Are You Having Difficulty Achieving A RECORD-BREAKING PRICE For Your Home?

October 1, 2023

The resale market isn’t the only thing that can overheat.

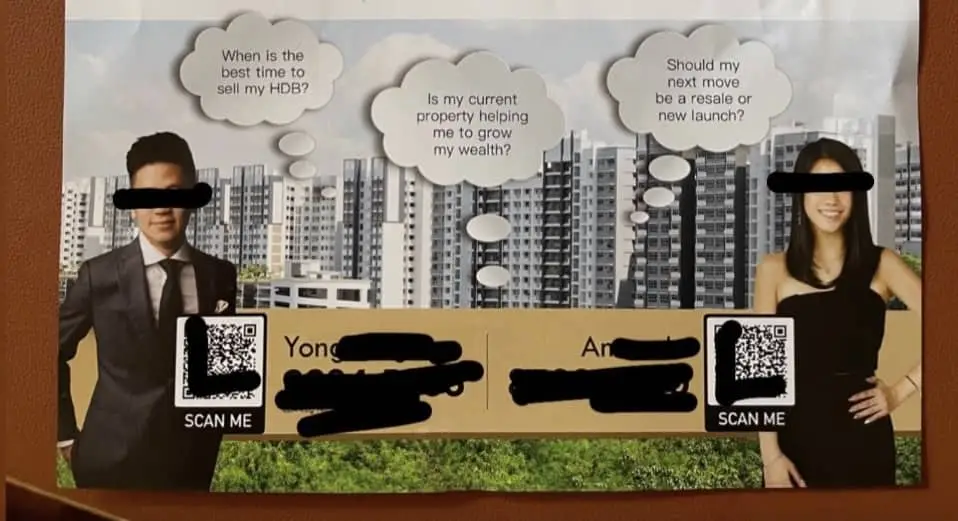

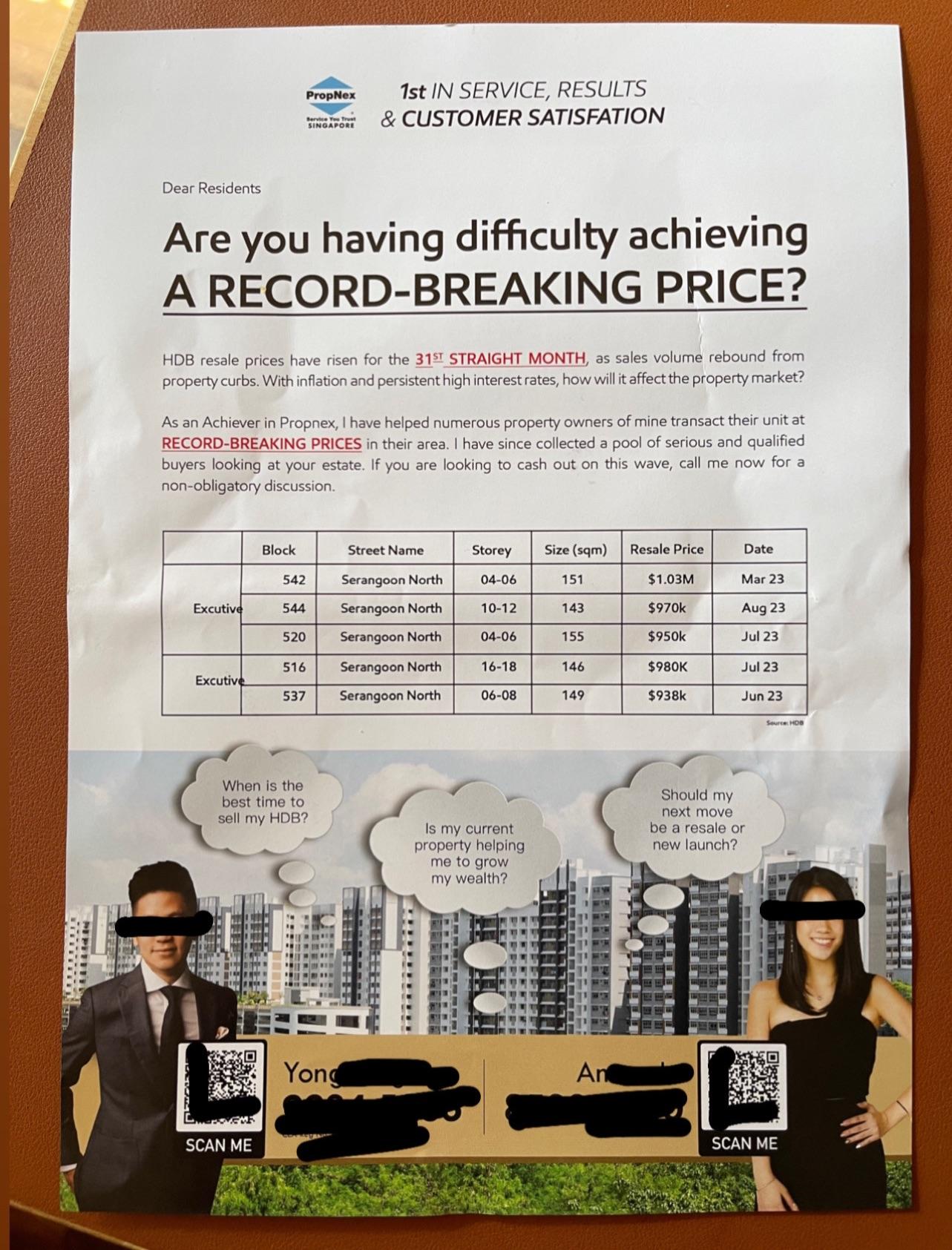

From what I saw on Reddit, some property agents’ flyers are also raising the heat:

Perhaps blatantly advertising your skills in raising home prices isn’t a great idea right now. I mean, if even HDB is putting out notices to assure the public flat prices are affordable, then what can I say? Read the room, am I right?

But here’s an interesting thing to notice: the flyer is directed at sellers, and not at all at buyers. In a way, the flyer itself explains why prices are so high. One of the quirks of property sales is that, unlike selling cars, insurance, etc., realtors need to source their own inventory. They not only need to find buyers, they need to have something to sell to said buyer.

(With the exception of those selling new launches; but there are other drawbacks to that which we won’t get into here; not least of which is potentially waiting nine months to get paid for your work.)

From this flyer, you can sort of see the issues we’ve been having the past few years: there’s a lack of supply. I know many agents who still have a long line of buyers right now. And for flats near the MRT or in a central area, well, you still see the headlines of million-dollar flats being bandied about.

The issue is that even now, few people are selling. Existing home owners look at prices of replacement homes, and decide they better just stay where they are. This means buyers – and indirectly the agents – have to resort to increasingly bold moves to convince someone to sell.

That leaves agents to tread a fine line: they need to incentivise someone to sell, but also avoid agitating a frustrated public. Maybe it’s best to just provide accurate information, and leave a potential seller to draw their own conclusions.

And do it online, because flyers are only good for shampoos, burgers, or anything where I can turn it in for a discount, okay?

(Ps. To any agent reading this, I’m not kidding. The point of using a flyer is so you can count the flyer coupons that get returned, and measure the effectiveness of your advertising. That’s why shampoo and fast food companies have flyers with coupons. But if you’re just stashing flyers in people’s front gates, that’s probably just a waste of money and will annoy someone. Stop it.)

Some Redditors also complained about some agents’ behaviour:

As one Reddit user pointed out:

“My estate was brand new. TOP was Dec 2014. Needless to say, all these property agents swarmed my estate like rats once Dec 2019 came (5 year MOP achieved).

At one point, one agent rang the doorbell at 10 pm. Just after my baby had fallen asleep after 2 hours of non-stop wailing. I answered the door with the crying baby. I told the agent, ‘You woke her up. YOU TAKE HER.’

The agent mumbled sorry and ran off.”

And another:

“Same. My place MOPed in the same year and it got so bad that I had to paste a sticker beside my door bell that it is only for deliveries; no property agents/insurance/door to door sales.

F****rs dont have the EQ to realise they shouldn’t be bothering people when its getting late at night. One did ring my bell despite the sign and when I asked if he can’t read, he asked me “Why don’t you want to make money.” Boy that got me riled up. Can’t a person just treat his BTO as his forever home FFS.”

(So those of you who sneer about the “real worth” of condo security, think about this for a second.)

More from Stacked

1,480 New Condos Sold In 1 Weekend: Why Are Singaporeans Rushing Despite “High” Prices?

If you haven’t heard the news, well, new launch fever has hit town. Emerald of Katong sold out 99 per…

This sort of behaviour is also another interesting indicator. Along with badly written ads and listings, and crappy photos of homes, it often suggests a booming property market.

When real estate prices are high, loads of newbies rush to get a license and sell a home. It’s perceived as easy money, and in some cases, agencies do get more aggressive in recruitment (they need more hands on deck after all.) But a painful side-effect of that is less professionalism, and more tactlessness.

When the real estate market is down, and only the lifelong veterans are still sticking about – that’s when you see better quality listings, and better quality realtors too.

Meanwhile, in other property news…

- Can you find a freehold landed home for $2 million or under? Yes you can! Look, it’s not Dempsey or anything as fanciful, but it does mean affordable low-density living. Check out these places.

- We would never make the same mistake of bragging about how high HDB prices can go. In like, each estate even. 😀 But seriously, you can also use the same list to look at where prices have risen the least.

- I talked to someone who took the plunge and bought a property abroad. Apparently, there are firms that come to Singapore to help. Here’s the story.

- Want a waterfront view with your flat? Check out these HDB projects.

Weekly Sales Roundup (18 September – 24 September)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| MIDTOWN MODERN | $5,827,000 | 1808 | $3,222 | 99 yrs (2019) |

| KLIMT CAIRNHILL | $5,720,000 | 1496 | $3,823 | FH |

| BOULEVARD 88 | $4,941,600 | 1313 | $3,763 | FH |

| LIV @ MB | $3,694,237 | 1518 | $2,434 | 99 yrs (2021) |

| PULLMAN RESIDENCES NEWTON | $3,653,440 | 1163 | $3,143 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE ARDEN | $1,179,000 | 753 | $1,565 | 99 yrs (1969) |

| PINETREE HILL | $1,267,000 | 538 | $2,354 | 99 yrs (2022) |

| LENTOR HILLS RESIDENCES | $1,315,000 | 603 | $2,182 | 99 yrs (2022) |

| ORCHARD SOPHIA | $1,352,000 | 474 | $2,855 | FH |

| THE MYST | $1,445,000 | 678 | $2,131 | 99 yrs (2023) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE CASCADIA | $7,260,000 | 4715 | $1,540 | FH |

| PEBBLE BAY | $5,150,000 | 2745 | $1,876 | 99 yrs (1994) |

| THE WATERSIDE | $4,728,000 | 2411 | $1,961 | FH |

| RIVERGATE | $4,150,000 | 1604 | $2,588 | FH |

| ORION | $3,935,000 | 1776 | $2,216 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SUITES @ PAYA LEBAR | $645,000 | 377 | $1,712 | FH |

| ISUITES @ PALM | $675,000 | 431 | $1,568 | 999 yrs (1878) |

| SUITES@CHANGI | $685,000 | 409 | $1,675 | FH |

| NESS | $695,000 | 463 | $1,502 | FH |

| THE GARDEN RESIDENCES | $800,000 | 452 | $1,770 | 99 yrs (2017) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| PEBBLE BAY | $5,150,000 | 2745 | $1,876 | $2,976,000 | 29 Years |

| CORONATION GROVE | $3,600,000 | 1916 | $1,879 | $2,100,000 | 17 Years |

| WILLYN VILLE | $2,850,000 | 1518 | $1,878 | $2,002,000 | 19 Years |

| NEWTON LODGE | $2,688,000 | 1658 | $1,622 | $1,897,300 | 25 Years |

| RIVERGATE | $4,150,000 | 1604 | $2,588 | $1,773,900 | 17 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| ORION | $3,935,000 | 1776 | $2,216 | -$1,426,000 | 16 Years |

| OUE TWIN PEAKS | $1,350,000 | 549 | $2,459 | -$246,767 | 7 Years |

| THE SAIL @ MARINA BAY | $1,185,000 | 667 | $1,776 | -$235,000 | 11 Years |

| THE VERVE | $820,000 | 614 | $1,336 | -$78,989 | 10 Years |

| ECO | $870,000 | 635 | $1,370 | $1,314 | 11 Years |

Transaction Breakdown

Some interesting links of the week:

– Here’s a thought, have you ever wondered if squiggly road lines would help with traffic?

Unlike a busy city like Singapore, smaller villages would find less need to have traffic lights to control traffic. Speed signs aren’t always effective, and speed bumps are also just an unpleasant driving experience.

Enter the next best idea – confusing squiggly road lines. It’s a crazy idea that was recently used in the french village of Bauné. Do you think such a scheme would work in our heartland areas?

– Insane new chatGPT updates

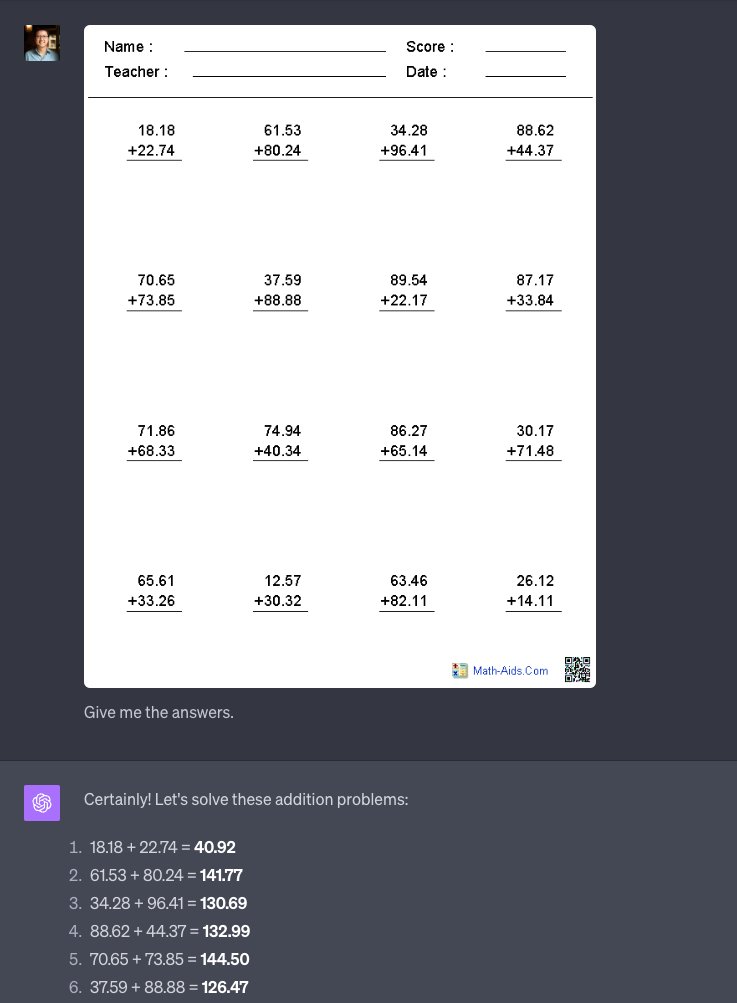

Okay, obviously this is tongue-in-cheek, but ChatGPT’s latest update (GPT-4 Vision) is amazing. You can now feed it photos and it can describe them, you can build software from just drawing it out, it can do logic reasoning based on the image, and maybe even better yet (for kid’s at least), you possibly never have to do homework again.

I’m definitely looking forward to what this will change in real estate again. There will be lots to unpack here soon, so stay tuned for the updates.

For more news on the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are property prices so high in Singapore right now?

What behaviors from real estate agents are mentioned as signs of a booming market?

Can you find affordable landed homes in Singapore today?

What are some issues with real estate advertising and agent conduct discussed in the article?

Are there any recent trends in property sales prices in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments