Top 10 Old Condos That Have Seen The Highest Gains Since 2010

October 17, 2020

Sometimes you really just have to look past the dated exterior, peeling paintwork at places, and a facility list shorter than the list of countries we are currently allowed to travel to.

The truth is that old condos still have a lot to offer, with its biggest advantages being the (usually) expansive grounds and more spacious unit sizes.

Some old condos can still be viable investments as well, there are even some buyers who emphatically seek out this “old gold”. Whereas you may see faded playgrounds, tiny pools, and residential blocks that Lara Croft should be exploring, some investors see hidden gold mines.

Here are some of the top (old) condos since 2010, that still impress with their location and gains:

To provide a point of comparison:

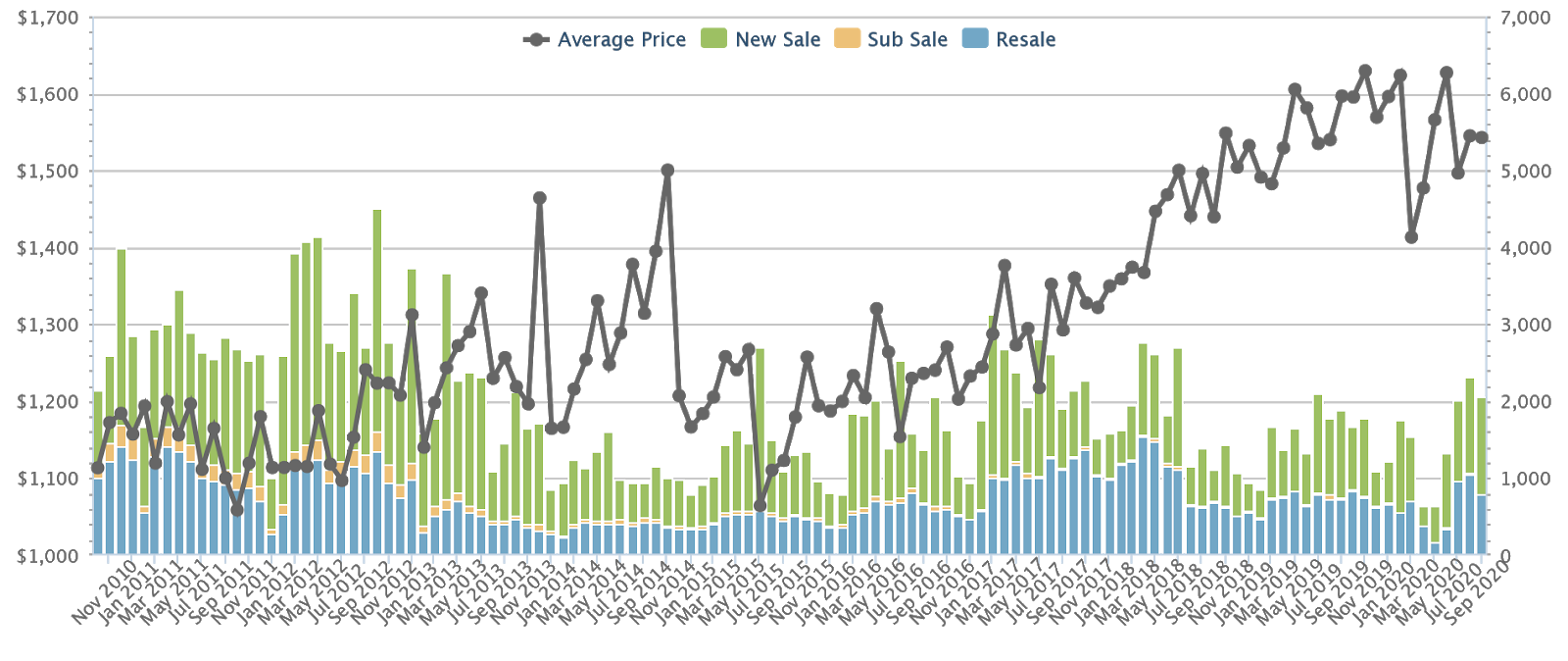

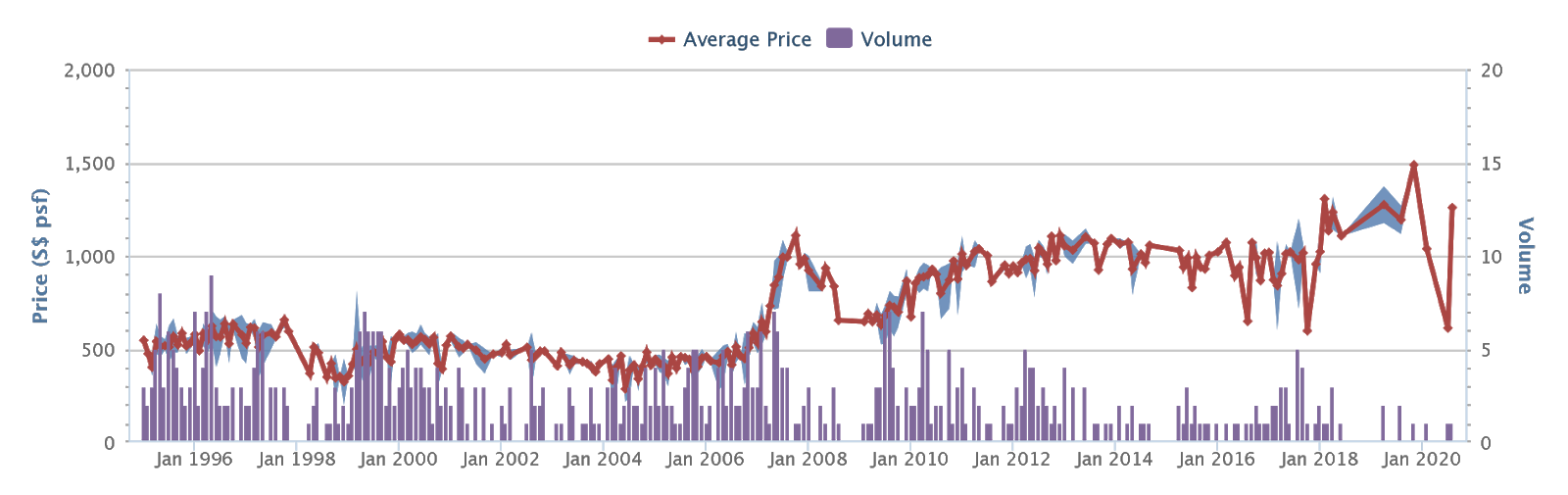

Just so you can understand the gains of these old condos, here’s a snapshot of the condo market (excluding ECs) at this point: between 2010 to the present, prices have risen from an average of $1,114 psf, to $1,543 psf.

This is a percentage gain of about 38.5 per cent, or an annualised gain of around 3.3 per cent.

Caveat:

With older condos, the limited volume of transactions is always a factor (e.g. some condos may have seen only one or two resale transactions every few years. As such, there’s a limit to the accuracy possible.

In addition, to try to paint a clearer picture, we have also included the lowest, median, and highest profitable transactions since 2010 (although the condos are sorted by average gain)

Top 10 old condos by average gains:

- Nicon Gardens – 99%

- Coronation Grove – 95.6%

- Finland Gardens – 87.6%

- Katong Gardens – 71.7%

- Chestnut Ville – 64.9%

- Flame Tree Park – 63.4%

- Thomson Grove – 62.4%

- The Hacienda – 59.5%

- Pandan Valley – 57.6%

- Gilstead Court – 52.6%

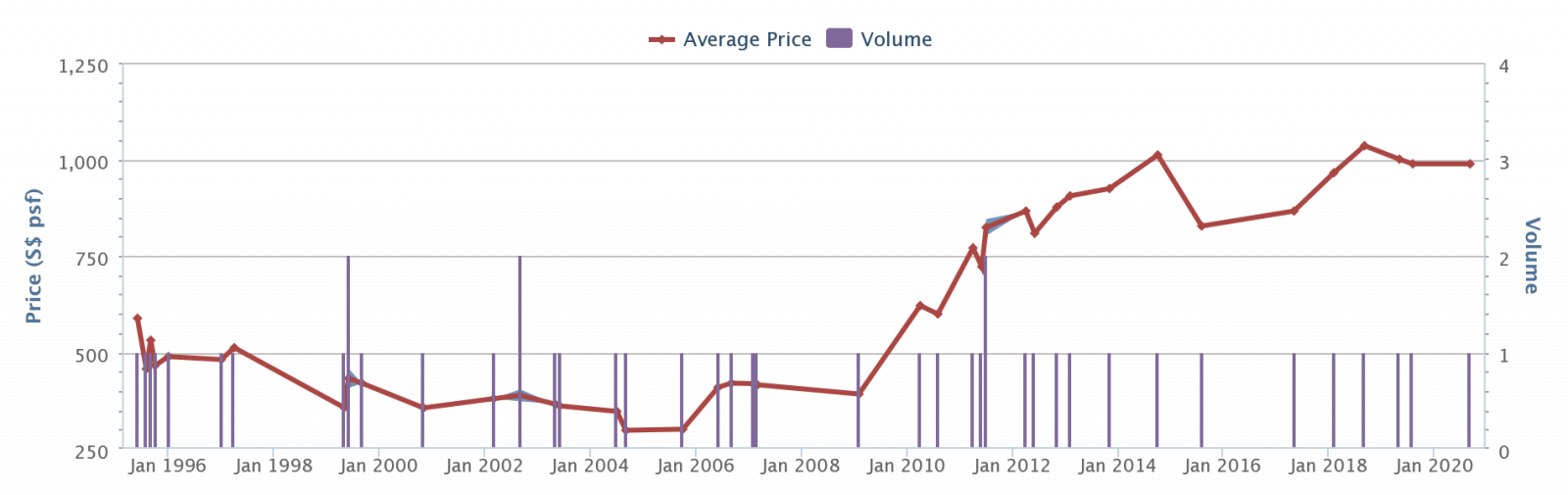

1. Nicon Gardens

Average gain from 2010: $323 psf to $643 psf (Approx. 99% increase)

Annualised gain of approx. 7.1%

Lowest profitable transaction from 2010: 3.8%

(From $646 psf to $671 psf)

Median profitable transaction(s) from 2010: 5.5 to 6.2%

(From $226 to $352 psf / From $278 to $451 psf)

Highest profitable transaction from 2010: 176.1%

(From $251 to $693 psf)

Address: Choa Chu Kang Road, District 23

Lease: 99-years from 1981

Completion: 1984

Land size (Sqm): 15,290

Number of units: 47

In 2010, Nicon Gardens averaged $323 psf. As of 2020, this has almost doubled to $643 psf (around 99 per cent increase). This is an annualised return of about 7.1 per cent.

Overview:

Nicon Gardens is located along Choa Chu Kang road, where many people mistake the low-rise buildings as disparate landed homes. But this is a condo development, with a gym, tennis court, etc. and no swimming pool. (This was not outrageous in the early-80’s.)

Nicon Gardens is within seven minutes’ walk to the Bukit Panjang MRT station (Downtown Line), and right across the road from Phoenix LRT station. For drivers, it’s close to the BKE. So you have the rare combination of being in a quiet enclave, with good general accessibility.

As with most old condos, it’s 47 units are huge compared to today’s launches. We found only two layouts: three-bedders at over 2,000 sq.ft., and four-bedders at around 1,990 sq.ft (yes, they’re a bit smaller; the ‘80s were a strange time).

The lack of a pool will be off-putting to some buyers though; and be warned that retail / entertainment is a bit sparse in the general area.

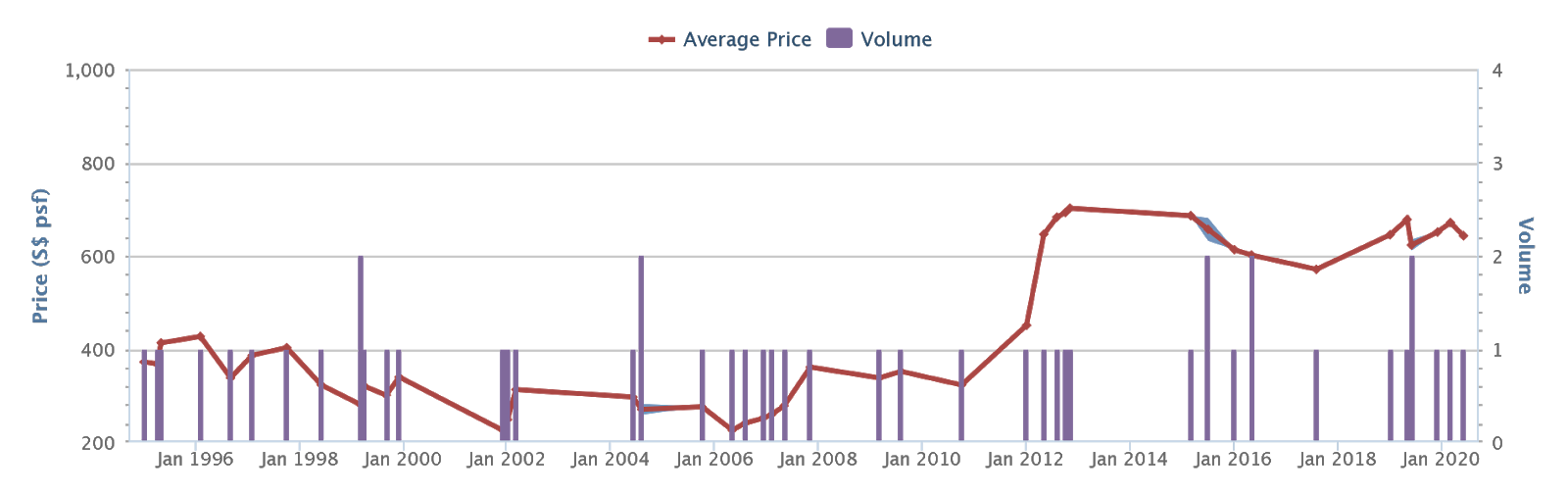

2. Coronation Grove

Average gain from 2010: $875 psf to $1,712 psf (Approx. 95.6% increase)

Annualised gain of approx. 6.9%

Lowest profitable transaction from 2010: 2.7%

(From $652 psf to $670 psf)

Median profitable transaction(s) from 2010: 25.5%

(From $697 to $875 psf)

Highest profitable transaction from 2010: 134.3%

(From $670 to $1,570 psf)

Address: Coronation Road, District 10

Lease: 999-years from 1875

Completion: 1985

Land size (Sqm): 5,762

Number of units: 24

Overview:

999-years is effectively freehold, so it’s unsurprising the value of this condo has held. The main draw of this development is the proximity to Hwa Chong Institution (five minutes’ walk), and National Junior College (seven minutes’ drive).

Coronation Plaza is a walkable distance (about 12 minutes), and can provide most day-to-day needs (FairPrice is also located there).

This is not good development for tenants or home buyers who don’t own a car though. The closest MRT station – Tan Kah Kee on the Downtown line is about a 12-minute walk. Amenities are also sparse apart from Coronation Plaza, so you should expect to drive out for your shopping, entertainment, etc.

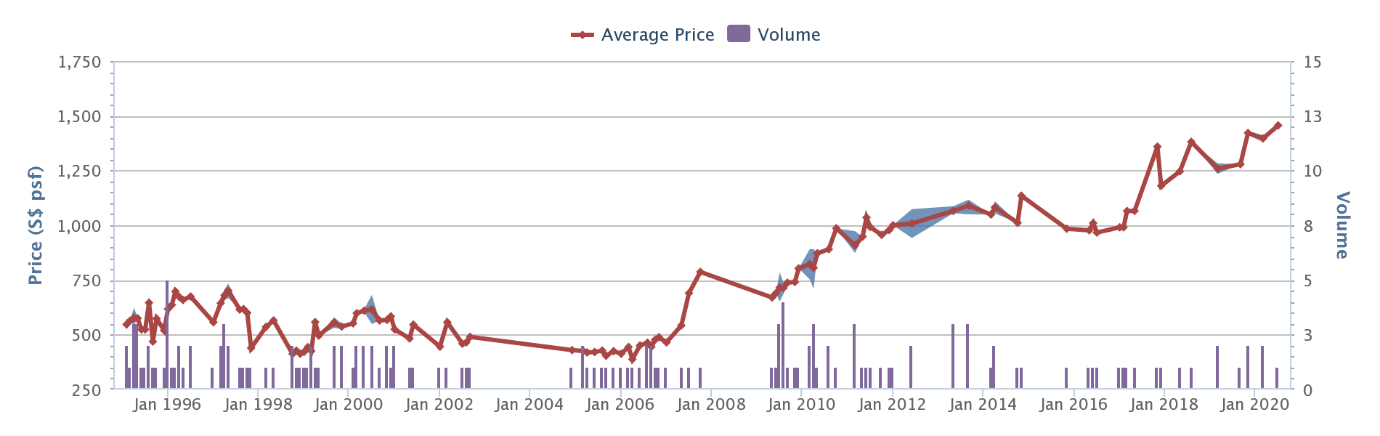

3. Finland Gardens

Average gain from 2010: $785 psf to $1,473 psf (Approx. 87.6% increase)

Annualised gain of approx. 6.5%

Lowest profitable transaction from 2010: 3.6%

(From $627 psf to $650 psf)

Median profitable transaction(s) from 2010: 39.9% to 48.2%

(From $678 to $949 psf / From $653 to $968 psf)

Highest profitable transaction from 2010: 124.2%

(From $657 to $1,473 psf)

Address: East Coast Terrace (District 15)

Lease: Freehold

Completion: 1989

Land size (Sqm): 9,131

Number of units: 48

Overview:

Finland Gardens is in a low-density area, close to the landed housing enclave of Siglap. It’s about three minutes to Siglap Centre, and across the road from there is Cold Storage.

The area benefits from proximity to East Coast Road, where i12 Katong (currently closed for renovations) is located. The stretch is about a five-minute car-ride away, and the area is loaded with all-night entertainment and eateries.

This condo is a favourite among tenants and homeowners with pets, incidentally, as Amber Vet is nearby, and Mount Pleasant (another vet) is only a five-minute drive away (so you don’t need to call pet taxis or pet ambulances).

This development is for drivers or those happy to use Grab; but the upcoming Siglap MRT should help a fair bit.

4. Katong Gardens

Average gain from 2010: $765 psf to $1,314 psf (Approx. 71.7% increase)

Annualised gain of approx. 5.5%

Lowest profitable transaction from 2010: 0.65%

(From $612 psf to $616 psf)

Median profitable transaction(s) from 2010: 48.2%

(From $661 to $980 psf)

Highest profitable transaction from 2010: 189.5%

(From $412 to $1,193 psf)

Address: Tembeling Road (District 15)

Lease: Freehold

Completion: 1984

Land size (Sqm): 11,299

Number of units: 80

Overview:

Katong Gardens is located in the proximity of Joo Chiat, where it joins up with East Coast Road. This stretch is quite known for its increasing number of hipster cafes (e.g. Forty Hands), which joins up with old favourites like Boon Tong Kee. This is a good place to live if you want to gain weight, fast.

Some buyers are surprised to learn the quantum or a two-bedder here reaches $1.57 million; but do note the two-bedder is 1,200 sq.ft. The other alternative, the four-bedder, can reach over 2,300 sq.ft.

Katong Gardens is known as something of an “expat condo”, which is unsurprising given the area is a bit of an enclave. About a quarter of the residents are PRs, while over eight per cent are foreigners.

If you don’t drive or like taking the bus, look somewhere else; this condo is far from any MRT station.

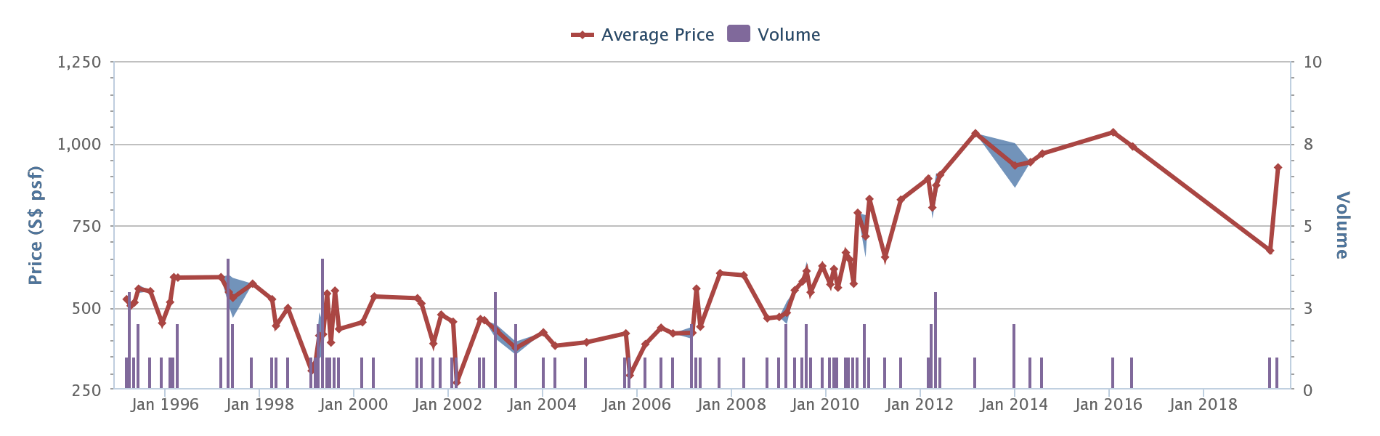

5. Chestnut Ville

Average gain from 2010: $599 psf to $988 psf (Approx. 64.9% increase)

Annualised gain of approx. 5.1%

Lowest profitable transaction from 2010: 0.49%

(From $407 psf to $409 psf)

Median profitable transaction(s) from 2010: 39.9% to 48.2%

(From $678 to $949 psf / From $653 to $968 psf)

Highest profitable transaction from 2010: 124.2%

(From $657 to $1,473 psf)

Address: Dairy Farm Crescent (District 23)

Lease: 999-years from 1882

Completion: 1984

Land size (Sqm): 1,927

Number of units: 45

Overview:

Chestnut Ville mainly benefits from recent developments like the Rail Mall, which is about a four-minute drive away. The appearance of the Downtown line (Cashew MRT station) has also helped its value; this is about one kilometre or 12-minutes’ walk.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

5 Freehold Homes With A Private Pool Under $2 Million

Whether you like to swim or not, most people would find it hard to turn down the allure of boasting…

What’s especially attractive is the presence of three schools, all less than five minutes away on foot. These are Fajar Secondary School, CHIJ Our Lady Queen of Peace, and Assumption English School.

Other amenities are sparse, however, so expect to have to go out often for your shopping, entertainment, etc. You need to be the sort to enjoy nature walks and bicycling to Bukit Timah, to fully appreciate living here.

6. Flame Tree Park

Average gain from 2010: $891 psf to $1,456 psf (Approx. 63.4% increase)

Annualised gain of approx. 5%

Lowest profitable transaction from 2010: 1.7%

(From $678 psf to $690 psf)

Median profitable transaction(s) from 2010: 42.5%

(From $628 to $895 psf)

Highest profitable transaction from 2010: 163.1%

(From $413 to $1,087 psf)

Address: Sin Ming Avenue (District 20)

Lease: Freehold

Completion: 1989

Land size (Sqm): 14,915

Number of units: 160

Overview:

This condo was briefly famous in March this year; that’s when a 1,600 sq. ft. unit transacted at $1,381 psf, up 144 per cent from its $565 psf sale price in 2000. Notably, every resale unit in Flame Tree Park since 2017 has been profitable.

Benefits are mainly on the back of Midview City, an integrated development that’s just eight minutes’ walk from here. Midview City was completed in 2010, and since then it’s become a commercial / light industrial hub (Grab is headquartered here).

It doesn’t hurt that, on top of this nice upgrade, Flame Tree Park is freehold; so it’s age is less of an issue. Expect landlords to still be eyeing units here, and trying to capture tenants from Midview.

There’s no MRT nearby, so you’ll want to drive if you live here (up till Bright Hill MRT is up, at the very least).

7. Thomson Grove

Average gain from 2010: $570 psf to $926 psf (Approx. 62.4% increase)

Annualised gain of approx. 4.9%

Lowest profitable transaction from 2010: 10.6%

(From $498 psf to $551 psf)

Median profitable transaction(s) from 2010: 64.8%

(From $478 to $788 psf)

Highest profitable transaction from 2010: 153.6%

(From $356 to $903 psf)

Address: Yio Chu Kang Road (District 26)

Lease: Freehold

Completion: 1984

Land size (Sqm): 18,694

Number of units: 116

Overview:

Thomson Grove used to have accessibility issues; but prices have risen with the upcoming Lentor MRT station (likely to be finished in 2021). This station will be a three-minute walk from Thomson Grove.

Anderson Primary School and Presbyterian High School are both one kilometre of this development, with Yio Chu Kang Secondary school being a bit further out at 950 metres.

There isn’t much in the way of other amenities (besides a Giant supermarket nearby); and until the MRT station is up, getting around can be inconvenient. Still, this is freehold property for under $1,000 psf, and the accessibility problem is soon to be rectified.

We feel most of the current buyers are eyeing the en-bloc potential, once Lentor MRT is running.

8. The Hacienda

Average gain from 2010: $936 psf to $1,493 psf (Approx. 59.5% increase)

Annualised gain of approx. 4.78%

Lowest profitable transaction from 2010: 0.35%

(From $560 psf to $562 psf)

Median profitable transaction(s) from 2010: 42.8% to 45.9%

(From $753 to $1,053 psf / From $660 to $963 psf)

Highest profitable transaction from 2010: 137.6%

(From $422 to $1,003 psf)

Address: Hacienda Grove (District 15)

Lease: Freehold

Completion: 1986

Land size (Sqm): 20,532

Number of units: 109

Overview:

The Hacienda is located along a well-known stretch of Upper East Coast Road – it’s where you find eateries like The Black Pearl, or ice-cream parlour Udders (ask east-side inhabitants, and most will immediately know where you’re referring to). It’s about a six-minute walk to Siglap Centre, where you can get most of your everyday retail needs (there’s also a Cold Storage across from Siglap Centre).

This is a laid-back, low density area, that’s also only a five-minute drive to East Coast Park.

The drawback, however, is the lack of any convenient MRT station; so make sure you drive or are okay to use the bus – although the upcoming appearance of Siglap MRT should go some way to mitigate that.

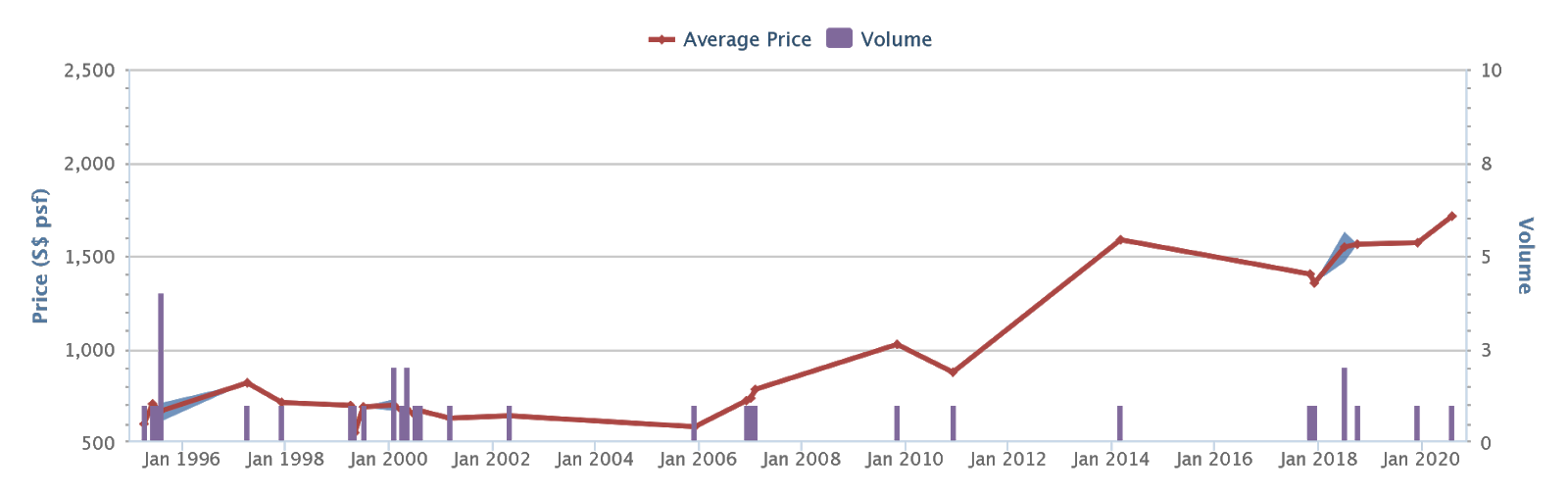

9. Pandan Valley

Average gain from 2010: $798 psf to $1,258 psf (Approx. 57.6% increase)

Annualised gain of approx. 4.66%

Lowest profitable transaction from 2010: 0.31%

(From $629 psf to $631 psf)

Median profitable transaction(s) from 2010: 51.6%

(From $453 to $687 psf)

Highest profitable transaction from 2010: 218.6%

(From $414 to $1,319 psf)

Address: Pandan Valley (District 21)

Lease: Freehold

Completion: 1978

Land size (Sqm): 80,385

Number of units: 605

Overview:

We have an in-depth review of this grand-daddy of condos, on Stacked. This is one of the oldest developments in Singapore. To give you some sense of its age, the Vietnam War had only ended three years before Pandan Valley was built.

Pandan Valley feels more like a whole estate than a single condo, with its clinic, restaurants, vet, and HDB-like layout (with regard to the blocks surrounding the playgrounds). As we’ve mentioned in our review, this development can feel quite messy and unplanned, which gives it a unique vibe.

Pandan Valley is spacious and unique, but it’s not for people who don’t drive. The nearest MRT station (Dover on the East West line) took us over 22 minutes to get to by bus (perhaps we were just unlucky; but in any case, you really want Grab, GoJek, or your own wheels to live here).

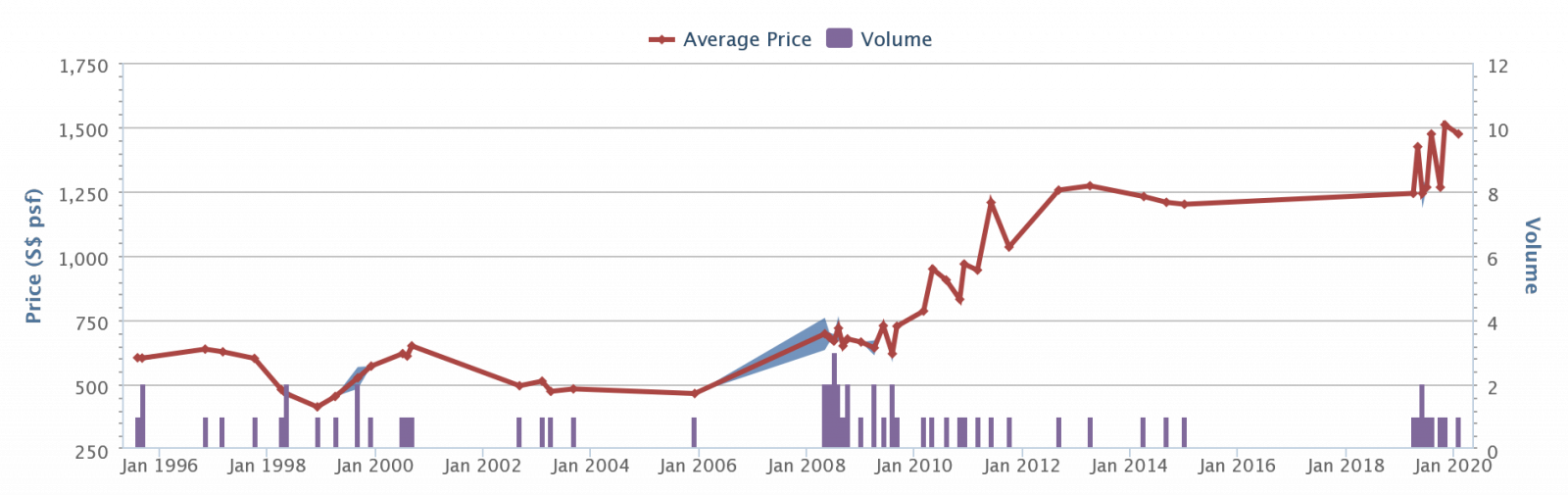

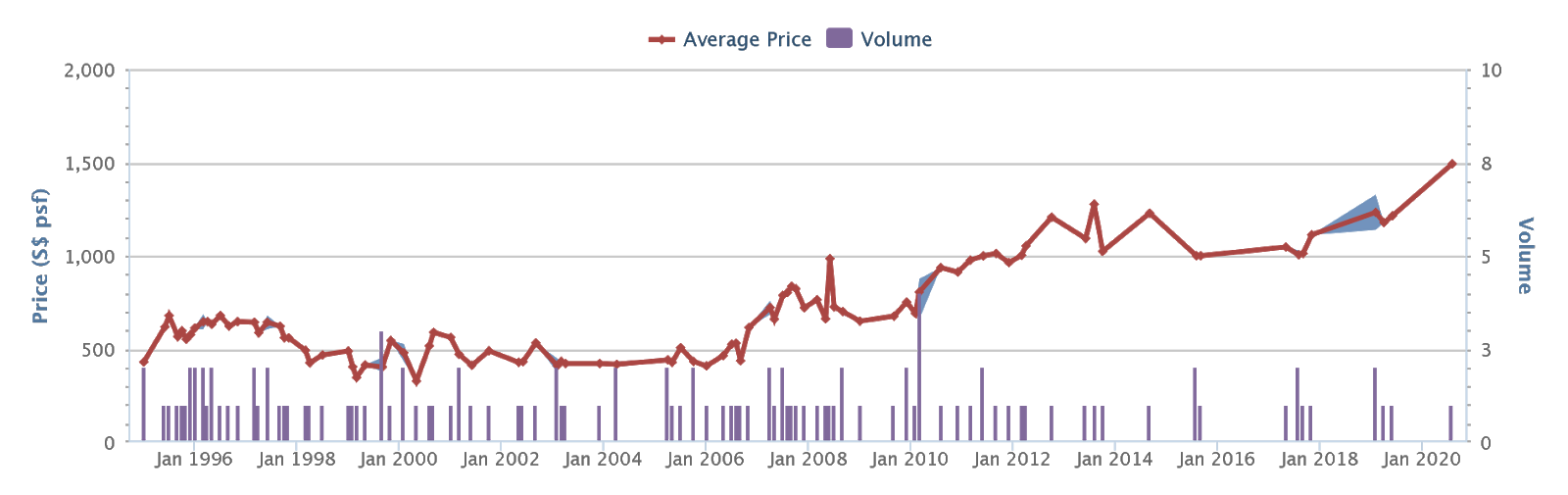

10. Gilstead Court

Average gain from 2010: $1,127 psf to $1,720 psf (Approx. 52.6% increase)

Annualised gain of approx. 4.3%

Lowest profitable transaction from 2010: 3%

(From $583 psf to $601 psf)

Median profitable transaction(s) from 2010: 53.4% to 132.3%

(From $601 to $922 psf / From $485 to $1,127 psf)

Highest profitable transaction from 2010: 214.4%

(From $547 to $1,720 psf)

Address: Gilstead Road (District 11)

Lease: Freehold

Completion: 1978

Land size (Sqm): 7,012

Number of units: 48 units

Overview:

This condo is as old as Pandan Valley, but has the advantage of better accessibility. The Novena MRT station (North-South line) is only about a seven-minute walk; and this is most people’s favourite line as it leads directly to Orchard.

Anglo-Chinese Primary School, and their Barker Road campus, are both around a six-minute walk. The development is also a four-minute drive to Newton Food Centre, making it good for night-time dining.

Coupled with the convenient location and small size (48 units only), it can be hard to buy a unit here even if you want to.

Take note, however, of ongoing en-bloc attempts. We haven’t had any news of this lately (thanks to Covid-19), but follow us on Facebook and we’ll update you as things unfold.

Please note we’re not saying every old condo is a sure-fire investment!

Our point is just that ageing condos, even some leasehold ones, can still be good prospects.

But we don’t want to go too far in that direction either, and convince you that old is always gold; note that the above are the best gainers among a large pool of older condos. We’ll add more in-depth reviews of such condos over time on Stacked, so do follow us for the details.

In the meantime, stay with us for a future article on the how’s and why’s of buying older properties (for home owners or investors).

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Which old condos in Singapore have seen the highest gains since 2010?

What are the main advantages of owning an older condo in Singapore?

How much have condo prices increased in Singapore from 2010 to now?

Are old condos good investment options in Singapore?

What should I consider when buying an old condo in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Picks

Property Picks Where to Find Singapore’s Oldest HDB Flats (And What They Cost In 2025)

Property Picks Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025

Latest Posts

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

0 Comments