $776,643 | +$49,773 | +6.8% |

| Bukit Panjang | $734,969 | $781,736 | +$46,767 | +6.4% |

| Bukit Timah | $1,069,782 | $1,165,130 | +$95,347 | +8.9% |

| Choa Chu Kang | $687,060 | $730,317 | +$43,257 | +6.3% |

| Clementi | $859,746 | $895,450 | +$35,704 | +4.2% |

| Geylang | $817,096 | $844,367 | +$27,271 | +3.3% |

| Hougang | $773,284 | $811,878 | +$38,594 | +5.0% |

| Jurong East | $718,968 | $742,709 | +$23,741 | +3.3% |

| Jurong West | $644,726 | $669,779 | +$25,053 | +3.9% |

| Kallang/Whampoa | $857,143 | $925,000 | +$67,857 | +7.9% |

| Pasir Ris | $772,672 | $842,016 | +$69,344 | +9.0% |

| Queenstown | $1,164,200 | $1,234,000 | +$69,800 | +6.0% |

| Sembawang | $680,000 | None | ||

| Sengkang | $744,526 | $823,000 | +$78,474 | +10.5% |

| Serangoon | $841,757 | $902,016 | +$60,259 | +7.2% |

| Tampines | $786,424 | $839,079 | +$52,655 | +6.7% |

| Toa Payoh | $866,441 | $938,581 | +$72,140 | +8.3% |

| Woodlands | $682,170 | $726,348 | +$44,177 | +6.5% |

| Yishun | $698,723 | $760,571 | +$61,848 | +8.9% |

More from Stacked

5 Cheapest 5-Room HDB Flats You Can Buy Right Now From $535k

Last week, we looked at the cheapest 4-room HDB flat listings we could find. This week, we’re exploring the most…

Ang Mo Kio was the only town where the price dipped, but we can broadly discount this as there was only a single transaction.

In terms of transaction volume, Tampines led the list, with a whopping 91 transactions. Hougang was second with 62 transactions, while Bishan saw 40 transactions.

What’s driving the price increases?

Most realtors we spoke to said EM prices were rising for the same reason resale flat prices are rising: high demand, coupled with limited supply.

As of August this year, resale flat prices have risen for 26 straight months. A blend of different factors, from Work From Home arrangements to some buyers being priced out of the private market, have maintained upward pressure on resale flat prices.

One realtor noted that HDB’s plans to cope, by ramping up flat production by 35 per cent, also happens to underline the scarcity value of older flats. She noted that the newer flats would never have the same size and features of maisonettes and jumbo flats.

She opines: “Even if HDB doubles or triples the new supply, the new flats will not be as spacious or luxurious as a maisonette. So maisonettes can keep appreciating even when the lease is quite stretched, even when the supply of flats keeps going up; higher supply doesn’t alter their perceived value in the eyes of buyers.”

Another possible reason comes from the demographic that purchases maisonettes:

“Maisonettes are older flats, so it’s usually older buyers who target them. I usually see buyers who have accumulated high savings into their 40s or 50’s, or sometimes they are private property owners who are right-sizing.

Actually, these buyers can even afford a condo if they want, so a million dollars for a flat is not unmanageable.”

However, rising interest rates could impact maisonettes more than most other flat types

One mortgage broker we spoke to warned that, when it comes to pricey and exotic flats like DBSS flats or maisonettes, rising interest rates could have an impact.

The broker noted that, for these types of properties, buyers may be told to use a bank loan instead of an HDB loan. This could be due to buyers of these flat types having a much higher income, compared to the average Singaporean (unlike BTO flats, there is no income ceiling for resale flats).

If a bank loan is to be used, then rising interest rates may be an increasing concern. At the time of writing, fixed rate home loans are inching toward three per cent per annum, while many home loan packages have reached 2.75 per cent.

This is now higher than the 2.6 per cent charged by HDB loans; so if you buy a maisonette, DBSS, jumbo flat, etc., with the bank, take note that you may be paying more interest.

The new PLH model may also cause a bump in maisonette prices

Under the Prime Location Housing (PLH) model, new flats in prime regions will come with a Minimum Occupancy Period of 10 years, and a Subsidy Recovery (SR), or a clawback upon resale, for the first batch of buyers.

However, there are flats with locations near or comparable to PLH housing, but which don’t have PLH restrictions. These properties are likely to see a bump in value, as they have the same advantages with none of the drawbacks.

Given that most maisonettes are around 30 years old this year, many are likely to be located in precisely these mature areas. As resale prices in these areas rise, maisonettes are likely to ride the same wave.

Overall, we’d raise the same caution for buyers that we did earlier in the year: while maisonettes are unique and luxurious, keep in mind the effects of lease decay. Most younger Singaporeans are better off with newer flats. And as for older Singaporeans, think hard about whether you want to climb those steps, in your twilight years.

For more updates as the situation progresses, follow us on Stacked. We’ll also provide you with in-depth reviews of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are HDB maisonettes and how big are they?

Have the prices of HDB maisonettes increased recently?

What factors are driving the increase in maisonette prices?

How might rising interest rates affect maisonette buyers?

Could the new Prime Location Housing (PLH) model influence maisonette prices?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Picks

Property Picks Where to Find Singapore’s Oldest HDB Flats (And What They Cost In 2025)

Property Picks Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025

Latest Posts

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Singapore Property News You Can Now Buy Part Of A $300M Singapore Bungalow — But You Can’t Live In It

4 Comments

I had a chance to buy a EM in Bukit Batok for $250k under a walk in selection back in 2009.