7 Surprising Condos That Are Profitable Despite Not Being Near An MRT Station

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Here’s the thing about profitable condos, it’s never really down to just one reason. A lot of people mistakenly believe that it needs to be near an MRT, or it has to be freehold – for it to be a safe purchase but sometimes that is far from the truth.

We’ve seen condos that tick all the boxes: close to the MRT, freehold, near good schools and amenities, but yet a combination of high launch prices and wrong timing result in an unprofitable purchase.

So for those who hold the belief that a good condo requires an MRT station next door, here are some projects that buck that trend:

A quick note on the dates:

We’re putting this here rather than repeating it below, as it applies to many of the following condos.

Many of these projects were launched or completed in 2018, or one or two years prior. During this period the market was soft, as the market was reeling from one cooling measure after another; the government was deliberately trying to bring down prices from the 2013 peak.

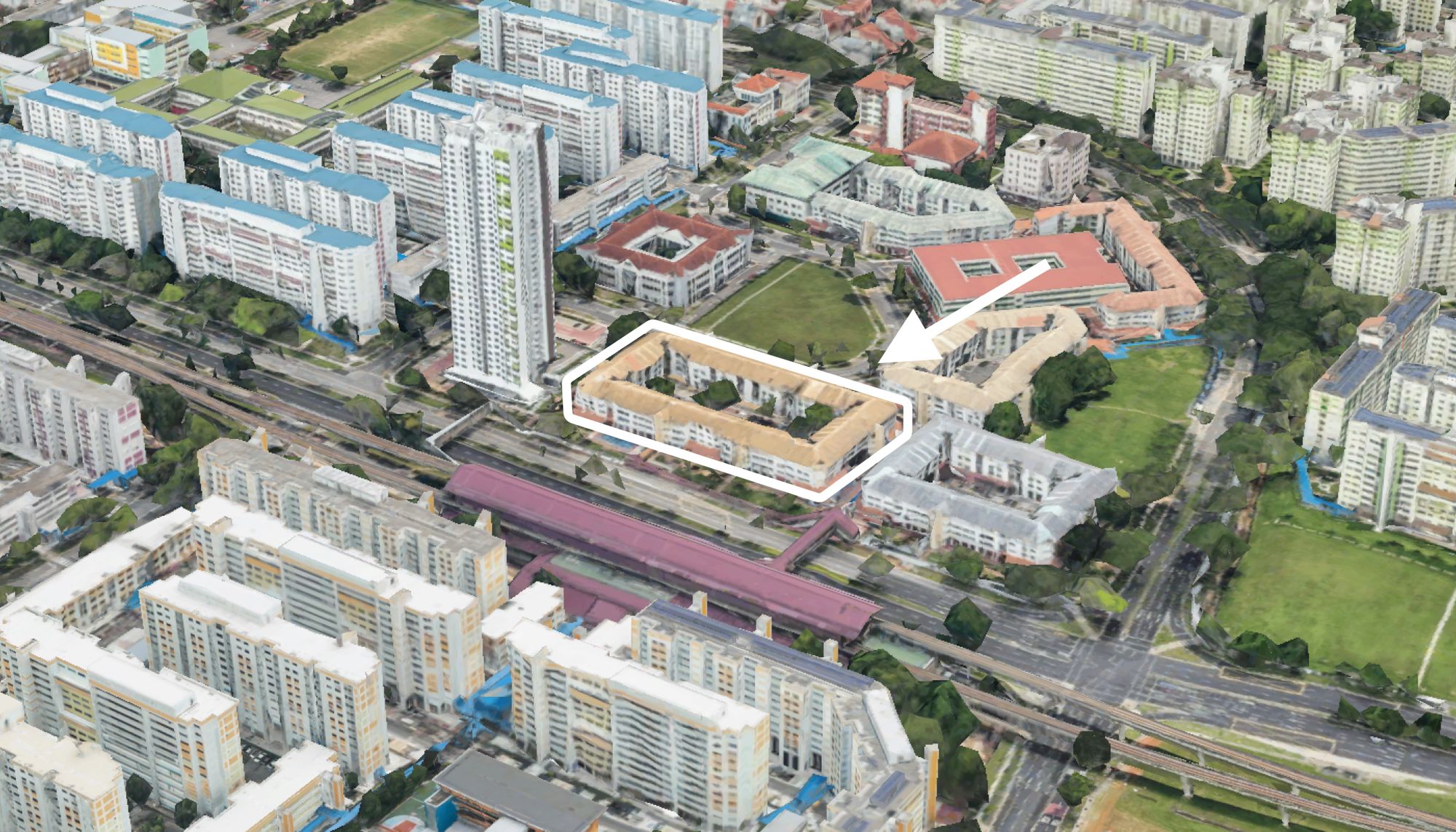

1. Principal Garden

Principal Garden is a mid-sized (663-unit) leasehold condo at Prince Charles Crescent, right next to the Alexandra Park Connector. This project was launched in November 2015, selling at about $1,633 psf. By the time developer sales ended in January 2018, the average had risen to $1,849 psf.

At the time, there was some debate about the distance to Redhill MRT (EWL). Marketing materials claim Principal Garden is close to the station, but not everyone might agree. You have to walk from the Alexandra Canal down to Tiong Bahru Road, which is a bit of a hike. Possible, but not what everyone might call convenient; and definitely not for older residents. In fact, among the cluster of new condos around Redhill MRT at that time (like Echelon and Alex Residences, some buyers may have opted against Principal Garden for this very reason.

The main draw is the park connector, which links up all the way to the Singapore River and CBD. This is great for the view, and if you like to cycle to the city centre. If you find Redhill MRT walkable from Principal Garden, you may also find the distance to River Valley walkable. In that case, Valley Point Mall might be a convenient shopping spot. For most people though, cycling would be better for that distance.

