What A $6.99 Cup of Matcha Tells Us About Liveability in Singapore

January 10, 2026

Can the cost for a cup of matcha latte tell you how liveable a city is?

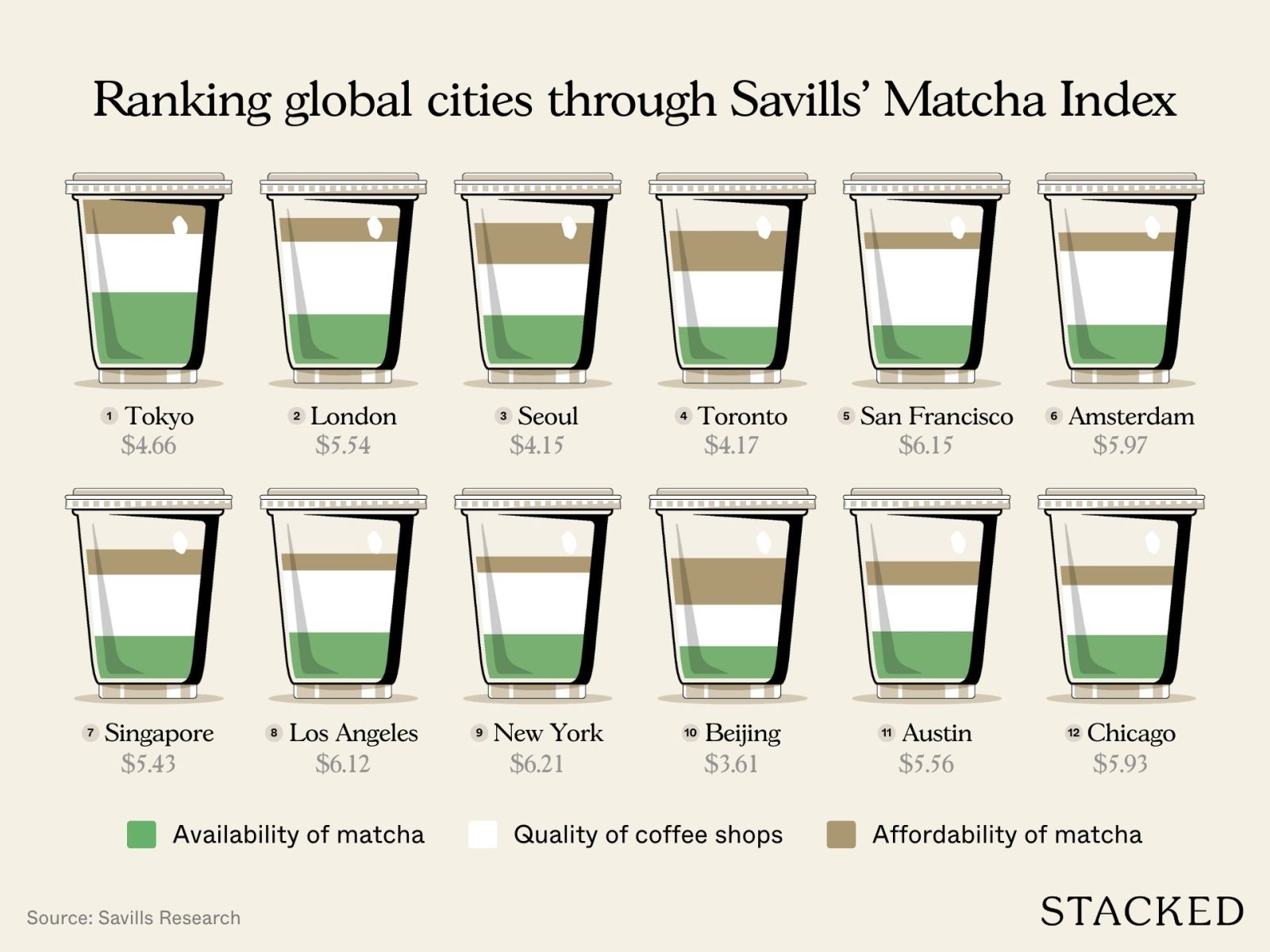

That’s one of the factors that Savills, a global real estate services provider, is using in its inaugural Matcha Index – a study that assesses urban liveability through cafe culture, matcha affordability, and quality of cafes.

You might be thinking that considering how much the average price for a cup of matcha latte in Singapore costs today, that we must easily be among the most expensive cities in the world to enjoy this trending beverage.

And it’s true, in Singapore matcha lattes cost an average of US$5.43 ($6.99), placing us among the higher-cost markets in this index.

“Singapore has a vibrant and rich café culture. Besides the strong presence of established and new coffee chains, our café culture has evolved to embrace anything Matcha, which you can find in lattes, gelato, cakes, and even bubble tea,” says Sulian Tan-Wijaya, executive director of Retail & Lifestyle at Savills Singapore.

New Yorkers fork out an average of US$6.21 for a matcha latte, followed by the residents of San Francisco who pay about US$6.15 for a cup.

Other locations on the top 12 list of cities in the Savills Matcha Index include Los Angeles (US$6.12), Amsterdam (US$5.97), London (US$5.54), and Tokyo ($4.66), and Seoul (US$4.15).

Beijing was the only city to make it on the list and is the cheapest place among the 12 global cities where you can enjoy a matcha latte, only setting you back US$3.61.

Cafe culture and our social infrastructure

Beyond the headline cost for matcha in these global cities, this Matcha Index by Savills should prompt a conversation about the urban lifestyles and out of the box markers that make a location liveable.

More from Stacked

How Much Would You Have Made If You Invested $1 Million In Singapore Property?

Yes, it is a very common question that’s been used for clickbait, but this isn’t another advertisement. Rather, it’s a…

For example, Singapore cafes and F&B companies were quick to adopt their menus to this new trend. The city-state is also an early adopter of the emerging trend of Matcha rave parties – innovative, alcohol-free events combining wellness and nightlife, says Tan-Wijaya.

So, despite the jaw-dropping cost for a matcha latte in Singapore, the dynamism of our retail market suggests that we offer the places and spaces that generate buzz and a vibrant social scene.

“Coffee culture has in effect become a vital part of the social infrastructure that supports the tech ecosystem, and matcha lattes have taken over as the ‘go-to’ drink for young professionals,” says Tan-Wijaya. She adds that Singapore remains competitive based on its overall liveability for workers, supported by strong café availability, quality and connectivity.

While the Matcha Index may appear playful, it underscores a serious truth about urban liveability today; that vibrant cafe cultures, whether centred on espresso or matcha, are vital to sustaining the social fabric of modern global cities like Singapore.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How much does a matcha latte cost in Singapore?

What does the Matcha Index measure about cities?

Why is cafe culture important for a city’s liveability?

Which cities have the most expensive matcha lattes?

How does Singapore compare to other cities in matcha prices?

What role do cafes play in Singapore’s social scene?

Timothy Tay

As Editor-in-Chief of Stacked, Timothy leads the newsroom and shapes our editorial direction, ensuring readers receive timely, thoughtful, and well-researched news and analysis. He brings over eight years of experience as a business and real estate journalist, with a strong track record across both print and digital platforms. His reporting spans luxury residential, commercial real estate, and capital markets, alongside in-depth coverage of sustainability and design.Need help with a property decision?

Speak to our team →Read next from Overseas Property Investing

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Overseas Property Investing What Under $200K Buys In Malaysia Today — From Freehold Apartments to Beachfront Suites

Overseas Property Investing A London Landmark Is Turning Into 975-Year Lease Homes — And The Entry Price May Surprise Singapore Buyers

Overseas Property Investing This Overlooked Property Market Could Deliver 12–20% Growth — But There’s a Catch

Latest Posts

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments