If you live in an integrated development, maybe it’s better to give up the car.

After all, the whole point is that you’re connected to an MRT station and/or bus interchange. Also, having a commercial component invariably means busier roads nearby.

That’s the experience we’re hearing about in Woodleigh Residences, which recently made it into the news. Apparently, some drives can wait a half-hour on weekends and evenings to get home. The reason: the mall car park and residential car park share the same single-lane entrance.

What’s amazing is that the Transport Impact Assessment, done before the projects completion, had concluded that the shared entrance would be more convenient for residents. That’s another real estate mystery, since I’m not sure how anyonecould decide that, why yes, forcing the huge mall crowd and residents to cram into a single lane will be “convenient.”

Bear in mind, Woodleigh Mall is after all the only mall in Bidadari right now, so it’s not as if they expected a small crowd.

Also, you’d think they would have learned some lesson by now given this was what happened at Punggol Watertown too.

That said, this isn’t the only time I’ve heard grumbling about congestions at integrated projects. I’ve known tenants and home owners at Park Place Residences (Paya Lebar) who bemoan the crowded roads when getting home; and at the launch of Canninghill Piers (still under construction), I distinctly remember disgruntled comments about the roads. Being where the CTE meets River Valley Road, I’d expect jams near the project too.

Now integrated developments do tend to be pricier, so as a matter of opinion: if you have a car and like driving, pay a premium for something else instead – a sea view, a low-density enclave, greenery view, etc.

But if you don’t want a car, and prize having lots of amenities, then consider an integrated development. The heavy traffic nearby won’t be a bother to you (with the possible exception of road noise).

Two residents of Serangoon showed us what “grass roots communications” mean this week

Via a vulgar yelling match, in the best tradition of old-school Singapore (hey, it was how two uncles in my neighbourhood fought every night on Reinzi Street. That place is not as atas as you might think.)

This was how it was done in the days before WhatsApp messages; even if you couldn’t see each other face-to-face, you’d sometimes yell things across the block. Granted, some of it was crude arguments – but there was no more effective way to tell the karang-guni man to wait up.

When I moved to an HDB area, the last vestiges of “just shout” communications were already fading. But even then, my late grandfather would holler from the second floor to the nearby coffee shop that he wanted his toast and eggs – and it would be ready by the time he walked across.

I can’t seriously endorse disrupting the peace, but I do miss this element of HDB living. Like many HDB noises from my childhood – which includes ball games in the void deck, and the “void deck guitarist” (every block had one) – there’s a certain raw authenticity to it that’s just missing today.

Meanwhile in other serious property news…

- Want to stay somewhere super convenient without integrated development prices? Are food, retail, and entertainment more important than a nice view? Here are some options to consider.

- Need a two-bedder condo on a budget, while still keeping it freehold? Here are five underrated projects to check out.

- Have you seen how everyone’s reacting to The Reserve Residences?

Here’s why it’s selling fast, despite new cooling measures.

More from Stacked

Why Are Landed Home Sales Hitting New Highs Despite Covid-19?

If you’re like most people, you might guess the most expensive property segment – landed property – will fare worst…

- Finally, here are some surprising losses despite the property bull market of 2023. What’s causing these projects to falter?

Weekly Sales Roundup (15-21 May)

As Friday (June 02 2023) was a public holiday, the latest information was not available at the time of publication. The following are last week’s data.

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| MIDTOWN MODERN | $5,617,000 | 1808 | $3,106 | 99 yrs (2019) |

| KLIMT CAIRNHILL | $5,200,000 | 1496 | $3,475 | FH |

| AMBER PARK | $5,000,000 | 2142 | $2,334 | FH |

| PULLMAN RESIDENCES NEWTON | $4,425,300 | 1281 | $3,455 | FH |

| LIV @ MB | $3,926,860 | 1518 | $2,587 | 99 yrs (2021) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE RESERVE RESIDENCES | $1,142,660 | 441 | $2,589 | 99 yrs |

| TEMBUSU GRAND | $1,340,000 | 527 | $2,541 | 99 yrs (2022) |

| THE ATELIER | $1,565,190 | 549 | $2,851 | FH |

| 10 EVELYN | $1,615,000 | 527 | $3,062 | FH |

| THE AVENIR | $1,718,000 | 538 | $3,192 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SCOTTS HIGHPARK | $12,680,000 | 4112 | $3,084 | FH |

| PATERSON RESIDENCE | $8,500,000 | 4058 | $2,095 | FH |

| CLIVEDEN AT GRANGE | $8,100,000 | 2842 | $2,850 | FH |

| NOUVEL 18 | $7,696,000 | 2476 | $3,109 | FH |

| CORALS AT KEPPEL BAY | $6,800,000 | 2723 | $2,497 | 99 yrs (2007) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| FLORAVIEW | $605,888 | 377 | $1,608 | FH |

| THE EBONY | $628,000 | 366 | $1,716 | FH |

| SUITES @ EASTCOAST | $660,000 | 377 | $1,752 | FH |

| METRO LOFT | $670,000 | 452 | $1,482 | FH |

| HAIG 162 | $674,000 | 355 | $1,897 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| SCOTTS HIGHPARK | $12,680,000 | 4112 | $3,084 | $3,987,400 | 16 Years |

| PATERSON RESIDENCE | $8,500,000 | 4058 | $2,095 | $2,150,000 | 5 Years |

| CASUARINA COVE | $2,338,388 | 1528 | $1,530 | $1,410,388 | 21 Years |

| HUNDRED TREES | $2,700,000 | 1475 | $1,831 | $1,306,000 | 14 Years |

| D’LEEDON | $4,000,000 | 2013 | $1,987 | $1,250,000 | 6 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| CLIVEDEN AT GRANGE | $8,100,000 | 2842 | $2,850 | -$1,403,800 | 16 Years |

| THE SAIL @ MARINA BAY | $1,630,000 | 883 | $1,847 | -$190,000 | 12 Years |

| MON JERVOIS | $3,780,000 | 1905 | $1,984 | -$123,000 | 10 Years |

| THE ROCHESTER RESIDENCES | $1,420,000 | 1141 | $1,245 | -$100,000 | 10 Years |

| THE SAIL @ MARINA BAY | $1,230,000 | 667 | $1,843 | -$20,000 | 5 Years |

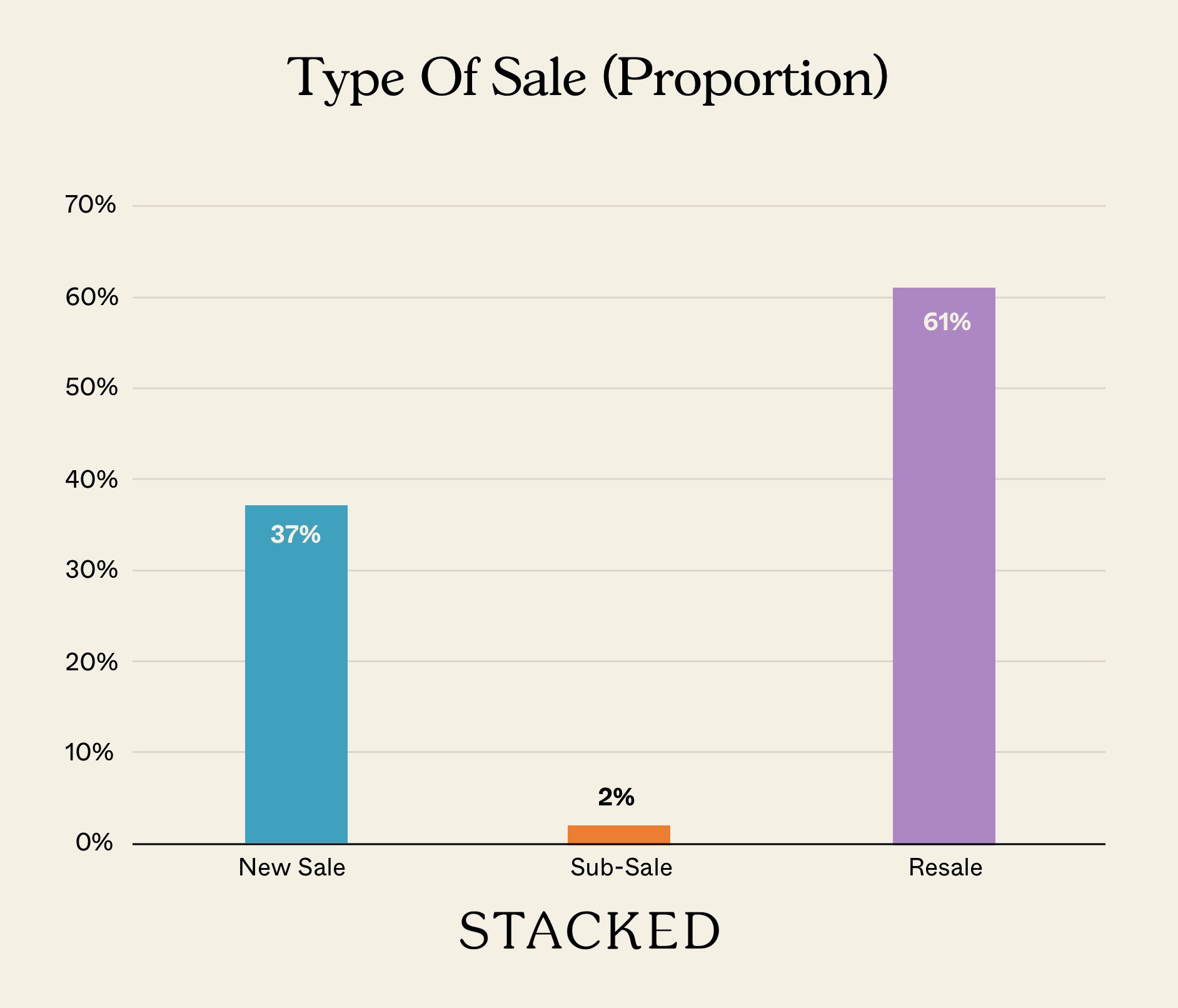

Transaction Breakdown

My interesting links of the week:

- Does increasing wealth tax really help?

We’ve often seen many arguments against the low tax for the rich in Singapore (there’s no capital gains tax). But there’s also the counter argument of pushing the rich out of Singapore should this happen.

Well, I’m not here to argue on the merits of either. But very interestingly, this happened in Norway recently.

In short, the increase in wealth tax recently was supposed to bring in $146m in yearly tax revenue. Instead the ultra rich worth $54 billion supposedly left the country, losing the country $594 million instead!

- Photoshop magic for everyone

I wrote about Google Magic editor last week, but this week Photoshop Generative AI took everyone by storm. If you haven’t seen it yet, be amazed (check it out here). It’s still in beta mode, so not everything is working perfectly. But when it works, boy does it really blow your mind.

It can generate practically anything and blend it with the surroundings so well. It even offers multiple options to choose from, if you don’t like the first iteration. Again, it’s easy to see jobs being cut out here, and if you haven’t been keeping up with AI, you really should.

Just like last week, there are lots of tools for agents to use now for better quality photos for their listing (and this is just scraping the barrel at what AI can do).

Follow us on Stacked for news and trends on the Singapore private housing market, as well as in-depth data and property reviews.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the challenges of living in an integrated development with shared parking and amenities?

Is it better to avoid owning a car if I live in an integrated development?

How do residents communicate or resolve issues in older Singapore neighborhoods?

Are integrated developments more expensive than other types of housing?

What are some alternative housing options if I want convenience without the high cost of integrated developments?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News When A “Common” Property Strategy Becomes A $180K Problem

Singapore Property News Tanjong Rhu’s First GLS In 28 Years Just Sold For $709M — Here’s What The Next Condo May Launch At

Singapore Property News Singapore’s CBD Office Rents Have Risen For 7 Straight Quarters — But Who’s Really Driving The Demand?

Singapore Property News 19 Pre-War Bungalows At Adam Park Just Went Up For Tender — But There’s A Catch

Latest Posts

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Overseas Property Investing What Under $200K Buys In Malaysia Today — From Freehold Apartments to Beachfront Suites

Overseas Property Investing A London Landmark Is Turning Into 975-Year Lease Homes — And The Entry Price May Surprise Singapore Buyers

0 Comments