Singapore’s Most Expensive Neighbourhoods Are Changing—4 Buyer Trends That Prove It In 2025

July 29, 2025

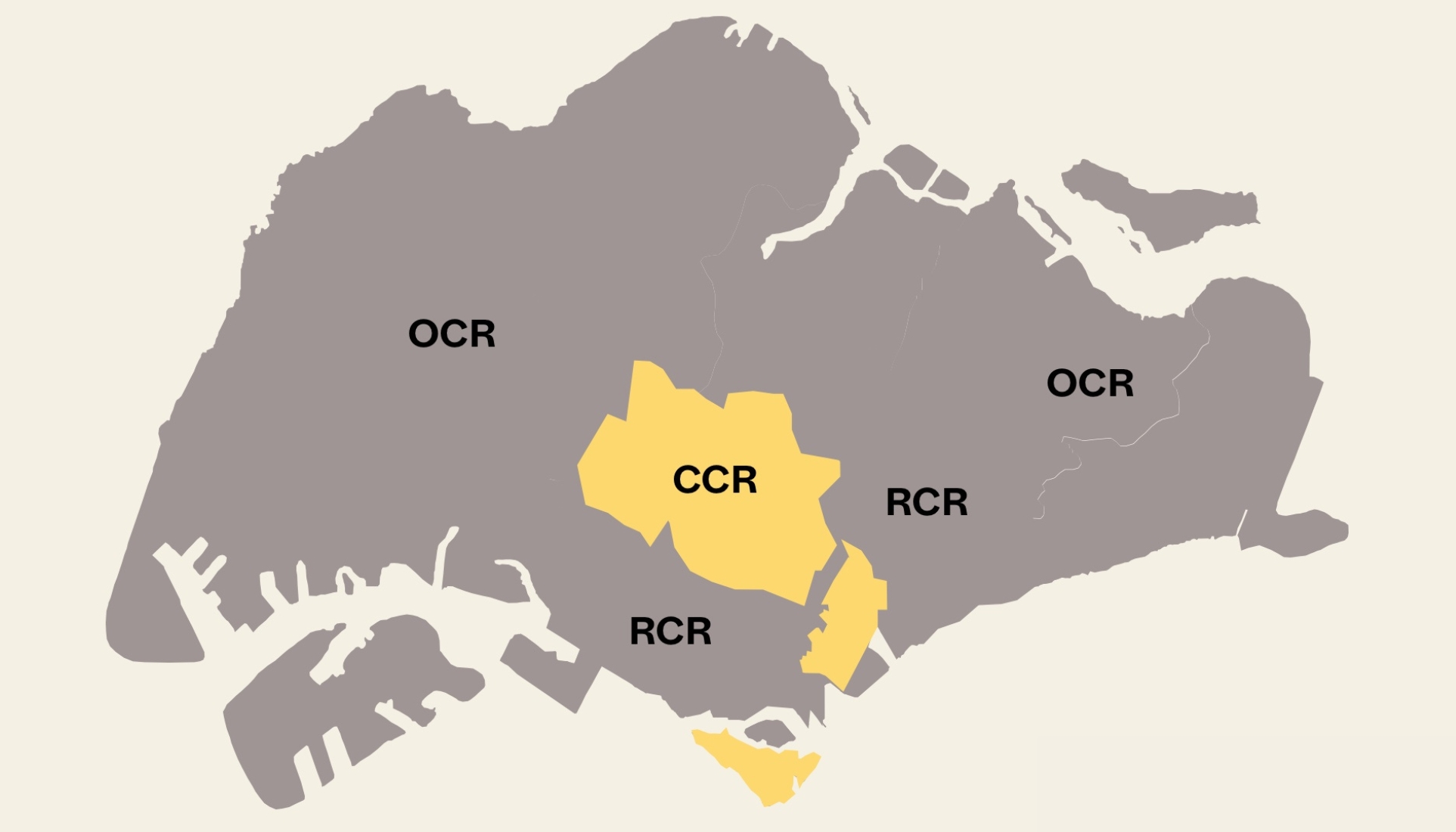

Back in the 2000s or earlier, buying a Core Central Region (CCR) condo was only a serious comment if it came from the mouths of the super-rich, or an affluent foreign investor. Coming from an average Singaporean, it was a joke on par with gargling Bird’s Nest in the morning, or ordering up silk toilet paper. But fast forward to 2025, and we can see that the situation has changed.

