When Is Singapore Property The Right Or Wrong Investment For You?

June 11, 2024

Some people get frustrated when they ask us if they should invest in real estate, and we start rambling on for quite a bit. But as much as we’d like to answer with a quick sound bite or a few sentences, that’s just not possible (well, not unless you’d consider a vague statement like “it depends” to be useful). In truth, different people buy or invest for different reasons, and that precludes simple answers. So while this may take a while to explain, it’s worth understanding in some depth:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

To answer this question, let’s start with a root problem: the property valuation

This may seem like we’re going off-topic, but bear with us: it’s entirely relevant to whether a specific property is a right or wrong investment for you.

So: given that properties have so many intangible qualities, and appeal in different ways to different people, how could a property valuation even work? We’ll let you in on a secret:

It doesn’t.

We just need a fixed number so we can issue loans, price stamp duties, etc. but in reality, what one buyer considers to be reasonable value is utterly absurd to another. Consider the attitudes of three different buyers, to a new launch one-bedder at $1.2 million, in a central location:

HDB upgrader: This is stupid, it’s half the size of my former flat, my family will never fit, and my sale proceeds barely cover the down payment. Who would buy this?

Retiree landlord: I just need something for retirement that can provide $3,000+ a month, and which can rise with inflation. I can buy this and just collect rent till the end. Seems okay.

Person who wants to flip the unit: Who cares what the price is, I’m selling it for higher in four or five years anyway. I hope.

Lifelong single: 10 minutes walk to Orchard Road, a few stops from my office in the CBD, and within my budget range? Sold!

The truth is, we subscribe to grossly oversimplified ideas of “property value”, that makes it easy to assign property taxes, stamp duties, loans, etc., but which ignore the underlying reality: the same property can be much more valuable to one person than it is to another.

To use an analogy, think of properties as the playing cards in a deck. Some people are playing Poker, some are playing Blackjack, some are playing Gin Rummy or Solitaire. And depending on the type of game they’re playing, the same cards can have different values to each of them.

How do you decide if the property is right or wrong for your purpose?

It would be ironic if we just said that every case is individual, and then proceeded to give a generalised answer; so to be clear: it’s best if you reach out to us directly, so we can help do a walkthrough of your individual needs and situation.

That said, these are concerns to address before you start investing:

Finally, we’ll have a quick word on the inescapable nature of biases

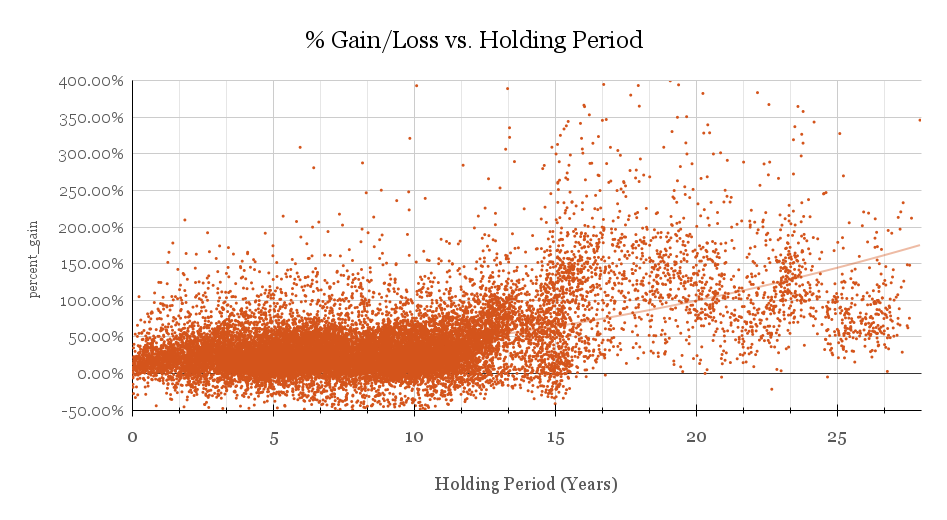

1. Your investment horizon

If you have a very long holding period, such as 20+ years, then the lease may matter more to you than other investors. In general, financing gets tough for properties with 60 or fewer years on the lease, whilst financing at 30 years or less might not even be possible. This affects resale gains, as buyers will definitely pay a much lower price, given the huge cash outlay and limited lifespan.

As such, investors looking at very long investment horizons may do better with freehold properties, despite the initial premium.

Conversely, for short holding periods like 10 years or less, a new launch property may not age enough for freehold status to show its advantage. In these cases, it may be worth looking for a leasehold condo, to avoid the higher costs.

There are also bolder, high-risk, high-return investors, who may aim to sell in as little as four years. This may entail purchasing new launches rather than resale condos: the earliest launch phases tend to come with better prices, so you can quickly sell and realise your profits close to the Temporary Occupancy Permit (TOP). This is a big gamble, as you’re counting on the developer not lowering the price later, as well as there being demand for your sub sale unit.

Finally, investors who only want to sit back and collect rent till the end may not even care about resale gains. They may not even foresee themselves selling within their lifetime, so transaction history is irrelevant. All they care about is whether the rental income is sufficient (in absolute numbers) to meet their targets.

