Another 2,000 New Homes To Come: What Does This Mean For Prices?

June 16, 2024

You know how Batman, Wonder Woman, and Superman form the trinity of DC comics?

We have something exactly like that in the property market, and it’s about to go big. URA is planning for close to 2,000 new homes in Tengah, Dairy Farm, and Bayshore, which form the trinity of ulu-ness in 2024 Singapore. I’m allowed to say that okay, I actually live in one of these places.

*Okay, maybe Bayshore isn’t so bad with the new MRT line

Anyway, these upcoming sites consist of:

- A land parcel near a part of Petir Road (Dairy Farm), with its exciting gravel and grass

- A land parcel along the uncompleted road near the uncompleted Garden Terrace Tengah and uncompleted Plantation Creek, serviced by the uncompleted Tengah Plantation MRT (see if you can spot the common theme there)

- The land parcel opposite the three Bayshore condos, so the owners can have their views evenly blocked by an HDB enclave on one side, and the Long Island Project on the other. Balance is an important part of urban planning.

Comments by property analysts suggest developer bids may be on the low side. But to put that in context, some analysts are the sort of people who, if a giant sinkhole were to swallow half of Bugis, would describe that as a reason to temper your expectations for property gains in District 7.

Honestly, most of the low expectations are for reasons we know too well: Land Betterment Charges (LBCs) are high, interest rates are worrying, developers are no longer allowed to charge you for planter boxes you could park a Volvo in, etc.

The truth that’s being tiptoed around is that these three areas will need more work. These locations are in a sort of “start from zero” position: they lack sizeable retail and entertainment options, and accessibility is just now being improved (prior to Bayshore MRT, we could only have recommended the nearby condos to people who drive).

As for food, let’s just say I have over two dozen late night supper options here in Bayshore (labelled H1 to H24, assuming I have change for that particular vending machine.)

Were this the 2010s, developers would be much more confident of buyers seeing first-mover advantage in their offerings, and of nearby HDB dwellers choosing to upgrade. But as 2024, a grim economic outlook, coupled with HDB upgraders who feel priced out of new launches, make these less developed plots a bigger risk.

Which isn’t to say that these land parcels are somehow bad for individual homeowners; it’s just that you’re better off buying in these areas if you have a longer holding period in mind.

Also, very coincidental timing. I just wrote about new residential plot being in prime areas – so it seems someone up there is listening.

On another topic, eyes are on the effect of rental rates, as the PPHS vouchers roll out.

From 1st July, the Parenthood Provisional Housing Scheme (PPHS) Open Market vouchers will start being issued. This provides a $300 per month subsidy, to renters who are waiting to collect the keys to their BTO flat (you can find out more about the PPHS here). This can be used to rent a room or HDB flat on the open market.

More from Stacked

The Effect Of Trump’s Policies On Singapore Property: What Could Happen This Time?

The US seems to be undergoing a volatile time, and it’s just the start of their current President’s (the Trump…

Now helping renters, especially young parents, is always a good thing; but here’s the grumbling we’ve heard:

The more cynical-minded are claiming that all the government’s done is raise rental rates by $300. This is on their assumption that landlords will respond to the news by just increasing their rental demands, probably while hissing and backing away from wooden stakes or crosses.

So while the government will be monitoring how much the system helps, the more disgruntled Singaporeans will probably be monitoring whether their naysaying comes true. It’ll be an interesting time.

Meanwhile in other property news…

- Is SORA worth a look? Yes, because you should always know your home loan interest rate. Then after that take a look at Sora, which has 78 per cent of its units facing beautiful Jurong Lake Gardens.

- Check out some affordable and convenient one-bedders, where you can take advantage of integrated developments nearby (without having to buy in the pricier integrated project)

- It’s 2024, and en-bloc sales have taken off like a herd of turtles. Here’s why.

- Can singles in Singapore still afford 3-room flats? My guess is definitely, if they don’t like retirement; but check out the article for a more informed take.

Weekly Sales Roundup (03 June – 09 June)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| WATTEN HOUSE | $4,996,000 | 1539 | $3,246 | FH |

| PINETREE HILL | $3,718,000 | 1464 | $2,540 | 99 yrs (2022) |

| THE MYST | $2,993,000 | 1518 | $1,972 | 99 yrs (2023) |

| TEMBUSU GRAND | $2,976,000 | 1173 | $2,536 | 99 yrs (2022) |

| THE LANDMARK | $2,965,000 | 1076 | $2,755 | 99 yrs (2020) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE ARDEN | $1,250,000 | 657 | $1,904 | 99 yrs (2023) |

| HILLOCK GREEN | $1,299,000 | 517 | $2,514 | 99 yrs (2022) |

| THE LAKEGARDEN RESIDENCES | $1,340,100 | 592 | $2,264 | 99 yrs (2023) |

| TEMBUSU GRAND | $1,344,000 | 527 | $2,548 | 99 yrs (2022) |

| HILLHAVEN | $1,445,556 | 678 | $2,132 | 99 yrs (2023) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| HELIOS RESIDENCES | $4,250,000 | 1916 | $2,218 | FH |

| THE BERTH BY THE COVE | $4,100,000 | 3315 | $1,237 | 99 yrs (2004) |

| THE WATERSIDE | $4,025,800 | 2142 | $1,879 | FH |

| THE SUITES AT CENTRAL | $3,750,000 | 1442 | $2,600 | FH |

| SKYLINE RESIDENCES | $3,540,000 | 1615 | $2,192 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SUITES @ KOVAN | $630,000 | 366 | $1,721 | FH |

| CRADELS | $775,000 | 441 | $1,756 | FH |

| THE WISTERIA | $780,888 | 549 | $1,422 | 99 yrs (2015) |

| KOVAN REGENCY | $800,000 | 506 | $1,581 | 99 yrs (2012) |

| TREASURE AT TAMPINES | $812,000 | 463 | $1,754 | 99 yrs (2018) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| ONE AMBER | $3,350,000 | 1658 | $2,021 | $2,095,000 | 18 Years |

| PARKSHORE | $2,800,000 | 1324 | $2,115 | $1,832,000 | 25 Years |

| DORMER PARK | $3,400,000 | 1668 | $2,038 | $1,580,000 | 17 Years |

| VERANDA | $2,880,000 | 2390 | $1,205 | $1,355,000 | 8 Years |

| HUME PARK II | $1,980,000 | 1249 | $1,586 | $1,342,000 | 26 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| HELIOS RESIDENCES | $4,250,000 | 1916 | $2,218 | -$1,110,220 | 17 Years |

| THE BERTH BY THE COVE | $4,100,000 | 3315 | $1,237 | -$780,000 | 10 Years |

| V ON SHENTON | $3,070,000 | 1528 | $2,009 | -$730,000 | 7 Years |

| THE CENTREPOINT | $2,500,000 | 1119 | $2,233 | -$411,000 | 5 Years |

| ONE SHENTON | $1,340,000 | 829 | $1,617 | -$100,000 | 6 Years |

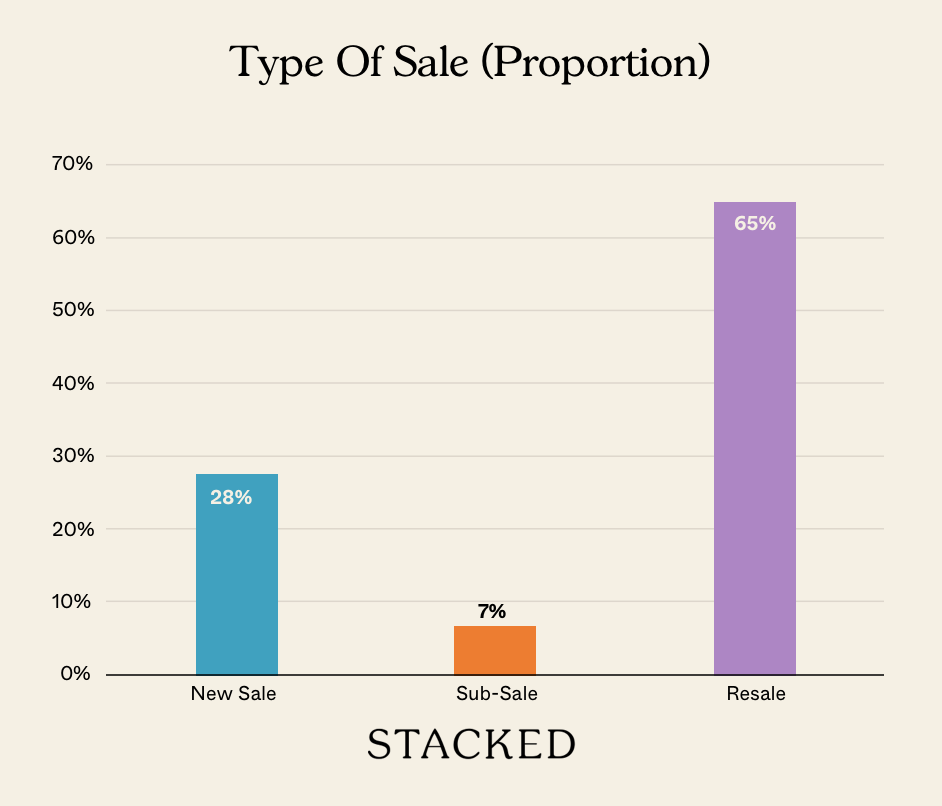

Transaction Breakdown

For more on the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What impact will the new homes in Tengah, Dairy Farm, and Bayshore have on property prices?

How might the new residential developments affect rental rates in Singapore?

Are the upcoming areas in Tengah, Dairy Farm, and Bayshore good investments for long-term property owners?

What are the main challenges facing the new sites in Tengah, Dairy Farm, and Bayshore?

What should potential buyers consider before investing in these upcoming areas?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments