Is This The Right Way To Cut Property Agent Numbers?

May 5, 2024

One way to lower prices is to take out the middleman, right?

It used to be a no-brainer for me. But over the years, I’ve been forced to admit that some middlemen (and related fee collectors) are indispensable. Like when it’s raining at two in the morning and I’m pulling an all-nighter, I’m pretty grateful I can pay platform fees for someone to magically appear at my door, with fried chicken.

Those are the small things. But when it comes to real estate, it’s not just about convenience is it? A messed-up transaction is nowhere near your fries or large drink not arriving; it can mean a thousands lost due to lapsed options, or just not getting the best offer.

So I’m not as quick to jump on the bandwagon of capping agent commissions, with the supposition that it could lower home prices. On the one hand, I do understand how this is plaguing the new launch industry: commissions for developer sales can be much higher than the two per cent “norm” paid by home sellers. There have even been cases of new launches delivering commissions of five per cent, although this also tends to happen for the toughest-to-sell units (and perhaps when developers are facing the end of their five-year ABSD deadline).

But given that these deals are between agents and developers, how sure are we that lower commissions mean lower home prices? I want to be an idealist and think that, if developers pay lower commissions, we’ll all be charged less per square foot; but another part of me believes that if the agents charge less, the developers will maintain the price and just pocket more profit.

It would certainly be a strong temptation on the developers’ part, given their rapidly shrinking margins.

But who remembers when property prices were at a high too in the earlier years like 2007? My memory might be failing me a little here, but I don’t think new launch commissions were as high as they are today.

The biggest problem? It’s the 5 year ABSD that developers have to sell by. With the high financial penalty of not clearing all the units (and while that has been relaxed), they have to resort to such means. It’s either lower your prices and piss off the earliest buyers, or push commissions high enough so that agents are incentivised to sell your project.

Then there’s the issue of there being too many agents. In truth, real estate agents have always numbered around 30,000+ over the past few years; the industry does suffer from a high churn rate. It’s also worth noting many who have a CEA license don’t actually transact. And some are cases like this one.

I don’t know if capping commissions will actually decrease the number of agents though – in my experience, sales (be it insurance, property, etc.) will always draw a large initial crop of hopefuls, which then thins out fast.

Anyway, for new launches, I think the problem isn’t that there’s too many agents, but that there’s too few property agencies

It’s more or less an oligopoly at this point. Developers have few options besides the “big three” property agencies; and if there’s ever an attempt to collaborate and fix higher commissions (not that I’m saying there is), we might all have an industry-wide issue.

Then there’s the issue of the resale market.

For starters, I would imagine one of the industry players against capping commissions isn’t just the agents, but the property portals that sell listing space. This is already a huge portion of where agents’ marketing budgets go, and with fewer agents and lower commissions, they would certainly not want such a move.

More from Stacked

We Asked: Is The New PLH Model Fair? Here’s The Collated Response From 175 People

The PLH model is one of the biggest changes we’ve seen to the housing market, since the first cooling measures.

But we’re not here to worry about the health of portal sites: a more immediate concern is the quality of service. Consider, for instance, someone who urgently needs to sell their home, before the six-month ABSD deadline. If there’s an absolute cap on commissions – say 1.5 per cent – there’s a question of how many agents are willing to go through the expense of aggressive marketing, dropping everything to focus on this one listing, staging the unit to make videos, etc.

If the remuneration doesn’t justify the effort, such buyers may find themselves on their own, or with agents who do the proverbial half-past-six job because they see low hopes of success anyway.

As is, we already have agents who refuse to pick up the phone to co-broke; this will be much worse if those agents have a capped commission, and have already spent way too much refreshing a listing.

So I think the agent’s marketing budget should be discussed in more detail, with the clients. I think it would go a long way for some agents to better describe the likely costs they’re looking at, in relation to their commissions. This could absolve the agent if the lower commissions show slower results (at least they don’t look like they’re doing nothing), and help sellers to temper their expectations.

Meanwhile in other property news…

- A recently MOP’ed 4-room flat for $618,000? They can still be found, and here’s where.

- We have some really high profile flats about to join the resale market in ‘24 and ‘25, so keep your eyes out for these ones.

- Trying to decide between the “big three” new launches in the East? Here’s how to compare between Grand Dunman, Tembusu Grand, and the Continuum.

- It’s discounts galore, with some projects shaving off as much as $650,000. See if you find these to be worth it.

- Fernhill: it’s near Orchard, it’s low density, and it’s so low profile you may never have noticed. Check out this surprisingly cheap (for its location) enclave.

Weekly Sales Roundup (22 April – 28 April)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| 32 GILSTEAD | $14,543,000 | 4209 | $3,455 | FH |

| WATTEN HOUSE | $4,996,000 | 1539 | $3,246 | FH |

| TEMBUSU GRAND | $3,363,000 | 1432 | $2,349 | 99 yrs (2022) |

| LENTOR MANSION | $3,342,000 | 1485 | $2,250 | 99 yrs (2023) |

| GRAND DUNMAN | $3,256,000 | 1292 | $2,521 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE LAKEGARDEN RESIDENCES | $1,224,200 | 527 | $2,321 | 99 yrs (2023) |

| HILLHAVEN | $1,367,140 | 678 | $2,016 | 99 yrs (2023) |

| THE LANDMARK | $1,432,000 | 495 | $2,892 | 99 yrs (2020) |

| THE MYST | $1,502,000 | 678 | $2,215 | 99 yrs (2023) |

| LENTORIA | $1,561,000 | 732 | $2,133 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ARDMORE PARK | $12,500,000 | 2885 | $4,333 | FH |

| THE RESIDENCES AT W SINGAPORE SENTOSA COVE | $6,110,000 | 3348 | $1,825 | 99 yrs (2006) |

| AALTO | $5,820,000 | 2443 | $2,382 | FH |

| THE LUMOS | $5,700,000 | 2433 | $2,343 | FH |

| THE TRIZON | $4,215,000 | 1894 | $2,225 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| EIGHT COURTYARDS | $700,000 | 549 | $1,275 | 99 yrs (2010) |

| SYCAMORE TREE | $700,000 | 344 | $2,032 | FH |

| THE GREENWICH | $710,000 | 603 | $1,178 | 99 yrs (2009) |

| URBAN VISTA | $725,000 | 441 | $1,643 | 99 yrs (2012) |

| CENTRA HEIGHTS | $738,888 | 431 | $1,716 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| ARDMORE PARK | $12,500,000 | 2885 | $4,333 | $6,500,000 | 17 Years |

| SPANISH VILLAGE | $4,200,000 | 2056 | $2,043 | $2,700,000 | 28 Years |

| AALTO | $5,820,000 | 2443 | $2,382 | $2,170,000 | 9 Years |

| PANDAN VALLEY | $3,818,000 | 2325 | $1,642 | $1,993,000 | 15 Years |

| MERA SPRINGS | $2,500,888 | 1292 | $1,936 | $1,635,888 | 18 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE LUMOS | $5,700,000 | 2433 | $2,343 | -$2,520,450 | 17 Years |

| THE SCOTTS TOWER | $1,300,000 | 657 | $1,980 | -$1,386,828 | 11 Years |

| DUO RESIDENCES | $1,450,000 | 646 | $2,245 | -$147,000 | 10 Years |

| THE GREENWICH | $710,000 | 603 | $1,178 | -$120,000 | 12 Years |

| WATERSCAPE AT CAVENAGH | $1,038,000 | 581 | $1,786 | -$5,000 | 14 Years |

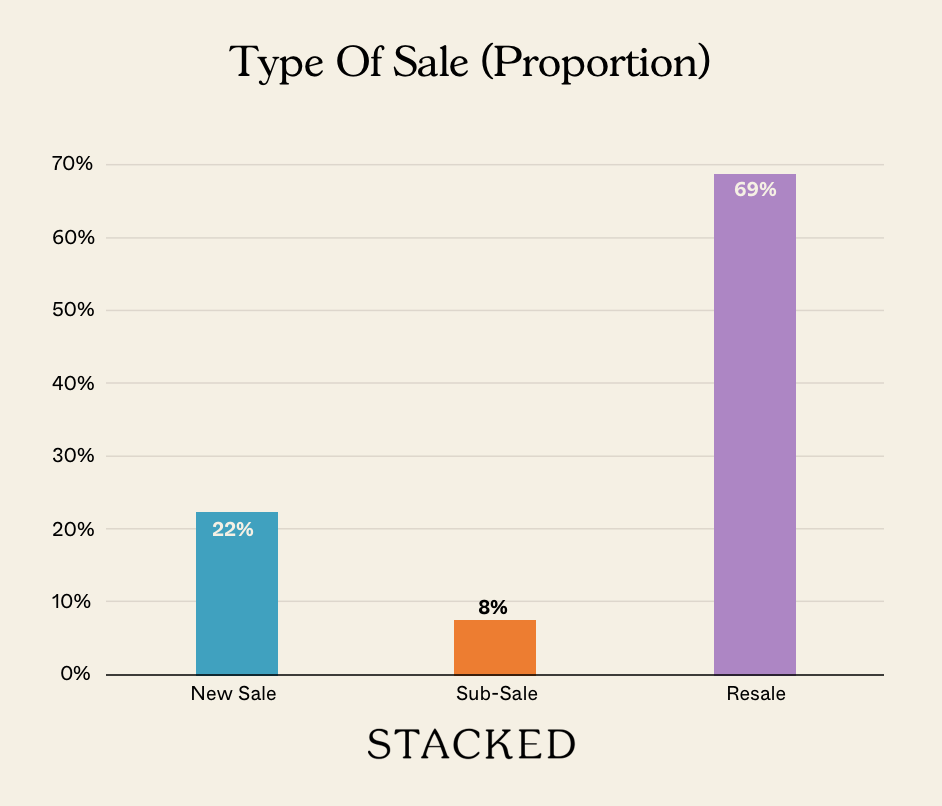

Transaction Breakdown

Follow us on Stacked for in-depth reviews of new and resale condos alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Does capping property agent commissions help lower home prices?

Why are property agent numbers considered too high, and what is the industry situation?

How could capping commissions impact the resale market and service quality?

What are some factors influencing high commissions for new property launches?

Are there alternative ways to address the issue of too many property agents?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments