Lentor’s First Condo Is Complete — The Early Profits May Surprise You

December 21, 2025

The first real test has begun: Lentor Modern has gone live.

The Lentor enclave is primed for transformation. But unlike the regional shifts and master planned rejuvenation in areas like Jurong East or Woodlands North, Lentor’s rejuvenation is not helmed by a single large developer. Instead, the transformation of the previously quiet landed neighbourhood is being helmed by several private developers based on the government’s master plan for the area.

The neighbourhood is also shedding its former perception as an ‘ulu’ and inconveniently* located estate, into a connected and integrated residential hub with its direct link to the Thomson-East Coast (TEL) MRT line.

*That’s not as negative as it sounds. Most landed enclaves are planned to be some distance away from most retail malls and transport networks, and if you can afford the luxury and privacy of a landed estate, you can probably afford a car. The apparent lack of amenities within some landed estates is a feature, not a bug.

Some might describe the transformation of Lentor as a brute force tactic. What had been a quiet, forested backwater has quickly turned into a series of new condominiums, such as Lentor Modern, Lentor Hills Residences, Hillock Green, Lentoria, and Lentor Mansion.

What’s also remarkable is how much of this redevelopment was taken on pure faith. Lentor back then was the property equivalent of “bring snacks, there’s nothing here”. So for some time, all of it was a vision on the master plan, development concept boards, and property brochures.

But that will soon change.

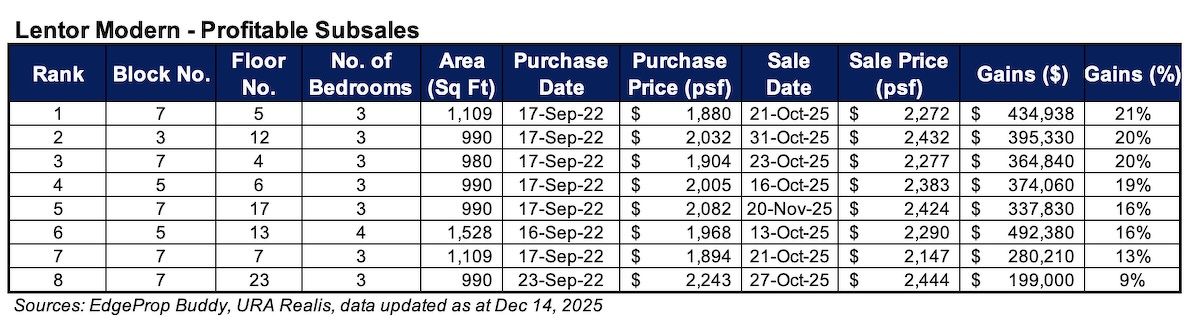

Lentor Modern, the first new condominium in Lentor, is completed and homeowners are already collecting keys after it received its temporary occupation permit (TOP) in August 2025. This project will be Lentor’s first real test case, and we have started to see several subsale transactions already taking place just months after its TOP, with most sellers recording double-digit percentage gains.

Also, to put those sub-sale gains in perspective: remember these aren’t long holds. These are owners raking in gains that, in many developments, could take years to accumulate.

While it’s still early days, this is a good sign given Lentor’s rapid build-up. When this many condos launch in the same area in quick succession, the concern is whether demand collapses once the novelty wears off; or perhaps when buyers decide future competition is too intense.

But so far, signs show that Lentor’s brute-force transformation may actually be sticking.

More importantly, Lentor Modern is more than just a landmark residential project in Lentor.

It’s an integrated development with a mall that is also linked to Lentor MRT (TEL). It is expected to be fully up and running next year, with confirmed tenants including a supermarket, preschool, and a mix of F&B and daily-use services.

This fits a very specific development pattern, which I’ve mentioned in an earlier article. Some of these projects have a strong payoff not only because they’re integrated, but because they’re first movers in an area that hasn’t seen much redevelopment. Think Waterway Point in its early days or Northpoint City. The projects kick start the neighbourhood and contribute towards establishing their vicinity as the neighbourhood hub.

This effect can stabilise much later on when surrounding projects mature and alternative amenities are introduced. However, given that Lentor’s recent rejuvenation is new and has a much longer way to go, it’ll be quite a while before this happens and Lentor Modern could be dominant in the area for a very long time.

The strong early subsales don’t mean that Lentor is immune to the usual risks.

There will be a lot of alternatives for buyers here once the various projects reach the resale market at very similar points in time. This could soften the negotiating power of later sellers. But the strong subsales do suggest that the area isn’t struggling from oversupply at the moment.

Whether Lentor eventually becomes just another OCR neighbourhood, or develops a strong identity of its own, is still an open question. But it will be closely watched, as a sort of bellwether for how quickly an area can change if enough land parcels go up for grabs.

More from Stacked

Here’s Why A Property Valuation Is A Big Deal When Getting Your Home Loan

It’s every buyer’s worst nightmare: you’ve agreed on the condo price, you’ve put your old flat up for sale for…

A quick prediction on how the Lentor area will shift in the near future

One underrated thing about brute-force development is speed. When enough projects TOP around the same time, there’s a huge bump in food traffic which draws businesses to the area, and businesses – in particular service industries – are incentivised to start finding ways in.

But because Lentor doesn’t really have a specific theme or specialisation, the area will feel polished but …maybe a bit flat for quite a while. Identity takes time, and you can’t master plan an area’s soul. Much like Northpoint City-era Yishun, or Punggol in the immediate post-Waterway Point era, the vibes take time to form. So those who expect an immediate Katong / Bishan style feel are going to be disappointed. Even if all the construction is finished, it could still take decades for that kind of vibe to fully materalise.

Also, the main risk isn’t so much the supply of new homes here. The bigger risk is whether the market will feel a lack of differentiation between projects. Lentor Modern, for instance, is quite safe from that – it stands out for being the first and only integrated project. But the issue for the future resale market is whether buyers will look at the various unit mixes, pricing bands, layouts, etc. and decide that they’re mostly the same.

It’ll be an interesting area to study once it joins the resale market, as we can see if specific layouts or unit mixes fare better, within an enclave where multiple nearby projects came about at close to the same time.

Meanwhile in other property news…

- You’re not imagining it: the property game is much tougher for Singaporeans now than it used to be, and here’s why.

- We compiled the best performing resale condos in 2025, and some of the very top performers have been under the radar. Check if yours makes the list.

- The bid for a land parcel in Hougang Central may put future prices above $2,500 psf. Ouch, if you’re a buyer. Check out the details here.

- New condo sales figures fell by a dramatic 87 per cent in November, but this may not be as alarming as it seems.

- The Panorama wasn’t the most eye-catching dramatic development when it launched in 2014…so why is it now topping the charts in 2025? Join our Stacked Pro readers in finding out.

Weekly Sales Roundup (08 – 15 December)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| 21 ANDERSON | $23,300,000 | 4489 | $5,191 | FH |

| 8@BT | $4,180,000 | 1593 | $2,624 | 99 yrs (2023) |

| THE CONTINUUM | $3,501,000 | 1238 | $2,828 | FH |

| ELTA | $3,219,000 | 1184 | $2,719 | 99 yrs (2024) |

| PINETREE HILL | $3,173,000 | 1216 | $2,609 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| BAGNALL HAUS | $1,340,000 | 495 | $2,706 | FH |

| THE CONTINUUM | $1,378,000 | 560 | $2,462 | FH |

| OTTO PLACE | $1,449,000 | 872 | $1,662 | 99 yrs (2024) |

| KASSIA | $1,569,000 | 753 | $2,082 | FH |

| THE ROBERTSON OPUS | $1,644,000 | 495 | $3,320 | 999 yrs (1841) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ARDMORE II | $7,000,000 | 2024 | $3,459 | FH |

| GALLOP GABLES | $6,880,000 | 2842 | $2,421 | FH |

| SUI GENERIS | $5,175,000 | 2131 | $2,428 | FH |

| PATERSON SUITES | $4,850,000 | 1722 | $2,816 | FH |

| BELLE VUE RESIDENCES | $4,600,000 | 2121 | $2,169 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PRIMEDGE | $656,000 | 452 | $1,451 | FH |

| CENTRA RESIDENCE | $660,000 | 398 | $1,657 | FH |

| PRESTO@UPPER SERANGOON | $730,000 | 420 | $1,739 | FH |

| KINGSFORD WATERBAY | $732,000 | 484 | $1,511 | 99 yrs (2014) |

| 28 RC SUITES | $735,000 | 441 | $1,665 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| OCEAN PARK | $3,850,000 | 1873 | $2,056 | $2,770,000 | 28 Years |

| THE STERLING | $4,450,000 | 1948 | $2,284 | $2,507,000 | 26 Years |

| THE TREVOSE | $3,682,000 | 1841 | $2,000 | $2,433,120 | 23 Years |

| GALLOP GABLES | $6,880,000 | 2842 | $2,421 | $2,080,000 | 12 Years |

| VALLEY PARK | $2,740,000 | 1216 | $2,253 | $1,970,000 | 27 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MARINA ONE RESIDENCES | $1,350,000 | 721 | $1,872 | -$219,051 | 11 Years |

| SOPHIA HILLS | $1,080,000 | 570 | $1,893 | -$68,000 | 8 Years |

| 76 SHENTON | $1,050,000 | 592 | $1,774 | -$30,000 | 5 Years |

| 28 RC SUITES | $735,000 | 441 | $1,665 | $2,000 | 12 Years |

| SUITES @ NEWTON | $1,300,000 | 603 | $2,157 | $8,605 | 14 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| CHERRYHILL | $2,350,000 | 1453 | $1,617 | 288% | 21 Years |

| OCEAN PARK | $3,850,000 | 1873 | $2,056 | 256% | 28 Years |

| VALLEY PARK | $2,740,000 | 1216 | $2,253 | 256% | 27 Years |

| CITYLIGHTS | $1,390,000 | 678 | $2,050 | 207% | 21 Years |

| FERNWOOD TOWERS | $2,700,000 | 1636 | $1,650 | 200% | 27 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| MARINA ONE RESIDENCES | $1,350,000 | 721 | $1,872 | -14% | 11 Years |

| SOPHIA HILLS | $1,080,000 | 570 | $1,893 | -6% | 8 Years |

| 76 SHENTON | $1,050,000 | 592 | $1,774 | -3% | 5 Years |

| 28 RC SUITES | $735,000 | 441 | $1,665 | 0% | 12 Years |

| PATERSON SUITES | $4,850,000 | 1722 | $2,816 | 1% | 15 Years |

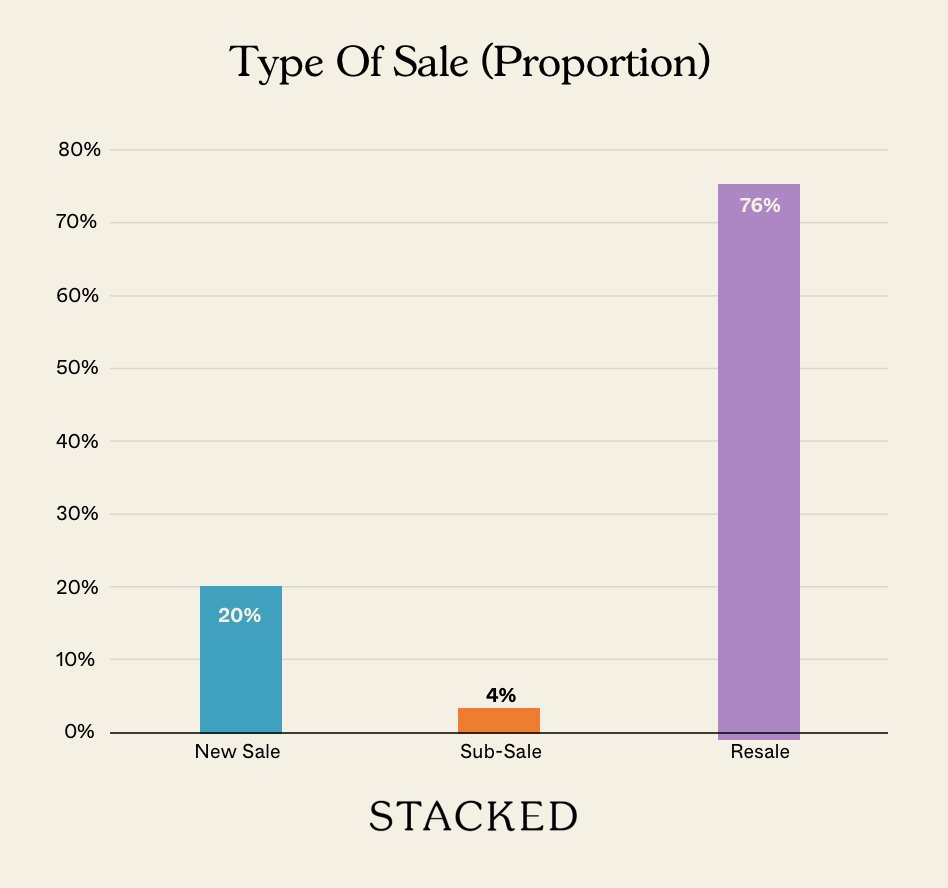

Transaction Breakdown

Follow us on Stacked for more news and updates on the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

When did Lentor Modern get its temporary occupation permit?

What makes Lentor Modern different from other new condos?

Are the early sales gains in Lentor Modern typical for new condos?

How is Lentor expected to develop as a neighbourhood?

What are the risks for buyers in the Lentor area?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

1 Comments

So? After a long-winded article, what is the answer to the question posed? The article is dressed like a multi-storey mall where the answer is maybe on the 10th floor but the escalators force you to go through 9 floors of hell before getting to it.