Here’s How The Sellers Stamp Duty Has Affected Boutique Condos

October 29, 2020

Have you ever wondered why things in limited quantities are so weirdly appealing?

Just attach the word “exclusive” to any product and it seems to take on a whole new light.

So much so that entire businesses are built upon the premise of being exclusive, where limiting the supply creates such a demand for the product.

Ferrari is known to limit sales of its cars to a certain number per year – if you want the latest model, you’d have to be a repeat customer just to get on the waitlist.

Supreme is another such example.

One of its craziest feats is the $30 Supreme red clay brick that sold out in minutes.

If you were wondering what was special about it, I’ll be the first to tell you – nothing. It was just a regular old red brick with the Supreme logo stamped upon it.

And as with any Supreme product, people were trying to sell these bricks at $1,000 a pop online.

Now, if you’re feeling bewildered at this point, don’t worry. I felt the exact same way when I first heard of the Supreme brick.

But then again, it’s also probably because neither you nor I are the target Supreme customer base.

So as simple as it may sound, it all relates back to a very basic human behaviour:

You always want what you can’t have.

And let me just say that this isn’t just because Ferrari and Supreme are established brands – research has actually proven this theory – with cookies.

Back in 1975, researchers Worchel, Lee, and Adewole put ten cookies in one jar, and two cookies in another.

Even though the cookies and the jars were exactly the same, participants still valued the ones with two cookies more highly.

Somehow the scarcity of it actually affected the way people perceived the value of the cookies.

So now the question is, how does this relate back to today’s topic at hand about boutique condos?

Going by everything I’ve said so far, if I were to ask you to rate the profitability potential of a boutique condo what would you say?

It would seem like boutique condos in Singapore would naturally be more profitable than its bigger condo siblings, no?

After all, if you take into account the laws of supply and demand, boutique condos should by right do well precisely because of its scarcity.

Going by conventional thinking – it has a lot less units, so there will definitely be less competition when it comes to selling.

It is also more private too, which is certainly one of the perks if you are more introverted.

Plus, if you like the unique factor of it all, what is more unique than owning a unit out of only 20 units in a development?

So knowing all that, why would anyone even be afraid that a boutique condo wouldn’t do well?

Every week, we do get a lot of requests from people asking about boutique condos.

Many people are attracted to its traits, but are hesitant because of its future profitability.

Here’s my take on its current biggest roadblock:

The sellers stamp duty.

Currently, it’s set at 12% for the first year, 8% for the second, and 4% for the third.

Couple that with the already low transactions for a boutique condo and you can see why it may pose a problem for its resalability.

But that’s just my hypothesis, let’s take a closer look at the numbers to see.

As always, here are a few pointers that you should be aware of.

- The first introduction of the SSD was on 20 Feb 2010. Although the SSD was just a year then, for simplicity sake I will be using that date as the base.

- So to compare the periods, I will be taking 10 years pre Feb 2010, and 10 years of data post Feb 2010.

- In this scenario, I have attributed condos with 150 units or less as my definition of a boutique condo, and compared it with developments with more than 150 units.

- Transactions for those with more than 150 units are much larger, so it isn’t exactly an apples to apples comparison.

- The data collected was based on actual unit transactions – this means that a particular unit will have to be bought and sold for it to be counted. This is more accurate than comparing the usual average PSF values.

- Transactions are based on gross numbers – numbers like tax, selling costs are not taken into account here.

Pre Feb 2010

| Units | Breakeven | Profitable | Unprofitable | Total Units |

| 150 or less | 0.14% | 84.89% | 14.97% | 10,495 |

| More than 150 | 0.20% | 85.18% | 14.62% | 23,969 |

As you can see from above, there really isn’t a discernible difference between the two in terms of the number of profitable and unprofitable units.

Surprisingly, the scarcity effect doesn’t even really come into play here at all either.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Why This New HDB Rule Is A Big Win For Singles (After Years Of Being Overlooked)

Which is why I like the new family care scheme, starting in mid-2025. Under new rules coming next year, singles…

Post Feb 2010

| Units | Breakeven | Profitable | Unprofitable | Total Units |

| 150 or less | 0.69% | 78.53% | 20.78% | 6,963 |

| More than 150 | 0.46% | 84.37% | 15.16% | 18,988 |

Here’s what happens post Feb 2010. The number of profitable transactions for boutique condos are at 78.53%, which is lower than developments with more than 150 units, at 84.37%.

It isn’t a huge difference – just 5.84%. But you can see the effects of the seller stamp duty ruling on the smaller developments.

Now for those who are interested, I have broken down the numbers by district as well.

Editor's PickAdditional Buyer’s Stamp Duty (ABSD): A Comprehensive Guide

by Reuben DhanarajBoutique Condos (150 or less units)

| District | Breakeven | Profitable | Unprofitable | Total Units |

| 150 Or Less | 0.69% | 78.53% | 20.78% | 6963 |

| 1 | 0.00% | 46.15% | 53.85% | 13 |

| 4 | 0.00% | 50.00% | 50.00% | 50 |

| 25 | 0.00% | 53.33% | 46.67% | 15 |

| 9 | 0.98% | 60.98% | 38.04% | 510 |

| 7 | 15.00% | 65.00% | 20.00% | 20 |

| 28 | 0.00% | 66.67% | 33.33% | 3 |

| 10 | 0.88% | 67.84% | 31.29% | 684 |

| 21 | 0.00% | 68.02% | 31.98% | 172 |

| 11 | 1.18% | 68.24% | 30.59% | 510 |

| 27 | 3.23% | 70.97% | 25.81% | 31 |

| 17 | 0.00% | 74.68% | 25.32% | 79 |

| 8 | 1.32% | 75.00% | 23.68% | 228 |

| 12 | 0.89% | 82.17% | 16.93% | 561 |

| 19 | 0.64% | 83.04% | 16.32% | 625 |

| 5 | 0.48% | 83.33% | 16.19% | 210 |

| 16 | 0.48% | 83.65% | 15.87% | 208 |

| 15 | 0.50% | 83.82% | 15.68% | 1607 |

| 14 | 0.20% | 85.25% | 14.55% | 1010 |

| 13 | 0.00% | 85.44% | 14.56% | 103 |

| 2 | 1.56% | 87.50% | 10.94% | 64 |

| 26 | 0.00% | 89.47% | 10.53% | 19 |

| 23 | 0.00% | 91.60% | 8.40% | 119 |

| 3 | 3.13% | 93.75% | 3.13% | 64 |

| 20 | 0.00% | 94.00% | 6.00% | 50 |

| 6 | 0.00% | 100.00% | 0.00% | 1 |

| 22 | 0.00% | 100.00% | 0.00% | 7 |

Bigger Developments (More than 150)

| District | Breakeven | Profitable | Unprofitable | Total Units |

| 150 Or Less | 0.14% | 84.89% | 14.97% | 17458 |

| 26 | 0.00% | 56.79% | 43.21% | 100 |

| 25 | 0.00% | 73.68% | 26.32% | 34 |

| 19 | 0.19% | 75.23% | 24.58% | 1158 |

| 14 | 0.15% | 76.47% | 23.38% | 1673 |

| 17 | 0.00% | 77.08% | 22.92% | 223 |

| 23 | 0.00% | 77.84% | 22.16% | 286 |

| 21 | 0.56% | 78.53% | 20.90% | 349 |

| 7 | 0.00% | 80.77% | 19.23% | 98 |

| 20 | 0.00% | 80.77% | 19.23% | 154 |

| 16 | 0.00% | 81.88% | 18.12% | 506 |

| 12 | 0.28% | 82.58% | 17.13% | 1273 |

| 22 | 0.00% | 84.21% | 15.79% | 26 |

| 11 | 0.00% | 84.93% | 15.07% | 1658 |

| 1 | 0.00% | 85.19% | 14.81% | 40 |

| 15 | 0.26% | 85.22% | 14.52% | 3501 |

| 2 | 0.00% | 86.67% | 13.33% | 199 |

| 28 | 0.00% | 87.50% | 12.50% | 11 |

| 10 | 0.10% | 87.64% | 12.27% | 2771 |

| 9 | 0.17% | 89.63% | 10.20% | 1657 |

| 3 | 0.00% | 90.26% | 9.74% | 259 |

| 8 | 0.00% | 91.73% | 8.27% | 506 |

| 5 | 0.32% | 92.56% | 7.12% | 519 |

| 4 | 0.00% | 92.78% | 7.22% | 147 |

| 13 | 0.00% | 92.79% | 7.21% | 214 |

| 27 | 0.00% | 98.28% | 1.72% | 89 |

| 6 | 0.00% | 100.00% | 0.00% | 7 |

Other than the SSD issue, there are two other minor concerns that may have an effect on the transactions of boutique condos.

The first is just a logical deduction, but one that I unfortunately would not be able to back with numbers.

It all relates back to popularity, or awareness in the market if you will.

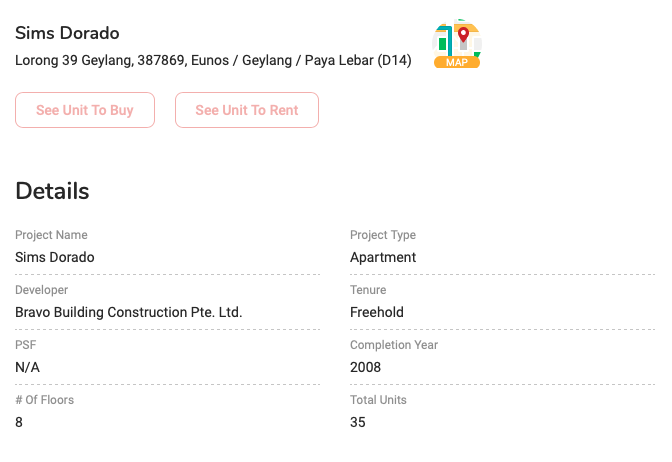

Let me ask you, have you heard of the development Sims Dorado?

I’d bet that 99% of you reading this would probably have no clue that such a development even exists.

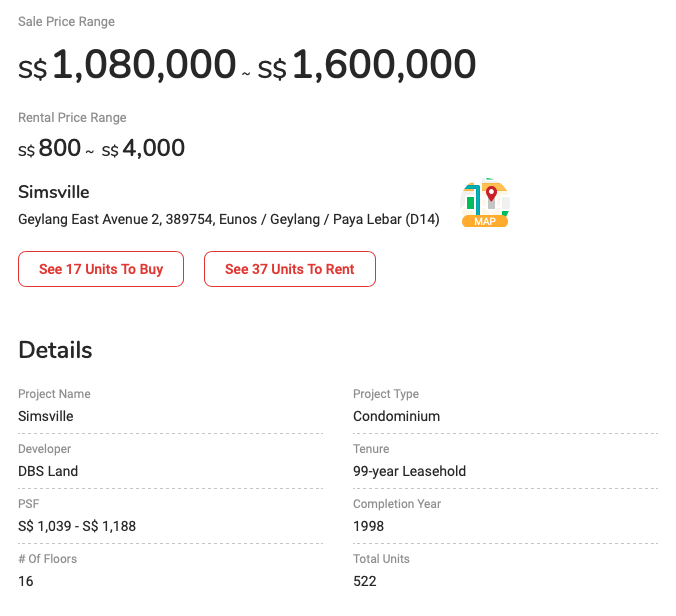

But what about a bigger development like Simsville?

Perhaps if you don’t live in the East you might not be aware of such a place, but I’m pretty sure if you’re an Eastsider you’d probably have an inkling of such a condo.

So if you are looking to move to the East, it’s only natural that the more famous projects will garner a lot more interest.

While the smaller ones run the risk of a lack of awareness.

It’s the same reason why you’d know of Samsung when it comes to buying a phone, while you might not know of Nubia – the awareness in the market is just of a different league.

The other factor that comes into play here is a matter of how people search for property.

There’s no question about it, if you are looking for a home today in Singapore, PropertyGuru would probably be one of the first places you’d start looking.

Again, for a boutique development like Sims Dorado with only 35 units, it’s quite likely that there could be months that go by without any unit being listed for sale.

Contrast this to its bigger neighbour, Simsville, and you’ll find that you’ll definitely come across at least one listing no matter which time of the year you are searching.

So what does this all mean?

Basically because your normal default search behaviour results are driven by listings and not the actual development, chances are you might never come across something like Sims Dorado purely because of the size of it.

Which leads me to my second and last point – transaction frequency (which is relatable to the SSD issue).

One of the more commonly mooted advantages of a bigger development is because of the frequency of transactions.

Due to the sheer number of units, there could be transactions happening every other week.

If the market is positive on the whole, what this creates is a “step up” scenario.

Meaning each unit is transacted slightly higher than the previous because sellers are able to refer back to previous transacted prices to ask for a slightly higher price each time.

As compared to a boutique condo where a transaction could take place once over a 5 year period, it makes it harder for sellers to justify that price jump.

There’s also the matter of bank valuations, where a bank would value the unit based on past transacted prices – the fewer the transactions, the harder it would be to get a relevant valuation.

So if you are the seller of a unit in a boutique condo asking for $2 million, but the last transacted in your development was 10 years ago at $1 million, you can see why it would be tough for a bank to evaluate – let alone a potential buyer looking at the price history.

Final Words

At the end of the day, by no means am I saying that a boutique condo will be a lousy investment or purchase – 78% transactions overall that are profitable is still nothing to be sniffed at.

It’s not so much the size of the condo you should consider but the value.

There will always be boutique condos that do well, as well as bigger developments that do not have good resale value – there are more factors that come into play than just the size of it.

As always, if you have any questions feel free to reach out to me at stories@stackedhomes.com!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

0 Comments