If You Invested $10,000 In Bitcoin, Tesla Or The ‘Best’ Singapore REIT 2 Years Ago, What Would That Be Today?

February 22, 2021

“Passive Income”

Or in other words, investing in assets and making free money while you sleep.

To the new investor, the idea itself might seem ludicrous. But to weathered tycoons, this very sentiment is the driving lifeforce behind massive oceans of wealth.

Of course, there are so many investment avenues to choose from today – from more traditional routes like Property REITs and Stock Market Indexes to the more recent headturners like Bitcoin and Tesla.

But the question remains.

Which has yielded the best returns thus far?

In today’s article, we take a look at how much you would have made if you had invested $10,000 in any one of these asset classes 2 years ago.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Singapore REITs

As we all know, $10,000 isn’t close enough to getting you a toilet in Singaporean Real Estate (let alone an entire unit).

Thankfully for those of us with smaller capitals, REITs (or Real Estate Investment Trusts) do exist.

They are essentially a portfolio of property that large corporations (think Capitaland) buy, operate and manage – all with their investors’ monies.

These REITs usually yield solid dividends ranging from 3-8% a year (paid out on a quarterly/bi-annually basis).

Of course, just like individual stocks, these REIT valuations are subjected to dips and rises over the years – with the recent Covid-19 market dip (and subsequent rebound) offering no exception.

There are also various REITS across sectors (retail, commercial, industrial, logistical, hospitality) – but for the sake of our article today, we’ll just be looking at this one REIT with the highest returns to date over the past 2 years.

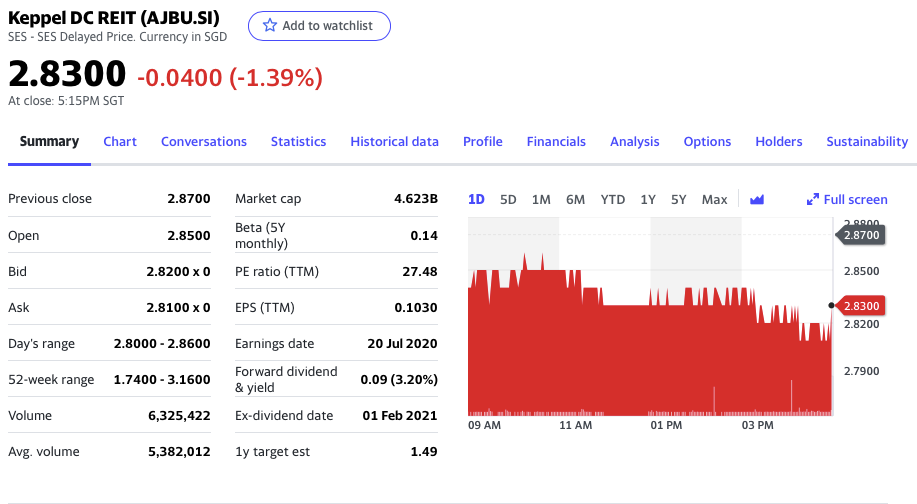

Keppel DC REIT (Ticker: AJBU.SI)

Because REITs are so heavily dependent on dividend yields, it would be fatal to ignore the total dividend returns during this 2 year time frame.

As such, I have taken into account both capital gains as well as dividends paid out during this timeframe to ascertain the ‘highest-paying’ REIT.

It does seem though that the total capital gains for our REIT of the day greatly outweighs its total dividend returns.

Here are the calculations in brief (feel free to skip to the end).

Assuming I invested $10,000 into the Keppel DC REIT on 15 February 2019 at market open, I would hypothetically have bought 7,022 shares at ~ $1.42 each.

That would run up to ~ $9998.63.

Over the next 2 years, we would go through 5 dividend payouts amounting to $1,171.11 ($265.47 + $124.80 + $136.93 + $307.21 + $336.70).

Regarding actual capital gains, assuming I sold my 7,022 shares on 15 February 2021 at market open at ~ $2.93 each, I would hypothetically have received a whopping $20,574.46.

Total Amount = $21,745.57 (117.49% gains)

(Note: More often than not, stock valuations tend to dip post-dividend payout to reflect well, the payouts. Also, unlike dividend stocks in the US, Singaporeans do not have to worry about paying for Dividend or Capital Gains tax on their REIT investments – yet. That said, additional brokerage/withdrawal fees do come into effect depending on the broker you are using.)

US Stock Market (NYSE/NASDAQ)

To make things simpler for our newer investors, there are essentially two markets at play here (well, 3 if you count the crypto ’market’ as well).

With Keppel DC REIT, it was listed under the SGX (Singapore Exchange). As for our upcoming Tesla stock, you’d find it under the NYSE (New York Stock Exchange).

In essence, US markets are notorious for their incredible volatility making it an incredibly attractive prospect for day and swing traders alike.

