6 Fastest-Selling New Launch Condos: How Are They Doing Now?

November 20, 2020

New launches are a bit like the Premier League matches of the property market. Behind the scenes, there’s always an undercurrent of nerves as developers – and their marketing teams – see whether their multi-million-dollar ventures are going to pan out. And for the general public, momentum is a real thing: properties that are selling out fast in turn attract more buyers; just like long queues at a hawker stall identify it as one of the “good ones”.

Just recently, a new launch (The Linq @ Beauty World) made headlines for selling 96% of its units on the first day. Okay, granted it was 115 units, but taking into account the Covid-19 situation and the recent OTP re-issue restrictions that is nonetheless an impressive showing.

Which is exactly what made us curious, what happened to the launch-day record setters of yesteryear? Just because a development sold well on launch day, does it mean it carried on to appreciate well, get higher rental yields, etc?

This week, we took at a look at the fastest selling condos in recent years, to see whether the high expectations of them have panned out:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

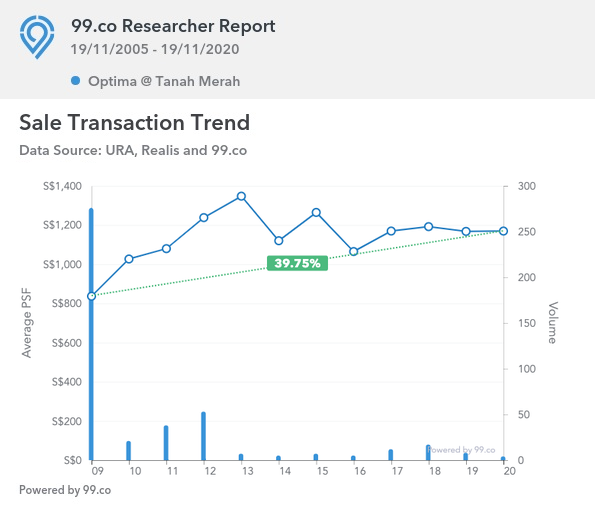

1. Optima @ Tanah Merah

When? August 2009

Where? Tanah Merah Kechil Avenue (District 16)

Who? TID Pte. Ltd.

Launch performance: 100 per cent sold out in three days

What happened?

Optima’s launch was 2009, which makes its launch-day performance quite phenomenal. This was the year Singapore became the first Asian country to slip into recession, following the Global Financial Crisis. It’s impressive to sell out an entire development in 72 hours (albeit a small one), at a time when many investors had just been burned by the Lehman Brothers collapse, the mini-bonds saga, etc.

At the time of launch, Optima @ Tanah Merah sold for $810 psf, with a total quantum ranging from $470,000 to just over $2 million. As a point of reference, the average price in the area (one-kilometre around the Tanah Merah MRT station) was about $749 psf in 2009, with an average quantum of $869,500. So Optima was quite attractively priced for a new launch – just that there was really nothing much going on in the immediate area at that point in time.

Optima @ Tanah Merah attracted investors who engaged heavily in sub-sales, and much of the profit was realised before its actual completion in 2012

Optima @ Tanah Merah was the first development in the area to offer one-bedder, shoebox style units at 484 sq. ft. At the time, these were often purchased by investors with an eye toward sub-sales (i.e. reselling the unit before TOP, or “house flipping”).

For example, one of these shoebox units – on the fourth floor – was purchased for $1,025 psf at launch, and sold only three months later for $1,215 psf. The same unit was sold for the third time, at $1,373 psf, within the same year.

This was possible because the Sellers Stamp Duty (SSD) was only introduced in February 2010; precisely to stop ballooning home prices from these shenanigans.

(The SSD imposes a tax of 12 per cent on sales proceeds if the property is sold within the first year, eight per cent on the second year, and four per cent on the third year).

In addition, Additional Buyers Stamp Duty (ABSD) wasn’t implemented until 2011, which made investors less hesitant in purchasing small, second properties.

It’s likely that the initial batch of investors, who bought and flipped their units, received the best gains from this development.

What are prices at Optima @ Tanah Merah like today?

Optima is a small development with a very low transaction volume, which makes prices hard to determine.

The given price range today is between $1,075 psf to $1,270 psf. Only three transactions were recorded this year:

| Date | Unit Size | Price PSF | Total Price |

| 4 Nov 2020 | 1,259 sq. ft. | $1,270 | $1.6 million |

| 29 Oct 2020 | 1,098 sq. ft. | $1,075 | $1.18 million |

| 14 Sep 2020 | 700 sq. ft. | $1,215 | $850,000 |

To date there have been 153 profitable transactions, with 10 unprofitable transactions.

Notable details:

- 190 metres (three minutes’ walk) to Tanah Merah MRT station

- Tanah Merah MRT station is two stops from Changi Airport

- There was recently a successful bid for a land plot near Optima @ Tanah Merah. This is expected to result in an integrated development that will add much needed retail amenities. We covered it in greater detail in a previous article.

Other condo details:

Lease: 99-years from 2008

TOP: 2012

Land size: 9,876 sqm.

Number of units: 297

What we think:

Some owners may have mis-timed the purchase, and were unable to flip their units before the SSD kicked in. Nonetheless, even they don’t have much to complain about at this point. Optima @ Tanah Merah has seen a good number of profitable transactions, and will benefit further from having a new integrated development nearby.

It’s also likely to keep appreciating given its close proximity to Changi Airport, and developments like The Changi Jewel and Changi Business Park. These also present a good stream of prospective tenants in the form of aviation industry workers (though there may be a dent in demand during the current pandemic).

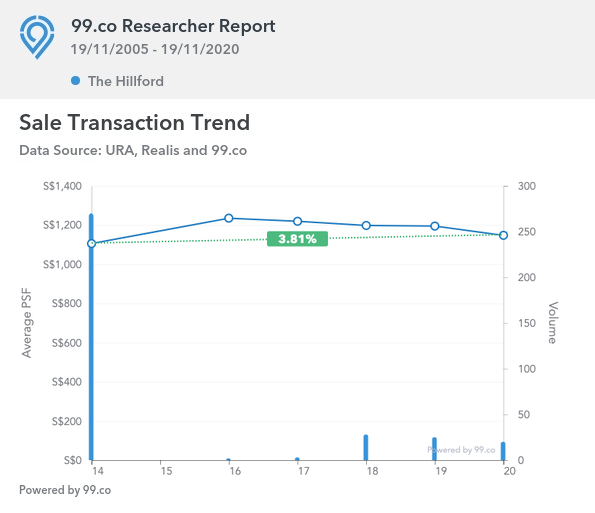

2. The Hillford

When? January 2014

Where? Jalan Jurong Kechil (District 21)

Who? World Class Developments (North) Pte. Ltd.

Launch performance: 100 per cent sold out on day one

What happened?

Despite the one-day sell-out, The Hillford caused a bit of consternation at first. This was due to its 60-year lease, which buyers more or less give up resale gains.

This was in-line with The Hillford was meant to be, which is a retirement resort. URA had released the site on condition that subsequent development supports “a private retirement housing product”. To incentivise developers, URA also lifted the restriction on the number of shoebox units that could be built (as more of the residents were expected to be single retirees).

On launch day however, the buyer demographic included those in the 30’s and even 20’s. The reason came down to price: 398 sq. ft. shoebox units were only about $388,000, while 657 sq. ft. dual-key units were about $648,000.

This comes to about $974.87 psf and $986.30 psf respectively as compared to an average of about $1,615 psf for District 21 in January 2014.

In addition to the low price, The Hillford is only 750 metres (less than 10 minutes’ walk) from Beauty World Centre and MRT station (the Beauty World MRT station opened in 2015, just a year after the launch).

As such, The Hillford drew a lot of pure home owners, who knew they would never find similarly priced developments in the area.

What are prices at The Hillford like today?

The current given price range is between $1,005 to $1,230 psf. There have been 15 transactions so far for, of which these are the five most recent:

| Date | Unit Size | Price PSF | Total Price |

| 5 Nov 2020 | 398 sq. ft. | $1,230 | $490,000 |

| 26 Oct 2020 | 398 sq. ft. | $1,203 | $479,000 |

| 20 Oct 2020 | 657 sq. ft. | $1,058 | $695,000 |

| 2 Oct 2020 | 398 sq. ft. | $1,180 | $470,000 |

| 22 Sep 2020 | 398 sq. ft. | $1,180 | $470,000 |

To date there have been 67 profitable transactions, and six unprofitable transactions.

Notable details:

- Under 10 minutes to Beauty World MRT station on foot

- This is an integrated development with 18 shops, including restaurants and convenience stores

- The development includes clinics, pharmacies, and healthcare amenities as it is a retirement resort. Residents can pay for assistance such as domestic help, prepared meals, etc.

- Senior-friendly interiors, such as emergency call systems in bathrooms, light switches installed near bedsides, etc.

Other condo details:

Lease: 60-year lease from 2013

TOP: 2016

Land size: 10,171 sqm.

Number of units: 281

What we think:

This was an innovative approach, beyond just building another retirement home. Note that the prices of the recent transactions (often below $500,000) mean many older Singaporeans could cover all or the entire cost by selling a four or five-room flat.

We can’t recommend The Hillford to younger buyers or investors of course, given the 60-year lease that began in 2013; but this is a retirement place, that was never meant for that demographic to begin with.

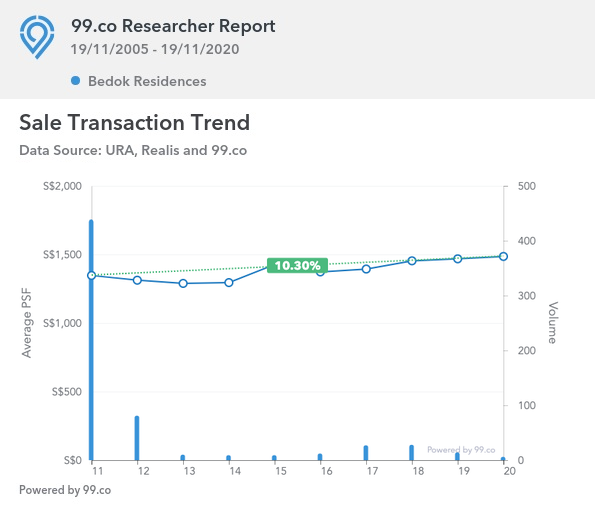

3. Bedok Residences

When? November 2011

Where? Bedok North Drive (District 16)

Who? Brilliance Residential (1) Pte. Ltd. / Brilliance Trustee Pte. Ltd. (CapitaLand)

Launch performance: 350 of 450 released units sold on launch day (approx. 78 per cent take-up)

What happened?

Market watchers knew this would be a hit from the moment it was announced. Bedok Residences was built to take advantage of the upgraded Bedok Town Centre, which added Bedok Mall to the existing eateries, shops, and transport interchange.

Bedok Residences is right on top of Bedok Mall (approximately 222,500 sq. ft. of retail space with about 200 shops), and is about 230 metres from the Bedok MRT station (three minutes’ walk).

At the time of its launch in November 2011, it had no other viable contender in Bedok; not in terms of condos. It was – and some argue still is – the best located private property in the neighbourhood.

On launch day, there were 600 queue numbers for the 450 units released. According to the developer, prices at launch averaged $1,350 psf. This is compared to the average prices of $1,012 psf for District 16, on November 2011. As such, Bedok Residences had a remarkably strong launch, despite what many would consider a high price point.

What are prices at Bedok Residences like today?

Indicative prices range from $1,422 to $1,552 psf. There have only been five transactions this year:

| Date | Unit Size | Price PSF | Total Price |

| 14 Oct 2020 | 548 sq. ft. | $1,468 | $790,000 |

| 10 Sep 2020 | 1,076 sq. ft. | $1,468 | $1,600,000 |

| 31 Aug 2020 | 850 sq. ft. | $1,552 | $1,320,000 |

| 24 Aug 2020 | 538 sq. ft. | $1,514 | $815,000 |

| 12 Aug 2020 | 883 sq. ft. | $1,422 | $1,255,000 |

To date there have been 72 profitable transactions, and six unprofitable transactions.

Notable details:

- On top of Bedok Mall, and three minutes’ walk from Bedok MRT station

- No real contenders in Bedok right now, in terms of being an integrated development

Other condo details:

Lease: 99-years from 2011

TOP: 2015

Land size: 24,902 sqm.

Number of units: 583

What we think:

This is pretty much the go-to condo, whenever private property in Bedok is referenced. That said, it’s developed something of a love-it or hate-it relationship with residents and tenants. Bedok Residences is noisy because it’s on top of a mall and facing the MRT track, and you’re surrounded by Bedok Town Centre.

But if you’re the sort who prizes convenience and accessibility, you’ll find it a more than reasonable trade. As such, we tend to find residents who either complain a lot about this condo, or swear they’ll never leave.

More from Stacked

The Essential Guide For First-Time Homebuyers: How To Pick The Right Property

Location, location, location.

Investment wise, however, it’s hard to argue with the location, amenities, and lack of any real competition.

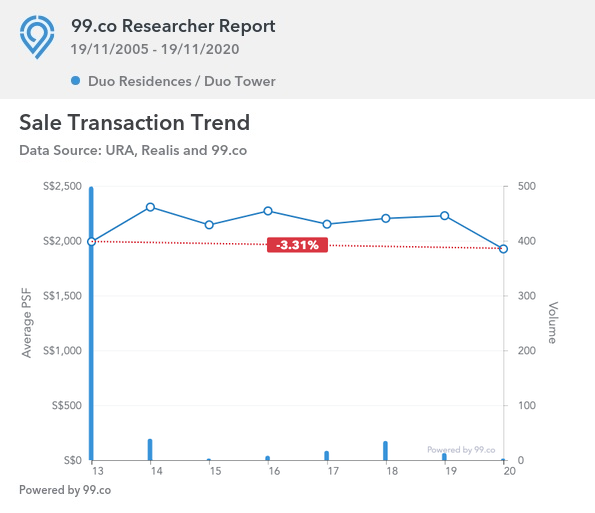

4. DUO Residences

When? November 2013

Where? Fraser Street (District 7)

Who? M+S (joint venture between Temasek Holdings and Khazanah Nasional)

Launch performance: 468 out of 540 units sold within three days (87 per cent take-up)

What happened?

DUO Residences actually launched amid a period of doom-and-gloom in the property market. This was because on 29th June 2013, the Total Debt Servicing Ratio (TDSR) framework had been implemented.

The TDSR, which is still in place today, is a loan curb that restricts your monthly loan repayments – inclusive of other debts – to 60 per cent of your monthly income, at a projected interest rate or 3.5 per cent per annum.

The TDSR had slowed sales, as investors found it harder to secure financing for property purchases.

Nonetheless, DUO Residences managed a take-up rate of 87 per cent. This was mainly due to its proximity to the Bugis MRT station, as well as being an integrated development. DUO Galleria, the commercial component, has 39 storeys and includes 570,000 sq. ft. of Grade A office space, as well as a five-star hotel between levels 25 and 37. It includes a retail gallery of 56,000 sq. ft. There is a direct connection to the Bugis MRT station from here.

(We have a more comprehensive review of DUO Residences here).

At the time of launch, the developer claimed average prices of $2,000 psf. A quick check of the past data shows that prices in District 7 averaged $1,969 psf in November 2013.

What are the prices at DUO Residences like today?

The indicative price range given is between $1,800 to $1,997 psf, based on the only three transactions so far this year:

| Date | Unit Size | Price PSF | Total Price |

| 5 Oct 2020 | 1,001 sq. ft. | $1,978 | $1,980,000 |

| 1 Oct 2020 | 646 sq. ft. | $1,997 | $1,290,000 |

| 26 Mar 2020 | 1,722 sq. ft. | $1,800 | $3,100,000 |

The volume of transactions is low, so the above prices may not be a good representation. To date, there have been 26 profitable transactions, and seven unprofitable transactions.

Other condo details:

Lease: 99-years from 2011

TOP: 2017

Land size: 13,008 sqm.

Number of units: 660

Notable details:

- Attached to DUO Galleria with 570,000 sq. ft. of Grade A office space, which provides a good stream of potential tenants

- Direct connection to Bugis MRT station via DUO Galleria

- Man Man, a Michelin Star restaurant, is located in DUO Galleria

What we think:

Note that the appearance of falling prices is not entirely accurate; it’s because there have been few recent transactions.

DUO Residences is likely to ride the wave of rising prices, as District 7 has since overtaken District 9 in price psf. Having a direct attachment to the Bugis MRT is definitely a big plus, although the retail in DUO Galleria is somewhat shouted down by the cram of nearby malls (Bugis Junction and Bugis+).

A newer alternative has also cropped up nearby; Midtown Bay – a new integrated development – is coming up just 450 metres away. Midtown Modern will cover the stretch at Tan Quee Lan street nearby as well. DUO Residences will have to share its previous dominance of the area with these new developments.

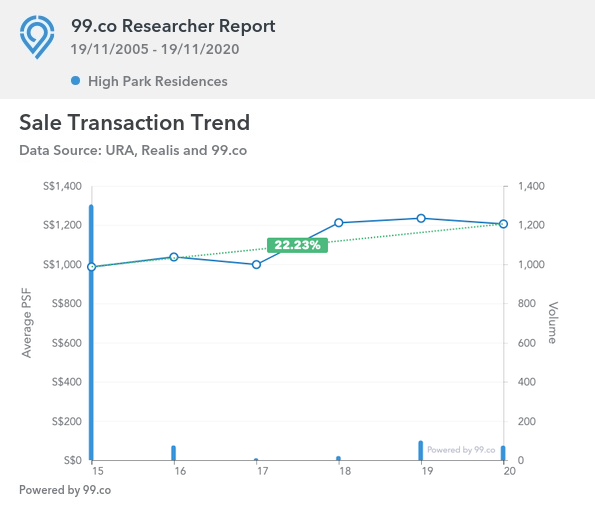

5. High Park Residences

When? July 2015

Where? Fernvale Road (District 28)

Who? Fernvale Development Pte. Ltd. (CEL Development)

Launch performance: 1,169 of 1,390 units sold within a month of the launch (approx. 84 per cent take-up rate)

What happened?

At the time of its launch, High Park Residences was one of the largest ever condo development in Singapore in recent times (a spot now taken by Treasure at Tampines). The launch drew media attention when around 4,000 interested buyers turned up on the first day of balloting.

Much like Treasure at Tampines today, the strategy seems to have been high volumes at competitive prices. The developer set an average price of about $989 psf, with plenty of small units to ensure a low quantum; the smallest unit – at about 387 sq. ft. – was priced at only $398,000.

By comparison, in July 2015, the average prices for District 28 was at $1,064 psf. This was one of the most affordable condos in its day, and buyers recognised the room for further appreciation.

(It’s also possible it wasn’t so much a planned strategy as it was a necessity; the slew of cooling measures in 2014, along with the TDSR, had set the Singapore private property market reeling at the time).

While High Park Residences is far from any MRT station, it’s just across the road from Thanggam LRT station. It’s also just 450 metres (five minutes’ walk) from Seletar Mall.

What are the prices at High Park Residences like today?

Indicative prices range between $1,043 to $1,416 psf. There have already been 15 transactions this year, with the five most recent below:

| Date | Unit Size | Price PSF | Total Price |

| 2 Nov 2020 | 452 sq. ft. | $1,389 | $626,000 |

| 30 Oct 2020 | 452 sq. ft. | $1,360 | $615,000 |

| 30 Oct 2020 | 441 sq. ft. | $1,339 | $591,000 |

| 29 Oct 2020 | 452 sq. ft. | $1,378 | $623,000 |

| 22 Oct 2020 | 667 sq. ft. | $1,214 | $810,000 |

Every recorded transaction at High Park Residences (197 to date) has been profitable.

Other condo details:

- Lease: 99-years

- TOP: 2019

- Land size: 16,604 sqm.

- Number of units: 1,390

Notable details:

- Units are small in this development. In terms of size distribution, almost a third (30.8 per cent or 424) of the units are 600 sq. ft. or below, while another 21.3 per cent (293 units) are between 600 to 700 sq. ft.

- To date, a perfect track record of profitability for resale units

What we think:

Overall, this is one of the best performers on the list, thanks to its competitive initial pricing. However, we do question if the perfect track record will continue in coming years – the bulk of new buyers these days are HDB upgraders (read: mostly families). Many of the units at High Park Residences are going to be too small for this demographic.

But this may be balanced out by the low quantum – at resale prices that are typically in the $600,000 to $700,000 range, High Park Residences remains one of the most affordable private homes in terms of overall cost.

This is a prime choice for right-sizers who don’t want to move into an HDB flat, or new investors trying to get a foot in the rental market.

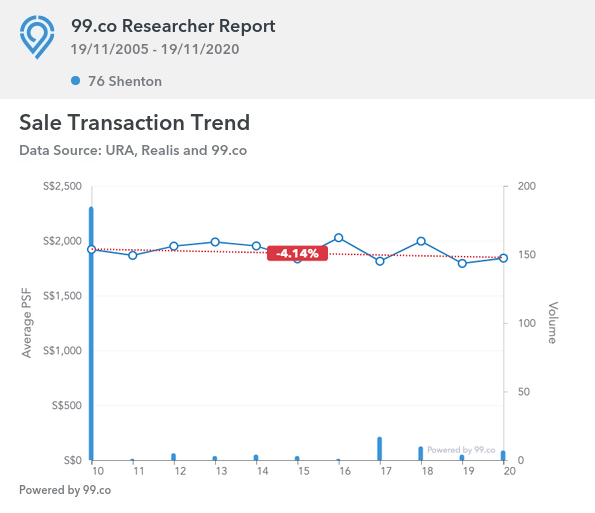

6. 76 Shenton

When? March 2010

Where? Shenton Way (District 02)

Who? Hong Leong Holdings

Launch performance: 100 per cent sold out (all 202 units) during launch day

What happened?

At the time of launch, 76 Shenton was widely considered a “sure-fire” investment. Its predecessor was a well-tenanted office development, but 76 Shenton had been redeveloped from a pure office space, to a mixed-use development with commercial space (seven restaurants and some retail shops, at the time of launch).

In terms of location, it was only about 400 metres (five minutes’ walk) to Tanjong Pagar MRT station, although today Prince Edward MRT station is even closer (240 metres, or a three-minute walk).

The famous Maxwell Hawker Centre is about one kilometre from here; a little too long on foot (about 13 minutes’ walk), but just a four-minute drive. This appeals to both office tenants as well as the residents.

Aside from the prime location, the quantum of the units was low given the smaller sizes; they range from 592 to 980 sq. ft. (there are only one and two-bedroom units at 76 Shenton). Note that in 2010 there was also no Additional Buyers Stamp Duty (ABSD), making a low-quantum CBD property even more alluring.

The developer claimed launch prices of averaging $1,600 to $2,600 psf for the one-bedders, and $1,600 to $2,300 for the two-bedders. For comparison, average prices in District 02 on February 2010 were at $1,814 psf, making 76 Shenton attractively priced for its day.

The queue at launch was allegedly up to three hours for some, and the entire development was sold out by around noon on the same day.

What are prices at 76 Shenton like today?

The indicative price range is between $1,797 to $1,970 psf. The following are the five most recent transactions this year:

| Date | Unit Size | Price PSF | Total Price |

| 22 Oct 2020 | 969 sq. ft. | $1,801 | $1,745,000 |

| 9 Oct 2020 | 592 sq. ft. | $1,892 | $1,120,000 |

| 2 Oct 2020 | 624 sq. ft. | $1,842 | $1,150,000 |

| 18 Sep 2020 | 624 sq. ft. | $1,890 | $1,180,000 |

| 1 Sep 2020 | 980 sq. ft. | $1,797 | $1,760,000 |

There have been 31 profitable transactions, with 15 unprofitable transactions.

Other condo details:

Lease: 99-years from 2007

TOP: 2014

Land size: 16,500 sqm.

Number of units: 202

Notable details:

- The Prince Edward MRT station now provides a closer MRT node than Tanjong Pagar, and it means there are two stations within walking distance

- By 76 Shenton’s completion date in 2014, two other condo developments had popped up within walking distance: Altez and Skysuites@Anson. Spottiswoode 18 also came up around 1.5 kilometres away.

What we think:

As mentioned above, about half of the transactions have been unprofitable, with prices being somewhat stagnant. Despite having two MRT stations nearby, the presence of three other nearby condos puts downward pressure on the price point and causes landlords to compete for tenants.

This is likely to worsen in the near term, given that Covid-19 has changed the office-working situation, and could see fewer foreign tenants.

There’s also a bit of bad luck in terms of timing: just as 76 Shenton was finished in 2014, the government launched a raft of cooling measures including the ABSD. Given that most buyers here are investors (owner-occupiers are few in one and two-bedder CBD properties), the higher stamp duties make it difficult for earlier buyers to offload their units at a good margin.

In terms of fundamentals however, 76 Shenton is in a solid location; it may just take a longer horizon – at least past the Covid-19 period – for initial buyers to realise their gains. All said, this is still a well-located CBD property, which should have no issue with rentability once Covid-19 blows over.

All that said, selling out quickly isn’t always an indication that the development will go on to do well

Sometimes the “wisdom of the crowd” does apply to some extent, but a lot more factors come into play after – government intervention (cooling measures) and economic factors can have huge roles in the performance of the new launches. For more information on the real estate market, follow us on Stacked, where we couple the latest real estate news with the most in-depth condo reviews.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What made Optima @ Tanah Merah sell out so quickly in 2009?

Why was The Hillford's one-day sell-out in 2014 considered surprising?

How has Bedok Residences performed in terms of resale prices since its launch in 2011?

What factors contributed to the rapid sales of DUO Residences in 2013?

Are fast-selling condos like these good indicators of future property appreciation?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

3 Comments

Hi Ryan, this is a great read. Just wondering, were there any developments that went under the radar when it was first launched, and yet it has enjoyed good capital appreciation since the development was completed? I thought it was worth looking at what attributes buyers may have missed out then that eventually led to the success of the development(s).