There are several schools in this area: Crescent Girls may be a strong draw for many parents, while Gan Eng Seng and Henderson Secondary are also within one kilometre. The closest school, Alexandra Primary, is within walking distance.

Recent prices

Principal Garden has a solid record of 183 profitable transactions and only a single loss. The single loss wasn’t too significant: it was a one-bedder (495 sq. ft.) which transacted in March 2022, for a loss of under one per cent. There were four transactions in October 2024, which averaged $2,204 psf:

Between Echelon and Alex Residences, Principal Garden has had more profitable transactions, as well as much fewer unprofitable transactions. Even among the profitable ones, the average at $295,959 is still very respectable – as compared to Echelon ($190,371) and Alex Residences ($174,728). It’s worth mentioning that Artra has the highest average profitability, but it was launched later so it isn’t as fair a comparison.

Investors and singles may want to note that Principal Garden’s one-bedders (495 sq. ft.) still transact at under $1 million; decent for the proximity to Tiong Bahru and River Valley. Also, blocks 93, 95, 97, and 99 facing the Alexandra Canal will have blocked views once Alexandra Peaks BTO is up.

2. Whistler Grand

Whistler Grand is a mid-to-large project (716 units) that launched in November 2018. Its launch was competitive because of the neighbouring Twin VEW (which launched in May 2018) and Parc Riviera, which had launched two years prior.

Competition aside, the main issue was the “ulu” surroundings. While the area around the Pandan River is certainly peaceful and provides a waterfront, it’s also quite light in amenities. It’s a bit of an odd spot: sitting between Jurong East and Clementi, but not being close to the major conveniences of either. Clementi Mall and IMM, for instance, are the major malls in the area – but both are well over a kilometre away, with no MRT station nearby to help.

There were two things going for Whistler Grand though, which seem to have paid off. The first was the pricing:

Starting developer sales averaged $1,352 psf, lower than neighbouring Twin VEW’s average of $1,400+ psf. This is despite Whistler Grand launching later and having a higher breakeven land price than Twin VEW. It seems CDL was willing to thin its margins to undercut the competition. Developer sales closed at an average of $1,489 psf.

The second advantage is the plot ratios of surrounding land parcels: still low at a Gross Plot Ratio of 1.4. This preserves the scenic view and quiet; qualities that appeal to a specific group of family buyers.

There are, incidentally, bus services near Whistler Grand that connect directly to Clementi and Jurong East, so it’s not as inaccessible as it first appears.

Recent prices:

Whistler Grand has managed a perfect track record of 130 transactions, with zero losses.

In October 2024, seven units transacted at an average of $1,850 psf, a significant pick-up from its launch prices. Most notably, a transaction on 18th October this year saw a 7.2 per cent return. This was for a 990 sq. ft. unit bought at $1,413 psf in 2020 and resold at $1,969 psf. The average profit per unit so far is at $314,284, a very healthy number indeed.

3. Twin VEW

This is a mid-sized, 520-unit leasehold project, which neighbours Whistler Grand (see above). Like Whistler Grand, it does suffer from a lack of MRT access; residents will need a bus to get to Clementi Mall and the attached Clementi MRT (EWL). Also, as noted above, Twin VEW had a higher launch price than Whistler Grand, despite its breakeven land price being lower:

The developer sales are a bit volatile. The earliest recorded transactions averaged $1,350 psf in June, but this quickly rose to $1,548 psf by August, settling at $1,542 psf by the end of developer sales.

The location’s advantages (and drawbacks) are similar to Whistler Grand. Twin VEW was quite highly rated for the quality of finishings, as well as the range of facilities. It will come down to viewings of the specific units if you’re comparing to Whistler Grand though, as Whistler’s developer (CDL) is also no slouch when it comes to high-end finishing and facilities.

Price movement:

Twin VEW retains a perfect record so far, with 107 profitable transactions and zero losses:

As of October 2024, five transactions averaged $1,766 psf. This is lower than the average we saw for Whistler Grand above, though it’s still a decent appreciation for the original buyers. Family buyers may also want to note that 1,000+ sq. ft. units are quite affordable here – in October this year, a 1,055 sq. ft. home was transacted for just $1.86 million. The average profit per unit so far is $283,093, just slightly lower than Whistler Grand.

4. High Park Residences

High Park Residences dominated property news in the mid-2010’s. In a rather bold move, this 1,399-unit, leasehold mega-development was launched in July 2015: a low point in the market. Despite that, High Park Residences was the largest condo project since around 2010. Due to its size and circumstances, its launch weekend caused new private home sales to spike to the highest in two years.

High Park’s marketing novelty was to keep prices below $1,000 psf, and combine these with some units that are very compact (some as low as 388 sq. ft.!) While High Park also has family-sized units (e.g., 1,163 sq. ft. three-bedders), most of the units ended up with a quantum below $1 million. This was enough to get the momentum going and draw buyers:

It seems surreal by today’s standards, but the average launch price was $989 psf in July 2015. When developer sales closed in March 2017, prices averaged $1,018 psf.

When High Park Residences was completed in 2019, it also became evident that the distance to the MRT station was not going to hamper resale buyers. The Thanggam LRT station is just a short walk away, providing quick access to Sengkang MRT station (NEL). The Compass One mall is next to the station, which can provide most retail, dining, and grocery needs.

More from Stacked

Should You Buy Sora? A Pricing Review Comparison With Lakegarden Residences And Surrounding Resale Condos

Given the attractiveness of Sora’s launch pricing in the wider context of the property market in 2024, let’s now take…

The nearby Fernvale HDB enclave also provides heartland amenities. While Sengkang is still a non-mature town, there’s a sufficient assortment of coffee shops, minimarts, and everyday conveniences to keep things convenient. There’s also a small mall (Seletar Mall) within walking distance. In short, this condo turned out to be a lot less ulu than it looked on paper.

Price movement:

We see a healthy volume, with an impressive 522 profitable and zero losses! A lot of this can probably be credited to the highly competitive prices at the beginning:

Prices average $1,547 psf, from 12 units transacted in October this year. The very latest transaction in November was for an 893 sq. ft. unit, sold at $1,531 psf. This was originally bought in November 2019 for $1,106 psf. That’s a pretty good annualised return of 6.7 per cent.

The quantum for that transaction was a mere $1.368 million by the way; so this is still one of the most competitively priced condos, 10 years on.

5. Daintree Residence

Daintree Residence is a leasehold, 327-unit condo, which saw an initially discounted launch. Due to a stroke of bad luck, there was a round of cooling measures (July 2018) that coincided with Daintree’s launch. This made it the first launch to face cooling measures, and the developer added a five per cent discount to the already lower launch prices.

There was also a conservative launch of just 80 of the 327 units at first; but perhaps due to the lower price, 50 of the 80 units sold over the launch.

Daintree Residence saw an average of $1,716 psf at launch and went through a rather volatile series of developer price movements. Nonetheless, it closed developer sales at a high point of $1,903 psf.

As befits an Upper Bukit Timah location, serenity and greenery are the main draws. Daintree Residence is quite recognisable for its sky gardens and treetop walkways, as well as the generally low-density surroundings. This is complemented by the condo’s low unit count, which makes it a highly private residence.

The amenities around Daintree Residence are of the sort you normally find for landed housing: no big malls but stretches with restaurants, cafes, fast food, etc. This is complemented by an eclectic mix of services, from bike shops to pet stores. There’s also a good number of minimarts/convenience stores nearby, so you don’t have to travel too far from groceries.

While you can walk to Beauty World MRT station (DTL), it’s a bit far and unsheltered; okay if you’re young and fit, but we wouldn’t recommend it for older residents. Nonetheless, if you can make it there, Beauty World Plaza is an older mall with retail and entertainment options. In any case, there will be future upgrades to the area in the form of commercial units at The Linq @ Beauty World and The Reserve Residences.

Price movement:

This is a smaller condo, so there are fewer transactions and prices can be a bit more volatile. Nonetheless, there have been 38 transactions, and no losses to date:

In October this year, there were five transactions averaging $2,016 psf. The prices were attractive for 2024: among them was a 1,001 sq. ft unit that transacted for $1.95 million, and a 710 sq. ft. unit that transacted for $1.47 million.

If you’re looking to stay in the Upper Bukit Timah area for under $2 million, this could be a very viable resale option.

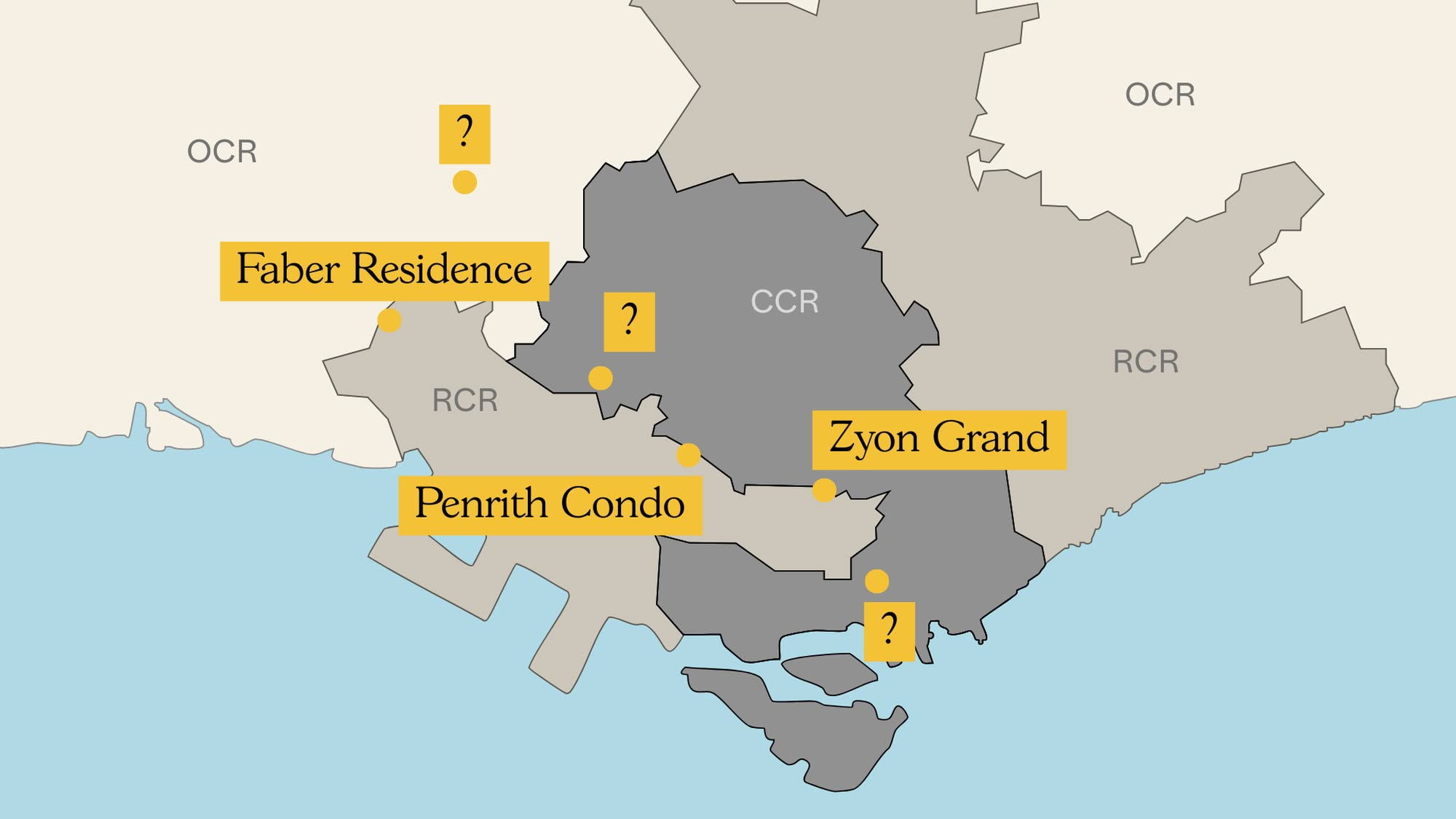

6. Normanton Park

One of the headline launches in 2021, Normanton Park is a redevelopment of the older HUDC estate of the same name. The launch was challenging as, despite being a gigantic 1,862-unit mega-development, the developer was hit by a no-sale license. The full details are here, but to summarise, it meant that sales couldn’t start until much later, due to past transgressions.

Sales were steady nonetheless:

In January 2021, initial sales averaged $1,763 psf, ending at $1,871 psf in July 2022. Develop prices never seemed to sink along the way, so most early buyers already locked in gains by then.

Normanton Park did manage to sell on time despite the no-sale license, and despite a location that looks bad on paper. While there’s no MRT station in walking distance, there is a bus stop just outside the condo. From here, some buses go directly to the Fusionopolis/JTC LaunchPad area, where the One North MRT station is. There’s also a supermarket and dining options at Fusionopolis, which makes the area quite convenient. Alternatively, the same bus goes all the way to Buona Vista, where you’ll find The Star Vista – a major mall servicing the area.

Given that the One-North area is a major tech and media hub, this also makes Normanton Park a viable rental asset, catering to workers in that area (not to mention schools like INSEAD and ESSEC).

Overall, this is a somewhat misleading area: if you just check on maps, the location looks ulu with nothing around it. But if you visit the area and use the bus routes, you’ll see Normanton Park is more convenient than it seems. Also, as the One North area develops further, you’re likely to have more amenities to come.

The only real drawback to the location is the lack of Primary and Secondary school access.

Price movement

Normanton Park was only just completed in 2023, so a lot of the transactions so far are sub sales. Nonetheless, there are already 59 recorded transactions with no losses:

The last recorded price was $2,157 psf; and while it’s still early in the day for this condo, there are a lot of positive signs. Being able to sell out despite the no-sale license, and being far from the MRT station, already bodes well. It’s likely that, over time, more people will catch on to how good the location really is.

7. Clavon

Clavon was one of the fastest-selling condos when it launched in December 2020. Around 70 per cent of the condo sold out over its launch weekend, mainly from demand in the Clementi area. At the time of its launch, there hadn’t been a new condo in Clementi for around three years (and the previous launch, Clement Canopy, had been by the same developer UOL – so this must have felt like a second chance for those who missed out).

Clavon saw an average price of $1,637 psf when it launched in December 2020, ending developer sales at $1,697 psf. This is a leasehold, mid-sized (640-unit) project.

Clavon sought to cater to both own-stay use and investors. One of the highlights is its proximity to Science Park I & II, which has a sizeable foreign workforce. This is reflected in the attention paid to small one and two-bedders (check out the review here).

For own-stay use, Clavon draws families who like proximity to the NUS High School of Maths and Science (a mere 370 metres distance), as well as Clementi Primary, Nan Hua (across the road), Pei Tong, and New Town Secondary. The HDB enclave, in the direction of block 420, is mature and well-developed: it has its own Sheng Siong, along with coffee shops, convenience stores, and other heartland amenities.

Unfortunately, the distance to Clementi Mall and the connected Clementi MRT station (EWL) is a “close, but not close enough” situation. If you’re willing to take a rather long walk along Commonwealth Avenue, you could get there on foot; but most wouldn’t consider it a comfortable walking distance. It’s probably easier to use the nearby bus. Once you are at Clementi Mall, however, this huge shopping hub can serve most of your needs.

Price movement:

Clavon was just completed, so the transactions reflected are sub sales. There are 62 on record, and being sub sales, it’s normal for all of them to be profitable.

So far the price seems to be sitting at $1,991 psf. We’d need to wait for some resale transactions to get a full grip on the price, but there’s clearly demand given Clavon’s location. It’s doubtful that buyers will consider the distance to Clementi MRT as a huge drawback, given the easy and quick bus connection. Do note too there’s a new condo coming up soon in the form of Elta.

For more in-depth reviews or a walk-through of condos that fit your specific needs, reach out to us at Stacked with your questions. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Investment Insights

Property Investment Insights District 15 Resale vs New Launch Condos – Analysing Price Gaps for Larger Family Units

Property Investment Insights Are Singapore’s Suburban Condos Still Affordable? The Surprising Truth

Property Investment Insights New Launch vs Resale One and Two Bedders in D15: Here’s Where The Price Gaps Are The Biggest

Property Investment Insights Analysing 10 Years of District 12 Boutique Condo Transactions: Insights Into What Drives Profitability

Latest Posts

Singapore Property News How A Waterfront Development With 4,000 Homes Is Going To Reshape Singapore’s Property Market

On The Market 5 Rare HDB Flats Above 1,700 Sq Ft You Can Buy Right Now – From $850K

On The Market Rare 16,000 Sq ft Freehold Plot In D15 Hits The Market For $39M

Editor's Pick I Transformed My Two-Bedroom Unit Into A Dual-Key Layout – Here’s Why I Would Not Do It Again

Property Market Commentary Why More Families Are Choosing Two-Bedders Over Bigger Properties in 2025

Property Market Commentary What The URA Master Plan Reveals About Marina Bay’s Future (And How It Could Impact Property Values)

Editor's Pick We Toured An ‘Exclusive’ Freehold Landed Enclave In Singapore That Feels Close To Nature – And Even Has A Canal Running Through It

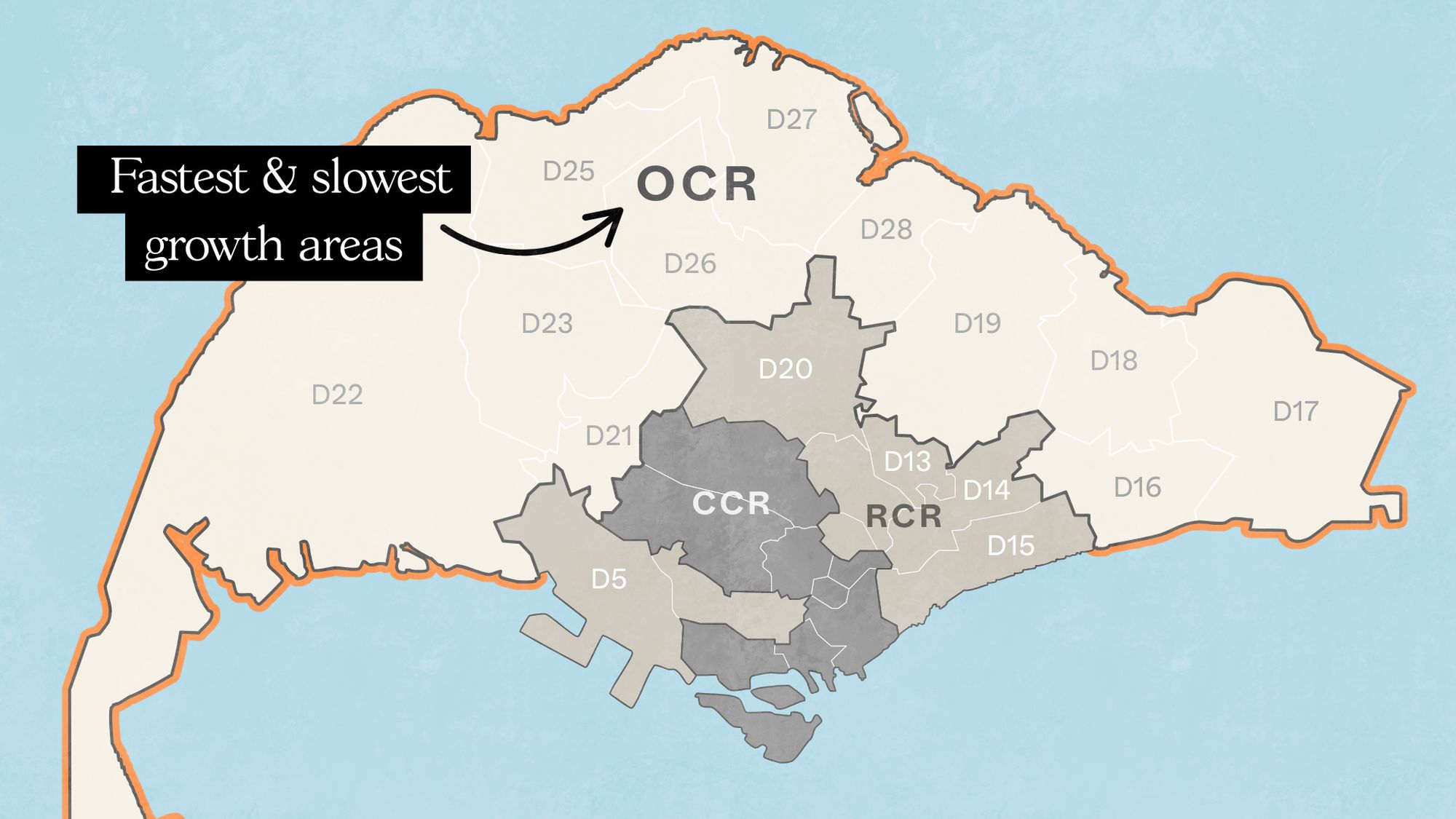

Singapore Property News Where Condo Prices Rose Fastest (and Slowest) in Singapore’s Outside Central Regions

Editor's Pick I Left Singapore for New York and Ended Up Launching a $450M Manhattan Project. Here’s What I Learned About Buying Property Here

On The Market 5 Cheapest Freehold 3-Bedroom Condo Units In Singapore You Can Buy This Week – Including Quiet Spot in Floraville

Editor's Pick Rare Detached Freehold Home On Singapore’s ‘Millionaire’s Row’ Up For Sale At $14m

Editor's Pick The 5 Most Common Property Questions Everyone Asks In Singapore – But No One Can Answer

Editor's Pick A 5-Room HDB In Boon Keng Just Sold For A Record $1.5m – Here’s How Much The Owners Could Have Made

Property Market Commentary 6 Upcoming New Condo Launches To Keep On Your Radar For The Rest Of 2025

Editor's Pick We Toured A Little Known Landed Enclave Where The Last Sale Fetched Under $3 Million