New Record For Landed Home Prices In Singapore: It’s Like An A+ in The Least Important Exam

May 11, 2025

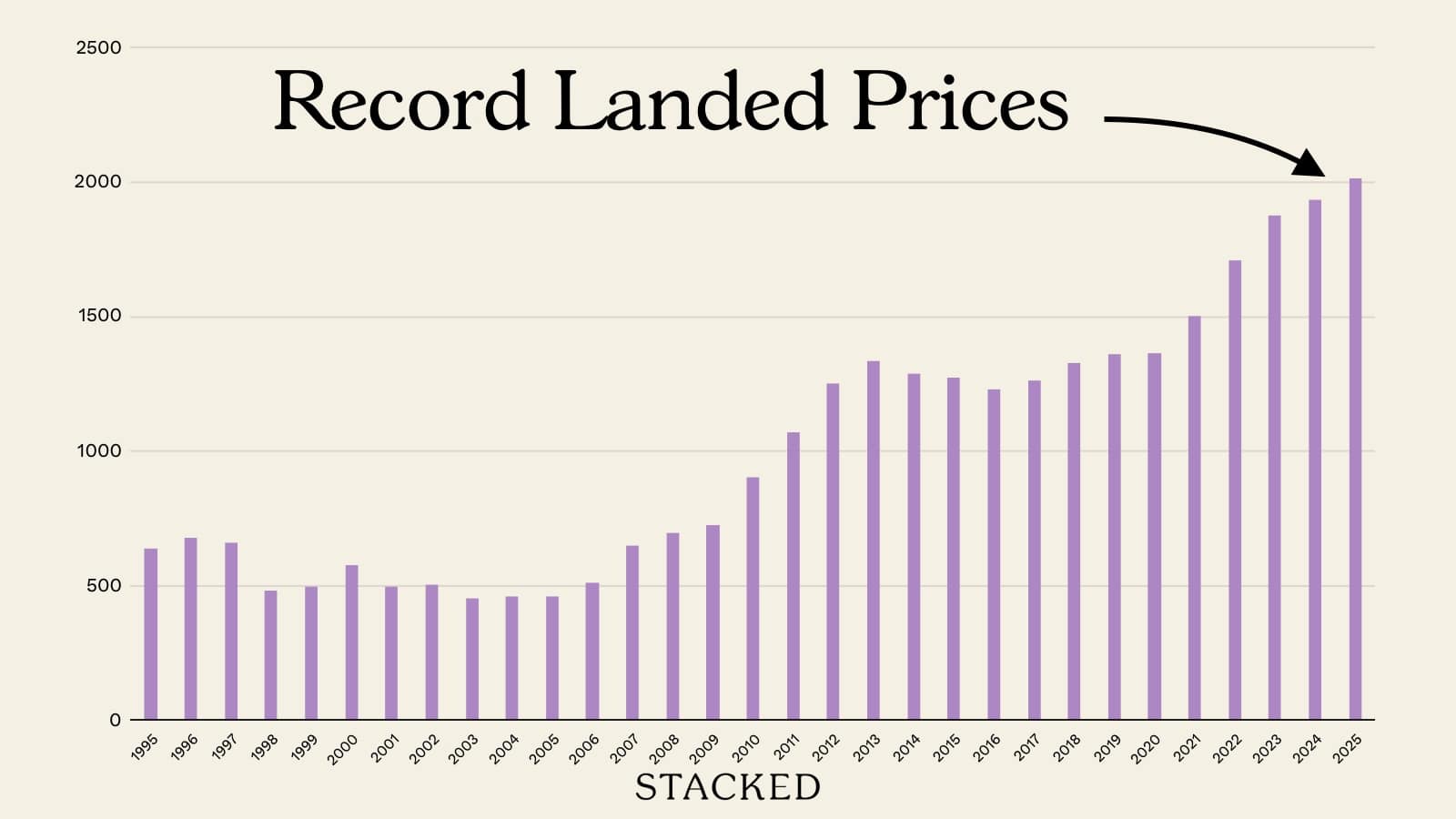

I just found out something interesting about landed homes in Q1 this year: they’ve officially breached the $2,000 psf mark.

