A Worrying New Property Scam May Be Coming To Singapore…

July 7, 2024

There’s a pessimistic saying that criminals are faster at adopting tech than governments.

I like to believe that’s not true, but my experience so far has taught me otherwise. Case in point: someone at Stacked recently had a family member targeted by a scam call. The voice at the end of the line sounded exactly like them, and the scammer only put down the phone when the family member answered in Chinese. But the call came from a landline, and the voice was close enough to fool a family member.

There are AI tools that clone and generate voices in minutes today; and as the tech improves, AI also gets better at imitating speech patterns. You can, for instance, get ChatGPT to write a message as if they were a certain celebrity, politician, historical figure, etc. It’s still not very convincing yet, but it gets better all the time – and it’s clear it can be done.

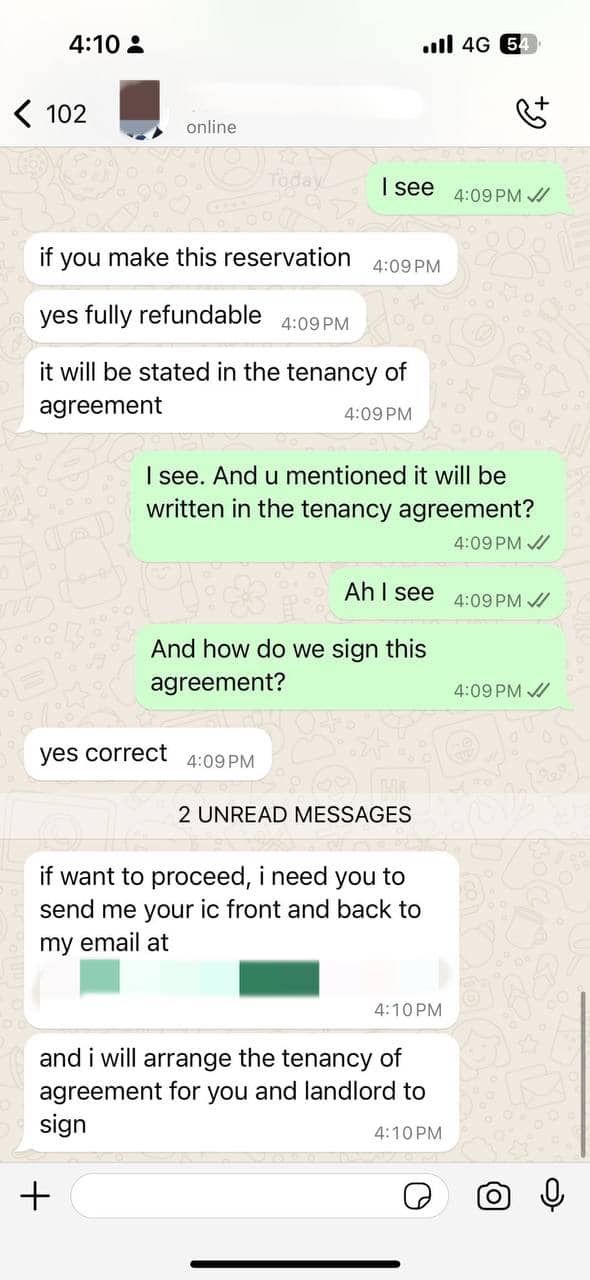

In light of this, it’s only a matter of time before some enterprising crook decides to use this in the property market. Imagine a call that perfectly mimics your property agent’s voice and speech patterns; or even worse, one that mimics your conveyancing lawyer. This goes way beyond the simple security measure of “check the CEA database for their license number.”

But while some scam artists are probably already thinking of this, our regulatory bodies aren’t doing much to pre-empt it. The hard reality is that, more often than not, the authorities have been reactive and in a position of playing catch-up (that’s not a criticism directed at Singaporean authorities by the way, as it’s true the world over).

Just like how we have been talking about implementing a solution for fake property listings, where there would be a unique serial number for each listing. This was last talked about in 2021, and since then – it’s been a strangely long period of silence.

This is particularly worrying in the context of real estate, given the larger sums involved and the sensitivity of the transaction process.

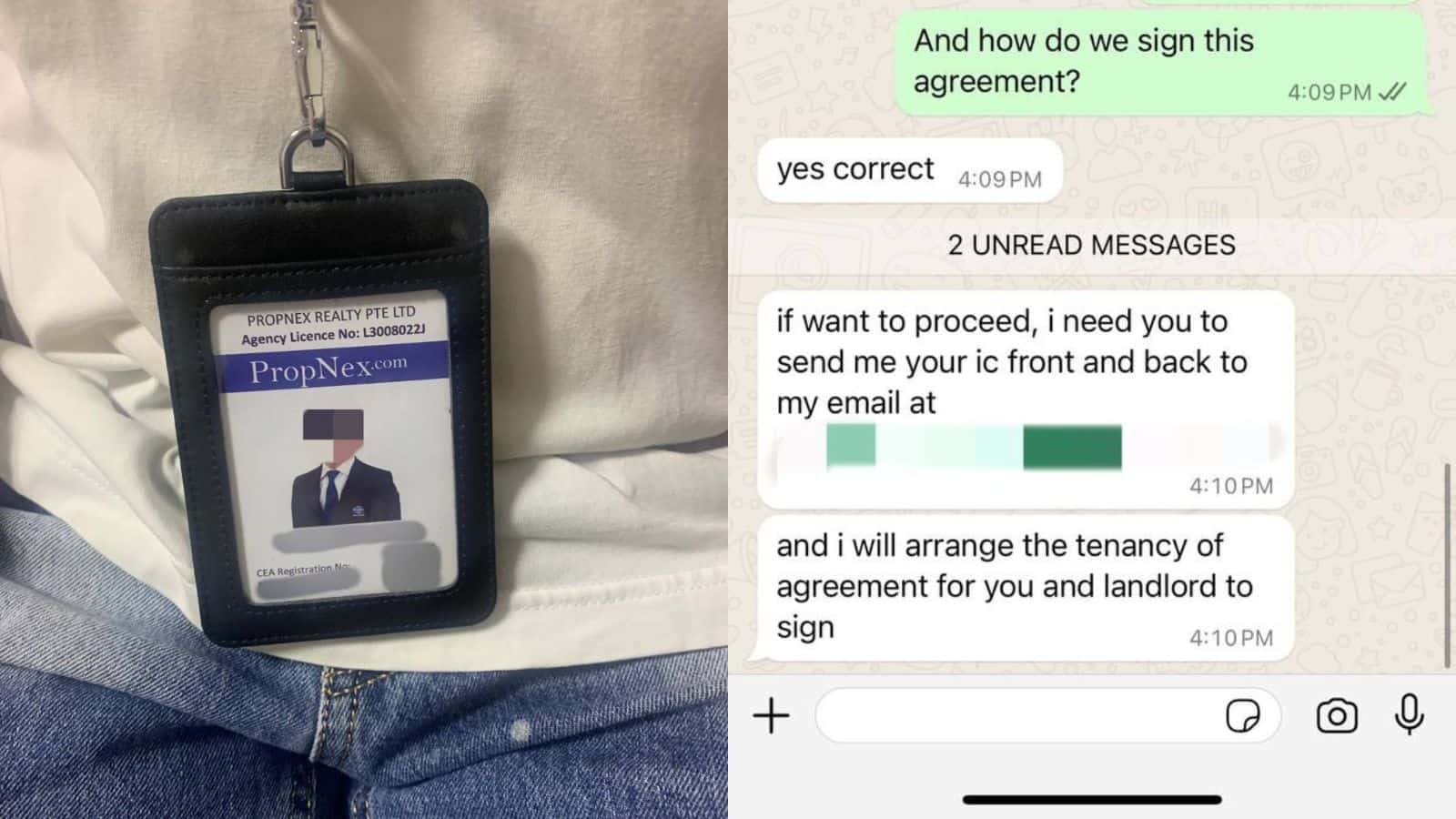

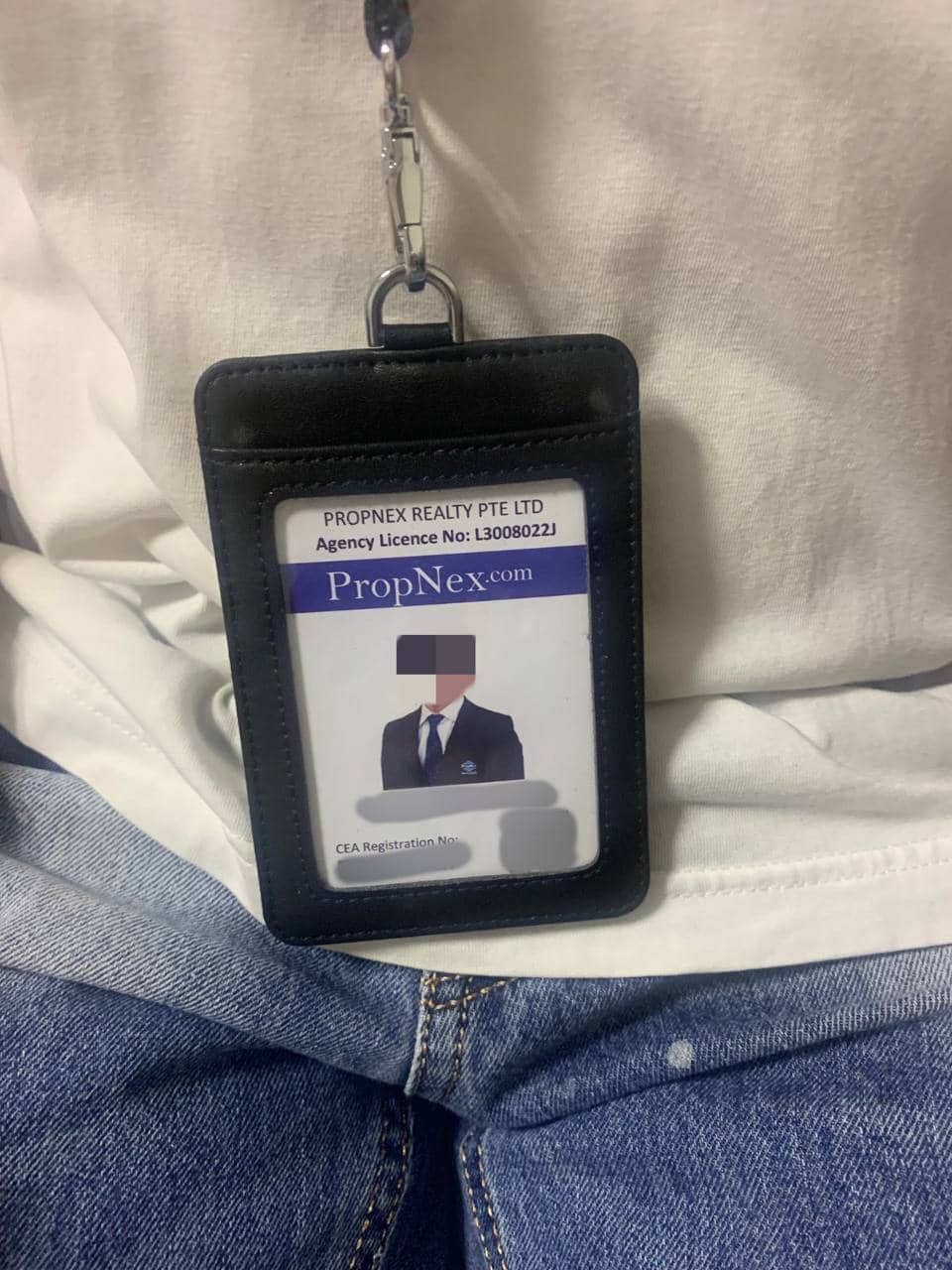

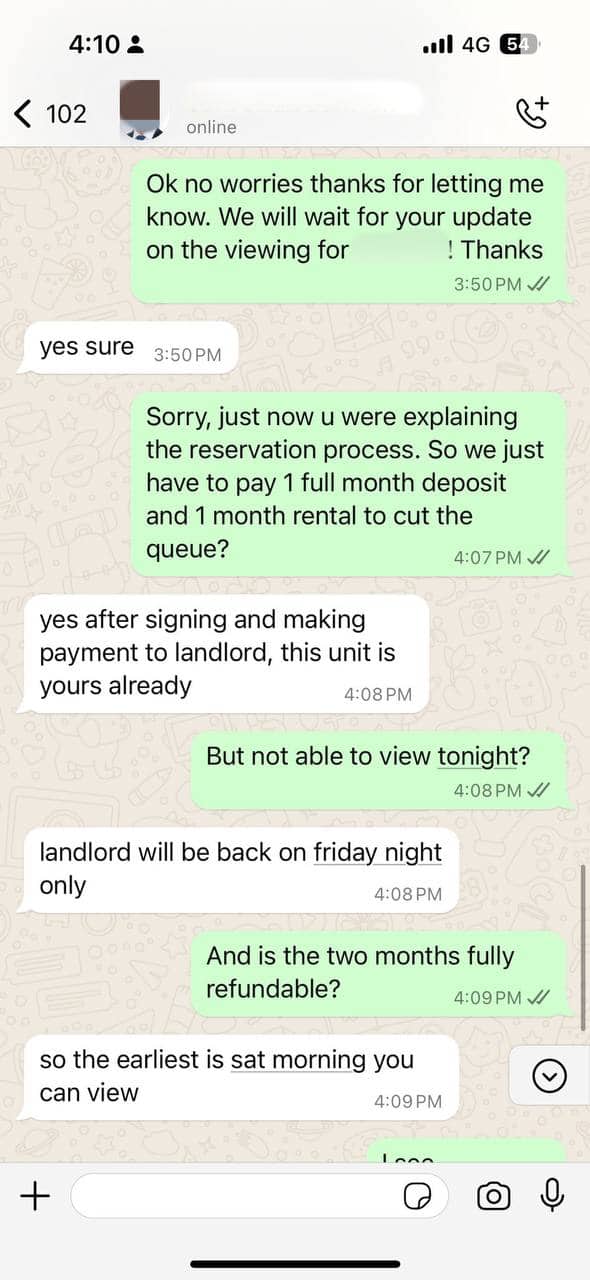

As an added cautionary message, don’t just look at a property agent’s lanyard

This has recently come to our attention: a friend of a staff member, who was a property agent, spotted his lanyard being used. This was complete with his picture, CEA number, and the QR code. But he isn’t even in Singapore anymore, and he hasn’t been practising in the real estate industry.

Nonetheless, several potential scam victims were quite far in their conversation with him, before action was taken. So let that be a warning – follow through and scan the QR code, check the license registry, etc. Don’t be fooled by a convincing-looking lanyard.

In other news, I was recently addressed about what I said regarding a “deluge of HDB flats”

I’ve mentioned in a few articles that we can’t go overboard with building flats, which runs contrary to the current sentiment. Most people would like to see more supply and prices go down, which I empathise with.

But Singapore is ageing, and a time will come when the previous generation leaves behind their flats. Given that we can’t own multiple HDB flats, and foreigners can’t buy them, we may be facing an eventual supply overhang (unless, of course, the white paper for a 6 million+ population slows this a bit).

While I have no doubt the government has plans for this – perhaps repurposing land or having some other way to absorb the excess flats – it does demonstrate the close parallels between housing policies, and our birth rates.

More from Stacked

Oversupply of housing in Singapore – Should you be worried?

As early as last year in December 2017, there were warnings of a possible oversupply of housing in Singapore from…

With fewer Singaporeans inheriting flats, it might not make sense to maintain the heightened pace of construction from episodic events, such as the post-Covid shortage. It’s also likely that we’ll need to review the mix of flat sizes and layouts at some point: there may, for instance, come a day when 2 or 3-room flats become more ubiquitous than 4-room flats; that might make sense if we’re seeing more singles without children.

The most overlooked factor, however, is how much family-oriented housing (or the lack thereof) changes entire neighbourhoods. We have seen, for instance, the rise of dementia-friendly towns in Singapore such as Woodlands and Kebun Baru (see here for more details).

But as the population ages and the birth rate declines, we may start to see fewer playgrounds, less in the way of outdoor-oriented areas (even exercise stations need to change), and consolidation of schools. This may also affect the viability of businesses such as childcare centres, tuition centres, etc. The immediate relevance of this is that buyers do need to care about the demographic of their HDB town.

Consider if you’re in your mid-twenties or thirties, and buy a flat in a town where most people are over 50: chances are, the amenities are going to be less helpful over the next decade.

(The flipside is also true: if you’re elderly, a town for the young – packed with childcare centres or basketball courts – may not be as accommodating for you).

So while some people handwave the notion of predominantly “young” or “old” neighbourhoods, I think it bears some thinking about; and I do think it’s going to be a bigger and bigger factor in our housing policy and urban planning, as the years move on.

Meanwhile in other property news:

- The October BTO launch is not only huge, it’s got a lot of first-time differences. Check out what’s going to happen.

- Looking for gigantic 2,000+ sq. ft. freehold condos? AND in peaceful areas to boot? Here’s where to begin your search.

- A Singaporean living in France tells us the key things to consider, when buying a property abroad.

- How do you choose the best BTO flat? It’s a big question, but here are some of the main pointers to consider before you pick.

Weekly Sales Roundup (24 June – 30 June)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| MIDTOWN MODERN | $6,688,000 | 1808 | $3,698 | 99 yrs (2019) |

| KLIMT CAIRNHILL | $5,530,000 | 1432 | $3,863 | FH |

| BOULEVARD 88 | $5,400,000 | 1313 | $4,112 | FH |

| WATTEN HOUSE | $4,976,000 | 1539 | $3,233 | FH |

| SCENECA RESIDENCE | $4,900,000 | 2400 | $2,041 | 99 yrs (2021) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| HILLOCK GREEN | $1,276,000 | 517 | $2,470 | 99 yrs (2022) |

| THE LAKEGARDEN RESIDENCES | $1,558,200 | 732 | $2,129 | 99 yrs (2023) |

| HILLHAVEN | $1,715,012 | 797 | $2,153 | 99 yrs (2023) |

| THE CONTINUUM | $1,795,000 | 667 | $2,690 | FH |

| PINETREE HILL | $1,796,000 | 764 | $2,350 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| YONG AN PARK | $6,900,000 | 3111 | $2,218 | FH |

| LEONIE TOWERS | $6,400,000 | 3251 | $1,969 | FH |

| PATERSON SUITES | $4,900,000 | 1679 | $2,918 | FH |

| ORCHARD SCOTTS | $4,000,000 | 2336 | $1,712 | 99 yrs (2001) |

| THE INTERLACE | $3,674,000 | 3875 | $948 | 99 yrs (2009) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CARDIFF RESIDENCE | $710,000 | 420 | $1,691 | 99 yrs (2011) |

| PALM ISLES | $717,000 | 517 | $1,388 | 99 yrs (2011) |

| SUITES@ KATONG | $725,000 | 431 | $1,684 | FH |

| # 1 LOFT | $750,000 | 549 | $1,366 | FH |

| KINGSFORD HILLVIEW PEAK | $760,000 | 517 | $1,471 | 99 yrs (2012) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| LEONIE TOWERS | $6,400,000 | 3251 | $1,969 | $2,650,000 | 17 Years |

| MIRAGE TOWER | $3,400,000 | 1496 | $2,272 | $1,900,000 | 15 Years |

| THOMSON 800 | $2,720,000 | 1410 | $1,929 | $1,813,000 | 18 Years |

| THE CALROSE | $2,428,000 | 1238 | $1,961 | $1,460,000 | 16 Years |

| MAPLE WOODS | $3,200,000 | 1496 | $2,139 | $1,410,000 | 14 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| ONE SHENTON | $1,950,000 | 1098 | $1,776 | -$338,650 | 17 Years |

| UP@ROBERTSON QUAY | $1,175,000 | 527 | $2,228 | -$323,000 | 12 Years |

| LINCOLN SUITES | $1,168,000 | 463 | $2,523 | -$127,000 | 11 Years |

| ICON | $1,035,000 | 570 | $1,814 | -$65,000 | 11 Years |

| REFLECTIONS AT KEPPEL BAY | $2,200,000 | 1378 | $1,597 | -$48,200 | 17 Years |

Transaction Breakdown

For the lowdown on the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the new scam risk related to property agents in Singapore?

How could AI technology increase property scam risks in Singapore?

What measures are being discussed to prevent fake property listings in Singapore?

Why should buyers consider the demographic of HDB towns before purchasing?

What are the potential future challenges for Singapore’s housing market due to demographic changes?

What should I check to avoid falling for a property scam involving a fake property agent?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Why The Feb 2026 BTO Launch Saw Muted Demand — Except In One Town

Singapore Property News One Of The Last Riverfront Condos In River Valley Is Launching — From $2,877 PSF

Singapore Property News When A “Common” Property Strategy Becomes A $180K Problem

Singapore Property News Tanjong Rhu’s First GLS In 28 Years Just Sold For $709M — Here’s What The Next Condo May Launch At

Latest Posts

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Pro This Singapore Condo Skipped 1-Bedders And Focused On Space — Here’s What Happened 8 Years Later

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

0 Comments