A Jadescape Condo Owner Just Made A Record $1.1m In Profit: Why Is This Mega Condo Raking In The Big Bucks?

November 18, 2023

If you’re tracking the latest trends in Singapore’s property market, you’ll find the recent sale at Jadescape particularly noteworthy. A unit at the development has just notched a profit of $1.122 million, a figure that stands out despite it being in the mass market segment. To put this into perspective, there was a $1.169 million profit at Seaside Residences in September 2023, but that property arguably falls into a more premium category, given its desirable sea views in the East.

Now, focusing on the Jadescape transaction, we’re looking at a 2,099 square foot unit. Purchased for $1,633 psf and sold in October 2023 for $2,168 psf, the selling price of $4.55 million makes it the priciest unit the development has seen to date. For a new development in the Rest of Central Region (RCR), such a hefty profit margin is quite exceptional, as it’s quite rare for profits to exceed the million-dollar mark. According to data available from URA, only around 0.88% of transactions exceed $1 million in profits since 2013.

Digging deeper, a look at the average profits at Jadescape reveals an interesting trend. Sellers here have generally fared better than their counterparts in other competing mega launches from around the same period in 2018.

| Average Profit (First sale till November 2023) | |||

| Project | $ Gain | % Gain | Holding Period (Years) |

| JADESCAPE | $334,661 | 22.37% | 3.7 |

| 1 Bedroom | $156,538 | 17.16% | 3.6 |

| 2 Bedroom | $269,040 | 21.47% | 3.7 |

| 3 Bedroom | $413,359 | 25.43% | 3.8 |

| 4 Bedroom | $431,288 | 19.37% | 3.2 |

| 5 Bedroom | $854,667 | 25.67% | 3.6 |

| PARC CLEMATIS | $286,823 | 22.38% | 3.4 |

| 1 Bedroom | $145,667 | 19.23% | 3.7 |

| 2 Bedroom | $255,529 | 21.37% | 3.3 |

| 3 Bedroom | $387,885 | 25.89% | 3.3 |

| 4 Bedroom | $518,000 | 24.30% | 2.9 |

| 5 Bedroom | $732,000 | 26.45% | 4.2 |

| PARC ESTA | $285,576 | 22.73% | 3.7 |

| 1 Bedroom | $139,065 | 16.69% | 3.8 |

| 2 Bedroom | $286,040 | 23.77% | 3.7 |

| 3 Bedroom | $431,942 | 27.53% | 3.5 |

| 4 Bedroom | $697,000 | 33.46% | 3.3 |

| 5 Bedroom | $479,667 | 20.90% | 3.5 |

| RIVERFRONT RESIDENCES | $180,672 | 19.02% | 4.1 |

| 1 Bedroom | $101,186 | 15.67% | 3.9 |

| 2 Bedroom | $170,935 | 19.52% | 4.3 |

| 3 Bedroom | $306,314 | 23.76% | 4.1 |

| 4 Bedroom | $554,889 | 29.57% | 4.1 |

| 5 Bedroom | $675,944 | 31.44% | 3.9 |

| STIRLING RESIDENCES | $295,139 | 22.02% | 3.8 |

| 1 Bedroom | $190,049 | 21.37% | 4.2 |

| 2 Bedroom | $274,561 | 21.02% | 3.8 |

| 3 Bedroom | $428,048 | 26.09% | 3.9 |

| 4 Bedroom | $707,500 | 31.26% | 4.1 |

| THE FLORENCE RESIDENCES | $246,678 | 20.85% | 3.7 |

| 1 Bedroom | $165,500 | 17.94% | 3.7 |

| 2 Bedroom | $255,898 | 22.46% | 3.9 |

| 3 Bedroom | $305,476 | 21.24% | 3.5 |

| 4 Bedroom | $401,500 | 22.23% | 3.9 |

| TREASURE AT TAMPINES | $224,079 | 21.03% | 3.6 |

| 1 Bedroom | $115,965 | 17.86% | 3.8 |

| 2 Bedroom | $160,224 | 18.21% | 3.5 |

| 3 Bedroom | $291,638 | 24.25% | 3.7 |

| 4 Bedroom | $424,111 | 25.62% | 2.9 |

| 5 Bedroom | $598,722 | 29.58% | 3.7 |

This is also of further interest, especially considering that Jadescape launched right after the July 2018 cooling measures and initially trailed behind other developments like Riverfront, Parc Esta, and Stirling Residences in sales. So, what sets Jadescape apart?

