A Landed Home For Just $750K? It’s Possible, But There’s A Catch. We Tour Fuyong Estate To Find Out.

June 12, 2022

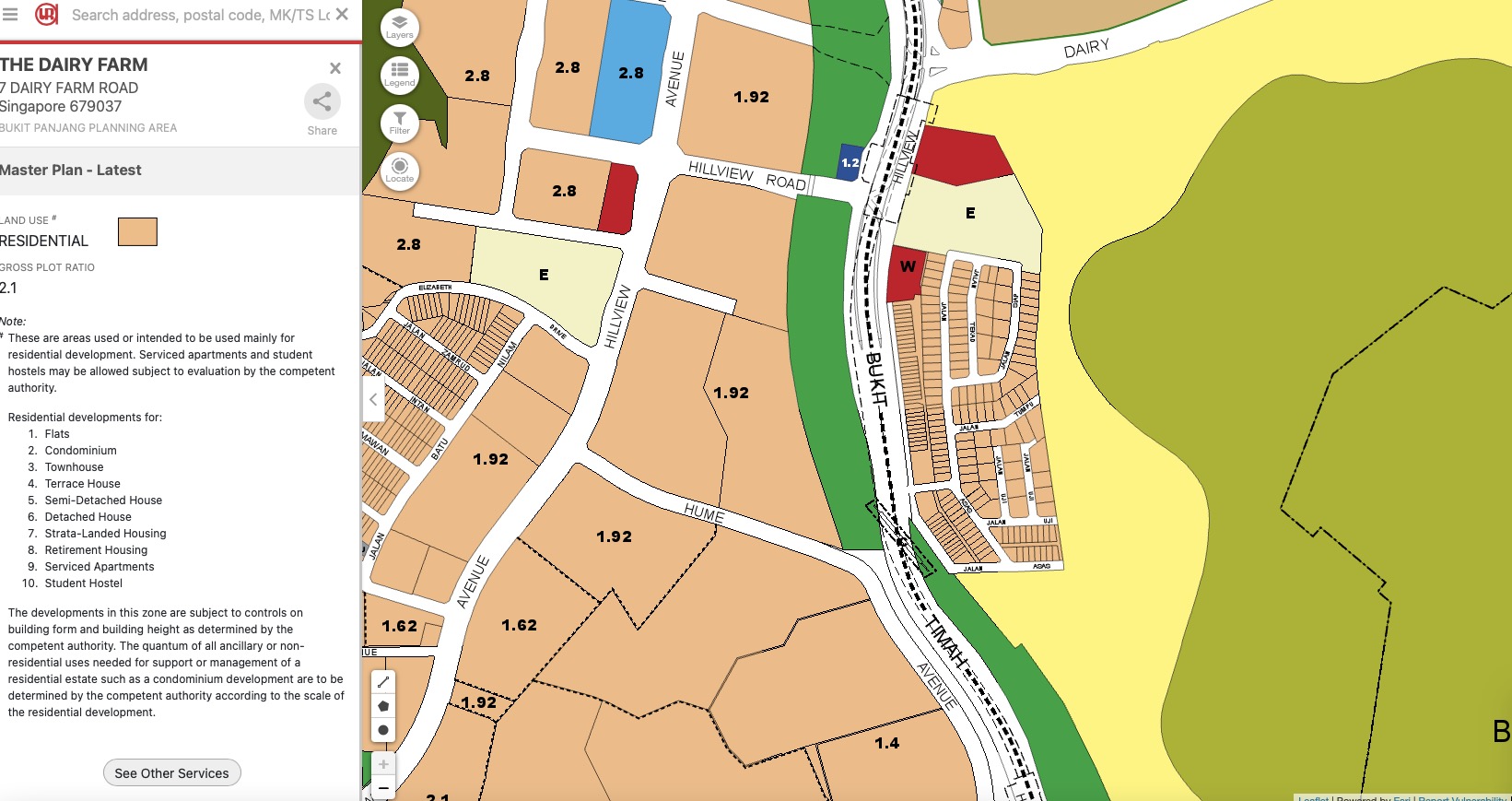

Today’s landed estate tour is probably going to be our most controversial ever. Fuyong Estate is a collection of terrace houses, semi-Ds, and detached houses that is just a stone’s throw from Rail Mall. But here’s where it gets intriguing.

While 99-year leasehold landed properties definitely aren’t the most popular properties in Singapore, what’s really interesting here is that Fuyong Estate only has 24-years left on its lease till it expires on 18 March 2046. However, for every type of property, there is a buyer, however few and far between he or she is. Given how niche the audience for Fuyong Estate is, there haven’t been many in-depth articles on it, so today’s tour will, I hope, be useful to that group of buyers. Moreover, it may also provide a little insight into the future of newer 99-year leasehold houses as their leases start to run down!

Who would buy such a property???

You may be thinking: why would anyone in their right mind buy a property that has only 24 years left on the lease?! Indeed, if you’re thinking of buying property for asset appreciation or for creating a family home to pass down to the next generation, Fuyong Estate may not make much, if any, sense. However, there are other reasons that I can think of that this could make sense.

Instead of thinking of buying a property at Fuyong Estate as buying an asset to be re-sold for a profit later on or to be passed down to your descendants (if any), if you re-frame the purchase as signing a long-term “rental” agreement for 24 years then you could see how, at a low enough price point (i.e. where the sum you pay is less than the net present value of what you would pay in rent + expenses to maintain the house), a property at Fuyong Estate would become attractive.

If you are interested in the rent, the rental for houses in the estate averages around $2,000-$3,000, although there were 1 or 2 outlier rental transactions at $4,000-$4,500. I spoke to an agent for one of the houses there and she says she’s received offers around $8,000 for a detached house (but they’re not that high in the records though).

For example, an older retiree who just wants to enjoy the luxury of space and gardening for the rest of one’s life. Or even someone middle-aged who would want to live there till the lease expires and then down-size to a smaller & more manageable property in later years. (Keep in mind that he or she would need to have enough capital on hand to buy or rent somewhere else after the lease at Fuyong expires, as based on the precedent of the 191 60-year houses at Geylang which returned to the State in 2020, no compensation will be given when the lease expires.)

When I walked around Fuyong Estate, there were several houses that wouldn’t have looked amiss in a GCB enclave such as King Albert Park, Chestnut Avenue, or Holland. Some of the houses at Fuyong Estate had swimming pools, others had huge rooftop terraces with 100% unblocked views, etc. So basically, it could be possible to spend a fraction of the amount but live in almost GCB style here. (I say “could be” as the occupants of the “GCB-like” houses may not be too keen on selling, as they won’t be able to have the same standard of living elsewhere, for the price that they can get for their properties.)

Another group of investors is those looking at the rental income that these houses can generate. This is probably a strategy that makes more sense for those who are quite property investment-savvy as it could go very wrong for the less well-informed. Again, such a purchase would only make (financial) sense if the net present value (NPV) of the rental income exceeds the purchase price + any other expenses associated with the property, such as property tax, maintenance costs, etc. (If you’re not familiar with NPV, here is a great introduction by Harvard Business Review.)

Case-in-point, in 2022 alone, there were already 3 sales at the time of writing, so you can see that these properties do appeal to some:

| Sale Date | Transacted Price ($) | Area (SQFT) | Unit Price ($ PSF) | Sale Date | Property Type | Tenure |

| 05 Jan 2022 | $1,688,888 | 5,371 | $314 | 05 Jan 2022 | Detached House | 99 yrs from 18/03/1947 |

| 13 Jan 2022 | $760,000 | 2,597 | $293 | 13 Jan 2022 | Semi-Detached House | 99 yrs from 18/03/1947 |

| 14 Mar 2022 | $750,000 | 2,781 | $270 | 14 Mar 2022 | Semi-Detached House | 99 yrs from 18/03/1947 |

- A semi-D sold in March 2022 for $750,000

- Another semi-D sold in January 2022 for $760,000

- A detached house sold in January for $1.688888 million (According to the agent, this was purchased by a 3-generation family who wanted somewhere big enough to house all their family members. )

In fact, when I was researching past purchases and sales at Fuyong Estate, there were actually quite a few people who’d made very nice profits here. Here are just 2 examples based on the sales data:

- 11 Jalan Siap was purchased in 2006 for $445,000 then sold in 2007 for $500,000 (i.e. over 10% profit in 1 year), then re-sold in 2011 for $1.35 million (i.e. over 200% profit in 4 years!)

- Similarly, 16 Jalan Siap was bought in 2007 for $570,000 and then sold in 2011 for a whopping $3.58million – almost 7x the purchase price!!

Having said that, there were obviously other people who made losses. Moreover, the profitable sales occurred when the remaining lease was significantly longer than 24 years, as well as when the property prices were much lower. (The higher the purchase price, the smaller the pool of buyers that can afford the property.) I’d be gobsmacked… extremely impressed if anyone manages this feat buying a property at Fuyong Estate today, especially given how some of the asking prices at the time of writing were asking for 50% more than the last (2022) transacted PSFs!

Financing

Now that we’ve gotten why a property at Fuyong Estate could be appealing to a certain group of buyers, let’s get the most important thing out of the way: money! Note that with only 24 years left on its lease, interested buyers will have to pay in cash and won’t be able to use their CPF. So our pool of viable buyers has now reduced even further. Not only must it be someone who is willing to accept a short lease, but he or she must also have a significant amount of cash on hand.

Now that we’ve got the questions about financing out of the way, let’s proceed with our tour of the area!

Amenities

One of the most attractive things about Fuyong Estate is its proximity to Rail Mall, a small and quaint row of shops that nonetheless has enough to keep residents very happy. You can get hawker food (Let’s Eat (mainly noodles), Springleaf Prata, New Teck Kee Chicken Rice, and Nam Kee Pau), groceries (Cold Storage), coffee shops (Coffee Bean and Toast Box), a dental clinic, an enrichment centre, a doctor, beauty salon eyeshot and even a specialty Japanese store as shown in the photo above. I’ve even seen movie nights under the stars organised on the Rail Mall Facebook group!

If you turn left yet again, there is a staircase leading up towards the Jalan Uji side of Fuyong Estate.

After turning around, such that the stairs and shops are behind me, you can see a smoke-free park, as shown above. From what I could gather on the Fuyong Group Facebook group, this seems to be a rather recent investment by the government.

On the left of the park are both the shops of Rail Mall (I think they’re the ones with the orange pitched roofs on the left of the above photo) as well as the houses of Fuyong Estate (the taller row of buildings on the right – you can see it’s separated from the shophouses by only a small alley.)

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A 5-Room HDB In Sengkang Just Sold For A Record $1.06M – Here’s How Much The Owners Could Have Made

A 5-room Premium Apartment at Block 217A Compassvale Drive just transacted for $1.062 million in November 2025, setting a new…

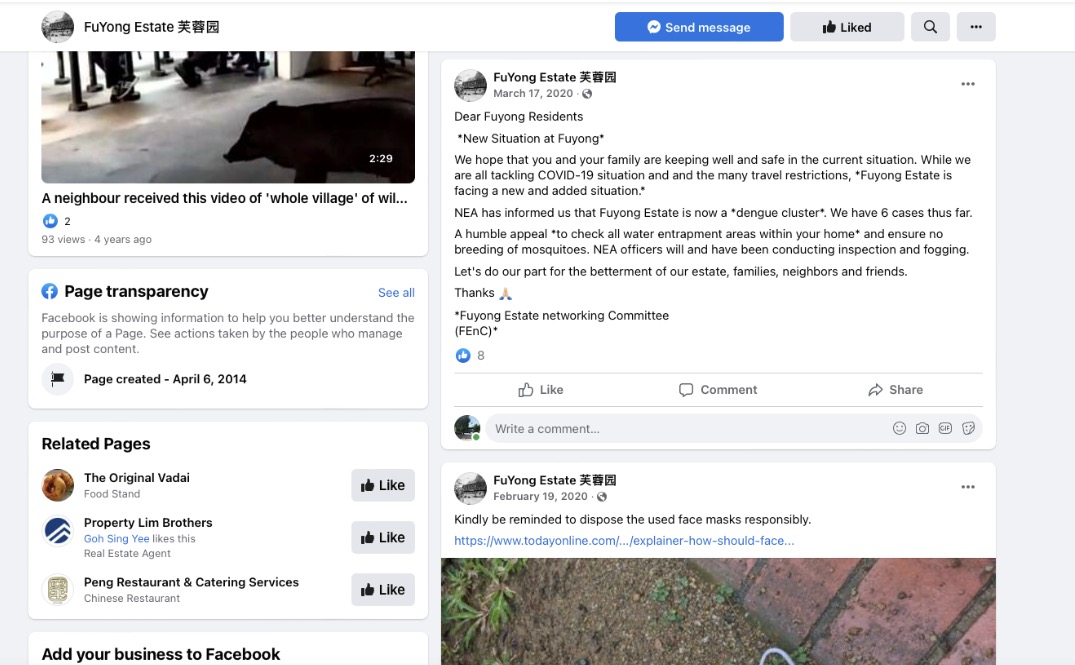

According to the agents I’ve spoken to, the land’s been empty for over a year now and as the asking price is over $1 million, I’m not sure when it will sell. Which leads me to wonder about stagnant water and the possibility of dengue?

It’s really nice that the community here is strong enough to have a communal Facebook group, although from what I saw of the page (and I browsed quite a few pages) only a few people (under 5) are actually active on it.

Sidetrack since we’re on the note of community: judging from what I saw on the Facebook group, the residents appear pretty close and they have annual street parties! (Or at least they did pre-COVID. A resident I met when doing my tour did tell me that they are trying to see if they can organise something for 2022.) In fact, the residents even got together and published a book on the history of the Estate!

There is also a sculpture by a resident of the estate, Mr. Oh Chai Hoo, in commemoration of SG50 (i.e. in 2015) in the interim park! The sculpture is shaped like the Chinese character for “ren” or “human” to represent the estate’s Kampung spirit which did come across during my walkabout of the estate (and was also mentioned by the residents I spoke to.)

Anyway, back to the tour. Standing almost at the end of the road, looking back down in the direction of Rail Mall- you can see how some of the houses have been redeveloped into more modern and higher structures. When we were touring, I saw a couple of residents lepak-ing on the roof terraces of these newer buildings, looking very comfortable indeed!

Perhaps because of the “kampung spirit” mentioned, the residents here are very cooperative when it comes to parking. They all parked on one side of the road, making it easy for cars to pass through and exit/ enter their residences.

Moreover, regardless of which road you live on, it’s very easy to get down to the main road as there are staircases that serve as shortcuts (so you don’t have to walk the entire length of the road to get down.)

Standing at the entrance to the estate, looking out onto Rail Mall and the main road, we’ve now come to the end of the tour of our estate. One thing to note here is that there’s a bit of a blind spot when you turn into the estate, so you’ll need to drive a bit more carefully. However, there are mirrors that help to show you any on-coming traffic that may be blocked by parked vehicles.

What does the future hold for Fuyong Estate?

I’m, alas, not a fortune teller, so I can’t say for sure. However, it always helps to look at history to see what the precedent was if you want to predict what’s going to happen next.

Fuyong Estate will actually be the 4th leasehold landed enclave whose lease has expired in Singapore. To date, the 1st and only “expired” landed leasehold property is Geylang Lorong 3, which was returned to the government on 31 Dec 2020. (The next 2 will be Jalan Chempaka Kuning and Jalan Chempaka Pith in 2034.)

If we look at what happened at Geylang: by 2017, 3 years before the lease ended, according to an article in Today, only 33 of the houses were owner-occupied, with another 143 (75%) occupied by foreign workers (i.e. dormitories) and 31 by places of worship. This led to “illegal dumping… and general cleanliness issues” such that government agencies received over 400 letters of such complaints between 2010-2017, which obviously had a major negative impact on residents’ quality of life. (Another article I read about the Geylang houses said that the pest issue became so bad, that the residents needed to put up barricades to keep the rats out!)

A resident of Geylang mentioned that these changes occurred when people started moving out en-masse about 20 years before 2017, i.e. around 23 years before the lease expired, which is where Fuyong Estate currently is in its “lifetime”. (Like Fuyong, the Geylang estate also had a community with an “association”. However, even the head of the Geylang association left about 8 years before the lease expired!)

So, if you’re thinking of buying a house at Fuyong Estate (or any other old leasehold landed area) to enjoy your retirement years, you may want to check out your neighbours and the condition of their properties first. Whilst not everyone may be forthcoming with their selling plans, if they’ve recently spent major $$ upgrading their house, or just moved in – chances are they probably aren’t going to sell that soon.

Now I’m not saying that what happened at Geylang would happen here but the possibility of a similar outcome at Fuyong is certainly something I think potential buyers would want to be aware of. (Even if you’re buying the houses to rent out, I’m guessing that rat and rubbish problems would probably drive down rental prices rather than increase them, so that would have an impact on how much you feel a property here is worth.)

Note: One thing to highlight is that the houses at Geylang were all terraces (i.e. cheaper) whilst Fuyong also has semi-Ds and detached houses, so it may not make economic sense for people to buy them and turn them into foreigner worker dormitories or places of worship.

We’ve now come to the end of our tour of Fuyong Estate and for those who hate leasehold landed properties, rest assured, next week we’ll be touring an area that is freehold! For others who have enjoyed this snapshot into old Singapore, here are some fun facts about the estate:

History of Fuyong Estate

Fu Yong Estate was developed by Lee Kong Chian (think OCBC bank) in the 1950s. These 142 houses were built as low-cost housing and the estate is said to be named after Lee Kong Chian’s hometown in China. I saw a YouTube video that said that Lee Kong Chian actually sold the houses at a cost price but I was unable to find a source to back this up online. If you want to find out more about Fuyong, read this post by one of the earlier residents who lived here back in a time when there were still night soil carriers in Singapore!)

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why would someone buy a property in Fuyong Estate with only 24 years left on the lease?

What are the potential benefits of living in Fuyong Estate?

Is investing in Fuyong Estate a good idea for rental income?

What are the challenges of buying property in Fuyong Estate?

What amenities are available near Fuyong Estate?

TJ

TJ's interest in property was sparked after returning from the UK- where balconies are not counted in one's square footage!- and finding that the Singapore property had totally changed in the 7 years she was away. When not reading and watching articles & videos about property, she is busy cooking and baking for friends, family & her blog GreedygirlgourmetNeed help with a property decision?

Speak to our team →Read next from Landed Home Tours

Landed Home Tours Why Singaporean Families Are Looking At This Landed Enclave From Around $4M

Landed Home Tours We Toured A Quiet Freehold Landed Area Near Reputable Schools — Where Owners Rarely Sell

Landed Home Tours We Toured a Freehold Landed Area Buyers Overlook — It’s Cheaper (and Surprisingly Convenient) From $3.2M

Landed Home Tours Inside One of Orchard’s Rarest Freehold Enclaves: Conserved Homes You Can Still Buy From $6.8M

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

3 Comments

Hey TJ thanks for this article. It completely changed our life plan. My other half and I both read it and thought it made complete sense for us. So next week we will own a house at Jalan Asas which needs LOADS of work and hopefully we will shortly sell our current house.

Going to be an interesting next 24 years all because of your article.

Is it not possible for either the existing owner or a potential buyer to apply to the SLA for a lease extension/renewal and pay the necessary price for that?

Fascinating deep-dive into Fuyong Estate! The $750 K landed homes are eye-catching—but the 99-year lease nearing 2046 really is the catch. Still, for buyers chasing space near Rail Mall and Hillview MRT with minimal resale expectations, this niche offer could make sense. Thanks for shedding light on this trade-off!