HDB Rental Rates Are Up A Crazy 20.9% In 2022: Could It Still Go Higher?

November 1, 2022

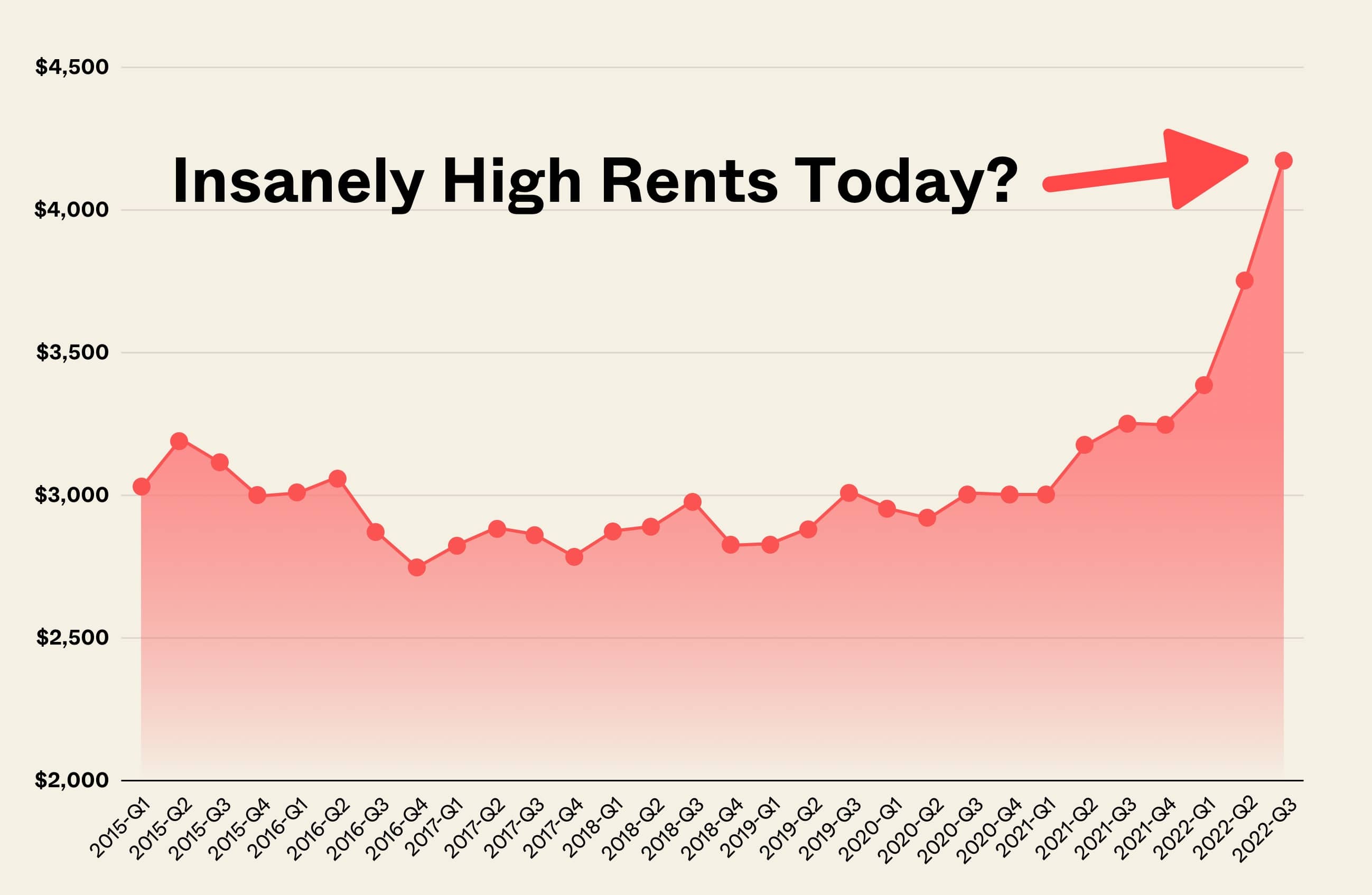

In recent news, the Straits Times reported that the Singapore rental market may be “going bananas”. It’s certainly true that 2022 has been a better year for landlords, but is the rental market as “crazy” as reported? We did some digging into rental rates over the years, and found some interesting details:

Table Of Contents

- What are rental rates like in Singapore in 2022?

