GuocoLand Wins The Lentor Site; But Is It Worth Waiting For (At Potentially $2,000 PSF)?

August 3, 2021

The Lentor Central site, which was on the Government Land Sales (GLS) list this year, has been awarded to GuocoLand. This site is one of the highlights of the property market this year; and those looking to upgrade in a few years’ time will probably have their eye on it. In fact, among buyers considering the area, we already have questions as to whether it is worth waiting for. Here’s what to weigh up:

Why is the Lentor site a big deal?

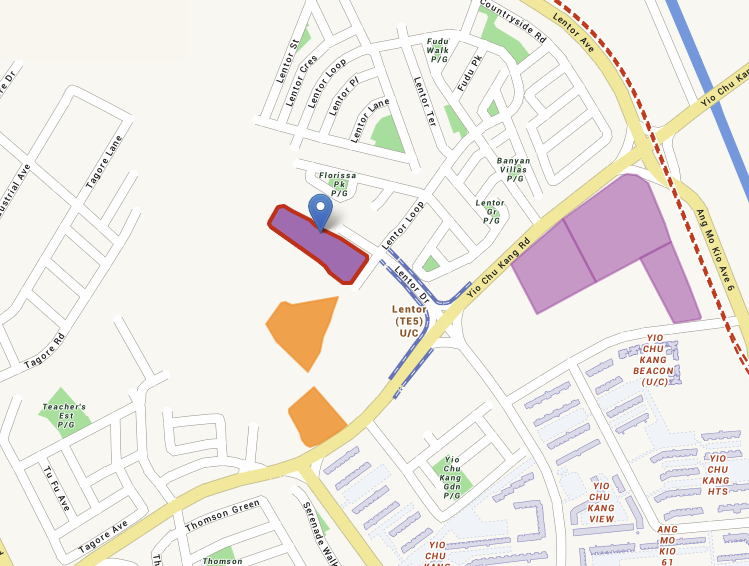

The Lentor site is located along Lentor Drive, near Ang Mo Kio Avenue 4. For property market watchers, this alone is enough to draw attention. There have been no condo developments in this area for a long time.

Other than The Calrose, which goes all the way back to 2008, this neighbourhood has long been seen as a low density, landed area.

The Lentor site is also an integrated development, tied to public transport, and at the “sweet spot” with regard to project size (more on this below). And while we’ve yet to see the final results from what GuocoLand will achieve with the Guoco Midtown project (Midtown Bay and Midtown Modern), they have done very well with the transformation over at Wallich Residence.

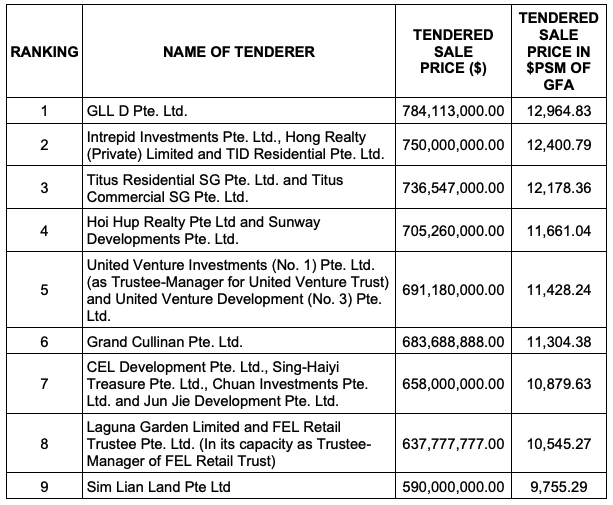

Given that many developers have depleted land banks in 2021, this site would have been an immediate buy for many of them. There were nine bids in total, with GuocoLand winning at $784.1 million (about $1,204 psf). This surpassed the projected amounts we got from analysts; but no one is especially surprised given it’s a hot spot.

And the current prices, this is a 4.5% increase from the second-highest bid (subsequent bids aren’t too far off either), so you could point to this to say that GuocoLand isn’t alone in their perceived valuation of this site.

What you should know about the site and GuocoLand’s plans

The Lentor Central site will yield around 600 homes, making for a mid-sized development. This 99-year lease plot is surrounded by lower-density residential plots (it has a GPR of 3.5, while surrounding plots range from 2.8 to 3.0). A look at the site suggests potential views facing the landed development of Florissa Park, or Hillock Park.

We don’t think the low-density, quiet nature of this neighbourhood will change anytime soon. That’s because URA plans to make Lentor Hills pedestrian friendly, and preserve the greenery. Note also that the same plans will provide good access to the Linear Park, a sort of Singaporean counterpart to New York’s High Line Park.

The project here will be integrated with the Lentor MRT station, on the Thomson-East Coast Line (TEL). In addition, we understand that the developer is required to provide at least 10,764 sq. ft. for early childhood facilities (this is not necessarily a single facility, it can be split into two centres).

A small amount of retail space (86,111 sq. ft.) will be available. This is usually too small to be considered impactful – but it might matter in Lentor Drive, which is an area long deprived of across-the-road amenities. We’ve been told a minimum of 10,763 sq. ft. will have to be used for a supermarket (with luck it will be much bigger, as that’s not a lot of space for what’s essentially the only supermarket in the neighbourhood).

Will this development be waiting for?

We were told the launch is expected to be in 2H2022. If you’re interested in Lentor Hills, is it worth waiting for this?

It’s quite easy to filter your choices, as the area has a few immediate alternatives:

- Florissa Park (Landed)

- The Calrose (300 metres away)

- Thomson Grove (220 metres away)

1. Florissa Park

More from Stacked

Why Buy A Million-Dollar HDB Flat Instead Of A Condo? 4 Singaporeans Share Their Experience

2021 and 2022 both saw record numbers of million-dollar flats; and while these are still outliers, they are becoming almost…

Current prices shows an average price of $1,267 psf. These were two transactions over the past year:

| Date | Unit size | Price PSF | Price |

| 14 May 2021 | 4,004 sq. ft. | $1,267 | $5,075,000 |

| 18 Feb 2020 | 3,240 sq. ft. | $1,219 | $3,950,000 |

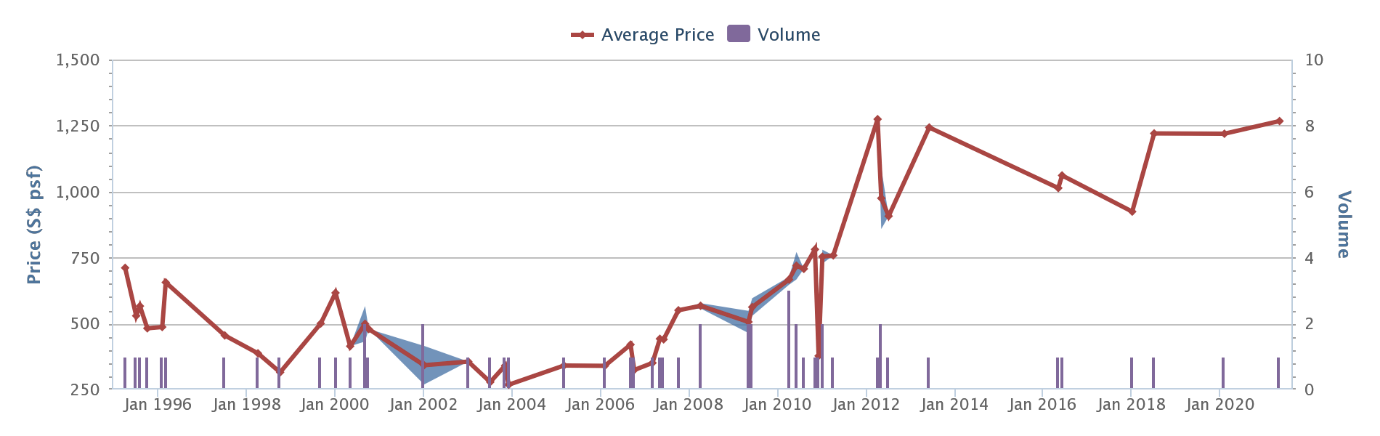

There have been 12 profitable transactions and three unprofitable transactions. This is a freehold development, but the completion date is unknown.

