The Differing Sale Tactics Of Chuan Park And Emerald of Katong

November 24, 2024

Fast or slow: what’s the best way to sell a condo?

The answer seems obvious right? But not quite. Speed does count to some extent: condo developers work within tight time constraints – if the project isn’t completed and sold in five years, they risk paying a hefty ABSD.

(Yes, developers pay ABSD too, not just buyers; and since their ABSD is a percentage of the land price, we’re talking multi-million dollar penalties here. There has been a slight concession in 2024, which you can read about here.)

When you have a ticking clock like that, speed is one way to reduce risk. The lower the price, the faster the units move – and sometimes a developer may choose to reduce their margins to make that happen.

Take, for instance, Emerald of Katong. Prices were surprisingly competitive for this District 15 condo, and this is despite launching after the Grand Dunman, Tembusu Grand, and The Continuum. Not to mention, despite more demand than Chuan Park (if we were to go by the number of cheques), there were no price increases on the day itself.

You can see a comprehensive price breakdown here.

The pricing had the desired result, with Emerald of Katong being hands-down the bestseller of the quarter; and quite likely the year. It was 99 per cent sold on the launch weekend, with the only downside from sales teams being the risk of burst bladders. We’re told some of them were so busy, they could barely take a minute to run to the toilet.

There’s a tradeoff that you may not see behind this though:

We don’t know if this was all part of the plan, but we do know some developers have had some kind of remorse even if the condo sells out. Sounds strange?

That’s because when sales practically begin and end with the launch weekend, and the competitive angle is pricing, the developers may be leaving money on the table. Put it this way: You could sell condo units that would fetch $2 million for $1.5 million all day. The queue would be around the block. But total up the money that could have been made from the sale, and the developer has to ask if they played it too safe. (These were the same questions asked after the impressive results from the Clavon launch).

Given that developers today work on thinning margins and need hefty sums to roll into the next project, the decision to go this route is a tough one to make.

Conversely, Chuan Park has adopted a different approach

Chuan Park is also seeing good sales numbers, although not to the extent of 99 per cent sold out on one weekend. Still, 76 per cent sold on a launch weekend is nothing to sneeze at either. The developer does seem content to go slower though, and some buyers (who were probably new to the market) were miffed at the fact that prices were increased multiple times on launch day. This isn’t anything new, if anyone remembers Pasir Ris 8, prices were increased 6 times during the day – forcing some buyers to walk away.

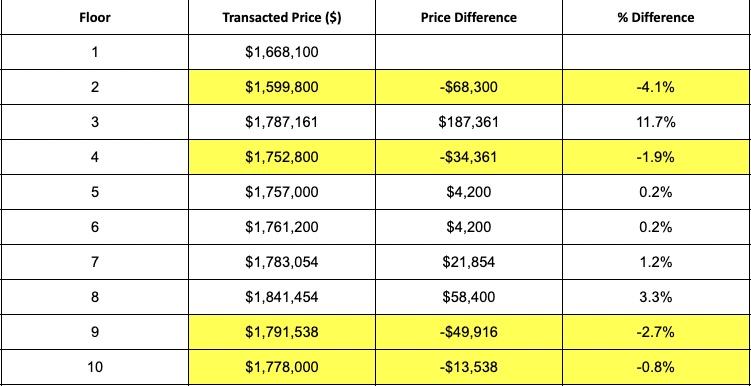

As a last point, I did hear from some buyers too who were predictably unhappy at how “misleading” the indicative prices were from Chuan Park. For those who remember, the initial prices shown for the 2 bedders were starting from $1.5xm. Come launch day, there was actually only one unit available at this indicative price ($1,599,800). Just look at how the prices were staged up at this particular stack:

More from Stacked

Why Singapore Homes Feel So Unaffordable (Even If Incomes Have Risen)

When discussing housing affordability, the standard yardsticks often include wage growth versus home prices, or sometimes debt-to-income ratios. But there’s…

Now, technically there’s nothing wrong with this. After all, they are right to say that the indicative price was accurate, as there was indeed one unit priced at $1.59 million. However, this marketing tactic, while common, tends to leave a bitter aftertaste for buyers who feel they’ve been misled into expecting more units at that price point.

This approach is not unique to Chuan Park. Many developers use similar strategies, especially in a hot market where demand is high. It works well in such situations, as buyers feel pressured to commit to higher prices (beyond what they originally budgeted for) as you don’t have much time to make a decision. If you’ve been to one of these high-demand new launch weekends you’d know what I mean – there’s a real sense of FOMO even when the prices may not make sense.

As such, it does raise some questions about transparency in pricing and whether buyers deserve clearer communication about unit availability and pricing beforehand.

Ultimately, whether buyers feel justified in their frustration comes down to expectations versus reality. For those accustomed to the high-pressure world of new condo launches, this might seem like par for the course. For newer buyers, however, such practices can feel discouraging, if not outright frustrating, especially when combined with the escalating prices seen across the market.

Meanwhile in other property news…

- Looking for the biggest flats at the cheapest prices? We’ve got you, here’s where to start looking in 2024.

- Upcoming HDB launches in 2025 are looking crazy good. Here’s what to look out for.

- Need to rent a family-sized condo while waiting for your new home? Here’s where you might find a better deal.

- Everyone keeps saying condo prices are high, but the market numbers seem to suggest we don’t have an issue.

Weekly Sales Roundup (11 November – 17 November)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CANNINGHILL PIERS | $5,490,000 | 1959 | $2,802 | 99 yrs (2021) |

| WATTEN HOUSE | $5,084,000 | 1539 | $3,303 | FH |

| THE RESERVE RESIDENCES | $4,834,779 | 1991 | $2,419 | 99 yrs (2021) |

| NAVA GROVE | $4,319,200 | 1722 | $2,508 | 99 yrs |

| GRAND DUNMAN | $4,159,000 | 1690 | $2,461 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| KASSIA | $1,054,000 | 474 | $2,225 | FH |

| THE COLLECTIVE AT ONE SOPHIA | $1,143,000 | 431 | $2,655 | 99 years |

| EMERALD OF KATONG | $1,240,000 | 484 | $2,560 | 99 years |

| LENTORIA | $1,299,000 | 538 | $2,414 | 99 yrs (2022) |

| HILL HOUSE | $1,329,000 | 431 | $3,087 | 999 yrs (1841) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| BOULEVARD 88 | $5,176,500 | 1313 | $3,942 | FH |

| ST REGIS RESIDENCES SINGAPORE | $5,150,000 | 2153 | $2,392 | 999 yrs (1995) |

| ORANGE GROVE RESIDENCES | $5,150,000 | 2390 | $2,155 | FH |

| KING’S MANSION | $4,780,000 | 2734 | $1,748 | FH |

| SOPHIA RESIDENCE | $4,750,000 | 3003 | $1,582 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| URBAN RESIDENCES | $720,000 | 484 | $1,486 | 99 yrs (2012) |

| AIRSTREAM | $740,000 | 474 | $1,562 | 99 yrs (2008) |

| THE TAPESTRY | $745,000 | 441 | $1,688 | 99 yrs (2017) |

| KINGSFORD . HILLVIEW PEAK | $790,000 | 527 | $1,498 | 99 yrs (2012) |

| BARTLEY RESIDENCES | $810,000 | 463 | $1,750 | 99 yrs (2011) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE MARBELLA | $3,400,000 | 1496 | $2,272 | $2,346,000 | 20 Years |

| CHUAN PARK | $2,585,438 | 1023 | $2,528 | $2,130,438 | 29 Years |

| MAPLE WOODS | $3,300,000 | 1539 | $2,144 | $2,023,000 | 16 Years |

| UE SQUARE | $2,950,000 | 1528 | $1,930 | $1,651,200 | 27 Years |

| MONTEREY PARK CONDOMINIUM | $2,450,000 | 1367 | $1,792 | $1,602,398 | 21 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE GREENWICH | $823,000 | 657 | $1,253 | -$161,000 | 13 Years |

| FORTE SUITES | $1,170,000 | 678 | $1,725 | -$70,100 | 8 Years |

| ICON | $1,150,000 | 570 | $2,016 | -$10,000 | 6 Years |

| ONE EIGHTIES RESIDENCES | $950,000 | 635 | $1,496 | $0 | 3 Years |

| SOPHIA HILLS | $1,180,000 | 570 | $2,068 | $12,000 | 7 Years |

Transaction Breakdown

Follow us on Stacked for more news and developments (pun intended) on the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How do the sales strategies of Chuan Park and Emerald of Katong differ?

Why do some developers choose to sell condos quickly at lower prices?

What concerns do buyers have about the pricing tactics used by developers like Chuan Park?

How successful was Emerald of Katong in its sales, and what was notable about its pricing?

What are some potential drawbacks of the rapid sales approach used by developers like Emerald of Katong?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

0 Comments