Resale HDB Flat Prices Reach A Record High For Q1, But There’s Hope For Buyers Yet

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

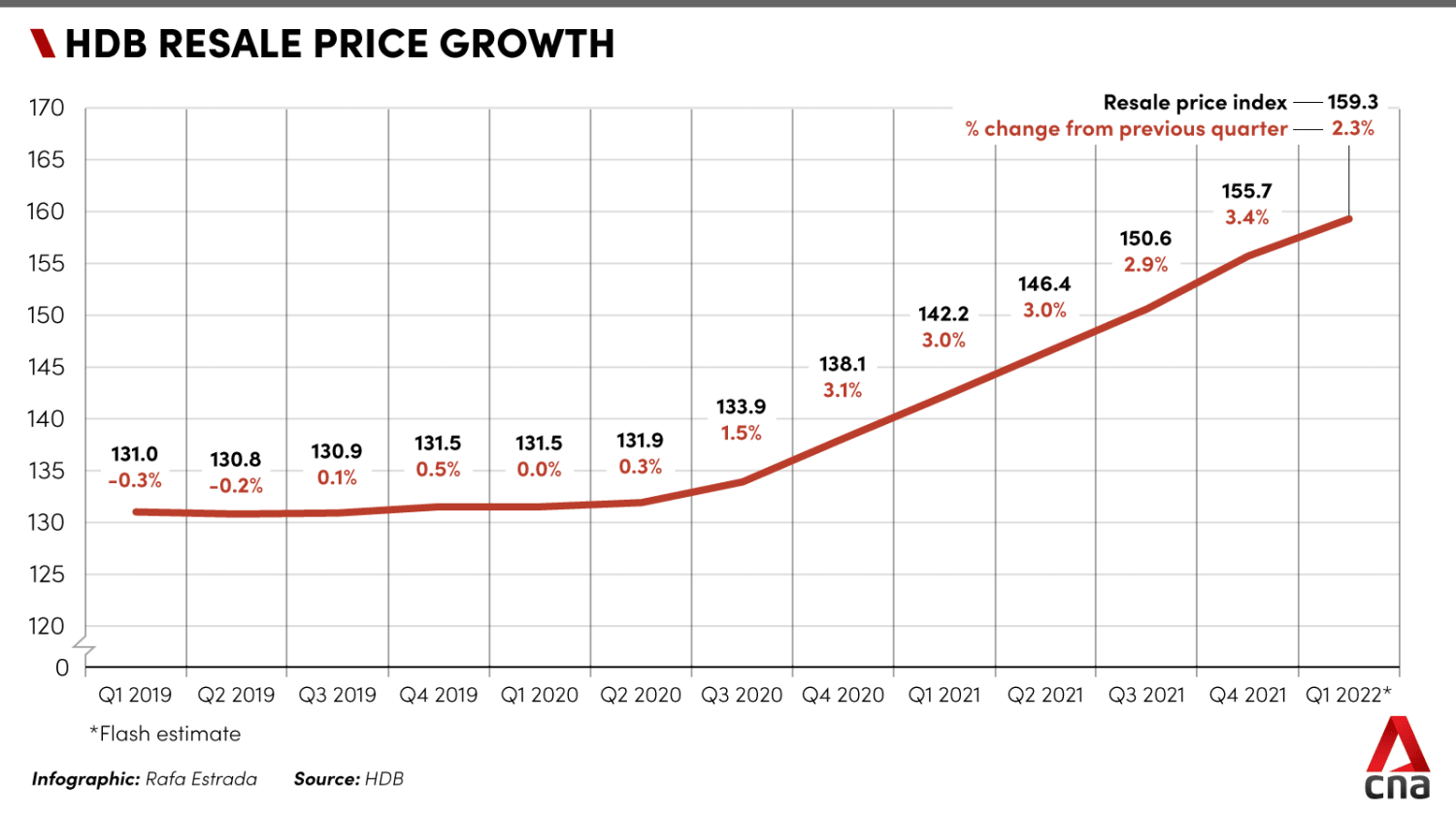

Let’s start with a bit of bad news for homebuyers: resale flat prices ended Q1 2022 at a record high. This is, in fact, the highest we’ve ever seen in around a decade – we’ve even beat the previous peak prices in 2013. This is coupled with a bit of good news, however small: the quarterly increase was at least a bit lower. Here’s what’s happening in the resale market:

Resale flat prices are at their highest in around a decade

As of end-March 2022, resale flat prices averaged $519 psf. Prices have increased for eight consecutive quarters at this point.

Above, you can see that resale flat prices have surpassed the last peak, which was in Q2 of 2013. What’s significant here is how fast prices have risen:

For almost all of 2020, HDB prices still stayed well below the 2013 peak. Then came 2021, during which prices rose by a shocking 12.5 per cent year-on-year. It’s rare to see a double-digit increase in a single year for resale flats, and it is also the highest annual growth recorded since 2010 (prices grew by 14.1 per cent).

The market has adapted to the 2013 measures

Back in 2013, there was a growing complaint about the unaffordability of flats. This led the government to introduce the Mortgage Servicing Ratio (MSR) and to remove the publication of Cash Over Valuation (COV) amounts.

The resulting impact was significant, and sent resale flat prices into seven years of consecutive decline. All of this has now been reversed in the space of around a year.

In addition, word on the ground is that Cash Over Valuation (COV) is continuing to rise, even for resale flats in non-mature areas like Punggol and Yishun.

As HDB no longer publishes COV numbers, we have crowdsourced some numbers in this article; and with a third of all resale flats coming with COV, it’s fast reasserting itself as a norm.

Resale flats also came through the December cooling measures almost unscathed

We have more details on the last round of cooling measures here. But to summarise, the impact on the resale flat market is not as sharp as some buyers may have hoped.

The new cooling measures lowers the maximum HDB loan amount by five per cent, while bank loans have the same loan quantum. This is immaterial to most flat buyers, as most already pay more than the minimum down payment.

The maximum Total Debt Servicing Ratio (TDSR) was lowered from 60 to 55 per cent; and this could affect a buyer using bank loans. But HDB has its own Mortgage Servicing Ratio (MSR) with even tighter limits, and anyone who can meet the MSR can more than likely meet the TDSR (unless they have other significant debts).

As such, the cooling measures don’t do much to halt rising resale prices.

However, the current spike in prices is losing momentum

On a quarterly basis, resale prices were up 2.3 per cent in Q1 2022. This is lower than the 3.4 per cent increase (HDB flash estimates) in Q4 2021. While prices are going up, they at least aren’t rising as quickly as before.

There are also three other factors that may help the buyer side:

- A surge in available resale flats is expected this year

- Ramped up BTO offerings may soak up some demand

- Covid-related delays may ease in the coming years

1. A surge in available resale flats expected this year

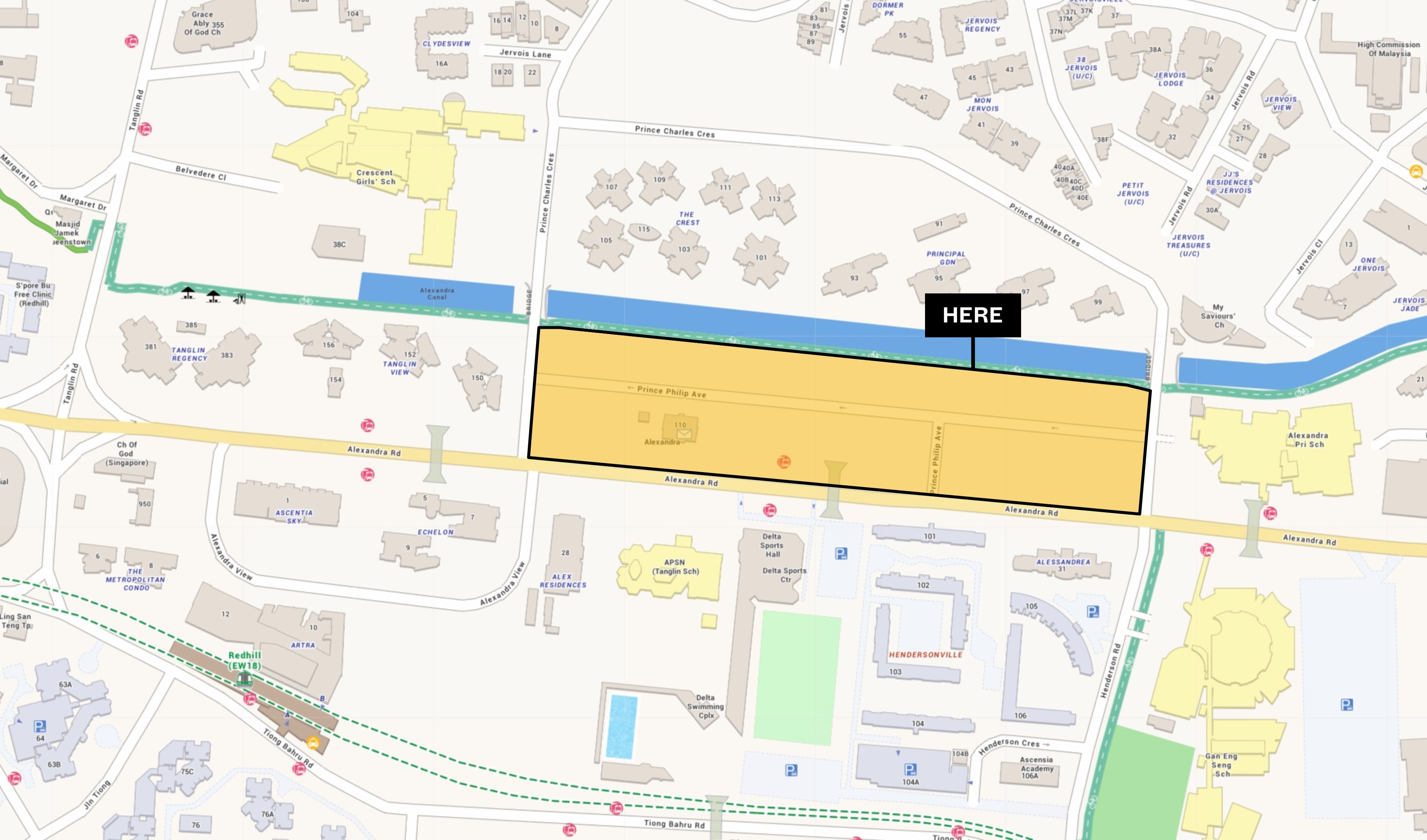

About 35,000 flats are expected to reach their MOP this year. This is an unusually large number and could soak up some of the existing demand.

More from Stacked

$1.16M For A 4-Room HDB In Clementi? Why This Integrated Development Commands Premium Prices

We have a new record for a 4-room resale flat! The winner is 441B Clementi Avenue 3, in Clementi Towers.…

Opinion on the effects is somewhat divided:

On the one hand, some realtors feel that an increased supply of resale flats will put downward pressure on prices. This follows the argument that the 2021 price surge was caused by Work From Home arrangements, which saw more Singaporeans eager to move out and find a new home on shorter notice. One realtor opined that:

“If we have more resale flats available, there’s less competition for the existing ones – especially those that have issues like reaching the ethnic quota. 2021 was honestly a freak incident where there was a big jam up, a sudden increase in buyers all fighting for the same flats.”

However, we note that price increases could also be due to higher costs of five-year old flats, which push up the average.

A five-year old resale flat can be moved into right away, has negligible lease decay, and may not even need renovations if everything is new.

So, this could go either way; but at the very least, buyers will know there are more options for them.

Most Affordable 40-Year Old+ Resale HDB Flats In Singapore: 12 Areas To Find Them

by Ryan J. Ong2. Ramped up BTO offerings may soak up some demand

HBD has said it’s increasing the supply of flats by a significant 35 per cent, over the coming two years. April’s BTO launch will put out 5,300 new homes, while an estimated 6,800 new homes may come in August – both sizeable launch numbers.

It’s also expected that, with Covid-related issues easing in the next few years (see below), BTO flats have lower risks of delays. This might make some buyers opt for BTO instead of resale, taking them out of the competition.

We should point out, however, that certain demographics are unaffected by increased BTO numbers. These include people who absolutely need to move in right away, or buyers who are not eligible to buy BTO flats (e.g., anyone who busts the income ceiling, or families with no Singapore Citizens in the household).

3. Covid-related delays may ease in the coming years

It may not seem obvious, but Covid-related delays even in the private market can affect resale flat prices.

Consider that an HDB upgrader may have intended to sell their flat, but changed their mind because of potential delays in the private market. This could result in many upgraders holding off on their private home purchases, thus staying on in their flats and reducing supply.

Besides this, fewer Covid-related delays in construction can mean getting a flat in four rather than five years; and the shorter wait time may convince a few buyers to switch to BTO (especially since resale prices are so high).

Most will feel that the current rise in resale flat prices is unsustainable, and that we are close to the ceiling. However, with recent news of BTO projects at Tampines GreenCourt, Clementi NorthArc, and Woodleigh Hillside projects that will be further delayed (homeowners will have to wait for another 3 to 6 months), will cause some potential buyers to reevaluate their options.

For more on the situation as it unfolds, follow us on Stacked. We’ll keep you updated on what’s happening in the Singapore property market, so you can make an informed decision.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Market Commentary

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Property Market Commentary Why Early Buyers In New Housing Estates May See Less Upside In 2026

Property Market Commentary Landed Home Sales Hit a Four-Year High — Here’s What That Could Mean for Prices in 2026

Property Market Commentary Where HDB Flats Continue to Hold Value Despite Ageing Leases

Latest Posts

Singapore Property News Tanjong Rhu’s First GLS In 28 Years Just Sold For $709M — Here’s What The Next Condo May Launch At

Editor's Pick I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

BTO Reviews February 2026 BTO Launch Review: Ultimate Guide To Choosing The Best Unit

Singapore Property News Singapore’s CBD Office Rents Have Risen For 7 Straight Quarters — But Who’s Really Driving The Demand?

Singapore Property News 19 Pre-War Bungalows At Adam Park Just Went Up For Tender — But There’s A Catch

Pro Why Buyers in the Same Condo Ended Up With Very Different Results

Singapore Property News February 2026’s BTO Includes Flats Ready in Under 3 Years — With Big Implications for Buyers

Singapore Property News 1,600 New BTO Flats Are Coming To These Areas For The First Time In Over 40 Years

Singapore Property News Why ‘Accurate’ Property Listings Still Mislead Buyers In Singapore

Editor's Pick Narra Residences Sets a New Price Benchmark for Dairy Farm at $2,180 PSF — and the sales breakdown offers

Editor's Pick This Overlooked Property Market Could Deliver 12–20% Growth — But There’s a Catch

Singapore Property News Newport Residences Sells 57% at Launch Weekend — But the Real Surprise Came From the Large Units

Singapore Property News A Rare Freehold Mall Is Up for Sale At $295 Million: Why the Market Is Paying Attention

On The Market Here Are The Rare HDB Flats With Unblocked Views That Hardly Come Up for Sale

Editor's Pick We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Is it worthwhile to downgrade from a four bedroom EC in Woodlands to a new private condo two bedroom?

Is EC in MOP achieved the highest price likewise for the HDB?

A four bedroom HDB flat at Toa Payoh Crest that just hit MOP fetch more than $900k makes us think whether is

worthwhile to buy or not

After viewing a show flat of two bedroom PC found that bathrooms have no window also make us think twice.

What is your comment?