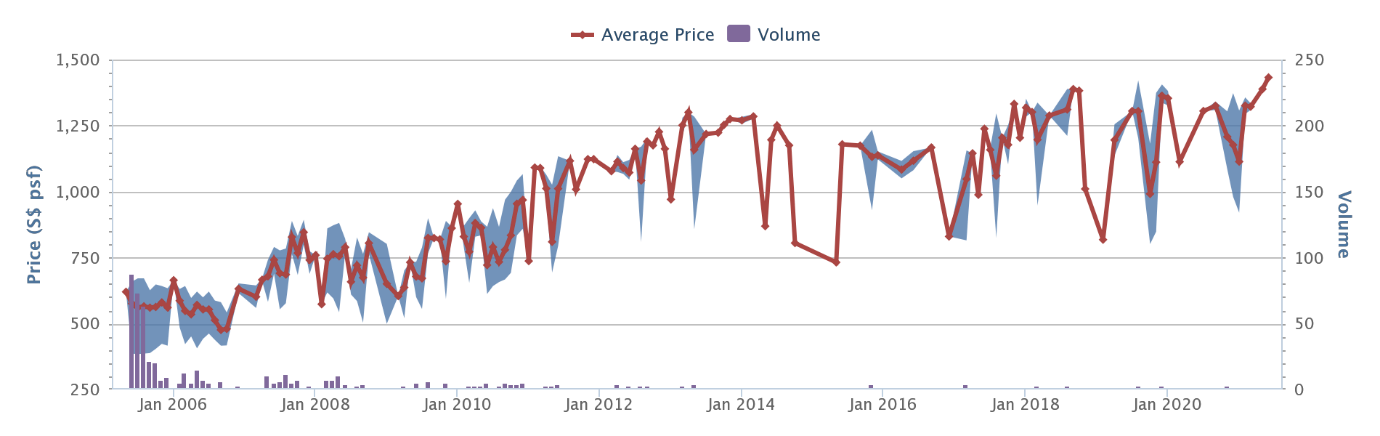

2. The Calrose

Current prices shows an average price of $1,432 psf. These are the five latest transactions

| Date | Unit size | Price PSF | Price |

| 11 Jun 2021 | 969 sq. ft. | $1,445 | $1,400,000 |

| 8 Jun 2021 | 1,163 sq. ft. | $1,419 | $1,650,000 |

| 19 May 2021 | 1,238 sq. ft. | $1,388 | $1,718,000 |

| 25 Mar 2021 | 1,389 sq. ft. | $1,309 | $1,818,000 |

| 19 Mar 2021 | 1,012 sq. ft. | $1,334 | $1,350,000 |

There have been 261 profitable transactions, and four unprofitable transactions. This is a freehold property, completed in 2008.

(The surge of interest is largely attributed to URA’s ongoing development of Lentor Hills as a family-friendly area, and the suitability of Calrose’s larger units for that same demographic).

3. Thomson Grove

Current prices shows an average price of $1,212 psf. There has only been transaction in the past year:

| Date | Unit size | Price PSF | Price |

| 23 Nov 2020 | 1,485 sq. ft. | $1,212 | $1,800,000 |

| 8 Jun 2021 | 1,163 sq. ft. | $1,419 | $1,650,000 |

| 19 May 2021 | 1,238 sq. ft. | $1,388 | $1,718,000 |

| 25 Mar 2021 | 1,389 sq. ft. | $1,309 | $1,818,000 |

| 19 Mar 2021 | 1,012 sq. ft. | $1,334 | $1,350,000 |

There have been 24 profitable transactions, and 11 unprofitable transactions. This is a freehold property, completed in 1984.

You can see that The Calrose, despite being older, is a strong alternative

Analysts we spoke to suggested a price range of $1,950 to $2,000 psf, for the Lentor development – this is based on the rather high bid of $1,204 psf by the developer.

While the new development will be integrated, have childcare, a supermarket, etc., The Calrose remains a strong alternative. At 300 metres, residents of The Calrose might be said to enjoy the same amenities, albeit with a short walk included. But at the same time, The Calrose has seen prices of $1.6 million or below for 1,000+ sq. ft. condos. The same price is likely to fetch a much smaller unit by new launch standards.

On top of that, The Calrose – along with the much older Thomson Grove – are freehold. And in our experience, bigger freehold units, at the same price and in the same general location, will give buyers pause for thought.

Thomson Grove dates back to 1984 however, and the age difference is tangible; so we don’t think there will be as many eager buyers. Likewise, Florissa Park is landed and really caters to a different buyer demographic.

Overall, we’d say it’s looking like a toss-up between The Calrose, and a pricier leasehold, new launch project. We’ll have to take a second look, once the new development is up.

In the meantime, buyers looking at Lentor Hills should be braced for prices here to climb. The presence of CHIJ St. Nicholas and Raffles Institution, as well as being a lower density area, will draw families. This happens to reflect most buyers in the market today (i.e., HDB upgraders, moving up from 4 and 5-room flats). Demand is almost certain to be high.

For more on the Singapore private property market, and in-depth reviews of new and resale properties alike, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is the Lentor property development worth waiting for?

How does the price of the new Lentor development compare to nearby properties?

What are the main alternatives to waiting for the Lentor new launch?

What factors might influence the decision to buy now or wait for the Lentor development?

Will the Lentor area see significant changes in its neighborhood or environment?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

0 Comments