Are Foreigners Really The Major Cause Of The Rise Of Property Prices In Singapore?

September 20, 2022

Whenever private home prices start to soar in Singapore, there’s a tendency to look toward foreign buyers. We were, for instance, subject to a slew of news reports about Chinese buyers rushing into the Singapore market during Covid-19; and veterans of the property market will recall similar fears in the aftermath of 2008/9 Global Financial Crisis. But how much do foreigners really contribute to rising home prices today? Or is it mostly just finger-pointing?

The current private property market in Singapore

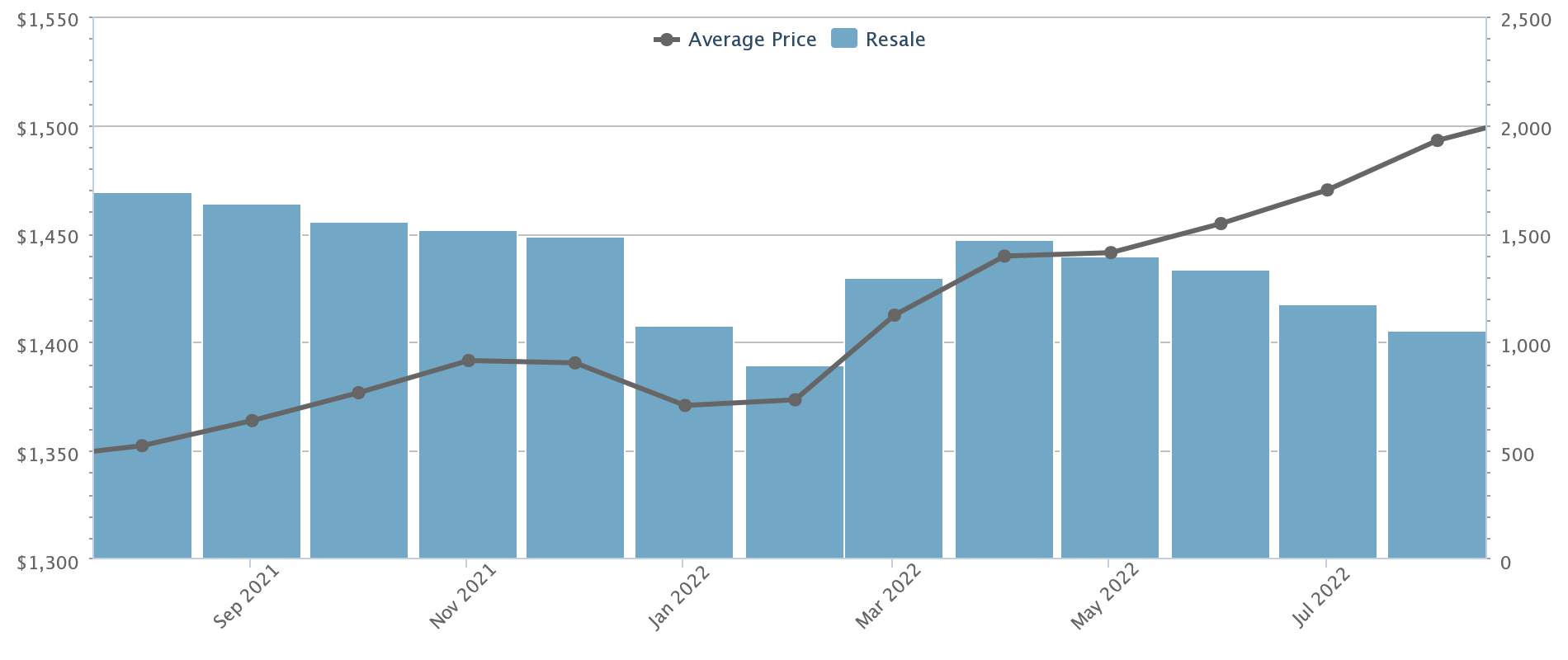

According to Square Foot Research, new launch prices averaged $2,518 psf as of end-August this year, up from $1,794 psf in August 2021.

Resale prices averaged $1,493 psf in end-august, also up from $1,352 psf in August last year.

As of Q2 this year, private home prices had risen around 3.2 per cent quarter-on-quarter. Overall, private home prices are now up around 18.6 per cent since the last trough in Q1 2020, which saw the start of the pandemic.

At the current pace of increase, most property firms are estimating a three to five per cent increase in home prices from last year, by end 2022.

These numbers are starting to raise alarm bells. As is, we’re seeing an increasing tendency for HDB upgraders (the bulk of current buyers) to be slowly priced out of new launch condos. Even launches in fringe regions, such as the recent AMO Residence and Lentor Modern, have family-sized units reaching a quantum of $2 million. That said, judging from the sales numbers from launch weekend (AMO Residence nearly sold out, and Lentor Modern sold 84%), some people may be confused at these mixed signals.