Holding power is essential here, as things may not go to plan

Always factor in the possibility that you need to hold longer than expected. For example: you may have intended to flip a unit in four years, but you’re one of the unlucky cases where the developer dropped the price instead.

This could entail waiting a few more years for the property to appreciate; and if you can’t manage this, you might end up reselling at cost or even a loss.

We suggest having a margin of error in your planning. Be prepared to hold on to the property for a longer period than planned; it may take a few years to ride out a property downturn.

2. Specific investment goals

You can’t win a game if you don’t know where the goalposts are. “Making more money” is not a good investment goal for property. Try to make it quantifiable, such as a certain percentage of returns, or a certain targeted amount for the sale proceeds.

More from Stacked

Disgruntled About My Walk-Up Apartment: A Homeowner’s Cautionary Tale

Walk-up apartments are a niche type of property that isn't for everyone. While you do often have more interior space…

Planning to just sit back and collect rent, to meet a targeted Income Replacement Rate (IRR), might work too, depending on your retirement goals.

In some cases, the investment goals may not involve yourself. They may be part of legacy planning, in which case you need to pay attention to factors like lease decay, or whether the property can be passed down as intended (e.g., remember your children can’t inherit your flat if they already have one of their own).

Setting your investment goals is beyond our scope, as our field is property and not financial planning. But if you can get those specific numbers, reach out to us and we can help you shortlist properties that could meet those goals.

3. Whether you’re renting out the property

If you don’t ever intend to rent out the property, that makes certain factors – such as rental yield – immaterial to your concerns. On the flip side, if you’re living somewhere else and renting out the whole unit, rental yield may be all that matters:

Some landlords don’t even like the properties they rent out to tenants (not that they’d ever admit it). It may also entail buying properties that have no relation to your needs: a good rental asset may be so far from your office or your children’s school, that you’d never consider moving in.

Alternatively, some properties are purchased as replacement homes so you can rent out your current one. A typical example today, due to high ABSD rates, are Singaporeans who buy a property to stay in Malaysia, while renting out their unit in Singapore. Rental income from the Singaporean asset can possibly cover the whole mortgage for the cheaper Malaysian property.

There are also situations where properties are bought to be rented out, but the rental remains a secondary concern. This can be helpful if you want to buy a private home for your children: you can rent out the condo until they get older, get married, etc., after which your children move in and it ceases to be a rental asset.

Do note that rental and resale gains can sometimes be at cross-purposes. Some properties with good rental yields can be terrible for gains (e.g., if you buy a really old and cheap property to rent out, your yields could be unusually high – but there’s not much left to sell).

4. Invisible costs

There is a price tag on your property that isn’t visible, and that’s the emotional stress or anxiety that goes with it.

We’ve come across young buyers who stretch themselves financially, by getting a condo as a first home. This can be rational in some sense, such as if they’re staying with parents while renting out the unit; and they may even be making good money. But the fear of vacancies, dealing with tenants, and the frightening numbers of monthly mortgages can take them past their sleeping point.

Likewise, tying up too much of your capital in property can prevent you from investing elsewhere. We definitely don’t recommend buying property if it means you compromise on insurance coverage, or if it means your entire portfolio is tied up in a one-way, unhedged bet on a single real estate asset.

Most people are also wired to be sensitive to losses, less so than they are to gains – so news stories of falling property values, rising interest rates, government land acquisitions, etc. can all fuel anxiety. Bearing with all this, and staying the course, is part of the invisible price tag.

You need to be emotionally ready for this; and if you take on tenants, you need to brace for additional time, costs, and stress. Being a landlord is nothing like buying an index fund.

5. Sufficient liquidity

Properties are not easy to sell, and there’s a huge cost in agent commissions and lost time to divest yourself of one (unless you’re willing to take gigantic losses on a fire sale). It also locks up your capital, in a way that’s hard to imagine until you’ve experienced it.

We’ve met people who need to borrow for bus fares and lunch money, despite having fully paid-up flats and condo units. You can’t pull money out of the walls, and the chicken rice seller doesn’t care that your $600,000 flat is fully paid up when you’re starving. And quite often, you’re not in a position to “just sell it” when you’re cash-strapped.

In a word, don’t end up being asset-rich and cash-poor. The results can turn your property asset into a plain liability.

Property does have its place in a balanced portfolio; but that means having a clear idea of why you’re investing in property, and buying only when you’re ready. We may not be in the earlier stage of the property market where the gains can be amazingly eye-popping, but neither are we in the same boat where the market is subject to a lot of speculation. And don’t be too quick to copy other property investors, because they may be playing a different game from you.

For help specific to your situation, reach out to us on Stacked. It’s best if you reach out to us directly, so we can help do a walkthrough of your individual needs and situation.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How do I know if Singapore property is a good investment for my long-term goals?

What should I consider before buying a property to rent out in Singapore?

What are invisible costs or risks involved in investing in Singapore property?

Why is liquidity an important factor in Singapore property investment?

When should I consider buying a freehold property versus leasehold in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

1 Comments

1. How to overcome hdb upgraders’ obstacle of paying their life savings (cpf) to downgrade to a smaller condo?

2. The nowaday issue is ABSD, which makes you think very hard to afford one residential. What is comfortable to stay is not the best investable property, how to overcome?