New Launch Or Resale Property: 4 Considerations To Think About In 2021

June 18, 2021

2021 is shaping up to be an interesting year, for those choosing between new and resale condos. A number of unusual factors (such as Covid-19 related delays) pose a risk for new launches, but new private home volumes still managed a four-year high in April. Here’s an updated look at what buyers need to know right now:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

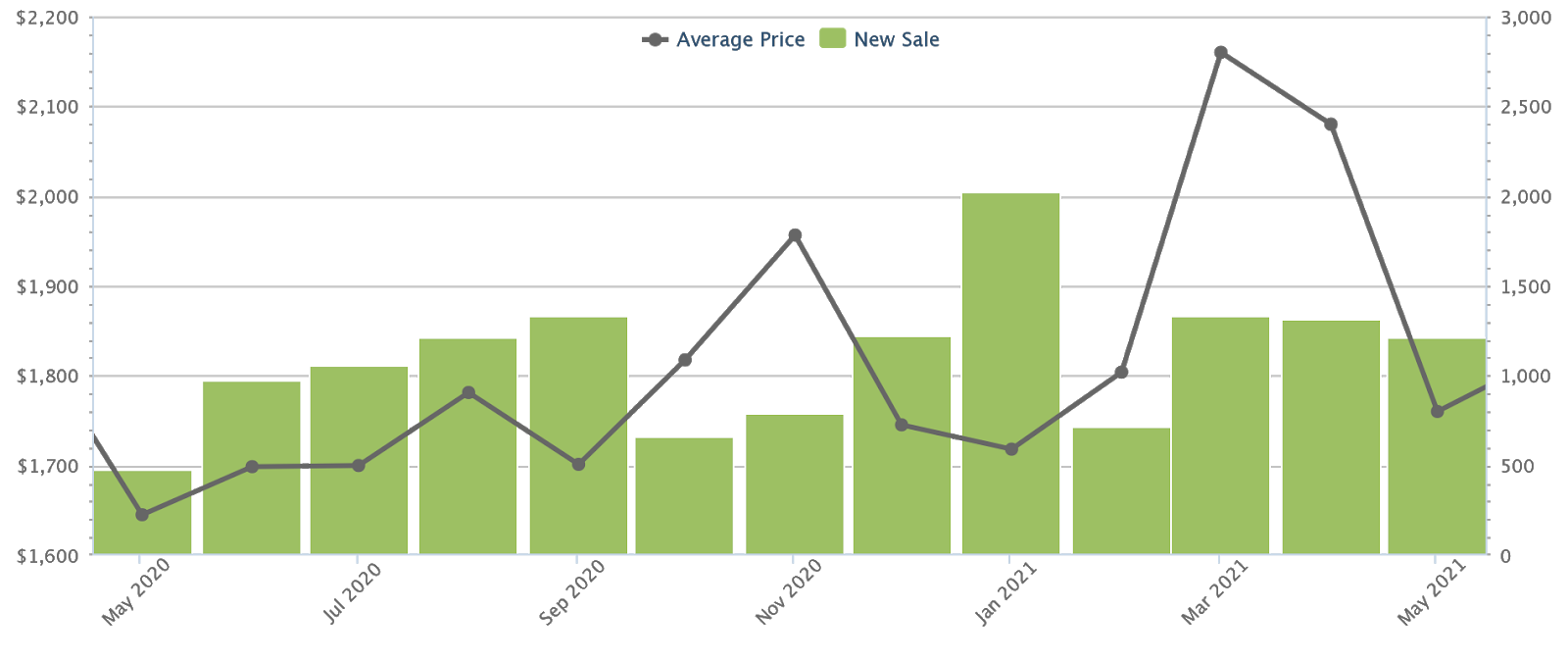

A snapshot of new condo prices

New sale condos in Singapore averaged $1,760 psf in end-May 2021. Prices have lost the momentum that was building in January 2021, partly due to a lower number of launches, and in other cases due to Covid-19 restrictions (see below).

Nonetheless, a new record was set for the Orchard Boulevard area by Park Nova. A penthouse transaction on 7th May reached a quantum of $34,438,000, or about $5,838 psf.

Transaction volumes were muted in end-May, at 1,206 units. Realtors attributed this to Phase 2 (Heightened Alert) measures, which restricted home and show flat viewings from 16th May onwards.

Top sales for new launches in May 2021 were:

- One Bernam (82 units)

- Treasure at Tampines (63 units)

- Normanton Park (52 units)

- Midwood (40 units)

- Affinity at Serangoon (37 units)

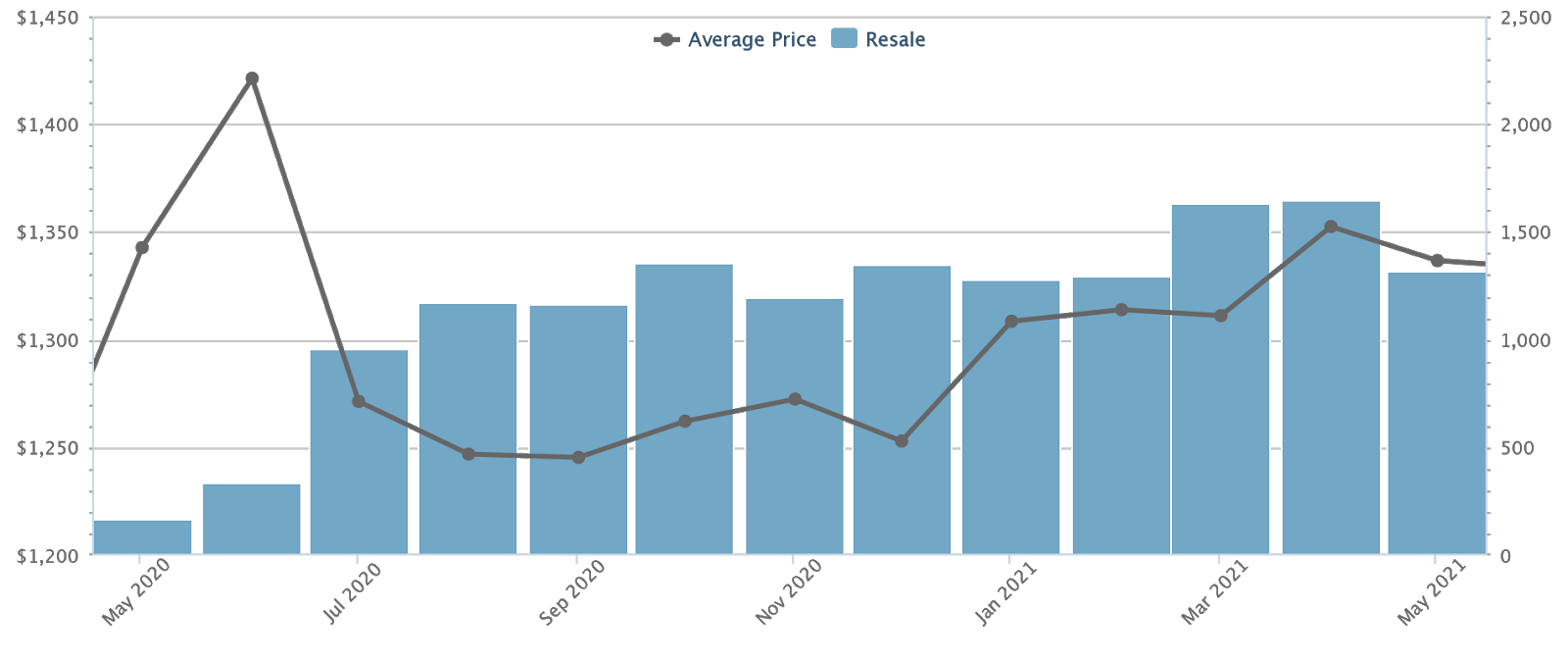

A snapshot of resale condo prices

Resale condo prices were more resilient than their new launch counterparts. Prices averaged $1,337 psf in end-May, despite falling sales volumes. The average was also pulled up by The Marq on Paterson Hill, where a penthouse unit was sold for $13.3 million, or about $4,305 psf.

Resale volumes have dropped to 1,317 units, down from 1,643 units the month before. The reason is similar to the drop in new launch counterparts – realtors are facing the challenge of having only two persons (including the agent) at home viewings.

Some realtors have expressed that the situation is worse for resale than for new launch condos. One of them explained that:

“For resale buyers, one of the main advantages is that they can inspect the actual property. They want to know what the neighbours are like, the condition of the unit, and so forth. For new launches, due to the strength of Singapore developers’ reputations, buyers can be more willing to take certain things on faith.”

What’s changed in new versus resale condo considerations in 2021?

- Construction delays from Covid-19

- Better en-bloc prospects favouring resale

- Old resale condo sizes working in their favour

- More new launches targeting a lower quantum, higher price psf

1. Construction delays from Covid-19

The public housing sector has already disclosed that 85 per cent of BTO projects will face delays, of between six to nine months. There’s no common source for the private sector; but realtors and analysts that we spoke to claimed a similar risk for delays. This is, for instance, the government’s reason for granting a six-month extension on deadlines such as the five-year ABSD.

As such, home buyers who are sensitive about the time frame may prefer a resale unit. Likewise, some investors may be worried about loss of rental, should the completion of a new launch be set back.

That said, resale condos are not totally unscathed by this. The delays are due to labour and supply shortages in the construction industry; but this means there are also delays in renovation work.

One contractor we spoke to, who asked to remain anonymous, cautioned that the cost of renovations is also increasing. This is due to more reliance on local, rather than (cheaper) foreign craftsmen. As such, new launch condos, which tend to be in “ready to move in” condition, may be spared the worst of this.

2. Better en-bloc prospects favouring resale

As we’ve discussed in a previous article, all of the developments arising from the 2017 en-bloc fever have now been completed or launched. This has left many developers in a rush to replenish their land bank; and Government Land Sales alone may not suffice.

This situation favours older resale condos, as it makes a collective sale more likely. However, due to Covid-19 delays and the ABSD deadline, the general consensus is that small to mid-sized developments (i.e., 500 units or less) have better chances.

One reason is that the five-year ABSD time limit applies regardless of development size; a developer has the same time frame to complete and sell a 50-unit condo, that they would a 1,000+ unit condo.

As such, only the most confident developers might consider a 1,000+ unit mega-development in the current environment. Very big older condos, such as Braddell View, Bullion Park, etc. may be a hard sell.

That said, there’s also an advantage to older resale condos right now:

Property PicksA Detailed List Of 287 Freehold Condos With En Bloc Potential In 2021 (Part 2)

by Ryan J. Ong

3. Old resale condo sizes working in their favour

HDB upgraders have made up a dominant force among buyers, since around 2019. Most upgraders are, however, family units. This means they’re not interested in shoebox units, or anything but the largest two-bedders.

Anecdotally, realtors have pointed to the fear of new cooling measures as driving the demand for larger homes. They noted that some buyers want to get larger properties now, while these are still within reach.

Cushman & Wakefield Singapore recently reported that the median size of purchased units is up from 710 sq. ft. to 743 sq. ft. year-on-year. For new homes, sales for units above 1,200 sq. ft. rose 72 per cent between Q4 of last year, and Q1 this year.

With current prices, resale condos also look like a value buy next to high price PSF in new launches. For example: Caribbean at Keppel Bay, for instance has 1,270 sq. ft. units for as low as $1.75 million. The average cost of a new launch three-bedder (around 970 sq. ft.) is about $1.6 million.

On the flipside, note that very large older condos have diminished en-bloc prospects (see above).

4. More new launches targeting a lower quantum, higher price psf

While the current buyer preference is for larger homes, developers still like to offer smaller units as these are easier to sell (shoebox units are the low-hanging fruit, to get the ball rolling).

The trend here is to offer very small units, that would lower the quantum in prime region properties. The M was the most obvious example in 2020 (one-bedders were as low as below $1 million, but about $3,000 psf, in the expensive District 7 area).

Irwell Hill Residences is a more recent example: the smallest units (398 to 452 sq. ft.) offer a chance to stay a few minutes away from Great World City. The overall cost is now around $1.15 million, a seemingly reasonable price for its location.

For buyers who prize a central location over living space, new launches may be more affordable, compared to bigger resale alternatives.

Finally, a reminder on the factors that are relevant in any year

Buyers seeking immediate rental income, or who want a proven transaction history, will still prefer resale properties. And let’s not forget the most current important point – the need for more space at home. One could argue that’s even more important in 2021, given the volatile pandemic situation.

On the flip side, new launch properties have the undeniable psychological appeal of being new. Early bird discounts and progressive payment schemes may also appeal to home buyers; but remember to factor in possible delays in moving in (e.g., you should prepare for higher temporary accommodation costs).

For more on unfolding events in the Singapore private property market, follow us on Stacked. We’ll also provide you with the latest in-depth reviews on new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

0 Comments