Property Market CommentaryAre HDB Upgraders Getting Priced Out Of New Launches In 2022?

by Ryan J. OngSo many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The proportion of foreign buyers has dropped since before Covid-19

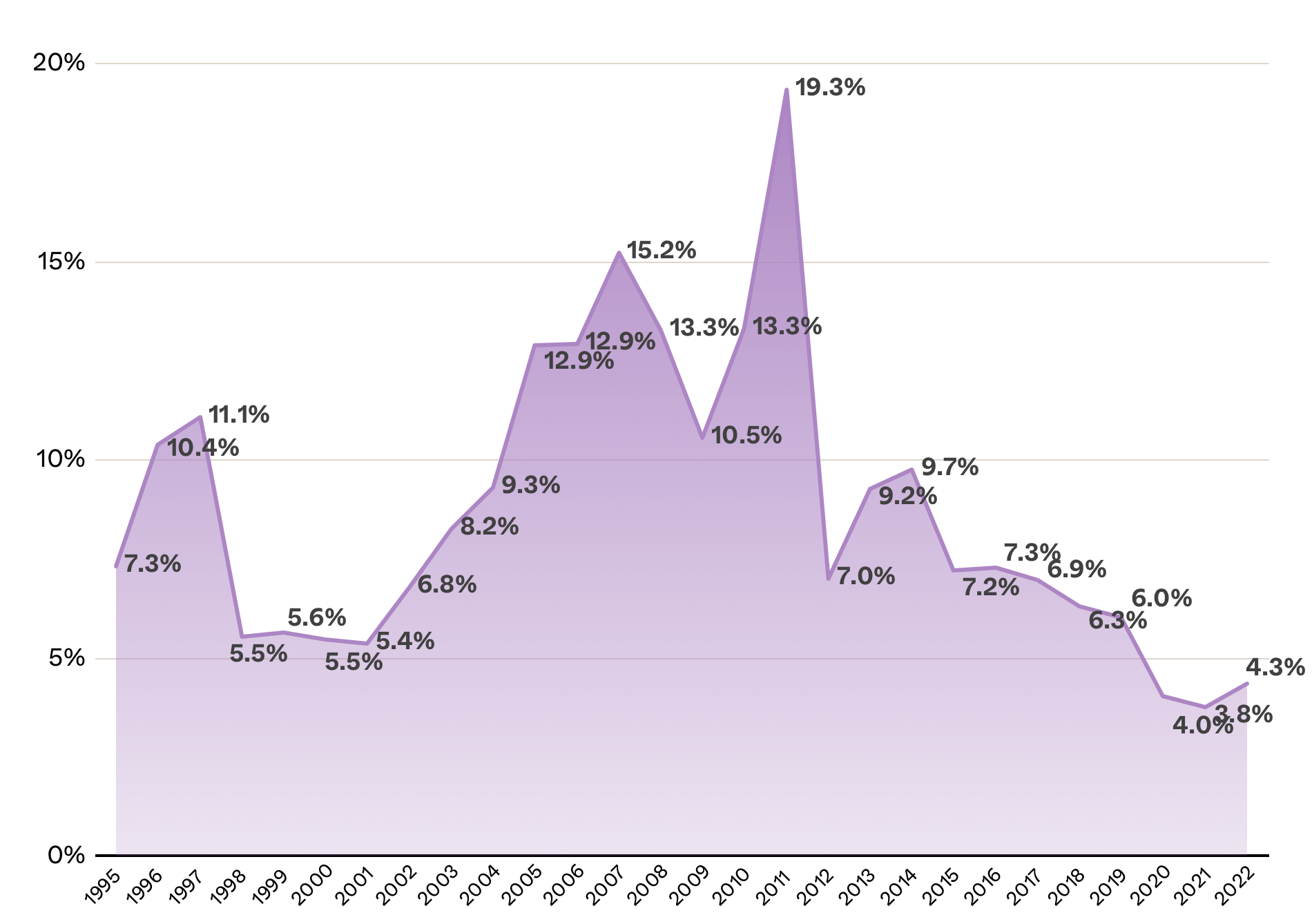

Despite word-on-the-ground discussion of foreign buyers “returning after Covid”, the figures don’t really support that.

In a recent Parliamentary response, Minister Desmond Lee noted that foreigners accounted for just around three per cent of private residential transactions, over the past two years. This is down from around five per cent, during the pre-pandemic years.

