Comparing Sentosa Cove Condos To District 9/10 Properties: How Much Cheaper Are They Today?

August 31, 2021

The resurgence in Sentosa Cove condos, in August this year, is one of the more unexpected events in the property market. Besides a decade of decline, the combination of ABSD and weak rental prospects offered no silver lining. Despite this, transactions have seen a sharp recent spike. We keep hearing the reason is the price decline over the years, which now makes the area palatable; so we did a quick comparison to see how low it’s really gotten:

What is happening at Sentosa Cove right now?

Sentosa Cove has had an unusually good year, with 103 transactions between January to mid-August. 85 of these were for non-landed properties, and 18 for landed; this is already an 84 per cent increase in volume from last year (43 condos and 13 landed previously).

We’ve actually been keeping an eye on Sentosa Cove (the landed side at least), since the start of the year; and as we mentioned in the earlier article, Sentosa Cove has trended downward in price and volume for around a decade at this point.

It was expected that at some point, it would be attractive enough for buyers to move back in. We didn’t think, however, that it would happen this soon; or that it would happen during Covid-19 of all times.

How much cheaper is a Sentosa Cove property, exactly?

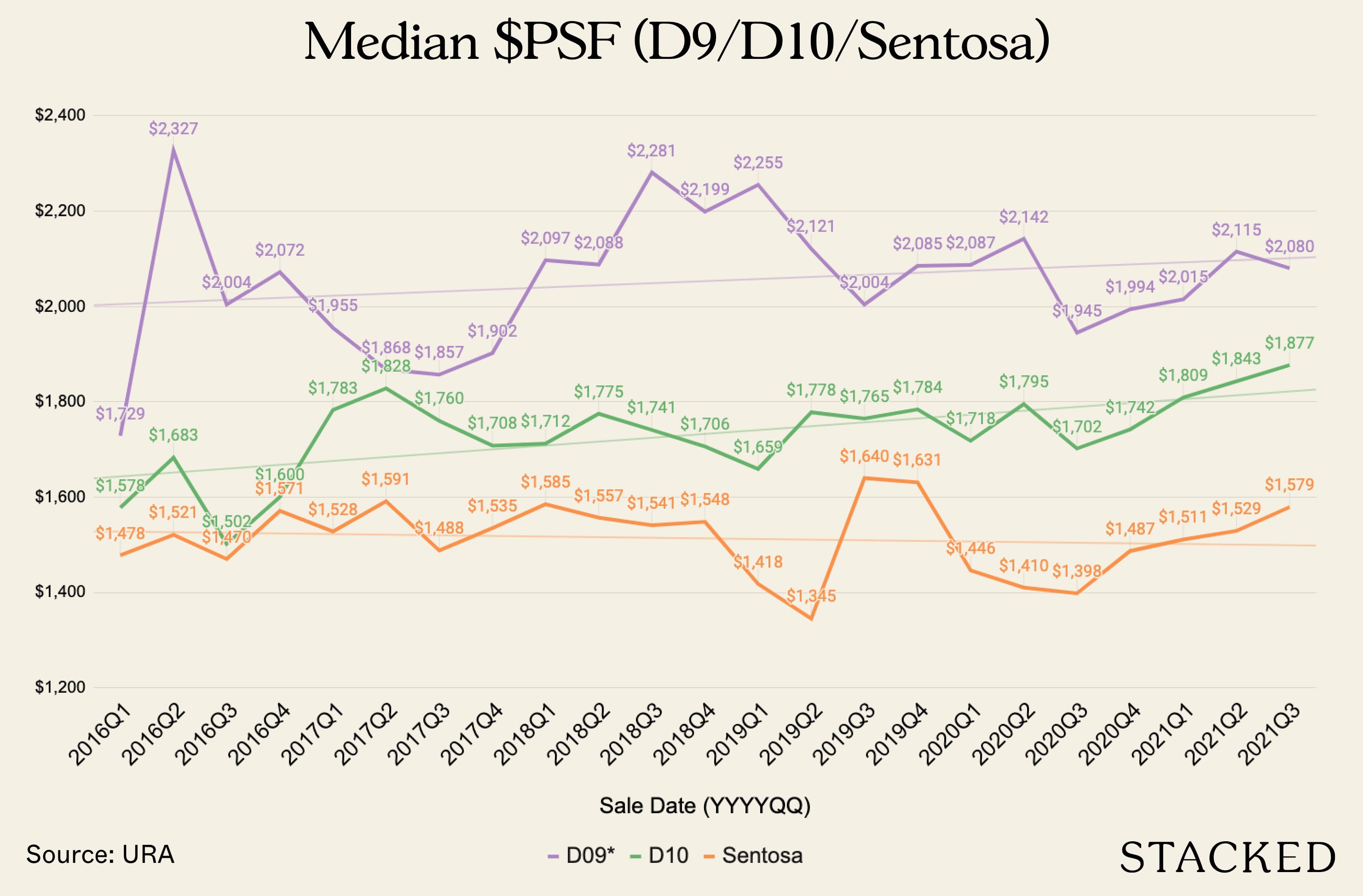

As Sentosa Cove is a luxury area, it makes more sense to compare it to similar districts, with similar property types. As such, we’ve compared it against Districts 9 (Orchard) and 10 (Holland, Bukit Timah).

We’ve compared this over a period from the start of 2016, to around the present (nearing the end of August). We’ve kept comparisons to resale transactions only, to avoid skewed data from new launches, and based it on median price psf.

To put Sentosa’s median price of $1,579 psf in context, consider that – back in 2007 – buyers of developments like Turquoise would have paid over $2,600 psf. Today, recent purchases here have gone as low as $2.74 million, for a massive 2,088 sq. ft. unit (that’s nearly half off, if you’re keeping tabs).

The lack of new developments in Sentosa Cove is also a possible factor

New launch developments are always priced higher than existing counterparts. However, this has a knock-on effect, and eventually helps to pull up prices of surrounding resale units as well.

Sentosa Cove proper has not seen a new launch, for many years (while there have been new launches in District 4, these have mainly been around the HarbourFront area).

New Launch Condo ReviewsThe Reef At King’s Dock Review: Singapore’s First Condo With A Floating Deck

by Matthew KwanNonetheless, some realtors will position this as an advantage. They will point out that there’s little room for more new launches, and this means there’s less competition in terms of resale or rental. We’re uncertain of how true this is – it may be relevant to mass market condos, but in our experience, luxury property seldom runs into oversupply problems.

With landed homes, however, there are a mere 350 bungalows on Sentosa – and this can create scarcity value among affluent foreign buyers.

Being a purely leasehold area is still an issue for Sentosa

The graph above is for all tenure types; but we feel that Sentosa’s negative trendline, relative to Districts 9 and 10, maybe due to having only leasehold properties.

Note that when we don’t differentiate between freehold and leasehold, there is a widening gap between Sentosa and District 9 and 10 properties, in terms of price psf. But if we were to restrict comparisons to just leasehold properties, Sentosa has mostly kept pace with leasehold counterparts in Districts 9 and 10.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Hi Stacked Team, I was hoping to get your take on private properties around Sophia Road. Most developments there are…

Other factors that could boost Sentosa Cove interest

The ABSD, which imposes a 20 per cent tax on foreign buyers, usually works against Sentosa Cove. However, expectations of renewed cooling measures could temporarily work in its favour.

On the ground, some realtors pointed out that foreign buyers are the first to be targeted when ABSD rises. Initial implementation of ABSD, in 2011, was 10 per cent of the price or value (whichever is higher) on foreign buyers.

By 2013, it was revised to 15 per cent. By 2018, it had risen even further to 20 per cent.

As such, many foreign investors, who have been eyeing Singapore for some time, may have decided to buy before ABSD rises again.

Note that for landed property, foreigners cannot buy on the mainland without special permission from Singapore Land Authority (SLA). Almost all their landed purchases end up in Sentosa Cove, helping to boost transaction volume.

For landed homes, most realtors we spoke to feel that demand from locals is still not high, when it comes to Sentosa Cove.

They said that Singaporeans prefer freehold landed property, which is only available on the mainland. The buyer demographic able to afford Sentosa Cove properties are more inclined toward homes like Good Class Bungalows (GCBs).

According to Realis caveats data, Singapore citizens have bought only six bungalows in Sentosa Cove, as of mid-August 2021. Most buyers have come from China, who are unfazed by 99-year leases; these buyers have similar restrictions on most properties back home.

Does this mean now is the right time to buy a Sentosa Cove home?

As a matter of pure homeowner indulgence, there are few objections to be made. If you want seafront views and golf courses, and luxury living, you’d probably pay even more for it by choosing property on the mainland.

The only real drawback we see is the lower accessibility, and the fact that many day-to-day delivery services (e.g., food delivery) won’t send drivers all the way to Sentosa. This could be a real pain, while Covid-19 still rages.

As another plus point, Sentosa Cove provides home sizes that you’d be hard-pressed to find on the mainland. You’re unlikely to find many 2,000+ sq. ft. condos outside of Singapore, barring older resale units.

As an investment, however, Sentosa Cove is still seen as less of a stable one. Freehold properties in Districts 9 and 10 have demonstrated better potential for gains, and they tend to have higher rentability (even if you’re catering to wealthier tenants, don’t assume all of them like driving all the way from Sentosa Cove to the CBD).

Also, Covid-19 raises the possibility that smaller numbers of foreigners will be entering Singapore; and that even large corporations might be slashing housing allowances, depending on how bad business gets. Luxury rental properties will be the first to bear the brunt of this.

For more updates as the situation unfolds, follow us on Stacked. You can also follow us to get the most in-depth reviews of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How much cheaper are Sentosa Cove condos compared to District 9 and 10 properties today?

Why has Sentosa Cove seen a recent increase in property transactions?

Are new developments in Sentosa Cove influencing property prices?

How does the leasehold status of Sentosa Cove affect its property value?

What factors could make Sentosa Cove more attractive to buyers now?

Is Sentosa Cove a good investment or better for homeowners?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Property Advice Should I Pay $500K More For A New Launch — Or Buy A Resale Condo Instead?

Singapore Property News A Rare Freehold CBD Office Unit Is Up For Sale At $20.5M — And Foreigners Can Buy It

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

0 Comments