She Lost $590,000 On A Shop Space That Didn’t Exist: The Problem With Floor Plans In Singapore

June 22, 2025

Let me tell you a heartwarming story about property, trust, and losing $590,000.

All because you thought you were buying a shop and instead bought air in the shape of an invisible trapezoid. A beauty salon owner recently sued her agent over a commercial unit in D’Leedon, which was advertised as 818 sq ft. Problem is, she only got 619 sq ft of usable space. The rest of the space came from the top of the unit, which was wider than the base because of the sloping walls.

Which, incidentally, makes me wonder how they worked out the square footage of the Art Science Museum, because the attempt alone must have broken three calculators. But the point is, square footage can get both expensive and annoying; and in case you’re wondering, the poor shop owner didn’t win.

It seems that legally, the agent wasn’t at fault, no more than the buyer. They were both “jointly misled” by this geometric magic trick. And yet I can’t help but notice that only one party in this dispute lost the equivalent of an S-Class Mercedes.

But don’t let the issue in commercial units blind you to the one we’re facing in residential.

In 2023, Singapore launched GFA Harmonisation, also widely regarded as a sort of War on Developer Margins. Here’s the basic idea:

- Old condos? You paid for planter boxes, air-con ledges, void space, and other areas you couldn’t use unless you squeezed in with your local crows.

- New condos? Nope. Only real, usable floor area counts now, and that’s all you pay for.

👏 That’s 👏 good 👏 right?

Except for two things: first, we keep having to explain to all newcomers to the market (and even some veterans) why a new, post-harmonisation, 850 sq ft condo unit is in fact the same as a 1,000 sq ft resale condo 500 metres down the road.

In general, condo buyers are already irritated about 2025 prices, and are naturally guarded. So when I try to explain the pre-harmonisation condos’ Price Per Square Fantasy to them, I look like a pig-butchering scammer who just wants to push a new launch.

But that isn’t the end of the issue. Property is an industry that moves with the speed of a really tired clam, so don’t expect instant updates to old floor plans. Now, when you want to compare anything to an older condo (especially a new launch), you’re just going to have to disbelieve $PSF.

Use your own eyes to check if double-beds can really fit every bedroom of that supposedly 1,600+ sq ft condo, even if it has bay windows the RSAF could land a Chinook on. Check out the air-con ledge, and avoid if it could comfortably host a Sumo match. Buyers now have to look beyond alleged square footage, and compare in more direct ways (bring a tape measure on viewings if you have to.)

More from Stacked

So When Was The Actual Best Time To Buy A Property In Singapore? Here’s A Look At What History Tells Us

"When is the best time to buy a property?" echoes as one of the most perennial questions in the world…

One exception: deceptive square footage doesn’t usually apply to properties before the 2000s. If you’re looking at a project that was built when The Simpsons were still edgy, it’s mostly safe: it existed before developers were incentivised to use tricks like big bay windows. In that case, the gigantic square footage is often real; but sometimes still squandered on balconies big enough to hold a decently profitable rice farm.

I’m looking at you, ‘80s era terrace condos.

Meanwhile in other property news…

- Springleaf versus Faber Walk: which GLS site is better, the one with MRT access, or the one within enrolment range to Nan Hua Primary?

- HDB’s two and three-room showflats: good reno and layout ideas, or still too squeezy?

- Buying property in Malaysia? Here are a few restrictions you need to be ready for.

- Rivergate is a benchmark condo and a seemingly unstoppable ROI juggernaut, despite its age. Here’s a deep dive as to why, for Stacked Pro.

Weekly Sales Roundup (09 June – 15 June)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| IRWELL HILL RESIDENCES | $7,800,000 | 2605 | $2,994 | 99 yrs (2020) |

| CANNINGHILL PIERS | $7,584,000 | 2788 | $2,720 | 99 yrs (2021) |

| TEMBUSU GRAND | $4,124,000 | 1711 | $2,410 | 99 yrs (2022) |

| PULLMAN RESIDENCES NEWTON | $4,100,000 | 1378 | $2,976 | FH |

| ONE MARINA GARDENS | $3,761,110 | 1238 | $3,038 | 99 yrs (2023) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ONE MARINA GARDENS | $1,234,281 | 420 | $2,940 | 99 yrs (2023) |

| NOVO PLACE | $1,388,000 | 872 | $1,592 | 99 yrs (2023) |

| LUMINA GRAND | $1,401,000 | 936 | $1,496 | 99 yrs (2022) |

| NORTH GAIA | $1,403,000 | 980 | $1,432 | 99 yrs (2021) |

| NOVO PLACE | $1,440,000 | 883 | $1,631 | 99 yrs (2023) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE ORCHARD RESIDENCES | $7,700,000 | 2465 | $3,124 | 99 yrs (2006) |

