The Trivelis DBSS Vs Clementi Ridges Issue 10 Years On: Did Trivelis Owners Really Lose Out?

December 20, 2022

Several years ago, the DBSS project Trivelis made the news, but not in a good way. Besides some quality complaints, the biggest issue was due to their newer neighbour next door. Buyers were miffed when a BTO project – Clementi Ridges – launched next door to them.

Probably the most frustrating thing was the timing of it all. Clementi Ridges was announced just 5 months after, and it would be bigger, cheaper, and newer by a year. Views would also be blocked, as Clementi Ridges would be at the same 40-storeys. It was also reported that some even forfeited their Trivelis deposit to try their luck on the Clementi Ridges BTO, such was the appeal.

However, some argued that Trivelis may still have been a good deal, as the quality of DBSS flats would win out. Now, close to a decade after Trivelis was launched, let’s see the outcome by comparing the prices between the two:

Many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The significance of Trivelis vs. Clementi Ridges

The Design, Build, and Sell Scheme (DBSS) was another mid-point between condos and flats. They were designed and built entirely by private developers, but did not have the common facilities associated with full-fledged condos or Executive Condos (ECs). They were also sold under the auspices of HDB, rather than sold directly by developers in show flats.

Due to several complaints involving quality and rising cost (and frankly, it just wasn’t differentiated enough), DBSS was suspended indefinitely in 2012. This is where the story of Trivelis comes in.

Trivelis was the second-last DBSS project to be launched; and on the ground, there have always been rumours that it was the final nail in the DBSS coffin. Trivelis buyers complained about several defects, but that wasn’t even the biggest issue: their biggest gripe was the launch of a BTO project next door, called Clementi Ridges. As you’ll see below, Clementi Ridges was both significantly cheaper, and yet larger. This caused several Trivelis buyers to cry foul, and feel they’d been short-changed.

Not everyone agreed with this, however. Some felt that DBSS status would mean Trivelis will see higher demand, and win out in gains in the end. Over the course of last year, it was also seen that many of the million-dollar flats were in fact DBSS projects, regardless of earlier complaints over quality.

As we approach 2023, we decided to check on the prices at Trivelis and Clementi Ridges, to see whether the “DBSS effect” has ultimately turned things around:

How have prices moved since launch?

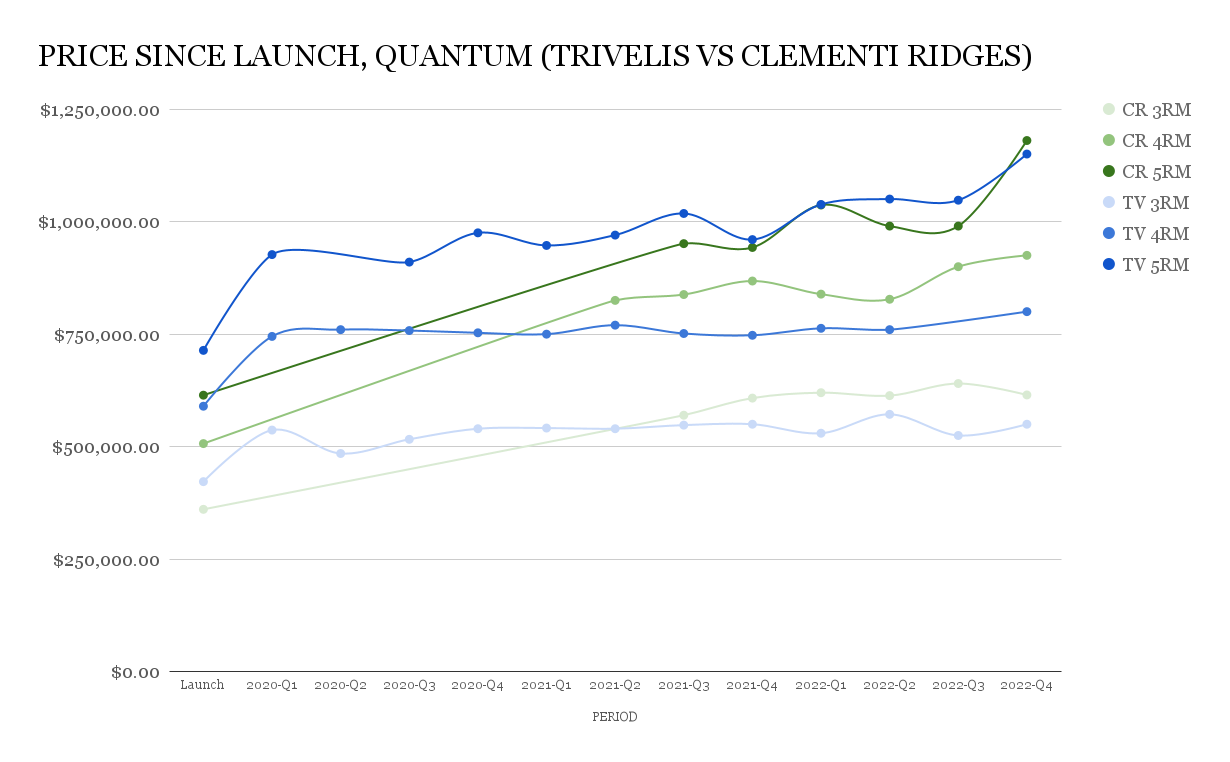

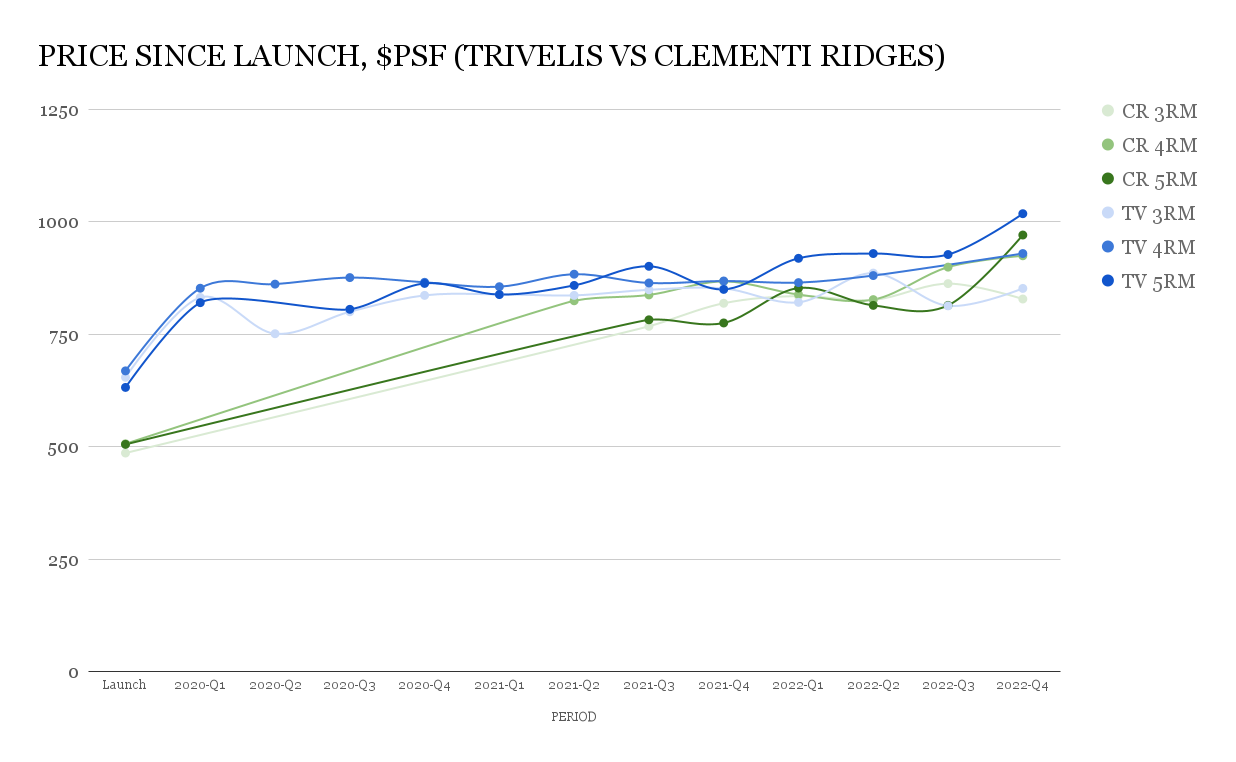

Trivelis and Clementi Ridges were launched less than half a year apart, with Trivelis launching in October 2011, and Clementi Ridges launching in March the next year. Here’s how their prices have moved:

(Do note that CR = Clementi Ridges, TV = Trivelis. It was shortened for ease of viewing).

Notable details:

- Clementi Ridges had a head-start due to the much lower pricing

- Size probably worked to Clementi Ridges advantage

- 5-room flats make the difference

1. Clementi Ridges had a head-start due to the much lower pricing

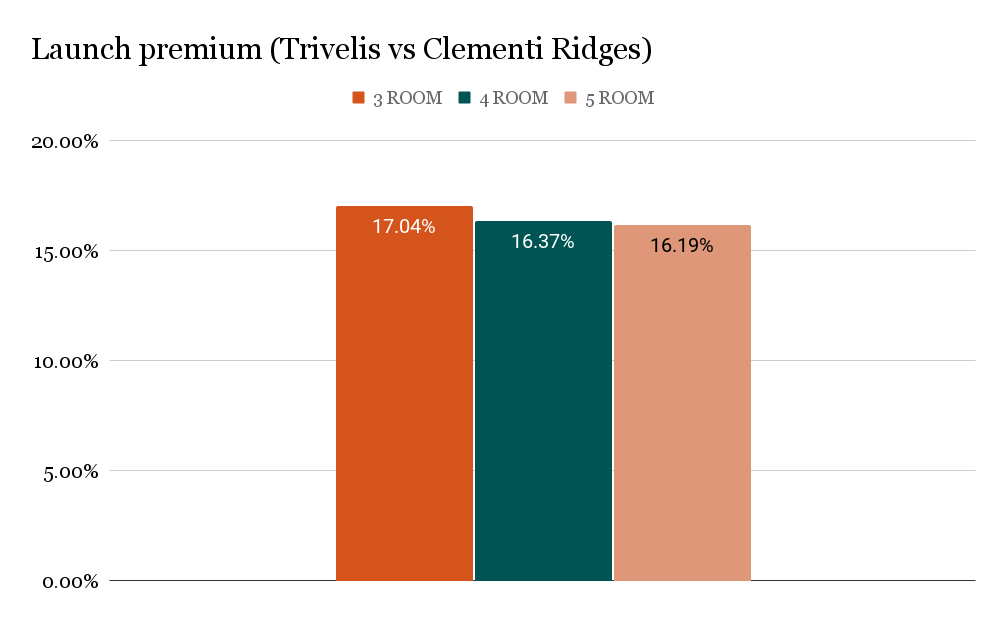

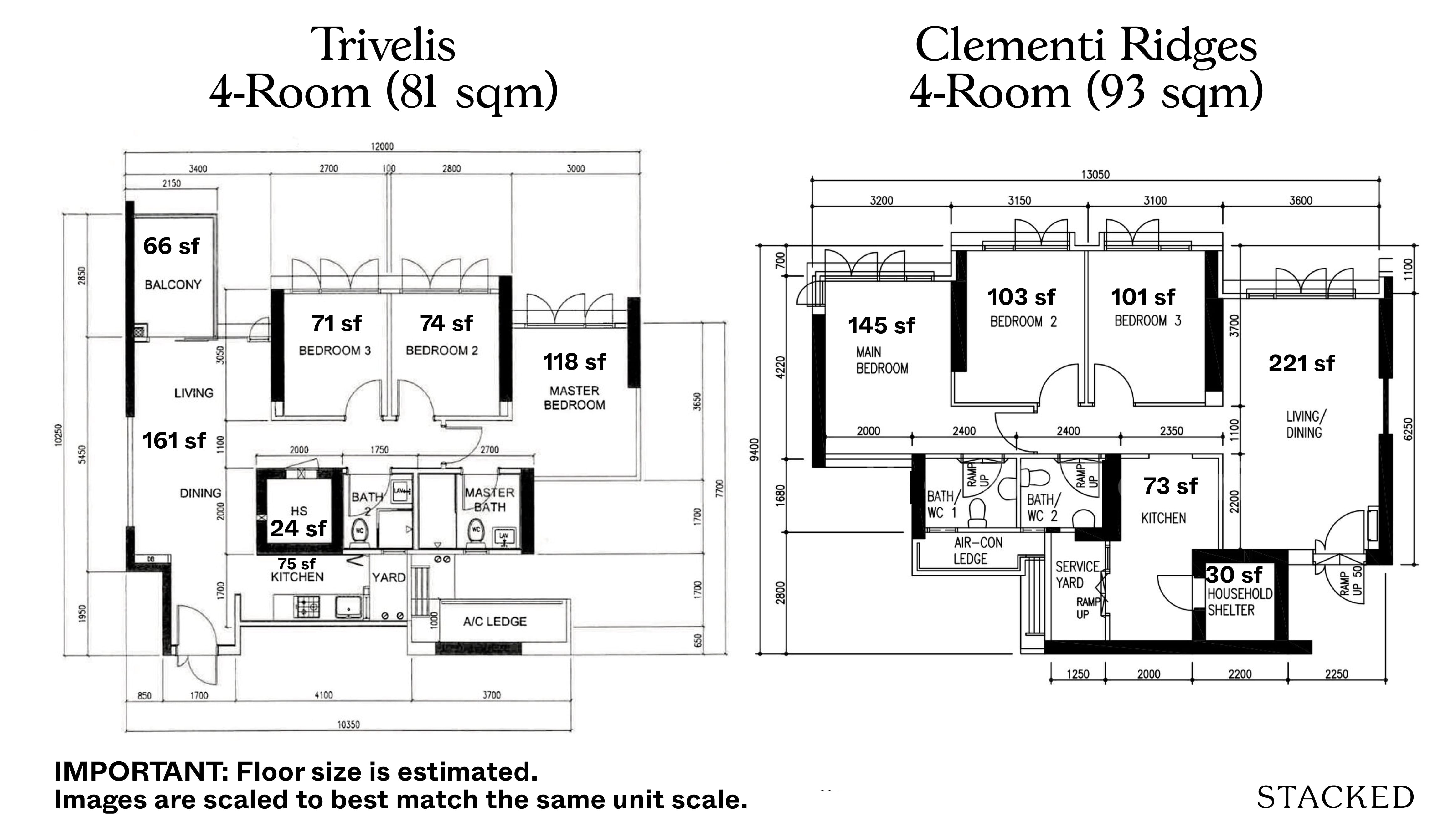

In terms of overall quantum, a 4-room flat at Clementi Ridges was about $507,000 at launch, compared to $590,000 at Trivelis. A 5-room flat was $614,500 at Clementi Ridges, but $714,000 at Trivelis. Overall, Trivelis was about 16 to 17 per cent more expensive.

(There were news reports at the time that Clement Ridges cost 25 per cent less, but this is true only for price per square foot; see above).

It’s quite tough for Trivelis to compete under these circumstances: both properties were almost the same age with the same general location, and Clementi Ridges tended to have larger units.

Trivelis only had “better finishing” from private developers to count on; and it’s unlikely that alone could make up for a 16 per cent price gap; especially not when complaints about defects began to pour in.

As an aside, note that over time, Clementi Ridges also managed to close the price psf gap with Trivelis!

More from Stacked

CPF Accrued Interest: Why You Should Not Pay For Your HDB With CPF

So you've reached one of the most important milestones in your life - buying your first home.

2. Size probably worked to Clementi Ridges advantage

HDB flat buyers are overwhelmingly family units. These buyers tend to prize space above many other concerns; you can see it in the constant complaints about how HDB flats have gotten smaller.

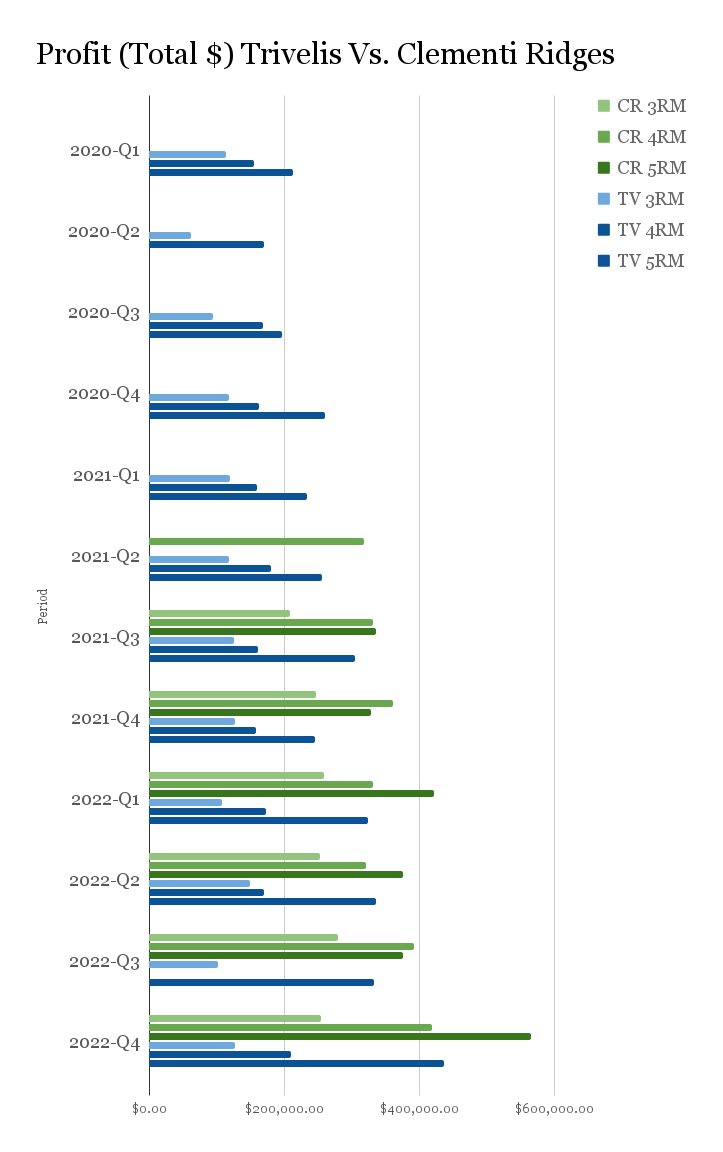

Along with the lower launch price, this might explain why Clementi Ridges ended up performing so much better on the resale market. From the numbers above, we can see transactions with 65 to 70 per cent profit for Clementi Ridges, while the typical profit for Trivelis is 27 to 40 per cent.

Overall, those who bought and sold Clementi Ridges would be making around twice as much as their Trivelis neighbours.

3. 5-room flats make the difference

The different sized units in Clementi Ridges see a comparable distribution of profits (as a percentage). But for Trivelis, the 5-room flat clearly beats out the 3 and 4-room counterparts. This is, again, likely related to size; and the 3 and 4-room units probably look small in contrast to the 5-room units.

Among the initial buyers at Trivelis, those who opted for the largest units have probably fared the best.

HDB ReviewsTrivelis Clementi DBSS Review: Convenience & Greenery But Small Living Spaces

by Reuben DhanarajA quick note on the defects

Some will definitely ask why we’re not bringing up the issue of defects, as there were several complaints about Trivelis; this even made it into the media.

This included:

- Defective stove knobs

- Rusty dish racks

- Poor quality laminate flooring

- Flooding along the corridor

- Scratched floor tiles

- Exposed sanitary pipes and water heater

We hesitate to do so because the phenomenon was not specific to Trivelis. Even the very last DBSS flat in the series, Pasir Ris One, ended up with complaints like its narrow corridors (an arguably worse problem than Trivelis, since it’s not fixable). Some of the DBSS flats that had complaints have subsequently done well. The Peak at Toa Payoh, for instance, saw numerous complaints at first; but even have been flats that have reached the million-dollar mark.

We can’t be certain that the defects haven’t, at this point, been sufficiently corrected or just accepted; perhaps to the point where they don’t impact price.

Two important takeaways from the Trivelis vs. Clementi Ridges situation

The first is that we need to pay attention to nearby land plots, before buying. If we can spot nearby plots for residential development, we need to consider the potential impact if they end up blocking the view, creating more traffic, or just making your property look like a poor alternative (in this case, by being both larger and cheaper).

The second, which is perhaps more for the authorities, is that developers should be made to sell the units on their own – not under the auspices of a government agency.

Notice that ECs, for which developers need to build showflats and handle all the marketing, never got as many complaints as DBSS projects.

With DBSS, units were sold through HDB. This may have had the unintended effect of subjecting the projects to less scrutiny, as Singaporeans overwhelmingly trust HDB (while often overlooking the fact that HDB didn’t build their DBSS flats).

In any case, given the learnings and outcome from the DBSS projects, we are unlikely to see such a scheme again.

For more on the Singapore property market, follow us on Stacked. We’ll provide you with price movements and in-depth reviews, so you can make a better decision.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Did Trivelis owners lose out compared to Clementi Ridges buyers?

Why was the DBSS scheme suspended and how did it affect projects like Trivelis?

How did the prices of Trivelis compare to Clementi Ridges when they launched?

What role did flat size play in the resale performance of Clementi Ridges versus Trivelis?

Were there issues with defects in Trivelis, and did they impact the flats' value?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

1 Comments

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?