How Much Do You Need To Buy A Condo In Singapore

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

Druce is the Chief Editor at the Stacked Editorial. He was first interested in property since university but never had any aspiration to become an agent, so this is probably the next best thing.

Let’s face it, if we want to be prudent to the point of necessity, all we need to live is a cave, a fire, and a big club to whack our prey to death. But life is about aspirations; and sometimes, even if you can still qualify for a HDB flat, you want a condo anyway. Well for you big dreamers out there, we at ezbuy.sg have broken down the cost:

How much does a typical condo cost?

Condos in Singapore vary in price, based on which district their in. The priciest districts are 9, 10, and 11, which include Orchard Road, Tanglin, and Sentosa. These condos cost so much money ($6 million or above is not uncommon), we suspect CNB checks your car for smuggled heroin if you so much as step in the showroom.

Most Singaporeans though, when they talk about condos, are referring to mass market condos. These are condos in the Outside of Central Region (OCR), in places like Tampines or Clementi. For the purposes of this example, we will assume you’re looking at one of these more typical condos, which will cost around $1.2 million.

Here’s the breakdown of what you’ll pay:

1. The down payment

Assuming you have no outstanding home loans, you can get a maximum Loan to Value (LTV) ratio of 80 per cent from the bank. That is, the bank can lend you a maximum of 80 per cent of the property value.

(In case it needs to be said, you can’t take a HDB loan for your condo. Due to, you know, the fact that it’s not a HDB property?)

So for our $1.2 million condo, you would be able to borrow a grand total of $960,000, or about the IQ of the average ezbuy employee. Now mind you, this assumes the bank agrees to give you the full 80 per cent; they are not required to do that.

This means there is a remaining payment of 20 per cent, or $240,000.

Another 15 per cent can be paid using your CPF Ordinary Account (CPF OA) funds ($180,000 in this case), and the remaining five per cent has to be paid in cold, hard cash ($60,000).

You may think that’s a lot, but most of the people who managed it have robbed fewer than three banks.

2. The monthly repayment

Okay, here’s where things get complicated. You see in Singapore, banks don’t have perpetual fixed rate loans. That means your mortgage (what you borrowed to buy the house) repayments can go up or down.

I’d love to explain the intricate details of how it moves up and down, but ezbuy threatened to fire me if I sent another customer into a coma. So instead, I’ll simplify.

The typical mortgage interest rate, as I write this, is about 1.8 per cent per annum. I’m going to make it two per cent though, because that will be the most typical rate by the end of 2017. That’s Donald Trump’s fault*.

(*Not a joke. American interest rate hikes cause interest rates to rise in Singapore as well).

I’m going to assume you take a 25 year loan, at two per cent interest. This means, via a formula more complex than calculus and less complex than nasi padang prices, that you will pay around $4,069 per month.

Yes, I know that’s more than some people’s entire salary (median income in Singapore is around $4,000 a month). Now you know just how rich some of your fellow Singaporeans really are. Ask your boss for a raise.

If it makes you feel better though, you can use your CPF OA to make the monthly repayments.

Over a period of 25 years, you would have paid around $1,220,700, for a $960,000 loan. For the record, this is also one of the cheapest loans you will ever get in your life. We bet that really makes your day, huh.

Oh, and that’s not the end of the costs. You see there’s…

3. The monthly maintenance fee

You know how HDB estates have a conservancy charge? Well condos have maintenance fees too, except you may notice condos have fewer residents than an HDB estate. You know what means?

It means the cost of maintenance is shared between fewer people. So now you know why developers bother to list the total number of units. A condo with 400 units will probably have sky high maintenance charges, whereas a condo with 1,500 units will probably have much lower costs.

Also, the bigger the unit you own, the bigger your share of the maintenance fees.

For a typical mass market condo with 1,400 square feet, you can expect a maintenance fee of about $300 a month. That’s an approximation. Fancier condos can cost more, and luxury condos with concierge services can have maintenance fees in excess of $1,000 a month.

Oh wait, we’re not done yet. There’s still the price of…

Property Advice10 Things a First Time Condo Buyer Should Look Out For To Avoid Regret

by Druce Teo4. Renovations

Unless you sleep on the bare concrete, you’ll have to renovate.

This will cost at least $30,000. We know that because of highly accurate horoscope readings. Or maybe we know because the maximum renovation loan granted by banks is $30,000, or up to six months of your income (whichever is higher), and contractors plan around that. One of those two reasons is true.

Contractors will generally demand 20 per cent upfront, and 20 per cent as each stage of the renovation is completed.

This is where ezbuy can save you a ton of money. If you see furnishings that you like, don’t buy it from a big designer store. Mark-ups for branding and marketing can be as high as 60 to 100 per cent.

Instead, check out ezbuy’s huge furniture selections, and see if you can find a more competitively priced version. And if you use ezbuy Prime, you can have anything shipped over for $2.99, no matter how absurdly bulky or heavy it is. Yes, even if it’s a 200 kilo bed. Only three per cent of our interns leave without hernias.

And after you’ve done all that, and painted the walls (around $1,500 to $2,000 for most four to five room units), you can start working out the…

5. Property tax

Your property tax depends on the Annual Valuation (AV) of your home. The AV is based on how much the government thinks you could rent your property for (even if you don’t rent it). So if your property could be rented out for $3,000 a month, you would have an AV of $36,000.

(At the time of writing, Singapore’s rental market has taken a worse beating than a henchman in a kung-fu movie, so a rental income of $3,000 for a mass market condo really is possible. That’s almost no different from some HDB flats).

The Inland Revenue Authority of Singapore (IRAS) has a tiered system used to calculate the property tax; but for simplicity’s sake, an AV of $36,000 means you’d pay $1,120 a year.

Good luck with getting that condo!

Just remember, what seems impossible and out of reach, can become a reality with slow and constant effort. Your CPF contributions are probably higher than you think, as your employer tops up and additional 16 per cent; and compounded over 10 or 20 years, you can probably afford more than you imagine.

Looking for furniture for your new home? Browse our home & garden section for more inspiration!

This article was first published on ezbuy’s online shopping & lifestyle blog.

ezbuy.sg is Singapore’s largest global online shopping platform offering you unbeatable savings.!

Like ezbuy Singapore on Facebook now to receive the latest updates on promotions, discounts and more.

Druce Teo

Druce is the Chief Editor at the Stacked Editorial. He was first interested in property since university but never had any aspiration to become an agent, so this is probably the next best thing.Read next from Property Advice

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Property Advice Why Punggol Northshore Could Be The Next Hotspot In The HDB Resale Market

Property Advice How Much Is Your Home Really Worth? How Property Valuations Work in Singapore

Property Advice Why I Had Second Thoughts After Buying My Dream Home In Singapore

