It’s still early days in 2021, but it doesn’t look as if the property train will be slowing down much (we’ve detailed it more here). 2020 has ended with private residential prices rising by 2.2% for the whole of 2020, which while it is lower than 2019, is still very encouraging given the major Covid-19 pandemic that has gripped the world.

Even if you are not exactly in a hurry to buy a home, it is still worth keeping your ears to the ground for what is about to come up in the property market in 2021. So before you put down any cheques or rush to a show flat, here’s a sense of what’s coming up this year:

Most recent fully sold condos as of January 2021

| Development | Location | Selling Price |

| Artra | Alexandra View | $1,669 psf |

| Le Quest | Bukit Batok West Ave. 6 | $1,304 psf |

| 120 Grange | 120 Grange Road | $3,178 psf |

| The Linq @ Beauty World | Upper Bukit Timah Road | $2,186 |

Condos with 90% or more units sold in January 2021

| Development | Location | Percentage sold | Selling price |

| The Tre Ver | Potong Pasir Ave 1 | 99.9% | $1,548 psf |

| The Tapestry | Tampines Avenue 10 | 99.8% | $1,390 psf |

| Parc Botannia | Fernvale Road | 99.7% | $1,293 psf |

| Magaret Ville | Magaret Drive | 99.7% | $1,895 psf |

| Queens Peak | Dundee Road | 99.5% | $1,631 psf |

| Grandeur Park Residences | Bedok South Ave 3 | 99.4% | $1,331 psf |

| Parc Esta | Changi Road | 98.6% | $1,714 psf |

| Seaside Residences | Siglap Road | 98.5% | $1,592 psf |

| Amber 45 | Amber Road | 97.1% | $2,360 psf |

| Kallang Riverside | Kampong Bugis | 94.3% | $2,081 psf |

| Twin VEW | West Coast Vale | 94.2% | $1,442 psf |

| Stirling Residences | Stirling Road | 93.7% | $1,754 psf |

| Parc Colonial | Woodleigh Lane | 93.4% | $1,747 |

| Daintree Residence | Toh Tuck Road | 92.7% | $1,743 psf |

| Riverfront Residences | Upper Serangoon View | 91.6% | $1,314 psf |

| Jui Residences | Serangoon Road | 90.6% | $1,684 psf |

Condos with 20% or less units sold in January 2021

| Development | Location | Percentage Sold | Selling Price |

| The Lilium | How Sun Road | 1.30% | $2,126 |

| Cuscaden Reserve | Cuscaden Road | 3.60% | $3,435 |

| Dairy Farm Residences | Dairy Farm Road | 9.60% | $1,550 |

| The Gazania | How Sun Drive | 10.40% | $2,072 |

| Petit Jervois | Jervois Road | 10.90% | $2,892 |

| Juniper Hill | Ewe Boon Road | 11.30% | $2,810 |

| Midwood | Hillview Rise | 11.50% | $1,648 |

| The Avenir | River Valley Close | 12.20% | $3,235 |

| Leedon Green | Farrer Road | 13.80% | $2,723 |

| Pullman Residences | Dunearn Road | 14.70% | $2,750 |

| Wilshire Residences | Farrer Road | 15.30% | $2,657 |

| Sloane Residences | Balmoral Road | 15.40% | $2,930 |

| Meyerhouse | Meyer Road | 17.90% | $2,561 |

| Riviere | Jiak Kim Street | 18.00% | $2,924 |

| Haus on Handy | Handy Road | 18.10% | $2,866 |

| The Hyde | Balmoral Road | 19.70% | $2,900 |

| Urban Treasures | Jalan Eunos | 19.80% | $1,960 |

All known new launches for 2021:

- Normanton Park

- Cairnhill 16

- The Reef at King’s Dock

- Midtown Modern

- Le Maisons Nassim

- The Atelier

- One-North Eden

- Rymden 77

- Peak Residences

- Perfect Ten

- Klimt Cairnhill

- Eden

- Irwell Hill Residences

- Park Nova

- One Bernam

- Amber Sea

- La Mariposa

- Pollen Collection

- The Cairnhill

- LIV @ MB

- Grange 1866

- Sunstone Hill

- The Ryse

Highlight developments as of January 2021

While we can’t cover every single development yet (many are still too new), there are some highlights already emerging. Here are the ones to take note of early this year:

1. Normanton Park

Address: Normanton Park (District 5)

Developer: Kingsford Huray Development Pte. Ltd.

Lease: 99-years from 2019

Expected TOP: 31 Dec 2023

Number of units: 1,862 (1,840 apartments, 22 villas)

Why is this interesting?

There’s a lot of buzz around Normanton Park, mainly revolving around its former no-sale license. As this is something of a long topic, we’ll present a detailed explanation of this later in the week (and our review); do follow us on Facebook for an update. The other really hinges on the fact that it will be the largest new launch project of 2021.

That said, Normanton Park had something of a late start, due to the aforementioned incident. This has led to speculation that the developer will price it to move, due to the five-year Additional Buyers Stamp Duty (ABSD) deadline (even with the Covid-19 extension). This is especially given the size of Normanton Park (1,840 units and 22 villas), which is a lot of units to sell in a tighter than usual time frame.

We’ll let you know if these expectations pan out, once we get hold of the real pricing. In the meantime, bargain hunters might want to keep an eye on this project.

Normanton Park has the same name, and same locational advantages, as its predecessor. We do expect it to generate investor interest, due to its close proximity to the One-North tech and media hub. Even with the arrival of One-North Eden (see below), the area is still packed with prospective tenants; from students at institutes like INSEAD, to the foreign workers in the nearby tech start-ups.

One major drawback, however, is that it’s quite far from any MRT station.

2. One-North Eden

Address: Slim Barracks Rise (District 5, Queenstown)

Developer: TID Residential Pte. Ltd.

Lease: 99-years from 2019

Expected TOP: 2024

Number of units: 165 units

Why is this interesting?

As we mentioned regarding Normanton Park above, there has been little supply of homes in the One-North area up till now (an even One-North Eden is quite small, at 165 units). This is despite the area being a tech and media hub, with a good supply of prospective tenants.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Are New Executive Condos Still For The “Sandwich Class” In Singapore?

I know this will ruffle some feathers, but it’s time we gave this some thought. The EC scheme, which dates…

One-North Eden also has the advantage of being about 400 metres (five minutes’ walk) from the One-North MRT station; and the nearby Fusionopolis, Biopolis, etc. are packed with amenities (there is, for instance, a Cold Storage and Watsons already in Fusionopolis). Failing that, it’s just one train ride to Buona Vista, where you’ll find The Star Vista mall.

This isn’t a family condo, but it will definitely draw attention from singles or couples working in the area; as well as from pure investors.

3. Midtown Modern

Address: Tan Quee Lan Street (District 7)

Developer: GuocoLand Pte. Ltd.

Lease: 99-years

Expected TOP: 29 Jun 2022

Number of units: 556 units

Why is it interesting?

Back when Midtown Bay was launched, GuocoLand pointed out they had also secured a land plot along Tan Quee Lan Street. This is where Midtown Modern is sited.

This development will be one of the closest ever to Bugis Junction, and the attached Bugis MRT station. This location is more or less guaranteed to make it one of the hottest launches this year; we believe those who didn’t secure a unit at Midtown Bay (which had only 219 units) will look at either The M, or Midtown Modern as the next alternative.

Landlords are bound to have their eye on these three developments, as a way to capitalise on the Ophir-Rochor corridor (we have a more detailed explanation of these factors in an earlier article).

Midtown Modern is also adjacent to the Bras Basah area, which is Singapore’s designated cultural district (it’s within a one-kilometre radius of art schools like La Salle, NAFA, and SOTA).

That said, we have to wonder if there’s getting to be too many condos clustered in the same area; especially with the former Shaw Tower being redeveloped into even more residential housing.

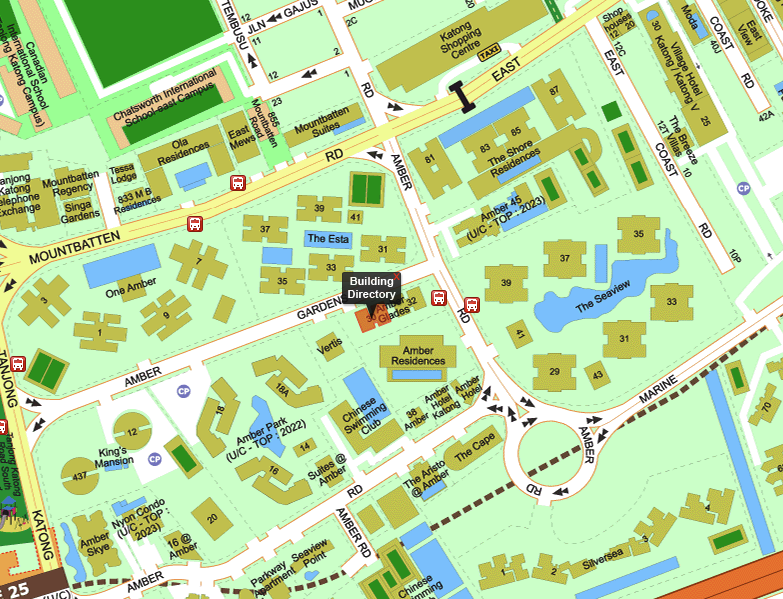

4. Amber Sea

Address: Amber Gardens (District 15)

Developer: Far East Organisation

Lease: Freehold

Expected TOP: TBD

Number of units: 110

Why is it interesting?

This is built on the site of the former Amber Gardens, which was regarded as one of the best East Coast locations in its day. It’s located close (about four minutes’ walk) to the stretch of eateries and family-friendly pubs along East Coast Road, starting from Katong Shopping Centre all the way down to Joo Chiat.

It’s also about 1.2 kilometres (a three-minute drive, or a long 15-minute walk if you can manage it) to Parkway Parade, where you’ll find Giant and Cold Storage.

Right now, it’s a bit far from any MRT station; but Tanjong Katong station (slated for completion in 2023) will just be a few minutes’ walk away. This is likely to be up before Amber Sea is completed.

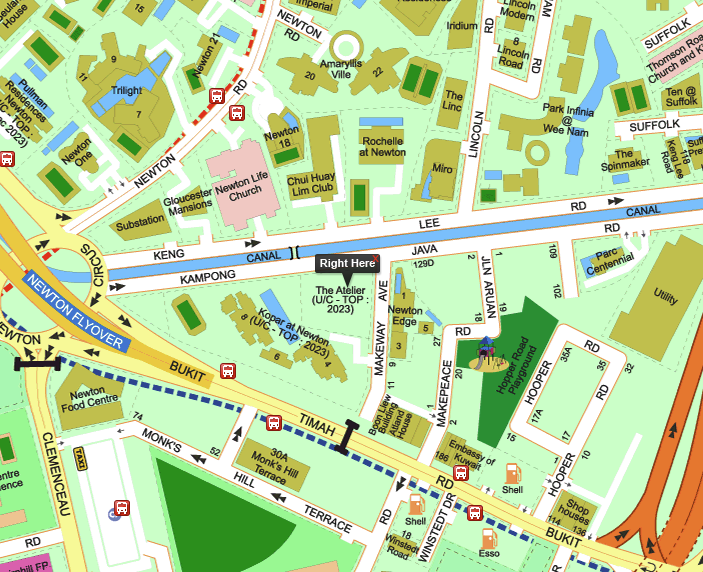

5. The Atelier

Address: Makeway Avenue (District 9)

Developer: Bukit Sembawang Estates Pte. Ltd.

Lease: Freehold

Expected TOP: 2024

Number of units: 120

Why is it interesting?

This condo is roughly 600 metres (eight minutes’ walk) to Newton MRT station. This is likely to be viewed as an alternative to the larger Kopar at Newtown, which is also close to the Newton train station.

The highlight is definitely the location – beside being near Newton Circus, it’s also within striking range of Novena, with malls like United Square. And, of course, landlords are quick to zero in on such centrally located properties (tenants are seldom in short supply in the Newton area, which is minutes from the city centre, but not so expensive as living along Robinson Road or Raffles Place).

What a lot of buyers will point out, of course, is that Kopar at Newton is marketed on more or less the same advantages. We feel the Atelier will appeal to buyers who prefer smaller, more boutique-like developments compared to the larger Kopar.

(Kopar, on the other hand, is likely to have much lower maintenance fees given the larger number of units. We’ll keep you updated as the numbers are revealed).

In addition, the following sites have been confirmed for residential or mixed-use development, although they have not been named yet.

- Former Kovan Lodge

- Former Realty Centre (mixed-use)

- Canberra Drive A site

- Canberra Drive B site

- Jalan Bunga Rampai site

There are four Executive Condominium (EC) developments for 2021, with two of them already named:

- Parc Central Residences

- Provence Residences

- Yishun Avenue 9 site

- Fernvale Lane site

The most interesting of these sites, at the moment, is Yishun Avenue 9. This is simply because there hasn’t been a Yishun EC since 2015, and market watchers will be eager to see how well it performs.

While the site is quite far from any MRT station – a common challenge for ECs – it’s just around 700 metres to Junction 9 shopping mall. We have a little more on this upcoming site in an earlier article.

There aren’t quite as many launches in 2021 as there were last year

The new launches this year also seem to be well spread out, giving a wide range of options – and there are no less than four ECs to look forward to.

With regard to discounts however, sellers don’t seem to be flinching or lowering prices much; so we wouldn’t count too much on it being a strong buyers’ market, despite earlier Covid-19 predictions.

Do follow us on Stacked, and we’ll update you with more detailed reviews of these new launches as they become available.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the main new condo developments launching in 2021?

Why is Normanton Park considered a significant project in 2021?

What makes Midtown Modern a noteworthy development this year?

Are there any new executive condominiums (ECs) launching in 2021?

What are some challenges or considerations for buyers looking at new launches in 2021?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

1 Comments

???