The Rise Of Million-Dollar HDB Flats In Singapore: Is This Going To Be The New Norm?

January 22, 2024

Million-dollar HDB flats are still outliers, making up some one per cent of HDB transactions; and even those that are close to a million (e.g., $800,000 or $900,000) are hardly the majority. However, there’s no denying that these outliers are growing in number – and fast. In 2023, we had a record number of million-dollar flats (460 units), up from the previous year’s record of 369 such transactions. If you’ve followed us on Stacked, you might also have seen this list of soon-to-be million-dollar flats.

Will this be a continuing trend? Let’s first examine how many more HDB flats are close to that million-dollar mark.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

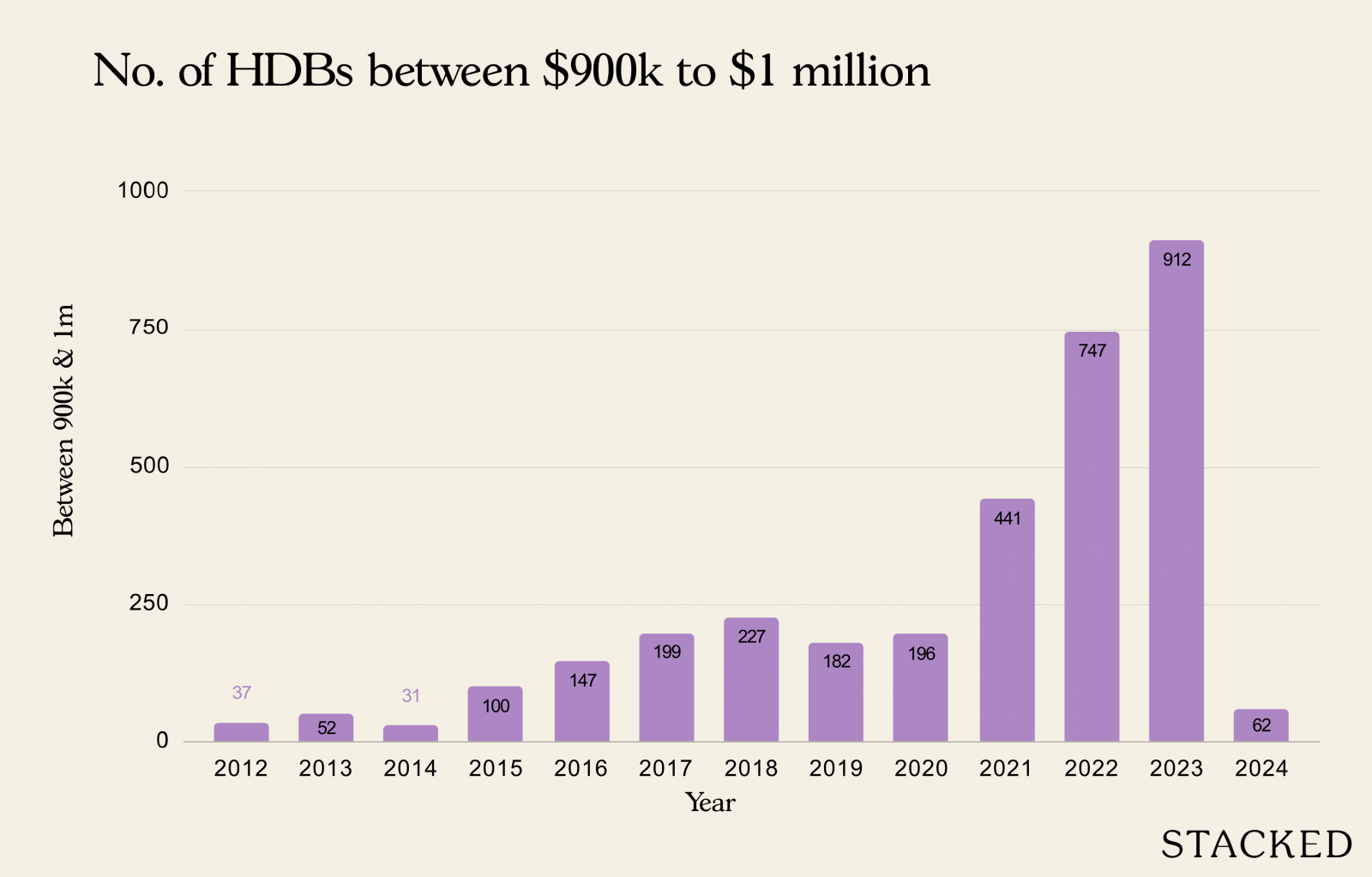

Close to million-dollar flats have grown in number almost every year

| Year | <900k or >1m | Between 900k & 1m | Total | Proportion |

| 2012 | 23161 | 37 | 23198 | 0.16% |

| 2013 | 16045 | 52 | 16097 | 0.32% |

| 2014 | 16065 | 31 | 16096 | 0.19% |

| 2015 | 17680 | 100 | 17780 | 0.56% |

| 2016 | 19226 | 147 | 19373 | 0.76% |

| 2017 | 20310 | 199 | 20509 | 0.97% |

| 2018 | 21334 | 227 | 21561 | 1.05% |

| 2019 | 22004 | 182 | 22186 | 0.82% |

| 2020 | 23137 | 196 | 23333 | 0.84% |

| 2021 | 28646 | 441 | 29087 | 1.52% |

| 2022 | 25973 | 747 | 26720 | 2.80% |

| 2023 | 24862 | 912 | 25774 | 3.54% |

| 2024 | 1679 | 62 | 1741 | 3.56% |

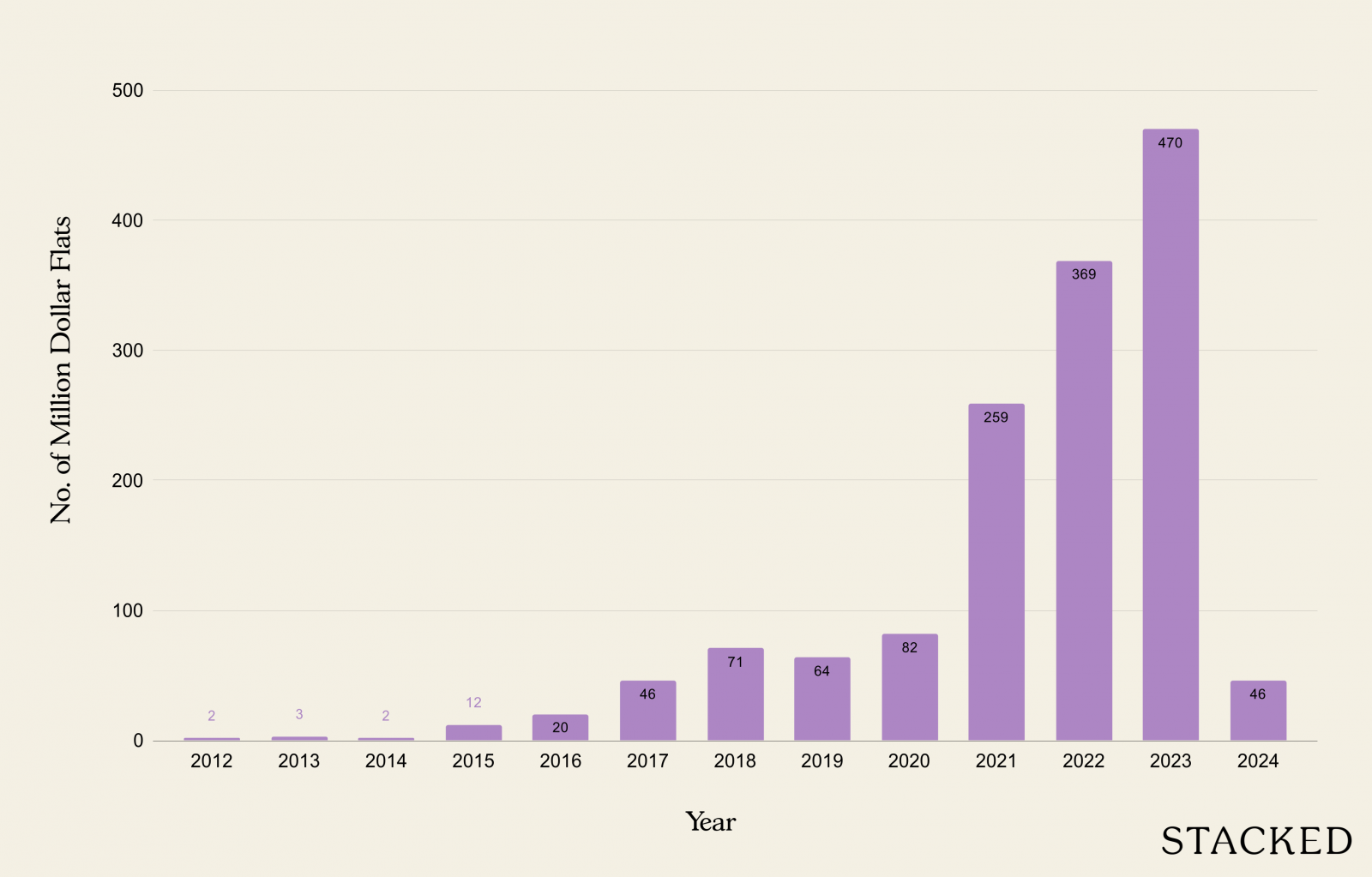

Million-dollar flats have also grown in number almost every year

| Year | No. of Million Dollar Flats | Total Volume | % Million Dollar Flats |

| 2012 | 2 | 23,198 | 0.01% |

| 2013 | 3 | 16,097 | 0.02% |

| 2014 | 2 | 16,096 | 0.01% |

| 2015 | 12 | 17,780 | 0.07% |

| 2016 | 20 | 19,373 | 0.10% |

| 2017 | 46 | 20,509 | 0.22% |

| 2018 | 71 | 21,561 | 0.33% |

| 2019 | 64 | 22,186 | 0.29% |

| 2020 | 82 | 23,333 | 0.35% |

| 2021 | 259 | 29,087 | 0.89% |

| 2022 | 369 | 26,720 | 1.38% |

| 2023 | 470 | 25,774 | 1.82% |

| 2024 | 46 | 1,741 | 2.64% |

Looking at the numbers, we can see that the number of soon-to-be million-dollar HDB flats declined year-on-year on two occasions: between 2013 and 2014, and between 2018 and 2019. Barring these two occasions, the number of million-dollar/near-million-dollar flats has grown every other year since 2012.

But why the dip during these two periods?

From 2013 to 2014, two big changes were introduced to the HDB market: first, the Mortgage Servicing Ratio (MSR) came into being. This capped monthly loan repayments to 30 per cent of the borrower’s income, which placed significant downward pressure on the prices.

The second big change was that HDB stopped publishing Cash Over Valuation (COV) rates. Prior to this, buyers and sellers would obtain the valuation, and then haggle over the COV amount; it was a given that COV would always exist.

HDB changed this so that now, buyers and sellers need to agree on the amount first, and HDB will only disclose the valuation later. This caused COV rates to fall to zero in many transactions, by the time we were in 2014.

Note that almost every soon-to-be million-dollar HDB flat involves a large COV amount, as HDB rarely values flats at that sort of pricing (at least at the time).

As an interesting aside, the dip in 2013 shows how different the wider HDB resale market is from the million-dollar flats

The number of million and near-million-dollar HDB flats dipped in 2014, but rose again in 2015. This was not the case for the wider HDB resale market, which sank into a slump that lasted all the way to around Covid:

So it’s interesting to note that the number of million-dollar and near-million dollar HDB flats can rise, even as the HDB resale market is declining. The two don’t always move in tandem, and a rising number of near-million-dollar flats doesn’t always mean all resale flats are getting more expensive…

The next dip, between 2018 and 2019 and the year after, is likely due to supply issues. During this year, a bumper crop of around 30,000 flats reached their Minimum Occupancy Period (MOP); some buyers may also have opted for these newer flats (some just five-years old), over their pricier and older counterparts.

More from Stacked

Tour This Dawson BTO Transformation: How A Couple Achieved A Cosy Korean Aesthetic Look With A $50k Reno Budget

Who doesn’t like to work from home?

This is rather ironic, as a mere year later, there would be a serious housing shortage that would drive up the prices. COVID-19 caused a literal U-turn, as a combination of Work From Home, delayed construction, and even upgraders opting for a bigger resale flat instead of a condo all rushed into the market.

Post-Covid has been the most significant period for million-dollar flats

As we can see from above, the number of million-dollar flat transactions exploded in the aftermath of COVID-19 – it grew by around a single percentage point every year from 2020 to 2023.

One often mooted reason is that, after the trauma of Covid and the rise of Work From Home, buyers started to look for bigger flats; even younger buyers started to show interest in old, big HDB flats (i.e., the ones more likely to be able to approach the million-dollar mark). Living space trumped concerns over the remaining lease.

Also, the private residential market was getting increasingly expensive, and there were more buyers being priced out.

Coupled with the desire to move in immediately, this saw the return of COV (we covered this in an earlier article, during those years.)

Will the growth of million-dollar flats continue?

Two new factors could impact these near-million-dollar transactions and the current trend. The first is the Prime and Plus housing models.

As these are totally new to the market, we don’t yet know exactly how they’ll impact resale prices going forward (and it will be a while more before we know, as they have 10-year MOPs). The question here is whether Singaporeans will be willing to ballot and wait for a Prime or Plus flat, rather than fork out high COV for a million-dollar resale flat.

For the first time in a long while, it’s become “easier” to get a key location like Bukit Merah, Queenstown, Kallang-Whampoa, etc. in the form of a BTO flat.

On the flip side though, Prime and Plus restrictions are not retroactively applied to existing flats, which are already in desirable areas. Who wants to buy a new flat with a 10-year MOP and four-year construction time, when there’s a resale flat 10 minutes away that has a five-year MOP, and can be moved into right away?

So it’s entirely possible that sellers near Prime and Plus areas will raise their prices (we have more on this here as it seems to already be happening on the ground), and cause the appearance of more high-priced resale flats; at least in the near term.

We should also add that Prime and Plus flats come with an income ceiling of $14,000 per month, whereas resale flats still have no ceiling. So the more affluent buyers are still being channelled toward resale, where they can drive prices up.

The second factor, which is relevant over a longer period, is age.

Most high-priced flats are also older flats; a good number, such as Maisonettes, date back to the ‘80s and before. For now, Singapore has yet to see an HDB estate reach the end of its lease; but that’s inevitably going to change (or at least, consumer perceptions may start to change the older these get).

When some flats have just 30 years left, for example, will buyers still fork out huge sums just because they’re jumbo, maisonettes, HDB landed properties, etc.? As the reality of a declining lease sinks in, we may see less enthusiasm for million-dollar flats going forward.

Ultimately though, million-dollar and near-million-dollar HDB flats remain outliers, and it’s improbable that we’ll see them become the norm in the near future. What we will likely see, however, is that every HDB town will have at least a handful of these flats; perhaps on account of being closer to the mall or MRT station. So it may no longer just be in “hotspots” like Bishan, Tiong Bahru, etc. where we glimpse such transactions.

In the long-run, however, we can expect to see a greater proportion of million-dollar HDBs given both inflation and population growth. This implies that the yearly cost to stay in any form of housing would only go up – even HDBs.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are million-dollar HDB flats common in Singapore?

Why did the number of million-dollar HDB flats decline in 2014 and 2019?

Has COVID-19 affected the prices of HDB flats in Singapore?

Will the trend of rising million-dollar HDB flats continue?

How do Prime and Plus flats impact the resale market?

Could older flats with fewer years left on their lease become less expensive?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

0 Comments