Tesla (Ticker: TSLA)

Things get a lot more straightforward here.

Although I would have to briefly add in currency conversions (excuse the OCD).

Assuming you converted $10,000SGD to USD on 15 Feb 2019 at the market open rate of ~ 0.7364, you’d have $7,364USD to play with.

Also assuming you’d invested this $7,364USD into the Tesla stock on 15 Feb 2019 at market open, you’d have bought a maximum of 120 shares at $60.90USD each (post stock-split price).

This would amount to ~$7,308USD.

Fast forward 2 years later, and again on the premise that you sold at market open price of ~$818USD (16 Feb 2021), you’d have amassed a staggering $98,160USD.

Now all that’s left is to convert that figure back to SGD on the following day’s market open rate of ~ 1.327, and you’re left with a ridonculous:

Total Amount = $130,258 (1,212.56% gains)

Cryptocurrency

Bitcoin, Bitcoin, Bitcoin.

“It’s nonsense.”

“It’s fraud.”

“Eh… that guy bought Bitcoin at $3k leh. If only I had bought at that time”.

In essence, think of cryptocurrency as a decentralised, blockchained, virtual currency that make its nearly impossible to counterfeit, is (theoretically) unmanipulatable by governments (ie. printed/altered) – and is easy to track.

In a way, Bitcoin resembles Gold in the sense that there will ultimately be a finite number of bitcoins in this world – hence hedging against inflation.

Of course it’s only been around for the past decade, and given its virtual nature, has often been touted by many as a speculative asset.

Bitcoin

Although it’s possible to invest in Bitcoin using SGD, note that only a few ‘local’ brokers (eg. Coinhako/Binance SG) allow you to do so.

Alternatively, you would have to convert your SGD to USD – which again poses another hassle altogether.

Assuming that you had invested $10,000SGD into Bitcoin at its market open price of $4,874.22SGD on 15 Feb 2019, you’d have been able to buy 2 Bitcoins at the price of $9,748.44SGD.

Fast forward two years, and assuming you’d sold at market open price on 15 Feb 2021 at $64,409SGD, you’d have amassed:

Total Amount = $128,818 (1,221.42% gains)

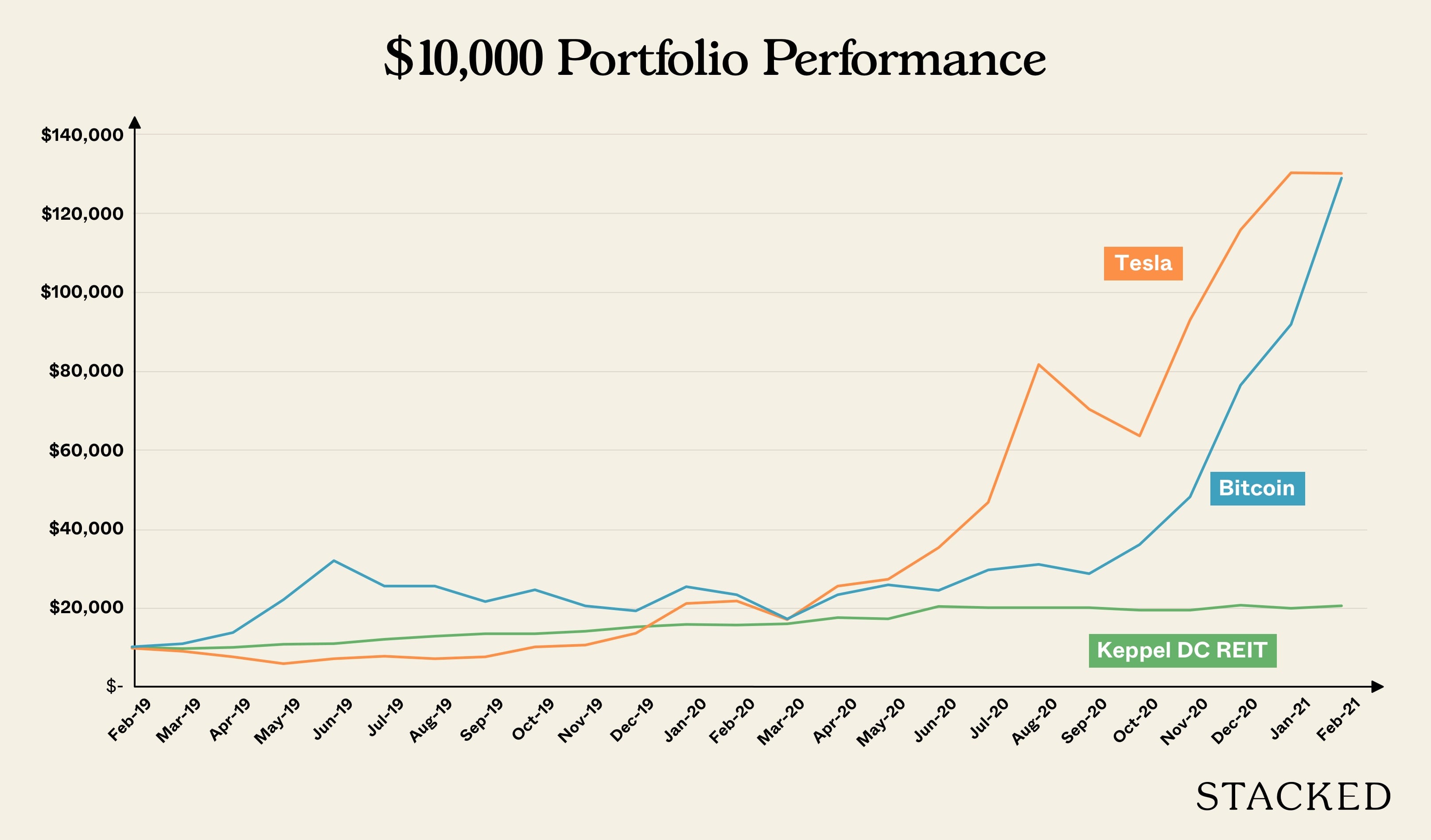

Here’s an illustration of what the portfolio would look like over the 2 years.

So who’s the Real Winner?

While the Tesla investment had the highest total figure in the end (due to total stock purchased based on $10,000 capital), it was Bitcoin that generated the largest overall gains at an astonishing 1,221.42%.

(Again, note that these calculations exclude both brokerage and withdrawal fees and are really just a ballpark to show the incredible gains of both these asset classes.)

The Ultimate Cherry-Pick? Indeed.

If you had a look at both the SNP500 and iEdge Reit returns over the past 2 years, they would pale in comparison to the individual asset gains we’ve calculated today.

Note that this doesn’t even reflect the broader market average – rather, they are indexes which include a basket of ‘similar’ companies/trusts.

In essence, this shows that both Tesla and Keppel DC Reit were outliers of their classes during these 2 years.

I won’t go into average market gains because that’s a whole new ballgame altogether – but it’s important to note that not all stocks/speculative assets will yield such returns.

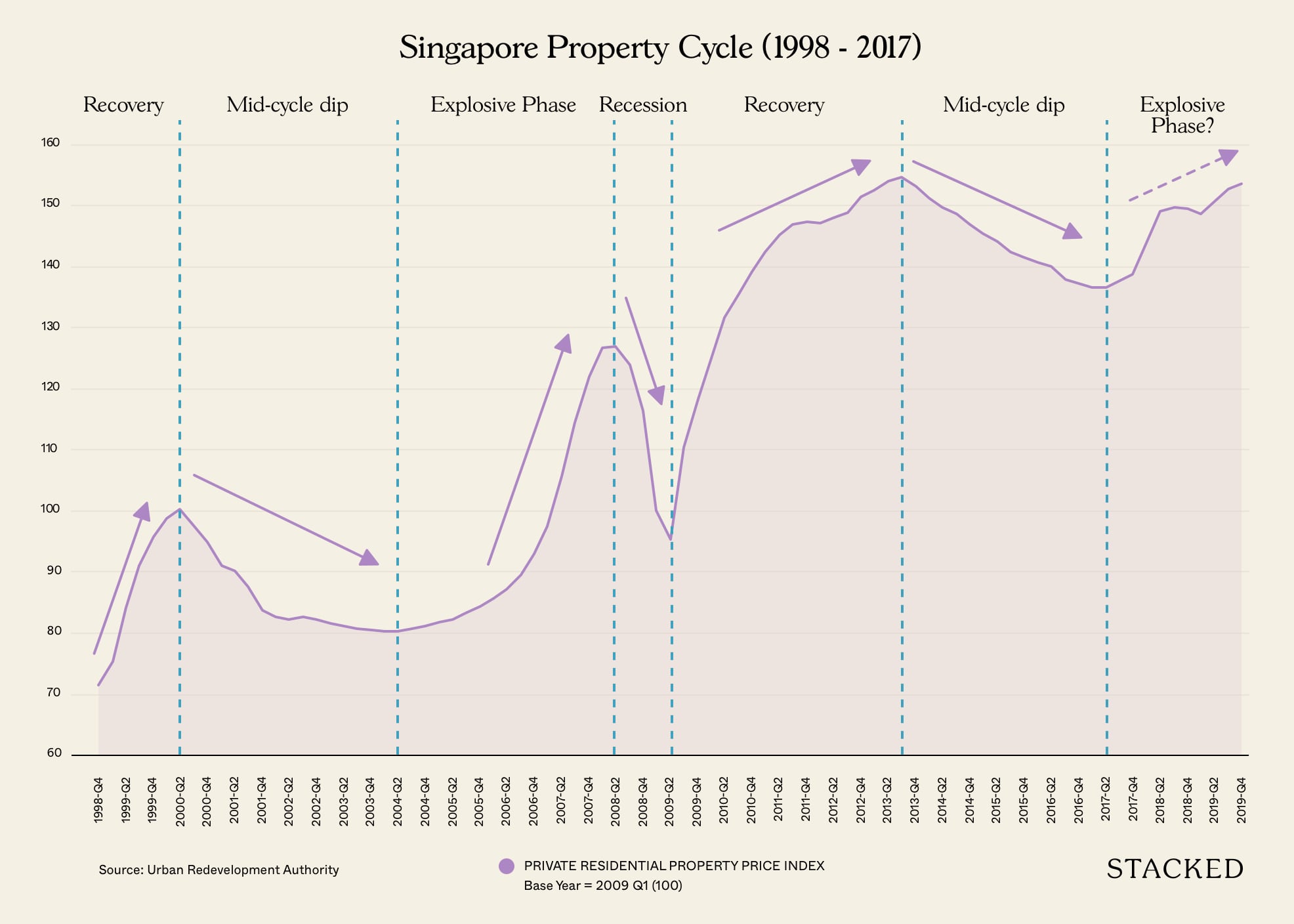

Property Market CommentaryWhy Knowing The Singapore Property Cycle Can Make You A Better Investor

by Sean GohConclusion (Investment Tips)

At the end of the day, there are tons of investment methods and assets to choose from. Growth, value, dividend, speculative assets – these are really just the tip of the iceberg.

Now jumping into the pros and cons of each individual asset would be a massive wormhole dive, so instead, I’ll conclude with some investing tips based on the current investment climate:

- “The most dangerous investors are those who have only seen a bull market”.

This age-old adage couldn’t be more fitting for the market europhia we are seeing today.

Over the past month, I’ve heard the same phrase countless times – “Reuben, I’ve made 2 years salary in just less than a year… without doing anything!”

Congratulations!

But for those new to investing, the inverse is also true – especially for those who’ve invested in speculative assets that have since seen massive growth.

The solution to all this?

Invest wisely.

- For starters, dedicate just 5-10% of your stock netwealth (note: not your total netwealth) into speculative assets – no matter how lucrative they may seem…and be prepared to lose it all.

Remember, it’s always speculation until it’s not – and for every 1 who’s made a successful speculation, 10 others have crashed and burned.

TLDR: Wishful hindsight is for those who play it safe. But it is those who play it safe that are guaranteed a semblance of stability.

- Next, be sure that you’re invested for the long term (you never know when the ‘big green days’ will come, and you want to be in the market when they do. It also just saves a ton of time and headache on your end).

- Third, invest a bulk of your portfolio in solid companies with good fundamentals/leadership/prospects. Of course, the current climate has seen the valuation of many such companies skyrocketing to ridiculous heights so finding your ‘right entry prices’ are important now, more than ever before (easier said than done I know).

- Fourth, have reserves outside of your stock portfolio for daily expenses leading up to 6 months (personally, I feel this rule applies more to singles… which then leads me on to my final point).

- Evaluate your position in life – and invest accordingly.

Assuming you are just starting out, you’d naturally have the opportunity to make riskier plays as opposed to a family man in his late 40s or even a retiree in his 60s who craves stability more than anything.

By riskier plays, I mean dedicating more capital to individual stocks/ETS as opposed to illiquid asset classes (ie. Real Estate), taking bigger loans, dedicating more netwealth to speculative assets etc.

You always want to have a clear idea of the fixed percentages of your netwealth that you’re willing to invest – and into which assets.

By following these tried and tested methods, you’ll not panic as much if your stocks were to take a dip/plunge down the road, and instead, can dollar-cost average (ie. continue to buy lower every other month) for greater returns in a few years.

Finally, if you’re a new investor just starting out, be disciplined about adding portions of your salary every month to your portfolio – think of it as a savings plan of sorts.

At the end of the day, a young investor’s biggest ally is truly the benefit of time and the incredible effects from compounding.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What would my $10,000 investment in Bitcoin have been worth after 2 years?

How much could I have made if I invested $10,000 in Tesla stock two years ago?

What is Keppel DC REIT and how did it perform over the past two years?

Would investing in the US stock market have been profitable in the last two years?

Are cryptocurrencies like Bitcoin a good investment for high returns?

What are some key investment tips for new investors based on the article?

Reuben Dhanaraj

Reuben is a digital nomad gone rogue. An avid traveler, photographer and public speaker, he now resides in Singapore where he has since found a new passion in generating creative and enriching content for Stacked. Outside of work, you’ll find him either relaxing in nature or retreated to his cozy man-cave in quiet contemplation.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

0 Comments