If you’re thinking, “What? So low?”—It’s not. Not for landed property. The larger the property, the lower the price per square foot is supposed to be. Yet according to Huttons Asia, landed homes averaged $2,008 psf as of end-Q1 2025. That includes a 9,850 sq. ft. detached home in Holland Grove, sold for $24.7 million—the priciest landed deal on record so far this year.

What’s different this time is the lack of the usual cheerleading.

Typically, when landed prices rise in a volatile market, the average realtor is just one pom-pom short of being a full-time hype squad. I half expected the usual lines: that it’s proof Singapore property is a safe haven, that foreign buyers will flood in to rescue us, and that real estate is the best crisis asset.

Instead, more agents responded with the equivalent of “meh.”

One agent pointed out that transaction volumes are actually down 5.3 per cent quarter-on-quarter, and that inventory remains painfully tight. There’s little comfort in record-high prices when there’s hardly anything to sell or buy.

The ongoing trade tensions aren’t helping either; with more Singaporeans questioning the viability of retirement plans, many are holding off upgrading. Prospective sellers are just as hesitant as buyers: downsizing today often means shelling out more for a smaller home, as resale and condo prices are also high.

Combine this with the fear of a 60 per cent ABSD on foreigners, and you’ll see why many realtors may not be sleeping well. While foreigners can’t buy landed properties without special permission, they still can make purchases on Sentosa, or be among the rare few with SLA permission. But affluent Chinese buyers are reportedly losing interest in Singapore already, so agents who relied on this niche will have to adapt very quickly.

So it wasn’t surprising when several agents told me the landed market may stay where it is: high in price, but low in activity. A slow-moving, sideways market. This makes it a strange moment: a record-breaking quarter that feels more like a footnote than a headline.

More from Stacked

How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Every time a large TOTO jackpot makes the headlines, everyone starts contemplating what exactly they’d buy if that money materialised…

A bit like a student being told they got straight A’s, and the response is just a nervous “Oh. Okay,” because they’re not sure if it will hold true next term.

Meanwhile in other property news…

- Five-year old flats are never going to be cheap; but here are some four-room units we managed to find from just $585,000.

- Mortgagee sales (distressed properties) have indeed gone up as times get harder. But don’t get your hopes too high, if you think it means some sort of discount.

- How could a flat with a 62-year lease set a record price of over $1.5 million? Here are some reasons.

- Some buyers at Clement Canopy saw huge gains, like $700,000, simply by buying a few months earlier. Here’s a good case study as to why you shouldn’t dawdle, when it comes to property.

Weekly Sales Roundup (28 April – 04 May)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CANNINGHILL PIERS | $5,698,000 | 1959 | $2,909 | 99 yrs (2021) |

| WATTEN HOUSE | $5,011,000 | 1539 | $3,255 | FH |

| BLOOMSBURY RESIDENCES | $3,832,000 | 1421 | $2,697 | 99 years |

| MEYER BLUE | $3,781,000 | 1141 | $3,314 | FH |

| TEMBUSU GRAND | $3,743,000 | 1604 | $2,334 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PARKTOWN RESIDENCE | $1,231,000 | 506 | $2,433 | 99 yrs (2023) |

| LENTORIA | $1,329,000 | 538 | $2,469 | 99 yrs (2022) |

| BLOOMSBURY RESIDENCES | $1,354,000 | 570 | $2,373 | 99 years |

| NOVO PLACE | $1,393,000 | 872 | $1,598 | 99 yrs (2023) |

| LUMINA GRAND | $1,465,000 | 936 | $1,564 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CUSCADEN RESERVE | $7,111,800 | 2099 | $3,388 | 99 yrs (2018) |

| SKY@ELEVEN | $5,230,000 | 2271 | $2,303 | FH |

| GOODWOOD RESIDENCE | $5,120,000 | 1970 | $2,599 | FH |

| PEACH GARDEN | $5,120,000 | 2766 | $1,851 | FH |

| THE WATERSIDE | $5,040,000 | 2411 | $2,090 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PARC ROSEWOOD | $668,000 | 506 | $1,320 | 99 yrs (2011) |

| THOMSON V ONE | $670,000 | 441 | $1,518 | 99 yrs (2001) |

| PARC OLYMPIA | $680,000 | 495 | $1,373 | 99 yrs (2012) |

| PRESTIGE HEIGHTS | $680,000 | 377 | $1,805 | FH |

| LAUREL TREE | $690,000 | 463 | $1,491 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| PEACH GARDEN | $5,120,000 | 2766 | $1,851 | $3,370,000 | 28 Years |

| VIVA | $5,020,000 | 1959 | $2,562 | $2,216,500 | 16 Years |

| THOMSON 800 | $3,080,000 | 1625 | $1,895 | $2,156,000 | 27 Years |

| THE STERLING | $3,450,000 | 1528 | $2,257 | $2,070,400 | 25 Years |

| SKY@ELEVEN | $5,230,000 | 2271 | $2,303 | $1,982,470 | 15 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| REFLECTIONS AT KEPPEL BAY | $3,250,000 | 1604 | $2,026 | -$741,500 | 18 Years |

| OUE TWIN PEAKS | $3,300,000 | 1399 | $2,358 | -$240,170 | 9 Years |

| SILVERSEA | $3,120,000 | 1496 | $2,085 | -$190,000 | 0 Years |

| THE SAIL @ MARINA BAY | $2,060,888 | 883 | $2,335 | -$173,102 | 18 Years |

| ESPADA | $1,450,000 | 646 | $2,245 | -$130,000 | 15 Years |

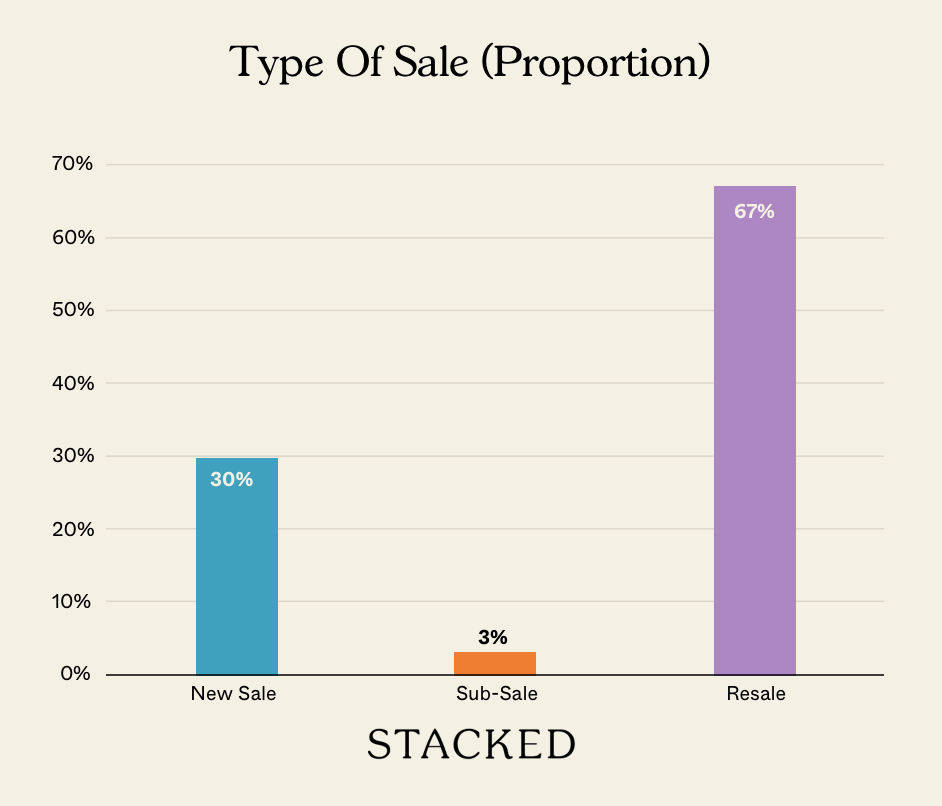

Transaction Breakdown

Follow us on Stacked for more on the Singapore property market, and the prices of new and resale projects alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did landed home prices in Singapore reach a record high in Q1 2025?

Are property agents optimistic about the Singapore landed property market right now?

What factors are affecting the property market in Singapore currently?

How are distressed property sales changing in Singapore?

What are some recent notable property sales in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

1 Comments

Not surprising when agent are selling landed prices base on psf for built up area instead of psf for land.

This portray an image that landed is under value.