| RIVERGATE | $5,900,000 | 2077 | $2,840 | FH |

| THE GLYNDEBOURNE | $5,528,888 | 2508 | $2,204 | FH |

| RIVERGATE | $5,060,000 | 1722 | $2,938 | FH |

| THE BEAUMONT | $4,880,000 | 1948 | $2,505 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| HEDGES PARK CONDOMINIUM | $670,000 | 484 | $1,383 | 99 yrs (2010) |

| SEASTRAND | $765,000 | 592 | $1,292 | 99 yrs (2011) |

| THE TAPESTRY | $825,000 | 474 | $1,742 | 99 yrs (2017) |

| COCO PALMS | $850,000 | 463 | $1,836 | 99 yrs (2008) |

| ECHELON | $905,888 | 452 | $2,004 | 99 yrs (2012) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THOMSON 800 | $3,218,000 | 1625 | $1,980 | $2,395,000 | 19 Years |

| OCEAN PARK | $2,800,000 | 1302 | $2,150 | $1,840,000 | 24 Years |

| RIVERGATE | $5,900,000 | 2077 | $2,840 | $1,790,000 | 12 Years |

| THE BEAUMONT | $4,880,000 | 1948 | $2,505 | $1,700,000 | 16 Years |

| HAIG COURT | $2,988,888 | 1442 | $2,072 | $1,699,000 | 15 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MARINA ONE RESIDENCES | $2,400,000 | 1141 | $2,103 | -$195,775 | 8 Years |

| SOPHIA HILLS | $1,132,500 | 570 | $1,985 | -$164,500 | 7 Years |

| ECHELON | $905,888 | 452 | $2,004 | -$91,232 | 12 Years |

| THE PLAZA | $980,000 | 807 | $1,214 | -$65,000 | 3 Years |

| ESPADA | $1,240,000 | 560 | $2,215 | -$10,000 | 7 Years |

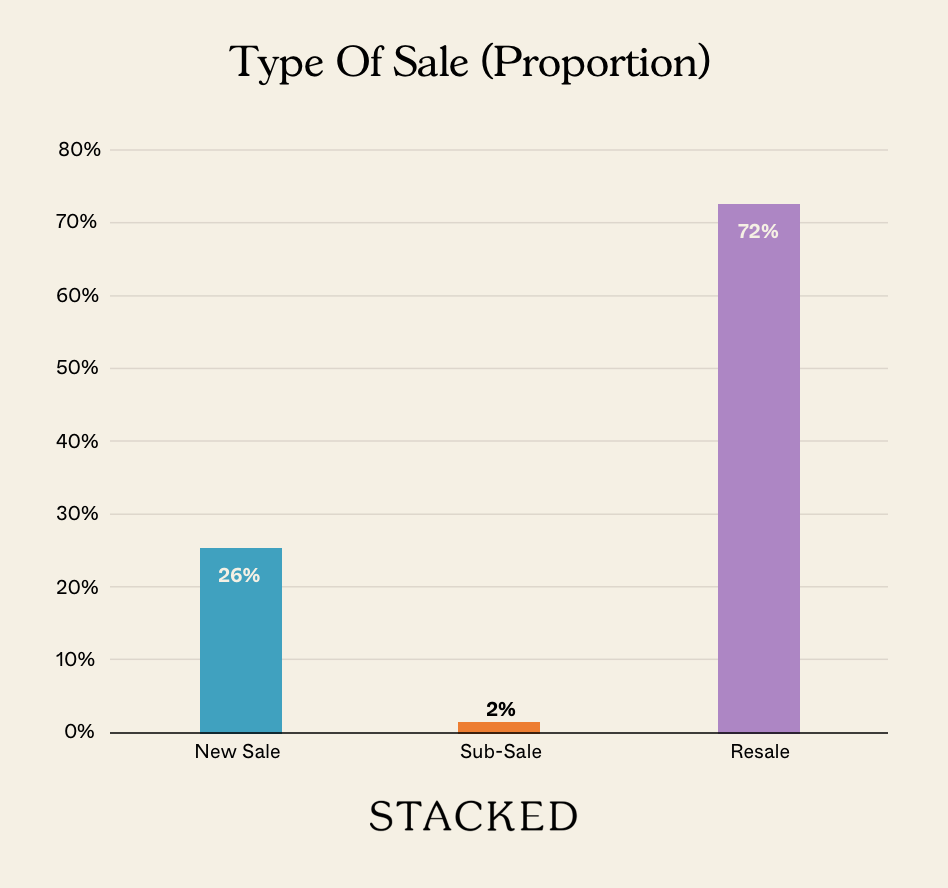

Transaction Breakdown

For more on the Singapore property market and in-depth reviews, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the risks of relying solely on floor plans when buying property in Singapore?

How did the property dispute in D’Leedon highlight issues with floor plan accuracy?

What is the impact of Singapore’s GFA Harmonisation on property buyers?

Why should buyers check property dimensions in person rather than relying on square footage?

Are older properties less likely to have deceptive floor plans compared to newer developments?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

0 Comments