From An EC To A 999-Year Landed Home: How I Helped My Clients Achieve Their Dream Home

February 8, 2021

This couple approached me to sell their 3-bedder EC last year in 2020. Their EC was the Tampines Trilliant which hit the 5-year MOP last year.

As a family of 4 – they were looking forward to move up to the next stage of home ownership.

They Shared Their Dream Home With Me

For this couple who are aged 39 and 40 years old – working as a teacher and marketing director – they shared with me their ultimate goal was to own a landed property.

Why? They sincerely believe it was possible and would provide a bigger space for their family to enjoy the lifestyle.

They also shared that a landed home will likely be their “forever home” – a legacy that they plan to pass down to their 2 children eventually.

To be honest, I was concerned on whether it was possible – the expected monthly mortgage for a landed home would be upwards of $7,500 especially if the loan amount is about $2 million.

So I wanted to be sure whether the financial pressure of such a monthly payment is comfortable enough for them.

They received an In-Principle Approval (IPA) based on their income and that gave me the confidence to start searching for their next home.

Began Marketing their Tampines Trilliant EC During Circuit Breaker

I started in earnest to market their EC home during the last week of the Singapore’s circuit breaker aka the pandemic lockdown. But response was slow as no physical viewings was allowed.

Once physical viewings was allowed to be resumed during Phase 2 on 15 June 2020 – interest skyrocketed.

I secured a buyer within just 2 weeks – and by July 2020 – the unit was sold.

In my observation, the pandemic was an advantage for them as the demand for a newly-MOP EC was significant.

Demand is shifting towards larger units which are relatively brand new.

These buyers are attracted to the following:

- a relatively new home with long lease

- ability to move in immediately

- their large 3-bedder unit

- condo amenities

For a 5-year old, newly MOP EC, there is not much restriction on who the buyers can be.

Only foreigners are not allowed to buy a 5-year old EC.

But everyone else – Singaporeans and PRs are welcome to purchase a unit at the Tampines Trilliant EC – regardless of income and relationship status.

Singaporeans or PR singles below 35 years old are also able to purchase a 5-year old EC if they wish to do so.

So most of these potential buyers are likely to be those who are:

- beyond the income eligibility of BTO flats

- not willing or unable to wait for BTO flat completion

- strong preference for Tampines area

- have the financial option of purchasing a resale condo

- not willing or unable to wait for the new launch condos completion

The perception of EC being saddled in between HDB and fully private condos is an attractive idea – especially for those who wants condo-like amenities without being seen as “too atas“.

(Oh yes – there are buyers who think like that!)

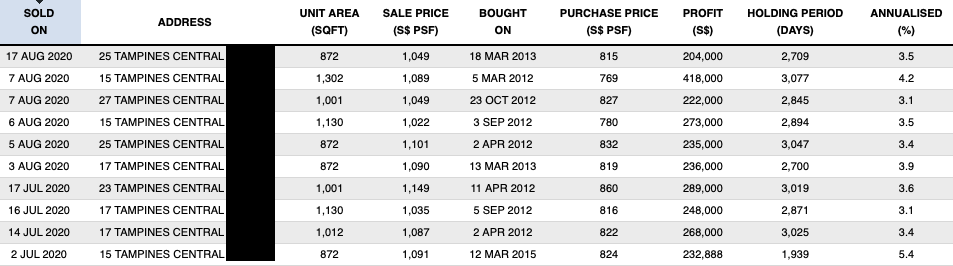

The overall gross gains from the sale of their 3-bedder EC was about $250K.

I noticed that the bigger the unit, the larger was the overall profits – further reflecting the strong demand for larger units.

This is likely to be fueled by the fact that most people are going to be working from home for the next few years – hence the demand for a bigger home.

For this couple – their gains were significant and was going to be helpful for the purchase of their next home.

Sales Proceeds: Trilliant EC

| Selling Price | $1,100,000 |

| Outstanding Loan | $599,000 |

| CPF Refund | $131,880 |

| CPF Refund | $158,650 |

| Legal | $1,710 |

| Agency | $23,540 |

| Cash Proceeds | $185,220 |

Total Assets

| CPF OA | $75,700 |

| Selling Refund | $131,880 |

| CPF OA | $99,956 |

| Selling Refund | $158,650 |

| Cash | $200,000 |

| Total | $666,186 |

Inter-terrace is an Entry Point for Landed Homes

Based on their budget and requirements, I shortlisted a few potential landed homes for them.

It was tough negotiating with various sellers – many landed property owners were very fixated with their asking price.

I can safely say that 2020 was the year where demand for ready-to-move-in homes was really at its peak.

Landed homes was no exception.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Can You Afford A Sentosa Property Now That It’s “Cheap”?

Let's start with some numbers that we've gathered on Sentosa.

There were a few units for sale at this row of inter-terrace landed homes in Kovan. One new listing popped up while I was monitoring the area and I quickly brought in my clients to view.

They agreed to make an offer to the seller.

It was immediately accepted – the seller was keen to sell as he was getting the keys to his next home soon.

Within 3 days of listing it for sale – the landed home was officially off the market.

By December 2020 – my clients were the new owners of this 999-year leasehold landed home.

The Seeds was Planted Almost 10 Years Ago

If you were to ask me, I think this couple had planned for this about a decade ago.

They made a booking for a unit at the Tampines Trilliant EC about 9 years ago when it was launched in Jan 2012 when they were 30 years old.

- Made a decision to book for an EC when they first got engaged

- Waited 3 years for the EC to be completed in 2015

- Completed the 5-years MOP period in 2020

- Made another decision to cash out and sell the EC

- Sealed their landed home dream by end 2020

They could have bought a resale HDB back then. Or even waited for a BTO flat.

But they did not.

Instead they probably were confident of the following:

- our incomes will grow by the next 10 years

- our EC can be a stepping stone to our next home

- let’s aim for the next home to be a landed one

Or perhaps I am just over-reaching and they were indeed just lucky people?

Homeowner StoriesHere’s What I Learnt After Spending 2 Weeks To Earn A $300 Commission.

by Daron AngThe Luck Factor Is Determined By Your Own Expectations

In my daily life, I sincerely believe I will do my best, but I will leave the rest to God.

Do the legwork, put in the effort and when the time comes – say a prayer and leave the rest to the Infinite Source.

In life, there is an element of luck everywhere. The country we are born in, the parents we get, the health we are granted.

Not everyone gets the same luck.

But we are granted the same daily 24 hours, being able to plan ahead as well as the ability to reflect and think.

To me, the element of luck is more obvious when one slows down and notice the various chance opportunities around them.

We all have expectations about the future.

Some of us expect to be happy and healthy; others are convinced that they will be miserable and sad.

Some people expect to find their perfect partner; others anticipate moving from one failed relationship to the next.

Some people think that they will do well in their jobs; others expect to remain at the bottom of the career ladder.

This couple had expected they will do well enough to go after their dream home.

Conclusion

For me, I am just an observer.

Meeting different people from all walks of life – I have seen humble people attributing their good fortune to luck and not-so-humble people attributing it to hard work.

They are not wrong though as it is a mixture of both.

But what is common is they have the goal of wanting to propel themselves forward and having strong expectations about their future.

I noticed those blessed with good fortune – they have expectations about the future which help them fulfil their dreams and ambitions.

And when bad luck happens – like not achieving their dream unit during a balloting – they see the positive side. They see it as an opportunity to explore other developments.

That being said, don’t leave something as important as your property portfolio to pure luck or chance.

If you are keen to take stock of what you have control over, and to explore your choices – drop us a message.

I will be happy to provide guidance and context on where you stand – in terms of both your luck and your expectations.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Daron Ang

Daron is a multi-award-winning property consultant known for his dedication to service and unwavering passion for real estate. Embracing the ethos of giving back, he approaches each client interaction as a trusted friend and attentive listener, ensuring a personalised and seamless experience. To date, he has assisted over 400 clients with their real estate transactions. With a background in creating efficient structures and a commitment to continuous improvement, Daron consistently delivers optimal results for his clients, reflected in his impressive track record of success. In his free time, he dedicates himself to serving his church community at Kingdomcity, further exemplifying his commitment to making a positive impact both professionally and personally.Need help with a property decision?

Speak to our team →Read next from Homeowner Stories

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

Homeowner Stories What I Only Learned After My First Year Of Homeownership In Singapore

Homeowner Stories I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

Homeowner Stories “I Thought I Could Wait for a Better New Launch Condo” How One Buyer’s Fear Ended Up Costing Him $358K

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments