Should You “Sell One, Buy Two”, Or Just Buy A Bigger Condo Unit?

December 12, 2020

With a bumper crop of resale flats hitting the market, and prices rising across the board, it seems the Singapore private property market is in upgrading mode; and so much for the coronavirus. This inevitably brings up the upgrading trend of the year:

Do you go with this newly-pushed “sell one, buy two” approach? Or should you stick to that most traditional method of asset progression – simply to sell your flat, and then buy a bigger condo unit?

The ultimate answer is, as always, going to vary based on your financial goals and situation. However, you should at least know the basic cost considerations and risks involved, when deciding between the two.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

If you’re not sure what “sell one, buy two” means yet, please check out this previous article before going further. Some of the things we mention below may not make sense, without an understanding of the general strategy.

A simplified summary of the two strategies:

| Sell one, buy two | Upgrade to a bigger condo | |

| Additional Buyers Stamp Duty (ABSD) | Can buy a second property without incurring ABSD. | No ABSD if you sell your previous home first, but you only end up with one property. |

| Property tax | Almost always higher, as you pay property tax on two condo units, and one is at the higher (non-owner occupied) rate | The usual owner-occupied property tax on your condo |

| Maintenance fees | Almost always higher, as you pay the maintenance fees on two units | Depends on the size of your unit, but almost always lower |

| Rental income | Yes, because you can rent out one unit and live in the other | Zero unless you’re willing to rent out rooms |

| Income requirements | Very high, with each co-borrower having to shoulder a separate mortgage | Less demanding, as both co-borrowers are splitting the mortgage |

| Initial cash outlay | Almost always higher, as there is a minimum cash down on two separate properties | Minimum cash down only on your next home |

| Overall risk | Higher risk, as you are taking on two mortgages | Similar to the risks you face taking on any single mortgage |

| Potential gains | Realistically, there’s no crystal ball to determine which strategy will come out ahead |

1. ABSD concerns

A big advantage of the “sell one, buy two” strategy is that you avoid paying the ABSD on the second condo unit. This is because, as explained in the linked article above, each spouse has a property count of zero (after selling the previous home). They are each buying their “first” properties separately.

This can be seen as an indirect savings by some buyers: not paying the ABSD on a $1.5 million property, for instance, can be viewed as a way to reduce your costs by $180,000 (the ABSD is 12 per cent of a second property’s price or value, whichever is higher, for Singapore citizens).

This is, however, a matter of perspective – neither approach would cause you to incur ABSD*.

*Assuming you don’t buy the condo unit before selling your previous home.

2. Property tax

The property tax is based on the estimated rental income your property could generate. This is set by IRAS, and is called the Annual Value (AV). For the full list of property tax rates, please see the IRAS website.

Let’s say you purchase two condo units: the first is your home, with an AV of $40,000. This would incur a property tax of $1,280.

The second property, which you rent out, is a smaller condo unit with an AV of $24,000. Note that this property, which is let out, uses a higher tax rate (non-owner-occupier residential tax rate); it incurs a property tax of $2,400.

In total, you would pay $3,680 in property tax, before claiming any deductions*.

On the other hand, let’s say you purchase a single, larger condo unit as your home. The AV is $48,000. The property tax payable is only $1,600.

*In practice this amount will be a bit lower, as you can claim tax deductions for utilities, mortgage interest rates, repairs, etc.

3. Maintenance fees

Maintenance fees are charged based on the share value of your unit. As a loose guideline, the costs will come to about $50 to $80 per share value for most condos.

Let’s say you choose to “sell one, buy two”. Your first condo unit has a share value of six (51 to 100 sqm), while your second, smaller unit has a share value of five (50 sqm and below). Assuming $75 per share value for both, this is $825 per month in maintenance.

On the other hand, say you just buy a single, much bigger condo. At a humongous 101 sqm. to 150 sqm., your share value is still just seven. This comes to just $525 per month.

However, there are exceptions to this. Some condos – particularly luxury units – have maintenance fees that are so high, they may cost more than the fees for any two other units; but these are not common.

Property AdviceAlways Factor Maintenance Fees into Your Condo-Buying Decision

by Ryan J. Ong4. Rental income

The main point of “sell one, buy two” is that the second property is used to generate rental income. Do note that it’s also possible to live in the smaller condo as a home, while renting out the bigger one to generate more income.

Buyers who upgrade to a single bigger unit are often counting on the appreciation of their property only, to generate profits. Even if they rent out rooms, it’s likely insufficient to even cover the mortgage interest.

5. Income requirements

Let’s say you buy two properties. The first has a loan amount of $1,125,000, while the second smaller property has a loan amount of $525,000.

We will assume a 25-year loan for both, at the projected interest rate of 3.5 per cent per annum*.

The borrower taking on the first loan would have a projected monthly repayment of about $5,632 per month, requiring a minimum income of $9,386 per month.

The borrower taking on the second loan would have a projected repayment of about $2,628 per month, requiring a minimum income of $4,380 per month.

As such, the two borrowers would need a combined household income of about $13,766 per month.

On the other hand, say you both purchase a single larger unit, with a loan of $1.5 million. Using the same loan terms, the monthly repayment for both borrowers is projected at about $7,509 per month. This would require a combined income of about $12,515, still lower than trying to buy two condos.

(The above example assumes no debts outside of the home loan)

*For the purposes of debt servicing ratios. The actual rate is likely to be 1.3 per cent per annum.

6. Initial cash outlay

The minimum cash down payment, using a bank loan, is five per cent*

If you buy a $1.5 million condo and a smaller $700,000 shoebox unit, you would need $110,000 in cash ($75,000 and $35,000 respectively).

If you were to buy a single bigger condo unit – even if it were a prime region property priced at $2 million – you’d still have a lower initial cash outlay of $100,000.

For upgraders, this is important as they typically need the sale proceeds of their previous home to cover the cash portion. Bear in mind that any CPF monies used for your previous home must also be refunded at 2.5 per cent interest, before you get anything left of the sale proceeds.

*The total minimum down payment is 25 per cent. Five per cent cash, and 20 per cent cash or CPF.

7. Overall risks

This is fairly straightforward and we don’t have to explain it right? “Sell one, buy two” means taking on a lot more debt. Having two mortgages means there’s less backup – if one of you gets retrenched, gets a pay cut, etc. there’s a greater risk you’ll be forced to liquidate one of the properties.

We would suggest that, besides speaking to property experts, you also should consult a qualified finance expert, to determine if you have the right risk capacity.

Now let us show you two examples, one of a couple that would be able to undertake the sell one buy two approach, and another that isn’t financially able to do so.

Sell one buy two detailed example of a successful case

Here’s an example of a couple’s financial background.

| Buyer 1 | Buyer 2 | |

| Income | $7,200 | $5,000 |

| Cash Savings | $100,000 | $10,000 |

| CPF OA | $150,000 | $140,000 |

| Outstanding CPF Used + Accrued Interest | $146,000 | $100,000 |

| Age | 37 | 36 |

First, we determine what’s left after selling their HDB at $620,000.

| Selling the HDB | |

| Cash On Hand Now | $110,000 |

| Plus Proceeds From Sale ($620K) | $620,000 |

| Less Principal Owed | $190,000 |

| Less CPF Owed | $246,000 |

| Less Misc. Fees | $15,268 |

| Total Cash On Hand | $278,732 |

Now we look at whether buyer 1 can purchase a $1.1m condo.

| Buyer 1 Buys The 1st Condo ($1,100,000) | |

| Total Cash On Hand | $278,732 |

| Less 5% Cash Downpayment | $55,000 |

| Household Cash Remaining | $223,732 |

| Buyer 1 CPF | $296,000 |

| Less 20% CPF/Cash Downpayment | $220,000 |

| Buyer Stamp Duty (Cash Payment) | $28,600 |

| Legal Fees | $3,000 |

| Remaining Household Cash | $192,132 |

| Buyer 1 CPF Remaining | $76,000 |

Since it’s possible for buyer 1 to make the move, we now focus our attention on buyer 2.

| Buyer 2 Buys The 2nd Condo ($900,000) | |

| Total Cash On Hand | $192,132 |

| Less 5% Cash Downpayment | $45,000 |

| Household Cash Remaining | $147,132 |

| Buyer 2 CPF | $240,000 |

| Less 20% CPF/Cash Downpayment | $180,000 |

| Cash Top Up (To Meet TDSR Requirements) | $19,737 |

| Buyer Stamp Duty | $21,600 |

| Legal Fees | $3,000 |

| Remaining Household Cash | $102,795 |

| Buyer 1 CPF Remaining | $105,795 |

Note that buyer 2’s income was not enough to support the loan, hence a cash top-up of $19,737 was required to bring the mortgage lower. Given buyer 2’s age is 36, a 28-year loan has to be taken instead of a 30-year loan.

At the end, we assess how comfortable both buyers are with their situation. We do this by seeing how much cash they would have to top-up as a whole to keep this sustainable.

| Determine Monthly Cash Top-Ups Required | |

| 1st Condo Monthly Mortgage | $3,855 |

| 2nd Condo Monthly Mortgage | $3,000 |

| Less CPF Payment From Buyer 1 | $1,260 |

| Less CPF Payment From Buyer 2 | $1,050 |

| Less Rental From 2nd Condo (3.36% Yield Assumed) | $2,520 |

| Cash Top-Up Required Each Month | $2,025 |

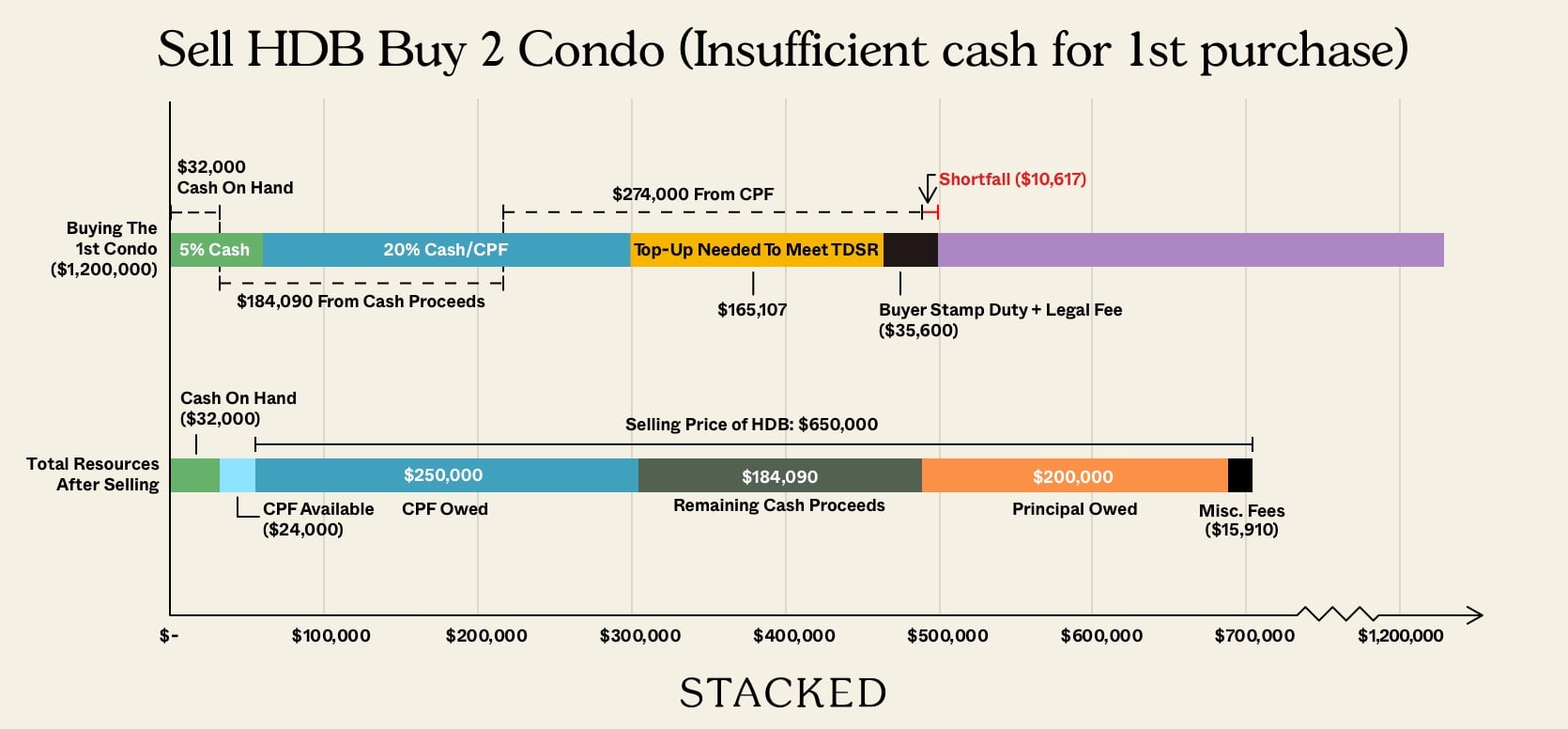

Sell one buy two detailed example of an unsuccessful case

Finally, there’s the issue of which strategy makes you more money

In theory, “sell one, buy two” carries the potential for better returns. This is on the basis that you’re using more leverage, having two loans instead of one.

In reality, there’s no guarantee that “sell one, buy two” results in better returns. There are too many variables at play. For example, the second property you buy may fail to appreciate as expected; or the rental market may weaken, to the point where the second unit is just a liability.

There’s also the possibility that one good property will appreciate much better, at lower risk and lower initial cash outlay, than two other condo units.

If you’re still uncertain of which approach suits you best, do drop us a message to explain your current situation; we’ll be able to help you better if we know the specifics. But we can end off saying one thing for sure:

“Sell one, buy two” is a relatively new and ambitious strategy, one born out of the ABSD.

Simply selling your previous home to upgrade, in a traditional asset progression model, is not new and with all the recent cooling measures, is still the easiest less risky way forward.

In the meantime, do follow us on Stacked so you can check out the most thorough reviews of condos in the Singapore private property market. Whatever your asset progression strategy, it still comes down to picking the right unit(s).

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

4 Comments

Hi, can you explain what does “less cpf payment from buyer 1 – $1260″ and less cpf payment from buyer 2 – $1050” mean and calculated?

thanks

CC

Hi, if I have the intention to upgrade from a HDB to a condo that has yet to TOP, do I have to sell my HDB while waiting for the condo to be completed? Else, I would be incurring ABSD?