Why We Need To Be Careful About A Property Oversupply In Singapore

July 17, 2024

Recent real estate troubles in China have shown how Governments can, and do, intervene in real estate. The Chinese government’s attempts to support its struggling property industry have come at the cost of investors and homeowners, as former policies are reversed overnight. Whilst moves are rarely so drastic in Singapore, we’ve seen the same kind of interventions happen too – and property owners often overlook this sort of intervention as a risk factor:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Why should Singaporeans watch China’s real estate market?

Beyond the most obvious reason (i.e., a lot of major Chinese developers are actively building in Singapore), there are some strong similarities.

China has a strong cultural affinity for home ownership, and the Chinese government itself encourages this over renting. Property buyers in China prefer it to more intangible assets like equities, and typically with an eye toward resale gains. When we speak to Chinese investors, both at home and here in Singapore, there’s also a tendency to see real estate as a safety valve: it’s expected that, as a last-ditch move, homeowners can sell and downgrade. These are all strikingly similar attitudes to Singaporeans when it comes to home ownership.

Even the country’s policymakers have made moves that are eerily familiar to Singaporeans. In Chengdu, for example, a lottery system is used to determine who gets a new flat, while some cities have a mandatory holding period of 3.5 years if they buy a property. In times when China’s property market was booming, these moves were used to restrain the market; but ever since the fall of giants like Evergrande, and diminished confidence, almost all the restrictions have been scrapped.

We often forget how big our policy changes in Singapore have been

The best-known example of this was post-independence Singapore, where efforts were made to house most of the population. To aggressively ramp up supply, the government bought land at prices that would panic a real estate investor today. Before 2007, if your land was compulsorily acquired, the compensation was pegged to market prices several years back (e.g., for acquisitions made in 1987, compensation was pegged to prices in 1973). This was done quite unapologetically, as it was necessary for the reconstruction of the country after the war.

Comment

byu/what_the_foot from discussion

inaskSingapore

On the flip side, the government has also taken drastic action in times of oversupply. One example of this is the Built To Order (BTO) system – this was developed after HDB had a huge supply overhang starting in ‘89. The BTO system allowed construction to go ahead only after sufficient interest had been expressed in a site; and the system worked for a time.

But again, we see how delicate the balance of supply and demand can be: during the post-Covid period, HDB found itself facing a housing shortage, and we’d say the cause is the same BTO system: were HDB free to build quickly in anticipation of demand and without the restriction, perhaps the shortage would have ended sooner.

However, in the long run, that could again be a short-term fix. We’ve spoken before about the possibility of an oversupply in the future, especially when households are getting smaller, the birth rate is declining, and the older generation passes on.

Another example of this is our policy toward en-bloc sales. From conversations on the ground, we’ve come to realise not many people know it’s the government that made en-bloc sales easier.

It was the Land Titles (Strata) (Amendment) Bill 1999 that allowed for collective sales to proceed, with just 80 per cent consensus (by Share Value and strata area). Had the government not done this, en-bloc sales would require unanimous approval; a feat that’s near impossible for all but the smallest boutique projects.

But why would the government intervene in a private, free-market process? The reason was again the balance of supply and demand: en-bloc sales ultimately increase the available stock of housing, as the redevelopment is justified by greater land use (this also has the side-effect of renewing the built environment and avoiding urban blight).

For the individual home buyer, supply and demand issues have a direct impact too

More from Stacked

One Segment of the Singapore Property Market Is Still Climbing — Even as the Rest Slowed in 2025

The 4Q2025 real estate statistics were published by the Urban Redevelopment Authority (URA) on Jan 23.

Two recent examples of this show how increased supply can affect buyer interest:

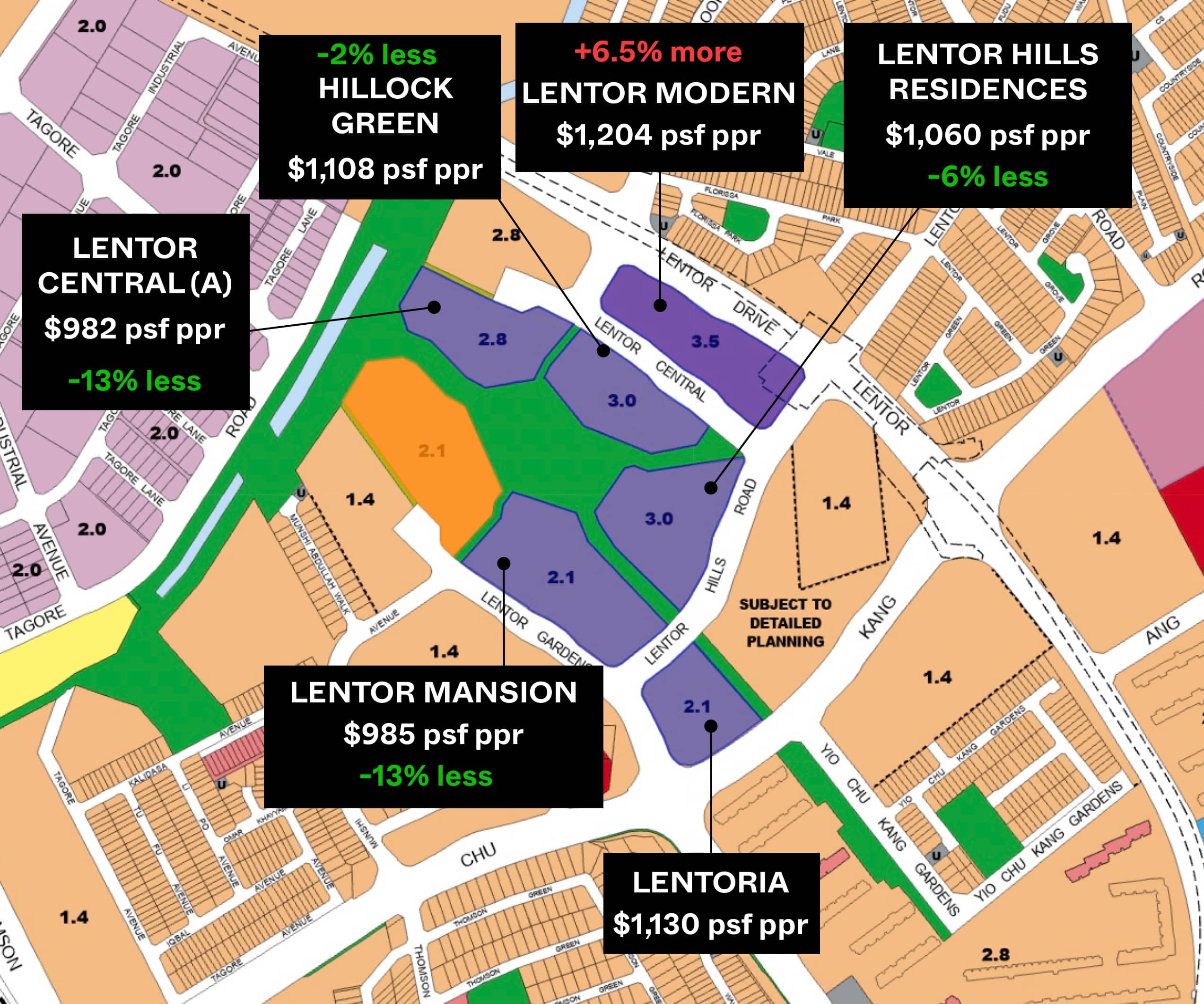

The first is the Lentor area, which has been quite subdued over the past decade. Now, there are suddenly five condo projects here in just two years. While there was pent-up demand in the area, even buyers now have to wonder if the scales are tipped too much in the direction of supply.

Another would be the three-way competition of Tembusu Grand, Grand Dunman, and The Continuum, all of which are in close proximity (from Katong to around the boundary line of Paya Lebar). We’ve explained in this article how that tends to impact sales.

All of this occurs against a backdrop of the government’s increasing supply, and the inventory of unsold homes is now at around 20 per cent; this may rise even further by the end of 2024, due to a combination of high new launch prices and further project completions.

But many buyers still find 2024 property prices to be untenable, with new launches averaging over $2,100 psf, and resale condos averaging over $1,600 psf. This then raises the ever-tricky question of whether it’s time to draw the line: is supply high enough when prices are still so elevated?

On the flip side, when does supply become “too much,” to the point where home prices plummet? This is a matter of “guesswork” with no easy answer.

HDB flats are not immune to this, by the way. As we’ve pointed out often, HDB flats are more prone to oversupply due to their inbuilt restrictions. Foreigners cannot buy HDB flats for example, while PRs may have additional waiting times; and Singaporeans can’t own more than one HDB property. If the government overbuilds, it will be much harder for the supply overhang to be rectified, compared to private homes where foreigners or PRs can soak up some of the demand.

Are there properties resistant to oversupply?

In the past, a common sales pitch for prime region properties used to be their resistance to oversupply. The theory was that, however many condos are built in Bedok or Orchard or even Upper Bukit Timah, it won’t affect the value of condos in places like Orchard: this is because the location of the property is inimitable.

Which sounds reasonable in theory, even though all the data we have suggests prime freehold properties tend to fare worse (although admittedly, not for issues related to supply or the lack thereof).

Certainly, one of the main incentives to own a freehold landed property, or something like a Good Class Bungalow (GCB), is the old saying that “they don’t make them any more.” Perhaps it’s only the wealthiest, who can afford such properties, who are free of the supply and demand issues; and from the constant policy changes to balance them out.

Maintaining the Delicate Balance

The interplay of supply and demand in the property market is a nuanced dance that requires careful management. Too much supply can lead to a glut, depressing prices and potentially causing financial distress for homeowners and developers alike. Conversely, too little supply can drive prices to unaffordable levels, excluding many from the housing market and exacerbating inequality.

In Singapore, the government has historically played a significant role in managing this balance. Policies such as the BTO system and en-bloc sales adjustments reflect an ongoing effort to fine-tune supply in response to demand. However, as recent history shows, these efforts are not always perfectly timed or executed.

But here’s the thing. Everyone wants lower prices, until they’ve acquired their property – and then they would suddenly be part of the camp that wants property prices to go up.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why should Singaporeans be concerned about property oversupply in Singapore based on China's real estate issues?

How has the Singapore government historically managed property supply and demand?

What are some signs that Singapore might be experiencing too much property supply?

Are HDB flats more vulnerable to oversupply compared to private properties?

What types of properties are considered more resistant to oversupply, and why?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

1 Comments

What a ludicrously interfering gahmen. Firstly the mission of HDB is finished. It should have been dismantled once most of the pop’n were housed and then the dual tier housing system completely privatised except for some social welfare housing. Because this hasn’t happened you now see prime areas of Singapore (for example Serangoon Rd) turned into a BTO ghetto. Zero attraction or beauty.

As for private property the gahmen has utterly destroyed the market with it’s massive cooling measures. This is now evidenced by all owner turning into Landlords as it’s far more lucrative to rent out than sell in an illiquid market.

Stop meddling in the property market.