Can “Ulu” Condos Match The Performance Of The Overall Condo Market?

November 28, 2020

There are two schools of thought regarding condos in “ulu” or less accessible locations. The first are the buyers who shun them as bad decisions – to them, the inaccessibility means limited potential for appreciation. Then there’s a second group who are more focused on the long term: low values now just mean room for more gains, as the neighbourhood becomes more built up.

Which is right? We’re not sure (it might depend on what the person you ask is trying to sell you). That’s why we’ve decided to take a closer look at the price performance of some “ulu” condo developments:

The following are condos in areas that, at least at the time of launch, were considered limited in accessibility or amenities.

As most of these condos are now approaching a full decade, some of the locations are no longer as “backwoods” as was once criticised. However, they still provide a quick snapshot of how values can move, if you purchase a more affordable unit in a less prime area.

1. Eight Courtyards

Address: Canberra Drive (District 27)

Developer: Yishun Gold Pte. Ltd.

Lease: 99-years from 2010

Completion date: 2014

Number of units: 654 units

Profile:

Eight Courtyards was a tough call at its initial launch, as Canberra Drive had sparse amenities. There were two main points of appeal though: one was the number of schools within one kilometre; these include Ahmad Ibrahim Primary and Secondary, Yishun Primary, Chongfu School, and Xishan Primary School.

The second was being within one kilometre of Sembawang Hot Springs Park. But frankly there wasn’t much else besides these.

A further challenge occurred when 1 Canberra, an Executive Condo directly across the street, was priced at about $711 psf. Given that the facilities and age of the two developments are so close, it was a challenge to justify the higher prices of Eight Courtyards (beyond 1 Canberra’s 10-year EC limitations).

Perspectives today:

Three notable upgrades in the area have helped to boost value: the coming of Canberra MRT station, the revamp of Sembawang Hot Springs, and the ongoing development of Bukit Canberra (Canberra Integrated Hub).

The arrival of the MRT station has definitely helped, as prior to this there was only Yishun MRT station, which is 1.4 kilometres away.

Sembawang Hot Springs has been revamped and improved as a family location, and Bukit Canberra adds even more lifestyle options to the area.

The downside is that Eight Courtyards sees competition from an EC yet again. Parc Canberra is just across from the Canberra MRT station, and even closer to Bukit Canberra; and given its affordable EC pricing, buyers are likely to put that higher on their shortlist than Eight Courtyards.

Nonetheless, the Canberra area is much improved, which bodes well for the development in general.

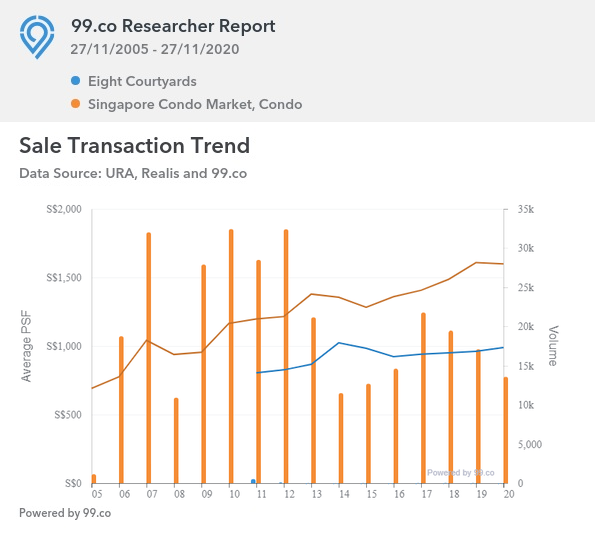

How has it fared against the general condo market?

During initial sales in 2011, Eight Courtyards saw an average price of about $805 psf. At present, average prices here are at $989 psf. This is a 22.8 per cent increase.

In contrast, average condo prices in the same time rose from $1,197 psf to $1,599 psf (about 33.6 per cent).

The five most recent transactions this year are:

| Date | Unit Size (Sq. Ft.) | Price PSF | Total Price | Purchase PSF | Profit/Loss |

| 26 Oct 2020 | 1,378 | $1,062 | $1,450,000 | $871 | $250,560 |

| 6 Oct 2020 | 1,141 | $1,007 | $1,148,888 | $852 | $177,008 |

| 22 Sep 2020 | 1,152 | $1,059 | $1,220,000 | $848 | $242,990 |

| 3 Sep 2020 | 990 | $949 | $940,000 | $771 | $176,140 |

| 7 Aug 2020 | 1,141 | $1,027 | $1,172,000 | $808 | $249,760 |

There have been 156 profitable transactions recorded, with three unprofitable transactions.

2. Parc Rosewood

Address: Rosewood Drive (District 25)

Developer: Fragrance Group Ltd. / World Class Land

Lease: 99-years from 2011

Completion date: 2014

Number of units: 689 units

Profile:

We have an in-depth review of Parc Rosewood on Stacked. In summary, this is one of the few “ulu” condos (it’s on Woodlands) that was a hot seller: at launch, 120 of its offered units sold out in just four hours.

Parc Rosewood’s main attraction at the time was pricing, with some units going at a quantum of just $400,000; less than most five-room resale flats today. Facilities were also impressive, boasting 10 swimming pools.

Nonetheless, there were naysayers despite the low price point. In 2012, concepts like the Woodlands Regional Centre weren’t on the radar. The only thing Woodlands was known for was the freshest air in Singapore, and being close to the Causeway.

Perspectives today:

The Woodlands Regional Centre, as mentioned above, has improved prospects in the area. However, there isn’t much beyond this (perhaps it’s enough). One of the ongoing challenges facing this condo is the distance from any MRT station (Woodlands is the closest station at around 1.5 kilometres).

Its less accessible location could make it harder for Parc Rosewood to draw tenants or future buyers, even with the inflows from the upcoming Woodlands Regional Centre. In addition, it has some limited competition from the adjacent Rosewood Suites (see below), although Rosewood Suites is much smaller.

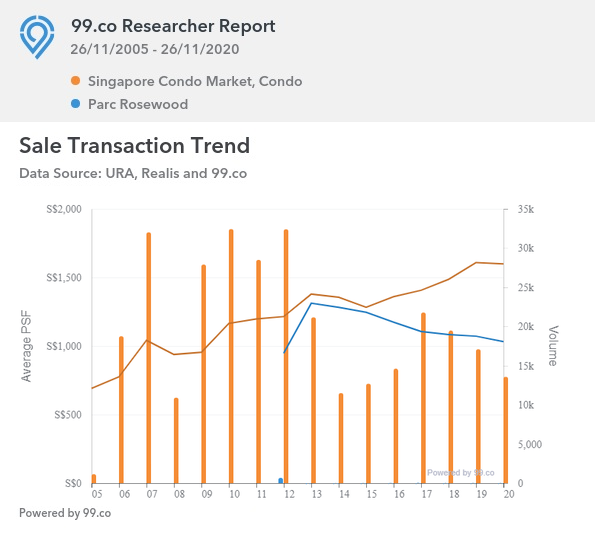

How has it fared against the general condo market?

Parc Rosewood was priced at $947 psf in 2012. Today, average prices for Parc Rosewood are at $1,032 psf. This is an 8.9 per cent increase.

Over the same period, the condo market saw prices rise from $1,214 psf to $1,599 psf, an increase of 31.7 per cent.

The five most recent transactions this year are:

| Date | Unit Size (Sq. Ft.) | Price PSF | Total Price | Purchase PSF | Profit/Loss |

| 16 Oct 2020 | 764 | $883 | $675,000 | $933 | -$38,216 |

| 9 Oct 2020 | 829 | $917 | $760,000 | $939 | -$18,000 |

| 9 Oct 2020 | 1,701 | $659 | $1,120,000 | $728 | -$118,000 |

| 8 Oct 2020 | 431 | $1,161 | $500,000 | $1,185 | -$10,000 |

| 9 Sep 2020 | 431 | $1,185 | $510,000 | $1,059 | $53,959 |

There have been 147 profitable transactions, with 20 unprofitable transactions.

3. Rosewood Suites

Address: Rosewood Drive (District 25)

Developer: El Development (Rosewood) Pte. Ltd.

Lease: 99-years from 2008

Completion date: 2011

Number of units: 200 units

Profile:

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How A Once “Ulu” Condo Launched In 1997 Became A Top Performer

When Aquarius By The Park launched in October 1997 it was a real challenge for the developer and its marketing…

Rosewood Suites is a small development, just next to Parc Rosewood (see above). Most of what we said, regarding the Woodlands location, also applies to Rosewood suites.

However, Rosewood Suites offers a greater degree of exclusivity compared to its bigger counterpart. At just 200 units, each floor of this condo only had four units. As such, buyers who dislike big developments will probably prefer this as an alternative.

Perspectives today:

As with Parc Rosewood, the main change to look forward to is the general transformation of Woodlands. As with Parc Rosewood though, Rosewood Suites is quite a distance from the MRT station.

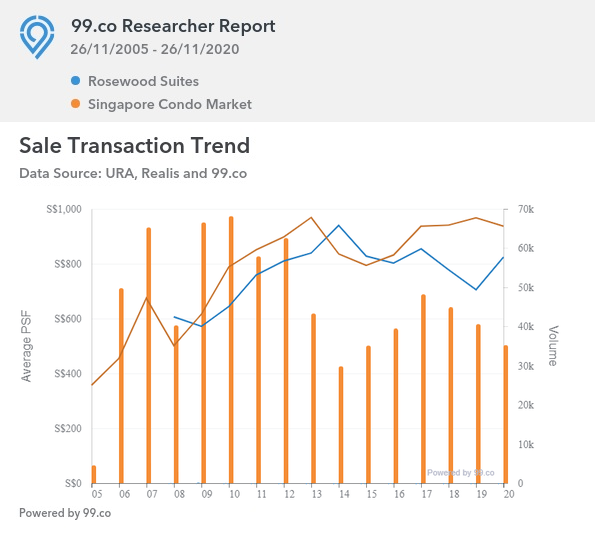

How has it fared against the general condo market?

During its initial launch in 2008, Rosewood Suites’ prices for the year averaged $606 psf. At present, Rosewood Suites’ average prices stand at $824 psf, an increase of about 36 per cent.

In the same time, average condo prices rose from $938 psf to $1,599 psf, or about 70.5 per cent.

The five most recent transactions this year are:

| Date | Unit Size (Sq. Ft.) | Price PSF | Total Price | Purchase PSF | Profit/Loss |

| 2 Oct 2020 | 710 | $940 | $668,000 | $873 | $48,000 |

| 2 Oct 2020 | 667 | $929 | $620,000 | $914 | $10,000 |

| 3 Sep 2020 | 1,098 | $770 | $845,000 | $625 | $158,930 |

| 24 Apr 2020 | 1,518 | $761 | $1,155,000 | $611 | $227,000 |

| 13 Apr 2020 | 710 | $901 | $640,000 | $933 | -$22,800 |

There have been 107 profitable transactions, and eight unprofitable transactions.

4. A Treasure Trove

Address: Punggol Walk (District 19)

Developer: Sim Lian JV (Punggol Central) Pte. Ltd.

Lease: 99-years from 2011

Completion date: 2015

Number of units: 882 units

Profile:

A Treasure Trove is probably best known for three things:

First, the Matilda House landmark. This is one of the oldest conserved houses in Singapore (dating back to 1902), and the conserved structure is now part of the condo development. It currently acts as a clubhouse for the development, and this was one of the earliest instances of condos incorporating local landmarks.

Second, it made the news in June 2016, when two units made profits exceeding $100,000 in less than five years. There were also 67 profitable sub-sales by that point (although one was unprofitable with the inclusion of Sellers Stamp Duty).

As such, this development got off to a very strong start, with good appreciation in the early years; unusual given that Punggol was quite a sparse area at the time.

Third, it was competitively priced in exchange for its less developed location (see below).

Perspectives today:

A Treasure Trove remains one of the more famous Punggol-area condos, not least because of the nearby MRT stations. Punggol MRT station is five minutes on foot, while Sumang is just a little bit further. Soo Teck MRT station is the closest, at just 275 metres (less than five minutes’ walk).

There are also four schools nearby (Punggol Green, Punggol View, Edgefield Secondary, and Punggol Cove), so it’s a draw for younger families who want more affordable private housing.

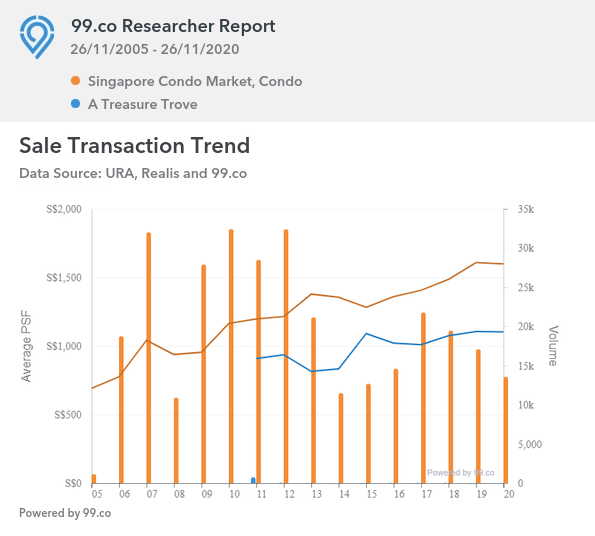

How has it fared against the general condo market?

A Treasure Trove was priced at an average of $909 psf in 2011. Currently it has seen average prices of $1,102 psf, an increase of 21.2 per cent.

Over the same period, the general condo market has moved from $1,197 psf, to $1,599 psf, or about 33.6 per cent.

The five most recent transactions this year are:

| Date | Unit Size (Sq. Ft.) | Price PSF | Total Price | Purchase PSF | Profit/Loss |

| 10 Nov 2020 | 1,335 | $1,146 | $1,530,000 | $904 | $323,000 |

| 29 Oct 2020 | 1,044 | $1,121 | $1,275,000 | – | – |

| 5 Oct 2020 | 775 | $1,135 | $880,000 | $1,116 | $15,000 |

| 1 Oct 2020 | 1,528 | $811 | $1,240,000 | $678 | $204,000 |

| 24 Sep 2020 | 1,044 | $1,149 | $1,200,000 | $960 | $198,000 |

There have been 168 profitable transactions, and one unprofitable transaction.

