Love Without A BTO Flat: The Tough Housing Choices Facing Mixed-Nationality Couples In Singapore

June 6, 2025

With Singapore being more cosmopolitan in recent decades, and how connected we are globally, it is getting more common to see Singaporeans dating foreigners. I belong to this ‘minority’ demographic, and dating a foreigner is possibly the least logical thing I’ve done in my life; because it forced me to realise one of the most painful realities of dating someone foreign for love: You’re not eligible for a shared BTO flat as a married couple – foreigners can’t own an HDB flat, so only one of you is the owner; and there are restrictions besides.

Mixed-nationality couples are becoming more common

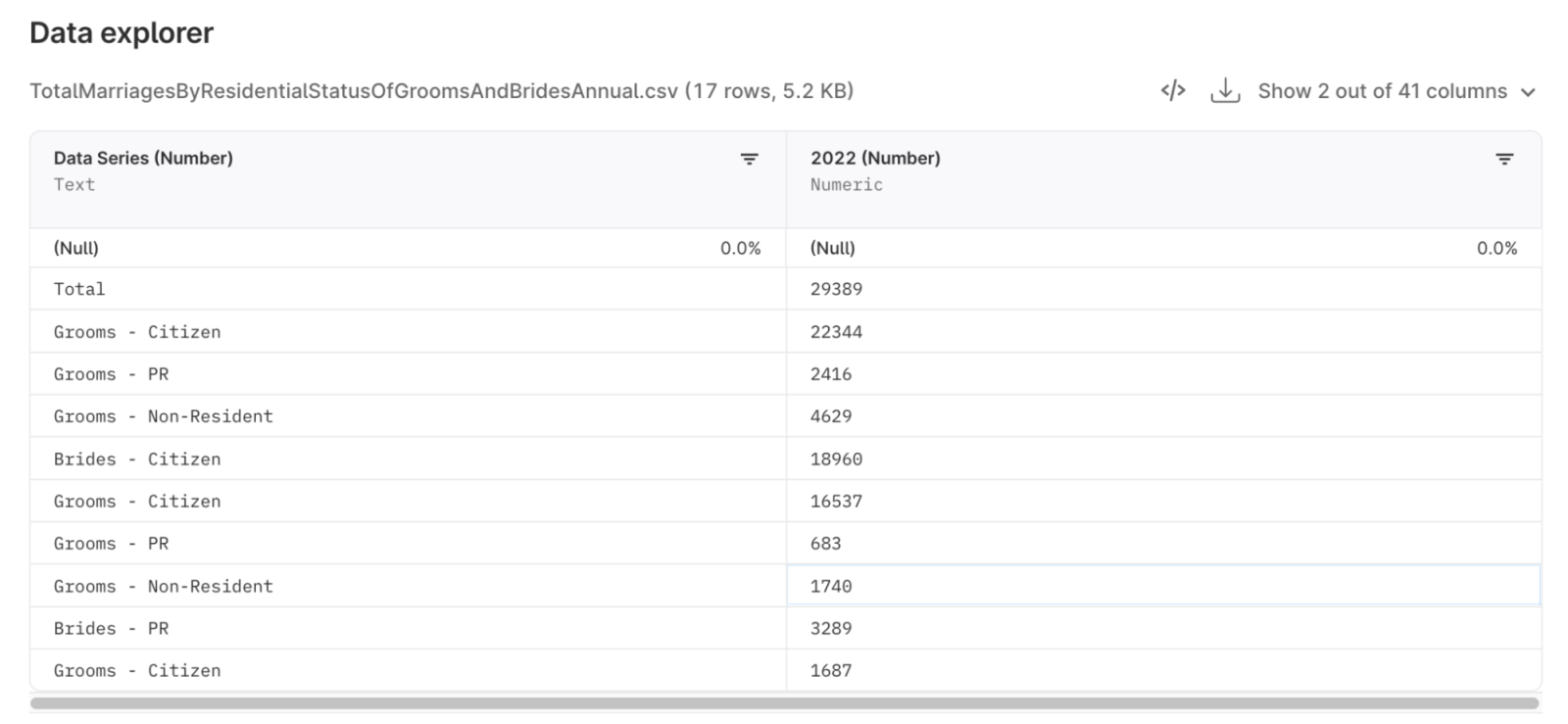

In 2022, about 20 per cent of marriages were between a Singaporean and a foreigner; a number that has stayed broadly similar over the past few years. So I find it quite surprising that today, there are still not many options for couples in this demographic.

I wouldn’t really call us a minority, when we’re nearly a quarter of every year’s data set. A bigger piece of the pie compared to Singaporean-PR couples!

Anyway, back to the topic, for Singaporeans marrying foreigners, let’s take a look at the choices of property I have considered, and why my partner and I ended up not going for them.

Resale HDBs (Singapore)

The most common pathway for home ownership for Singaporean-Foreigner couples is resale flats. While there are still some eligibility requirements, it’s not as restrictive as a BTO unit. Only Singaporeans can own the flat, and the foreign spouse will require a Long-Term Visit Pass* or a Work Visa* of at least six months; they must be listed as an Essential Occupant.

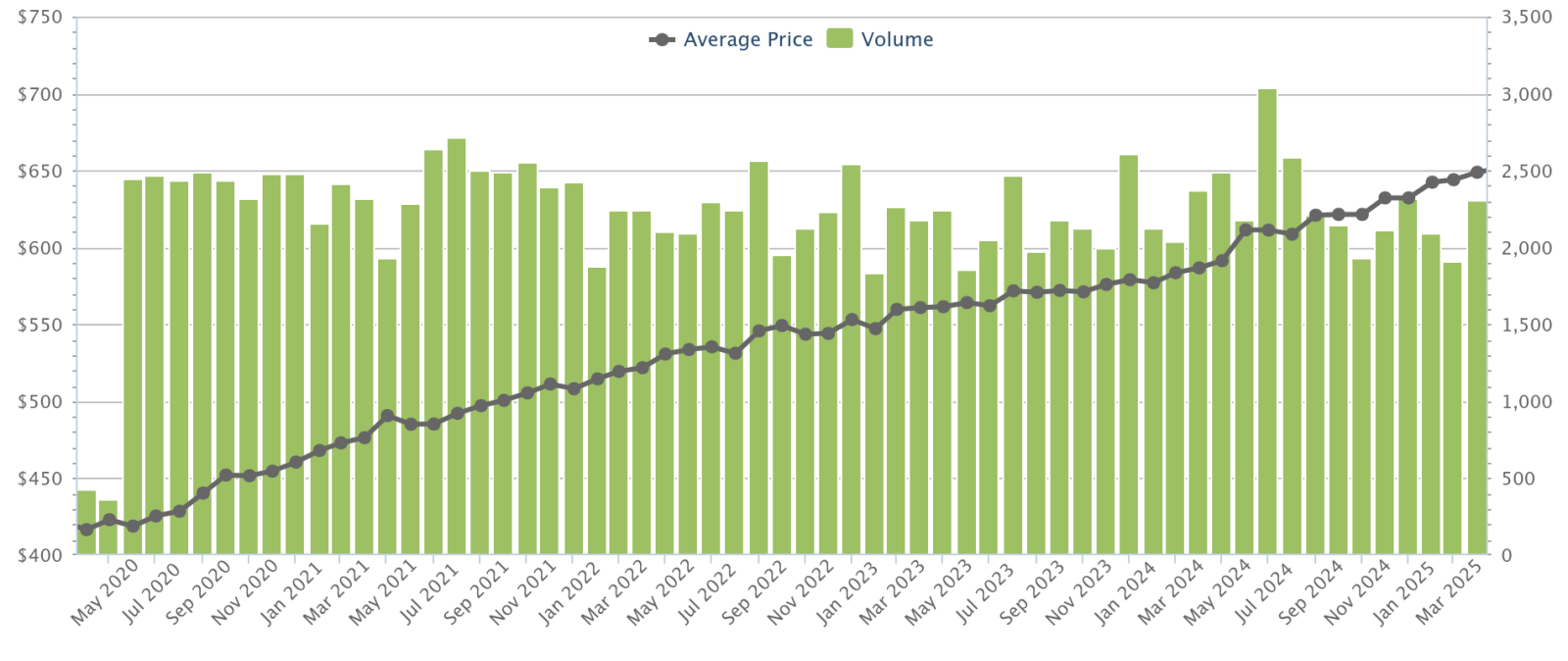

Before COVID-19, this was a possible reality. We were a bit too young to get married and commit to a mortgage together, so this was actually just Plan A for us to settle down in Singapore in a few years. But after COVID-19, we saw a huge spike in resale flat prices, and we were effectively priced out of the resale market:

Resale HDB prices were around $417 psf at around April 2020, the peak COVID period when Singapore had its Circuit Breaker. As of April 2025, the average resale flat price is around $649 psf.

So year after year, it became clear that resale would not be an option for us; not without derailing our long-term financial plans.

Plus, there was also an issue of non-equitable ownership, as my partner would not have been able to officially own the flat until he got his Permanent Resident (PR) status in Singapore. Since getting a PR is a shot in the dark with unclear requirements and timelines of acceptance, we also decided not to bet on the outcome. It would result in potential unfairness and insecurity, which might strain our relationship.

*Subject to HDB’s terms regarding non-resident spouses

2-Room Flexi BTO / SBF (Singapore)

The next option we thought to try was to wait till I reached 35 years old, to get a 2-Room Flexi BTO. This was far from an ideal situation as we wanted to start a family, so a 2-Room Flexi wouldn’t suffice. It also means waiting almost a decade to have this option available to us, and until then, we would have no other housing option available to us other than renting or living with my parents.

There’s also the income ceiling of $7,000; which I unfortunately exceeded by just a little bit. This option then became impossible. Incidentally, when you apply for a 2-Room Flexi BTO with a non-citizen spouse, you can only look in non-mature areas*. Frankly that’s not very practical, as it means a less developed location, with limited room for starting a family.

So at this point Singapore started to feel too restrictive for housing, and we felt like we were bending and twisting just to meet HDB’s public housing requirements.

*Update: This was relevant at the time when the writer was seeking a home with her spouse. The restriction regarding non-mature estates no longer applies as HDB has removed the mature / non-mature classification as of 2H 2024. Singles today can apply for a 2-Room Flexi in any town.

Privatised ECs (Singapore)

ECs are privatised after the 10th year, and are treated as fully private properties; so technically, we could buy and co-own ECs; but only out of their privatisation period. But if resale flat prices are too high, then the same can certainly be said of ECs, which are even pricier. Fully private properties were also out of the question.

Renting (Singapore)

I’ve been renting in Singapore since I got my right to vote, and the rental market really isn’t that bad if you value flexibility, and the ability to live in areas that you want (near work, near favourite hawker stalls, etc.)

Given the high prices in 2025, renting might not be a bad option for couples who are still figuring out their finances. And since Singaporean-Foreigner couples don’t have that much access to public housing options in Singapore, it can be good to rent and test-drive the neighbourhoods you might eventually want to live in.

One downside is that Singapore repealed its rent control acts way back in 2001, so your rental rates will depend on what you can “lock-in” with landlords. I have heard horror stories of landlords increasing the rental prices of their property, forcing them to move or accept a higher monthly rate.

More from Stacked

7 Considerations To Make When Partitioning Your Condo For Better Resale Value/Rental Returns

A lot of newer condos come with “flexi” rooms, whilst dumbbell layouts are quite versatile. These make it quite easy…

Also, while there is some flexibility in renting, it also takes some level of commitment. Getting married and applying for a Long Term Visit Pass (LTVP) for my partner was the first step, before we could even consider renting together. It’s a lot of paperwork and hassle, to end up paying potentially high rental rates.

But there’s an advantage to being married to a foreigner, which opens up a new avenue

Being married to a foreigner usually means you have options to live overseas and have a new life, outside the tiny red dot.

So if moving overseas is something that can be considered, it might not make much sense to commit to a property in Singapore, especially if your finances aren’t ready for it yet. So while renting, you don’t just need to be considering places in Singapore as well; you can use that time to also look at housing options in your partner’s home country (or countries.)

And so, we landed on our final decision.

Foreign property (Overseas)

When all other options in Singapore had exhausted themselves, we became the advocate for foreign property as a viable option for homeownership. Depending on where your spouse is from and what their country’s laws are on property and land ownership, the restrictions on Singaporeans will look a bit different.

After talking about financial goals and how to maximise the results from our options, we have decided to get property overseas first as the barrier of entry is lower (cheaper properties even in Europe), and there are far fewer restrictions on property ownership overseas.

While property appreciation is not as high, we are in less debt and under less financial stress. In this uncertain economy, where we cannot be sure if our careers will last past our mid-thirties, I am very glad we don’t have a 25-year Singaporean housing mortgage, but a manageable and humble European property that can serve us while we build our financial security.

If you must stay and find a home in Singapore though…

It would be best if both of you were already married, and that your foreign spouse has employment in Singapore. This is important because, when applying for bank loans to finance your property purchase, the bank is going to take a look at your taxable take-home incomes.

If your foreign spouse is not employed in Singapore, the bank could lower the Loan-To-Value (LTV) ratio. You may be able to borrow 20 to 30 per cent less, depending on the bank in question. Also due to compliance issues, banks may not be able to use all of a foreigner’s overseas income sources (e.g., even if your foreign spouse is getting dividends, rental income, or other monies from sources abroad, banks cannot always use it for loan application purposes.)

The upside is that home loan rates in Singapore can be much lower than in some other countries (around 3.75 per cent per annum as of 2025).

If a family is not yet in the picture, or you’re lifelong singles, a 2-room flat, as mentioned above, might also be viable. But if you’re a Singaporean-Foreigner couple who aren’t married yet, note that you must be married within three months of key collection.

Always consult relevant government bodies or a conveyancing lawyer before buying

Housing in Singapore is a pretty restrictive industry where there are many rules and laws in place; moreso for HDB than for private properties.

So please take our words at face value and when in doubt, go consult the relevant authorities before proceeding with your purchases. Be wary of so-called “grey area” issues to circumvent laws, such as trying to buy an HDB flat without declaring overseas property ownership. This could get your flat confiscated.

Be open to your options

Don’t be too sold on the Singapore dream where we go to university, graduate, get a job, get a BTO, start a family, plan for retirement… not all of us fit into that cookie cutter or want to, and that’s okay. Don’t feel guilty over circumstances you can’t control.

A lot of us are currently stuck at successfully passing the BTO phase, and then what? We just don’t move on with life? Nah, we just need to figure out alternatives and be open to our options. And that’s my best advice on navigating life and personal finance.

Don’t let the system determine your future for you.

For more homebuyer and overseas purchase experiences, follow us on Stacked. You can also reach out to us if you have questions about different property types or ownership issues; we have the experts on hand to help here.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Melody Koh

Melody is a designer who currently works in Tech and writes for fun. Her latest obsession is analysing and writing about real estate affordability for the younger generation. Coming from an Industrial Design background, she has a strong passion for spatial design and furnishing . Having worked in Finance for almost a decade, Melody has a keen interest in sustainable investments and a nose to sniff out numbers that don't make sense.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments