The Hidden Risks Of Investing In Freehold Luxury Properties In Singapore

October 13, 2023

If you’re new to Singapore’s property market it may shock you to learn this, but freehold luxury properties may not be as good as investment as you may think. These properties are considered the cream of the crop – but ask many real estate veterans, and you’ll often find they have lower expectations for these homes. There are some, of course, that make outsized returns, but you’d also find some familiar faces that keep cropping up. We took a look at why this tends to happen:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Looking at some freehold luxury properties over the past 10 years

Even the top-named condos, in prestigious areas like Orchard and Marine Parade, have seen losses. We looked at the numbers over the past 10 years, and some top names are on the list. Check out the famed Ardmore Park, with a transaction showing a $1.5 million loss; or the well-known St. Regis Residences, chalking up a $600,000 loss.

Some of the biggest luxury freehold condo losses:

More from Stacked

Are Older One- and Two-Bedders in District 21 Holding Up Against the New Launches? We Break It Down

District 21 (D21) covers Upper Bukit Timah, Clementi Park, and Ulu Pandan, and it’s one of the most varied districts.…

| Project | Bought | Sold | $PSF | Size (Sq Ft) | $ Loss | % Loss |

| 3 ORCHARD BY-THE-PARK | $8,184,000 | $6,558,520 | 3621 | 2260 | -$1,625,480 | -19.9% |

| FOUR SEASONS PARK | $11,000,000 | $9,500,000 | 2879 | 3821 | -$1,500,000 | -13.6% |

| ARDMORE PARK | $10,500,000 | $9,000,000 | 3640 | 2885 | -$1,500,000 | -14.3% |

| THE BELVEDERE | $4,370,000 | $3,168,000 | 1692 | 2583 | -$1,202,000 | -27.5% |

| NASSIM PARK RESIDENCES | $13,170,800 | $12,000,000 | 3800 | 3466 | -$1,170,800 | -8.9% |

| LEEDON RESIDENCE | $14,800,000 | $13,800,000 | 2112 | 7007 | -$1,000,000 | -6.8% |

| ARDMORE THREE | $5,904,780 | $5,150,000 | 3305 | 1787 | -$754,780 | -12.8% |

| ST REGIS RESIDENCES SINGAPORE | $5,200,000 | $4,600,000 | 2428 | 2142 | -$600,000 | -11.5% |

| AALTO | $4,000,000 | $3,500,000 | 1637 | 2443 | -$500,000 | -12.5% |

It’s not unreasonable to assume that these units are bought by affluent owners. But that should also mean said owners have significant holding power, and don’t need to resort to urgent sales or fire sales. Why then, do these high-end properties often rack up big losses?

From both word on the ground, and observation of their price movements, here’s what we can surmise:

What causes freehold luxury condos to be sold at a loss?

- 1. Units may not have been purchased as investment assets

- 2. Small prospective pool of buyers

- 3. First-mover advantage isn’t possible in most luxury locations

- 4. “Freehold among freehold” is a weaker selling point

- 5. Typically the first to suffer from any cooling measure

- 6. Rich buyers would tend to prefer the newer, more modern luxury properties

Almost every realtor we asked raised this point: many luxury properties are purchased for own-stay use. As an example, one realtor said that, while luxury freehold condos may seem a world apart from HDB resale flats, this is where the two properties actually may find common ground:

“Will you spend over a million dollars for a 40-years old flat? If your goal is to make money, I think no property agent will ever advise such a move. But if your plan is to settle down and live there for your whole life, you don’t care about the resale value. What matters is having a place you enjoy.

So even though luxury properties are very different from HDB flats, this is one area where both have some overlap. These two properties have buyers who only care about own-stay use. They’re not buying an asset, they’re buying a home.”

The combination of being difficult to sell (see below), plus the owners having no expectation of profit, raises the chances of a loss-making transaction.

Another realtor noted that, if returns are the bottom line, freehold luxury condos are likely not the preferred choice:

“The maintenance fees are higher, and freehold may have a worse rental yield* compared to a leasehold condo. For buyers who are more focused on returns, at that price point, I believe they will prefer freehold luxury properties in the form of landed houses.”

That said, she notes that there are “some exceptions to this, like when the development is bought new with discounts.” Although we didn’t see the results in the table above, the realtor asserted that new-to-resale transactions may perform better, compared to resale-to-resale transactions.

*This is because tenants don’t pay more for freehold accommodation, despite the cost of the freehold condo being higher than a leasehold counterpart.

2. Small prospective pool of buyers

We pointed out the Latitude transaction (see above) which saw a staggering $3.5 million loss to a realtor. In response, she noted that the transaction price was still $9 million, which she believes answers part of the question as to why luxury freehold isn’t great for gains:

“Even if you advertise a big discount of $3.5 million, the ultimate sale price of $9 million is unaffordable to most people. Even with such a large ‘discount’, serious inquiries take a while to come in.”

Another realtor agreed, and noted that: “For high-value properties, it’s possible that you can market for over a year and end up with one or two inquiries.” This can be true even for properties listed below valuation, due to the lack of buyers with sufficient purchasing power.

When you couple this with affluent owners, who are prepared to absorb significant losses (see point 1), the listing prices tend to come down. Quite often, the realtor is pressured not to bargain for higher prices, but to transact the property within a given deadline.

3. First-mover advantage isn’t possible in most luxury locations

First-mover advantage happens when you move into a lower-priced area, and ride the wave of neighbourhood upgrades over the coming years. Tiong Bahru and Joo Chiat are famous examples of this, as is Jurong.

With luxury properties, however, there’s less chance of this happening. These homes are launched in already established areas; typically the highest-priced parts of the city, where there’s little room left for appreciation.

One realtor felt that, possibly, we should look at all properties in Districts 10 and 15, rather than just freehold luxury ones. This is because:

“I don’t feel the results will be very different based on freehold or leasehold. I feel the issue is the location itself. If you look at districts like 10 and 15, and compare them to RCR or OCR districts, you’ll probably see higher losses and lower gains, because in prime areas the buyers are paying more to begin with.”

Taking his point though, we think it still means freehold condos are worse off, as they have a higher price compared to their leasehold counterparts.

4. “Freehold among freehold” is a weaker selling point

One realtor said that, when it comes to areas like Orchard or Marine Parade, the “freehold” element is not as much of a draw – at least not in marketing terms. She says that:

“Freehold is a powerful draw when a condo is freehold-among-leasehold. But when you look at prime areas, freehold is really nothing special. Almost all residential in Orchard, Tanglin, Cairnhill, and such places are all freehold anyway, so it’s not as big a deal.”

There is, in effect, a lower sense of scarcity when it comes to freehold status (at least in prime areas alone.)

The same realtor also noted that, for affluent buyers, a mark of prestige is a freehold landed rather than a freehold condo:

“Any foreigner if they are willing to pay ABSD can buy a freehold condo anywhere. But to buy a freehold landed, you need special permission from SLA, and it is very difficult to qualify. So buyers will not bid as aggressively or be as interested in a condo just because it’s freehold or 999-years. This is why this segment (freehold luxury condos) is maybe a bit lackluster, compared to its landed counterpart.”

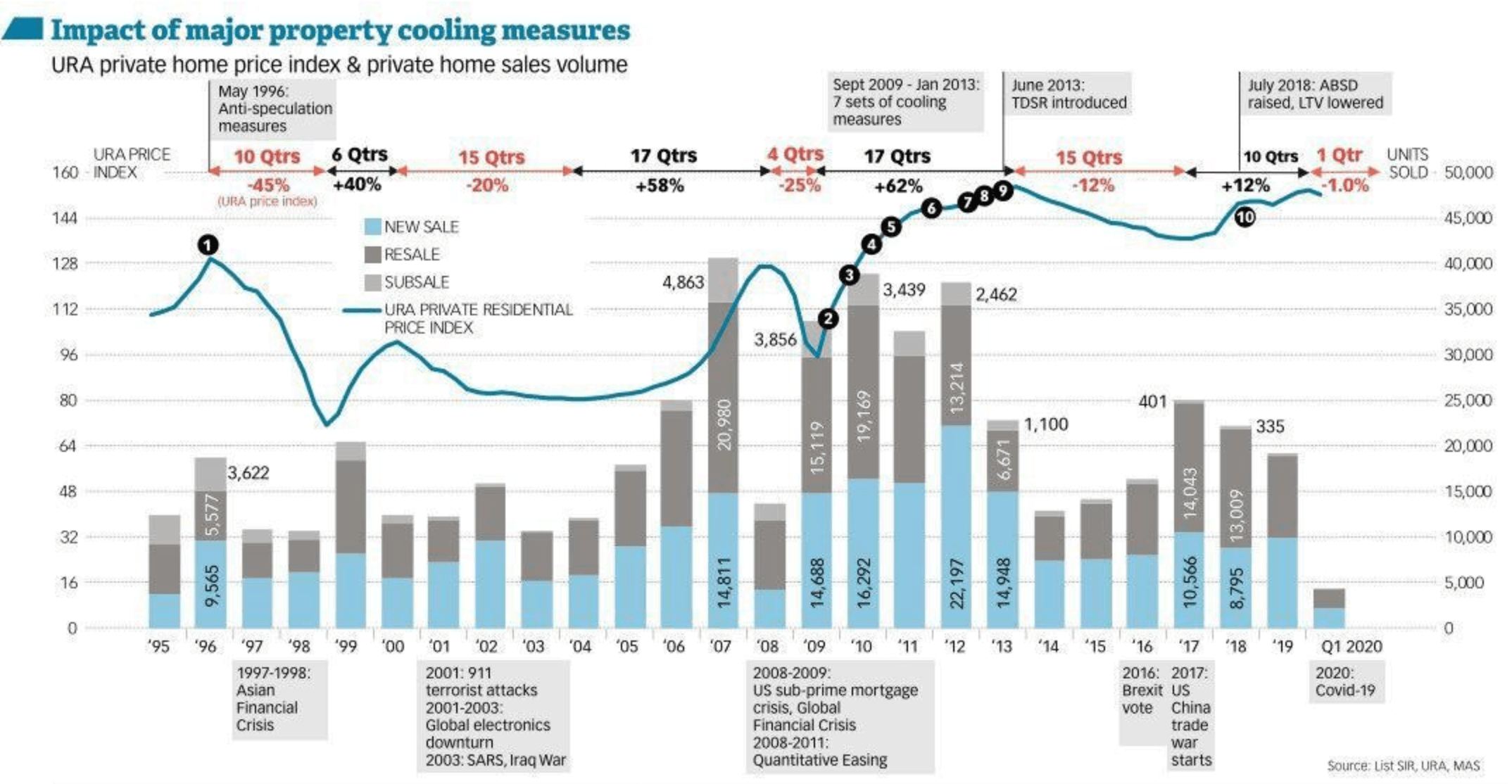

5. Typically the first to suffer from any cooling measure

The ABSD rate has been hiked many times, but in every revision, one element stays the same: foreigners and entities are always saddled with the highest rates (at the time of writing, 60 per cent and 65 per cent respectively.)

Singapore Property NewsProperty Cooling Measures In Singapore: Will 60% Foreigner ABSD Really Affect Singapore’s Property Market?

by Ryan J. OngThis impacts the luxury market first as overseas buyers – particularly the Chinese – make up a significant buyer demographic for freehold luxury properties. Conversely, fringe areas and leasehold, mass-market properties are often the least affected. An HDB upgrader buying a condo in, say, Sengkang right now, pays no ABSD (or at least qualifies for full remission.)

Now over the decades of cooling measures, the ABSD rate has never gone lower. It has only increased. On top of that, previous hopes of the measures being “temporary” have long faded, and the market has come to accept the measures as being permanent.

As such, we’ve seen constant downward pressure being exerted on the freehold luxury segment, which is the first to bear the brunt of each cooling measure. It’s no coincidence that the downward spiral began in 2013, which was the last property market peak – this was the point at which the most severe cooling measures started to kick in.

6. Rich buyers would tend to prefer the newer, more modern luxury properties

In the rapidly evolving world of luxury real estate, designs and standards can quickly become passé. What epitomised luxury in the 1990s might not measure up to today’s exacting standards. Although some older condos like Ardmore Park continue to be benchmarks for luxury, others, once deemed top-tier (e.g., Helios Residences), now find themselves overshadowed by newer developments like Boulevard 88 and Park Nova.

As such, buyers with substantial budgets often lean towards the latest and most modern offerings, even if it means paying a premium. So on the flip side, while some luxury properties can make spectacular losses, there are others that can make eye-popping profits as well.

However, older condos like Yong An Park or The Claymore still hold their value, particularly due to their spacious floor plates, a feature increasingly rare in today’s market.

But is there hope for the luxury property market going forward?

We don’t see anything on the immediate horizon that’s going to help. In fact, the combination of higher ABSD rates as well as bank loan rates may exert even more downward pressure.

However, that’s only in a collective sense. When it comes down to individual units, those with better views, better layouts, etc. will still continue to draw buyers, and could buck the trend. There are always some affluent buyers, willing to pay more for niche, high-end properties.

But as a whole, we think the freehold luxury market will be unfazed by losses. Buyers even today are aware of the potential losses, but go ahead anyway. In the end, this is a property segment characterised by genuine home buyers, rather than those eyeing a bottom line.

For more reviews of the Singapore property market, or an in-depth look at new or resale properties alike, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are freehold luxury properties in Singapore a good investment choice?

Why do some high-end freehold condos in Singapore sell at a loss?

Have top luxury condos in Singapore like Ardmore Park and St. Regis Residences made profits for owners?

What are the risks of investing in freehold luxury properties in Singapore?

Do wealthy owners of luxury condos in Singapore tend to sell at a profit or loss?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

Latest Posts

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Singapore Property News You Can Now Buy Part Of A $300M Singapore Bungalow — But You Can’t Live In It

0 Comments