I’m A Retiree With A Fully Paid Condo And HDB. Should I Continue Renting Out The HDB Or Sell One Or Both?

December 30, 2022

Hi Stacked,

I am 68, a divorcee who has retired. I own a 19 year-old 3 bedroom private condo at Yishun and a 20 year old 4 room model A HDB flat in McNair area. Both are fully paid.

The HDB flat is currently being tenanted out. It is at close proximity to Boon Keng MRT (4 mins walk) and a short walk from Kallang Polyclinic. The condo is not quite close to Yishun Central. It takes about 20 & 25 mins by foot to Yishun Polyclinic and Northpoint respectively. One could also commute by public bus to these destinations and Khoo Teck Puat Hospital nearby. Yishun mall, a neighbour centre with amenities like clinics, coffee shops, bakeries, hawker centre (Yishun Park Hawker Centre), Fairprice and Giant supermarket (mid scale) etc are within a comfortable walk of 5-10 mins from the condo.

My daughter and son-in-law will be moving out around 1st – 2nd Q 2024 once their apartment is ready. Since I’ll be living alone, I would like to seek your view if I should:

a. Remain status quo i.e. continue to rent out the HDB flat to enjoy passive income (about $2.6k) and stay at the condo, and maybe renting out the other room(s) to boost my passive income or

b. Sell one of them (since both are getting old, especially the condo)

c. Sell both and either downgrade to a smaller HDB to an even better location with amenities I prefer (MRT, bus interchange, wet market, large hawker centre, shopping mall, Polyclinic etc) for e.g. Bedok Central. Of course, my preference is still a private condo. However, given the current property price, I am not sure if it makes sense to spend a large portion of the sales proceeds for a smaller unit, albeit at a choice location. I also do not want to pay the ABSD (if I choose to keep one of the existing properties).

I hope to seek your views on how best I could balance between lifestyle (with more disposable income) and preserving the asset values i.e. my wealth. I would also appreciate it if you could share your opinions regarding when to sell and buy, if that is part of your recommendations.

Thank you for your kind attention.

Merry X’mas to all at Stacked and have a blessed and wonderful holidays.

Hi there,

Happy holidays and thank you for writing in to us!

It’s great to hear that you have 2 fully paid up properties – that’s nearly the Singaporean dream.

Let’s begin by looking at how your existing properties are performing. We don’t have the exact details for either, but we can make a good guesstimate based on what you’ve told us – let’s get to it.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Performance of existing properties

Lilydale

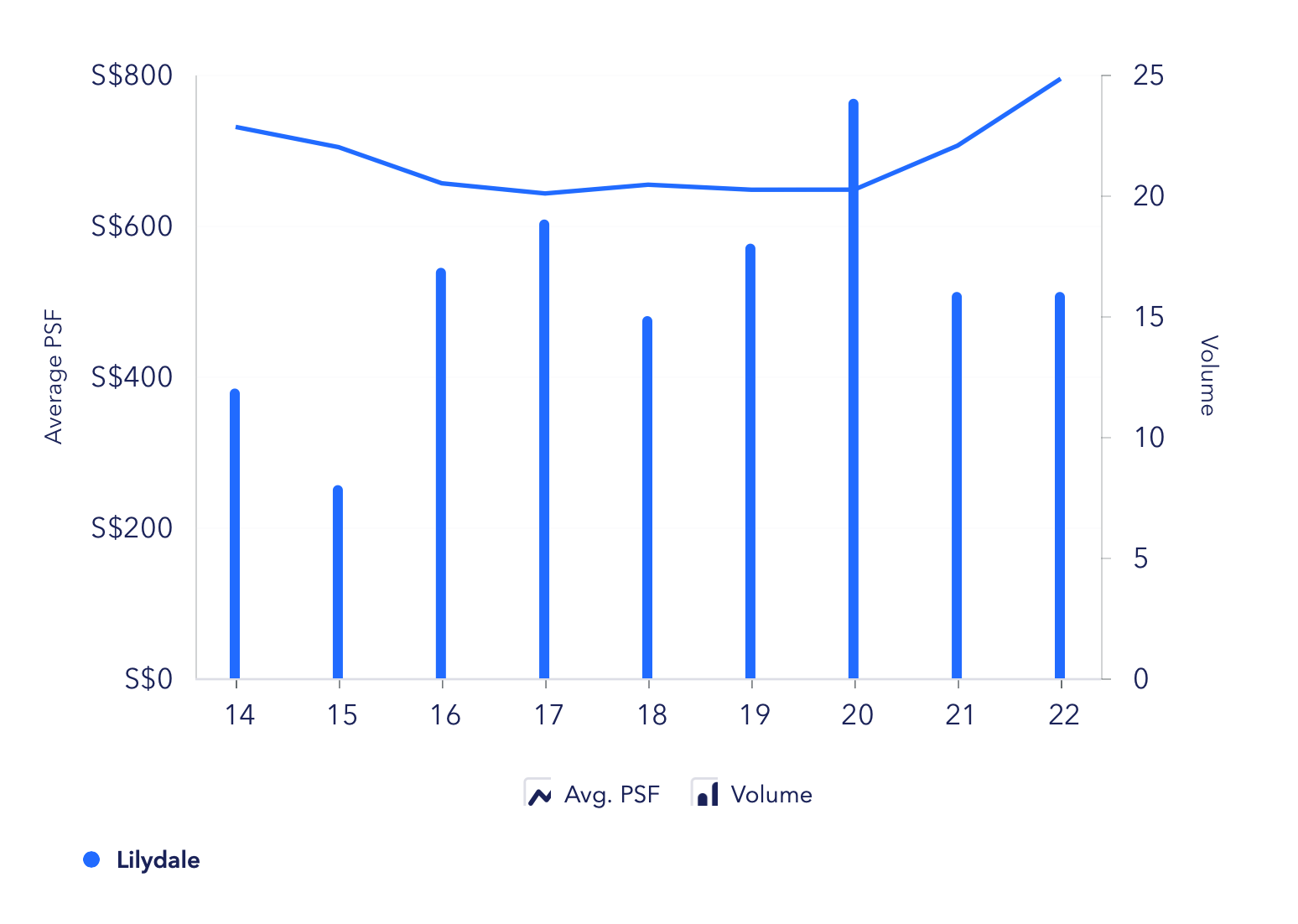

From what you’ve shared about the development, Lilydale probably best fits the description. It obtained its TOP in 2003 but its 99-year lease starts in 2000 which makes it 22 years old.

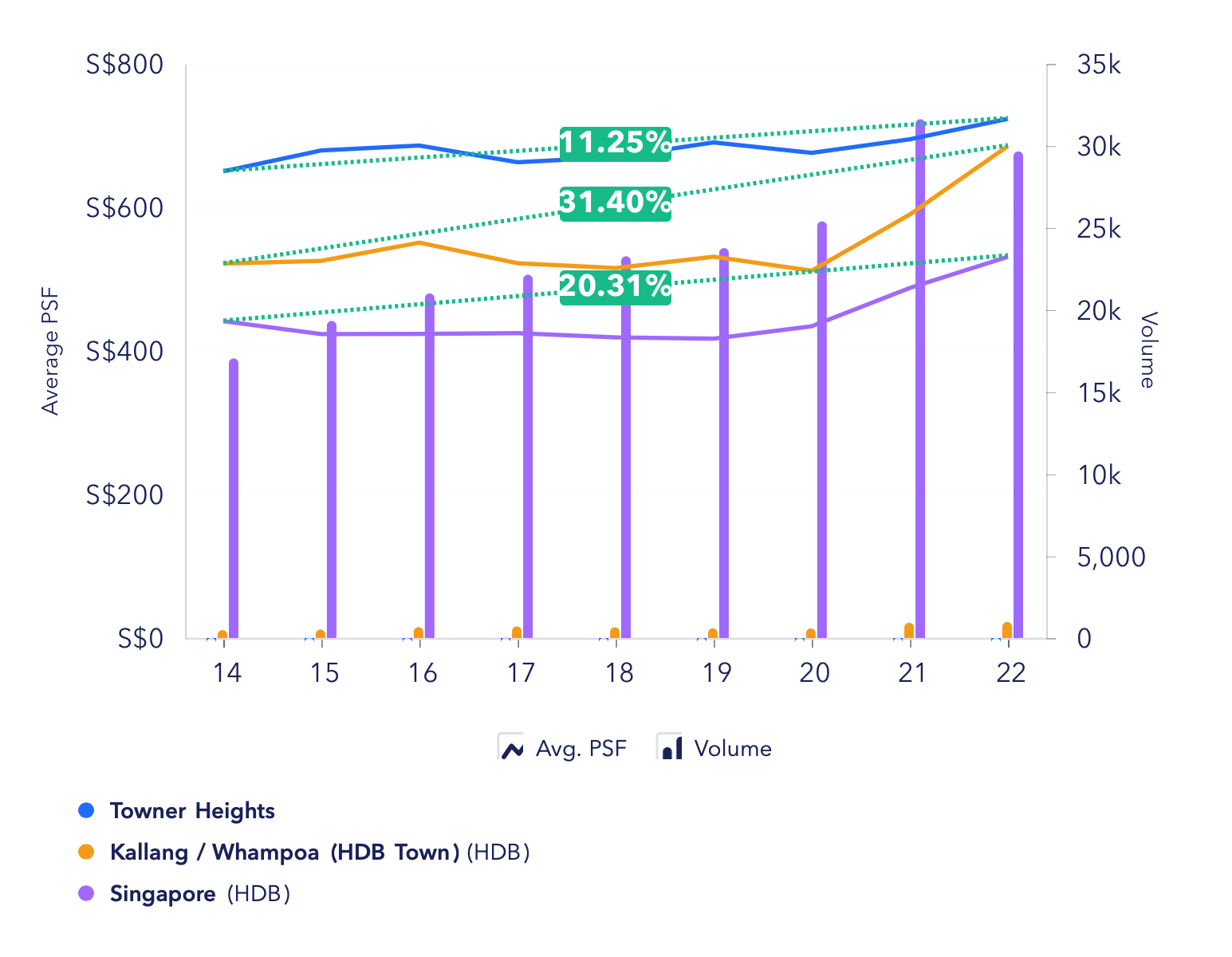

We can see from the graph above that pre-pandemic, prices were declining and remained stagnant for a couple of years before picking up when the overall market went up.

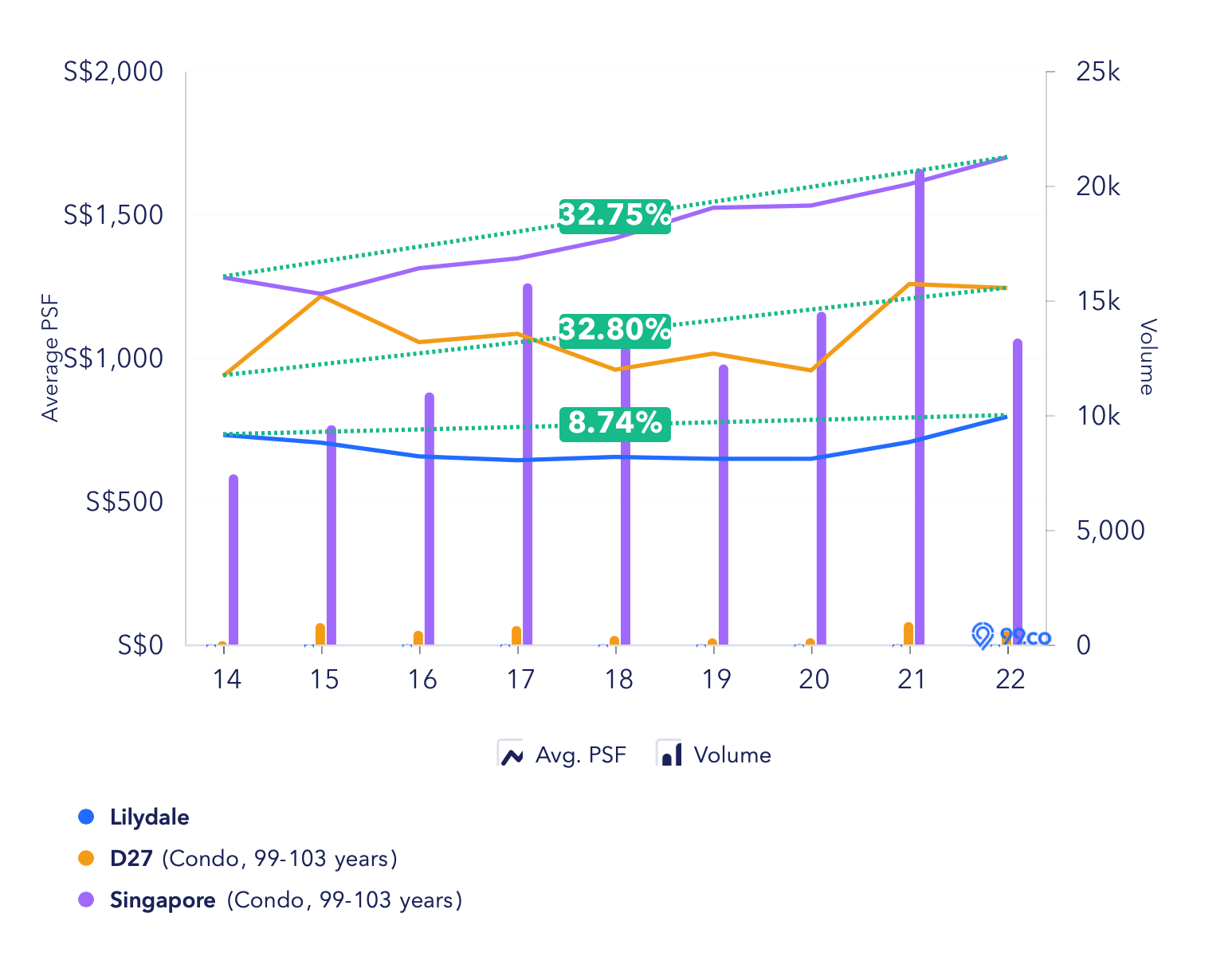

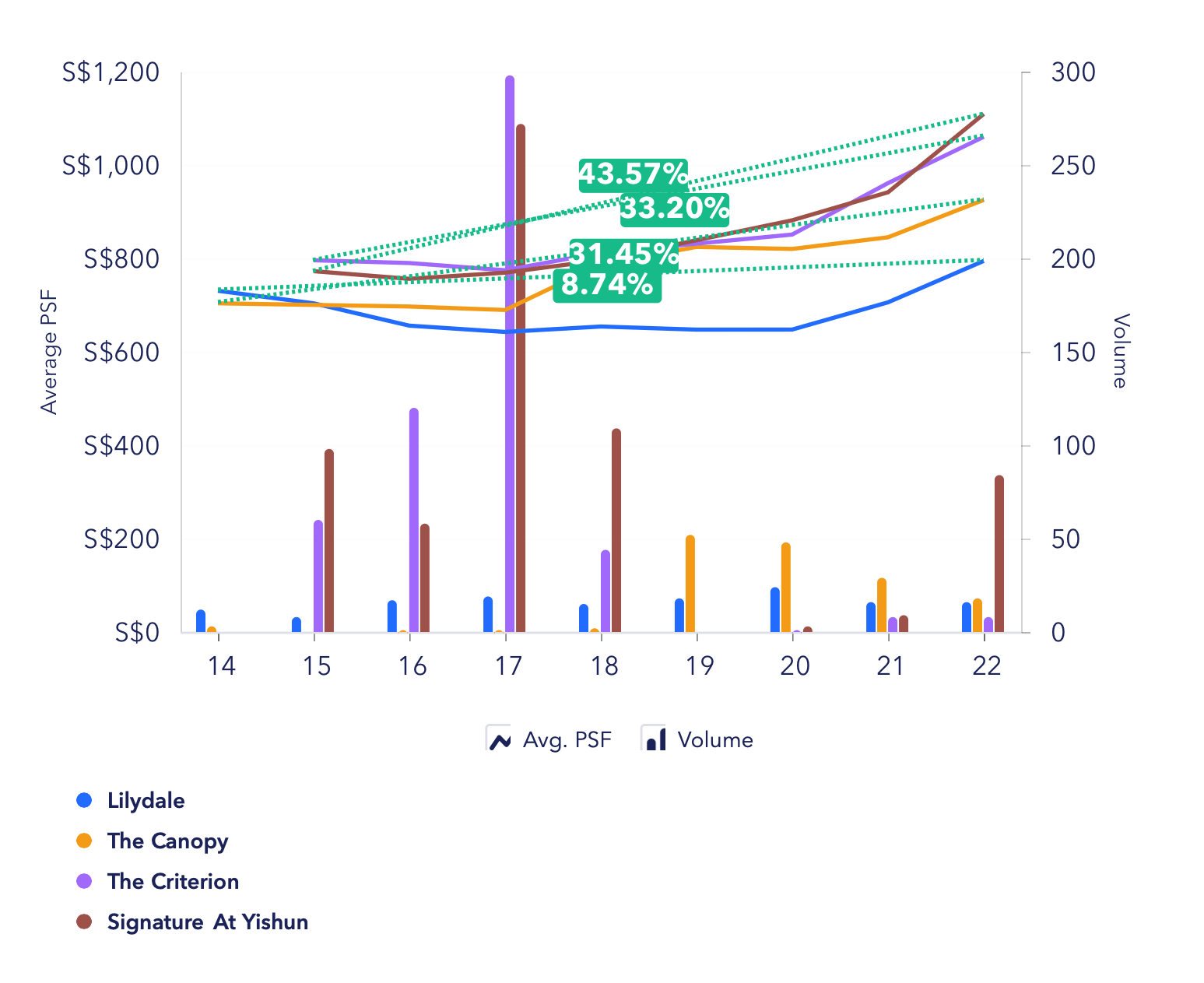

In comparison to other 99-year leasehold developments in District 27 as well as the whole of Singapore, we can see that Lilydale’s appreciation is lagging behind. The price trend for D27 may appear erratic but it’s mostly due to the numerous new launches that pushed the overall PSF up in certain years, causing more peaks and troughs.

Given that most of the projects in the vicinity are much newer, the majority of the demand generally flows to those developments. As such when compared to the other condominiums, Lilydale’s appreciation rate is much lower.

Signature At Yishun and The Criterion have just obtained their MOP so it might not be the fairest to compare against those. But if we were to look at The Canopy (currently 12 years old) which is situated just right next to Lilydale, its appreciation rate over the last 9 years is almost 4 times that of Lilydale’s.

These are some of the recent 3-bedroom transactions at Lilydale:

| Date | Size (sqft) | Bedrooms | PSF | Price | Level |

| Nov 2022 | 1,195 | 3 | $820 | $980,000 | #12 |

| Oct 2022 | 1,195 | 3 | $820 | $980,000 | #11 |

| Oct 2022 | 1,195 | 3 | $778 | $930,000 | #02 |

| Sep 2022 | 1,238 | 3 | $797 | $986,888 | #09 |

| Sep 2022 | 1,195 | 3 | $810 | $968,000 | #05 |

| Aug 2022 | 1,195 | 3 | $816 | $975,000 | #09 |

| Aug 2022 | 1,195 | 3 | $822 | $982,000 | #07 |

| Jul 2022 | 1,356 | 3 | $730 | $990,000 | #01 |

| Jun 2022 | 1,238 | 3 | $751 | $930,000 | #04 |

| Jun 2022 | 1,227 | 3 | $782 | $960,000 | #06 |

| Jun 2022 | 1,195 | 3 | $770 | $920,000 | #04 |

Now let’s look at your HDB unit.

Mcnair Road 4-room HDB

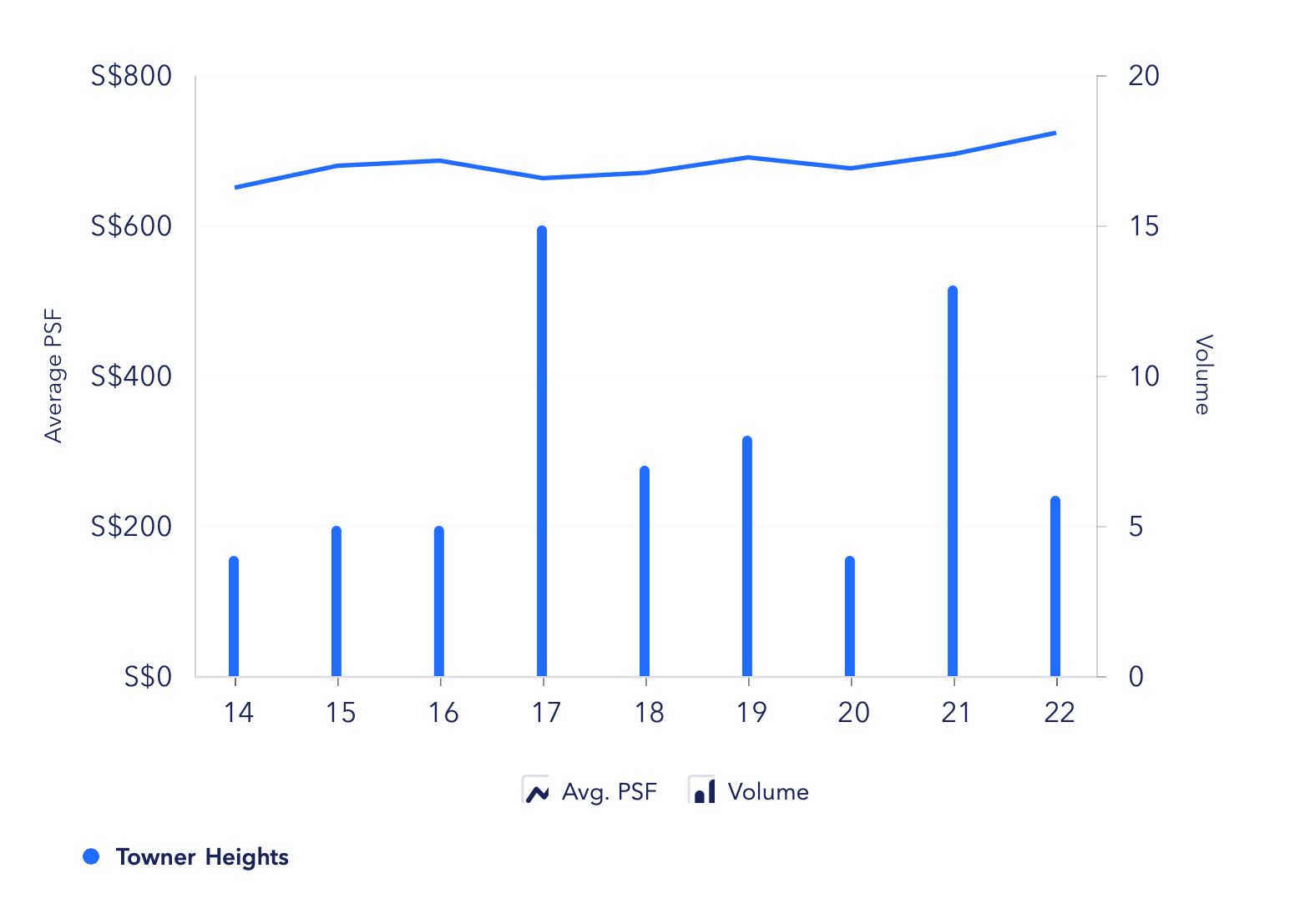

The Mcnair Road area only consists of a handful of clusters with Towner Heights being the closest in age to your description.

You’ll notice from the graph that prices at Towner Heights have been rather stagnant in the years preceding the pandemic but have picked up slightly in the last 2 years as well.

As compared to the rest of the Kallang/Whampoa estate and the overall HDB market, Towner Heights’ appreciation is lagging behind.

These are some of the recent 4-room transactions:

| Date | Block | Level | Size (sqm) / Flat Model | Lease Commence Date | Remaining Lease | Resale Price |

| Jul 2022 | 108B | 04 to 06 | 95.00 Model A | 2004 | 81 years 5 months | $738,000 |

| May 2022 | 108C | 07 to 09 | 95.00 Model A | 2005 | 81 years 9 months | $725,000 |

| Jan 2022 | 108C | 19 to 21 | 95.00 Model A | 2005 | 82 years | $780,000 |

| Dec 2021 | 108C | 25 to 27 | 90.00 Model A | 2005 | 82 years 2 months | $785,000 |

Now that we have a better understanding of how the properties are performing, let’s run through a few things we think you ought to ponder over before moving forward!

- Retirement funds

- As someone who has retired with 2 fully paid-up properties, you’re definitely in a good position. As we mentioned earlier, having two properties does give you some flexibility – either to rent out one property and receive a monthly passive income or sell and cash out to receive a lump sum. Now, we don’t know your exact cash position, but if you want to live off solely on the rental proceeds this will have to be adjusted accordingly.

- As someone who has retired with 2 fully paid-up properties, you’re definitely in a good position. As we mentioned earlier, having two properties does give you some flexibility – either to rent out one property and receive a monthly passive income or sell and cash out to receive a lump sum. Now, we don’t know your exact cash position, but if you want to live off solely on the rental proceeds this will have to be adjusted accordingly.

- Quality of life

- The lifestyle you want will determine which pathway you ought to take since we believe you’d like to live your retirement years as comfortably as you can.

- The lifestyle you want will determine which pathway you ought to take since we believe you’d like to live your retirement years as comfortably as you can.

- Legacy planning

- If you do have thoughts of leaving property behind for your daughter, holding onto your private property would make more sense because regardless of her own property being an HDB or private condominium, she will still be able to inherit the condominium. However, if you were to leave behind an HDB,

Now let’s run through the options you’ve listed!

A. Continue to rent out the HDB flat to enjoy passive income, stay in the condo and maybe rent out the other room(s) to boost passive income

Based on the recent transactions, the average price for a 4-room unit at Towner Heights is $757,000. With a monthly rental of $2,600, the rental yield is at 4.12%.

| Town | Avg 4-room rental | Avg 4-room price | Avg rental yield |

| Ang Mo Kio | $2,600 | $516,500 | 6.04% |

| Bedok | $2,500 | $475,000 | 6.32% |

| Bishan | $2,730 | $640,000 | 5.12% |

| Bukit Batok | $2,500 | $500,000 | 6% |

| Bukit Merah | $3,000 | $765,000 | 4.71% |

| Bukit Panjang | $2,550 | $471,900 | 6.48% |

| Bukit Timah | * | * | – |

| Central | $3,500 | $680,000 | 6.18% |

| Choa Chu Kang | $2,600 | $493,900 | 6.32% |

| Clementi | $3,100 | $555,000 | 6.7% |

| Geylang | $2,600 | $560,000 | 5.57% |

| Hougang | $2,600 | $506,000 | 6.17% |

| Jurong East | $2,800 | $460,000 | 7.3% |

| Jurong West | $2,600 | $475,000 | 6.57% |

| Kallang/ Whampoa | $2,900 | $778,400 | 4.47% |

| Marine Parade | $2,650 | * | – |

| Pasir Ris | $2,500 | $519,000 | 5.78% |

| Punggol | $2,800 | $555,000 | 6.05% |

| Queenstown | $3,450 | $860,000 | 4.81% |

| Sembawang | $2,450 | $515,000 | 5.71% |

| Sengkang | $2,700 | $536,000 | 6.04% |

| Serangoon | $2,750 | $520,900 | 6.34% |

| Tampines | $2,500 | $530,000 | 5.66% |

| Toa Payoh | $2,800 | $740,000 | 4.54% |

| Woodlands | $2,500 | $468,000 | 6.41% |

| Yishun | $2,500 | $473,000 | 6.34% |

As compared to other HDB towns, Kallang/Whampoa actually has the lowest average rental yield.

In spite of that, if you were to continue renting out the HDB and also rent out one or both of the common bedrooms at say, $1,200 each, your monthly passive income will amount to $3,800 – $5,000 which is pretty decent. But then again, this is also subjective to your lifestyle needs.

Also, there are pros and cons to renting out the bedroom(s) depending on how you look at it. You may not have as much privacy since someone will be staying with you but on the flip side, you won’t be staying alone. As such, your quality of life here would really depend on your relationship with the tenant.

This option will allow you to still stay in a condominium as you prefer and earn a passive income which can help support your retirement.

Just to give you an idea of the cash you’ll earn from this, here’s a 5-year projection:

| Description | Amount |

| Assuming a monthly passive income of $3,800 (rent out HDB + 1 common bedroom in your condo) for 11 months each year | $209,000 |

B. Sell one of the properties

This a consideration due to the age of both your condo and HDB.

As we have seen from the graphs above, prices of both properties were relatively stagnant before the pandemic hit. Most 99-year leasehold properties typically experience the highest growth rate in their younger years before they hit the 21-year mark. The influx of newer developments being built in their vicinity also affects the demand and in turn pricing of both properties.

It’s difficult to directly compare both properties because they two different property types in two different locations. The only similarity is in their performance.

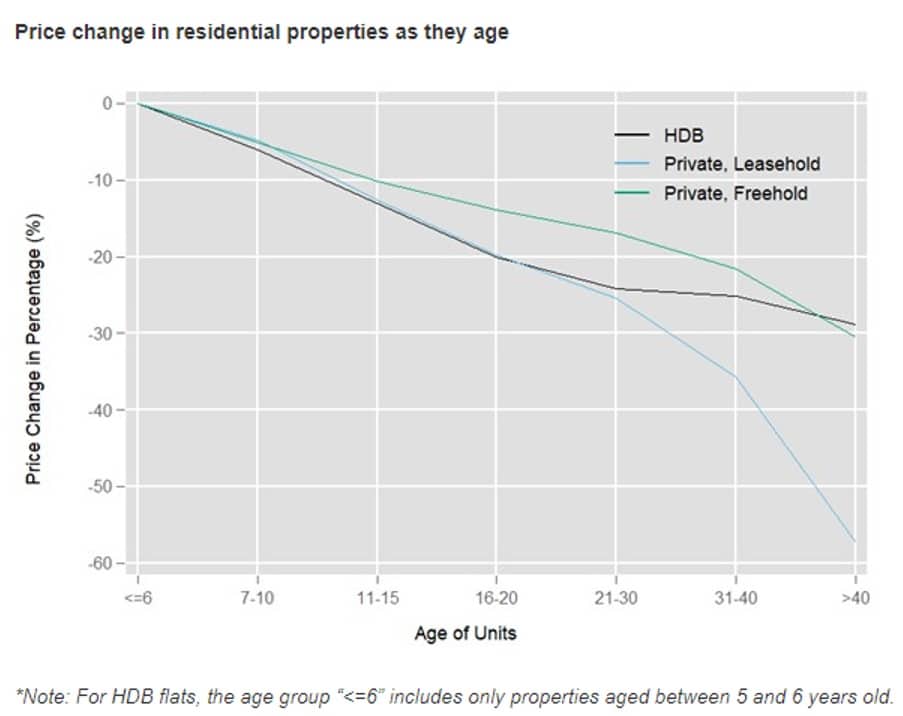

Usually, a private condominium is deemed as a better store of value as compared to an HDB. However, according to a study done by the National University of Singapore, it’s revealed that an HDB actually depreciates at a slower rate than a private condominium after they both hit the 30-year mark. We have previously written a piece on this as well which you can read here.

But to keep it brief, HDBs undergo continuous upgrading by the Town Council, cater to a much wider buyer profile and are supported by subsidies. These are some reasons why some HDBs tend to have better price protection than private leasehold properties – particularly those that are old and have lots of competing condos around.

Pros and cons of keeping the HDB

| Pros | Cons |

| In a prime location that is within walking distance of an MRT station | There are 4 upcoming BTO clusters in the vicinity which may affect prices at Towner Heights when they obtain their MOP down the road |

| Limited HDB supply in the area | No facilities |

| It is the middle ground between the newly-MOP flats and those that are 35 years old | |

| Low monthly town council S&C fees |

Pros and cons of keeping the private property

| Pros | Cons |

| Facilities that you can use | Located in the outskirts and not within walking distance to the MRT station |

| The oldest project in the area | |

| Higher monthly MCST fees (as compared to the HDB) |

Based on these two tables, there appears to be more reason to keep the HDB than the private property – at least for the short term.

But as you have mentioned, your preference would be to still stay in a condominium and if facilities are a major consideration, so it boils down to whether lifestyle or value preservation is of greater importance to you.

Let’s say you were to keep the HDB and sell Lilydale at the average selling price of $963,808. We will assume you used some CPF funds to pay for the property and that you have not met the Full Retirement Sum (FRS) just to be more conservative with our calculations.

Since you’re currently 68 which means you turned 55 in 2009, the FRS you’ll need to meet is $117,000. After deducting the FRS from the sale price, your cash proceeds will be $846,808.

Let’s presume you were to leave this amount in your retirement account which earns a 4% interest per annum (and you are also free to draw down on this whenever you need to).

Here’s the interest that you can earn in a year which you can withdraw on a yearly basis without touching your principal:

| Description | Returns |

| Monthly returns by keeping $846,808 in RA at 4% interest per annum | $2,822 |

| Returns over 5 years | $169,362 |

C. Sell both and downgrade to a smaller HDB/condo in a better location with amenities

First, let’s address whether or not you should sell your existing properties to purchase another two that could have better value retention.

As a single buyer, there is no way to avoid the ABSD if you decide to eventually purchase two properties. However, selling both properties just to buy another two at your age simply does not make sense either as you’re not able to leverage on the loan. Moreover, you’ll incur more transaction costs which eat into your profit.

If you still hope to have two properties, it’ll be a more rational choice to just do nothing and hold on to the existing two since they are already fully paid for.

Now if we consider selling both your properties and downgrading to one development, here’s what your affordability looks like.

Affordability after selling both properties:

| Description | Amount |

| Sales proceeds after deducting FRS ($963,808 + $757,000 – $117,000) | $1,603,808 |

| BSD based on $1,603,808 | $48,752 |

| Estimated affordability | $1,555,056 |

These are some available private condominiums on the market located in Bedok Central that is within your affordability:

| Project | Tenure | Completion year | Unit type | Size (sqft) | Asking price |

| Bedok Residences | 99 years | 2015 | 1 bedroom | 517 | $986,000 |

| Bedok Residences | 99 years | 2015 | 1 + S | 603 | $1,080,000 |

| Casafina | 99 years | 2000 | 2 bedrooms | 926 | $1,148,888 |

| Bedok Residences | 99 years | 2015 | 2 bedrooms | 979 | $1,450,000 |

And some of the HDBs in Bedok Central:

| Block and street | Completion year | Unit type | Size (sqft) | Asking price |

| 20 Chai Chee Rd | 1972 | 3I + U | 700 | $338,000 |

| 420 Bedok North St 1 | 1979 | 3NG | 732 | $408,000 |

| 35 Chai Chee Ave | 1974 | 4I | 882 | $458,888 |

| 134 Bedok North St 2 | 1977 | 4NG | 990 | $560,000 |

If you were to purchase a 1 bedder at Bedok Residences for $986,000:

| Description | Amount |

| Purchase price | $986,000 |

| BSD | $24,180 |

| Cash remaining after purchase | $593,628 |

| Description | Amount |

| Monthly returns keeping $593,628 in RA at 4% interest per annum | $1,979 |

| Keep $593,628 in RA at 4% interest per annum | $118,726 |

With this option, you will still stay in a condominium in your preferred location and have substantial cash remaining to invest and use as your retirement funds. Also, should you decide you want to leave the property behind for your daughter, this will be feasible. One thing is that you will have to compromise on the living space. Since you’re moving from a 3 bedder to a 1 bedder, it might take some getting used to.

If you were to purchase the 3NG HDB unit at $408,000:

| Description | Amount |

| Purchase price | $408,000 |

| BSD | $6,840 |

| Cash remaining after purchase | $1,188,968 |

| Description | Amount |

| Monthly returns keeping $1,188,968 in RA at 4% interest per annum | $3,963 |

| Keep $1,188,968 in RA at 4% interest per annum | $237,794 |

With this option, you still get to stay in your preferred location and with a more comfortable amount of living space but you will not get to enjoy the condominium facilities. However, the cash you’ll have after 5 years if you were to leave it in your RA will be double the amount as compared to if you were to purchase a private property. This extra cash can also be inherited by your daughter later on.

As we have mentioned earlier, it ultimately boils down to how you wish you spend your retirement years. There is no right or wrong choice but more your priorities – is having passive income more important for your lifestyle, or being able to have more assets/cash to pass down?

Alternative purchase – Dual Key unit

Another option you can consider is getting a dual key unit which will fulfil your preference of staying in a condominium while being able to rent out part of it to earn passive income, without compromising on your privacy.

These are some dual key units that are available on the market and are within your budget:

| Project | Tenure | Completion year | Unit type | Size (sqft) | Asking price |

| Urban Vista | 99 years | 2016 | 2 bedroom dual key | 678 | $1,150,000 |

| Gem Residences | 99 years | 2020 | 2 bedroom dual key | 775 | $1,398,000 |

| Sims Urban Oasis | 99 years | 2017 | 2 bedroom dual key | 786 | $1,450,000 |

| Sophia Hills | 99 years | 2018 | 2 bedroom dual key | 700 | $1,499,000 |

Let’s say you were to purchase the unit at Gem Residences given its location and proximity to amenities and rent out the studio at $2,000/month:

| Description | Amount |

| Purchase price | $1,398,000 |

| BSD | $40,520 |

| Cash remaining after purchase | $165,288 |

| Description | Amount |

| Monthly returns keeping $165,288 in RA at 4% interest per annum | $551 (or $6,612 yearly) |

| Keep $165,288 in RA at 4% interest per annum | $33,058 |

| Assuming a monthly passive income of $2,000 for 11 months each year | $110,000 |

| Total estimated gains after 5 years ($22,000 + $6,612)x5 | $143,060 |

Since a dual-key unit allows you to earn a passive income with property ownership, it does achieve your twin goals of having a passive income while benefiting from wealth preservation through real estate. Moreover, you will get to enjoy the facilities and pass on a private property to your daughter later – something which she might appreciate since owning two properties attracts ABSD, and one way to avoid that is to pass it on through inheritance.

Conclusion

Let’s quickly run through all your available options again.

| Options | Monthly Passive Income | Returns over 5 years |

| Option A (rent out HDB with the option to rent out your bedrooms) | $3,800 – $5,000 | $209,000 – $275,000 |

| Option B (sell the condo and invest proceeds in CPF, stay in HDB) | $2,822 | $169,362 |

| Option C (1) (sell both properties, buy a condo and invest the rest in CPF) | $1,979 | $118,726 |

| Option C (2) (sell both properties, buy an HDB and invest the rest in CPF) | $3,963 | $237,794 |

| Option C (3) (sell both properties, buy a dual-key unit and invest the rest in CPF) | $2,384 | $143,060 |

With Option A, you will still be able to stay in a condominium and make a decent amount of passive income each month, but you will not be able to fully enjoy the returns from the properties as you’re not cashing out from them. This is great if you intend to pass on your property to your daughter in the future, but it does mean less cash on hand.

For Option B, it would make more sense to keep the HDB given your current needs for a more convenient location when you retire. Selling one of the properties will also allow you to cash out a lump sum which you can reinvest and utilise the funds for your retirement.

Option C is quite interesting now as prices of both properties are higher now than before the pandemic hit when they were stagnating, so it might be an opportune time to sell.

Of course, when you sell high, you tend to buy high as well. But one good thing is that you’ll be paying in full so at least you will not have to worry about the high interest rates. Moreover, the cash you unlock is very useful in your retirement years – and with 4% guaranteed interest earned in your CPF Retirement Account, you aren’t actually losing out that much.

While the main benefit in real estate investment is in the leverage you can take, this is becoming less favourable with the rise in interest rates, and considering you are a retiree, taking a loan isn’t ideal nor is it possible too.

However, take note that your cashflow over the next 5 years really depends on what you purchase after selling:

Buying a condo would mean less cash for you to invest, and unless you also rent out bedrooms in the condo (assuming it’s a 2-bedder), the passive income you can earn from your CPF is the least favourable compared to all other options.

If you buy an HDB, you’ll unlock the most amount of cash to generate guaranteed returns of 4% in your CPF. This naturally results in the highest cashflow as a 4% return on over a million dollars is pretty tidy.

Going for a dual-key unit is akin to buying a condo and renting out another bedroom, except that you’ll have greater privacy. This explains why cashflow can be expected to be better than if you only purchased a condo and left the remaining sum in your CPF RA.

So which option should you go for? Again, we return to our 3 points:

- Retirement funds

- Quality of life

- Legacy planning

Retirement funds – the best option is in freeing up your cash to invest for the guaranteed 4% returns. Since you cannot (and should not) take a loan, leveraging on real estate isn’t an option. Not only is it guaranteed, you also wouldn’t have to deal with issues like tax, agent fees, transaction costs or maintenance fees that you’d normally deal with as a landlord. The second best option is just to sit tight and do nothing – you’ll be earning passive income from your rental. However, you would need to deal with the hassle of finding a tenant/maintenance issues when they arise.

Quality of life – this ultimately depends on what kind of lifestyle you wish you have, and there are many considerations. Do you want to continue dealing with tenants/agents in your senior years? If the answer is no, then downgrading to an HDB could be an option. It’s not only the best in terms of returns, staying in an HDB means you can afford a bigger space in a better location. Better connectivity and amenities could also be very valuable as you age. If facilities are important, you could consider getting a dual key unit that allows you to earn passive income from rental, while also still earning from your CPF.

Legacy planning – if passing on your property to your daughter is important to you, then leaving behind an HDB is somewhat of a risk. This is because your daughter cannot hold onto 2 HDBs. So unless she owns a private property or has no property ownership at the time of your passing, this could be an issue. Of course, the worst-case scenario is that your daughter sells the HDB which is definitely still a very viable option. However, you do miss out on one of the few ways in which you can pass on a property to someone with at least one property without incurring ABSD. In this case, owning a private property is much much straightforward. After inheriting it, your daughter can immediately rent it out or sell the property.

One last point to note:

We must emphasise the inflexibility of owning 1 property now. Whether it is a condo or HDB, having to sell your one and only home in the future means having to deal with moving house – probably the last thing on your mind in your retirement years. As such, option B and C is to be executed if you’re very sure that the next home is your forever home. We’ve written about things to look out for in this article.

Overall, on paper, we think that doing nothing is a good blend between earning passive income while also taking legacy planning into consideration.

However, we recognise your struggle in the condo being quite inconvenient – something that could irk you well into your 70s onwards when having to take the bus just to get to good amenities.

Perhaps you could consider moving into the HDB instead which is in a better location, and renting out the condo for passive income? While it is a hassle to move now, you do get to enjoy better amenities while retaining your condo which can be passed on to your daughter later on. The only issue is whether the McNair HDB is truly a forever home to you. You’re also free to liquidate your condominium later on if for some reason, you have to raise the cash.

Finally, there is also one option to consider of renting out both of your current properties, and renting elsewhere in a place that you find is more convenient for you. This allows you to keep both properties, yet still enjoy living in a more conducive location. That being said, the downside of renting would be the uncertainty of having a home in the long term. You’d have to be extra careful to find a home that you can rent for a long time – without having to stress about moving as you age.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

0 Comments