Why Buy A Million-Dollar HDB Flat Instead Of A Condo? 4 Singaporeans Share Their Experience

February 10, 2023

2021 and 2022 both saw record numbers of million-dollar flats; and while these are still outliers, they are becoming almost expected in some areas like Tiong Bahru, Queenstown, and more specific projects like Pinnacle @ Duxton. But is this a healthy phenomenon? As some people have incessantly pointed out, it could make sense to spend a bit more for even a resale condo, given the resale potential. Here are some of the opinions we’re getting on the ground:

Table Of Contents

- 1. Saving on maintenance fees

- 2. More living space for a lower price (per square foot)

- 3. Million-dollar flats tend to be in well-developed neighbourhoods

- 4. Worries about en-bloc sales in later years

- 5. If the million-dollar flat is intended to be a final home, resale issues don’t really apply

- In general conclusion, a million-dollar flat has the biggest advantage over a condo if there’s no intention to resell

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Saving on maintenance fees

One of the realtors we spoke to transacted a million-dollar DBSS flat just last year, and he said that:

“Some of them (condo owners) feel they are wasting money on maintenance once they grow older. They are paying around $300 to $400 per month for maintenance, whereas HDB conservancy fees are rarely even $100. But if you observe at the same time, most of the facilities are frankly for the young. As my last client asked me, what do I pay for tennis courts when I am almost 76?

Might as well keep the money to enjoy their retirement more. An extra $300 or $400 a month to enjoy, and maybe their resale flat is even bigger than their old condo.”

He also added that public housing provides subsidies on conservancy fees, for retirees with low or no income; but a condo MCST has no such consideration.

2. More living space for a lower price (per square foot)

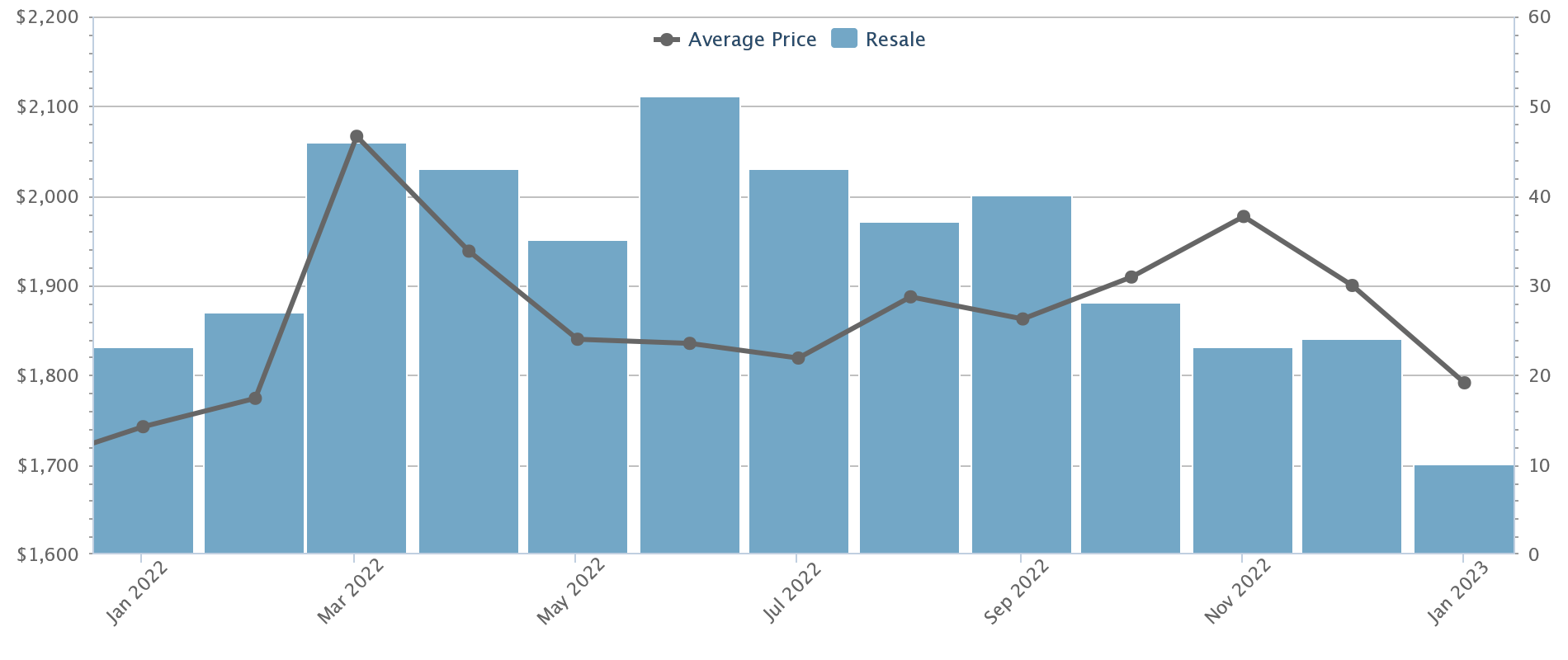

As an example, let’s take a look at resale condo prices in District 3. This area encompasses Queenstown, Commonwealth, and Tiong Bahru, all locations in which we’ve seen million-dollar flats transact:

Over the past year, resale condos in this district have gone from $1,743 to $1,791 psf. The typical Executive Apartment (EA) unit is about 1,240 sq. ft. So to buy a resale condo that’s of similar size in this area, you might expect a quantum of over $2.29 million.

If the size is important to you (as it is for many homeowners) you might understand why even a price of around $1 million can seem attractive; even if it’s for an HDB unit.

Like what we wrote in a comparison between the $1.4 million Henderson HDB flat, there’s a truly little comparison at the same price point. For example, take a look at the table we compiled below if you want to live in the same area:

| Project Name | Price | Size (Sqft) | $PSF | Sale Date | Address | Tenure |

| Alex Residences | $1,550,000 | 926 | 1,674 | 28-Jan-22 | 28 ALEXANDRA VIEW #03 | 99 yrs from 18/03/2013 |

| Alex Residences | $1,595,880 | 883 | 1,808 | 22-Oct-21 | 28 ALEXANDRA VIEW #02 | 99 yrs from 18/03/2013 |

| Echelon | $1,628,000 | 861 | 1,891 | 27-Aug-21 | 9 ALEXANDRA VIEW #02 | 99 yrs from 06/03/2012 |

| Echelon | $1,675,000 | 861 | 1,945 | 26-Jan-22 | 7 ALEXANDRA VIEW #10 | 99 yrs from 06/03/2012 |

| Alex Residences | $1,680,000 | 926 | 1,815 | 28-Feb-22 | 28 ALEXANDRA VIEW #04 | 99 yrs from 18/03/2013 |

And while it’s true a flat doesn’t come with facilities like a clubhouse, pool, etc., you do have to consider if the price difference justifies these niceties. At the high condo prices we’ve seen since 2021, the answer from most buyers is a resounding no; and this may have contributed to the rise in million-dollar flat transactions (at least before the September 2022 cooling measures).

3. Million-dollar flats tend to be in well-developed neighbourhoods

One reader noted that, for around $1.3 million, she could have indeed purchased a resale condo – but only a small one, and in a very fringe area. She says:

“For private, the only condo within our budget would have been in a very undeveloped area around Changi. Our current flat in Tanjong Pagar actually cost slightly less. But there is an MRT station nine minutes away, there are coffee shops, restaurants, and even some places that are open 24/7.

So if you compare in terms of amenities – between a mature HDB hub and a fringe condo at the same price – HDB wins out.”

We should throw in a disclaimer here though, and say that there are some older resale condos in the $1.3 million range which are also in well-developed spots, but you do need to spend a lot of effort looking for them. They might not necessarily be in the same size range though, as you can be sure if so these would have been snapped up in a jiffy.

More from Stacked

The Biggest Misconceptions About Buying Property In Singapore’s CCR In 2025

Singapore’s Core Central Region (CCR) is as straightforward as HDB eligibility rules. Everyone thinks they have a good idea of…

Likewise, for the $1.418 million Dawson flat comparison, we looked for equivalent-priced units to see what were possible comparisons at the same price point.

| Project | Price | Size (Sqft) | $PSF | Date | Address |

| The Skywoods | $1,418,000 | 1012 | $1,401 | 18-Nov-21 | 3 DAIRY FARM HEIGHTS #02 |

| The Gardens At Bishan | $1,418,000 | 1152 | $1,231 | 21-Sep-21 | 1 SIN MING WALK #09 |

| Residences Botanique | $1,418,000 | 1152 | $1,231 | 4-Aug-21 | 30 YIO CHU KANG ROAD #03 |

| A Treasure Trove | $1,418,000 | 1206 | $1,176 | 11-Feb-22 | 54 PUNGGOL WALK #02 |

| Grandeur 8 | $1,418,000 | 1227 | $1,156 | 5-Jul-21 | 18 ANG MO KIO CENTRAL 3 #13 |

| Bishan Park Condominium | $1,418,000 | 1270 | $1,116 | 14-Apr-22 | 18 SIN MING WALK #06 |

We do need to highlight that there were plenty of options at this price point, but as mentioned above, most options seemed to be in the fringe or less developed regions.

4. Worries about en-bloc sales in later years

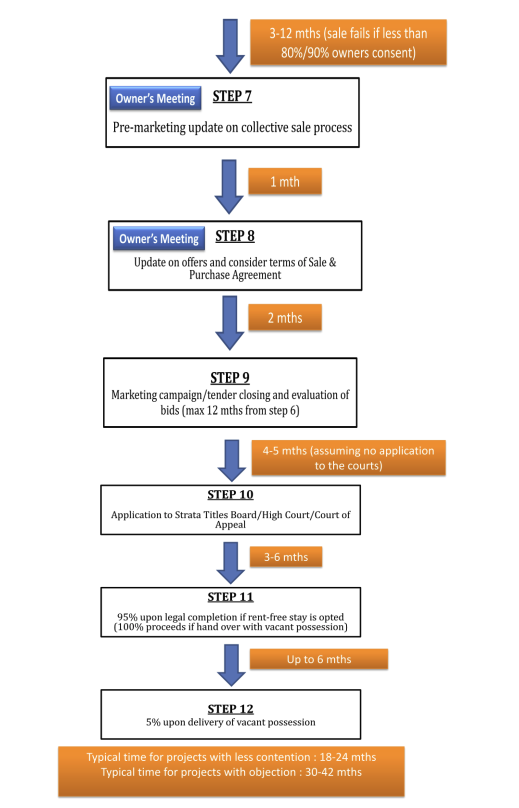

Not every home buyer looks forward to an en-bloc sale. Some people loathe the thought of having to move again; and for older homeowners, the financing issues can be a major headache (e.g., if you are 65 years or older, you may have more trouble getting a loan for your next home – and en-bloc sale proceeds can take as long as a year to arrive).

In the case of the Chuan Park en bloc saga, it’s reached a stage where if you’re an owner there, it’s not a great situation to be in. Because it seems uncertain if the sale would go through in the end, you’d be stuck in the limbo of whether to commit to another purchase or if you’d still be staying there in the long term.

It’s not so bad if you’re young, but when you are in your twilight years, the last thing you want is the stress of not knowing if you have to uproot or have to move homes despite wanting to stay.

One reader, who experienced such an upheaval back in 2014, said she no longer wants to accept such a risk:

“With HDB things like SERS are very rare. But with condos you can see they en-bloc like crazy – after 20 years people already start thinking of money from an en-bloc. Most of them don’t care about residents who find it hard to move, all they think about is the money.”

(We should add that HDB has discussed a VERS scheme for flats that are 60+ years old; this will lead to redevelopment if sufficient homeowners agree to it. However, we have yet to see a VERS exercise in Singapore).

For those who intend to age in place, developers’ voracious demand for new land is always a threat. The last thing you want to do is to have settled in, and have friends and your favourite hang-outs nearby, only to be forced to move against your will. This is more likely with a condo, so keep it in mind.

5. If the million-dollar flat is intended to be a final home, resale issues don’t really apply

For many who choose a flat, this is the argument that clinches it. As most realtors are quick to inform you, private property on the whole appreciates better than resale flats*. It’s certainly also true that – with their more advanced age – million-dollar flats may have greater issues with lease decay.

However, as the owner of a million-dollar DBSS flat explains:

“I am intending to stay here for the rest of my life, and even if you cut off 20 years from it, my flat will still last longer than me. I don’t intend to buy any other property after this. So it doesn’t matter to me whether a condo will make more profit.”

And as another realtor pointed out, a resale condo that is only around $1 million in the current boom market is probably an older leasehold condo; so it will also have lease decay issues anyway.

*Although many exceptions exist once you compare between specific projects and locations.

In general conclusion, a million-dollar flat has the biggest advantage over a condo if there’s no intention to resell

Younger buyers, who are not on their final leg of the property journey, should rethink the long-term prospects of a million-dollar flat. But for those who are certain the flat is their final home, a million-dollar flat can be worth it for purely home-owner reasons (i.e., personal comfort and a matching lifestyle).

Do let us know in the comments whether you’d opt for a pricey HDB flat, or a cheaper resale condo, if you had around $1 million. In the meantime, you can follow us on Stacked for in-depth reviews of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Homeowner Stories

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

Homeowner Stories What I Only Learned After My First Year Of Homeownership In Singapore

Homeowner Stories I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

Homeowner Stories “I Thought I Could Wait for a Better New Launch Condo” How One Buyer’s Fear Ended Up Costing Him $358K

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments