Q1 2021 Property Market Update: New Launch Condos And HDB Prices Spike Again

April 27, 2021

The Circuit Breaker seems to have had the strange effect of slowing Covid-19, and accelerating property sales. We like to think the trauma of being stuck at home for so long has made everyone realise they really need their own place (either that or expensive therapy, should another lockdown be needed) – whether or not there’s any way to prove that. In any case, anyone hoping for cheaper homes due to Covid-19 fall out can probably throw in the towel. Both public and private housing sectors are booming:

What’s happened to the property market in Q1 2021?

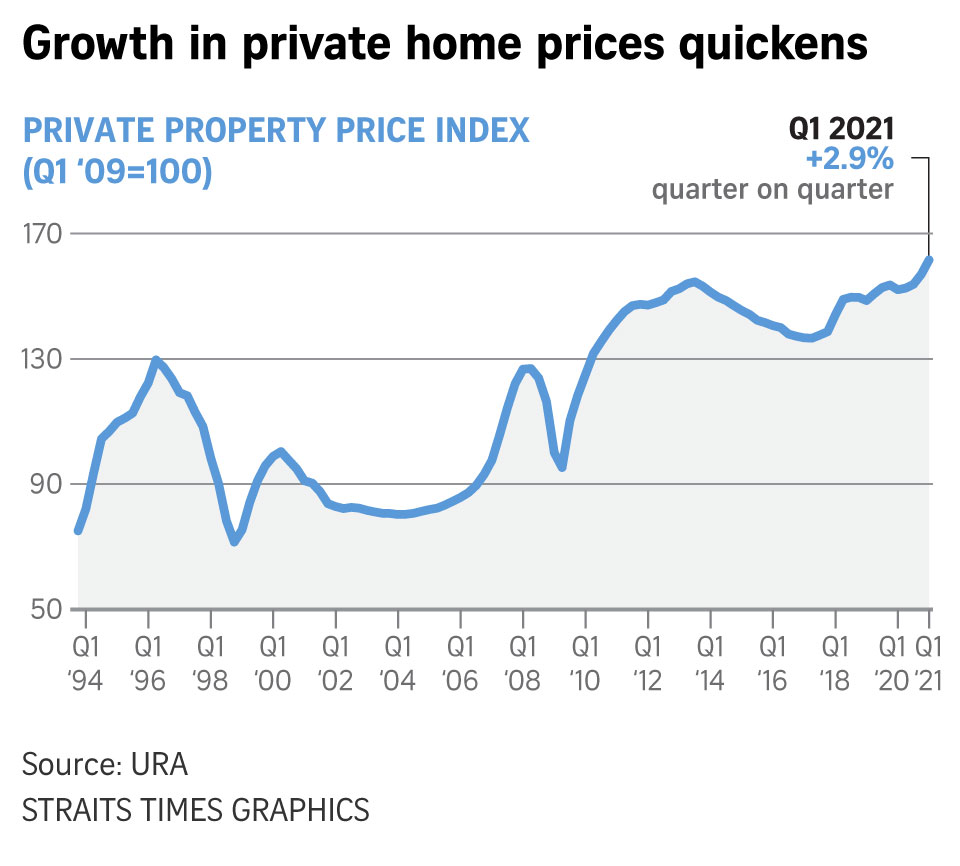

URA flash estimates previously put new condo prices at an increase of 2.9 per cent, for Q1. As it turns out, the actual increase was 3.3 per cent for Q1. This makes it the fourth consecutive quarter of rising prices:

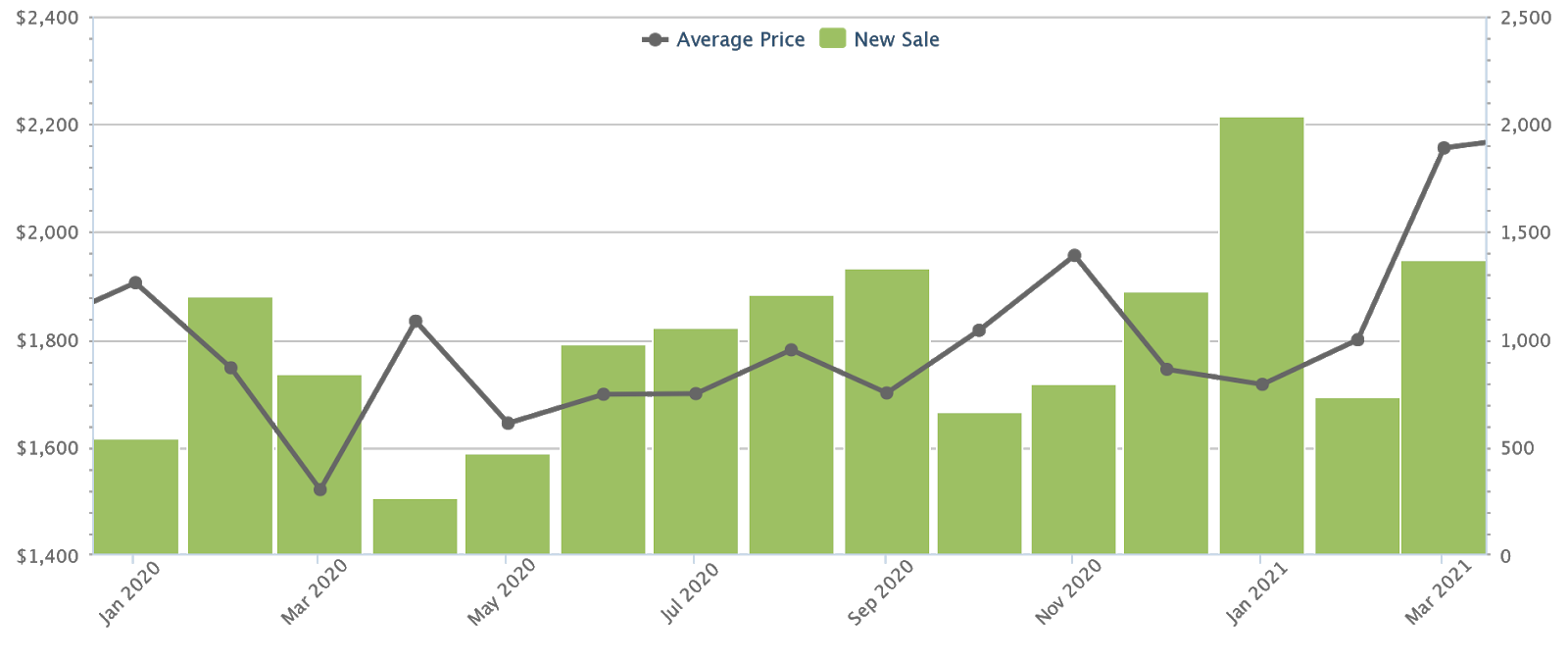

According to Square Foot Research, new condo prices now average $2,156 psf (notably high because of launches like Midtown Modern and Irwell Hill Residences). Notice that momentum is building rather than decreasing – the price hike in March was the steepest of the past four quarters. The previous quarters only saw a rise of just above two per cent.

Based on URA numbers, the biggest increase for the whole of Q1 was for new launches in the Rest of Central Region (RCR). New home prices here are up 6.1 per cent, while prices in the Outside of Central Region (OCR) are up 1.1 per cent. New home prices in the Core Central Region (CCR) are up only 0.5 per cent, despite this region leading for the month of March.

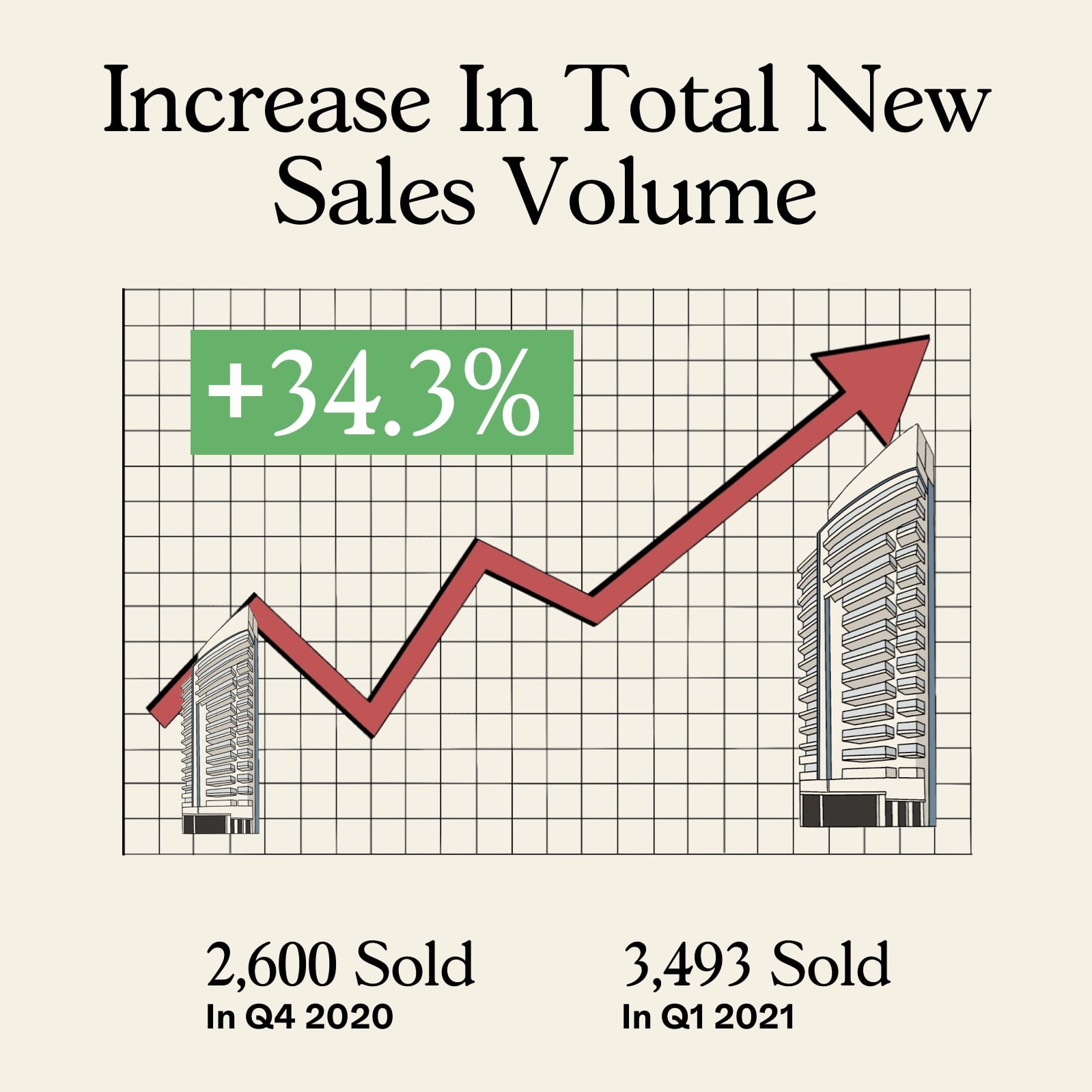

Total sales volumes also rose significantly in Q1, with a total of 3,493 new home transactions (excluding ECs). This is up from around 2,600 units the previous quarter.

At this point, the potential for new cooling measures has gone from possible to probable. We believe that, as the prospect of cooling measures become more likely, more buyers will also rush to buy before they kick in, thus instigating the policy change.

The existing inventory of unsold homes is being depleted fast

Analysts estimate that the number of unsold homes will stand at between 21,000 to 22,000, after Q1. This runs contrary to predictions in 2019, when a supply overhang of 31,948 units was expected to take about four years to clear.

Most of the supply came from the en-bloc fever of 2017 when foreign developers snapped up existing sites at a furious pace. However, the last tranche of condos originating from this period have now been completed and mostly sold.

At the current pace, the supposed “glut” may soon turn out to be a shortage. (We detail out the current take-up rate in our Ultimate New Launch Cheat Sheet).

With the risk of a new en-bloc fever in 2021, we believe the pick-up in the new launch market will eventually transfer benefits to the resale condo market as well; especially as developers grow eager to replenish their land bank.

However, this assumes any upcoming cooling measures are not so drastic, they turn things around completely.

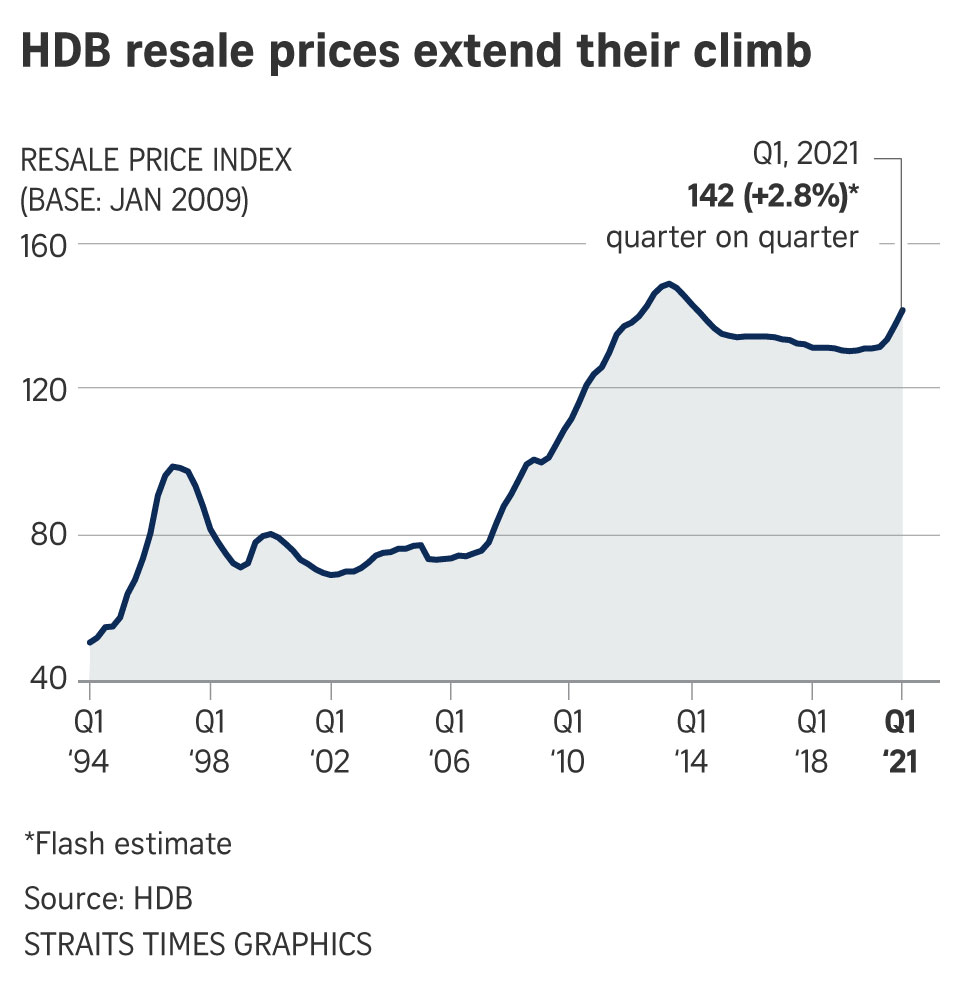

The HDB resale market also rose for a fourth consecutive quarter

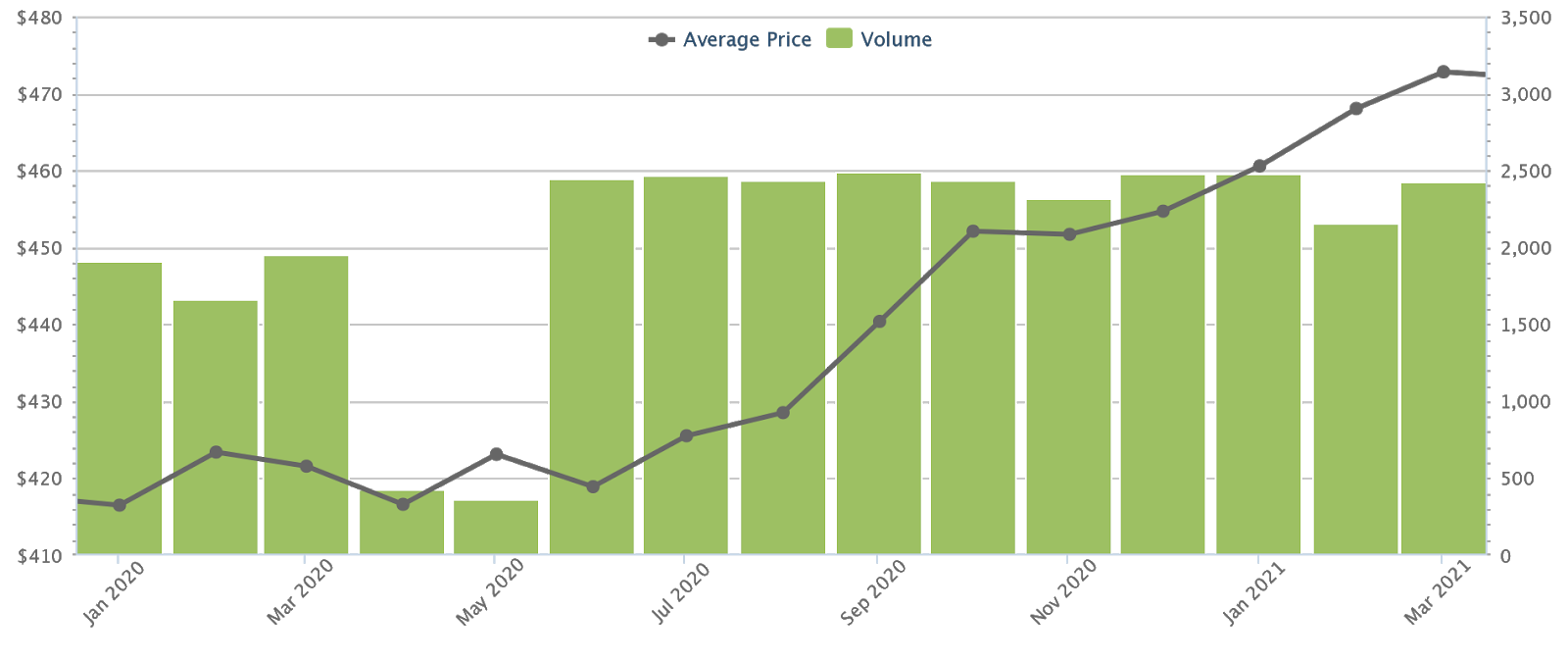

HDB resale Prices for Q1 2021 are up three percent. On a year-to-year basis, resale flat prices have seen an impressive 8.1 per cent increase. According to Square Foot Research, the average price now sits at $473 psf. This is almost on par with the last peak for resale flats, back in Q2 2013 – at the time, average resale flat prices stood at $475 psf.

It’s fair to say the HDB resale market has unwound the past seven years of price declines, brought about by the Mortgage Servicing Ratio (MSR) and worries of lease decay.

Cash Over Valuation (COV), the price paid for a flat above the official valuation, is also back in the picture. HDB no longer publishes this data to discourage high COV; but agents on the ground say that COV rates of $10,000 to $20,000 are becoming common across the board. This includes even non-mature areas like Woodlands and Punggol. Notably, a 5-room unit at TreeLodge @ Punggol was transacted at $910,000 in March.

Property Market CommentaryCan We Expect Cash Over Valuation (COV) To Keep Climbing For HDB Flats?

by Ryan J. OngQ1 2021 also saw a total of 53 flats transacted at $1 million or higher, as compared to only 13 in the same time last year.

So far, HDB resale prices have defied expectations that they will level off from supply. A record number of flats are reaching their Minimum Occupancy Period (MOP); but the heightened supply has done little to keep prices down.

Word on the ground is that higher new home prices are related to higher resale prices

More from Stacked

Resale Condos Were Underrated In 2020, But Might Take The Spotlight In 2021

You’ve been seeing one new launch after another for 2020; so it’s not surprising you may have missed the trend…

Speaking directly to realtors, we were told that many buyers of new condos are HDB upgraders. There’s been a spike in the number of these buyers, due to the sheer number of homes reaching their MOP.

These buyers push for higher prices on their resale flats, in order to make the down payments on their next home. One of the realtors, speaking on condition of anonymity, said that:

“For most local buyers the problem is not the TDSR*, it’s the down payment. Because they need to pay back to CPF**, they can end up with negative cash sales, so there is a certain minimum amount they need from the sale proceeds. So as new launch prices go up, there’s more pressure on this group to up the asking price on their flat.”

However, realtors noted that resale flat buyers appear able to meet these seller demands. Despite the increasing resale flat prices, Q1 2021 saw 7,581 resale flat transactions. This is an almost 29 per cent increase, from 5,893 transactions at the same time last year.

*TDSR – Total Debt Servicing Ratio, which sets an income requirement for home loans

**When selling a flat, buyers need to pay back all the CPF monies used, with the accrued interest of 2.5 per cent per annum. While this can be used for the next property purchase, it sometimes results in situations where the entire sale proceeds has to be refunded to CPF; this makes it difficult to meet the minimum cash down payment on the next property.

The demand for resale flats is expected to grow even further this year

One reason for this are the construction delays from Covid-19. Around 85 per cent of ongoing BTO projects are expected to be delayed, and will be about six to nine months late.

Many buyers are aware that Covid-19 is not yet over, despite vaccines being distributed. As such, there are worries of re-infection or subsequent waves resulting in even longer delays. This has prompted some buyers to opt for a resale flat instead, so they can move-in as soon as the transaction is complete.

It’s also a matter of prudence: with Covid-19 creating a volatile economic situation, some buyers – who are in the income range to buy private property – may instead opt for a large resale flat (there’s no income ceiling for resale flats).

In addition, recent BTO launches have featured mature or city fringe flats, but with low numbers. These over-subscribed flats will result in plenty of disappointed buyers looking for resale alternatives; and with a slew of flats reaching MOP, they’re likely to find what they want (at the appropriately high price).

Given how resale flat prices have been depressed for almost seven years (before the recovery in late 2020), there’s little room for the price to move except up.

For bargain hunters, the “Covid-19” fire sales never quite came around

Some might argue that low quantum, high price-per-square-foot condos like The M were a reaction to Covid-19. We suppose that’s possible, but there have been little outright developer discounts related to Covid-19, or even the Circuit Breaker.

This suggests two realities of the current market: the first is that developers may already be as squeezed as possible, given high land costs, increasing Development Charges, and a tight five-year timeline to finish and sell all units.

The second is that demand for property doesn’t always correlate to how volatile or threatening the economic situation gets. In fact, there may well be an inverse relationship, with buyers rushing into real estate as a safe haven. We’ve now seen that hard times can prop up the Singapore property market, rather than detract from it.

From word on the ground, many buyers in waiting have switched their hopes from Covid-19 to new cooling measures (because prices tend to fall right after new cooling measures are passed).

Meanwhile, developers have found a formula that works, and we can expect to see more of it in the near future: that’s to build smaller, but more centrally located properties with a lower quantum. It seems many of us are willing to squeeze, if it means living near Bugis, Great World City, etc.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How have property prices changed in Singapore during the first quarter of 2021?

What is the current state of the Singapore property market in terms of supply and demand?

How are HDB resale flat prices performing in Singapore?

What factors are influencing the resale flat market in Singapore?

Are developers offering discounts due to Covid-19 or market conditions?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

0 Comments