Unaffordable Homes In Singapore Are Causing The Younger Generation To Rent: Is This A Good Idea?

September 12, 2022

In a recent PropertyGuru survey, two-thirds of Singaporeans aged 22 to 29 said they’re renting because home ownership is still out of reach. Indeed, this is a trend that’s been noticed since last year, with more young Singaporeans also sharing housing to afford rent. Workers’ Party MP Louis Chua has even remarked that it may be time for HDB to look at rental as more than just housing for the needy.

Frankly, the survey is a little strange to us – mainly because of the age range that was targeted. Generally, the age Singaporeans are getting married is later, and from an age of 22 to 29, you’d expect this to be more of a single demographic. But then again, you can only buy an HDB flat if you’re above 35. So private housing is going to be even more out of reach.

Nevertheless, it does open up an interesting point of discussion. Is rental or shared housing actually a good idea for our younger demographic?

Shifting preferences among young Singaporeans

According to the PropertyGuru survey, 66 per cent of young Singaporeans prefer renting, and 32 per cent have begun experimenting with co-living or shared housing. This is a stark difference from before the 2010s when conventional wisdom has long insisted that renting is just “helping to pay the landlord’s mortgage”.

This seems to stem from a conjunction of two factors:

First, Work From Home (WFH), which began during the pandemic, has become normalised – about two-in-five Singaporeans have said they won’t accept a job that isn’t WFH. This has led to a surge in demand for accommodation, and an appreciation for larger homes.

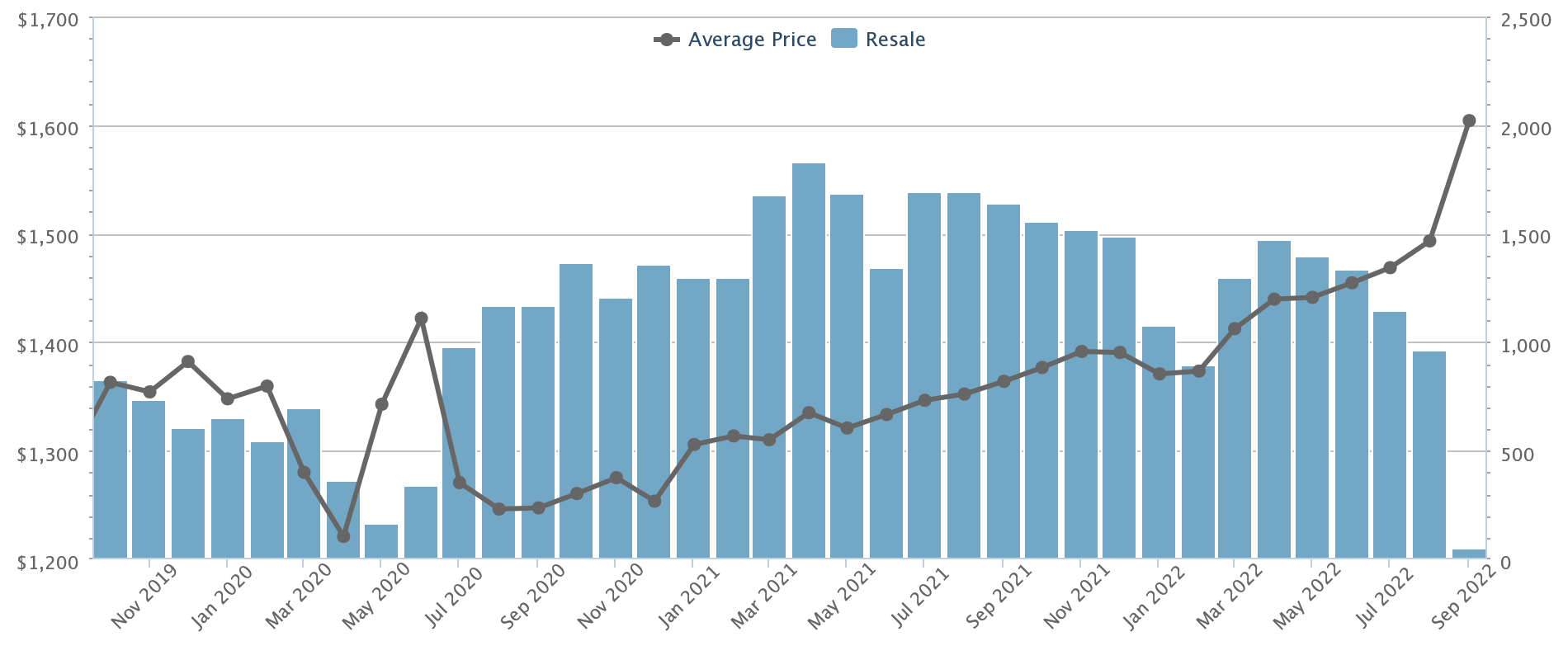

At the same time, developers are land-starved following the completion of projects from the 2017 en-bloc craze. This was compounded by the government moderating the supply of land during the pandemic, ultimately leading to tight supply, and record-high prices.

At the time we’re writing this, average resale prices of 4-room flats are starting to cross $490,000, while the average prices of resale condos (1,100 sq. ft.) are just above $1.6 million. These are a tough stretch for most first-time home buyers – so Singaporeans who urgently need a place are more or less forced to rent.

Property PicksWhy Are New Launch Condo Sales Dropping + 41 Upcoming Launches In 2022/23

by Ryan J. OngPros and cons of turning to rental and shared housing

There are a few upsides to the new shift:

- Ability to move in right away

- Limited consequences

- Flexibility and leeway to change

- A savvier generation of future owners

- Living without maintenance issues

1. Ability to move in right away

Young Singaporeans willing to rent do a favour to both the wider market, and themselves. Because rental homes can be moved into right away (many don’t even require furnishing), these soak up demand quicker than other alternatives.

Consider that, no matter how much HDB ramps up construction, it’s a solution that’s too slow to handle demand right now. Those who need a home today have no use for flats that must be balloted for, constructed in five years’ time, etc.

Young Singaporeans who are willing to rent can get a quicker head-start. It might mean living close to a better job, having the space to start their families sooner, or even starting their own ventures sooner.

(Some might argue that people don’t need their own homes to do these things; but anyone who has had to work in a crowded home, with young siblings running around and interrupting work to help parents, will know better).

2. Limited consequences

If you rent and find out you’re not ready, the worst that can happen is you break your lease. There’s financial damage from the loss of your deposit, but that’s as bad as it gets.

This is much less painful than buying a home and then having to sell it for financial reasons. Consider, for example, that an unprepared person selling a home within the first three years will be affected by the Sellers Stamp Duty (SSD); or that they would be unable to ballot for a BTO flat for 30 months, after disposing of their private property.

The financial fallout from over-leveraging, and buying a home before you’re ready, can take decades to recover from. So for young Singaporeans with variable income, or working in the volatile gig economy, renting may be a safer choice.

3. Flexibility and leeway to change

One advantage to renting is that, when you discover a place that isn’t for you, it’s simpler to try another block, another street, or another neighbourhood altogether.

Many expatriate tenants have cited a series of short (six-month) leases as an excellent exploratory phase – it’s only after renting in three or four different areas, that they can differentiate what they need, from what they only think they need.

This same experience is a benefit to young Singaporeans. You may learn, for instance, that you don’t need to be in a busy or crowded mature town to be happy; or that living in a low-density area turns out to be a huge inconvenience for you.

More from Stacked

What Should You Check When Buying A Tenanted Property In Singapore?

You’ve found the ideal property that’s five minutes from work and the children’s school, but there’s just one issue: a…

It’s good to learn these things while you’re renting, and still have the flexibility to move. Selling a home to move is a much more challenging prospect.

4. A savvier generation of future owners

When talking to home buyers, we often find it easy to distinguish between those who have rented before, and those who are totally new to finding their own home. The former tend to be savvier, and possess more in the way of applicable “street smarts”.