The price gap between Rest of Central Region (RCR) condos, and some might even argue Outside of Central Region (OCR) condos, is narrower than ever. We have projects like River Green selling at sub-$2 million prices despite being next to Great World MRT; or Promenade Peak that has a $PSF close to OCR condos like Chuan Park (around $2,680 psf). This may result in a fresh influx of CCR buyers, who no longer have the same preferences as the old CCR investor crowd, or its over-the-top ultralux buyers. Here are some of the changing preferences to watch for, whether you’re an upcoming or long-time CCR property owner:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Smaller units with a palatable quantum, for “entry-level” CCR properties

This isn’t something we would have imagined in the past. The “old” CCR often featured luxurious oversized properties, catered to buyers that – based on developer assumptions – would not be price sensitive.

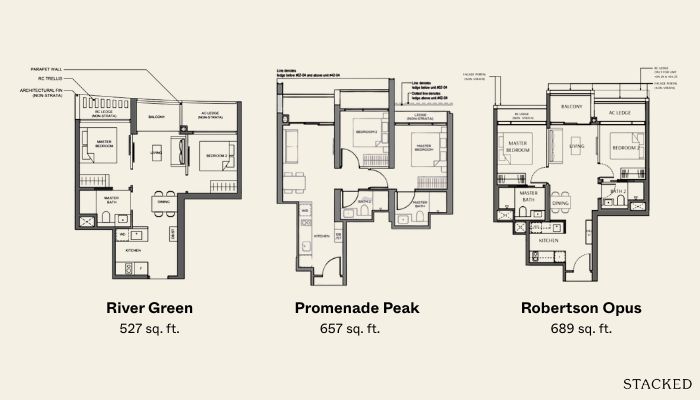

Today though, massive penthouses and sprawling four-bedders are no longer the default. In fact, new launches in the CCR now often come with a large proportion of two-bedroom units. We’ve already mentioned River Green and Promenade Peak above; but as another example, you can look at Robertson Opus, which has already seen a take-up rate of over 40 per cent at launch (selling out 40 to 50 per cent at launch is considered fast for a CCR property).

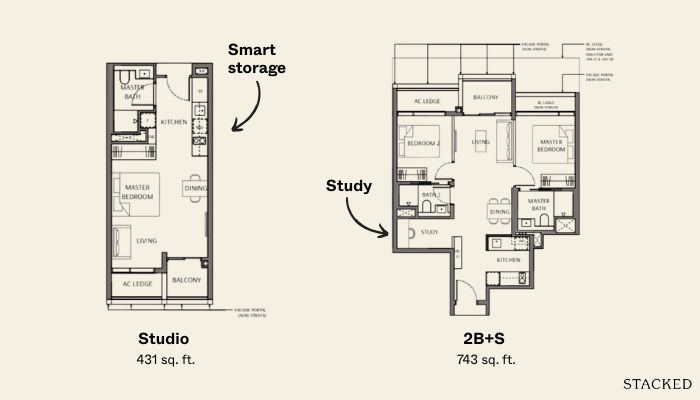

Of Robertson Opus’ 348 units, two-bedroom and smaller units make up 65 per cent of the project, with two-bedders alone accounting for 43 per cent of the total. The most common configuration here is the two-bedroom plus study, at around 743 sq ft. The market has shown an acceptance of this size for younger or smaller families. Even the three-bedroom units at Opus are kept at manageable sizes (starting from 926 sq ft), to keep the overall quantum below the $3 million mark.

This trend follows the success of earlier projects like Irwell Hill Residences (launched 2021), where over half the units sold during its launch weekend were the smallest formats: 1+Study and compact two-bedder units.

The bottom line is that smaller CCR units with lower total prices are what is needed to bring local buyers back. We can expect to see fewer developers building gigantic, $4 million+ units in the future, now that the ultra-wealthy foreign buyers and investors have left the scene (at least, until we see the 60 per cent foreigner ABSD tweaked).

2. We may be seeing less concern over 99-year leasehold status

Most properties in the CCR are freehold. In previous years, it was assumed this made 99-year leasehold properties in the CCR even more disadvantaged, by way of contrast. However, market demand for leasehold CCR projects may suggest the market now thinks otherwise.

Recent launches have shown that as long as prices and layouts align with modern expectations, 99-year projects can still perform strongly. Note that the aforementioned Irwell Hill (see above) is also a 99-year leasehold condo. We saw similar results with the launch performance of Upperhouse @ Orchard Boulevard, which achieved a 53 per cent take-up of its 301 units during its first weekend, at an average of $3,350 psf. This is despite Upperhouse being a leasehold property.

And to use a somewhat older example, we’re reminded of Canninghill Piers, which received a lot of on-the-ground comments about being expensive for a 99-year project. And yet, Canninghill Piers is 98 per cent sold out today (July 2025).

All this suggests that CCR buyers today are a more pragmatic lot. They’re prioritising factors like entry price, efficient layouts, and accessibility over more abstract qualities, like 999-year leases or freehold status.