A recent report by the Straits Times provided a breakdown that shows a notable decline in foreign buyers:

| Singapore citizens | Permanent residents | Non-residents | Companies | Total | |

| 2019 | 15,495 (79.7%) | 2,852 (14.7%) | 1,017 (5.2%) | 78 (0.4%) | 19,442 |

| 2020 | 18,520 (82.2%) | 3,133 (13.9%) | 756 (3.4%) | 134 (0.6%) | 22,543 |

| 2021 | 30,958 (82.7%) | 5,147 (13.7%) | 1,135 (3%) | 193 (0.5%) | 37,433 |

| H1 2022 | 10,681 (80.2%) | 2,134 (16%) | 444 (3.3%) | 52 (0.4%) | 13,311 |

Table: STRAITS TIMES GRAPHICS Source: MINISTRY OF NATIONAL DEVELOPMENT

It would appear that the proportion of foreign buyers has not seen a huge resurgence, even after the height of Covid.

This is partly due to cooling measures in December last year. Additional Buyers Stamp Duty (ABSD) rose across the board – but foreign buyers were one of the most affected parties. The ABSD for foreign buyers of residential properties is now 30 per cent of the price or value, whichever is higher. This is a significant 10 per cent jump in the tax rate.

Just to put things into perspective, this means that on a $10 million property, ABSD rates will set you back another cool $3 million.

A realtor we spoke to, who deals often with foreign clients, pointed out that Singapore’s ABSD is now much higher than regional alternatives. She says that Australia’s foreign purchaser stamp duty is just eight per cent, whereas Hong Kong’s stamp duty for foreigners is 15 per cent.

More from Stacked

5 Lesser-Known Condos With Unique Duplex Units (From $2.08m)

For some people, the impact of a duplex, double-volume unit is worth the maintenance effort. Singapore homes are getting more…

She also noted that China’s recent real estate woes, while not directly pertinent to Singapore, could have long-term consequences:

“Chinese buyers make up the majority of our foreign buyers, and many major developers in Singapore are Chinese companies… now we have a generation who have seen their parents lose their roofs, who may be more suspicious of property as an investment asset.”

The impact of foreign buyers is mainly confined to the luxury segment

A common consensus, among most realtors we spoke to, is that foreign buyers do not impact the Singapore private property market on a large scale. Rather, foreign buyers tend to impact one specific segment, which are luxury or prime region properties.

Common examples were the sale of ultra-luxe Swire Eden, when the Tsai family purchased the entire development for $293 million, or the sale of a $20 million unit at The Nassim (the buyer was a Chinese national, who was not deterred by 30 per cent ABSD). This was followed by the recent bulk purchase of 20 units at CanningHill Piers for around $85 million.

Realtors felt that reports on these transactions could be conveying the wrong impression. One realtor said that:

“When they see the numbers are so big, the instinct is to jump and say these foreigners are so rich, they buy at any price, they are pricing locals out of the market; but for these buyers, you can count the number of transactions on one hand.

These buyers are also targeting ultraluxe properties; they are not the competing with Singaporeans to buy mass-market condos in the RCR, OCR. Even if tomorrow all these ultra-high net worth buyers disappear, Singaporeans will not suddenly see their condo prices drop.”

As a side note, the full privatisation of ECs may be looking less attractive, even if foreigners can buy

An Executive Condominium (EC) is fully privatised after its 10th year; at that point, units can be sold even to foreigners. However, even if we assume ECs will appeal to foreign buyers (they are not luxury properties), recent ABSD tweaks may have made privatisation a moot point.

The main difference after privatisation is that foreigners and companies, including developers, can buy the EC.

But if you check out the ABSD rate hikes, these are the exact three categories of buyers (foreigners, entities, and developers) who now face the highest stamp duties.

As such, there’s a good chance for profit if you sell an EC after its five-year MOP (as subsequent buyers aren’t tied down by MOP). But we’re no longer certain how advantageous things can get after full privatisation – not at the rate foreigners and entities are being penalised.

The cause of rising home prices is more likely to be limited supply, and inflation in construction costs

One realtor noted that Singapore home prices have continued to soar, despite fewer foreign buyers being in the market today (see above). This alone should make us question theories of foreigners driving up prices.

The biggest impact on home prices is likely to be limited supply, increasing demand from homebuyers, coupled with rising costs faced by developers. The potential for an energy crisis come winter in Europe, or imported inflation, bear closer watching than the small handful of foreign investors.

For more news as it unfolds, follow us on Stacked. We’ll also provide you with in-depth reviews of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Do foreign buyers significantly influence property prices in Singapore?

Has the number of foreign property buyers in Singapore increased after Covid-19?

How do government measures affect foreign property buyers in Singapore?

Are foreign buyers mainly purchasing luxury properties in Singapore?

What factors are driving Singapore's property prices if not foreign buyers?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

2 Comments

Who knows if it is true but foreigners make for the easiest whipping boys!

If you look at the numbers, you can see that for 2022, the rate of increase from PR and Foreigners are rising faster than locals. Stats can be presented in many ways to get different ideas across. Unless there is data to show the actual transaction prices between foreigners and locals, it will be hard to determine if foreigners are indeed having a sizable impact to property prices here.