This Plot Of Land In Marina Bay Got Real Estate Experts Totally Divided

July 3, 2023

Sometimes, real estate experts can be very divided on the same plot of land

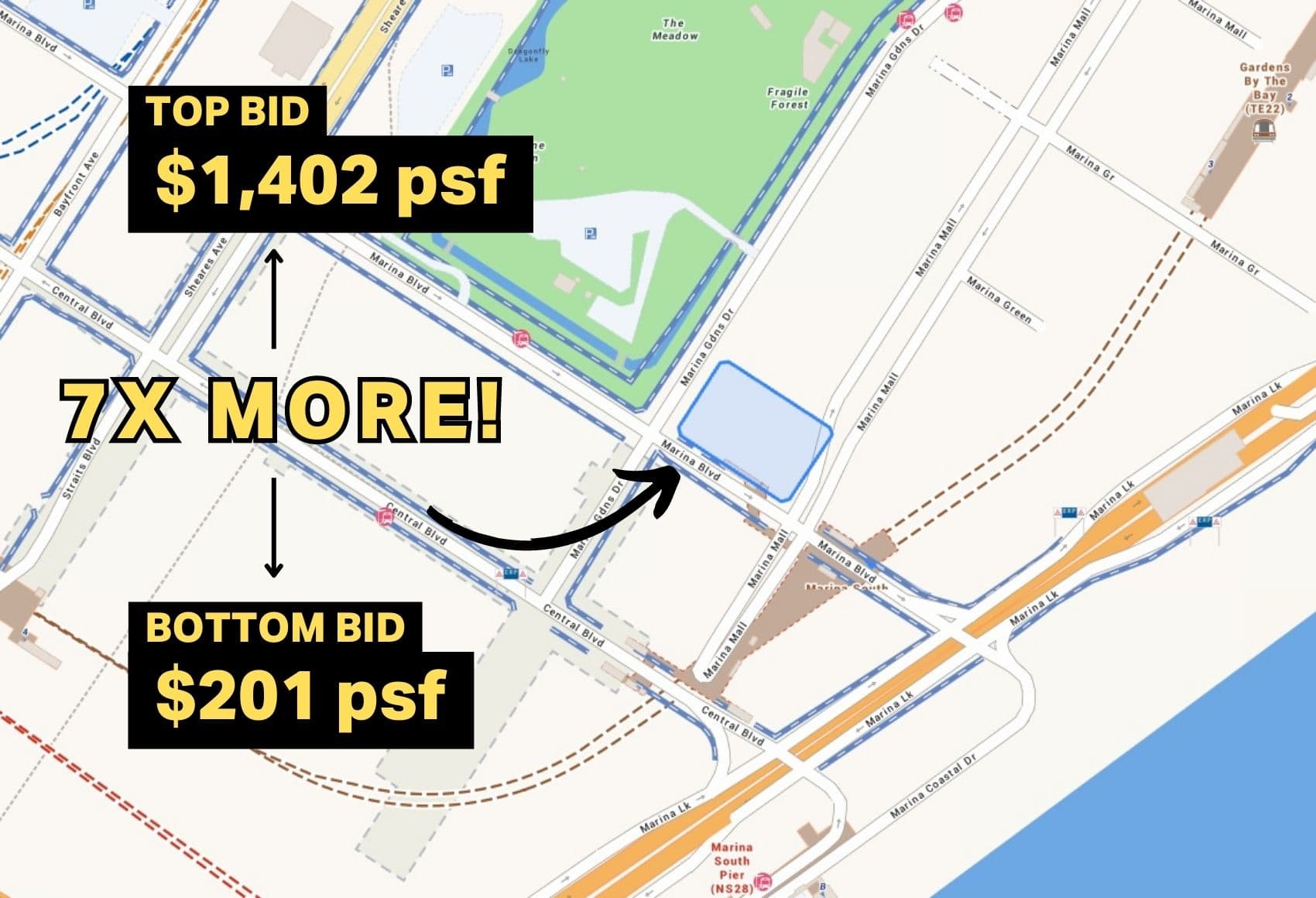

And it does show in things like bids. Take, for example, the Marina Gardens Lane plot: Kingsford Huray bid around $1,402 psf, while GuocoLand bid around $985 psf – already a huge price gap between the first and second bids (this is around a 42 per cent difference).

Far East Organization/Sino Group and CDL came a close third at around $952, but then Japura Development (linked to Hong Kong billionaire Li Ka-Shing’s CK Asset Holdings) bid… around $200 psf. I’m not sure how to take that, other than maybe someone at Japura was trying to highlight how deluded they think the others are. I can’t remember when was the last time I saw such a massive gap in opinions over the value of this plot.

Unless this was a genuine mistake, it could also reflect on the sheer difference of opinion over the Marina Gardens plot. Depending on who you ask right now, a billion-dollar price tag for this land plot (zoned for residential, with one floor of commercial) is either irrational exuberance, or a far-sighted move.

The Marina Gardens plot is a weird one: on the one hand, it’s in a prime downtown location. On the other, the area is still very under-developed; at least regarding residential prospects. There are few day-to-day amenities nearby (affordable food, low-cost grocers, etc.), so the commercial component will have to cater to that.

There are also currently no schools nearby (which could possibly change in the future), although perhaps direct access to Marina South MRT station could help to make up for that.

But new construction is expensive. At the given price tag, can the commercial component take on such lower-revenue tenants?

On top of this, prime location condos tend to be marketed more to affluent foreigners and investors, rather than owner-occupiers. But with 60 per cent ABSD for foreigners, and 20 per cent ABSD on the second property (for Singapore citizens), how confidently can a developer move a (potentially) 790-unit condo here?

I also spoke to a realtor just minutes before writing this, and she raised an interesting point: Marina One Residences may act as a cautionary tale for this area. Marina One has a shaky track record, with 19 profitable and 18 unprofitable transactions.

The Marina Bay area is ritzy; but is it somewhere people (locals) want to live? The answer so far seems uncertain.

On the flip side, you’ll have optimists who say the Marina Gardens area will see further development in due time; and that any projects here will be iconic triumphs. Perhaps it is for the developer, but bear in mind Reflections at Keppel Bay is also an architectural icon, with a terrible track record for investors.

Nevertheless, this would be the first-mover advantage that agents often like to pitch to clients to invest in. Given the amount of land yet to be redeveloped here, it may be hard to envision the final result (remember the early days of Punggol), but the smart money would be not to bet against the Government achieving that. This is a very prominent spot, so any missteps here will definitely be high profile.

Meanwhile, I notice someone backed out of buying a Blossoms By The Park unit, at a penalty of $30,000

This was reported by the Straits Times recently, but I should say it’s less uncommon than you might think. People back out purchases after putting down the non-refundable deposit, for even weirder reasons than buyer’s remorse.

I’ve even met someone who did with an HDB flat, back in the early ‘00s. The reason was his putting down the deposit before obtaining the HDB loan eligibility letter. Later he was unable to secure the HDB loan, and had to forfeit the deposit.

(I believe in recent years however, HDB has tweaked the process to prevent such situations)

Perhaps the most disastrous situation I encountered was a couple who secured OTP, but the husband passed away a few days later. The lone spouse was unable to qualify for the mortgage on her own, resulting in the loss of the deposit.

More from Stacked

Neighbourhood Of The Week: Queenstown (District 3)

Queenstown is the first satellite town in Singapore. The entire concept of having a “self-contained” township, with its own council,…

In any case, let this be a public service announcement and reminder: please secure your in-principal approval from the bank, BEFORE you put down the deposit.

Meanwhile, in other serious property news:

- Singapore has many condos that are architectural icons. But are they actually good from an investor’s perspective? Here’s a look at how they’re doing.

- Does the ABSD truly help to lower prices? In my opinion, lowering home prices may have more to do with loan curbs.

- A new launch condo where the quantu m can be under $1 million is a rarity in 2023; but there’s one right now in Upper Bukit Timah. Check out The Myst. (While you’re at it, Google Myst, which is an awesome classic point-and-click adventure game).

- Do you think boutique condos are just luxuries for rich people, with no investment potential? Here are 21 examples of tiny condos that have defied the odds.

Weekly Sales Roundup (18 – 25 June)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| KLIMT CAIRNHILL | $5,050,000 | 1432 | $3,527 | FH |

| THE RESERVE RESIDENCES | $3,844,811 | 1625 | $2,366 | 99 yrs (/2021) |

| ONE PEARL BANK | $3,800,000 | 1399 | $2,716 | 99 yrs (/2019) |

| THE RESERVE RESIDENCES | $3,673,344 | 1475 | $2,491 | 99 yrs (/2021) |

| BLOSSOMS BY THE PARK | $3,348,000 | 1302 | $2,571 | 99 yrs (/2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| LAVENDER RESIDENCE | $1,182,000 | 592 | $1,997 | 99 yrs |

| NORTH GAIA | $1,219,000 | 969 | $1,258 | 99 yrs (/2021) |

| LEEDON GREEN | $1,689,000 | 689 | $2,452 | FH |

| HYLL ON HOLLAND | $1,725,400 | 614 | $2,812 | FH |

| PIERMONT GRAND | $1,803,000 | 1335 | $1,351 | 99 yrs (/2018) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE MARQ ON PATERSON HILL | $13,000,000 | 3089 | $4,208 | FH |

| ST THOMAS SUITES | $5,700,000 | 2605 | $2,188 | FH |

| PEBBLE BAY | $4,150,000 | 2336 | $1,777 | 99 yrs (1994) |

| BALMORAL GATE | $3,400,000 | 1625 | $2,092 | FH |

| LUCKY PLAZA | $3,200,000 | 1550 | $2,064 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SUITES @ TOPAZ | $650,000 | 388 | $1,677 | FH |

| SUITES @ SHREWSBURY | $650,000 | 334 | $1,948 | FH |

| SUITES @ PAYA LEBAR | $655,000 | 398 | $1,645 | FH |

| HAIG 162 | $655,000 | 344 | $1,902 | FH |

| 38 I SUITES | $780,000 | 452 | $1,725 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| LUCKY PLAZA | $3,200,000 | 1550 | $2,064 | $1,750,000 | 26 Years |

| THE TESSARINA | $2,880,000 | 1356 | $2,123 | $1,685,000 | 23 Years |

| THE METROPOLITAN CONDOMINIUM | $2,900,000 | 1744 | $1,663 | $1,560,800 | 17 Years |

| PEBBLE BAY | $4,150,000 | 2336 | $1,777 | $1,230,000 | 6 Years |

| ST THOMAS SUITES | $5,700,000 | 2605 | $2,188 | $1,223,000 | 16 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| M5 | $950,000 | 474 | $2,006 | -$144,000 | 5 Years |

| VISIONCREST | $2,800,000 | 1227 | $2,282 | -$61,100 | 16 Years |

| THE MONTANA | $1,195,000 | 549 | $2,177 | -$30,320 | 9 Years |

| LOFT @ NATHAN | $880,000 | 463 | $1,901 | -$23,800 | 12 Years |

| GOODWOOD GRAND | $2,188,000 | 893 | $2,449 | -$11,000 | 6 Years |

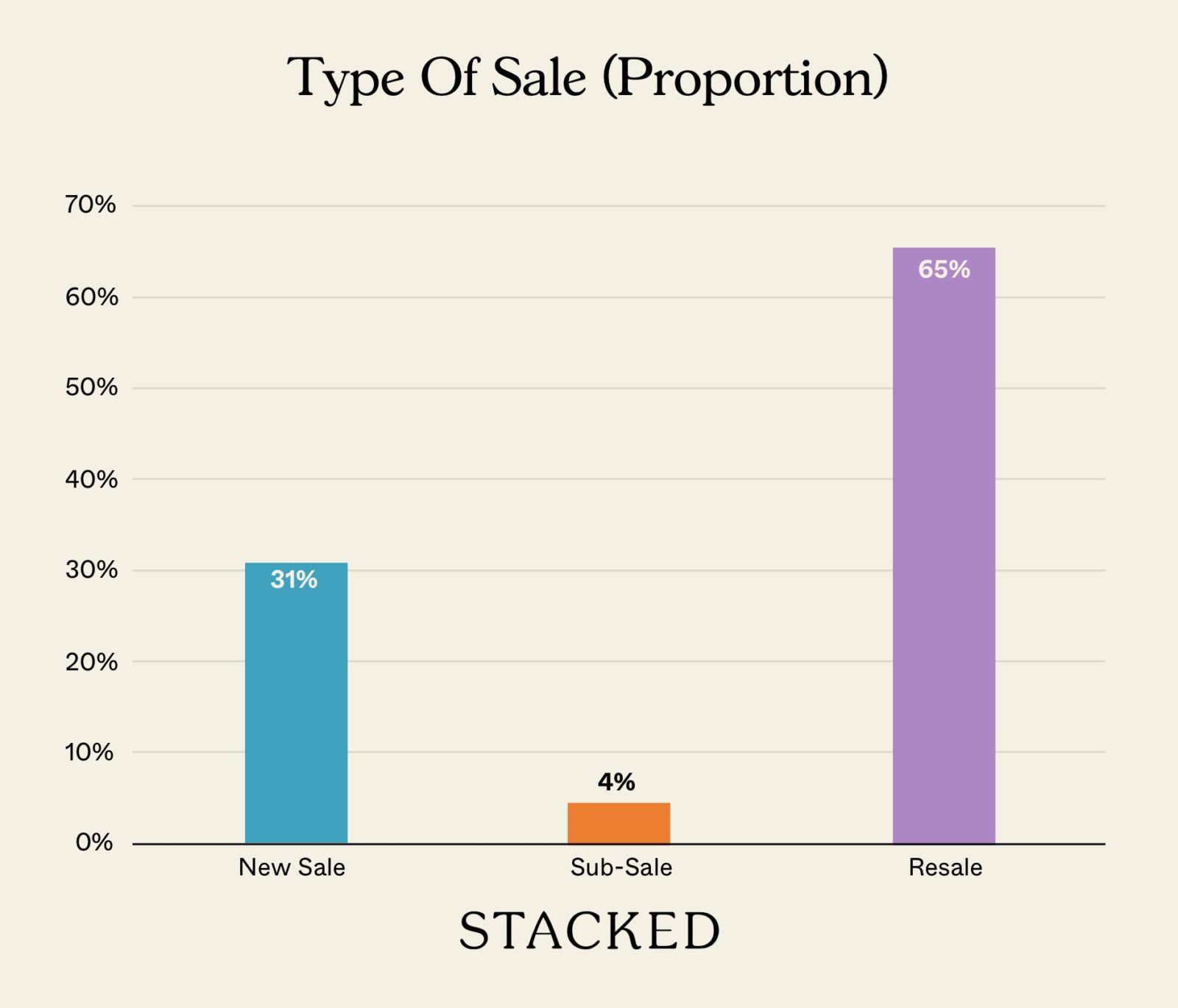

Transaction Breakdown

My favourite links of the week

- A genuinely good car ad

I came across this post on LinkedIn by Rémy Rey-De Barros who wrote a great hook of an introduction:

Imagine an agency pitching this: “How about we make a 4h commercial with a cartoon character driving your car, some low-fi music playing continually, no dialogue, and absolutely no action other than subtle background changes that periodically flash your brand?”

Well, that’s exactly what Nissan did to promote its new electric SUV that has garnered more than 18 million views on Youtube in 4 months.

This just reminds me of the often cringe, downright typical lifestyle advertising videos that our new launches often showcase here. Would definitely love to see some more creative advertising!

- Try before you buy a home

Since we are on the topic of creative advertising, what about being able to try before you buy a home?

I came across this ad that allows you to sleep at the house for a night before committing to an offer. It makes a ton of sense, doesn’t it? You can test drive million dollar cars before buying, so why not a home?

Admittedly, this can’t be done for a new launch, and you need to do more careful checks to sieve out serious buyers, but I would assume that you should get good conversions here.

Any developers keen to try?

Follow us on Stacked for the latest news and trends in the Singapore property market, as well as in-depth reviews of new and resale developments alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are real estate experts divided over the value of the Marina Gardens Lane plot?

What are the concerns about developing the Marina Gardens plot?

How does the location of Marina Gardens affect its development prospects?

What should buyers consider before purchasing property in Singapore, based on the article?

Are boutique condos in Singapore good investments?

Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

0 Comments