- HDB rental rates are at an all-time high now

- Private rentals are at an all-time high now too

- The gap between HDB and private rents went up overall but ticked down in Q3

- HDB rental growth rates may be steep now, but it’s not something new

- For HDB flats, rental yields haven’t even returned to their previous levels but it’s rising sharply

- Current circumstances don’t provide an end in sight to rising rental rates

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What are rental rates like in Singapore in 2022?

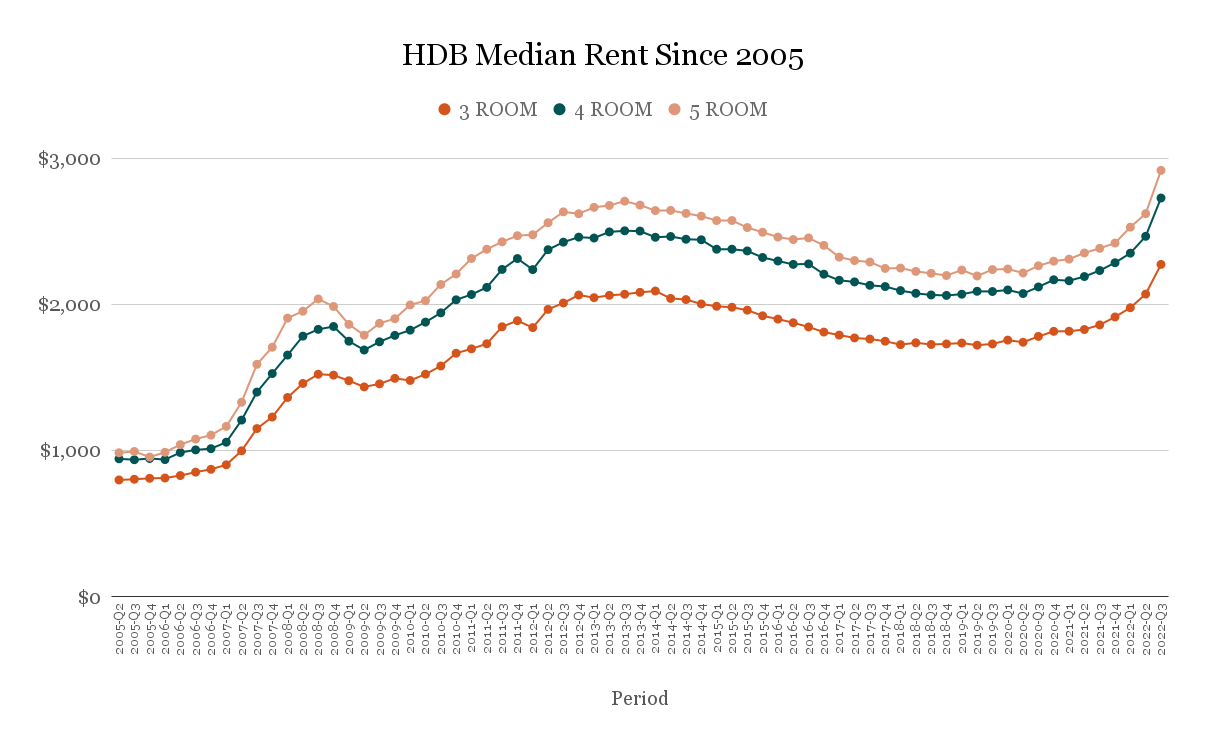

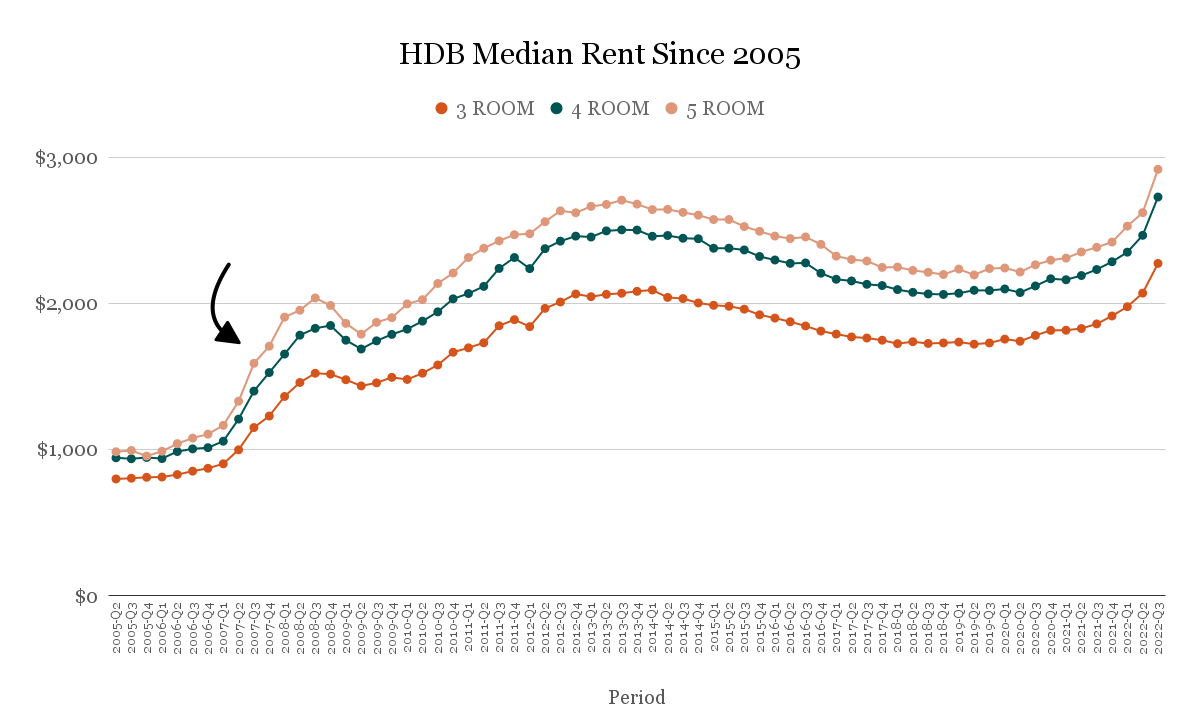

To get a wider contextual view, we looked at rental rates for 3 to 5-room flats and monitored their gross rental yield over the years. Executive flats were excluded due to the lack of volume, and given their large and varied sizes and thus configurations, it’s hard to confidently compare rental prices over time.

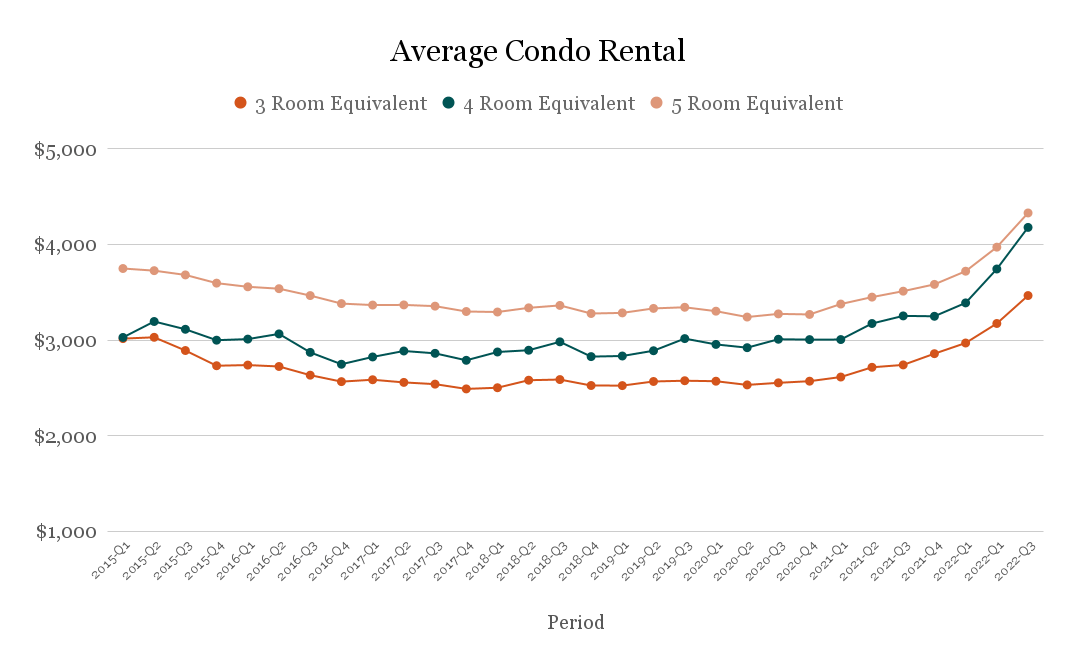

We also made a comparison of HDB rental rates against private counterparts since 2015, which include private 2-bedders (500 to 800 sq ft) which is comparable to 3-room flats, 3-bedders (800 to 1,000 sq ft) comparable to 4-room flats, and bigger 3-bedders (1,100 to 1,300 sq ft) comparable to 5-room flats.

These non-landed private residential rental rates were also charted out to show how rentals have changed since 2015. These rates reflect sizes and bedrooms equivalent to HDB flats so that we can make a fair comparison with them.

HDB rental rates are at an all-time high now

HDB’s recent press release confirms that HDB rental rates are at a high now, surpassing the last high in 2013 across 3 to 5-room flat types.

This huge jump may not come as a surprise to some given the news about surging rents, however, we must add that the jump between Q2 and Q3 is quite alarming.

The data could reflect the return of foreign tenants plus the surge of new homeowners/upgraders awaiting their new units.

Private rentals are at an all-time high now too

A common complaint from landlords in the past before Covid-19 was that rental rates were really low. Things continued to trudge downwards up until 2020 when rents started to stabilise.

In this graph, we looked at 2 and 3 bedrooms of certain sizes so as to make a better comparison with HDB rents:

- 2-bedders (500 to 800 sq ft) which is comparable to 3-room flats

- 3-bedders (800 to 1,000 sq ft) comparable to 4-room flats, and

- Bigger 3-bedders (1,100 to 1,300 sq ft) comparable to 5-room flats.

Between 2021 to early 2022, rental rates steadily increased. And like HDB rents, the jump between 2022-Q2 and Q3 is also quite stark.

Unless you absolutely need facilities/desire a certain lifestyle, renting an HDB today might seem like a better option considering its lower overall price. So how has the disparity between HDB and private rents been?