Let’s delve into the details to uncover the dynamics behind these impressive numbers:

Unit Specifics

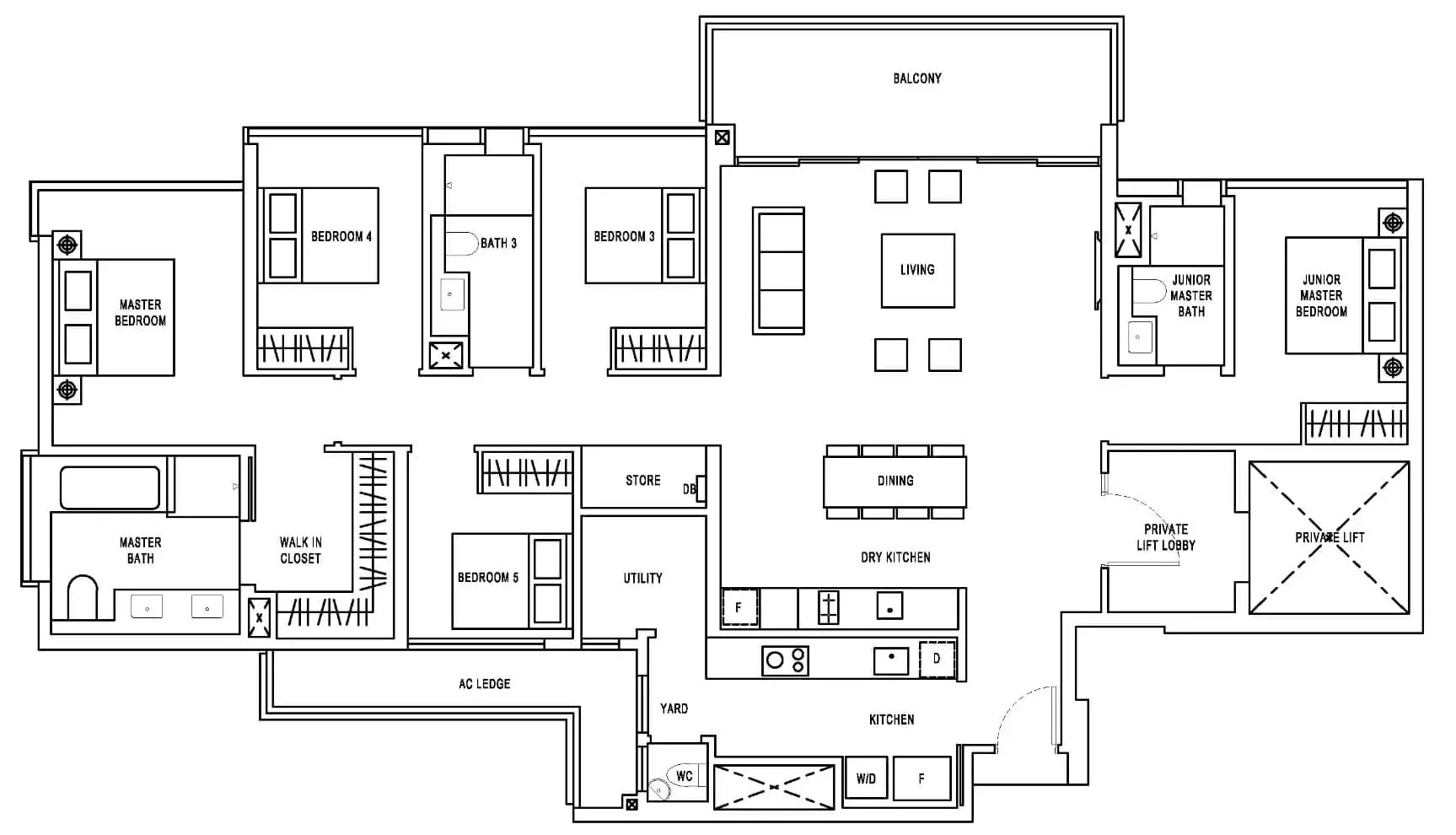

This particular unit is one of the largest in Jadescape, featuring five bedrooms and sprawling over 2,099 square feet. Located in stack 40, positioned on a mid-level floor, it offers unobstructed views of the Thomson Garden Estate. The layout is a practical dumbbell design, boasting a private lift and a junior master bedroom strategically placed for privacy. Bedrooms 3, 4, and 5 are arranged around a shared bathroom.

There are only 2 such stacks in the development (40 and 46), so as you might imagine, these are of a rare breed within the project.

Jadescape’s recent transactions have been notable, with prices reaching up to $2,283 psf. However, this specific sale at $4.55 million stands out, not only because of the unit’s size but also due to the significant premium it fetched compared to other similar-sized units sold in 2022 for $3.7m and $4m. This jump could be attributed to the development’s completion and the tangible appeal of the units, or possibly added value from renovations. The rarity of such large units could also be seen as a contributing factor, as the demand from the pandemic has shown.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

5 Telltale Signs to Watch Before Property Prices Move In Singapore

We’ve lost count of the times sellers have asked if they should take an offer or “if it’s too early,”…

Jadescape’s Market Context

To understand a bit more about why Jadescape has been performing well, we first have to understand the history of the development.

The development’s journey began with the acquisition of Shunfu Ville en bloc for $638 million – an underbid from the reserve price of $688 million. Despite the fact that the developers were able to acquire the land for a considerably good price, their launch prices were higher than most other mega developments during that period (aside from Parc Esta and Stirling Residences).

| Projects | Price ($) | Price ($PSF) |

| JADESCAPE | ||

| 1 Bedroom | $899,314 | $1,705 |

| 2 Bedroom | $1,216,648 | $1,691 |

| 3 Bedroom | $1,671,378 | $1,669 |

| 4 Bedroom | $2,283,449 | $1,655 |

| 5 Bedroom | $3,279,400 | $1,562 |

| PARC CLEMATIS | ||

| 1 Bedroom | $794,440 | $1,622 |

| 2 Bedroom | $1,158,529 | $1,607 |

| 3 Bedroom | $1,539,515 | $1,614 |

| 4 Bedroom | $2,202,625 | $1,653 |

| 5 Bedroom | $3,215,000 | $1,512 |

| PARC ESTA | ||

| 1 Bedroom | $830,480 | $1,779 |

| 2 Bedroom | $1,246,230 | $1,682 |

| 3 Bedroom | $1,576,993 | $1,624 |

| 4 Bedroom | $1,954,421 | $1,598 |

| 5 Bedroom | $2,294,938 | $1,626 |

| RIVERFRONT RESIDENCES | ||

| 1 Bedroom | $662,488 | $1,357 |

| 2 Bedroom | $883,085 | $1,317 |

| 3 Bedroom | $1,297,922 | $1,292 |

| 4 Bedroom | $1,884,235 | $1,281 |

| 5 Bedroom | $2,142,500 | $1,276 |

| STIRLING RESIDENCES | ||

| 1 Bedroom | $934,410 | $1,967 |

| 2 Bedroom | $1,302,165 | $1,795 |

| 3 Bedroom | $1,724,000 | $1,731 |

| 4 Bedroom | $2,438,579 | $1,771 |

| THE FLORENCE RESIDENCES | ||

| 1 Bedroom | $849,203 | $1,469 |

| 2 Bedroom | $1,068,766 | $1,443 |

| 3 Bedroom | $1,424,100 | $1,407 |

| 4 Bedroom | $1,826,250 | $1,399 |

| TREASURE AT TAMPINES | ||

| 1 Bedroom | $644,650 | $1,376 |

| 2 Bedroom | $854,422 | $1,368 |

| 3 Bedroom | $1,199,250 | $1,288 |

| 4 Bedroom | $1,640,515 | $1,293 |

| 5 Bedroom | $2,035,579 | $1,183 |

Launched just post the July 2018 cooling measures, Jadescape faced initial skepticism due to its slightly larger unit sizes and higher price points. The launch saw brisk sales of over 330 units, but overall it lagged behind other competitors. This was because some of these developments were launched at $1,6xx psf, and Jadescape was launched at a higher price point of $1,7xx psf.

As such, during that period the price of Jadescape was used by agents to push other competing projects like The Garden Residences.

It only really started to pick up more after other launches like Riverfront Residences, Tre Ver, Parc Esta, and Stirling Residences started to sell out the majority of their units.

Market Dynamics and Jadescape’s Success

In retrospect, several factors contributed to Jadescape’s success. The shift in preferences towards larger units post-pandemic played a significant role, as Jadescape offered more spacious layouts in contrast to many other developments.

For bigger units (5 bedders) especially, it wasn’t common to find them at a size above 2,000 square feet:

| Average Size (Sq Ft) | |||||

| Project | 1BR | 2BR | 3BR | 4BR | 5BR |

| JADESCAPE | 527 | 728 | 1,060 | 1,401 | 2,099 |

| PARC CLEMATIS | 560 | 753 | 1,061 | 1,368 | 2,040 |

| PARC ESTA | 515 | 741 | 1,044 | 1,277 | 1,469 |

| RIVERFRONT RESIDENCES | 549 | 710 | 1,098 | 1,518 | 1,755 |

| STIRLING RESIDENCES | 553 | 757 | 1,049 | 1,655 | |

| THE FLORENCE RESIDENCES | 558 | 791 | 1,059 | 1,425 | 1,733 |

| TREASURE AT TAMPINES | 474 | 630 | 952 | 1,304 | 1,701 |

The willingness to invest in spacious units outside the CCR is also evident in the broader market trends. For instance, Amo Residence recently sold its last penthouse unit at $5.6 million.

Here are also several other new launches that have sold in recent months that are close in size (but of course, not comparable in location).

| Project Name | Transacted Price ($) | Area (SQFT) | Bedroom | Unit Price ($ PSF) | Sale Date |

| TERRA HILL | 8,200,000 | 3,035.45 | 5 | 2,701 | 12-Apr-23 |

| THE RESERVE RESIDENCES | 6,119,762 | 2,335.79 | 5 | 2,620 | 26-May-23 |

| PICCADILLY GRAND | 3,684,000 | 2,045.16 | 5 | 1,801 | 28-Jan-23 |

| PICCADILLY GRAND | 3,449,000 | 1,894.46 | 5 | 1,821 | 1-Jun-23 |

| PINETREE HILL | 4,688,000 | 1,733 | 5 | 2,705 | 14-Jul-23 |

| PINETREE HILL | 4,388,000 | 1,733 | 5 | 2,532 | 14-Jul-23 |

| PINETREE HILL | 4,448,000 | 1,733 | 5 | 2,567 | 15-Jul-23 |

It also helped that they had a good margin due to the collective sale of Shunfu Ville. This meant that they had the means to invest in quality finishings that translated into a product that resonated well with buyers. Understandably, this is a factor that’s hard to quantify. But from what I’ve heard on the ground, the overall build quality at Jadescape seems to be quite decent – and given the wider trend of quality issues at other recently completed launches, Jadescape seems to have come out quite well.

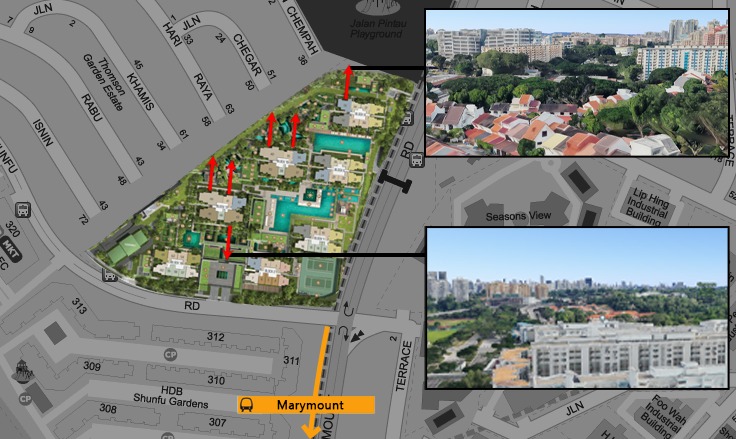

Jadescape’s RCR location is probably also another factor, as most of the competing mega-developments are in the OCR regions. Having easy access to Marymount MRT station on the Circle Line is certainly another major selling point.

It’ll definitely be interesting to see how these mega developments continue to perform as more units start coming on the market – as it stands many of these projects look to be a success, be it from being bought and sold at the right time, or just a product that is appealing to most Singaporeans.

The ongoing success of these projects will likely depend on their continued alignment with evolving consumer preferences and market dynamics, particularly in a landscape where buyers are increasingly discerning about factors such as space, amenities, and location. As the market absorbs more units, the sustained performance of these mega developments will be one that I’ll be keeping a keen eye on.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

0 Comments