3. Lifestyle-centric buyers, which cause variations in demand across different CCR districts

In the past, the CCR was the stomping ground of wealthy investors looking for trophy assets, or pure rental income. Projects were marketed on yield potential and prestige, not on whether they were a great place for Singaporean families.

Today, however, we’re seeing a stronger own-stay and lifestyle-driven demand in the CCR. This is partly a side effect of the Additional Buyer’s Stamp Duty (ABSD) cooling measures, which have dampened foreign investor interest and shifted the market toward local owner-occupiers.

More from Stacked

My Contractor Almost Cost Me A $10,000 Fine – Here’s What Happened:

When Jerry Sim saw the contractor’s sketches, he was hooked: the proposed changes to the interior of his 1,400 sq.ft.…

This also means that the CCR isn’t performing uniformly: locations with more family-centric features seem to do better, even when others share a similar prestige level. For instance, One Marina Gardens, located in Marina South, is technically in the RCR; but it sits right on the edge of the CCR and carries much of the same “glamour” as Marina Bay. Despite that, it saw relatively slower sales.

At the time, we noted the sluggish off-take was due to a lack of immediate family amenities, in particular, schools. In stark contrast, the Great World area – being adjacent to HDB estates and with a grass-roots element – could be in a better position to lead the CCR resurgence.

We’d keep our eye on the Great World, River Valley, Fort Canning, and Robertson Quay areas now and in the near future. These are areas which lack the “pure office” or “pure designer mall” elements of City Hall or Orchard areas; and which already have lifestyle elements that can cater to owner-occupiers.

In the much longer term, URA has plans to revamp even areas like Orchard Road, so we can expect every CCR district to be more of a “live-work-place enclave.” For now, though, the aforementioned areas seem to have a head start.

4. Smarter layouts that squeeze more utility into smaller spaces

While this is true everywhere in Singapore, it’s an especial point of emphasis in the CCR, for reasons mentioned above: developers are trying to keep total square footage down to keep the quantum manageable, so that requires a lot of emphasis on spatial efficiency.

URA’s Gross Floor Area (GFA) harmonisation rules, implemented in 2023, have turned out to be quite timely for the CCR resurgence. These rules standardise how developers calculate areas like aircon ledges, balconies, and void spaces. Because developers can no longer add these to your chargeable square footage, they’re no longer incentivised to pad units with these wasteful elements.

For specific details on how developers have gotten more creative, do check out our full condo reviews; but for now, several examples come to mind:

At Robertson Opus, even the smallest 431 sq ft studio unit includes smart storage and a functional kitchen with premium appliances, while the two-bedders (around 743 sq ft) still have space for a proper study. The three-bedders also showcase smart use of jack-and-jill bathrooms and flexible partitions. Similarly, at Irwell Hill Residences, the smallest 1+Study units (452 sq ft) and two-bedders (around 650–700 sq ft) manage to feel surprisingly livable, thanks to semi-enclosed kitchens, better window placement for ventilation. This ends up creating a rather stark contrast between the newer generation of CCR condos, and the older ones from previous decades.

Comparisons to the older CCR condos are a bit trickier now, as the older ones may have a higher square footage, but similar (or maybe even less) livable space due to oversized balconies, big air-con ledges and planter boxes, corridor spaces, etc. And again, the older ones were built very huge and tend to be unaffordable, despite the lower $PSF.

In light of this, buyer preference in the CCR may be on the new launches, and the resale options may suffer by comparison.

The CCR is no longer just for the ultra-rich, and it’s better for it

As prices between the CCR and other regions converge, and as developers recalibrate to the needs of more pragmatic buyers, the CCR is entering a more inclusive era. A better one from our perspective, because it opens the door for more Singaporeans and PRs to stake a claim in our country’s most central areas.

But at the same time, this will take getting used to. For buyers, it means learning to look beyond the clichés of the CCR as nothing more than penthouses, freehold bragging rights, and rental assets.

For developers, this reflects a tougher truth: the CCR simply doesn’t command the same premium it once did. Positioning a project as ‘above it all’, whether through price or exclusivity, no longer guarantees buyer interest.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How are buyer preferences changing in Singapore’s most expensive neighborhoods in 2025?

Are 99-year leasehold properties in Singapore’s central areas becoming more popular?

What types of units are now popular in Singapore’s core central region?

How are developers adapting condo layouts in Singapore’s central neighborhoods?

Is the traditional idea that only the ultra-rich buy in Singapore’s most expensive neighborhoods still true?

What future changes are expected in Singapore’s central neighborhoods?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

1 Comments

100% agree. I think more Singaporeans and PRs will now return to the CCR and RCR over coming 10-15 years.