This New Condo Rating System Is About to Shake Up Singapore’s Property Developers and Condos. Here’s Why.

May 28, 2023

CONQUAS is a way to rate developments, dating back to 1989 – but there have been a lot of changes since then. The latest upcoming change is a banding system, used to rate developers and the different projects.

Do you know how banks have credit grades for your creditworthiness? It’s somewhat similar. The new CONQUAS banding groups developers into different bands: the most proven – those who have delivered numerous projects with few defects – fall into Band 1 and 2. (You can check it out for yourself here, there are currently 20 developers and 15 builders that have been awarded Band 1).

Band 3 has an “average” number of defects and incidents reported, and those in Bands 5 and 6 have a high incidence of defects. This isn’t just useful for homebuyers, it makes it clear to industry players – like main contractors and developers – where exactly they stand. CONQUAS has already helped to raise quality standards before, and this should help even create better standards in the future.

This is convenient for buyers since a banding system is easier to understand than a literal point score. Obviously, this will help a lot in any buying decisions, and help prevent further buyer remorse later on. I’ve heard of many horror stories coming from buying properties in other countries, so this move will help create a much safer environment for homebuyers/investors.

Of course, the first thing many nosy people will do is to look for developers/projects banded 5/6 and start passing judgement on these. There will naturally be a knock-on effect, where owners of such properties may feel aggrieved at the ratings as it may affect their property values.

However, in the grand scheme of things, this has to be seen as a necessary “evil” to create better quality homes for everyone in Singapore.

But I do think it’s going to be rough for low-banded developers, as it may get harder to market a property that is literally classified as one of poorer quality (it’s going to be tougher to market a property for a Band 6 developer, versus a Band 1 developer).

I do also have one other worry: even the best developer slips up from time to time, and a Band 1 or Band 2 rating may cause some buyers to relax their scrutiny.

There are also further teething issues that will have to be ironed out for this to really take effect. First, the widespread education to buyers of such a system – there’s no point in having such ratings when no one else sees it. So it remains to be seen how much visibility this will get in new launches moving forward.

Developers in the higher bands will obviously want to display these and make it known, but how much of a requirement would it be for those in the lower bands to let consumers know?

Nonetheless, it’s an overall plus – few developers will want to be relegated to a lower band. CONQUAS has caused some practical changes over the years – there has been, for instance, a 25 per cent decrease in the incidence of water seepage over the years, as well as issues with floor tiles.

You’ll be able to access the CONQUAS score here, on the BCA website.

In other news, property agents now need seven to 10 hours more training to renew their licenses.

This starts in October 2025 and has around four hours of optional “add-ons” like customer service and digital marketing. Hopefully, the added hours will make room for many badly-needed lessons.

I suggest the following be key modules for 2023:

- How to pick up phones: a selling agent’s guide to co-broking

- Setting up “official” developer sites, and six other digital marketing methods to make everyone hate you

- Ponds, benches, and 10,000 trivial things to try calling a “facility”

- How not to put unwanted things in HDB gates

It’s good for the lessons to address what’s happening on the ground, rather than just plugging agents full of paper knowledge.

It’s patently absurd how many sellers’ agents try to avoid splitting their commissions, by refusing to pick up the phone when another agent calls.

If they co-broke a unit with a buyer’s agent, you see, they need to split their two per cent commission with the other realtor. So when they discover another realtor is calling, some suddenly lose the ability to answer their phone (as all offers must be conveyed to their client).

More from Stacked

How Grand Dunman “Helped” To Sell The Continuum: The Hidden Influence Of Price Anchoring In Real Estate

Imagine intending to buy a stock, but it's jumped from $50 to $100 since you started tracking it. Suddenly, $50…

They’d much rather wait for an unrepresented buyer to make an offer, so they can pocket the whole commission. And we know some of them are doing this because simple tricks like the buyer’s agent changing their number cause them to pick up.

This is an ongoing problem that CEA needs to shut down for the sake of sellers; everyone deserves to know the offers on their home.

Meanwhile, in other serious property news…

- With rental rates so high, it may even make sense to go travelling for months (while waiting for your BTO flat) instead of renting. One couple managed to do just that.

- We checked out the pros and cons of high-floor living, according to the real-life experiences of a couple.

- We found the cheapest resale ECs right now, for those looking to upgrade to private (or semi-private) homes on a budget.

- If you need a freehold three-bedder, here are some resale options that have kept it to $1.5 million or below; potentially affordable on an upgrader’s budget.

Weekly Sales Roundup (15-21 May)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| MIDTOWN MODERN | $5,617,000 | 1808 | $3,106 | 99 yrs (2019) |

| KLIMT CAIRNHILL | $5,200,000 | 1496 | $3,475 | FH |

| AMBER PARK | $5,000,000 | 2142 | $2,334 | FH |

| PULLMAN RESIDENCES NEWTON | $4,425,300 | 1281 | $3,455 | FH |

| LIV @ MB | $3,926,860 | 1518 | $2,587 | 99 yrs (2021) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE RESERVE RESIDENCES | $1,142,660 | 441 | $2,589 | 99 yrs |

| TEMBUSU GRAND | $1,340,000 | 527 | $2,541 | 99 yrs (2022) |

| THE ATELIER | $1,565,190 | 549 | $2,851 | FH |

| 10 EVELYN | $1,615,000 | 527 | $3,062 | FH |

| THE AVENIR | $1,718,000 | 538 | $3,192 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SCOTTS HIGHPARK | $12,680,000 | 4112 | $3,084 | FH |

| PATERSON RESIDENCE | $8,500,000 | 4058 | $2,095 | FH |

| CLIVEDEN AT GRANGE | $8,100,000 | 2842 | $2,850 | FH |

| NOUVEL 18 | $7,696,000 | 2476 | $3,109 | FH |

| CORALS AT KEPPEL BAY | $6,800,000 | 2723 | $2,497 | 99 yrs (2007) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| FLORAVIEW | $605,888 | 377 | $1,608 | FH |

| THE EBONY | $628,000 | 366 | $1,716 | FH |

| SUITES @ EASTCOAST | $660,000 | 377 | $1,752 | FH |

| METRO LOFT | $670,000 | 452 | $1,482 | FH |

| HAIG 162 | $674,000 | 355 | $1,897 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| SCOTTS HIGHPARK | $12,680,000 | 4112 | $3,084 | $3,987,400 | 16 Years |

| PATERSON RESIDENCE | $8,500,000 | 4058 | $2,095 | $2,150,000 | 5 Years |

| CASUARINA COVE | $2,338,388 | 1528 | $1,530 | $1,410,388 | 21 Years |

| HUNDRED TREES | $2,700,000 | 1475 | $1,831 | $1,306,000 | 14 Years |

| D’LEEDON | $4,000,000 | 2013 | $1,987 | $1,250,000 | 6 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| CLIVEDEN AT GRANGE | $8,100,000 | 2842 | $2,850 | -$1,403,800 | 16 Years |

| THE SAIL @ MARINA BAY | $1,630,000 | 883 | $1,847 | -$190,000 | 12 Years |

| MON JERVOIS | $3,780,000 | 1905 | $1,984 | -$123,000 | 10 Years |

| THE ROCHESTER RESIDENCES | $1,420,000 | 1141 | $1,245 | -$100,000 | 10 Years |

| THE SAIL @ MARINA BAY | $1,230,000 | 667 | $1,843 | -$20,000 | 5 Years |

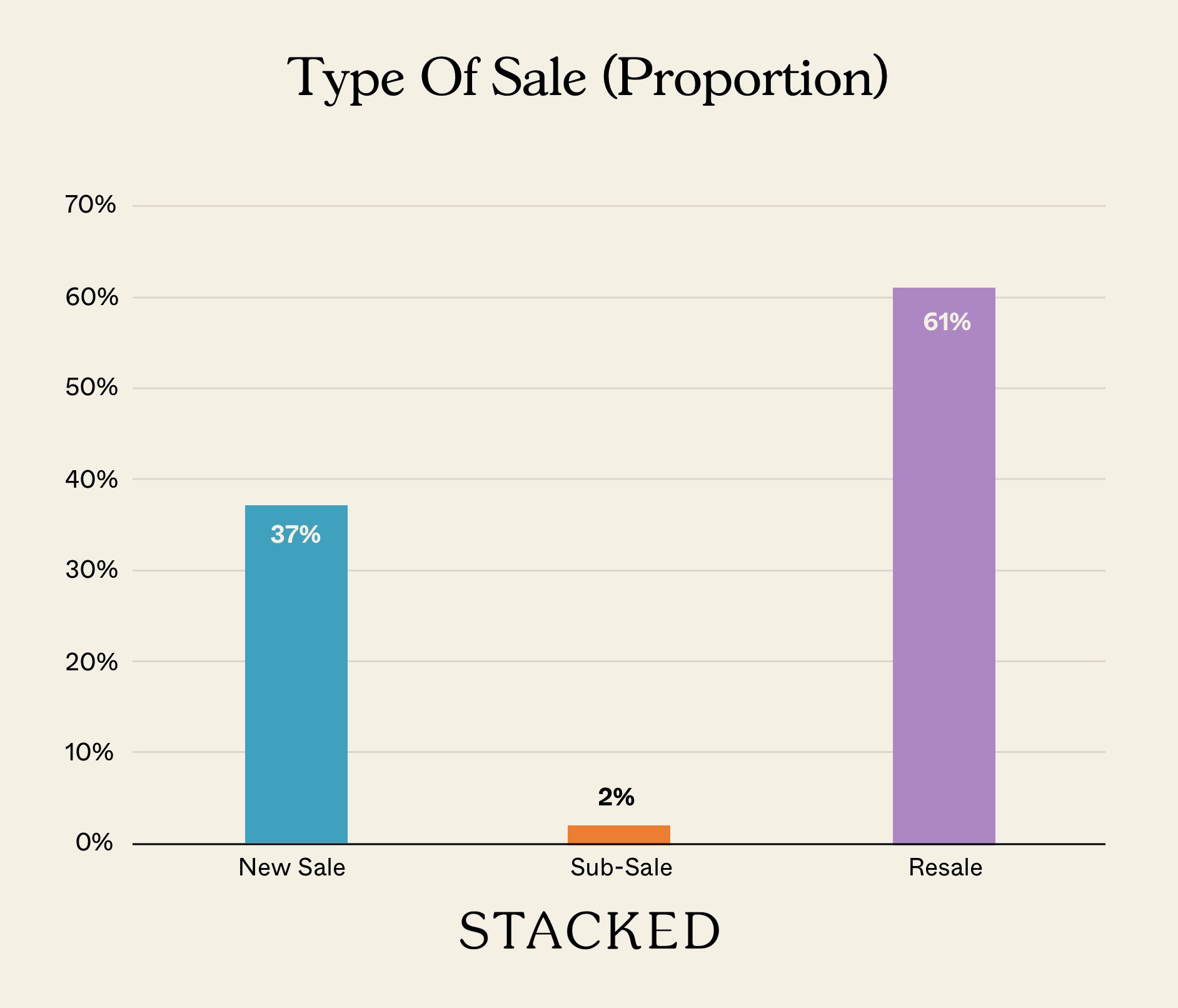

Transaction Breakdown

My interesting links of the week

- Be a Photoshop pro

Watch this video from MKBHD on the upcoming Google Magic Editor. It was stunning to see how you can manipulate images so easily – either by moving the subject anywhere you wanted, to even changing the weather. Not too long ago, you needed a Photoshop expert to create such images, today, that can be done at the touch of a button.

So what does that mean for everyone else? As always, there will be cries of losing jobs for some people. But I can see how this can impact the real estate industry as well. No longer will you have shoddy photos, when everyone can manipulate any image they want with such ease. This could create an environment where imagery can be very deceiving, and there would be a need to really go down to the property to have a look for yourself.

- China regulating the real estate agent

It’s interesting to note how CEA looks to improve the quality of property agents in Singapore (as written above), and compare that with the changes that China is regulating with their real estate agents.

(You can read it all here).

The biggest highlight by far is the co-payment of the agent commissions, as some are charging both sellers and buyers. There are also moves to lower commission fees to “reasonable” rates based on a guide of the higher the transaction, the lower the commission rate. How would such a move affect the market? Stay tuned over the next few months, as that would be a very interesting story to keep tabs on.

Follow us on Stacked as we navigate the twists and turns of the 2023 property market, and track the upcoming changes caused by new cooling measures.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the new condo rating system in Singapore and how does it work?

How will the condo rating bands affect property buyers and developers?

Will the condo rating system be visible to homebuyers at new launches?

What are the potential drawbacks of the new condo rating system?

Where can I check the CONQUAS scores for developers and projects?

What other recent changes are happening in Singapore's property industry besides the condo rating system?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Latest Posts

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

2 Comments

Stop those memes. It is headache inducing…