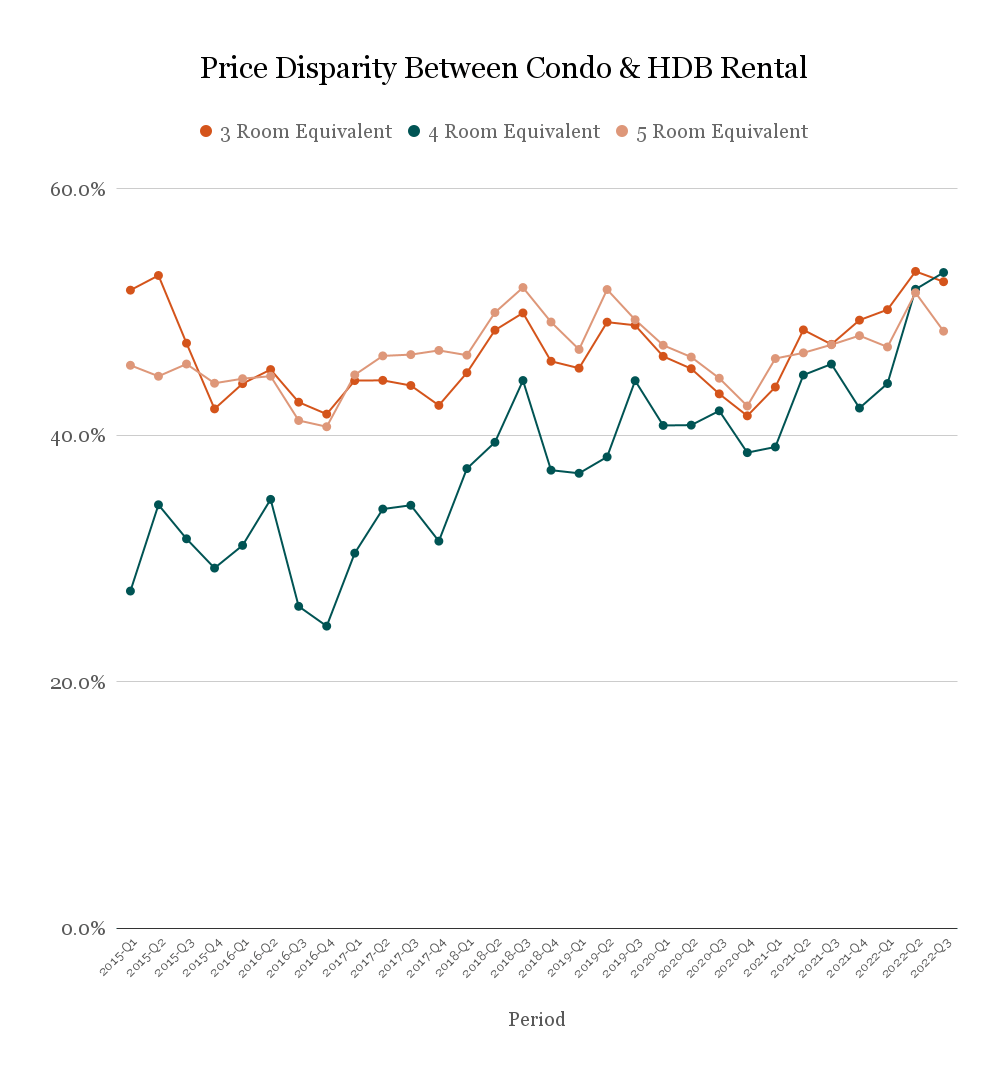

The gap between HDB and private rents went up overall but ticked down in Q3

This chart shows the difference between non-landed private rent vs HDB rent and is based on a comparable number of bedrooms and unit sizes.

Overall, the disparity has grown since the start of 2021. This isn’t a new phenomenon though. In fact, this happened before between 2016 Q4 – 2018 Q3. The disparity then dropped till 2020 Q4 and started to rise again across the board.

You’ll also see that, unlike 3 and 5-room flats, the disparity for rentals between 4-room flats has steadily gone up over time. This could be due to the increase in the number of smaller 3-bedroom units that have entered the market. Considering their newness, rental rates would also be high as tenants are more willing to pay for a new project compared to an old one.

Given how large the jump in rental rates was for HDBs in Q3, 3 and 5-room flats then saw a dip in their price disparity. It’s pretty understandable since many who find the condo rents too steep would need to settle for HDBs instead – and with the rising cost of living, it may be possible for this disparity to fall.

More from Stacked

An Overview Of The Bedok Property Market In 2024: HDB Price Trends And Key Developments

Bedok is one of the most transformed parts of Singapore, between the post-independence generation and today. This area used to…

HDB rental growth rates may be steep now, but it’s not something new

HDB rents have risen sharply between Q2 and Q3 this year. While this might lead you to think that it can’t possibly keep going on like this, you might want to look at what happened between 2007 – 2008:

HDB rents went up almost two-fold between 2007-2008. While it’s hard to imagine rents going up by that magnitude now, it’s certainly not impossible considering it has happened before.

And this brings us to the next point:

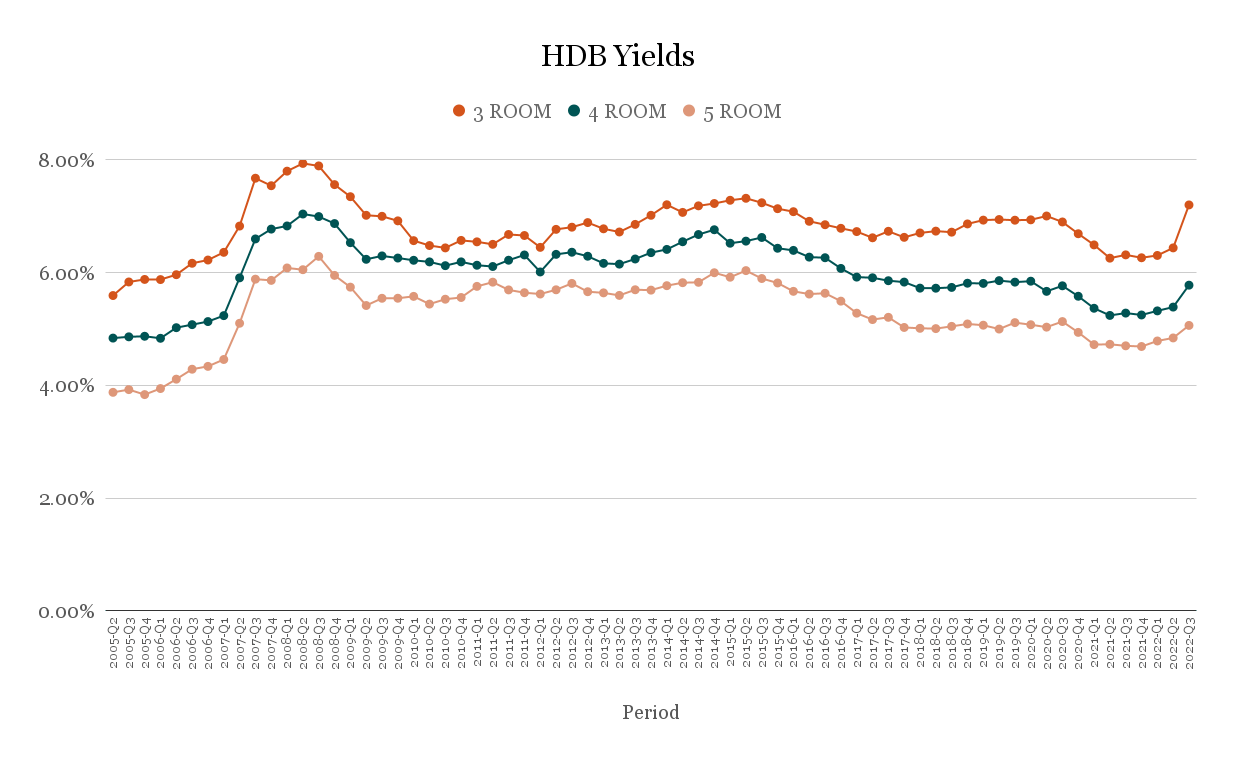

For HDB flats, rental yields haven’t even returned to their previous levels but it’s rising sharply

Back in the property heydays of 2008, near the time of the Global Financial Crisis, HDB flats had typical rental yields that would be eye-popping today.

At the time, 3-room flats could fetch yields of around eight per cent, as opposed to about six per cent today; and 5-room flats could fetch around six per cent, as opposed to over 4 per cent today.

Today, buyers of flats can’t expect the same yields because resale flat prices are at an eight-year peak; but at the same time, rental rates haven’t changed much since way back in 2013.

(Rental yield is the annual rental income divided by the cost of the unit; so if resale flat prices are rising, but rental rates are similar, the gross rental yield will decrease).

Rental yields for HDB flats seem to have stabilised between 2009 to 2015 and then declined due to rental rates falling quicker than HDB prices. At current rental rates and demand, however, there is room for HDB rental yields to grow significantly – provided HDB flat prices don’t keep rising much higher than they already have.

That being said, the latest data in Q3 has drastically increased rental yields, with 3-room flats at 7.2% – 0.74% away from the 7.92% seen in 2008.

We wouldn’t even need to go that far back to compare yields – 4 and 5-room flats have not surpassed yields found in 2014/15.

Current circumstances don’t provide an end in sight to rising rental rates

While the current rental rates are high, there is still room for rent to reach truly spectacular levels; we’re just not there yet. This can be seen from the fact that rental yields could possibly go higher, rental rates have for consecutive quarters before and the rental disparity with condos is pretty high, leaving room for HDB rental rates to catch up.

There are also two key factors to consider here:

The first is how the market responds to the 15-month wait-out period, for right-sizers who want HDB flats. It’s too early to tell if this will cause a massive surge of renters, or if those who want to right-size will simply wait for the measure to be removed. Most realtors we spoke to, however, are confident it will lead to at least a higher volume of leases if not higher rental rates.

The second pertains to landlords who are on bank loans. As interest rates continue to rise, landlords will be eyeing their bottom line – and many will see highly monthly repayments as justification to bump up rental rates accordingly. This is especially true for landlords who are dead set on cash-flow positive properties, even in 2022. As you can see from some stories from tenants, the current high rental rates have caused some landlords to attempt to take a piece of that pie.

So yes, rental rates are at a high now, and there’s certainly a possibility we could end up in an even crazier territory, depending on how these two factors play out. For more on the situation as it develops, follow us on Stacked.

(PS. Don’t forget our in-depth reviews of new and resale condos are useful for buyers and tenants alike).

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the current state of rental rates for HDB flats in Singapore?

Are private rental rates also high in Singapore right now?

How does the gap between HDB and private rental rates compare now to previous years?

Can rental rates for HDB flats keep rising at the current pace?

What are the rental yields for HDB flats compared to past years?

Is there potential for rental rates to go even higher in Singapore?

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Rental Market

Rental Market Is Singapore’s Rental Market Really Softening? We Break Down The 2024 Numbers By Unit Size

Editor's Pick The Cheapest Condos For Rent In 2024: Where To Find 1/2 Bedders For Rent From $1,700 Per Month

Rental Market Where To Find The Cheapest Landed Homes To Rent In 2024 (From $3,000 Per Month)

Rental Market Where To Find High Rental Yield Condos From 5.3% (In Actual Condos And Not Apartments)

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

0 Comments