This Homeowner Made $4.3m In Profit In 5 Years: The Best Performing New Launches Since 2018

December 19, 2024

Five years and one world-shaking epidemic later, the property market is like nothing we’ve ever seen. Realtors back then may have warned you prices would go up, but probably even they didn’t expect something this dramatic. For those who were lucky enough – or genius enough – to pick up a new launch condo five years ago, here are some of the top gains from those who have sold recently:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Most profitable new launches in the last 5 years

Top Gainers By Condo (Overall Gains)

| Condo | Bought At | Size | $PSF | Bought Date | Address | Tenure | Overall Price Gains | % Returns | Sell Date | Sell Price | Holding Period (Years) |

| JADESCAPE | $5,799,330 | 4,230 | $1,371 | 24/12/19 | 10 SHUNFU ROAD #23-43 | 99 yrs from 19/06/2018 | $4,350,000 | 75% | 9/12/19 | $10,147,770 | 5.0 |

| BOULEVARD 88 | $10,128,000 | 2,799 | $3,619 | 9/3/19 | 88 ORCHARD BOULEVARD #18-05 | Freehold | $3,872,000 | 38% | 13/4/23 | $14,000,000 | 4.1 |

| NEW FUTURA | $9,134,800 | 2,691 | $3,395 | 21/1/18 | 18 LEONIE HILL ROAD #24-05 | Freehold | $3,365,200 | 37% | 3/5/23 | $12,500,000 | 5.3 |

| MEYERHOUSE | $7,910,250 | 2,971 | $2,663 | 4/3/22 | 128 MEYER ROAD #04-09 | Freehold | $1,369,750 | 17% | 20/1/24 | $9,280,000 | 1.9 |

| PARKWOOD COLLECTION | $3,322,000 | 4,510 | $737 | 2/3/22 | 77 LORONG 1 REALTY PARK | 99 yrs from 22/09/2017 | $1,178,000 | 35% | 26/4/24 | $4,500,000 | 2.2 |

| LEEDON GREEN | $3,750,000 | 1,496 | $2,506 | 14/4/21 | 28 LEEDON HEIGHTS #11-11 | Freehold | $1,150,000 | 31% | 23/9/24 | $4,900,000 | 3.4 |

| STIRLING RESIDENCES | $2,283,000 | 1,346 | $1,697 | 27/7/18 | 21 STIRLING ROAD #15-08 | 99 yrs from 18/08/2017 | $1,042,000 | 46% | 8/11/24 | $3,325,000 | 6.3 |

| BELGRAVIA GREEN | $3,086,590 | 3,638 | $848 | 6/12/18 | 301 BELGRAVIA DRIVE | Freehold | $1,041,410 | 34% | 5/7/24 | $4,128,000 | 5.6 |

| THE AVENIR | $7,888,000 | 2,411 | $3,271 | 2/12/20 | 10 RIVER VALLEY CLOSE #26-11 | Freehold | $1,000,000 | 13% | 20/6/24 | $8,888,000 | 3.6 |

| AMBER 45 | $2,800,000 | 1,346 | $2,081 | 3/8/19 | 45 AMBER ROAD #19-05 | Freehold | $985,000 | 35% | 27/11/24 | $3,785,000 | 5.3 |

Top Gainers By Condo (Overall Returns)

| Condo | Bought At | Size | $PSF | Bought Date | Address | Tenure | Overall Price Gains | % Returns | Sell Date | Sell Price | Holding Period (Years) |

| JADESCAPE | $5,799,330 | 4,230 | $1,371 | 24/12/19 | 10 SHUNFU ROAD #23-43 | 99 yrs from 19/06/2018 | $4,350,000 | 75% | 9/12/19 | $10,147,770 | 5.0 |

| RIVERFRONT RESIDENCES | $1,323,000 | 1,109 | $1,193 | 5/7/18 | 51 HOUGANG AVENUE 7 #01-60 | 99 yrs from 31/05/2018 | $727,000 | 55% | 8/11/23 | $2,050,000 | 5.3 |

| PARC ESTA | $1,540,000 | 958 | $1,608 | 29/12/18 | 912 SIMS AVENUE #14-55 | 99 yrs from 12/07/2018 | $790,000 | 51% | 16/8/24 | $2,330,000 | 5.6 |

| WHISTLER GRAND | $1,241,730 | 958 | $1,296 | 18/8/19 | 109 WEST COAST VALE #09-21 | 99 yrs from 07/05/2018 | $618,270 | 50% | 20/9/23 | $1,860,000 | 4.1 |

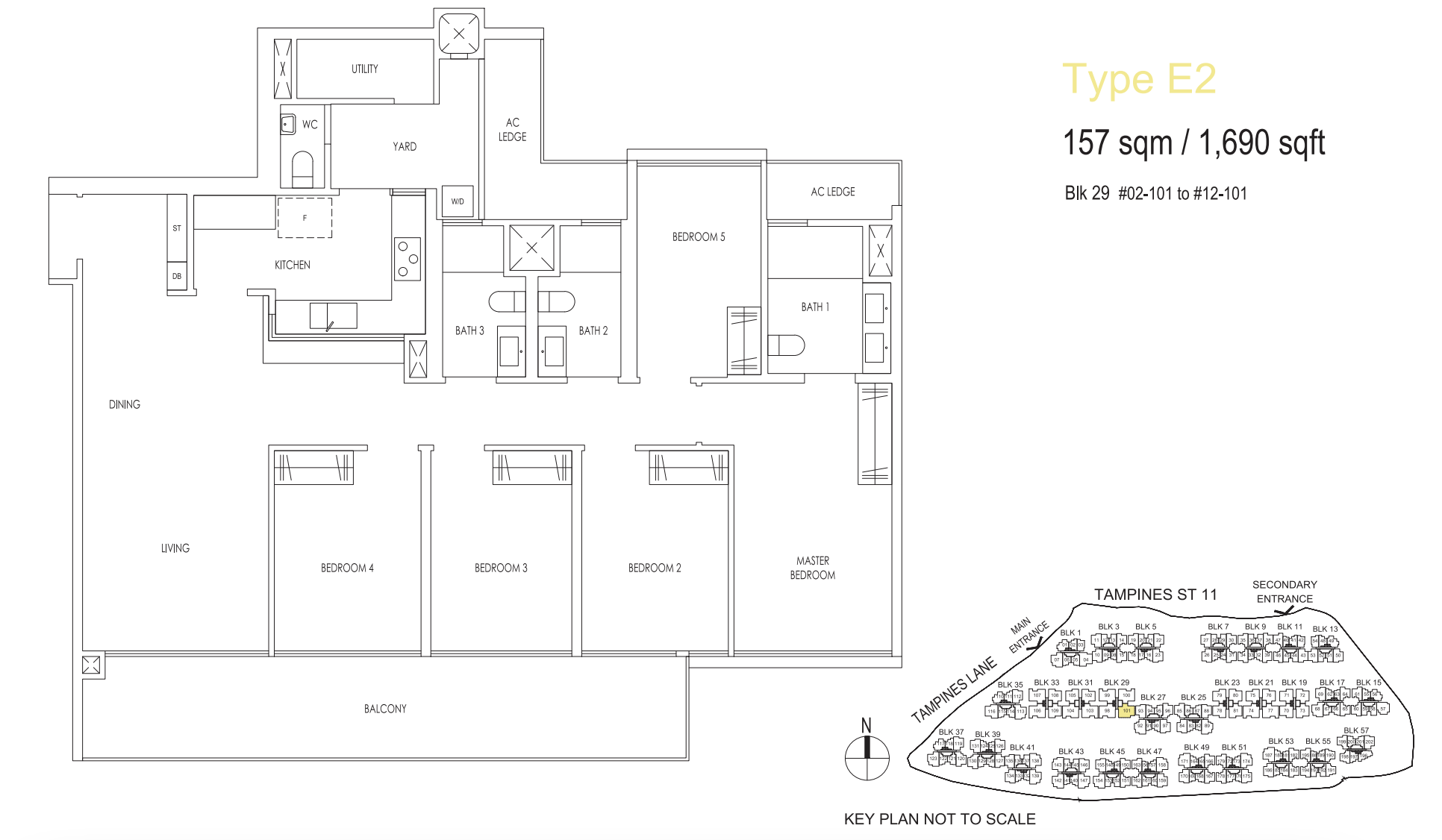

| TREASURE AT TAMPINES | $2,007,000 | 1,690 | $1,188 | 16/11/20 | 29 TAMPINES LANE #02-101 | 99 yrs from 29/11/2018 | $981,000 | 49% | 23/1/24 | $2,988,000 | 3.2 |

| PENROSE | $1,632,000 | 1,055 | $1,547 | 26/9/20 | 28 SIMS DRIVE #18-25 | 99 yrs from 03/07/2019 | $770,410 | 47% | 8/11/24 | $2,402,410 | 4.1 |

| PARK COLONIAL | $1,680,000 | 1,152 | $1,459 | 8/12/18 | 6 WOODLEIGH LANE #15-23 | 99 yrs from 11/10/2017 | $778,888 | 46% | 15/8/24 | $2,458,888 | 5.7 |

| STIRLING RESIDENCES | $2,283,000 | 1,346 | $1,697 | 27/7/18 | 21 STIRLING ROAD #15-08 | 99 yrs from 18/08/2017 | $1,042,000 | 46% | 8/11/24 | $3,325,000 | 6.3 |

| CLAVON | $2,044,000 | 1,356 | $1,507 | 28/5/21 | 6 CLEMENTI AVENUE 1 #05-04 | 99 yrs from 07/10/2019 | $906,000 | 44% | 25/9/24 | $2,950,000 | 3.3 |

| THE TAPESTRY | $1,690,470 | 1,432 | $1,181 | 15/4/18 | 57 TAMPINES STREET 86 #05-27 | 99 yrs from 31/07/2017 | $744,530 | 44% | 10/10/24 | $2,435,000 | 6.5 |

The condo names that keep appearing

From the above, you can see the following projects dominate the list, with units that have shown the highest returns:

1. Jadescape

We last wrote about Jadescape making a record $1.1m in profits, but this has just been eclipsed by the latest resale transaction in December – a stunning $4.35m for a 6-bedroom penthouse. It was bought for $5.8 million in December 2019, and just sold for $10.15 million on 9th December this year.

That’s an annualised return of 15 per cent, for just holding on for 5 years (although it must be said, perhaps there was a high amount of renovation cost to begin with to persuade the owner to sell at such a high price).

In any case, when we last ran the numbers in 2023, Jadescape was one of the top performing condos with a higher percentage gain over other similar new launches (you can read more here).

Top 5 Transactions By Overall Gains

| Condo | Bought At | Size | $PSF | Bought Date | Address | Tenure | Overall Price Gains | % Returns | Sell Date | Sell Price | Holding Period (Years) |

| JADESCAPE | $5,799,330 | 4,230 | $1,371 | 24/12/19 | 10 SHUNFU ROAD #23-43 | 99 yrs from 19/06/2018 | $4,350,000 | 75% | 9/12/19 | $10,147,770 | 5.0 |

| JADESCAPE | $3,278,280 | 2,099 | $1,562 | 23/9/18 | 10 SHUNFU ROAD #10-40 | 99 yrs from 19/06/2018 | $1,146,720 | 35% | 12/8/24 | $4,425,000 | 5.9 |

| JADESCAPE | $3,428,000 | 2,099 | $1,633 | 26/5/20 | 10 SHUNFU ROAD #08-40 | 99 yrs from 19/06/2018 | $1,122,000 | 33% | 18/10/23 | $4,550,000 | 3.4 |

| JADESCAPE | $3,100,000 | 2,099 | $1,477 | 10/7/20 | 12 SHUNFU ROAD #03-46 | 99 yrs from 19/06/2018 | $1,068,000 | 34% | 17/7/24 | $4,168,000 | 4 |

| JADESCAPE | $2,369,400 | 1,421 | $1,668 | 3/7/20 | 8 SHUNFU ROAD #11-32 | 99 yrs from 19/06/2018 | $910,600 | 38% | 5/8/24 | $3,280,000 | 4.1 |

2. Treasure at Tampines

Treasure at Tampines is currently the largest condo project in Singapore. Only completed in 2023, this leasehold project has an astounding 2,203 units. This is a redevelopment of a former HUDC Estate (Tampines Court), and it was known for its competitive pricing from the start – with most agents referring to this as a private condo but at EC prices.

Prices began at just around $1,280 psf at launch. As we mentioned in our review of this condo, affordability was a key highlight: not only were the units priced low, but the maintenance fees benefitted from such a high unit count. A three-bedder at Treasure has maintenance fees of just $180 to $198 per month, whilst a five-bedder’s maintenance costs between $240 to $264. For most condos, even mass-market ones, you would expect maintenance fees to be in the range of $300 to $400 per month.

The lower initial quantum explains most of the gains. A unit from Treasure at Tampines made nearly a million dollars: a 1,670 sq. ft. unit that was bought for $2.007 million in 2019, and resold for $2.988 million. You’ll also see multiple other units on the list that are from Treasure at Tampines.

More from Stacked

J’den Condo Review: A Rare New Launch Near 4 MRT Lines Replacing JCube

If you told Singaporeans 20 years ago that Jurong would evolve into what it is today and stand at the…

Note that even with the high gains today, Treasure at Tampines is still arguably affordable: a 1,034 sq. ft. unit here sold for just $1.8 million in November 2024, and a 915 sq. ft. unit sold for just $1.52 million the same month.

As we expressed in our review, the tradeoff for the price is in the lack of privacy, and facilities that can be a bit packed (inevitable given the size of the unit count). But this is still an affordable way to live in the regional centre of the east. The MRT station isn’t as close as you might like, but there are bus services right outside that take you to Tampines MRT (DTL, EWL). This is a major commercial hub with Tampines Mall, Century Square, and Tampines 1, as well as Grade A office spaces.

Treasure at Tampines is a counterargument to the theory that mega-developments won’t do well, because there’s too much competition from other units. It seems that so long as the initial price is right, a very high unit count won’t hurt profits.

Top 5 Transactions By Overall Gains

| Condo | Bought At | Size | $PSF | Bought Date | Address | Tenure | Overall Price Gains | % Returns | Sell Date | Sell Price | Holding Period (Years) |

| TREASURE AT TAMPINES | $2,007,000 | 1,690 | $1,188 | 16/11/20 | 29 TAMPINES LANE #02-101 | 99 yrs from 29/11/2018 | $981,000 | 49% | 23/1/24 | $2,988,000 | 3.2 |

| TREASURE AT TAMPINES | $2,065,000 | 1,722 | $1,199 | 20/1/21 | 31 TAMPINES LANE #03-103 | 99 yrs from 29/11/2018 | $815,000 | 39% | 5/4/24 | $2,880,000 | 3.2 |

| TREASURE AT TAMPINES | $2,034,000 | 1,711 | $1,188 | 27/9/20 | 29 TAMPINES LANE #05-100 | 99 yrs from 29/11/2018 | $756,000 | 37% | 21/5/24 | $2,790,000 | 3.6 |

| TREASURE AT TAMPINES | $2,036,000 | 1,722 | $1,182 | 13/11/20 | 29 TAMPINES LANE #02-98 | 99 yrs from 29/11/2018 | $724,000 | 36% | 2/4/24 | $2,760,000 | 3.4 |

| TREASURE AT TAMPINES | $2,061,000 | 1,722 | $1,197 | 28/2/21 | 29 TAMPINES LANE #04-99 | 99 yrs from 29/11/2018 | $709,000 | 34% | 20/5/24 | $2,770,000 | 3.2 |

3. Penrose

Penrose is a leasehold, 566-unit project that will probably be completed next year (2025). The developer could afford to go low, because of the land bid price of just $732 psf (see the link above).

During the launch weekend, one-bedders at Penrose started at $788,000, while three-bedders could be as low as $1.33 million. This resulted in being one of the fastest-selling new launches in 2020, and 60 per cent of Penrose was sold on its launch debut (although Clavon, below, beat it by moving 70 per cent of its units). The initial prices were very competitive even with a very new condo (at that time), Sims Urban Oasis beside it, but it could have been also brought about because of the initial scares of the pandemic.

There was a bit of scepticism over Penrose’s location, however. It is a very convenient location, being near Aljunied MRT (EWL) and hence also near Paya Lebar Quarter (PLQ). This is a major retail hub with shops, food, offices, and other entertainment. The HDB enclave across the road from Penrose is also super-convenient, with coffee shops, clinics, mini-marts, pet stores, and other heartland amenities.

What put some buyers off is the lack of green space, coupled with the heavy traffic along Sims Drive. This is a densely packed area and one that’s only going to appeal to hardcore urbanites.

Nonetheless, a few of the top transactions are from Penrose’s 1,055 sq. ft. units, with gains of $732,000 and $770,410 respectively.

Like Treasure at Tampines, this is a project that – on paper – has a very noticeable drawback. With Treasure at Tampines it was a very high unit count, and with Penrose, it’s traffic and lacking green space/pretty views. But in both cases, a low initial quantum was more than enough to compensate.

Top 5 Transactions By Overall Gains

| Condo | Bought At | Size | $PSF | Bought Date | Address | Tenure | Overall Price Gains | % Returns | Sell Date | Sell Price | Holding Period (Years) |

| PENROSE | $1,632,000 | 1,055 | $1,547 | 26/9/20 | 28 SIMS DRIVE #18-25 | 99 yrs from 03/07/2019 | $770,410 | 47% | 8/11/24 | $2,402,410 | 4.1 |

| PENROSE | $1,568,000 | 1,055 | $1,486 | 26/9/20 | 28 SIMS DRIVE #07-25 | 99 yrs from 03/07/2019 | $732,000 | 47% | 7/11/24 | $2,300,000 | 4.1 |

| PENROSE | $1,604,000 | 1,044 | $1,536 | 26/9/20 | 26 SIMS DRIVE #16-21 | 99 yrs from 03/07/2019 | $646,000 | 40% | 8/10/24 | $2,250,000 | 4 |

| PENROSE | $1,609,000 | 1,055 | $1,525 | 26/9/20 | 28 SIMS DRIVE #14-25 | 99 yrs from 03/07/2019 | $611,000 | 38% | 9/10/24 | $2,220,000 | 4 |

| PENROSE | $1,540,000 | 1,044 | $1,475 | 26/9/20 | 26 SIMS DRIVE #05-21 | 99 yrs from 03/07/2019 | $590,000 | 38% | 27/6/24 | $2,130,000 | 3.8 |

4. Clavon

This is a leasehold 640-unit project, which we rated highly for its smaller-unit layouts (we highlighted Clavon as having one of the best two-bedder layouts at that time). Continuing the overall trend above, this was a competitively priced condo at launch.

Clavon sold 70 per cent of its units over the launch weekend, mostly of the one and two-bedders; these mainly ranged between $800,000 and $ 1 million. But it’s quite expected for smaller units to go first. What was surprising was that the price, on a per square foot basis, was not very different between the smaller and larger units (see the link above).

Similar to what we’ve seen in the market so far, the demand for large bedroom types meant that some of the most profitable units were Clavon’s 1,356 sq. ft. units and 958 sq. ft. units (classified as four and three-bedders). The four-bedder in particular was impressive, with a gain of $906,000.

The location is also very strong: it’s close to Clementi MRT station (EWL, CRL) and hence Clementi Mall. The NUS High School of Maths and Science is closeby and Dover – one stop away – is home to Singapore Polytechnic. The number of existing HDB projects in this mature area, coupled with good school access, means there’s a sizeable pool of upgraders who may be interested in Clavon.

Top 5 Transactions By Overall Gains

| Condo | Bought At | Size | $PSF | Bought Date | Address | Tenure | Overall Price Gains | % Returns | Sell Date | Sell Price | Holding Period (Years) |

| CLAVON | $2,044,000 | 1,356 | $1,507 | 28/5/21 | 6 CLEMENTI AVENUE 1 #05-04 | 99 yrs from 07/10/2019 | $906,000 | 44% | 25/9/24 | $2,950,000 | 3.3 |

| CLAVON | $2,053,000 | 1,356 | $1,514 | 12/12/20 | 6 CLEMENTI AVENUE 1 #10-04 | 99 yrs from 07/10/2019 | $847,000 | 41% | 11/6/24 | $2,900,000 | 3.5 |

| CLAVON | $2,555,000 | 1,582 | $1,615 | 14/12/20 | 6 CLEMENTI AVENUE 1 #32-05 | 99 yrs from 07/10/2019 | $783,000 | 31% | 14/11/24 | $3,338,000 | 3.9 |

| CLAVON | $2,563,000 | 1,582 | $1,620 | 4/9/21 | 6 CLEMENTI AVENUE 1 #29-05 | 99 yrs from 07/10/2019 | $737,000 | 29% | 11/10/24 | $3,300,000 | 3.1 |

| CLAVON | $2,025,000 | 1,281 | $1,581 | 30/7/21 | 8 CLEMENTI AVENUE 1 #12-14 | 99 yrs from 07/10/2019 | $625,000 | 31% | 4/9/24 | $2,650,000 | 3.1 |

5. Parc Clematis

Yet another mega-development, Parc Clematis is a 99-year leasehold condo with 1,468 units, which was completed in 2023. This condo has one of the largest spaces given over to common facilities, at around 400,000 sq.ft.

Parc Clematis sold quite fast as well: 324 of the first 465 units released were sold at launch, that’s certainly been a trend on this list so far.

Like most mega-developments, the sheer scale allows for more affordable pricing. From the list above, note that the top-gaining units were all attractively priced; the best performer was a 904 sq. ft. unit that was bought for just $1.46 million, and resold for $2.1 million. Notice how many of the Parc Clematis units on the list sold for below $1.5 million as well, providing ample room for future gains.

Lower initial pricing isn’t the only secret ingredient here though. Like Clavon, this may be related to the Clementi location: Parc Clematis also is within proximity to Clementi MRT (EWL, CRL) and Clementi mall, and the excellent school access that characterises this neighbourhood. And like Clavon, there’s a ready pool of upgraders eager to stay within the same area. These are more than enough to overcome issues with the high unit count.

In a way, this is like a west-end counterpart to Treasure at Tampines (and one with a more spacious layout, we think).

The above shows there’s something to be said for the “wisdom of the crowd.” It’s true that hype and exuberance are constant hazards in real estate; but in the above cases, strong launch numbers really did indicate a good buy. Sometimes, the crowd can point you in the right direction.

Top 5 Transactions By Overall Gains

| Condo | Bought At | Size | $PSF | Bought Date | Address | Tenure | Overall Price Gains | % Returns | Sell Date | Sell Price | Holding Period (Years) |

| PARC CLEMATIS | $2,563,000 | 1,496 | $1,713 | 27/9/21 | 6 JALAN LEMPENG #13-04 | 99 yrs from 08/08/2019 | $895,000 | 35% | 6/11/24 | $3,458,000 | 3.1 |

| PARC CLEMATIS | $2,179,000 | 1,292 | $1,687 | 6/6/20 | 8F JALAN LEMPENG #22-65 | 99 yrs from 08/08/2019 | $859,000 | 39% | 20/9/24 | $3,038,000 | 4.3 |

| PARC CLEMATIS | $2,537,000 | 1,496 | $1,696 | 26/1/21 | 6 JALAN LEMPENG #18-04 | 99 yrs from 08/08/2019 | $843,000 | 33% | 27/2/24 | $3,380,000 | 3.1 |

| PARC CLEMATIS | $2,078,000 | 1,238 | $1,679 | 14/7/20 | 8D JALAN LEMPENG #22-46 | 99 yrs from 08/08/2019 | $832,000 | 40% | 29/10/24 | $2,910,000 | 4.3 |

| PARC CLEMATIS | $2,686,000 | 1,668 | $1,610 | 30/1/21 | 8 JALAN LEMPENG #22-13 | 99 yrs from 08/08/2019 | $824,000 | 31% | 27/2/24 | $3,510,000 | 3.1 |

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are some of the most profitable new condo launches in Singapore over the past five years?

How did Jadescape perform in terms of profit and returns?

Why is Treasure at Tampines considered a high-gain property despite its large size?

What factors contributed to the success of Penrose as an investment?

What is the significance of mega-developments like Parc Clematis in property gains?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from New Launch Condo Analysis

New Launch Condo Analysis This New Dairy Farm Condo Starts From $998K — How the Pricing Compares

New Launch Condo Analysis This New Freehold CBD Condo Starts From $1.29M — Here’s How the Pricing Compares

New Launch Condo Analysis This Freehold New Launch Condo In The CBD Is Launching From Just $1.29M

New Launch Condo Analysis I Reviewed A New Launch 4-Bedroom Penthouse At Beauty World

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

3 Comments

Hello, it’s not accurate to say Clavon is within priority enrolment for NUS high school of math and science. Enrolment is via dsa tests administered by the school.

Who is going to be the last one holding the baby?….this time it’s different mindset can be fatal.