Uncovering 10 Startling Loss-Making Condos Of 2022/23: What Valuable Lessons Can We Learn?

May 29, 2023

Whether you’re checking the background of a property, or looking for a potentially undervalued unit, it helps to know the losers as well as the winners. It’s unusual indeed for projects to see substantial losses in a bull market like 2023 – but there are a number of condos that have incurred bigger losses. Here’s a rundown of these condos, as well as what you can learn from some of them:

Condos that have seen the biggest losses for 2022/23

| Project | District | Bought Price | Sold Price | Loss | Date Sold |

| THE MARQ ON PATERSON HILL | 9 | $20,542,400 | $13,380,000 | -$7,162,400 | 07 Sep 22 |

| PATERSON SUITES | 9 | $20,000,000 | $13,800,000 | -$6,200,000 | 09 Dec 22 |

| MARINA COLLECTION | 4 | $9,295,000 | $4,650,000 | -$4,645,000 | 03 Apr 23 |

| SEASCAPE | 4 | $9,600,000 | $5,500,000 | -$4,100,000 | 28 Apr 23 |

| TURQUOISE | 4 | $8,417,500 | $4,630,000 | -$3,787,500 | 27 Dec 22 |

| SEASCAPE | 4 | $9,600,000 | $5,900,000 | -$3,700,000 | 21 Oct 22 |

| REFLECTIONS AT KEPPEL BAY | 4 | $15,554,000 | $12,200,000 | -$3,354,000 | 25 Aug 22 |

| MARINA BAY SUITES | 1 | $8,250,000 | $5,000,000 | -$3,250,000 | 16 Aug 22 |

| THE LUMOS | 9 | $8,433,000 | $5,737,875 | -$2,695,125 | 22 Aug 22 |

| PATERSON SUITES | 9 | $14,532,000 | $11,850,000 | -$2,682,000 | 01 Feb 23 |

| MARINA COLLECTION | 4 | $7,700,000 | $5,050,000 | -$2,650,000 | 10 Nov 22 |

| THE ARCADIA | 11 | $10,000,000 | $7,700,000 | -$2,300,000 | 14 Jul 22 |

| MARINA COLLECTION | 4 | $5,877,650 | $3,700,000 | -$2,177,650 | Jun 22 |

| HELIOS RESIDENCES | 9 | $6,000,000 | $3,980,000 | -$2,020,000 | 14 Nov 22 |

| CITYVISTA RESIDENCES | 9 | $7,702,455 | $5,688,800 | -$2,013,655 | 21 Feb 23 |

| CITYVISTA RESIDENCES | 9 | $7,152,996 | $5,200,000 | -$1,952,996 | 07 Nov 22 |

| CITYVISTA RESIDENCES | 9 | $6,827,600 | $4,950,000 | -$1,877,600 | 19 Jul 22 |

| REFLECTIONS AT KEPPEL BAY | 4 | $9,173,000 | $7,308,000 | -$1,865,000 | 05 Sep 22 |

| HELIOS RESIDENCES | 9 | $4,983,000 | $3,150,000 | -$1,833,000 | 21 Apr 23 |

| SEASCAPE | 4 | $5,924,100 | $4,280,000 | -$1,644,100 | 24 Aug 22 |

| 3 ORCHARD BY-THE- PARK | 10 | $8,184,000 | $6,558,520 | -$1,625,480 | 21 Oct 22 |

| MARINA COLLECTION | 4 | $4,907,280 | $3,300,000 | -$1,607,280 | 21 Feb 23 |

| HELIOS RESIDENCES | 9 | $4,623,000 | $3,058,000 | -$1,565,000 | 09 Nov 22 |

| MARINA BAY SUITES | 1 | $5,304,000 | $3,808,000 | -$1,496,000 | 25 Nov 22 |

| CLIVEDEN AT GRANGE | 10 | $9,503,800 | $8,100,000 | -$1,403,800 | 15 May 23 |

| ECHELON | 3 | $6,900,000 | $5,500,000 | -$1,400,000 | 05 Jul 22 |

| ORCHARD SCOTTS | 9 | $5,500,000 | $4,100,000 | -$1,400,000 | 20 Oct 22 |

| HELIOS RESIDENCES | 9 | $4,152,000 | $2,800,000 | -$1,352,000 | 08 Jun 22 |

| THE SCOTTS TOWER | 9 | $3,080,000 | $1,770,000 | -$1,310,000 | 24 Feb 23 |

| HELIOS RESIDENCES | 9 | $4,918,200 | $3,700,000 | -$1,218,200 | 28 Jul 22 |

| REFLECTIONS AT KEPPEL BAY | 4 | $8,397,000 | $7,220,000 | -$1,177,000 | 14 Oct 22 |

| MARINA BAY SUITES | 1 | $6,386,000 | $5,250,000 | -$1,136,000 | 10 Apr 23 |

| REFLECTIONS AT KEPPEL BAY | 4 | $5,418,000 | $4,300,000 | -$1,118,000 | 31 Oct 22 |

| REFLECTIONS AT KEPPEL BAY | 4 | $4,367,700 | $3,252,000 | -$1,115,700 | 21 Mar 23 |

| REFLECTIONS AT KEPPEL BAY | 4 | $9,112,000 | $8,000,000 | -$1,112,000 | 06 Mar 23 |

| THE ORCHARD RESIDENCES | 9 | $7,800,000 | $6,700,000 | -$1,100,000 | 27 Feb 23 |

| HELIOS RESIDENCES | 9 | $5,934,400 | $4,850,000 | -$1,084,400 | 23 Mar 23 |

| THE SAIL @ MARINA BAY | 1 | $3,600,000 | $2,550,000 | -$1,050,000 | 15 Jul 22 |

| REFLECTIONS AT KEPPEL BAY | 4 | $4,833,900 | $3,800,000 | -$1,033,900 | 02 May 23 |

| ST REGIS RESIDENCES SINGAPORE | 10 | $5,692,040 | $4,680,000 | -$1,012,040 | 08 Jun 22 |

| REFLECTIONS AT KEPPEL BAY | 4 | $5,500,000 | $4,500,000 | -$1,000,000 | 09 Jan 23 |

| ROBINSON SUITES | 1 | $2,772,000 | $1,828,000 | -$944,000 | 07 Mar 23 |

| THE CLIFT | 1 | $2,326,400 | $1,400,000 | -$926,400 | 26 Aug 22 |

| HELIOS RESIDENCES | 9 | $4,146,080 | $3,220,000 | -$926,080 | 01 Dec 22 |

| REFLECTIONS AT KEPPEL BAY | 4 | $3,984,040 | $3,068,000 | -$916,040 | 17 Jan 23 |

| ORCHARD SCOTTS | 9 | $4,109,477 | $3,200,000 | -$909,477 | 23 Jun 22 |

| THE SCOTTS TOWER | 9 | $2,200,500 | $1,300,000 | -$900,500 | 25 Oct 22 |

| THE ORCHARD RESIDENCES | 9 | $10,000,000 | $9,100,000 | -$900,000 | 01 Nov 22 |

| THE ORCHARD RESIDENCES | 9 | $8,874,000 | $8,000,000 | -$874,000 | 08 Dec 22 |

| HELIOS RESIDENCES | 9 | $3,938,790 | $3,080,000 | -$858,790 | 02 Feb 23 |

Notable projects on the list

Some of the following projects have repeated entries on the list. While there are many variables as to why condos may be unprofitable, we’ve tried to pinpoint the reasons (or combination of reasons) as to why the following hasn’t fared well even in a booming market:

- Turquoise, Seascape, and The Marina Collection

- Reflections at Keppel Bay

- Paterson Suites and The Marq on Paterson Hill

1. Turquoise, Seascape, and The Marina Collection

These properties share a common trait: they are private non-landed homes in Sentosa Cove.

Sentosa Cove properties are typically purchased by wealthy foreigners, who intend to use the place as a vacation home or retreat. However, foreigners pay the highest stamp duty rates: previously an Additional Buyers Stamp Duty (ABSD) of 30 per cent, and now doubled to 60 per cent after the latest cooling measures.

After paying the hefty tax, these properties are unlikely to yield any sort of good returns; so these properties are indulgences for owner-occupiers, more often than investments.

The Marina Collection, for instance, has seen only two profitable transactions in its history (and 15 unprofitable ones).

Seascape is a regular on “top losses” lists, and has a history of massive loss-incurring transactions; from a $6.6 million loss in 2017, to a $3.7 million loss in 2019. In fact, there are no profit-making transactions recorded from Seascape to date, just a straight run of 18 losses.

Turquoise is in the same boat, with only one winning transaction to date (and 25 losses).

We trust you see the pattern by now: Sentosa Cove condos are indulgences and money sinks, albeit beautifully designed and luxurious ones.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Springleaf Residence Launches From $878K — Is This 941-Unit Mega Development Worth It?

If Springleaf Prata is the first thing that comes to mind when you think of Springleaf, you’re not completely wrong.…

Even putting aside the ABSD, there are several that work against these condos:

First, most wealthy buyers interested in Sentosa Cove that can afford such properties would probably want landed properties, not condos. These buyers don’t need resale strata-titled homes: they want something new and custom-built for themselves.

Second, buyers who are locals or Permanent Residents tend to dislike the leasehold nature of Sentosa Cove condos. These buyers can, for a comparable or sometimes lower price, purchase freehold counterparts in equally prestigious locations like Orchard, Tanglin, etc. So you face a very niche audience when trying to offload such properties. Most Singaporeans would not want to stay in Sentosa (it’s terribly inconvenient if you don’t drive), and you would likely have to sell to another foreigner.

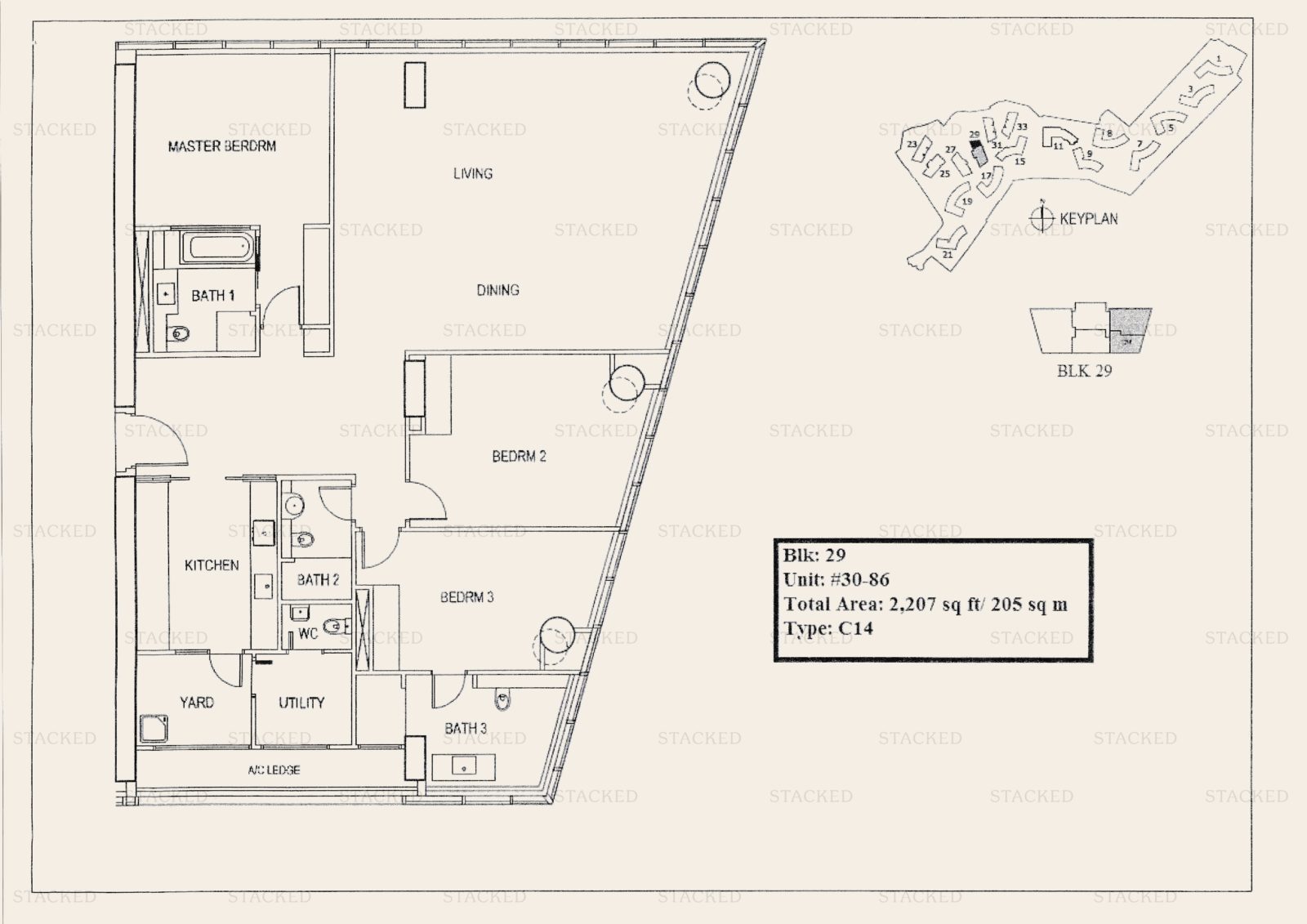

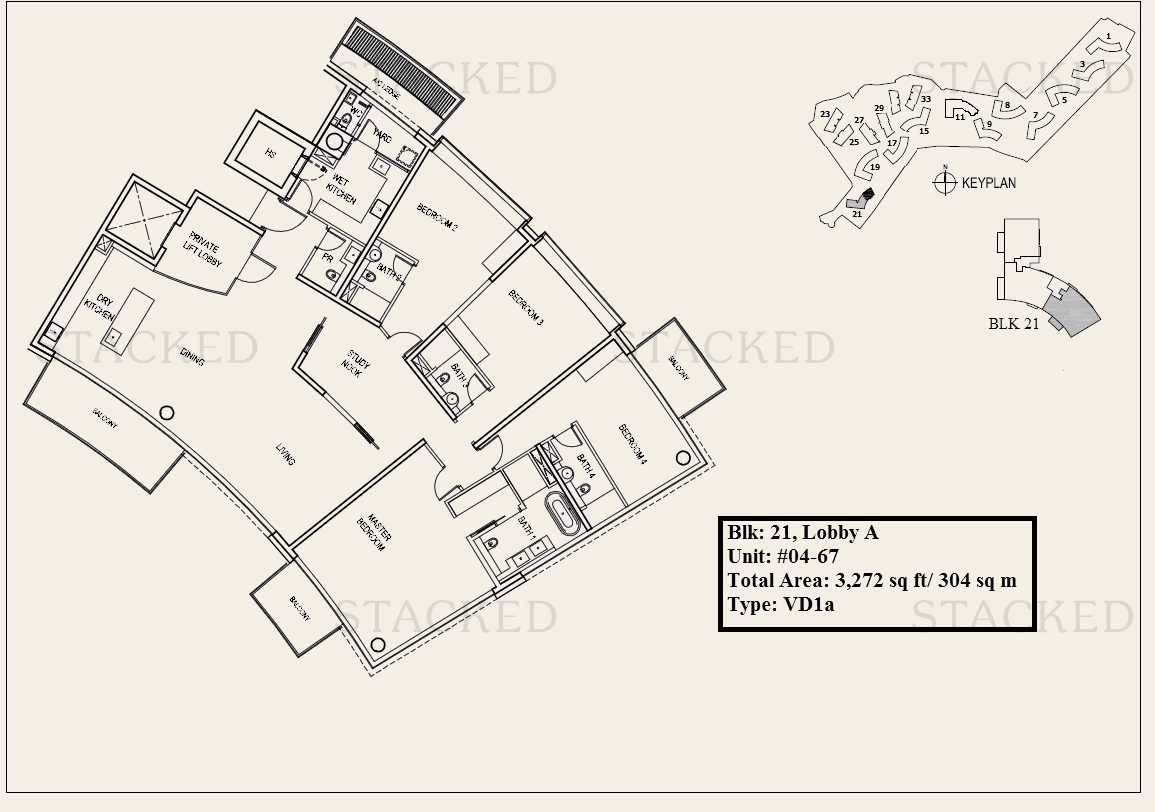

Lastly, it’s a matter of timing, as many of these initial transactions were bought during the last property market high in 2007/8. Take the latest loss at Marina Collection, for example, where a 3,272 sq. ft. unit was sold for just $1,421 psf in April 2023. This was nearly half the $2,842 psf it transacted for in March 2008.

In the years to come, losses are likely to worsen or remain the same, with the ABSD now doubled for foreigners. But don’t take this as a condemnation of Sentosa Cove condos: it’s simply that these are properties to be enjoyed, rather than invested in.

2. Reflections at Keppel Bay

Reflections at Keppel Bay topped the list for losses in the month of January this year, so we’re not surprised to see it on the list. There have been some other equally huge losses in subsequent months.

Dragging down the numbers would be three massive losing transactions:

A 2,465 sq. ft. unit (9th January 2023), a 3,391 sq. ft. unit (6th March 2023), and a 2,357 sq. ft. unit (2nd May 2023).

These transactions saw losses of $1 million, $1.12 million, and $1.03 million respectively.

Historically, the performance of this condo hasn’t been great, with 72 profitable transactions and 186 unprofitable ones. Realtors gave us a few speculative reasons for this, but one involves the Greater Southern Waterfront (GSW).

If you look at its location, you’ll note that Reflections at Keppel Bay is near the site of the former Keppel Club; this land was taken back by the government. Some believe that, along with the GSW project, there’s intent to construct an HDB estate near Reflections, likely as part of the Prime Location Housing (PLH) model. There is some anxiety over how this will affect the view and exclusivity of Reflections.

Other reasons given are the unsheltered walk to Telok Blangah MRT, or unit layouts that feature odd corners and inefficiencies. This can vary a lot depending on the unit type, and they may not always be entirely efficient.

That said, we should also consider that 2007 – the year when Reflections went up for sale – was close to a former property peak. In subsequent years, a slew of cooling measures and loan curbs (the TDSR) would kick in, making it hard to see strong resale gains. There’s also a lot to be said about trying to sell 1,129 units at such prices, as of 2023 there were still some units left for sale by the developer.

Interestingly enough, a massive 7.050 sq. ft. penthouse unit at Reflections did reach a record $6.6 million profit (a bit less minus the Sellers Stamp Duty), so the occasional unit can outperform. This is very much in line with what you’d see in properties that are seen as luxuries, as purchases are dependent on buyer emotion.

3. Paterson Suites and The Marq on Paterson Hill

Paterson Suites took a huge hit in end-2022, over the transaction of a gargantuan 6,663 sq. ft.(!) penthouse unit. This unit saw a loss of $6.2 million. Performance-wise, Paterson Suites seems to be struggling, with 18 profitable and 17 unprofitable transactions.

This is quite a strange one because, on paper, Paterson Suites seems to make sense. Just 3 and 4 bedrooms (which given the location, buyers would prefer), and it is freehold and exclusive with 102 units.

Perhaps this is down to the timing of purchases (those who bought in 2007 – some paid $3,000 psf and above), the views being blocked in the future, and because there have been bigger and more glamorous modern developments that have come up in the area.

The Marq on Paterson Hill saw an even bigger loss on a 3,089 sq. ft. unit, recording a loss of $7.75 million around September of 2022. The Marq has generally been unprofitable overall: there are only four profitable transactions dating back to 2007 (all in the same year), with 13 unprofitable transactions.

Again, this is likely due to the timing of the launch at the market peak in 2007, where prices here reached a high of $5,200+ psf. Given the large unit size as well, the quantum of such an ultra-luxury development means that it would likely only attract foreigners. Most well-heeled local buyers would be turning their attention to landed properties instead.

This often has nothing to do with the quality or location of the projects, which by all accounts are superb. It may simply be an issue of a few high-quantum units incurring large losses. We note, for instance, four profitable transactions for Paterson Suites so far in 2023, with just one loss.

With The Marq, transaction volumes are rather low (there are only 66 units), so significant losses from one or two high-quantum units can skew the perspective.

Some general observations on loss-making condos in 2023

Most of the losses are incurred by prime region, high-quantum condo units. Every realtor we spoke to had the same thing to say: these high-end properties make up a niche and very different market segment.

Singapore’s current property boom stems from mass-market properties, driven by HDB upgraders. A $14 million+ condo like The Marq, or even a $3 million+ unit at Reflections at Keppel Bay are not the sort of condos purchased by said upgraders; they’re all way beyond budget.

As such, it’s unsurprising that their prices seem to move independently of the wider market.

What may be making an impact, however, is the combination of higher interest rates and higher stamp duties. The combination of the two may cool investor interest; and when that happens, it tends to be CCR properties that bear the brunt. This may explain some of the losses above, as interest from more affluent buyers wanes.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did some condos in Sentosa Cove experience significant losses in 2022/23?

What are the main reasons for the losses at Reflections at Keppel Bay?

How do high-end condos like Paterson Suites and The Marq on Paterson Hill perform in terms of profitability?

Are losses in prime condos typical during Singapore’s property market boom?

What lessons can be learned from the condos that incurred big losses in 2022/23?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

Latest Posts

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments