Here’s What Property Prices In 2010 Can Teach You In 2020

February 16, 2020

There’s a famous saying that goes,

History is merely a list of surprises. It can only prepare us to be surprised yet again.

Kurt Vonnegut

Talk about an astute saying.

Especially so when you hear the same usual comments every property cycle.

“Property prices are too high! There’s no way it can keep going up!”

“$900 PSF for Punggol? Siao, who will pay that kinda price!?”

Here’s a teaser of a property pessimist that you would usually encounter.

But look at what has happened since then, the cycle has moved on – the value of properties in Singapore has risen up and up.

For those of you who’ve been around for long enough, you’ll know that the property market operates in cycles.

This means that while you have periods of long growth, there are also periods where prices are stagnant, or worse still, dips.

Sure, you might think that property prices now are way out of line. It might seem unsustainable, but the truth is – we’ve all been there before.

So since we are currently in the year 2020, let’s just take a walk down memory lane and look at prices (and pieces of news) back in 2010.

It’s quite fascinating to see what the consensus of the market was a decade ago.

Would you be surprised at where prices were back then?

It might have sounded like a crazy price back then, but in hindsight 10 years on, does it suddenly look reasonable to you?

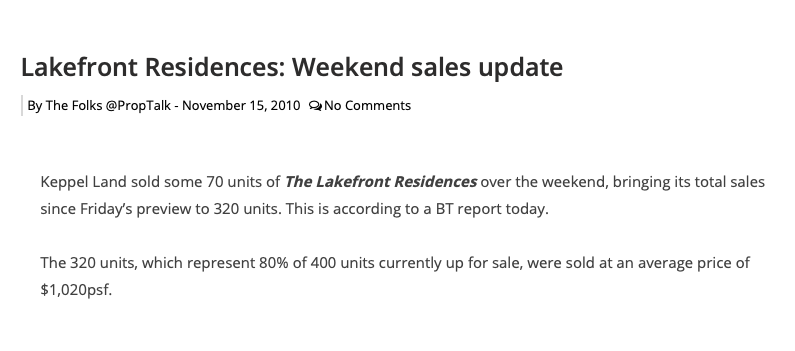

Let’s look at the Lakefront Residences, launched in 2010 and setting a record PSF for the area then at an average price of $1,020 PSF.

Bear in mind, this was after a period where there were significant cooling measures that were set earlier during the year.

Feb 2010

- Introduction of seller stamp duty (SSD) for property and land sold within 1 year.

- Loan to Value (LTV) lowered to 80% from 90% for all mortgage loans.

Aug 2010

- Holding period of SSD increased to 3 years from 1 year

- Minimum cash payments raised to 10% from 5% for buyers with one or more housing loans

- LTV lowered to 70% from 80% for second property

Here’s another example, the Minton – Launched in 2010 at an average price of $850 PSF

At those prices back then people were still finding it difficult to adjust as it only sold about 180 out of 300 in its first weekend – basically it underperformed on launch day. With a 2 bedroom at the Minton currently going for at least $1 million, I’m sure those prices today would be a no brainer.

More from Stacked

Many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Should You Right-Size To A Flat, Or Just A Smaller Condo?

Perhaps the children have moved out, or perhaps right-sizing was part of your retirement plans all along. Whatever the case,…

Lastly, Terrene at Bukit Timah is currently transacting at an average of $1,500 PSF. Not mind-blowing, but it has appreciated nonetheless.

2010 to 2019 District PSF Comparison

Let’s now take a look at how much property prices have increased on average by PSF since 2010.

| District | 2010 | 2019 | Change |

| 1 | 2,275 | 2,258 | -0.75% |

| 2 | 1,806 | 2,382 | 31.88% |

| 3 | 1,159 | 1,964 | 69.44% |

| 4 | 1,476 | 1,594 | 8.04% |

| 5 | 1,005 | 1,487 | 47.98% |

| 6 | 1,249 | 3,167 | 153.48% |

| 7 | 1,365 | 2,623 | 92.14% |

| 8 | 1,149 | 1,435 | 24.93% |

| 9 | 2,019 | 2,366 | 17.21% |

| 10 | 1,643 | 2,399 | 46.04% |

| 11 | 1,501 | 1,842 | 22.67% |

| 12 | 1,033 | 1,409 | 36.36% |

| 13 | 956 | 1,660 | 73.65% |

| 14 | 973 | 1,545 | 58.81% |

| 15 | 1,130 | 1,700 | 50.45% |

| 16 | 861 | 1,108 | 28.75% |

| 17 | 677 | 1,177 | 73.90% |

| 18 | 738 | 1,228 | 66.39% |

| 19 | 858 | 1,361 | 58.63% |

| 20 | 834 | 1,493 | 78.99% |

| 21 | 1,074 | 1,495 | 39.29% |

| 22 | 835 | 1,041 | 24.56% |

| 23 | 748 | 1,144 | 52.93% |

| 25 | 584 | 840 | 43.82% |

| 26 | 783 | 1,084 | 38.49% |

| 27 | 700 | 980 | 40.03% |

| 28 | 923 | 1,242 | 34.53% |

District 1 was a real surprise, but we’ll get to that in another article!

And just to keep things interesting – properties that have the highest appreciation since 2010, sorted by district.

| Condo Name | 2019 PSF | 2010 PSF | District | Change |

| EMERALD GARDEN | $ 2,017.50 | $ 1,461.90 | 1 | 38% |

| CRAIG PLACE | $ 1,757.50 | $ 1,164.00 | 2 | 51% |

| ENG HOON MANSIONS | $ 1,100.00 | $ 717.67 | 3 | 53% |

| TELOK BLANGAH HOUSE | $ 1,642.00 | $ 1,150.00 | 4 | 43% |

| PALM MANSIONS | $ 1,160.50 | $ 685.50 | 5 | 69% |

| HERITAGE PLACE | $ 1,701.00 | $ 1,243.00 | 7 | 37% |

| SOHO @ FARRER | $ 1,437.00 | $ 939.33 | 8 | 53% |

| 336 RIVER VALLEY | $ 2,462.00 | $ 972.25 | 9 | 153% |

| Royal Court | $ 1,100.00 | $ 698.25 | 10 | 58% |

| CORONATION GROVE | $ 1,570.00 | $ 875.00 | 10 | 79% |

| MINBU VILLA | $ 1,176.50 | $ 734.00 | 11 | 60% |

| ST FRANCIS LODGE | $ 1,100.00 | $ 634.00 | 12 | 74% |

| SOMMERVILLE LOFT | $ 1,091.00 | $ 595.00 | 13 | 83% |

| KINGSTON TERRACE | $ 1,093.00 | $ 646.50 | 14 | 69% |

| TAIPAN JADE | $ 1,110.50 | $ 463.00 | 15 | 140% |

| CASA FLORA | $ 897.00 | $ 556.40 | 16 | 61% |

| AZALEA PARK CONDOMINIUM | $ 910.33 | $ 608.58 | 17 | 50% |

| DOUBLE BAY RESIDENCES | $ 1,070.81 | $ 756.40 | 18 | 42% |

| CHOON KIM HOUSE | $ 1,000.00 | $ 567.00 | 19 | 76% |

| MARYMOUNT VIEW | $ 1,328.67 | $ 769.56 | 20 | 73% |

| IVORY HEIGHTS | $ 901.28 | $ 538.93 | 22 | 67% |

| NICON GARDENS | $ 644.00 | $ 323.00 | 23 | 99% |

| ROSEWOOD | $ 733.08 | $ 603.40 | 25 | 21% |

| HONG HENG MANSIONS | $ 857.00 | $ 557.17 | 26 | 54% |

| SELETARIS | $ 815.00 | $ 611.90 | 27 | 33% |

| MIMOSA PARK | $ 996.50 | $ 587.50 | 28 | 70% |

Let me just take the time to highlight something very important – I am in no way advocating that every property will make money. There are some that will have lost money, even if you had bought them way back in 2010.

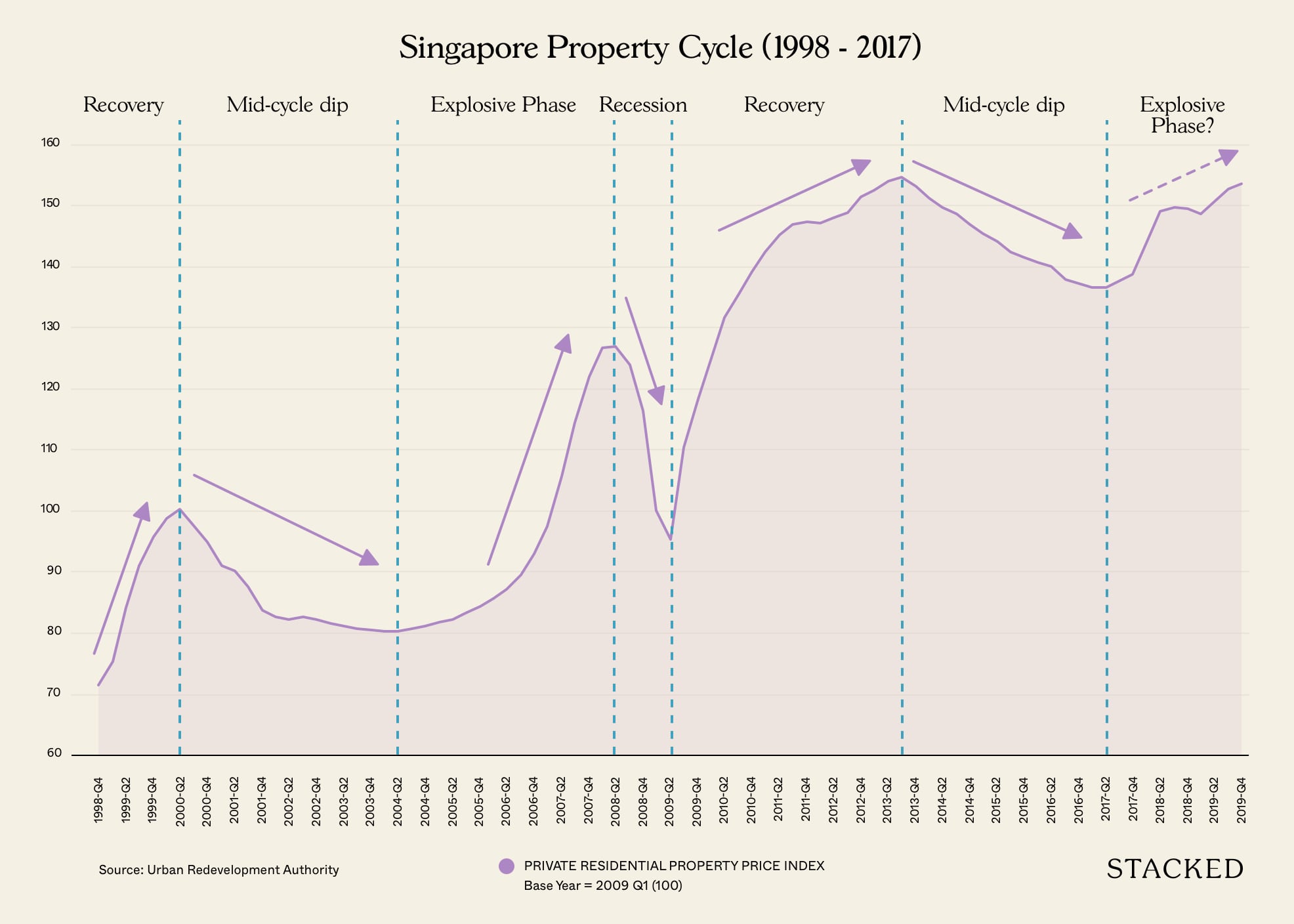

Property Market CommentaryWhy Knowing The Singapore Property Cycle Can Make You A Better Investor

by Sean GohBut it’s really common knowledge that the value of a property will increase over time.

It might not grow consistently, but in general, you should expect to see it increase.

So looking back at property prices, in a way, helps you to look forward.

Some might say, of course! Who wouldn’t want to buy houses at prices of yesteryear?

Let’s be honest, if that were possible, we could all bag some absolute bargains.

But you know what they say, hindsight is 20/20.

When all is said and done, as long as you take the time to do the right research, and follow a proper strategy, your long-term outlook will be favourable.

This will be true no matter how unsure the market seems to be, or how high current property prices are.

After all when you look back at prices in 2010 with a feeling of remorse, just imagine – how much prices could possibly be at a few decades from now!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What can property prices from 2010 teach us about the market in 2020?

How did property prices in Singapore change from 2010 to 2019?

Were there any significant property market measures introduced in 2010?

What are some examples of properties launched in 2010 that appreciated over time?

Does historical property price data suggest that buying property is a good long-term investment?

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

2 Comments

No matter what, you’ll always need a roof over your head. High prices or not, it has to be paid. If you’re buying for first home, never wait for lower prices for it may never come!

Thanks for sharing. It’s amazing how prices always look higher. The same can be said today, but this time I do think prices are really too high. The oversupply and recent outbreak of covid-19 will have an effect on our property market given the cooling measures in place.