Debunking Leasehold Decay: Are Old Condos Actually Underrated Or Are Freehold Condos Still The Best?

August 30, 2023

In our last deep dive, Ryan talked about how most condos in Singapore hardly last more than a couple of decades before they go en bloc. The magic number? 19 to 24 years. So naturally, that leads us to the next question:

Are freehold condos really worth their premium in Singapore? At face value, the data is, well, less than flattering for freehold enthusiasts.

You see, Singaporeans have a soft spot for freehold properties; they’re like the blue-chip stocks of the real estate world – seemingly timeless and forever yours. Meanwhile, 99-year leasehold condos often have to fight an uphill battle (especially among the older generation), mostly because of the impending doom of lease decay. I know many of such older folk who’ve refused to even consider a leasehold condo, because of such a steadfast belief.

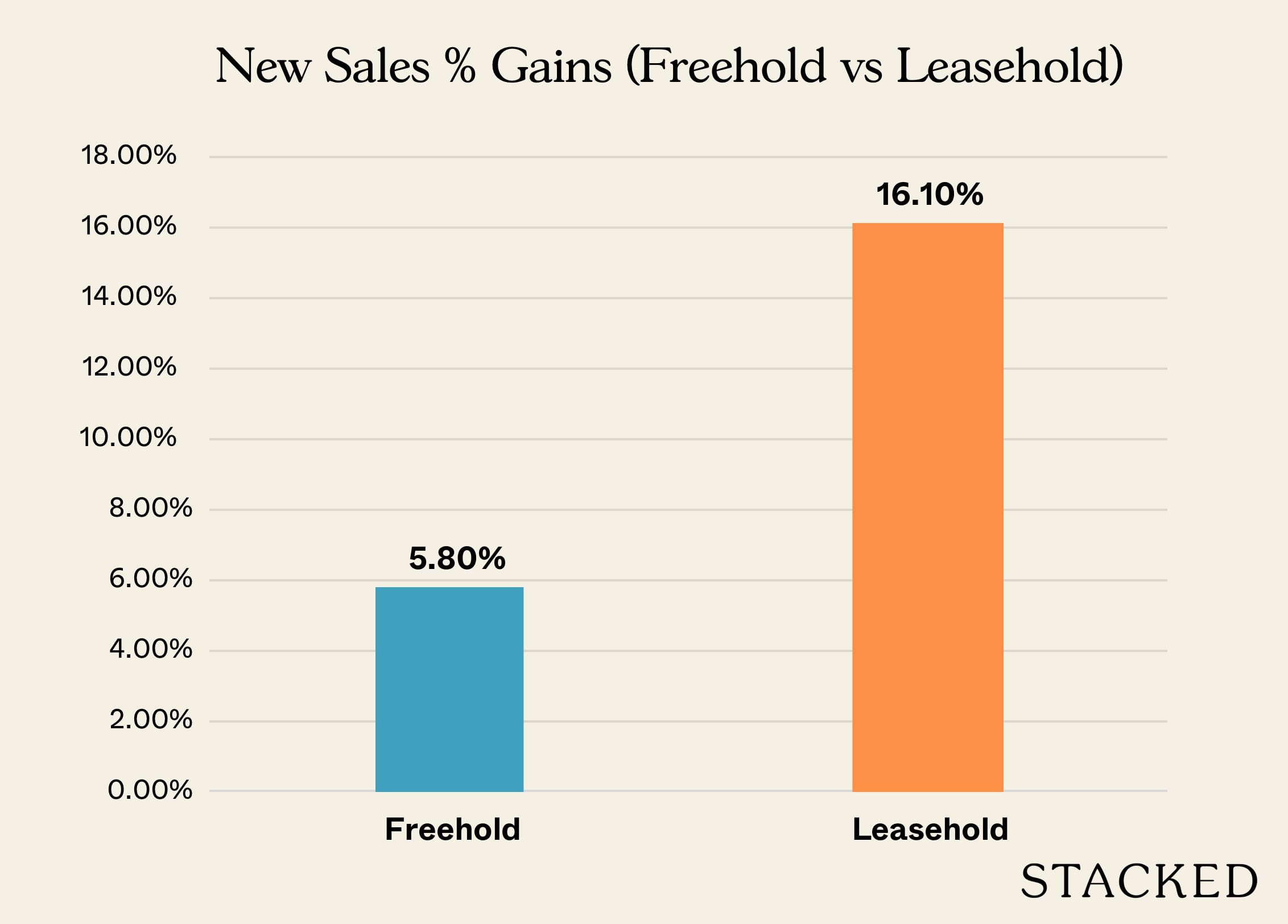

However, the data presents a case that’s worth exploring. It is especially interesting to see that leasehold condos do outperform their freehold rivals, especially if you’re looking at short-term gains.

Why is that, you ask? Well, one reason is that Singapore is constantly in a state of reinvention. Buildings get torn down and new ones spring up faster than you can say ‘property tax.’ In other words, the term ‘lease decay’ is almost an oxymoron in today’s rapidly redeveloping Singapore.

To put it another way: if we’re constantly buying, selling, and redeveloping in 20+ year cycles, then what difference does leasehold or freehold status make? Condos simply aren’t lasting long enough for the lease decay to matter.

So, as we delve into the nitty-gritty of freehold vs. leasehold properties, let’s question some long-held assumptions and see if freehold condos are really worth their premium over leasehold ones.

First, let’s take a look at how new freehold versus leasehold condos perform.

You can check out our previous article for more on this (do note, that this was last updated in 2022). But to quickly summarise:

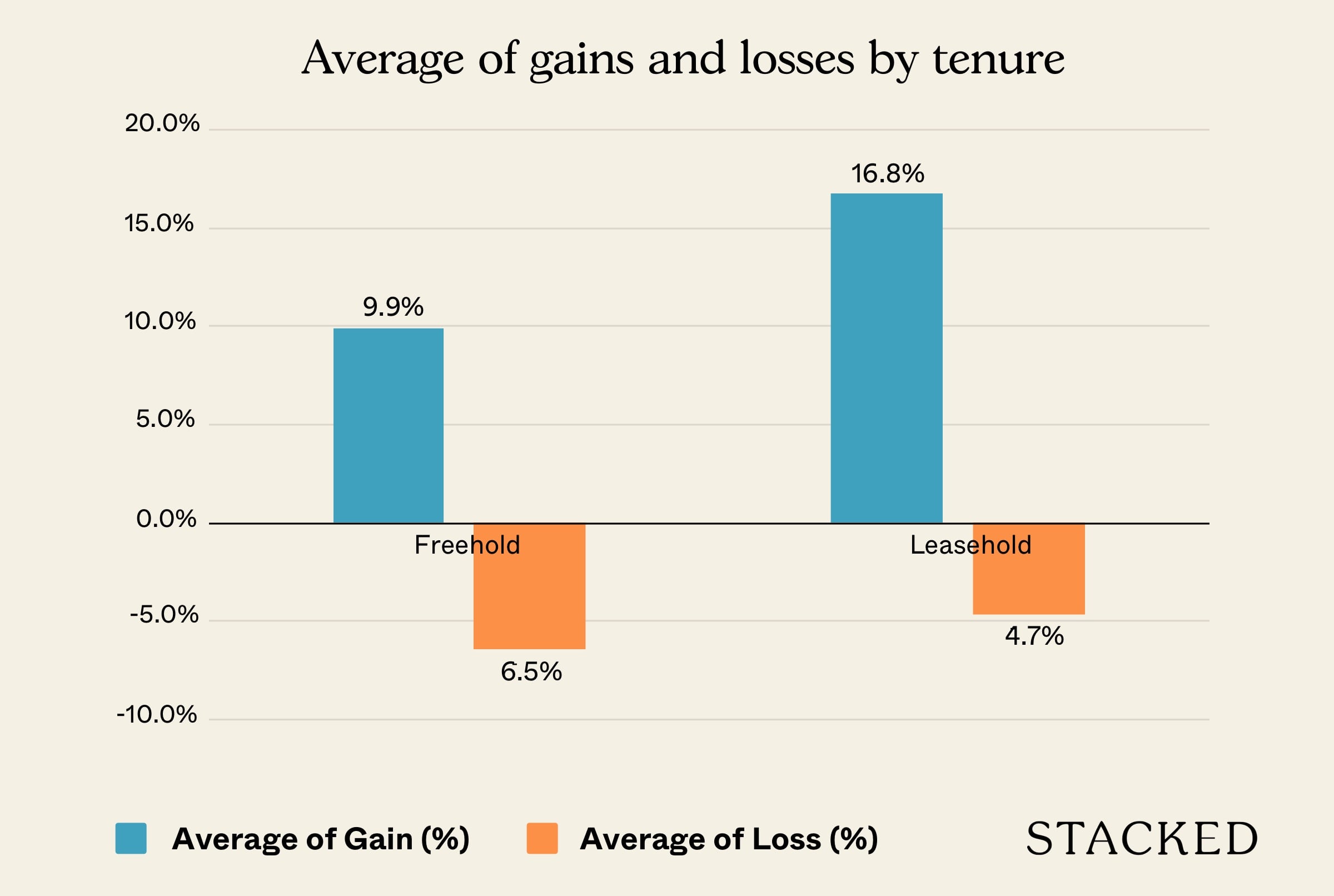

Short-Term Gains: Leasehold properties tend to outshine freehold ones in the short term, particularly within a decade. Freehold units typically cost 15-20% more, making the barrier to entry higher. Importantly, the quality of construction and amenities between the two types is generally similar. The current data suggests that for those looking to sell within a few years, a leasehold might offer better financial returns.

Smaller Losses: When it comes to financial risks, leasehold properties have historically shown smaller losses compared to their freehold counterparts. This could be important for investors who are eyeing a shorter holding period—say, five to six years. While not completely risk-free, leaseholds do offer a relatively safer bet for those wary of market volatility.

In any case, let’s look at what happens when we look at older leasehold condos as compared to freehold ones.

Are leaseholds really less profitable than freehold ones if they’re already old?

To determine this, we looked at leasehold condos that are already past 20 years in their lease (we defined them here as not freehold/999-year leasehold condos).

Here’s how many met the criteria of having a completion year or lease start year that’s at least 20 years apart:

| Tenure | Transactions (Buy & Sell) |

| Freehold | 508 |

| Leasehold | 903 |

| Grand Total | 1,411 |

And here’s how it looks profitability-wise:

| Tenure | AVERAGE of % |

| Freehold | 102.3% |

| Leasehold | 103.9% |

| Grand Total | 103.4% |

As you can see, leasehold has a slight advantage in terms of overall profitability. It’s so slim that there’s really not much in it between the two. The one takeaway?

Despite the age of these condos (where you might think being leasehold would be a big deterrent), it seems that there’s little impact here.

Now let’s see how it fares when it comes to the proportion of winners instead:

| Tenure | Breakeven | Gain | Loss | Proportion Winners | Grand Total |

| Freehold | 490 | 18 | 96.5% | 508 | |

| Leasehold | 1 | 857 | 45 | 94.9% | 903 |

Freehold condos come up on top here, but only marginally – it’s very negligible in fact.

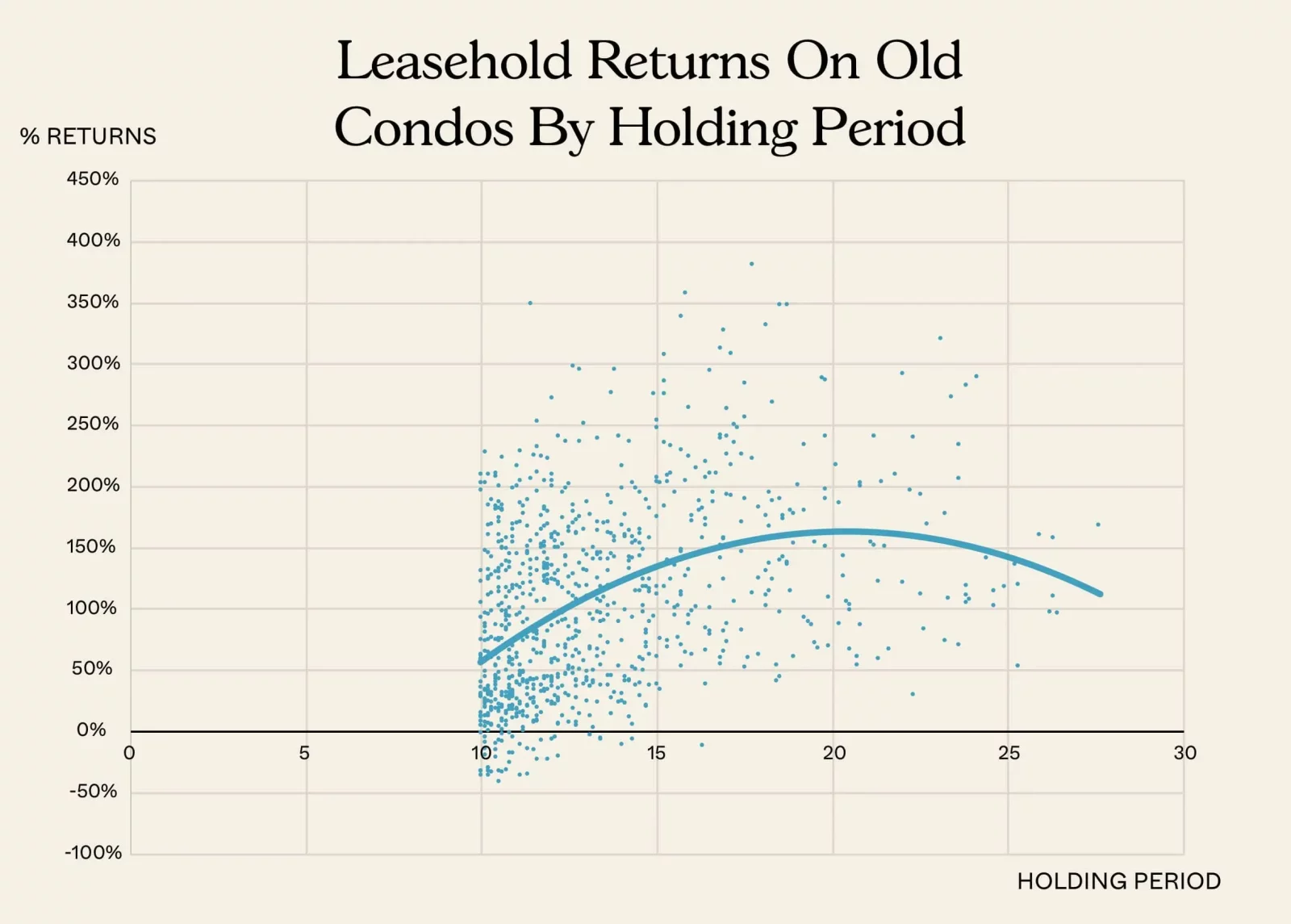

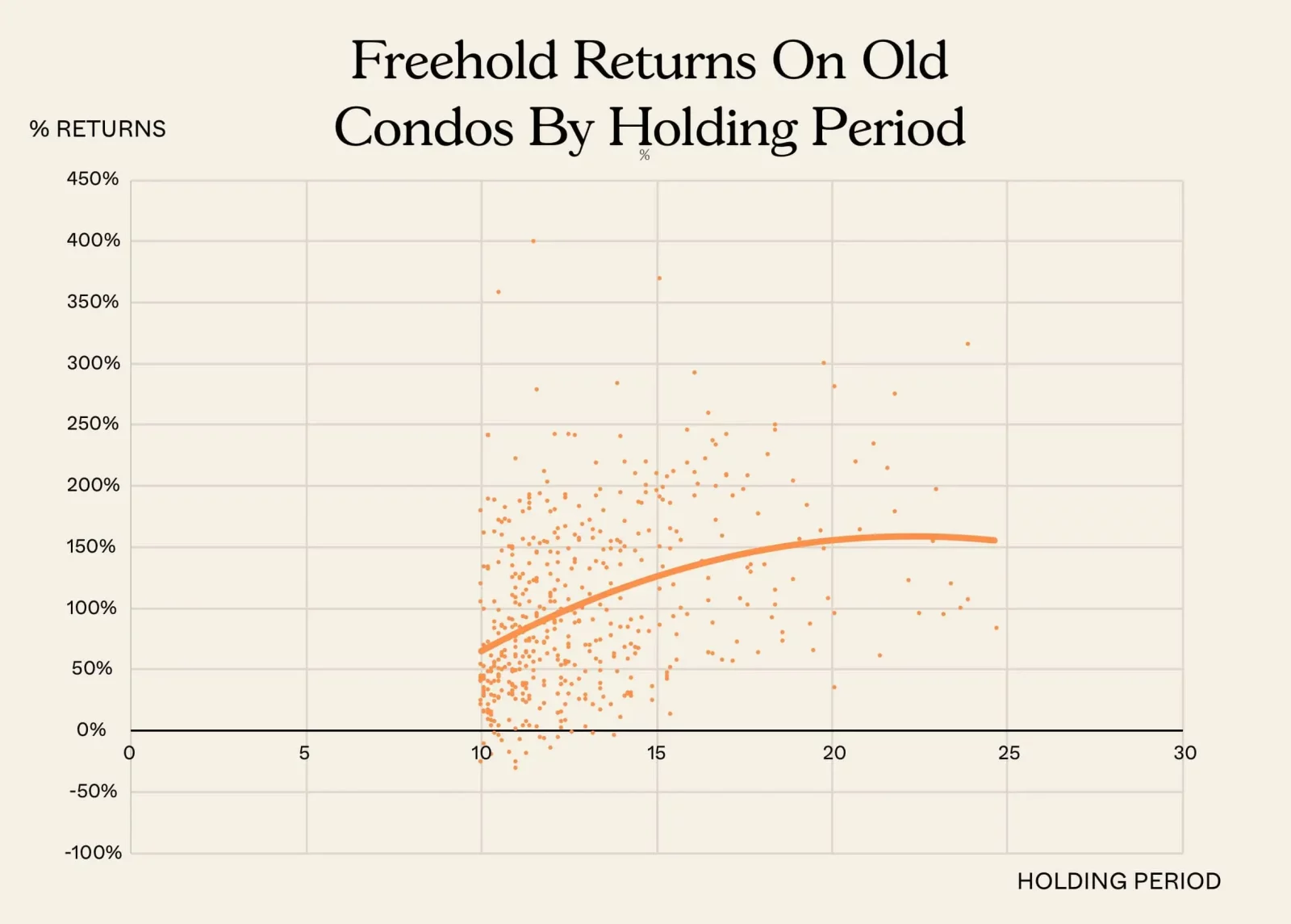

Now what about profitability versus the holding period?

Freehold/leasehold gains versus holding period

In the above scatterplot, each point represents a buy/sell transaction. The x-axis features the holding period, while the y-axis shows the percentage return.

As anticipated, both leasehold and freehold properties generally show an increasing return as the holding period lengthens. But that’s where the similarities end.

The 50-Year Inflection Point

Around the 50-year mark, the behavior of the two property types diverges. For leasehold properties, this period comprises a 20-year minimum acquisition period, followed by a 10-year minimum holding period, and another 20 years of holding. Just when you’d think long-term holding would pay off, the plot takes a nosedive. The line representing leasehold properties starts to trend downward, revealing diminishing or even lower returns.

Freehold properties, however, only display a slight dip around this time. They don’t suffer the same drastic decline as their leasehold counterparts.

So what explains this phenomenon? The key lies in the depreciating land value, which becomes increasingly significant over time. For leasehold properties, the value of the land tends to depreciate faster, particularly after 50 years. On the other hand, freehold properties retain their land value, but the development itself may lose its allure due to age, deterioration, or increased competition in other areas.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Promenade Peak Pricing Breakdown: How It Compares to Nearby Resale and New Launch Condos

Promenade Peak enters the market at a time when the price gap between the city fringe and prime locations continues…

Before you let this information sway your next investment decision, a caveat is in order. The scatterplot is based on a limited dataset: only 59 transactions for leasehold and 21 for freehold properties met the criteria of being held for 50 years from the completion or lease start year. The data may not fully capture the broader market trends.

Finally, what happens in the scenario if you bought a leasehold 20 years into its tenure but only held it for 10 to 15 years?

| Tenure | Breakeven | Gain | Loss | % Winners | Grand Total |

| Freehold | 388 | 18 | 95.6% | 406 | |

| Leasehold | 1 | 642 | 44 | 93.4% | 687 |

| Grand Total | 1 | 1,030 | 62 | 94.2% | 1,093 |

There were a total of 1,093 units transacted that met such criteria. Similarly, you’ll find the results of winners and losers to be very similar between the freehold and leasehold condos.

The price gap between leasehold and freehold properties in different market segments

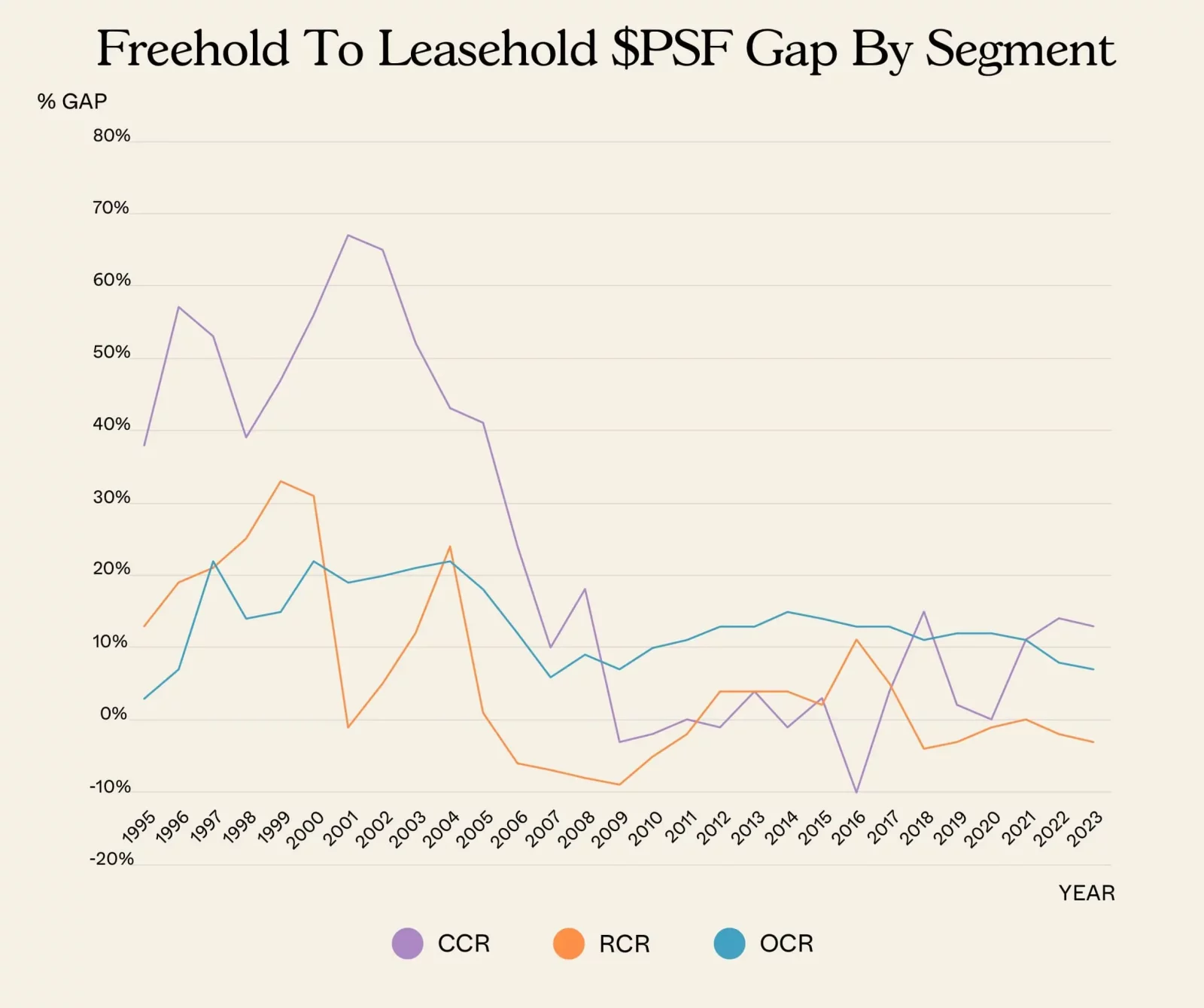

Note that, with the exception of the Outside of Central Region (OCR), the price gap between freehold and leasehold properties has generally narrowed since 1995.

A significant change seems to have occurred around 2008 (also roughly the time of the Global Financial Crisis), as after that we no longer see huge price gaps of 20 per cent or more. This may be due to the surge of interest in property investment at the time, as investors fled from stock and bond markets into the perceived safety of real estate.

This may also be the point at which investors started to notice the advantage of buying leasehold: landlords tend to prefer leasehold properties, as tenants don’t pay more for freehold status. This means a cheaper leasehold property tends to result in better yields. On top of that, the hectic pace of redevelopment (2007 was an unmatched banner year for en bloc sales) may have shed light on what we described above: freehold status isn’t helpful when condos don’t last the length of their lease anyway.

In that case, what makes freehold properties worth buying?

One strong reason is en-bloc potential. Developers may be less generous with leasehold condos for two reasons:

Editor's PickThe Surprising Lifespan Of Freehold And Leasehold Condos In Singapore: What Age Do Most Condos Go En-Bloc?

by Ryan J. OngFirst, the lease for the condo needs to be topped back up to 99 years. The older the leasehold condo, the more the developer will end up paying. This is making the assumption that a developer can top up the lease. In some condos, the land is actually freehold, even though the condo lease is 99 years. (The land owner has simply leased out the land for 99 years, to a developer to build the condo. They may not be interested in leasing out the land again, in which case the en-bloc is over).

Second, if a condo is approaching its 40th year, there are difficulties in selling it. The maximum bank loan, for example, may be reduced for such older properties. Every year the resale prospects get worse for the owners, and this allows the developer to negotiate from a position of strength.

Third, a freehold property has better legacy value. If your intent is to have an asset to pass down to children, grandchildren, etc., and you never intend to sell in your lifetime, then freehold could make sense. Just remember though, there’s a tendency for collective sales to happen, regardless of whether you own a freehold or leasehold condo.

Fourth, you can’t use your CPF to pay for properties that have 20 or fewer years on the lease. For now, however, this consideration is almost purely theoretical. As explained above, most condos will never become old enough for this to matter.

But going forward into the future, if condo projects start sticking around for longer, we may end up seeing this as a tangible benefit.

Ultimately, what drives the value of freehold condos may be more psychological than factual. One realtor, who has been in the industry for almost 13 years, described it as such:

“Singaporeans equate 99-year leases to HDB flats. Because it is only in the private segment that you can find a freehold home; so the mentality is that, if it’s not freehold, it’s not a so-called ‘real’ private property.”

Among realtors, it is also considered disadvantageous to have a leasehold project surrounded by freehold options. While we’ve never seen any specific studies to prove this, realtors have long claimed that such properties are harder to sell, as the leasehold status provides a negative contrast.

It may simply be that, barring changes in our built environment (e.g., we start keeping condos until they reach their last 20 or 30 years), freehold status won’t have the time needed to show its real worth. If this change were to come about someday, it would definitely swing things in favour of freehold.

For more on the situation as it unfolds, follow us on Stacked. We’ll also provide you with in-depth reviews of new and resale properties alike, be they freehold or leasehold.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

Latest Posts

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Singapore Property News You Can Now Buy Part Of A $300M Singapore Bungalow — But You Can’t Live In It

1 Comments

Interesting dataset but what if one takes stamp duty into consideration? We are PRs and everytime we transact, we have to pay up to 9pct stamp duty, wouldn’t that eat away at the gains? Assuming one does not need to transact with freehold?