5. The Luxurie

Address: Compassvale Road (District 19)

Developer: Keppel Land Realty Pte. Ltd.

Lease: 99-years from 2011

Completion date: 2015

Number of units: 622 units

Profile:

The Luxurie had a strong launch despite its Sengkang location, which was not (and some might argue still is not) as well developed. However, The Luxurie made up for this with proximity to the MRT station, being just four minutes’ walk from Sengkang MRT.

In addition, Compass One mall (then Compass Point) is only about a six-minute walk away. Sengkang Primary and Secondary Schools are both about a five-minute walk away. As such, even though the area is not heavily built up, the residents are unlikely to feel any lack of amenities or accessibility issues.

This led to an unexpectedly strong take-up for an “ulu” condo, with 80 per cent of the available units selling during the launch weekend.

Perspectives Now:

Sengkang will be a beneficiary of the Punggol Digital District, which combines tech firms with educational institutions (and the inevitable food and retail that follows). This is good news for landlords in particular, as it brings a much-needed inflow of prospective tenants (previously, tenants were mainly from Sengkang West industrial park).

Sengkang has also become more interconnected than in The Luxurie’s earlier days, with further development of the LRT system (it’s easier to get from one end of Sengkang to the other, with stops in-between).

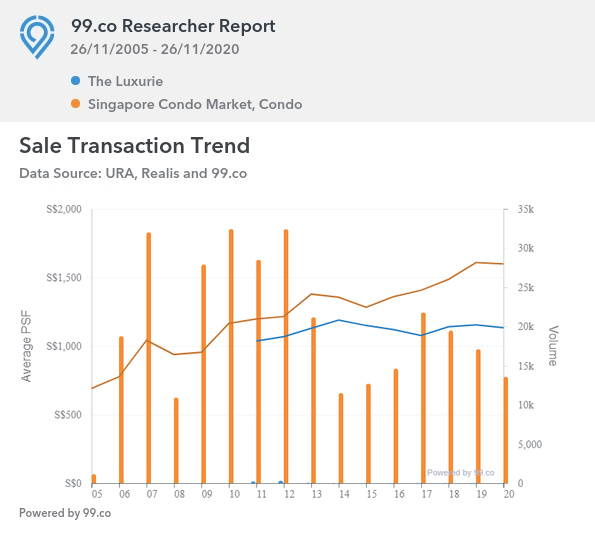

How has it fared against the general condo market?

Prices at The Luxurie stood at $1,036 psf in 2011, and average $1,133 psf today. This is an increase of about 9.3 per cent. In the same time, the condo market rose from $1,197 psf to $1,599 psf, an increase of about 33.6 per cent.

These were the five most recent transactions at The Luxurie:

| Date | Unit Size (Sq. Ft.) | Price PSF | Total Price | Purchase PSF | Profit/Loss |

| 16 Oct 2020 | 1,367 | $1,156 | $1,580,000 | $1,031 | $170,200 |

| 6 Oct 2020 | 775 | $1,129 | $875,000 | $1,108 | $16,400 |

| 30 Sep 2020 | 936 | $1,068 | $1,000,000 | $943 | $116,600 |

| 17 Sep 2020 | 1,001 | $1,139 | $1,140,000 | $1,020 | $119,400 |

| 23 Jul 2020 | 1,001 | $1,109 | $1,110,000 | $1,050 | $59,000 |

There have been 84 profitable transactions, with 22 unprofitable transactions.

This is by no means an in-depth study, but the few “ulu” ones we’ve picked out does show that condos in more fringe areas fall behind the overall market; but it’s not as bad as it’s often made out to be.

The majority of these condos still show profitable transactions outweighing the unprofitable ones. And with their lower cash outlay and capital commitment, they can still remain attractive to home buyers.

Home buyers of less accessible condos need to be more picky however, and choose developments that offset the locational disadvantages; you may not feel the inconvenience of living in a less built-up area, if the MRT is just across the road (Parc Canberra is a good current example of this).

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Do condos in less accessible areas perform as well as those in prime locations?

How has the price growth of 'ulu' condos compared to the general condo market?

Are there 'ulu' condos that have shown good appreciation over time?

What factors can help 'ulu' condos perform better despite their location?

Is investing in less accessible condos a good idea?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Property Investment Insights Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

Property Investment Insights This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Property Advice Should I Pay $500K More For A New Launch — Or Buy A Resale Condo Instead?

Singapore Property News A Rare Freehold CBD Office Unit Is Up For Sale At $20.5M — And Foreigners Can Buy It

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

0 Comments