Latest Posts

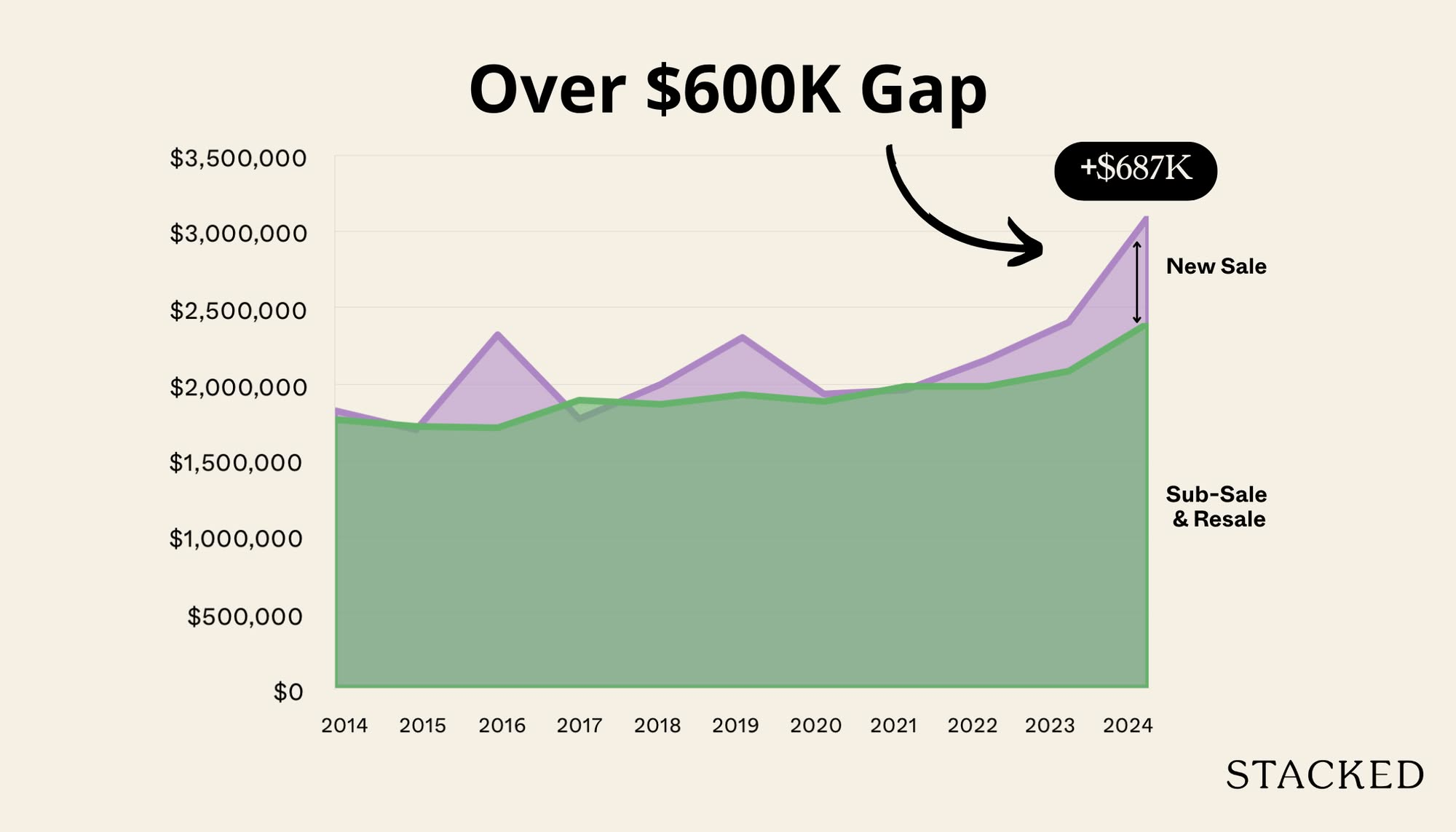

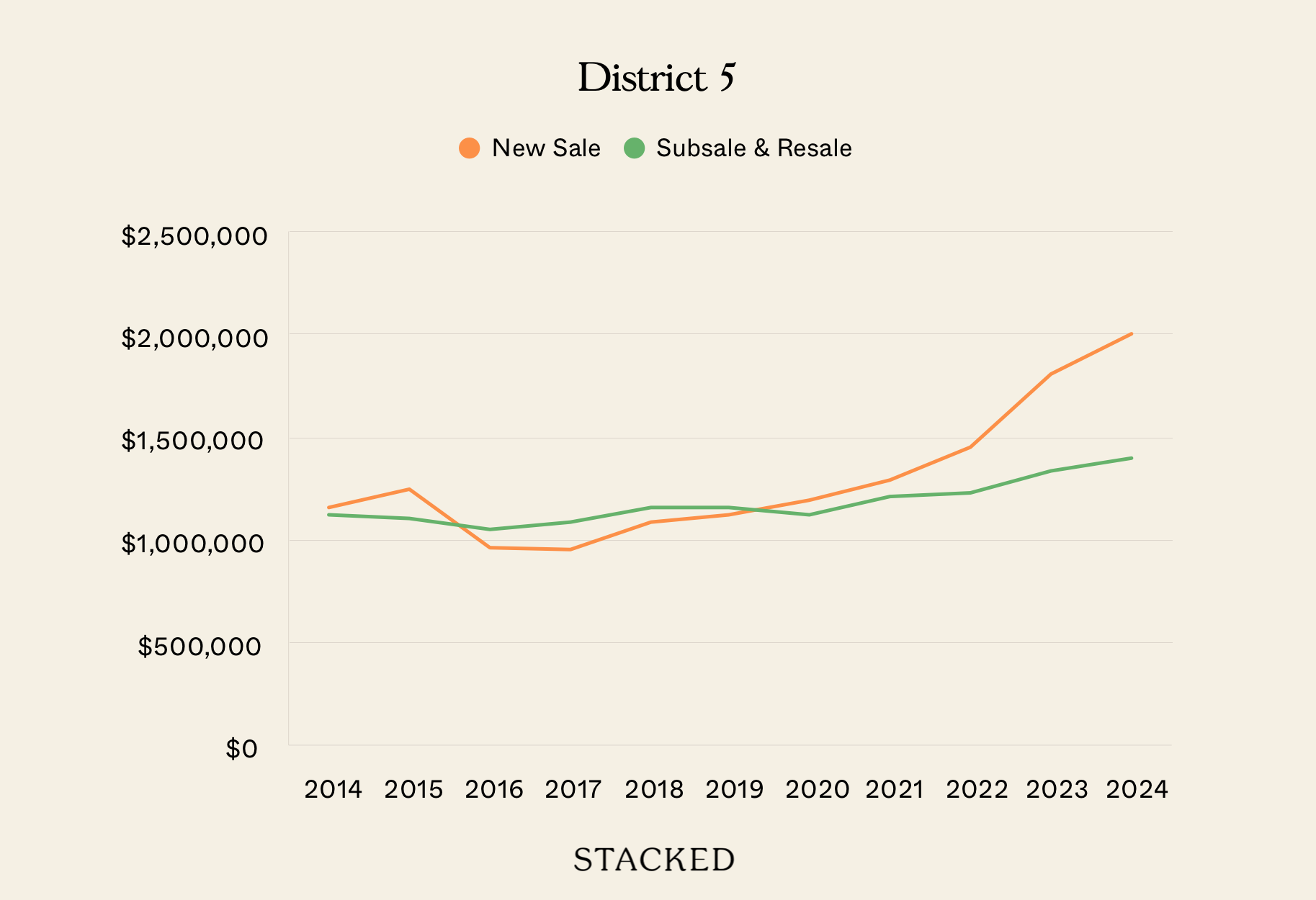

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

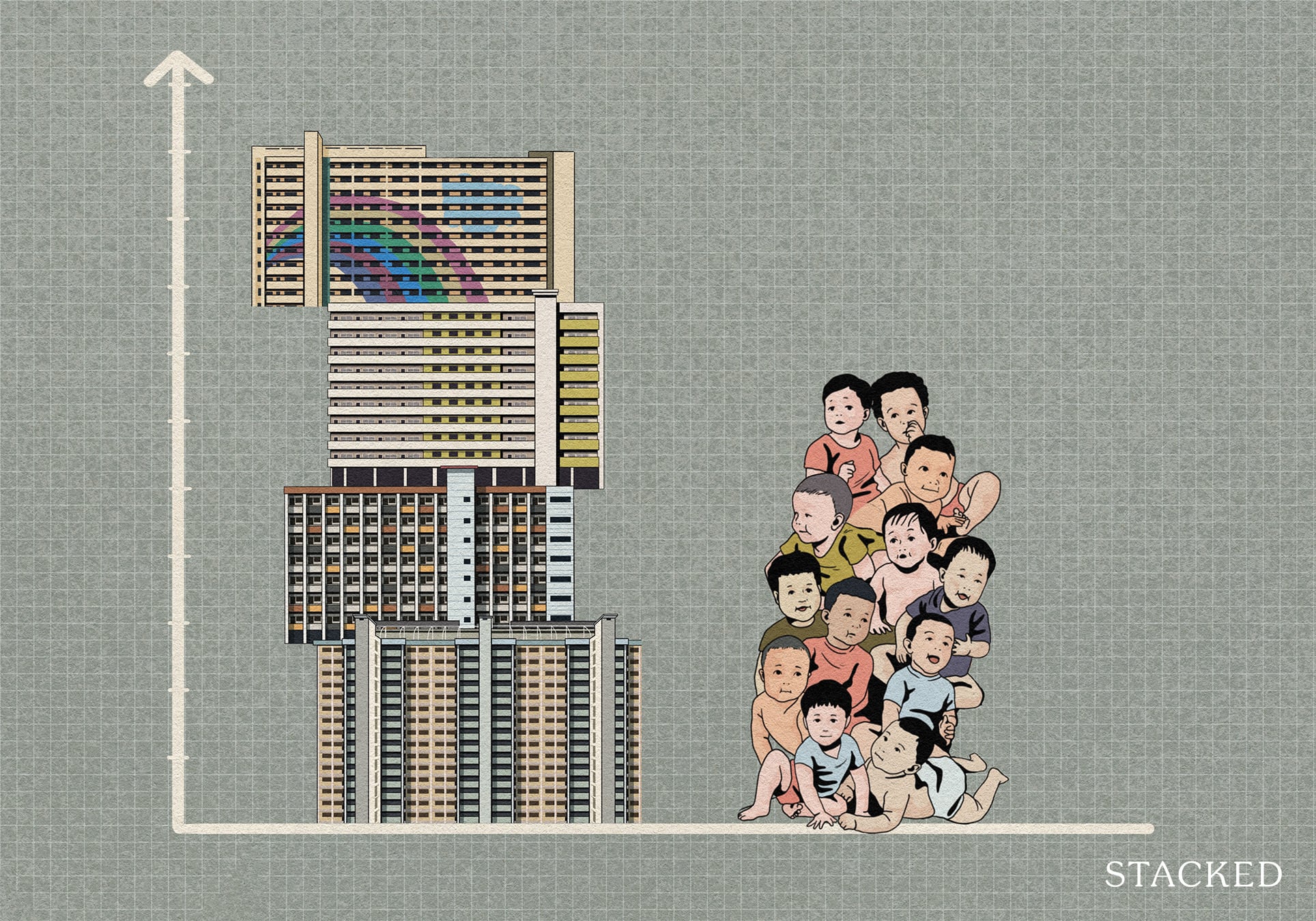

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

On The Market 5 Spacious Old But Freehold Condos Above 2,650 Sqft

Property Investment Insights We Compared New Launch And Resale Condo Prices Across Districts—Here’s Where The Price Gaps Are The Biggest

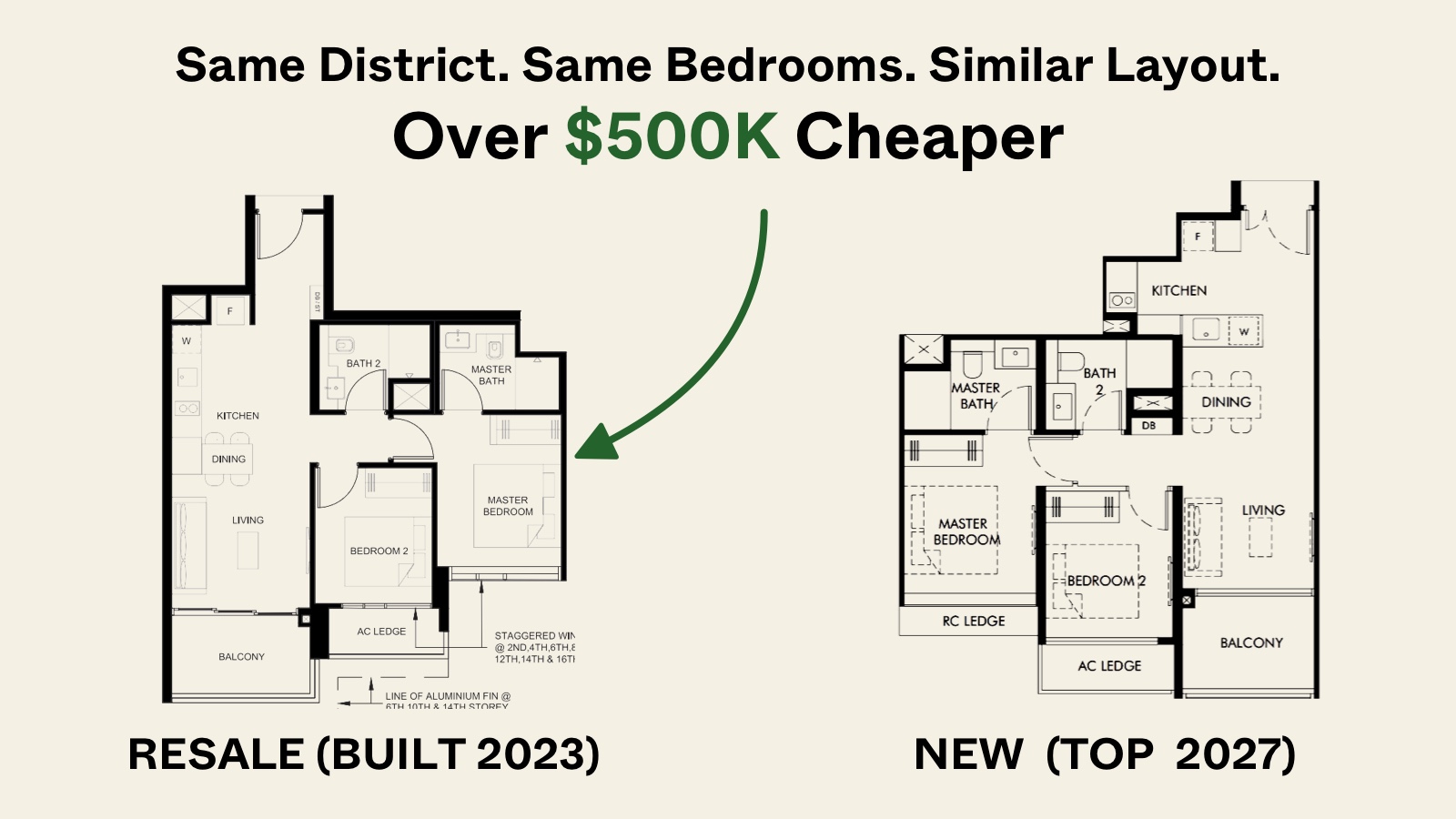

Pro Similar Layout, Same District—But Over $500K Cheaper? We Compare New Launch Vs Resale Condos In District 5

New Launch Condo Analysis The First New Condo In Science Park After 40 Years: Is LyndenWoods Worth A Look? (Priced From $2,173 Psf)

Editor's Pick Why The Johor-Singapore Economic Zone Isn’t Just “Iskandar 2.0”

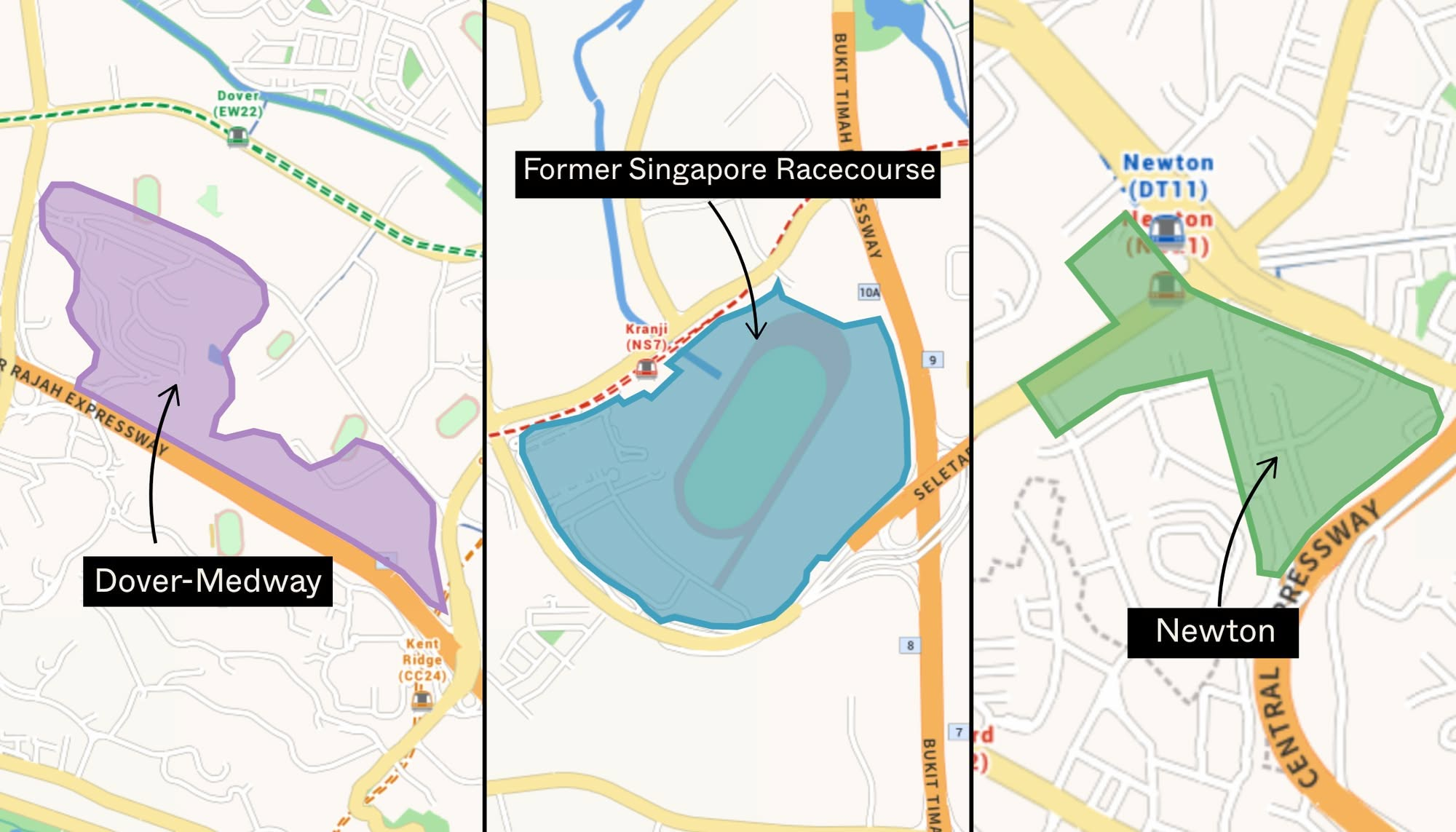

Editor's Pick URA’s 2025 Draft Master Plan: 80,000 New Homes Across 10 Estates — Here’s What To Look Out For

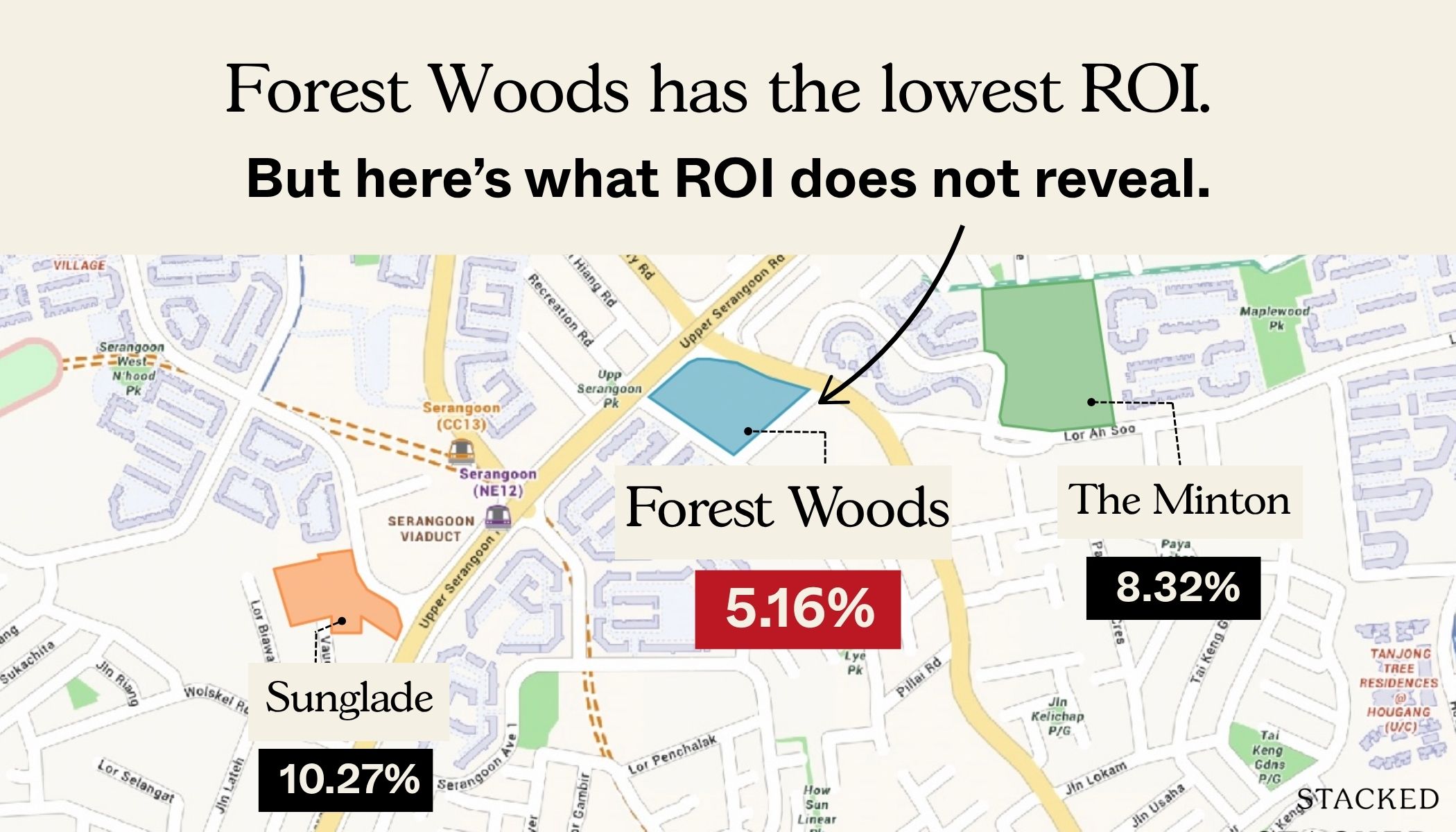

Pro Analysing Forest Woods Condo at Serangoon: Did This 2016 Project Hold Up Over Time?

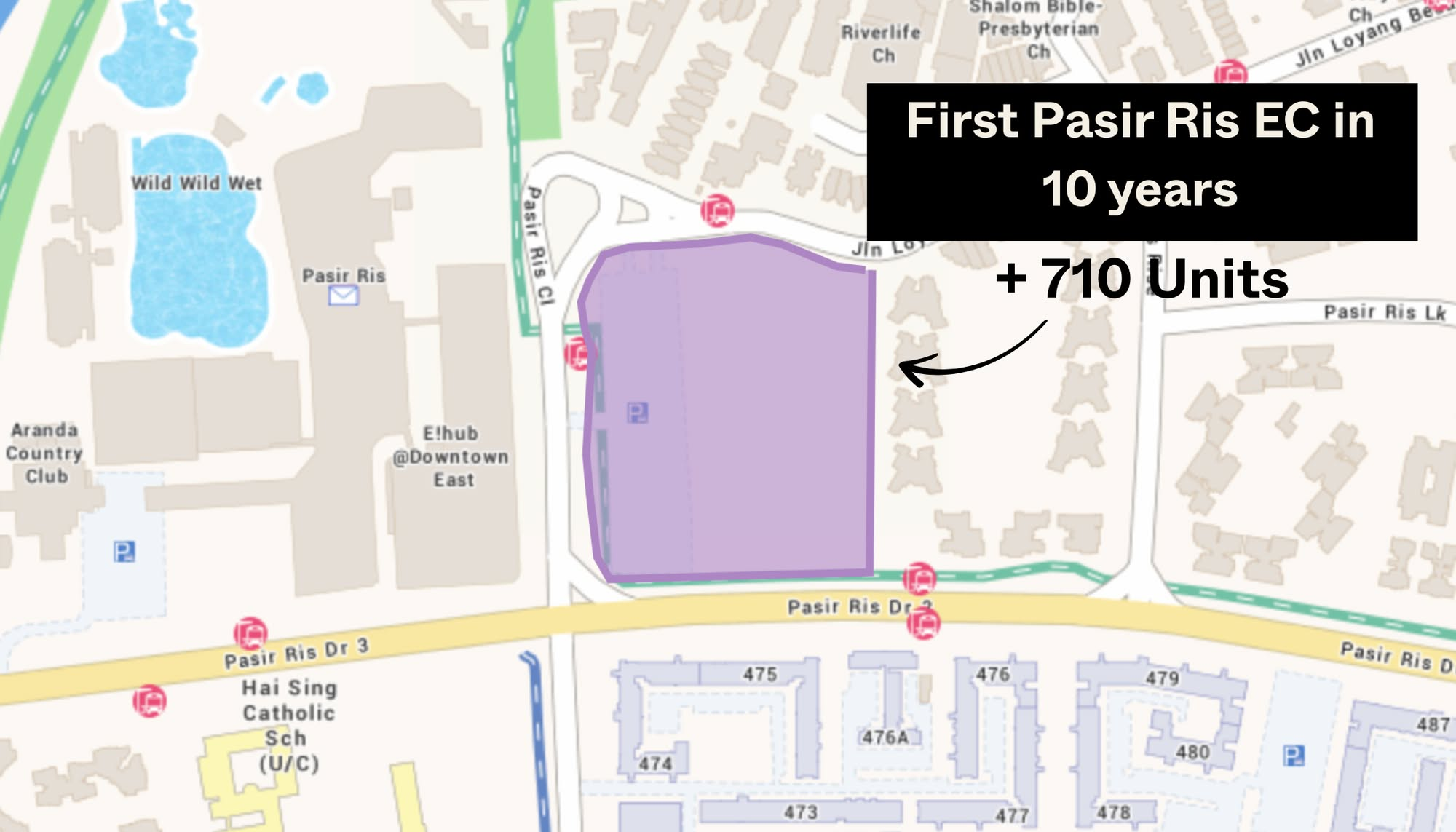

Property Market Commentary This Upcoming 710-Unit Executive Condo In Pasir Ris Will Be One To Watch For Families