We Make $26k Per Month And Have A Fully Paid BTO: Should We Upgrade To A Landed, Freehold, Or 99-Year Condo + Small Investment Property?

December 16, 2022

Hi team,

I have been following your posts and they have been informative. I have been in a dilemma for some time and wanted to tap on your expertise with regards to my next steps.

My husband, baby daughter and I live in a 3 room HDB at 132A Canberra Crescent. It was enough as a couple but with a young child, the space is no longer sufficient. The flat was fully paid up in cash on purchase and will MOP next year.

My monthly salary is $15K and I have a car loan of $800 a month. No other debts. My CPF OA has around $70K.

My husband is self employed with a monthly salary on average of $9K-$13K. He has around $20K CPF OA. Combined we have liquid cash is around $100K. We will both be 35 next year when we’re looking to buy.

We will require a 3 bedroom home, >1,000 sqf ideally in the East.

We are considering between.

1) stretch ourselves and go for a landed property (probably Changi would be cheaper?)

2) a freehold condo in East Coast that is not new

3) a 99 year old condo in East Coast + a small second condo for rental/investment

Appreciate your thoughts!

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hey there,

Thanks for reaching out to us and we’re always happy to hear our content has been useful!

You guys are definitely in a great spot financially, with just a car loan to account for. This isn’t something most younger couples can enjoy, and there is much to be said about not having the stress of having a huge mortgage hanging over your head – especially in this current situation of rising interest rates.

Although you didn’t mention it, given the 3 options that you’re detailed, it’s probably safe to say that you are more concerned about liveability and lifestyle than you are thinking of an investment (also because the investment option was the last on the list).

It’s 3 very different options, so let’s start by looking at your affordability.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

As your block has not obtained its MOP, there are no recorded transactions at the moment. As such, we will be using the sale prices of the neighbouring cluster as a guide as they’ve just hit the 5-year mark.

| Block | Street | Level | Size/Type (Sqm) | Price | Date |

| 130A | Canberra Cres | 10 to 12 | 68 Model A | $445,000 | Oct 2022 |

| 130B | Canberra Cres | 10 to 12 | 68 Model A | $455,000 | Oct 2022 |

| 130B | Canberra Cres | 07 to 09 | 68 Model A | $445,000 | Oct 2022 |

| 130B | Canberra Cres | 04 to 06 | 68 Model A | $470,000 | Sep 2022 |

| 130A | Canberra Cres | 04 to 06 | 68 Model A | $424,000 | Aug 2022 |

| 130B | Canberra Cres | 10 to 12 | 68 Model A | $450,000 | Aug 2022 |

| 130A | Canberra Cres | 07 to 09 | 68 Model A | $452,000 | Jun 2022 |

| 130A | Canberra Cres | 01 to 03 | 68 Model A | $405,000 | Jun 2022 |

In the last 6 months, there were eight 3-room transactions sold at an average price of $443,250. Of course, the selling price will vary depending on your floor level, facing, and unit condition but we will assume this as our selling price for calculation purposes. As the house was fully paid in cash, you will receive the full sale price as cash proceeds.

| Description | Amount |

| Maximum loan based on ages of 35, fixed monthly income of $15K and self employed monthly income of $11K, and an $800 car loan | $2,447,555 (30 years tenure) |

| Monthly repayment based on 4% interest | $11,685 |

| CPF funds | $90,000 |

| Cash (including sales proceeds) | $543,250 |

| Maximum affordability based on 25% downpayment of $633,250 (CPF + cash) | $2,533,000 |

| BSD based on $2,533,000 | $85,920 |

| Estimated affordability | $2,447,080 |

Some factors to consider

Objective of purchase

We understand that for many buyers, seeing their home as an investment tool is inevitable given it’s one of their biggest purchases. However, most of the time, a property you buy for your own stay will have very different characteristics than the one you buy purely for investment.

So generally, for own-stay properties, something that meets your lifestyle requirements may not necessarily be a good investment. For example, you may love staying in a development with as few units as possible, and in the quietest and most exclusive area. While it doesn’t mean that these types of condos wouldn’t be profitable, they are typically seen to have a lower capital appreciation potential as compared to bigger mass-market projects. There are various reasons for this, one of which is the niche appeal of such properties.

Or you might prefer to live in the East perhaps because you want to stay closer to your family members, or your workplace is close by. You’re considering a landed property perhaps because you want a spacious home for your child to run around in. So an own-stay property has to meet your emotional needs.

Whereas for an investment property, you’d look for whichever property has the best capital appreciation potential or rental yield, simple as that.

We’re not saying it’s impossible to find a property that fulfills both your own stay and investment purposes, but usually, there has to be some compromise. And sometimes, trying to achieve both may leave you achieving neither. This has to be made clear from the start to help frame your choices later on.

Holding period

We have also mentioned this many times before, but you really need to know how long you plan to stay in the property since different property types perform differently over time. This is also very much dependent on market conditions but there is a general trend that you can follow.

Your holding period will have a big say in which of the 3 options may be more suitable for your own timeline, so that’s something you should be thinking about.

Now let’s run through the options you’ve listed!

Option 1: Buy a landed property

Do note that your budget of $2.4M includes all your cash on hand and also all the cash proceeds from the sale of the HDB. So if you’re maxing out your budget, any renovation costs incurred will be added on top of that.

If you were to do a quick search online for landed homes under $2.4M in the eastern part of Singapore, you’ll find that there are only a small number of these properties available, most of which are 99-year leasehold houses.

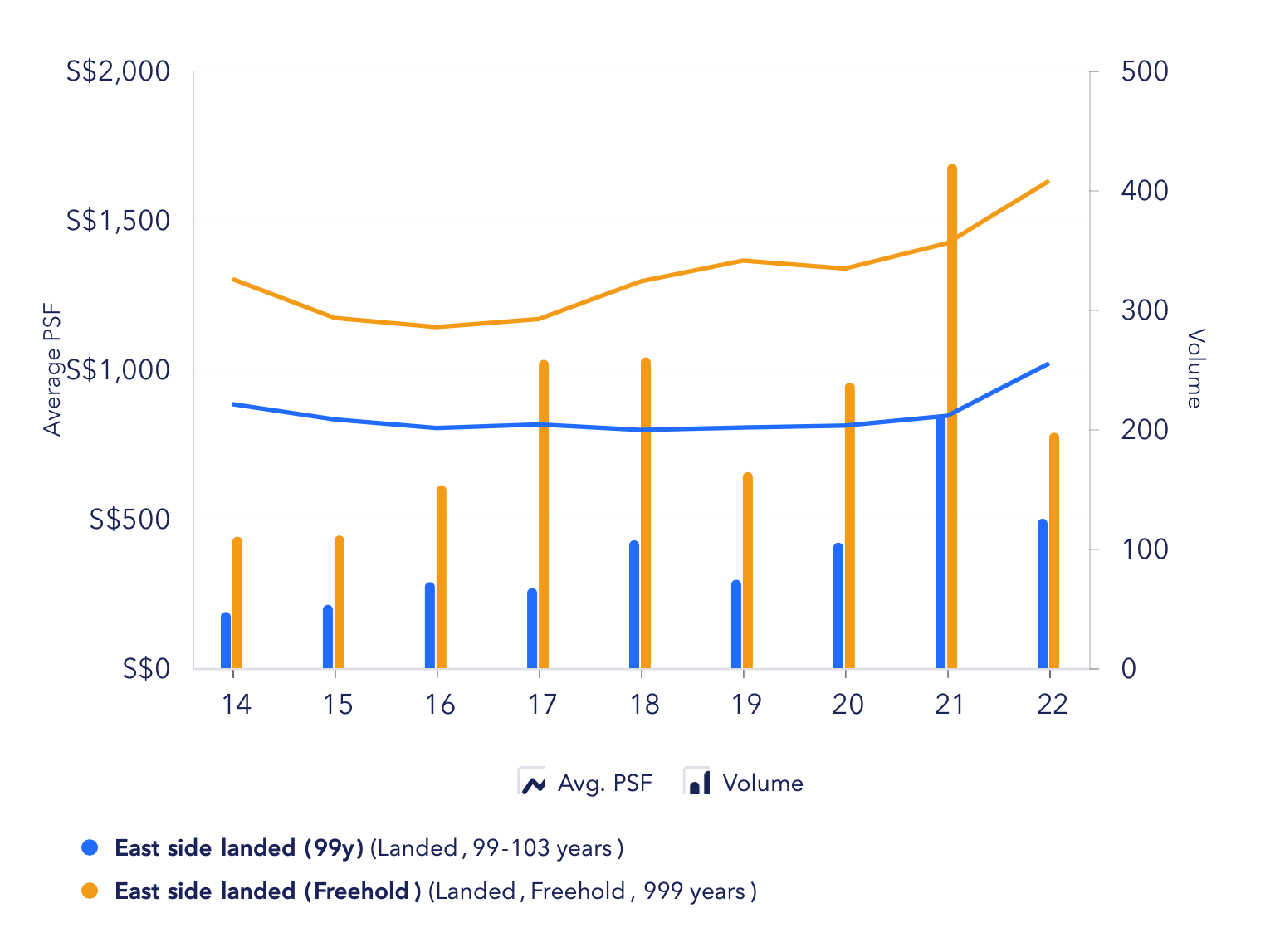

From this graph, we can see that prices of 99-year leasehold landed properties in the east declined slightly from 2014 – 2016 and remained mostly stagnant in the years after. But since 2020, it has gone up by 25.67%.

We can also see that there is a clear disparity in prices between a 99-year leasehold and a freehold landed. From January till date, the average PSF of a 99-year leasehold landed in the east is $1,020, and $1,631 for a freehold. If we’re looking at a piece of 2,000 sq ft land, the difference in overall quantum is $1.2M which is pretty significant. This could also be a reason that demand has picked up for 99-year leasehold houses in spite of lease decay concerns as they are the more affordable option if you’re set on a landed property in the east. It seems to be a general trend throughout the pandemic that people were prioritising lifestyle over everything else, and the size of the space mattered more than how well the property was going to perform in the long run.

That said, these are the few landed developments in the east with available units on the market that fall within your affordability:

| Project | Tenure | Completion year | No. of units |

| Loyang Villas | 99 years from 1993 | 1996 | 423 |

| Kew Residencia | 99 years from 1994 | 1996 | 37 |

| The Springfield | 99 years from 1995 | 1999 | 111 |

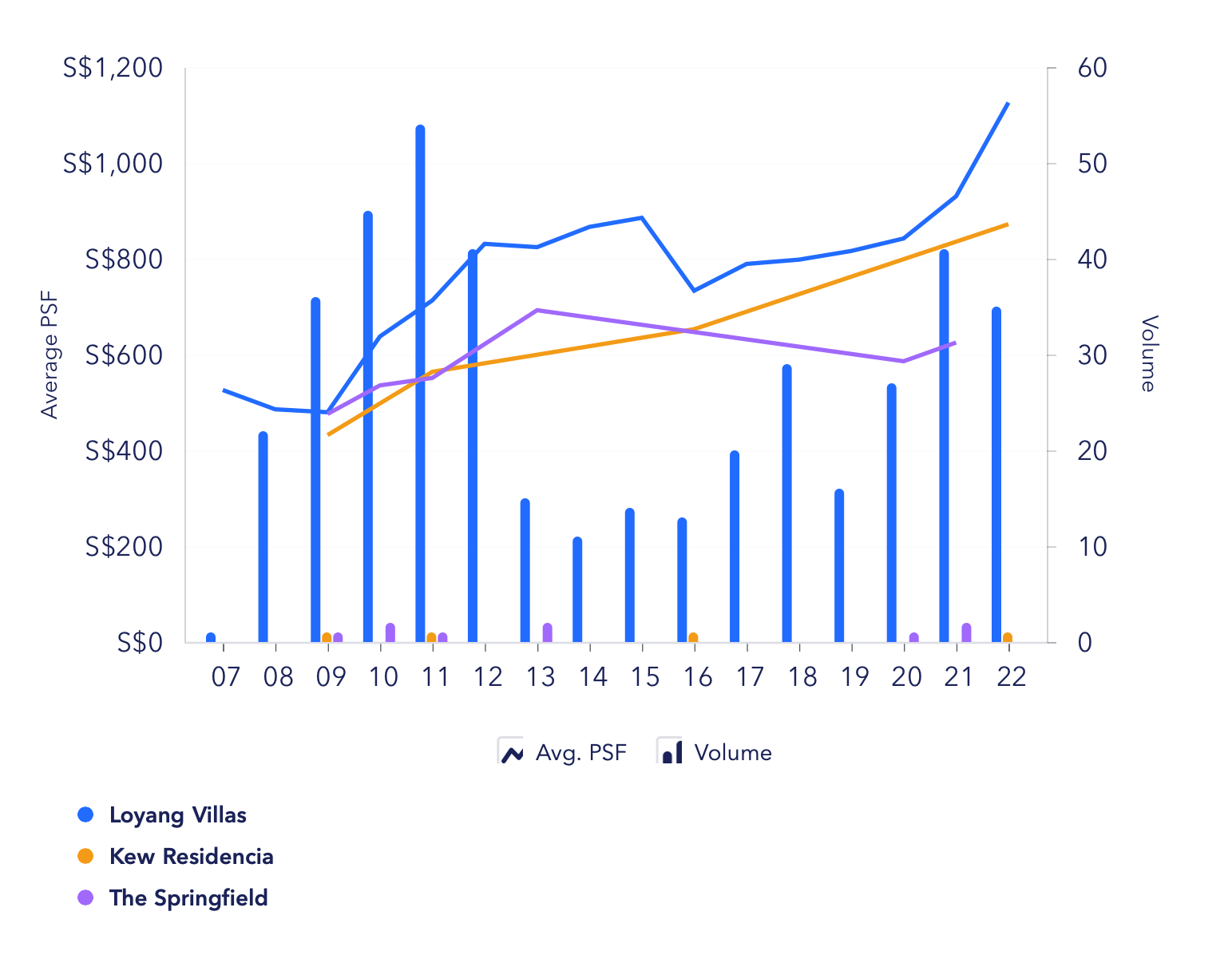

To be sure, there are very few transactions for Kew Residencia and The Springfield over the years so their trend lines may not be the most accurate. However, the turnover rate for Loyang Villas has been pretty consistent and we can see that prices have been growing even during the pre-pandemic years albeit slower. Having said that, buying in now would also mean that you’re buying at an all-time high.

Ultimately, buying an older 99-year leasehold landed is akin to buying a million-dollar HDB executive unit. You’re buying it more for the space and comfort it provides over its capital appreciation potential.

Given that you’re a small family of 3, perhaps one thing you can ponder over is whether it is really necessary to purchase a landed property at this point in time. Yes, you need a bigger place for sure but should you stretch yourselves to purchase a landed property that is ageing, and could require more extensive upkeep over the next few years?

Do also note that at these prices, something has got to give. So you may not actually have the land space compared to the average landed property.

Also, there’s another option to think about in terms of primary school for your child. A place like Loyang Villas is useful for now as there are 4 childcare centres within 500m of the estate (as well as one in it), but there is only White Sands Primary within the coveted 1 km radius if you are looking to stay in the longer term.

Option 2: Buy a freehold condo in East Coast that is not new

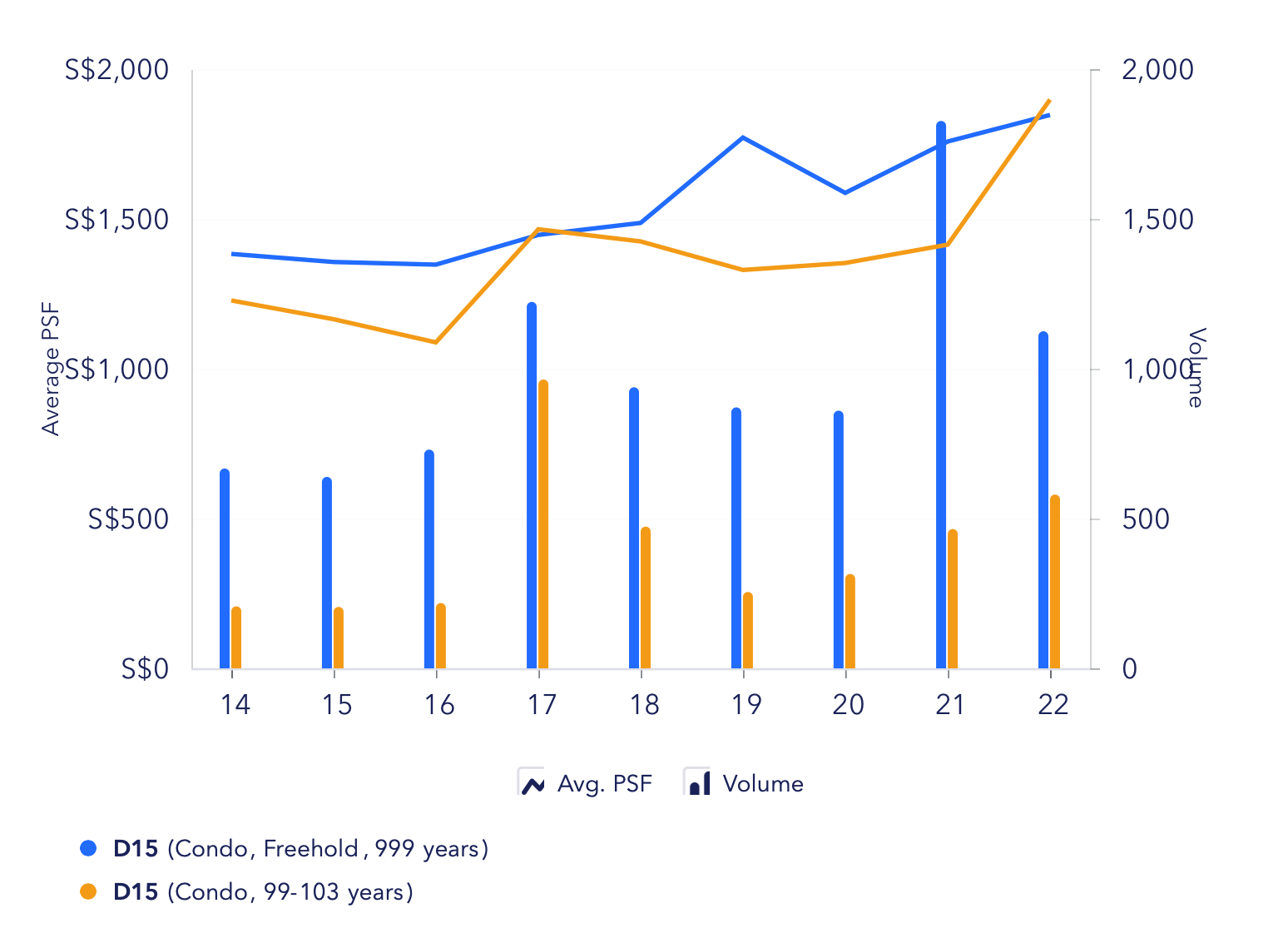

We can see that the average PSF for a 99-year leasehold condominium in District 15 has surpassed a freehold one. This is likely due to the launch of LIV@MB earlier this year which drove up the overall average as it was transacting at an average of $2,421 psf. But usually, freehold properties command a price premium over 99-year leasehold ones.

We are assuming your intention of buying a freehold property is that you are afraid of lease decay, but again this really depends on how long your holding period is. As such, the question really shouldn’t be on whether you should be looking at a freehold or leasehold property, but one that suits your needs based on the location and unit attributes.

So it goes without saying that freehold properties generally have better value retention potential in the long run. However if your plan is to just stay for a short term, it might not be worth paying the premium for a freehold property as prices of young 99-year leasehold properties generally tend to hold their own pretty well in the short run (provided you buy the right development).

Also, while there is an abundance of freehold developments in District 15, the majority of them are boutique developments which may not always be the best choice if capital appreciation is the main concern. This is mainly due to the lack of transaction volumes which can make it difficult for banks to give a more current valuation, thereby increasing the odds of a COV situation for buyers looking to purchase your home in the future.

We have previously written a piece on big vs small developments if you’d like to read more on that!

If we are looking at older mid-sized freehold developments specifically in East Coast, one issue is that the unit sizes are typically pretty big which pushes up the overall quantum so it might be challenging to find one within your affordability.

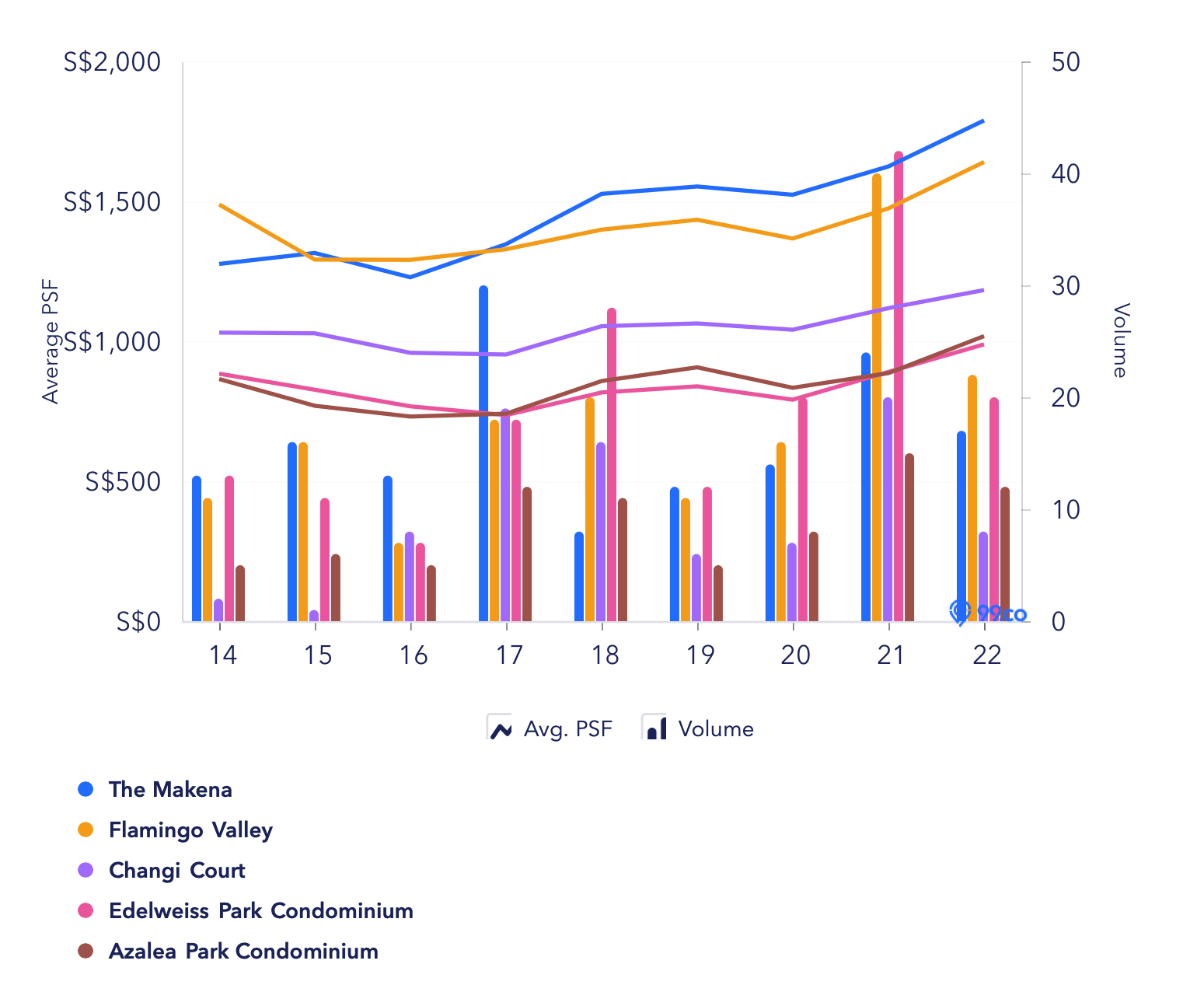

For now, these are some of the mid-sized freehold developments in the east that meets your budget and requirements and also have units available for sale on the market:

| Project | District | Tenure | Completion year | No. of units |

| The Makena | 15 | Freehold | 1998 | 504 |

| Flamingo Valley | 15 | Freehold | 2014 | 393 |

| Changi Court | 16 | Freehold | 1997 | 297 |

| Edelweiss Park Condominium | 17 | Freehold | 2006 | 517 |

| Azalea Park Condominium | 17 | 999 yrs from 1885 | 1996 | 316 |

Do note that these projects are selected on the basis that they meet your surface-level requirements, and may or may not be the most suitable for you.

Option 3: Buy a 99-year leasehold condo in East Coast + a smaller unit for rental/investment

We presume your plan is to purchase one property under each name as it only makes sense (to avoid paying unnecessary ABSD), so we will first calculate your individual affordability.

Wife’s affordability:

| Description | Amount |

| Maximum loan based on age of 35, fixed monthly income of $15K and an $800 car loan | $1,560,486 (30 years tenure) |

| Monthly repayment based on 4% interest | $7,450 |

| CPF funds | $70,000 |

| Cash | $371,625 |

| Maximum affordability based on 25% downpayment of $441,625 (CPF + cash) | $1,766,500 |

| BSD based on $1,766,500 | $55,260 |

| Estimated affordability | $1,711,240 |

Husband’s affordability:

| Description | Amount |

| Maximum loan based on age of 35 and self-employed monthly income of $11K | $887,068 (30 year tenure) |

| Monthly repayment based on 4% interest | $4,235 |

| CPF funds | $20,000 |

| Cash | $171,625 |

| Maximum affordability based on 25% downpayment of $191,625 (CPF + cash) | $766,500 |

| BSD based on $766,500 | $17,595 |

| Estimated affordability | $748,905 |

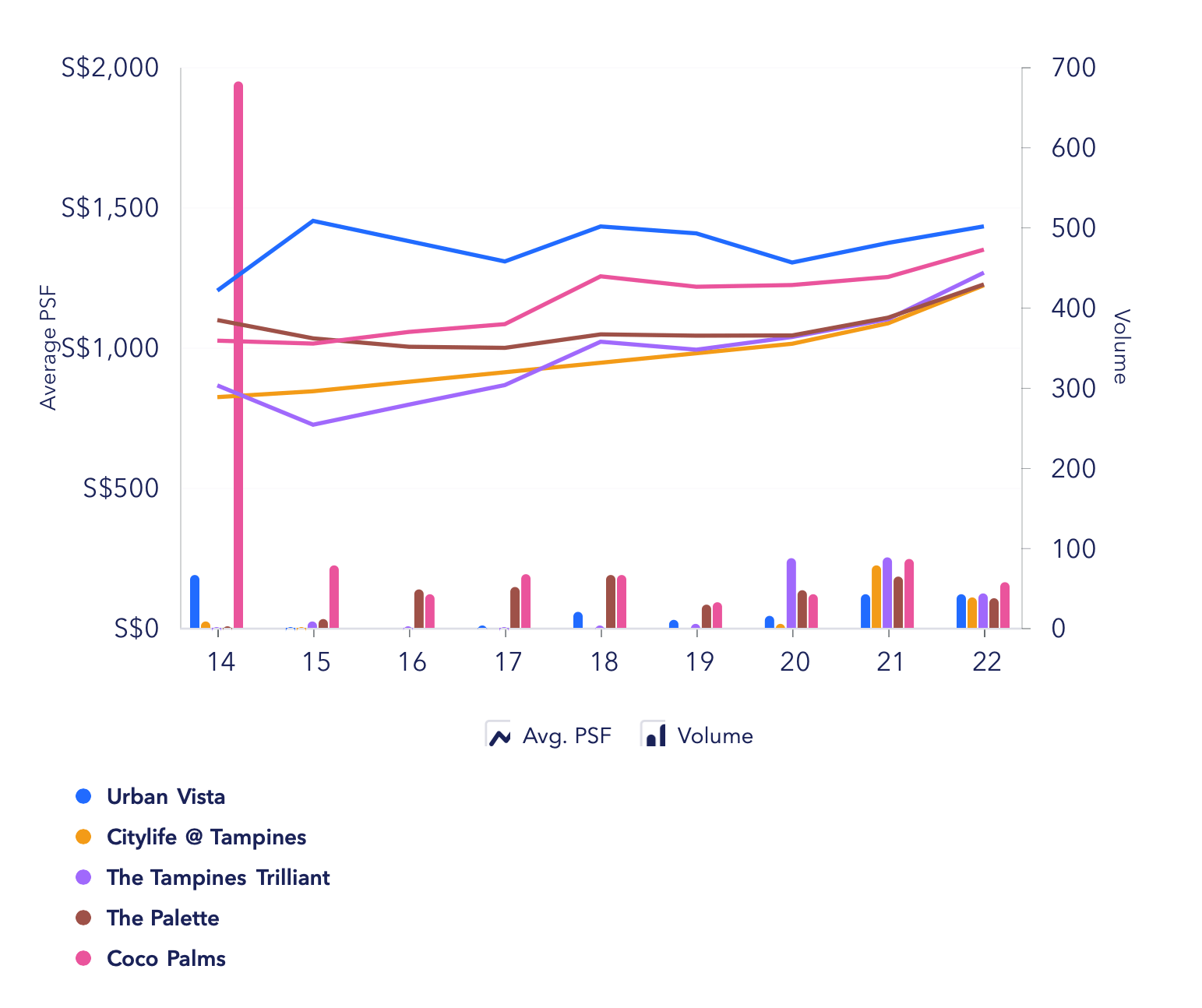

For 99-year leasehold properties, you of course want to get them with as much lease tenure left as possible. There are only a handful of developments in East Coast that matches your budget of $1.7M for a 3-bedder >1,000 sq ft, most of which are boutique projects. But if we look at other areas in the east, there are more options to choose from:

| Project | District | Tenure | Completion year | No. of units |

| Urban Vista | 16 | 99 years from 2012 | 2016 | 582 |

| Citylife @ Tampines | 18 | 99 years from 2012 | 2016 | 514 |

| The Tampines Trilliant | 18 | 99 years from 2011 | 2015 | 670 |

| The Palette | 18 | 99 years from 2010 | 2016 | 892 |

| Coco Palms | 18 | 99 years from 2008 | 2019 | 944 |

As for the investment property under $748K, these are some units available on the market with decent rental yields:

| Project | District | Tenure | Completion year | Unit type | Asking price | Avg rent (last 6 mths) | Rental yield |

| Kingsford Waterbay | 19 | 99 years | 2018 | 1 bedroom | $699,000 | $2,590 | 4.45% |

| High Park Residences | 28 | 99 years | 2019 | Studio | $640,000 | $2,397 | 4.49% |

| Parc Riviera | 05 | 99 years | 2020 | 1 bedroom | $745,000 | $2,823 | 4.55% |

| Hillion Residences | 23 | 99 years | 2018 | Studio | $748,000 | $2,735 | 4.39% |

| Trevista | 12 | 99 years | 2012 | Studio | $720,000 | $2,978 | 4.96% |

As before, these projects are picked out purely because they fit your budget and requirements, so we suggest speaking with an agent for further analysis of their suitability.

Owning two properties definitely offers more flexibility and also provides an additional stream of passive income. This option fulfils both the own stay and investment portion while keeping both separate so you won’t have to compromise on your lifestyle requirements.

However, we must also consider the rising interest rates at the moment. Currently, rental yields above 4% look pretty good for an investment property, but if interest rates rise higher than that, you may be facing a negative cashflow situation – especially after factoring in non-owner occupied taxes, maintenance and agent fees. That being said, if you purchase a bigger home for your own-stay, you’ll still have to pay the mortgage on that, but with this option, you stand a chance of getting good capital returns over time.

Conclusion

To conclude, Option 1 may not be the most ideal if your plan is to stay for the long term due to the tenure and age of the landed properties within your affordability. It still seems to be early days in your property journey, and while landed living may always seem like an attractive goal to achieve, perhaps if you have to stretch at this point, it may not seem like the best move. Unless it’s really suited to your needs (bigger space for your kid, or more kids in the future, near primary schools, convenient for amenities, etc), there could be better options for you right now.

Let’s also not forget that buying a landed home is one thing – renovating it to fit your lifestyle is another. With your budget, purchasing a landed home could sometimes really mean an internal living space that’s equivalent to a 4-room HDB flat – not much of an upgrade in liveable space. If the front porch is narrow (and you’re already going to park a car there), then there isn’t much space for your kid to run around either. So in this sense, is it really a lifestyle upgrade?

Perhaps the landed can be your next upgrade when your family grows bigger and you have saved up enough to buy a bigger landed home comfortably. This will also give you more time to capitalise on other properties in the time being and save up for a landed property in a location that you actually want.

For a long-term stay, Option 2 definitely makes sense. One issue is that many of these older freehold developments have huge floor plates so your choices may be limited. However, if your plan is to just stay for a couple of years, paying a premium for a freehold property may not be worth it.

Option 3 will be the most fitting if you’re considering both own-stay and investment purposes. As interest rates and property prices are high now, perhaps you could hold off on purchasing the investment property (unless you find a good opportunity) until the market cools down since there is no rush for that. You could purchase under your name while your husband keeps his name free from property ownership to capitalise on opportunities later on.

This option will allow you to choose an own stay unit that fits your requirements while having another property that is solely for investment.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

2 Comments

Has their maximum affordability been calculated correctly? Seems a bit strange that their max loan amount of 2.4m is the same as the max affordability?