When you’ve rented different types of properties or moved around a bit, you have a better sense of what it means to live on the ground floor vs. the top floor, how good the facilities are for the price, and whether nearby amenities are of actual practical value, etc. You’d also have a better idea of what layout suits your lifestyle, and be able to renovate exactly to your liking – rather than wasting money on building features that become a white elephant.

Should you become a landlord later, you would have an understanding of the market from both a landlord’s and tenant’s perspective; this will help you to estimate rentability when it comes time to buy.

5. Living without maintenance issues

Tenants are spared the need for condo maintenance fees or conservancy charges. For most damages to a property, most tenants are liable only for a small upfront amount, while the landlord has to fix the rest.

(If you check most Tenancy Agreements, tenants usually pay the first $150 for such damages, while the rest is covered by the landlord; but note that this is negotiable).

Pretty much the only serious maintenance the tenant faces is the air-conditioner*and keeping the property clean.

*The template TA provided by CEA actually states the tenant is responsible for air-con maintenance. You can negotiate for this to be different.

The drawback to all this is that rental rates are rising, and young Singaporeans are at the mercy of their landlords

Rental rates reached a six-year peak, and it isn’t just due to the return of foreign workers. We’re a seeing a rise in demand from local renters as well; and if the trend continues, Singaporeans could constitute a much larger part of the tenant market in future.

Rental rates can be much more volatile compared to servicing, say, an HDB loan – and this might work against one of the advantages we pointed out above (point 1). Singaporean couples may instead be more reluctant to start a family, a business, etc., if they feel rental rates could spike right after their current lease.

There’s also a risk that Singaporeans may end up paying too much for rent (e.g., over-indulging and renting a central region condo), while saving too little to move into proper home ownership.

And as much as renting can provide a greater deal of flexibility, there will be further impact down the line of ever-increasing rents, and stress and anxiety from the uncertain living conditions.

We do have loan curbs on home buyers, but so far we’ve said or done little to affect what tenants choose to rent. It may be time for more education or controls on this front.

Co-living arrangements could also do with some educational outreach and some template legal documents

We foresee a few young Singaporeans getting into trouble on this front. For example, many are at a loss on what to do, if one of their roommates suddenly decides they can’t pay rent and wants to break the lease; and on a more dangerous level, some Singaporeans may end up purchasing small properties with friends, or partners before marriage.

We need to put out more educational material on this, and it may be time to provide some legal support. This could, for instance, come in the form of template legal documents/agreements, for those who are about to partake in co-living arrangements.

Right now, such arrangements are quite loose, and a savvier tenant can take advantage of others. A simple example is a tenant who takes up the lion’s share of the electricity bill, convincing everyone that they should all evenly split the utility bill.

There are also other models that we could consider, such as a rent-to-own program – where it allows tenants to rent a home first, with an option to buy the home before the lease expires. Of course, there are both pros and cons to such methods, which we can explore in a later piece.

For more on the situation as it progresses, follow us on Stacked. We’ll also provide you with in-depth reviews of new and resale developments alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are more young Singaporeans choosing to rent instead of buy a home?

What are the advantages of renting for young Singaporeans?

What are the potential risks of renting for young Singaporeans?

How does renting help young Singaporeans become better future homeowners?

What legal or educational issues are associated with co-living arrangements in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

On The Market A 40-Year-Old Prime District 10 Condo Is Back On The Market — As Ultra-Luxury Prices In Singapore Hit New Highs

Pro This Singapore Condo Has Bigger Units Near The MRT — But Timing Decided Who Made Money

Editor's Pick Happy Chinese New Year from Stacked

3 Comments

Yes please continue renting and giving me rental income so my condo is effectively free of charge.

This is a great article I came across while seeing more younger people rent in 2022. One pro of moving out (earlier) is mental health because the younger generation experience different challenges now in a shared, multi-generational family space. And another con is rental racism. There are many landlords who discriminate tenants. Singapore is racially and religiously diverse. Even though there may be laws and rules about this rental racism is a problem here and needs to be addressed urgently.