7 Qualities You Want In A Property For Asset Progression

November 7, 2021

Asset progression, wealth progression, upgrading… we Singaporeans have all sorts of names for it, but the general idea is the same: using your existing property as a stepping stone, toward a bigger or more luxurious home (or just one with more investment potential). There are some different considerations from regular home buyers if you are interested in asset progression – and these are the ones to watch for:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Transaction history with sufficient volume

When you’re trying to pick between “stepping-stone” properties, you should compare gains for the specific property, or for properties nearby (if the development is new).

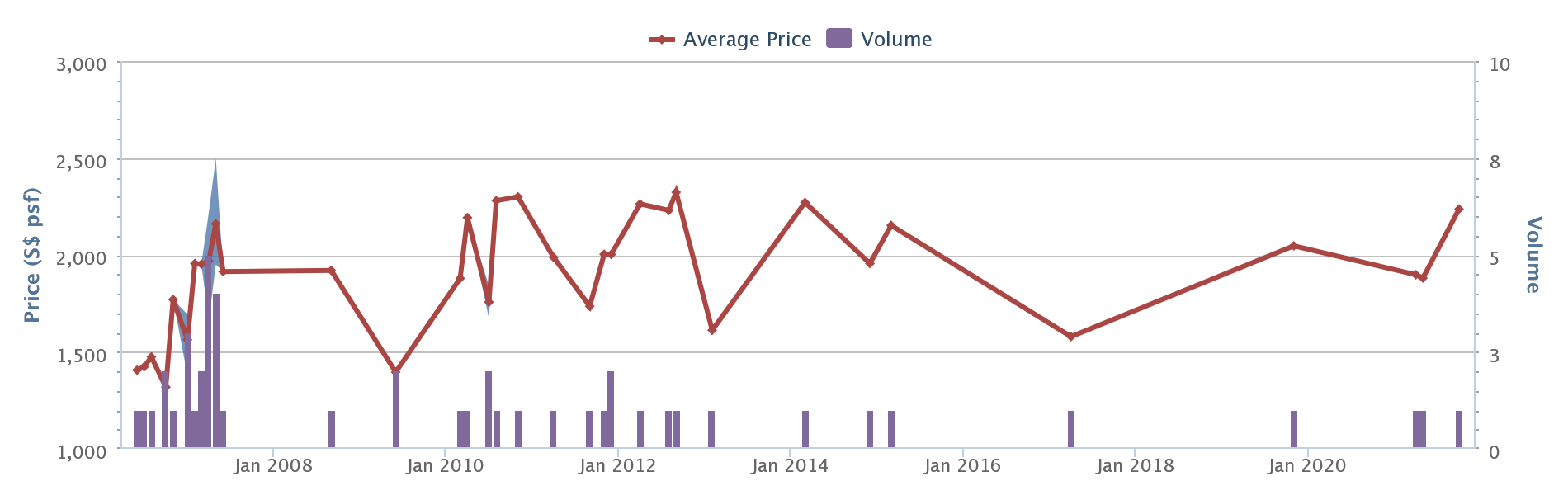

However, a commonly overlooked problem is transaction volume. Consider, for example, transaction volumes for Botanika in District 10:

For many years after initial sales, transactions have been few and isolated (from January 2010 onward, all the transactions are single units).

This makes the “median price” of $1,881 somewhat uncertain, as it’s based on a single unit; and you can see the price movement is quite volatile.

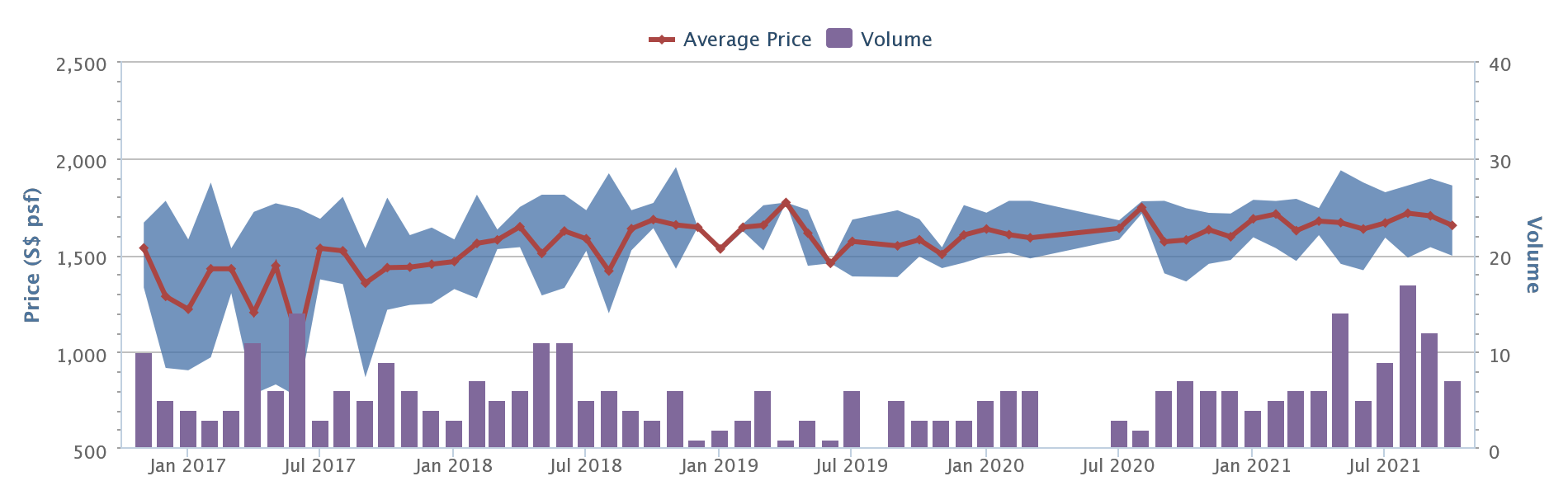

Conversely, D’Leedon – which is within one kilometre of Botanik, has a large number of units, and good transaction volumes:

This gives you a more reliable picture of the price movement (currently at $1,421 to $1,937 psf, averaging $1,682 psf), over the years.

To be clear, we’re not saying D’leedon is a better condo, simply that the price movement and gains are better reflected. This is an important factor if you have a definite intent to resell in a few years, and want to ensure resale gains can bridge the gap to your next home.

It does also mean that, for buyers with a clear upgrading plan, there tends to be a preference toward larger developments by unit count. This is because most boutique projects, with below 100 units, will tend to have fewer transactions and more volatile price movements.

One advantage to using HDB flats for asset progression is in fact the transaction volume – prices tend to be well supported and quite predictable, as opposed to some niche private counterparts.

2. Sufficient remaining lease for resale gains

Most upgraders don’t expect to stay long, in a “stepping-stone” property. A typical example would be expecting to stay for just five years in a resale flat (the duration of the MOP), or just five to 10 years in a condo.

However, banks often reduce financing for properties with 60 years or less on the lease. Loans are not possible for properties with 30 or fewer years on the lease. As such, older leasehold properties – such as those at 30 to 40 years of age – may just be more hampered by its lease.

Another overlooked consideration is the prospective pool of buyers: when the lease has only a few decades remaining, the property is often purchased by retirees, those who aren’t interested in passing property to their children, or investors emphasizing sheer rental yield.

These buyers don’t make up the bulk of the market, and many of them are quite conservative. As such, older leasehold properties can already be harder to sell, let alone at a good profit.

This does not necessarily mean you must buy a freehold or new launch unit. The premiums involved could also work against you. It’s a delicate balance between finding the right price point, room for appreciation, and avoiding serious lease decay.

Do reach out to us for a consultation, as this isn’t the easiest balancing act.

3. The property shouldn’t be a trend-chaser, which can result in niche/inefficient floor plans

We have described many of these undesirable traits in an earlier article.

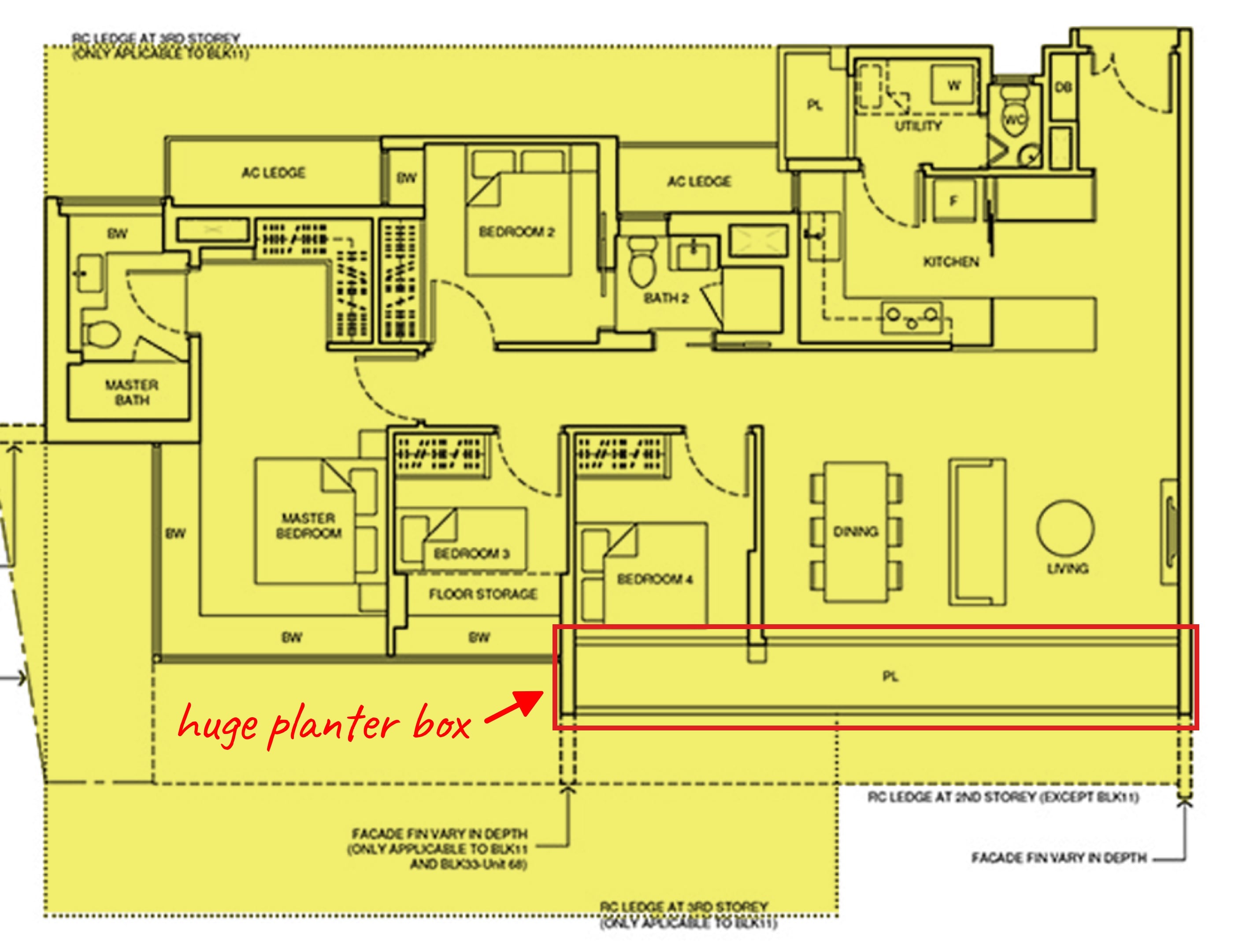

Existing trends can make a given unit “hot”. Some of the things we’ve seen, over the years, include high floor-to-ceiling ratios, a craze for Private Enclosed Spaces (PES) in the form of patios, and elaborate “green façade” planter boxes.

These market pleasers sometimes (but not always) result in price premiums or inefficiencies. For example, strata title void space, which is mostly useless extra cost; it’s the price of the empty space between floor and ceiling.

Depending on the trend, certain ones might not last very long, and can change in the span of a single year. As an upgrader, you don’t want to find – five years from now – that a “cool” feature like a loft ceiling is actually making your unit harder to sell.

It’s best to ignore the trends and focus on the fundamentals like location, number of units, etc.

This can result in buying a “boring” unit, which doesn’t exactly inspire you as a homeowner. But that’s fine, because it’s not your dream home: it’s just a stop on the way to it.

4. 500 to 600 units (mid-sized) is a nice number to aim for

Boutique developments tend to have low transaction numbers and volatile prices (see point 1). Conversely, very big developments – such as 1,000+ unit mega-developments – bring a lot of competition.

Property Picks10 boutique condominiums in Singapore for people who want some peace and quiet

by Druce TeoWhen it’s time to sell and upgrade, the last thing you want to see is 100+ listings in your same condo, all of which are selling units similar to yours. This sometimes degenerates into a price war, which benefits none of the sellers.

In general, mid-sized developments will combine lower maintenance fees and a reasonable price tag, without the overcrowding.

5. For HDB properties, the MOP needs to match your time frame

If your goal is to upgrade in five years, for example, a BTO flat won’t suit this purpose. You need to wait four to five years for the flat to be completed, and then five more years for the MOP.

Unless you have a flat with the (uncommon) ability to appreciate as well as private property, the delay could leave you struggling to bridge the price gap later.

This is especially a concern with the new Prime Location Housing (PLH) model. No one actually knows if the appreciation of PLH flats – after the heavy restrictions – can make up for the extra-long MOP period. It’s effectively 14 to 15 years before you can upgrade, if you account for construction time.

This is why many upgraders are advised to go for smaller, cheaper resale flats; and to just save heavily during the MOP. However, everyone’s circumstances are different.

If you know you won’t be able to upgrade in five years, for example, then there could be no harm in getting a BTO flat and waiting longer. The lower price point of BTO flats may even ultimately work in your favour.

The key is to have a timeline or plan for your upgrading, so you can buy something that fits.

6. Look for possible upgrades to the neighbourhood, within the correct time frame

We have discussed how to spot potential upgrades with the URA Master Plan.

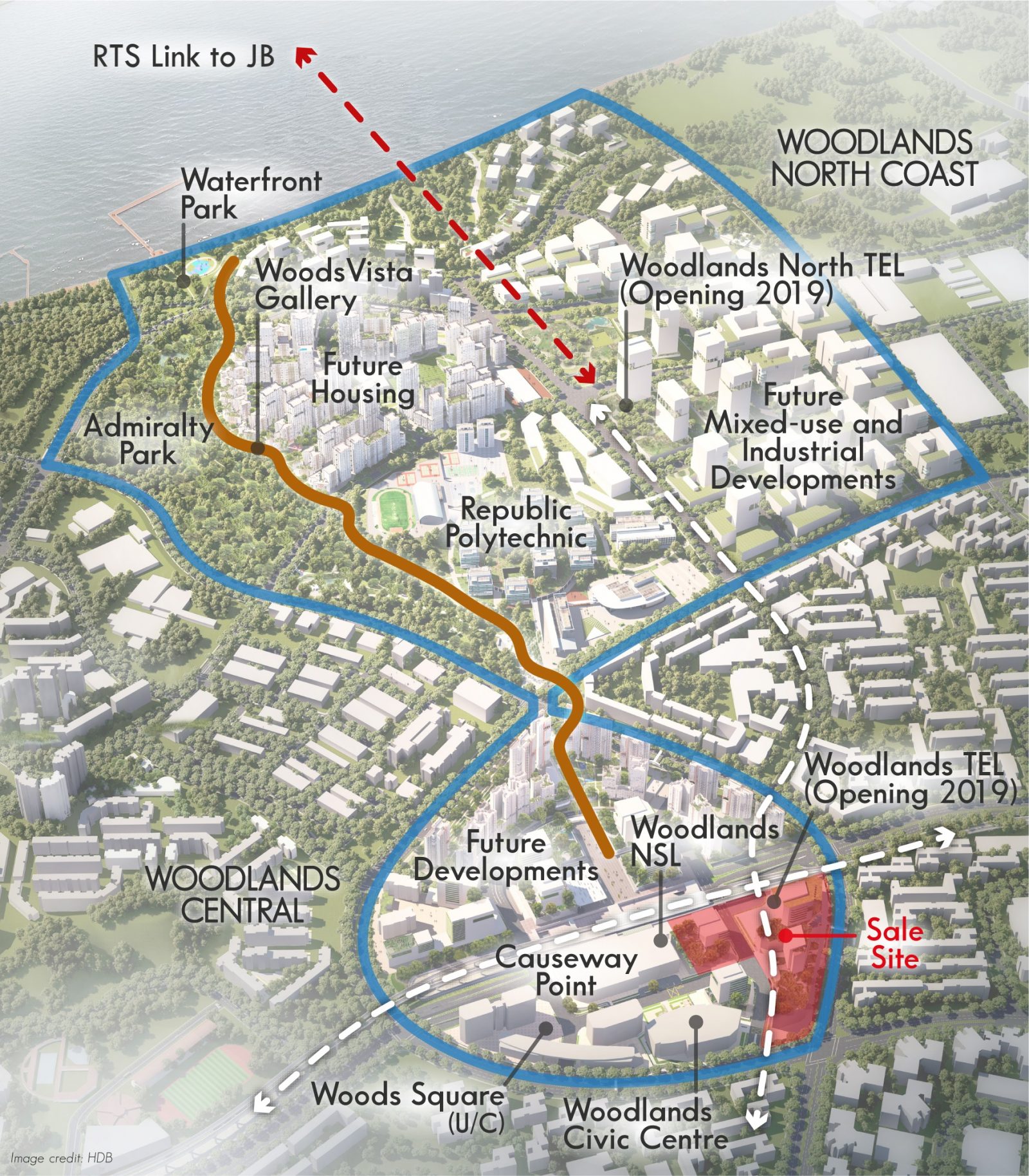

However, it’s also important to know the time frame involved. It would be reasonable, in 2021, for an upgrader to consider the Woodlands North Corridor.

This is because – back in 2017 – we learned the first developments would crop up in five to 10 years (2022 onward). Given a five-year timeframe to upgrade, it’s plausible buyers will be selling as the upgrades take effect.

The Greater Southern Waterfront (GSW), on the other hand, is likely to kick in well after 2040. So even if you buy a condo that could capitalise on it, we wouldn’t expect it to affect gains if you’re selling in just five to10 years.

7. One or two new upcoming launches nearby can be good

New launch properties are always priced higher than their existing counterparts. This creates a “knock-on” effect, as the average price psf will go up in the neighbourhood. In areas where there’s rarely a new condo, prices can end up becoming quite stagnant.

As such, having one or two upcoming launches within one-kilometre can sometimes help.

However, there’s a limit to this. As we’ve seen in Holland V, having too many new launches nearby creates competition and saturates the area. The numbers also become misleading: when there’s a lot of new launches in a short time, the neighbourhood’s price psf can seem to be skyrocketing. But this is due to mounting prices from new launches, rather than the reality on the ground.

The rising number of units can also cause competition, and weigh down potential gains later if the demand in the area doesn’t increase.

Likewise, while new launches can help to raise prices, sometimes you’ll want to avoid properties where potential new launches would be too close. This just creates a newer, more attractive-looking alternative to buyers in future. This can usually be spotted on the URA Master Plan, as empty residential plots near the project.

It takes a degree of experience to “read” a property, so it’s always worth asking experienced investors for an opinion. You can also talk to our pool of experts at Stacked, if you want a frank perspective or alternatives.

In the meantime, do check out our reviews of new and resale homes in the Singapore private property market, to aid your decision.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments